#medicare supplements

Text

Since 2005, Heartland Health Insurance has helped thousands of families get the world-class health insurance plans they desire. Our tight-knit team of experienced, licensed insurance brokers specialize in medical health insurance, dental insurance, vision insurance, medicare supplements, critical illness, accidental, and so much more. Check out our reviews online at https://g.page/Heartland-Health-Insurance!

Heartland Health Insurance

Noblesville, IN 46062

(317) 660-4200

https://heartlandhealthinsurance.com/

#Health Insurance#Dental Insurance#Vision Insurance#Critical Illness Insurance#Medicare Supplements#Accident Supplement Insurance#Retirement Planning#Investment Products#Life Insurance

0 notes

Text

How do I know if I need Medicare Supplement Insurance?

#medicare supplement plans#medicare supplement#medicare supplemental insurance#medicare supplement plan g#best medicare supplement plans#medicare supplement plan#best medicare supplement#medicare supplements#medicare advantage#medicare supplement insurance companies#medicare advantage vs medicare supplement#medicare supplement plan n#medicare supplement plans 2020#medicare supplement plan n vs g#medicare insurance#medicare advantage plans

0 notes

Text

After The White House and Republicans in Congress reached a tentative agreement on the debt ceiling, House Speaker Kevin McCarthy went on Fox News Sunday to boast about making struggling Americans work in order to continue receiving food aid.

Although precise details have not been released, the deal will increase the maximum age at which adults must work in order to receive Supplemental Nutrition Assistance Program (SNAP) food stamps from age 50 to 54. There are exceptions, however, for veterans, unhoused individuals, and those with dependents. The deal also includes changes to Temporary Assistance for Needy Families (TANF) but those details have not been made public.

“We finally were able to cut spending. We’re the first Congress to vote for cutting spending year over year,” McCarthy boasted Sunday on Fox. “So, you cut that back. You fully fund the veterans. You fully fund defense. But you take that non-defense spending all the way back to 2022 levels. Now you get work requirements for TANF and SNAP. The Democrats said that was a red line.”

At another point in the interview, McCarthy claimed that “We’re going to get America working again,” and that the deal includes “work requirements to help people out of poverty into jobs.” At this, host Shannon Bream pushed back on McCarthy, arguing that the work requirements are not tough enough for the most extreme members of the GOP caucus.

"We're gonna get America working again … When Republicans had the Presidency, the Senate and the House, did they ever cut spending? No, they increased it."

“The White House, that’s an area where they’re celebrating,” Bream said of the work requirements. “They say there are no changes to Medicaid. You referenced SNAP and TANF. So basically, SNAP includes an expansion for veterans and people who are homeless. So there’s an expansion there to some extent… and the changes that you did get will lift the age and the requirements and those kinds of things, but they sunset. So they don’t last for very long.”

It should be noted, though, that the vast majority of Americans are working. Unemployment remains extremely low at 3.4% as of this April.

McCarthy also bragged about cutting funding to the Centers for Disease Control and Prevention (CDC). “This is the largest recision in American history,” McCarthy said. “You can add up all the recisions from all the other Congresses. This is greater. And what are we pulling back? CDC’s Global Health Fund. So no longer are we sending $400 million of American taxpayers’ money to China.”

According to the CDC, the Global Health Fund supports HIV/AIDS prevention and care, immunizations, and global disease detection and emergency response. On the heels of a global pandemic, cutting this funding seems dangerous, but after seeing their response to COVID, it’s not surprising that Republicans in Congress don’t take global health seriously.

Returning to the topic of work requirements, McCarthy said, “At the end of the day, it saves more money, ’cause what does a work requirement do? It’s only on able-bodied people with no dependents. Instead of borrowing money from China to pay somebody to sit on the couch, we now give them the process to go get a job. Every study has shown when you do that, it puts people to work. And when they work, what happens? More people are paying into social security and Medicare.”

Sure, it may “save” some money in food aid, but at what cost?

#us politics#news#republicans#conservatives#tweet#2023#gop policy#gop platform#gop#rep. kevin mccarthy#national debt#debt crisis#debt ceiling#supplemental nutrition assistance program#Temporary Assistance for Needy Families#social security#medicare#Fox News Sunday#us house of representatives#biden administration#president joe biden#Shannon Bream#work requirements#china#center for disease control and prevention#Global Health Fund#aaron rupar#rolling stone magazine

38 notes

·

View notes

Text

With all of the Medicare plan options out there, many people may wonder, “Do I need to purchase Medicare supplement insurance?”

