#Natwest

Text

#uk#politics#ukpol#media#nigel farage#nazi#far right#coutts#natwest#shorting#hedge funds#gb news#poverty

40 notes

·

View notes

Text

Been following the horrific news of the British banking giant NatWest closing down thousands of people's bank accounts because of their political beliefs, and keeping dossiers on them. This has all come to light and become mainstream news because of it being done to Nigel Farage, the main proponent of Brexit, which the majority of the country voted for, so does not represent any particularly radical fringe politics or terrorist organizations or whatever.

Very heartening to see the progression of these three videos all put out in the course of one day, today:

youtube

youtube

youtube

22 notes

·

View notes

Text

🍎 Le grandi banche inglesi cedono al fascino di Bitcoin: tokenizzazione e blockchain in arrivo!

👼 Un nuovo paradigma per la finanza tradizionale?

🍎 Le tre grandi banche inglesi, Barclays, NatWest e HSBC, si preparano a rivoluzionare il panorama finanziario abbracciando la tecnologia blockchain e tokenizzando i loro prodotti. Questo storico passo, reso possibile dalla collaborazione con il progetto crypto SETL, rappresenta una svolta epocale che segna l'ingresso delle istituzioni tradizionali nel mondo decentralizzato delle criptovalute.

🍎 Quali sono i vantaggi di questa mossa?

🌟 Maggiore efficienza e trasparenza: la blockchain permette transazioni più veloci, sicure e tracciabili, riducendo i costi e la burocrazia.

🌟 Accessibilità democratica: la tokenizzazione rende i prodotti finanziari più accessibili a un pubblico più ampio, favorendo l'inclusione finanziaria.

🌟 Nuove opportunità di investimento: la tokenizzazione apre la porta a nuovi strumenti finanziari e strategie di investimento innovative.

🌟 Cosa significa questo per il futuro?

🌟 L'ingresso delle grandi banche nel mondo crypto è un segnale inequivocabile dell'affermazione di Bitcoin e delle criptovalute come asset legittimi e innovativi.

🌟 Non si tratta più di una tecnologia di nicchia, ma di un paradigma in grado di trasformare il sistema finanziario tradizionale.

Seguici sui nostri canali social ed unisciti al nostro gruppo Telegram:

https://t.me/Bitcoin_Report_Italia

#criptovalute#Cripto#halving#bitcoin#Tokenizzazione#btc#barclays bank#Barclays#NatWest#hsbc#bank#BitcoinReportItalia

0 notes

Text

The 51 year-old former senior manager at Natwest Gibraltar is accused of fraud and false accounting during her time at the bank dating back to between 2011 and 2017.

Gillian Balban has spent hours upon hours in the witness box responding to many of the accusations heard from other witnesses during the last eight weeks.

1 note

·

View note

Text

The Beauty Of London’s Windmill Street!

Windmill Street is a beautiful part of London best known for its incredible architecture, and the NatWest building shows the delicate attention to detail of London’s architectural landscape!

#shotoniphone #photography #london

View On WordPress

#Beautiful Destinations#iPhoneography#Landscape Photography#London#MN#NatWest#Photography#Shot on iPhone#Street#Travel#UK#United Kingdom#Windmill Street

0 notes

Text

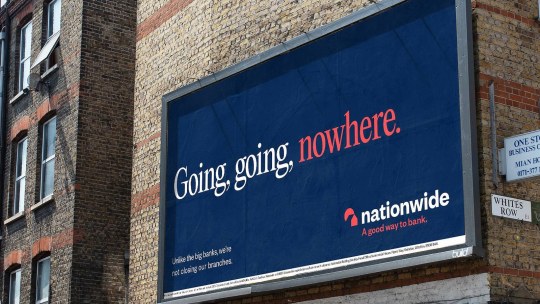

Nationwide

Another day another rebrand. This time it comes from building society, Nationwide. Taking a step into the modern digital world, Nationwide has revamped its look and feel. Simplifying their logo and iconography from a dated look and feel, they have replaced the serif font with a cleaner sans serif to compliment the lowercase wordmark. Whereas the serif is still being used outside the main wordmark. The circle and house icon have been changed into simple block shapes and negative space being used to create a 3D feel for the house.

