#Hongkong & Shanghai Banking Corporation

Text

Further reading:

HKFP: Leader of Hong Kong opposition party fined HK$1,000 for collecting money in public place without permit, March 17, 2023

HKFP: HSBC terminates bank accounts of Hong Kong opposition party League of Social Democrats without giving reason, June 2, 2023

#Hongkong Shanghai Banking Corporation#Dickson Chau#League of Social Democrats#Hong Kong#politics#political repression#Chan Po Ying#National Security Department#hong kong national security law#Hang Seng Bank#Bank of China#Raphael Wong#PayPal#Leung Kwok Hung#hong kong free press

0 notes

Text

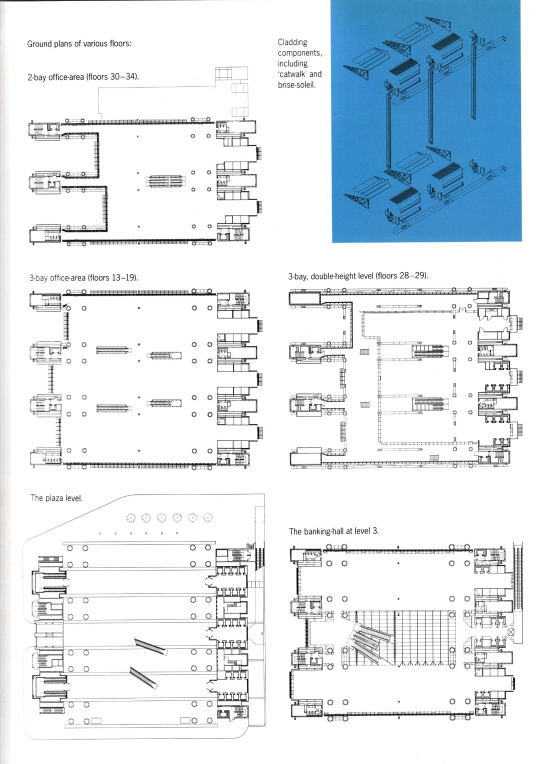

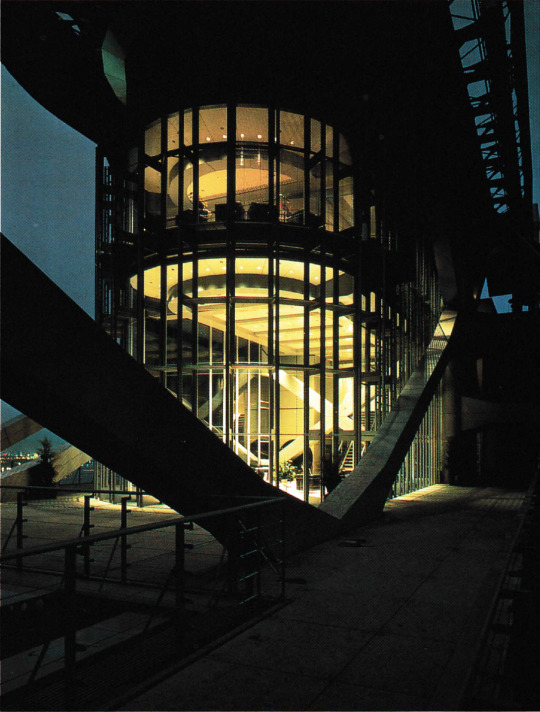

Hongkong & Shanghai Banking Corporation (HSBC) Headquarters, a high-tech architecture building standing in Hong Kong. Designed by Norman Foster. Project commenced in 1979 and was completed in 1986.

Scan

#scan#as some of you pointed out#“evil building”#norman foster#architecture#Hongkong & Shanghai Banking Corporation#high-tech#office#hong kong

294 notes

·

View notes

Photo

Hongkong & Shanghai Banking Corporation (HSBC) Headquarters, a high-tech architecture building standing in Hong Kong. Designed by Norman Foster. Project commenced in 1979 and was completed in 1986.

4 notes

·

View notes

Photo

Hongkong & Shanghai Banking Corporation Headquarters. Designed by Sir Norman Foster 1979 - 1983, completed in 1986.

106 notes

·

View notes

Text

HSBC remains committed to investing in the Philippines and supporting the government’s economic agenda

Recently the huge international financial firm The Hongkong and Shanghai Banking Corporation (HSBC) confirmed its commitment to investing in the Philippines and supporting the government’s economic agenda which President Ferdinand “Bongbong” Marcos, Jr., welcomed, according to a Philippine News Agency (PNA) news article.