2 notes

·

View notes

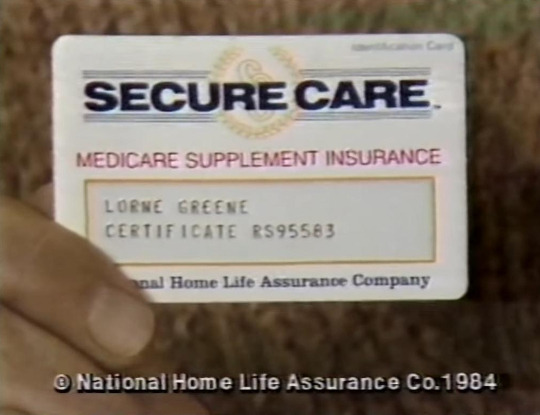

Photo

#secure care#lorne greene#national home life assurance#vhs#1985#medicare supplement insurance#medicare

18 notes

·

View notes

Text

do you think drugs would fix me. not weed real ones. okay not real ones like semi real ones. you know what maybe i'll just eat a really hot pepper and go for a bike ride or something

#I'm running out of zoloft so i've rationed down to a third of my prescribed dose#i think I'm feeling different but I can't pinpoint how. that may also be on account of totaling my car tho#I have the rest of my prescriptions so i'll live till the medicare kicks in#anyway they already decriminalized shrooms here they should start selling them at supplement chain stores already#windbag

3 notes

·

View notes

Text

Me for months: 'yeah, I'm financially okay, I can survive.'

Me now: 'To go to my gp and get my sleeping meds costs me just shy of $100, which means I can't afford food and travel properly or I can't afford therapy. And I need both to not be hospitalised, and go to physical therapy, and do the things so I can go on NDIS and get subsided treatments. So I'm going to procrastinate seeing my doctor and taking my sleeping meds.'

The worst part of this; melatonin is more expensive than valium. I'm not allowed back on valium even as a muscle relaxant for spasms yet, let alone sleeping meds. But it would be cheaper for me to go back on a substance I shouldn't be on to sleep than the safer option that gives me slightly normal sleep.

#I'm avoiding seeing my doctor because I'm afraid of going on anxiety meds#and because it's like $68 to see her and $57 for a months worth of melatonin#but I don't have that much money for meds and doctors tbh#my therapy costs me enough as is#not to mention buying accessibility equipment for PT#and supplements#and a heater now bc winter is killing my joints#which is new for me#and compression things bc I struggle to find them in my size that's not a sensory issue#and I'm dealing with clothing issues because T#and I can't get on NDIS bc my permanent condition'could improve'#it's ridiculous#also why tf isn't there a medicare coverage for melatonin#I'm an asshole without proper sleep#I hate me without sleep#give me access to the stupid hormone my brain doesn't make#it's not my fault my body doesn't work right I just want to be able to afford to fix it

3 notes

·

View notes

Text

Heartland Health Insurance

Serving Noblesville, IN

(317) 660-4200

Website

Since 2005, Heartland Health Insurance consists of a tight-knit team of licensed health insurance brokers who work with individuals and families all across the United States.

We help our clients secure medical health insurance, dental insurance, vision insurance, medicare supplements, critical illness, accidental, and so much more. Whether you are self-employed, unemployed, or other, we have the knowledge and tools to find the right health plan for you or your family's needs!

We pride ourselves in offering world-class customer service, by providing the best insurance solutions for your unique situation. Our team handles all of the paperwork and correspondances with the insurance carriers. So, if you have an insurance related question, you can call us directly and we'll be happy to assist.

We also understand that your time is valuable, so our streamlined application process is quick, painless, and efficient. Best of all, the entire process is conducted over the phone and via email for added convenience.

Lastly, we only work with the industries’ highest rated insurance carriers, and there is no cost to work with us. We, like all other insurance agents, are compensated by the insurance carriers directly, and the rates are fixed among all agents. We encourage you to contact us today, and find out why we are your top choice for all of your health related insurance needs. Check out our reviews online at https://g.page/Heartland-Health-Insurance!