One of the biggest talking points has been the colour scheme change. The red, blue and white have been kept the same but darker more toned-down shades of each. Just like the majority, it looks very much like NatWest. My initial thought was to have the two merged but they haven't. For me, the navy colour looks too similar to competitors and more corporate. I do like the rebrand however I would've preferred to see a blue more reflective of their original colour scheme.

0 notes

Text

Meanwhile, at the bank…….

0 notes

Text

NatWest and IBM Collaborate on Gen AI to Improve Customer Experience

NatWest and IBM collaboration

Today, NatWest and IBM unveiled improvements to Cora, the bank’s virtual assistant, which will leverage generative AI to give users conversational engagements and access to a greater variety of information. The bank will be among the first in the UK to implement generative AI with a virtual assistant, making its digital services safe, easy to use, and accessible.

As part of its broader goal, the bank is utilizing ethical and responsible AI, working with IBM and other specialists to provide individualized support to consumers in order to help them attain financial wellbeing. Teams are co-creating a digital concierge (Cora+) that advances the chatbot’s capabilities into a more engaging and conversational experience, which benefits clients, by utilizing IBM Watsonx, an enterprise-grade AI and data platform.

Conversational, individualized answers to challenging consumer questions

This cutting-edge feature was created to give users wishing to compare goods and services across the product suite or find information across the websites of the NatWest Group a more approachable and personalized experience.

Information regarding goods, services, bank details, and career prospects that was previously unavailable through chat alone will now be accessible to Cora+ through a variety of safe sources. Consumers can link to requested information and receive answers in a more conversational, natural way. They can examine the requested information right away or bookmark it for later. During business hours, customers will still be able to speak with branch representatives over the phone.

“NatWest are a relationship bank in a digital world, building trusted, long-term relationships with our customers through meaningful and personalised engagement,” stated Wendy Redshaw, Chief Digital Information Officer of the NatWest Group’s Retail Bank.

Expanding on Cora’s achievements in the previous five years, NatWest are collaborating with businesses such as IBM to use the most recent advancements in generative AI, which will contribute to Cora feeling even more ‘human’ and, above all, a dependable, safe, and trustworthy digital partner for our clients.”

In the age of digitalization, banks prioritize developing people, technology, and reliable partnerships

Attracting and keeping top technical talent has become a priority for the industry as banks transform into more and more digital organizations. As part of NatWest’s Digital X Strategy, which is centred around three pillars: Engineer, defend, and operate, mindful innovation and safe exploration are crucial. In order to deliver what matters most to consumers, this gives the bank the chance to partner with specialized industry experts like IBM and work together on cutting edge, new technologies.

The goal was to securely and quickly produce a viable generative AI digital assistant. To that end, the IBM Client Engineering team collaborated with the NatWest business and technology teams to quickly co-create, test, and certify the results.

According to John Duigenan, Distinguished Engineer and General Manager, Global Financial Services Industry at IBM, “NatWest and other forward-thinking leaders of financial institutions around the world are exploring the potential of AI technologies as part of their competitive business strategy.” The implementation of suitable regulations and oversight mechanisms to guarantee AI’s transparency, reliability, and focus can empower banks to offer a compelling value proposition that fosters even greater customer loyalty. IBM are thrilled to have the chance to work with NatWest on their customer service goal.”

Global leaders in the banking sector recognize the potential of generative AI and are carefully examining its applications

CEOs in the banking and financial sectors are using generative AI sparingly and thoughtfully, per a new report by IBM’s Institute for Business Value, CEO Decision-Making in the Age of AI. More than 40% of the leaders in banking and financial markets surveyed by 360 said that they anticipate generative AI, deep learning, and machine learning will contribute to financial performance in the next three years, demonstrating their recognition of its potential.