To put things in perspective, posted below is an excerpt from the PNA news…

View On WordPress

#Asia#banking#Blog#blogging#Bongbong Marcos#business#business news#capitalism#Carlo Carrasco#commerce#economics#economy#Economy of the Philippines#Ferdinand Marcos#finance#geek#governance#HSBC#Inspiration#investing#investments#investors#jobs#Marcos#Metro Manila#money#news#Philippine economy#Philippine News Agency (PNA)#Philippines

0 notes

Text

HSBC Holdings plc (Chinese: 滙豐), originally The Hongkong and Shanghai Banking Corporation, and known locally as HongkongBank in Hong Kong

0 notes

Text

Case Digest (NewCivilCode)

G. R. No. L-7817 October 31, 1956

ALFREDO M. VELAYO, in his capacity as Assignee of the insolvent COMMERCIAL AIR LINES INC. (CALI),

Plaintiff-Appellant,

vs.

SHELL COMPANY OF THE PHILIPPINE ISLAND, LTD.,

Defendant-Appellee

FELIX, J.:

A moral wrong or injury, even if it does not constitute a violation of a statute law, should be compensated by damages. In this case, the defendant clearly acted in bad faith when it schemed and effected the attachment of the C-54 plane of its debtor CALI by assigning its credit to its sister company in the US. Therefore, the defendant is liable to pay damages.

FACTS:

In 1948, the Commercial Air Lines, Inc., (CALI), is a corporation duly organized and existing in accordance with the Philippines laws, with offices in the City of Manila and previously engaged in air transportation business. The Shell Company of the P. I., Ltd., defendant-appellee, a corporation organized under the laws of England and duly licensed to do business in the Philippines, with principal offices at the Hongkong and Shanghai Bank building in the City of Manila.

The defendant was a supplier of fuel since the start of CALI’s operations, Mr. Desmond Fitzgerald, its Credit Manager who extended credit to CALI, was in charge of the collection thereof. As of August, 1948, the books of the Defendant showed that CALI had a balance of P170,162.58, and as partial settlement of their accounts, Mr. Alfonso Sycip, CALI’s President of the Board of Directors offered to Mr. Fitzgerald, the CALI’s Douglas C-54 plane, located in California. However, defendant declined as it thought that CALI had sufficient money to pay its debt.

CALI called upon informal meeting to its creditors and informed them that CALI was in a state of insolvency and had to stop operation. In that meeting, the creditors agreed to appoint representatives to a working committee that would determine the order of preference as to how each creditor should be paid. They also agreed not to file suit against CALI but CALI did reserve that it will file insolvency proceedings should its assets be not enough to pay them up.

Shell Company was represented by a certain Fitzgerald to the three man working committee. Later, the working committee convened to discuss how CALI’s asset should be divided amongst the creditors but while such was pending, Fitzgerald sent a telegraph message to Shell USA advising the latter that Shell Philippines is assigning its credit to Shell USA in the amount of $79k, thereby effectively collecting almost all if not the entire indebtedness of CALI to Shell Philippines. Shell USA got wind of the fact that CALI has a C-54 plane is California and so Shell USA petitioned before a California court to have the plane be the subject of a writ of attachment which was granted.

Meanwhile, the stockholders of CALI were unaware of the assignment of credit made by Shell Philippines to Shell USA and they went on to approve the sale of CALI’s asset to the Philippine Airlines. In September 1948, the other creditors learned of the assignment made by Shell. This prompted these other creditors to file their own complaint of attachment against CALI’s assets. CALI then filed for insolvency proceedings to protect its assets in the Philippines from being attached. Alfredo Velayo’s appointment as CALI’s assignee was approved in lieu of the insolvency proceeding. In order for him to recover the C-54 plane in California, it filed for a writ of injunction against Shell Philippines in order for the latter to restrain Shell USA from proceeding with the attachment and in the alternative that judgment be awarded in favor of CALI for damages double the amount of the C-54 plane. The C-54 planewas not recovered. Shell Company argued it is not liable for damages because there is nothing in the law which prohibits a company from assigning its credit, it being a common practice.

ISSUE:

Whether or not the defendant Shell Company of the P. I., Ltd., taking advantage of its knowledge of the existence of CALI’s airplane C-54 at the State of California, U. S. A. and their financial situation.