#Health Insurance#Dental Insurance#Vision Insurance#Critical Illness Insurance#Medicare Supplements#Accident Supplement Insurance#Retirement Planning#Investment Products#Life Insurance

1 note

·

View note

Text

How to Enroll in AARP United Healthcare Medicare Supplement Plans

Understanding Medicare Supplement Plans

Before delving into the enrollment process, it's essential to understand the basics of Medicare Supplement Plans. Also known as Medigap plans, these policies are offered by private insurance companies to fill the gaps in Original Medicare coverage. While Original Medicare provides significant healthcare coverage, it doesn't cover all expenses, leaving beneficiaries responsible for out-of-pocket costs such as deductibles, copayments, and coinsurance. Medigap plans help cover these costs, providing additional financial protection and peace of mind.

Assessing Your Healthcare Needs

The first step in enrolling in an AARP United Healthcare Medicare Supplement Plan is to assess your healthcare needs. Consider the following factors:

Current Health Status: Evaluate your current health status, including any ongoing medical conditions or anticipated healthcare needs.

Financial Situation: Assess your budget and determine how much you can afford to spend on monthly premiums and out-of-pocket costs.

Coverage Preferences: Consider the type of coverage you need, such as coverage for deductibles, copayments, and coinsurance, as well as any additional benefits like prescription drug coverage or vision care.

Provider Network: Determine if your preferred healthcare providers, including doctors, hospitals, and specialists, accept the AARP United Healthcare Medicare Supplement Plan you're considering.

Researching AARP United Healthcare Medicare Supplement Plans

Once you've assessed your healthcare needs, research the AARP United Healthcare Medicare Supplement Plans available in your area. Consider the following aspects:

Plan Options: AARP United Healthcare offers a range of Medicare Supplement Plans, each providing different levels of coverage. Compare the benefits and costs of each plan to determine which one best meets your needs.

Coverage Benefits: Review the coverage benefits offered by each plan, including coverage for deductibles, copayments, coinsurance, and any additional benefits such as prescription drug coverage or preventive care.

Premiums and Cost-sharing: Compare the monthly premiums, deductibles, and out-of-pocket costs of each plan to ensure that they fit within your budget.

Provider Network: Check if your preferred healthcare providers participate in the network associated with the AARP United Healthcare Medicare Supplement Plan you're considering. Inquire about any restrictions or limitations regarding provider choice.

Enrolling in AARP United Healthcare Medicare Supplement Plans

Once you've chosen an AARP United Healthcare Medicare Supplement Plan that meets your needs, you can proceed with the enrollment process. Here's how to enroll:

Eligibility: To enroll in a Medicare Supplement Plan, you must be enrolled in Medicare Part A and Part B. Most beneficiaries become eligible for Medicare when they turn 65, although some may qualify earlier due to disability or certain medical conditions.

Enrollment Period: The best time to enroll in a Medicare Supplement Plan is during the Medigap Open Enrollment Period, which begins on the first day of the month in which you're both 65 or older and enrolled in Medicare Part B. During this six-month period, you have guaranteed issue rights, meaning you can enroll in any Medigap plan offered in your state without medical underwriting.

Enrollment Options: There are several ways to enroll in an AARP United Healthcare Medicare Supplement Plan:

Online: Visit the AARP United Healthcare website or the Medicare website to enroll online. Follow the prompts to select your desired plan and complete the enrollment process electronically.

By Phone: Contact AARP United Healthcare's customer service representatives by phone and speak with a licensed agent who can assist you with the enrollment process and answer any questions you may have.

By Mail: If you prefer to enroll by mail, you can request an enrollment kit from AARP United Healthcare and complete the necessary forms. Mail the completed forms back to the address provided.

Provide Required Information: When enrolling in an AARP United Healthcare Medicare Supplement Plan, you'll need to provide certain information, including:

Personal Information: Your full name, date of birth, Social Security number, and contact details.

Medicare Information: Your Medicare card number and the date your Medicare coverage started.

Enrollment Preferences: The AARP United Healthcare Medicare Supplement Plan you wish to enroll in and any additional coverage options you may need, such as prescription drug coverage or supplemental benefits.

Review and Confirm: Before finalizing your enrollment, carefully review all the information you've provided to ensure its accuracy. Confirm your enrollment selections and agree to the terms and conditions of the plan.

Conclusion

Enrolling in an AARP United Healthcare Medicare Supplement Plan requires careful consideration of your healthcare needs, budget, and coverage preferences. By assessing your needs, researching plan options, and understanding the enrollment process, you can make an informed decision and select the plan that best meets your requirements. Whether you choose to enroll online, by phone, or by mail, AARP United Healthcare's Medicare Supplement Plans are designed to provide comprehensive coverage and peace of mind for Medicare beneficiaries.