Financial services professionals expressed interest in implementing generative AI most frequently in the areas of talent, security, and customer experience. A whopping three quarters (75%) of the CEOs surveyed in the financial services sector feel that the institutions with the most advanced usage of generative AI will have a competitive edge. These business chiefs named customer care as one of their top technology goals.

Regarding NatWest

The NatWest Group serves as a digital world’s relationship bank. In order for the 19 million individuals, families, and companies they support in communities across the UK and Ireland to recover and prosper, they champion potential by tearing down obstacles and fostering financial confidence. They will prosper iftheir clients do.

Concerning IBM

IBM is one of the top suppliers of business AI, security, hybrid cloud architecture, and ESG analytics to the world’s financial services industry. Its broad range of services and solutions, in-depth knowledge of the sector, and strong network of fintech partners foster innovation, creativity, and teamwork among customers. IBM is a reliable partner for banks, insurers, capital markets, and payment providers. Through IBM Consulting, the company supports financial institutions at every step of their digital transformation journeys, and through IBM Technology, it provides the tested infrastructure, software, and services they require.

Read more on Govindhtech.com

0 notes

Text

Can you make another Cash App account after being closed

Can you make another Cash App account after being closed?

If your Cash App account was closed, you're not the only one. You can open a new one with a different email address or mobile number. You'll need to complete the verification process, which takes a few minutes.

#Farage#Sinead#Mitch#BritishGas#NatWest#CurrysFIFAWWC#LoveIsland#Hibs#jungkook#Poveda#JordanHenderson#GoodOmens2#BBNaijaAllStar#RomanticiseThis#Aliens#GlobalBoiling#Andorra#Lavia#UFOs#DavidSilva#Byram#SecretInvasion#AlisonRose#Ilebaye#Doyin#Bellingham#Scott#Russophobia#Coutts#NothingCompares2U

1 note

·

View note

Text

FCA Identifies “Regulatory Breaches” in NatWest’s Handling of Nigel Farage’s Account Closure

London, UK – In a significant development, Britain’s Financial Conduct Authority (FCA) announced on Friday that it had uncovered potential “regulatory breaches” in NatWest’s handling of the decision to close the accounts of former Brexit Party leader Nigel Farage. The revelation sent shockwaves through the financial market, causing NatWest’s shares to plummet by as much as 17.7% in its most substantial drop since the Brexit vote in June 2016. This crisis for the bank coincided with disappointing third-quarter results and a downward revision of its performance outlook.

The Financial Conduct AuthorityStatement

The Financial Conduct Authority statement came shortly after NatWest’s acknowledgment of an initial review into the “debanking” of Farage, which revealed shortcomings in the bank’s treatment of him. NatWest contended that its actions were primarily driven by commercial considerations and were executed lawfully. In response to these findings, Farage issued a statement characterizing the report as a “whitewash.”

The bank’s tumultuous journey began when its private bank, Coutts, decided to sever ties with Nigel Farage earlier this year, leading to a political backlash and ultimately costing former CEO Alison Rose her position. In response to this predicament, NatWest has pledged to announce a decision regarding whether to dock Rose’s pay in connection with the matter “as soon as possible.” The bank’s woes were further exacerbated by the Information Commissioner’s Office, which concluded that Rose had violated data protection rules by briefing a journalist about Farage’s account. This has added pressure on NatWest to curtail Rose’s payout.

Customer-Related Broader Concerns

The Financial Conduct Authority investigation is now scrutinizing whether there are broader concerns related to the fair treatment of customers, although it has not divulged any details about potential enforcement actions at this stage.

A document uncovered by Nigel Farage in July revealed that an internal committee at NatWest had cited a misalignment of views with the bank as a basis for terminating his relationship with them. This was alongside other commercial considerations.