Whether or not Defendant may be made under the law to answer for the damages and if so, what should be the amount of such damages.

RULING:

YES. The Defendant took advantage of its knowledge of the existence of Airplane C-54 at the California and financial situation of the CALI.

Because of its action assigning the credit in favor of a sister Shell Company in the USA, and the court action involving the plane has cause delay on the sale of the plane, thus the other creditors have suffered because they could not be paid. The defendant did not show good faith, and honesty. Art 19. of the Civil Code said, “Any person must, in the exercise of his rights and in the performances of his duties, act with justice, give everyone his due and observe honesty and good faith".

It may be said that this article only contains a mere declarations of principles and while such statement may be is essentially correct, yet we find that such declaration is implemented by Article 21 and sequence of the same Chapter which prescribe the following: "Art. 21. Any person who wilfully causes loss or injury to another in a manner that is contrary to morals, good customs or public policy shall compensate the latter for the damage".

Now, Article 23 of the Civil Code goes as far as to provide that: "Even if an act or event causing damage to another’s property was not due to the fault or negligence of the defendant, the latter shall be liable for indemnity if through the act or event he was benefited." It supports the argument that even assuming Shell is not liable for taking advantage of situation of the airlines, it was nevertheless benefitted when its assigned credit to its sister company in the U. S. The Defendant should be liable for indemnity for acts it committed in bad faith and with betrayal of confidence. Shell was ordered to pay damages at double the value of the airplane.

0 notes

Text

Crypto Assets Guy, a prominent voice in the digital currency landscape, ignited discussions today with a tweet championing XRP. Drawing upon a mix of legal stances, technological advancements, and market dynamics, he crafted a detailed discourse on why he believes the token’s future is luminous.

Bullish On XRP: Reasons #1 And #2

The first reason to be bullish on the cryptocurrency is the legal standing in the US “Only digital asset in the US with legal clarity,” he began, further elaborating, that it’s the “only digital asset officially declared not a security.” His statements allude to the unique position of XRP in the crypto market. At the moment, only Bitcoin (BTC) and XRP have definitive legal statuses in the United States.

Bitcoin has been officially recognized as a non-security by the US Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC). In contrast, XRP’s status comes from Judge Analisa Torres’ summary judgment in the Ripple vs. SEC litigation. Importantly, in her recent interlocutory appeal ruling, Judge Torres clarified that her decision was solely pertinent to Ripple and shouldn’t be generalized to the wider cryptocurrency market.

Reasons #3 To #8

Diving into the technological aspects, he underscored the ledger’s efficiency: “Faster, cheaper and greener than BTC and ETH.” With transactions on the XRP Ledger settling in just 3–5 seconds and a TPS rate of 1,500, it’s a notable rival to leading cryptocurrencies. And while Ethereum is known for its gas fees, XRP emerges as a more user-friendly option. “No gas fees. No delays. No bullshit,” he quipped.

In terms of security, he was unequivocal: “The XRP ledger is the most secure blockchain. It has never been hacked.” He lauded the XUMM wallet, contrasting it favorably against its counterparts: “Extremely easy to use (XUMM is better than Metamask from every angle).”

Touching upon XRP’s application, he pointed out its efficacy in international transactions: “The most effective way for cross-border payments is with XRP.” Ripple’s partnerships further reinforced his bullish stance: “Partnerships with the most powerful banks and corporations in the world.”

According to the crypto trader thewallstreetbull, Ripple boasts a partnership with at least 141 entities, some of which are: Banco Santander, Bank Of America, HSBC (The Hongkong And Shanghai Banking Corporation Limited), Standard Chartered Bank, SBI Holdings, MUFG (Mizuho Financial Group), UBS, Barclays, Credit Suisse and the Bank of England.

#XRP #Ripple Partnerships let this sink in 💰🤌🏻🤌🏻

Banco Santander⁰Bank Of Indonesia⁰Bank Of Thailand⁰Moneygram⁰Cambridge Global Holdings⁰SBI Holdings⁰BBVA Banco Bilbao Vizcaya Argentaria⁰SCB Siam Commercial Bank⁰Zip Remit⁰InstaRem⁰IndusInd⁰Itau Unibanco⁰Beetech… pic.twitter.com/EOPDSmuhcA

— thewallstreetbull💸 (@thewallstbulloz) June 29, 2023

More Reasons

Highlighting the uniqueness of XRP, he stated, “It has a use case like no other digital asset. The adoption will be insane.” In his praises for Ripple’s team, he remarked, “Ripple has an amazing team. Defeated the SEC twice. Something never seen before.”