0 notes

Text

How Medicare Supplement Companies Are Changing The Healthcare Market?

Medicare Supplement companies, also known as Medigap insurers, are significantly transforming the healthcare market in several key ways. These changes are largely driven by demographic shifts, regulatory changes, technological advancements, and evolving consumer preferences.

Expanding Access and Affordability: Medicare Supplement plans are designed to fill the gaps in coverage left by Original Medicare (Parts A and B), such as copayments, coinsurance, and deductibles. By offering these plans, companies help reduce out-of-pocket costs for beneficiaries, making healthcare more accessible and affordable for millions of seniors. This financial security allows more individuals to seek necessary medical care without the fear of overwhelming expenses, promoting overall better health outcomes.

Increasing Competition and Innovation: The rise of Medicare Supplement companies has intensified competition in the healthcare market. To attract and retain customers, these companies are continuously innovating. This includes offering additional benefits beyond the standard Medigap plans, such as vision, dental, and hearing care, wellness programs, and even gym memberships. These enhancements not only make their plans more attractive but also encourage preventative care and healthier lifestyles among seniors.

Enhancing Customer Experience through Technology: Technological advancements have enabled Medicare Supplement companies to significantly enhance the customer experience. Many insurers are investing in digital tools and platforms that simplify plan selection, enrollment, and management. Online portals and mobile apps allow beneficiaries to easily compare plans, access policy information, file claims, and contact customer service. Additionally, telemedicine services have become more prevalent, providing convenient access to healthcare professionals without the need for in-person visits. These innovations improve efficiency, reduce administrative burdens, and offer greater convenience to policyholders.

Responding to Regulatory Changes: Medicare Supplement companies must navigate a complex and evolving regulatory landscape. Recent regulatory changes, such as the phasing out of Plans C and F for new enrollees as of 2020, have prompted insurers to adapt their offerings. Companies are developing new plans and adjusting existing ones to comply with regulations while still meeting consumer needs. This adaptability ensures that they remain competitive and compliant, thereby sustaining their market presence.

Promoting Preventive Care and Chronic Disease Management: Medicare Supplement plans increasingly emphasize preventive care and chronic disease management. Insurers are incorporating benefits that encourage regular health screenings, vaccinations, and routine check-ups. Chronic disease management programs, which provide support for conditions like diabetes, hypertension, and heart disease, are also becoming more common. By focusing on prevention and early intervention, these programs help reduce hospital admissions and long-term healthcare costs, leading to better health outcomes for beneficiaries.

Addressing Diverse Needs and Preferences: The diversity of the senior population requires Medicare Supplement companies to offer a variety of plans that cater to different health needs and financial situations. This customization includes plans with varying levels of coverage and premiums, enabling beneficiaries to choose options that best fit their circumstances. Insurers are also focusing on underserved communities, ensuring that all seniors, regardless of their background or location, have access to supplemental coverage.

Medicare Supplement companies are playing a crucial role in shaping the future of healthcare for seniors. By enhancing access and affordability, driving competition and innovation, leveraging technology, adapting to regulatory changes, promoting preventive care, and addressing diverse needs, these companies are not only transforming the market but also significantly improving the healthcare experience and outcomes for millions of beneficiaries. Their continued evolution will be essential in meeting the growing and changing demands of an aging population.

0 notes

Text

How Medicare Supplement Companies Are Revolutionizing Access To Healthcare?

Medicare supplement companies are revolutionizing access to healthcare by providing beneficiaries with additional coverage options beyond Original Medicare. These plans offer flexibility, allowing individuals to choose the coverage that best suits their needs, including options for prescription drug coverage, vision, dental, and more. By filling gaps in coverage and offering expanded benefits, Medicare supplement companies are empowering individuals to access a broader range of healthcare services, leading to improved health outcomes and greater peace of mind.