Economic Challenges

This upheaval within NatWest arrives at a precarious time when the entire banking industry grapples with a challenging economic outlook, heightened risk of loan defaults due to the rising cost of living, and mounting pressure from fierce competition for savings and mortgage products, squeezing their profit margins.

Despite the turmoil, NatWest reported a pre-tax profit of £1.3 billion ($1.58 billion) for the July-September quarter, compared to £1.1 billion in the previous year, closely aligning with analyst forecasts. However, the bank did report a decline in its net interest margin (NIM), a key indicator of lending profitability, which came in at 2.94%, down by 0.19 percentage points, as customers transferred their savings from non-interest-bearing accounts to those offering better returns. Consequently, NatWest revised its margin forecast for the full year, reducing it to “greater than 3%” from the earlier projection of around 3.15%.

Also Read: Financial Knowledge: Why Many Entrepreneurs Lack of This?

#FinancialRegulation#NatWest#NigelFarage#FCA#BankingIndustry#RegulatoryBreaches#Brexit#AlisonRose#DataProtection#EconomicChallenges

0 notes

Text

We can’t live in a society where you’ve got woke capitalists going through people's records to find out what they believe..

William Clouston, leader of the SDP

0 notes

Text

youtube

0 notes

Text

Yorkshire docked 48 points as well as find

Thirty-three-time County Championship winners Yorkshire, have been docked a whopping 48 points and fined £400,000 for their part in the Azeem Rafiq racism scandal.

The White Rose County have also been docked four Natwest T20 blast points.

Yorkshire said they accepted the sanctions imposed by the Cricket Discipline Commission, which saw a £400,000 fine levied, £300,000 of which was suspended for…

View On WordPress

#Bingo#County Championship#cricket#england#Google#Natwest#Sports#T20 Blast#The Sports Buff#yahoo#Yorkshire

0 notes

Text

Disclosing the Finest Banks within the Joined together Kingdom: Pioneers in Monetary Brilliance

The Joined together Kingdom gloats a strong and competitive keeping money division, with a wealthy history of eminent money related educate. From conventional stalwarts to computerized disruptors, the UK offers a differing extend of banks that give uncommon administrations and imaginative arrangements. In this article, we explore some of the most excellent banks within the Joined together Kingdom, known for their unwavering quality, customer-centric approach, and commitment to brilliance.

HSBC

HSBC, the Hongkong and Shanghai Managing an account Enterprise, may be a worldwide keeping money monster with a solid nearness within the Joined together Kingdom. With a legacy traversing over 150 a long time, HSBC offers a comprehensive suite of keeping money and budgetary administrations to people and businesses. Known for its universal reach and mastery, HSBC gives custom fitted arrangements, counting individual keeping money, riches administration, and corporate managing an account. The bank’s broad organize of branches and progressed advanced platforms ensures availability and comfort for its clients. HSBC’s commitment to supportability and responsible managing an account hones further solidifies its position as one of the beat banks within the UK.

Barclays

Barclays, a British multinational bank, includes a conspicuous nearness within the UK’s managing an account scene. With a history dating back to 1690, Barclays combines convention with advancement to provide remarkable monetary administrations. The bank offers a wide extend of items, counting individual managing an account, commerce keeping money, speculation arrangements, and corporate keeping money. Barclays is known for its mechanical headways, apparent in its user-friendly computerized platforms and versatile managing an account app. Besides, the bank’s commitment to corporate social obligation and community improvement activities grandstands its devotion to making a positive affect in society.

Lloyds Bank

Lloyds Bank, one of the oldest banks within the UK, includes a solid notoriety for unwavering quality and customer-focused administrations. With roots following back to 1765, Lloyds Bank gives a comprehensive run of managing an account arrangements for people, businesses, and corporate clients. The bank’s accentuation on computerized advancement is obvious through its online keeping money stage and versatile app, empowering clients to oversee their finances with ease. Lloyds Bank’s commitment to client fulfillment, illustrated by its proactive approach to settling issues, has earned it a faithful client base and a unmistakable position among the most excellent banks within the UK.