Moreover, the analyst paints Ripple as a paragon of transparency: “Ripple is literally the most transparent digital asset company.” And while the decentralization of XRP is a topic of debate, he asserted, “Fully decentralized (do your research).” Addressing its market performance, he hinted at its untapped potential: “It hasn’t reached its old ATH of $3.70 yet.”

On the market dynamics, he predicted an influx of liquidity: “A lot of liquidity is incoming. Numerous big players are ready to hit the buy button.” The thesis is particularly explosive. However, it is not known which major “players” the analyst is referring to.

He may be referring to the rumor that Bank of America could use Ripple’s technologies once the court case against the SEC is completely over. The rumor has been around for a while. Most recently, the Linqto CEO reported this during the Ripple Swell conference in 2022.

Impact Of The Broader Crypto Ecosystem

The broader crypto market’s future, the Crypto Assets Guy believes, is another reason to be bullish as it is intertwined with XRP’s success. “The next crypto bullrun is around the corner. It always starts months/weeks before the BTC halving (April 25, 2024),” he said.

The conspiracy theory, ETH Gate, also found a mention: “Many ETH whales shifting to XRP because of the ETHGate corruption.” He also shared his perspective on the shifting dynamics between the stock market and cryptocurrencies: “The stock market is going down because of too many world conflicts. Masses moving from stocks to crypto (safe haven).”

The 18th reason to be bullish according to the analyst is the upcoming approval of spot ETFs. He remarked, “BTC spot ETFs should get approved within the next 5 months. Which is super bullish for the whole space.”

Regarding the Ripple litigation, he speculated on a potential resolution before the upcoming trial: “Possible complete settlement Ripple-SEC before April 19, 2024 (like Judge Torres stated).” The trial between Ripple and the SEC is set to commence on April 19. There’s been considerable buzz lately suggesting a possible settlement between Ripple and the SEC. At the very least, Judge Torres ordered both parties to participate in a settlement hearing beforehand.

Lastly, celebrating the spirit of the community, he declared, “The XRP community is the most loyal, vocal, and strongest crypto community.”

At press time, XRP traded at $0.4961.

XRP price, 1-day chart | Source: XRPUSD on TradingView.com

0 notes

Text

What is Atm and how does Atm works?

Introduction:

ATM: Automated Teller Machine

ATM stands for Automated Teller Machine. ATM is an electro-mechanical machine that is used for making financial transactions from a bank account. These machines are used to withdraw money from personal bank accounts.

Basic ATM Parts

The ATM is a user-friendly machine. It features various input and output devices to enable people easily withdraw or deposit money. The basic input and output devices of an ATM are given below:

Input Devices:

· Card Reader: This input device reads the data of the card, which is stored in the magnetic strip on the back side of the ATM card. When the card is swiped or inserted into the given space, the card reader captures the account details and passes them to the server. Based on account details and the commands received from the user, the server allows the cash dispenser to dispense the cash.

· Keypad: It helps the user to provide the details asked by the machine-like personal identification number, amount of cash, receipt required or not, etc. The PIN number is sent in encrypted form to the server.

Output Devices:

· Speaker: It is provided in the ATM to produce the audio feedback when a key is pressed.

· Display Screen: It displays the transaction-related information on the screen. It shows the steps of cash withdrawal one by one in sequence. It can be a CRT screen or an LCD screen.

· Receipt Printer: It provides you with the receipt with details of transactions printed on it. It tells you the date and time of the transaction, the withdrawal amount, the balance, etc.

· Cash Dispenser: It is the main output device of the ATM as it dispenses the cash. The high-precision sensors provided in the ATM allow the cash dispenser to dispense the correct amount of cash as required by the user.

How ATM works

What ATM does

Now a day, ATMs have a lot of functionalities along with their basic use of cash dispensing. Some of them are:

· Cash and cheque deposit

· Fund transfer

· Cash withdrawal and balance inquiry

· PIN change and mini statement

· Bill payments and mobile recharge etc.

· The first ATM was used to dispense cash for customers by a Chemical bank in New York (USA) in 1969.