0 notes

Text

Boost Male Fertility with These Effective Supplements

Male fertility supplements can enhance reproductive health by improving sperm quality and count. Key ingredients often include antioxidants like vitamin C, vitamin E, zinc, and folic acid. Omega-3 fatty acids, Coenzyme Q10, and L-carnitine also support sperm motility and overall fertility. Consult a healthcare provider to determine the best supplement for individual needs. more info

Call:-833-966-2614

Mail : [email protected]

0 notes

Text

HealthMarkets Insurance - Scott Gulledge

Explore hassle-free health insurance and Medicare quotes online with Scott Gulledge. Easily compare affordable plans for individuals, families, seniors, and small businesses. Find coverage that fits your needs and budget effortlessly. Applying is simple, ensuring access to the healthcare solutions you need. Trust Scott Gulledge for streamlined searches across Life and Health Insurance, Employee Benefits, and Financial Services plans. Apply now for comprehensive coverage.

Address: 18434 N 99th Ave Ste 7, Sun City, AZ 85373

Tel No: +1 (602)-909-8424

Website: https://www.sgulledge.com/

#Medicare Supplement Plans Peoria AZ#Medicare Plan C Coverage Peoria AZ#Medicare Supplement Peoria AZ#Medicare Part C Plans Peoria AZ

0 notes

Text

Senior Source List: Your Trusted Source for Medicare Supplement Leads to Boost Your Business

In the competitive world of insurance marketing, finding the right medicare leads can often be the most challenging part of the job, especially within the senior market. That's where the Senior Source List comes in.

With a solid track record of over 30 years, we specialize in providing insurance marketers with high-quality, customizable Medicare supplement leads. By focusing on individuals who are turning 65, we offer a streamlined pathway to grow your business effectively.

The Importance of Quality Leads in Medicare Supplement Insurance Marketing

In the competitive landscape of Medicare Supplement Insurance marketing, the value of quality leads cannot be overstressed. High-quality medicare leads are the lifeline for insurance marketers, acting as a bridge to connect with potential clients who are genuinely interested in Medicare supplement plans.

These medicare advantages boost the efficiency of marketing campaigns and significantly increase the conversion rate, making them indispensable for achieving business growth and success in the senior market segment.

Quality medicare supplement leads ensure marketing efforts are directed towards individuals in the decision-making phase, making every outreach effort count.

How Senior Source List Distinguishes Itself in the Market

Senior Source List stands out from the competition by offering unparalleled data accuracy and customization options for Medicare supplement leads.

Our unique compilation process utilizes more sources than any other provider, ensuring a broad and reliable dataset. Additionally, our monthly processing against the National Change of Address (NCOA®) file and CASS certification exemplify our commitment to data precision.

This meticulous attention to detail means insurance marketers can confidently target their campaigns with the most current and relevant information available, greatly enhancing the potential for successful client connections.

Understanding the negative impacts of duplicate data can further highlight the importance of our rigorous data verification processes.

Customizable Demographic Selections for Targeted Marketing

Unlocking the potential of targeted marketing has always been challenging, thanks to Senior Source List's customizable demographic selections.

Our clients can refine their search for Medicare supplement leads using various criteria, including age, location, income level, homeowner status, and more. This granular approach ensures that your marketing efforts reach the target demographic you aim to connect with, maximizing campaign effectiveness and lead conversion.

Popular Selections for Enhancing Campaign Efficiency

Leveraging our popular selections can significantly increase the efficiency of your marketing campaigns. By incorporating filters like Telephone, Emails, Date of Birth, and Approaching Eligibility, you can directly communicate with your target demographic.

Tailoring campaigns based on Ethnicity, Homeowners, Income, and Lifestyle selections allows for more personalized and engaging outreach. For example, the 'Lifestyle' selection can help you target active seniors who may be more interested in Medicare Advantage plans.

This customization ensures that your efforts resonate well with prospective clients, increasing the likelihood of lead conversion and streamlining your marketing strategies for better outcomes.

These selections help you reach the right audience at the right time, making your marketing efforts more effective and efficient.

The Advantages of Choosing Senior Source List for Medicare Advantage Leads

Choosing a Senior Source List for your Medicare Advantage leads provides an unparalleled advantage. Our dedication to compiling the most comprehensive and up-to-date database includes a rigorous data verification process.

This process involves cross-referencing multiple sources, conducting regular data audits, and verifying data with the individuals themselves, ensuring that you access a vast pool of potential clients who are not just looking for Medicare supplements but are specifically interested in Medicare Advantage plans.

Targeting this niche group can make your marketing efforts more focused and yield higher conversions. Benefit from our data verification processes and customization options to pinpoint your ideal demographic, setting the stage for more effective outreach and engagement strategies tailored to the unique needs of Medicare Advantage seekers.