ATM deposits are also growing in popularity. If their bank permits it, account customers can deposit money and checks.

Important/Interesting Facts about ATM

Inventor of ATM: John Shepherd Barron.

· ATM Pin Number: John Shepherd Barron thought to keep a 6 digits PIN for the ATM, but it was not easy for his wife to remember a 6 digits pin, so he decided to prepare a 4-digit ATP PIN.

· World’s first floating ATM: State Bank of India (Kerala).

· First ATM in India: Installed by HSBC (Hongkong and Shanghai Banking Corporation) in 1987.

· First ATM in the World: It was installed on 27 June 1967, at the Barclays Bank of London.

· First Person to use ATM: The famous comedy actor Reg Varney was the first person to withdraw cash from the ATM.

· ATM without an Account: In Romania, which is a European country, one can withdraw money from an ATM without having a bank account.

· Biometric ATM: Biometric ATM is used in Brazil. As the name suggests, the user is required to scan his or her fingers at these ATMs before withdrawing money.

· World’s Highest ATM: It is installed in Nathu-La mainly for army personnel. Its height is 14,300 feet above sea level and is operated by the Union Bank of India.

Limits on ATM withdrawals

Banks have restrictions on the amount of money you can withdraw from an ATM each day, as we have already indicated. Put your hand or some other body part as a cover so nobody can see you type your PIN. This can help prevent fraud. Additionally, since each ATM can only hold a certain amount of money, capping the amount per withdrawal enables the bank to control the movement of cash.

Place and Security

Using ATMs that are situated in well-lit public areas is one way to prevent being a victim of crime when doing so. When you get your money, do not count it at the ATM; instead, wait until you are in a more private setting, like your car.

Conclusion :

The ATM is very important nowadays to use it is time-saving and u can withdraw the money as per your requirement. ATM can give you instant money as per your requirement.

0 notes

Text

Disclosing the Finest Banks within the Joined together Kingdom: Pioneers in Monetary Brilliance

The Joined together Kingdom gloats a strong and competitive keeping money division, with a wealthy history of eminent money related educate. From conventional stalwarts to computerized disruptors, the UK offers a differing extend of banks that give uncommon administrations and imaginative arrangements. In this article, we explore some of the most excellent banks within the Joined together Kingdom, known for their unwavering quality, customer-centric approach, and commitment to brilliance.

HSBC

HSBC, the Hongkong and Shanghai Managing an account Enterprise, may be a worldwide keeping money monster with a solid nearness within the Joined together Kingdom. With a legacy traversing over 150 a long time, HSBC offers a comprehensive suite of keeping money and budgetary administrations to people and businesses. Known for its universal reach and mastery, HSBC gives custom fitted arrangements, counting individual keeping money, riches administration, and corporate managing an account. The bank’s broad organize of branches and progressed advanced platforms ensures availability and comfort for its clients. HSBC’s commitment to supportability and responsible managing an account hones further solidifies its position as one of the beat banks within the UK.

Barclays

Barclays, a British multinational bank, includes a conspicuous nearness within the UK’s managing an account scene. With a history dating back to 1690, Barclays combines convention with advancement to provide remarkable monetary administrations. The bank offers a wide extend of items, counting individual managing an account, commerce keeping money, speculation arrangements, and corporate keeping money. Barclays is known for its mechanical headways, apparent in its user-friendly computerized platforms and versatile managing an account app. Besides, the bank’s commitment to corporate social obligation and community improvement activities grandstands its devotion to making a positive affect in society.

Lloyds Bank

Lloyds Bank, one of the oldest banks within the UK, includes a solid notoriety for unwavering quality and customer-focused administrations. With roots following back to 1765, Lloyds Bank gives a comprehensive run of managing an account arrangements for people, businesses, and corporate clients. The bank’s accentuation on computerized advancement is obvious through its online keeping money stage and versatile app, empowering clients to oversee their finances with ease. Lloyds Bank’s commitment to client fulfillment, illustrated by its proactive approach to settling issues, has earned it a faithful client base and a unmistakable position among the most excellent banks within the UK.

NatWest

NatWest, a backup of the Illustrious Bank of Scotland Bunch, is one of the driving retail and commercial banks within the Joined together Kingdom. Known for its strong customer benefit, NatWest offers a wide run of budgetary administrations, counting individual managing an account, contracts, ventures, and trade keeping money arrangements. The bank has grasped computerized change, giving clients with helpful online and versatile keeping money choices. NatWest’s commitment to inclusivity and differing qualities is reflected in its activities pointed at supporting little businesses and cultivating money related instruction. This customer-centric approach sets NatWest separated as a trusted and dependable keeping money accomplice.

Monzo

Monzo may be a computerized bank that has picked up critical ubiquity forits imaginative approach and user-friendly mobile banking app. With a solid center on rearranging keeping money, Monzo offers straightforward and natural money related administrations. The bank’s app gives real-time exchange notices, budgeting devices, and moment installment highlights. Monzo’s commitment to client criticism and persistent advancement has developed a steadfast community of clients. As a advanced local bank, Monzo requests to tech-savvy people looking for a consistent and modern banking involvement, making it one of the finest banks for those grasping the computerized age.

Conclusion

The United Kingdom’s banking division is domestic to a large number of exceptional institutions. From the worldwide reach of HSBC to the mechanical headways of Barclays, the unwavering quality of Lloyds Bank, the client center of NatWest, and the development of Monzo, these banks epitomize the finest in UK managing an account. Whether catering to conventional or advanced inclinations, these banks reliably provide brilliance and endeavor to meet the differing needs of their clients.

0 notes

Text

Further reading:

HKFP: ‘No room for us’: Hong Kong District Councillors say overhaul of local bodies serves gov’t interests, not residents, May 21, 2023

HKFP: Hong Kong’s pro-democracy Civic Party votes to dissolve, May 27, 2023

HKFP: Explainer: A history of Hong Kong’s pro-democracy Civic Party, May 29, 2023

HKFP: Hong Kong tables District Council overhaul bill, accuses ex-councillors of ‘swindling’ votes in 2019 election, May 31, 2023

#hong kong free press#Hong Kong#politics#league of social democrats#Civic Party#Hongkong and Shanghai Banking Corporation#Dickson Chau#political repression#corporations#Chan Po Ying#hong kong national security law#national security department#police#Alan Leong#Margaret Ng#Stephen Char#Audrey Eu#elections#ErickTsang#Ma Ngok#Janet Ng#Osman Cheng#Paul Zimmerman

0 notes

Text

Master post: Hongkong & Shanghai Banking Corporation (HSBC) Headquarters, a high-tech architecture building standing in Hong Kong. Designed by Norman Foster. Project commenced in 1979 and was completed in 1986. In the first (very cyberpunk!) photo, you can also see the Lippo Centre and Bank of China Tower.

Scan

! for educational purposes !

#scan#master post#architecture#norman foster#hong kong#Hongkong & Shanghai Banking Corporation#high tech#cyberpunk#skyline#skyscraper

207 notes

·

View notes

Text

[Cập nhật] Lãi suất ngân hàng HSBC mới nhất. So sánh lãi suất ngân hàng hiện nay

Lãi suất là nhân tố quyết định khách hàng lựa chọn ngân hàng nào để quản lý tài chính. Hiện nay, lãi suất ngân hàng HSBC bao nhiêu? Hãy cùng giavang.com tìm hiểu thông qua bài viết dưới đây nhé!

HSBC là ngân hàng gì?

HSBC là tập đoàn tài chính đa quốc gia được thành lập vào năm 1865 với tên gọi đầy đủ là Hongkong and Shanghai Banking Corporation. Với mục tiêu chính là tạo thuận lợi cho các giao…

View On WordPress

0 notes

Text

Rbi ने एक बैंको पर लगाई ₹1,73,75,000/ की Penalty

Rbi ने एक बैंको पर लगाई ₹1,73,75,000/ की PenaltyRbi ने 3 बैंको पर लगाई PenaltyRBI imposes monetary penalty on The Trichur Urban Co-operative Bank Ltd., Thrissur, Kerala

₹2.00 lakh RBI imposes monetary penalty on The Hongkong and Shanghai Banking Corporation Limited

₹1,73,75,000/ RBI imposes monetary penalty on Bhilai Nagarik Sahakari Bank Maryadit, Bhilai (Chhattisgarh)

₹1.25 lakh Rbi बैंको पर पर पेनाल्टी लगाती रहती हैRbi ने ₹1,73,75,000/ की Penalty की penalty लगाई Please Share This web storyWhite Frame CornerWhite Frame CornerArrowShareOther storiesGreen LeafGreen LeafWavy Line

Read the full article

0 notes