Getting Started with Senior Source List

Starting with the Senior Source List is simple and effective. We begin by understanding your unique business needs and then provide a curated list of leads that align with your marketing objectives.

With our partnership, you gain more than just access to information—you gain a strategic ally in the competitive world of Medicare supplement insurance marketing.

Contact us today to discover how we can transform your business approach and connect you with the right audience. Let's make your marketing efforts more productive and targeted than ever before!

0 notes

Text

youtube

GG Marketing DBA / Healthcare Solutions is your trusted partner in navigating the complex world of Medicare Supplement Plans in Amory MS. As you approach retirement or are already enrolled in Medicare, understanding your options for supplemental coverage is crucial for your financial well-being and peace of mind.

GG Marketing DBA / Healthcare Solutions

407A North Front St. Amory, MS 38821

(662) 257–1006

My Official Website: https://ggmarketing.org/

Google Plus Listing: https://www.google.com/maps?cid=11587535936286488134

Service We Offer:

medicare supplement insurance

Health Insurance

Life Insurance

term life insurance

disability insurance

dental insurance

final expense insurance

universal insurance

critical illness insurance

cancer insurance

in-home care insurance

short-term medical insurance

Follow Us On:

Twitter: https://twitter.com/GGMarketingDBA

Pinterest: https://www.pinterest.com/GGMarketingDBA/

#medicare supplement plans amory ms#medicare supplemental insurance amory ms#medicare supplement insurance amory ms#medicare supplement insurance brokers near me#independent medicare supplement insurance agents amory ms#Youtube

0 notes

Text

Facts About Medicare Supplements in Medina and Brunswick, OH

It is commonplace to consider enrolling in Medicare when one reaches the age of 65. This Federal healthcare plan has multiple advantages for elderly citizens with limited income prospects. Unfortunately, the coverage is pretty limited, with many Medicare users finding many aspects not covered by the original Medicare Plans. No worries! Such individuals can always buy Medicare supplements in Medina and Brunswick, OH.

Alternatively known as Medigap, the plan(s) address the areas that the original Medicare Plans omit. The plans are provided by private companies that enable the people enrolled in Medicare Plan A and Medicare Plan B to cover the gaps perfectly. One can expect to obtain assistance with the following by enrolling in Medigap:

· Co-payment

· Coinsurance

· Deductibles

Almost all states across the nation provide ten standardized Medicare Supplement plans. The difference between plans is related to the terms & conditions of the coverage, premium sums, and the requirements for sharing the costs

With each Plan named by a letter of the alphabet, A through N, Medicare supplement plans usually cover the following:-

· Plan A- Provides the basic benefits

· Plan B- Provides basic benefits plus deductible for original Medicare Plan A

· Plan M covers some out-of-pocket expenses for Medicare members, including co-pays, coinsurance, and deductibles. It is similar to the original Medicare Plan D but may be more competitively priced

· Plan D- It covers some out-of-pocket expenses for individuals enrolled in Original Medicare

· Plan G- It covers coinsurance, co-payments, and deductibles that aren't covered under Medicare Part A and Part B, with the plan being comparatively more expensive than other Medigap Plans

· Plan N- Provides coverage at low premiums but comes with higher co-pays

· Plan K & Plan L are also offered at lower premiums, but the coverage is not extensive and may only be partial

· Plan C & Plan F- These plans had been sold before, but people who hope to enroll for Medigap today will no longer be able to enroll in these plans

Exclusions

While Medicare supplement plans are believed to cover all gaps not provided by original Medicare, there are some exceptions, too. One cannot hope to be covered for the following by enrolling in a Medigap plan:

· Part B deductible- Not provided to new members

· Prescription drugs

· Long-term unskilled care

· Dental care

· Cost of Hearing Aid

· Vision care

· Private Nursing

The Cost of Enrolling in Medicare Supplement

The prospect of paying for Medigap in addition to original Medicare plans may be a trifle expensive, but the cost will surely be worth the money. The final expense will depend on multiple factors such as age, gender, general health condition, location, and use of tobacco. Monthly premiums for basic benefits may be low, but the expense will increase according to age and living in high-cost areas.

It is essential to have one's assets insured. Buying the right one requires requesting the concerned carrier for home insurance quotes in Medina and Brunswick, OH, which allows one to find an affordable way to avoid financial risks in the future.

0 notes