NatWest

NatWest, a backup of the Illustrious Bank of Scotland Bunch, is one of the driving retail and commercial banks within the Joined together Kingdom. Known for its strong customer benefit, NatWest offers a wide run of budgetary administrations, counting individual managing an account, contracts, ventures, and trade keeping money arrangements. The bank has grasped computerized change, giving clients with helpful online and versatile keeping money choices. NatWest’s commitment to inclusivity and differing qualities is reflected in its activities pointed at supporting little businesses and cultivating money related instruction. This customer-centric approach sets NatWest separated as a trusted and dependable keeping money accomplice.

Monzo

Monzo may be a computerized bank that has picked up critical ubiquity forits imaginative approach and user-friendly mobile banking app. With a solid center on rearranging keeping money, Monzo offers straightforward and natural money related administrations. The bank’s app gives real-time exchange notices, budgeting devices, and moment installment highlights. Monzo’s commitment to client criticism and persistent advancement has developed a steadfast community of clients. As a advanced local bank, Monzo requests to tech-savvy people looking for a consistent and modern banking involvement, making it one of the finest banks for those grasping the computerized age.

Conclusion

The United Kingdom’s banking division is domestic to a large number of exceptional institutions. From the worldwide reach of HSBC to the mechanical headways of Barclays, the unwavering quality of Lloyds Bank, the client center of NatWest, and the development of Monzo, these banks epitomize the finest in UK managing an account. Whether catering to conventional or advanced inclinations, these banks reliably provide brilliance and endeavor to meet the differing needs of their clients.

0 notes

Text

UK Gov Sells Shares in NatWest for £1.26 Billion, Ownership Now 38.6%

- Government sells c. £1.26 billion of NatWest shares to NatWest as stake reduced to c. 38.6%

- Announcement marks a further major milestone in returning the bank to private ownership

- Sixth block sale of NatWest shares since the government intervened in NatWest to protect financial and economic stability during the global financial crisis in 2008

NatWest is a step closer to being returned to full private ownership as the government sells c. £1.26 billion in shares back to NatWest via a Directed Buyback.

The sale reduces the government’s shareholding to c. 38.6% - down from around 84% at its peak – delivering significant progress against the government’s intention as announced at Spring Budget to fully exit the shareholding by 2025-2026, subject to market conditions and achieving value for money for taxpayers.

Andrew Griffith MP. UK economics secretary. Photo by UK Government.

The Economic Secretary to the Treasury, Andrew Griffith said:

Today’s sale is another major milestone in returning NatWest to full private ownership as promised. The government has now sold well over half of its shareholding.

The government intervened in NatWest (formerly the Royal Bank of Scotland, RBS) with the objective of protecting financial and economic stability during the 2008 global financial crisis.

Welsh Royal Bank of Scotland branch. Photo by Alex Liivet. Flickr.

The Office for Budget Responsibility has been clear that – without the government’s interventions in the financial sector – the cost of the 2008 global financial crisis would almost certainly have been far greater.

The government will only dispose of its NatWest shareholding when it represents value for money to do so and market conditions allow.

Alongside progress being made by the ongoing trading plan, HMT and UK Government Investments continue to keep all options under active consideration for future sales, including via accelerated bookbuilds if conditions permit.

Sources: THX News & HM Treasury.

Read the full article

0 notes

Text

#NatWest Bank caps customers'#crypto transfers to £1,000 q.d., #dictatorship

#UK more #surveillance camera per capita than all countries excl.#China

#Biden adm kill economy with #rates,or #hyperinflation

#SVB never bothered hedging vs interest-rate risk

https://salvatoremercogliano.blogspot.com/2023/03/they-hit-us-with-left.html?spref=tw

0 notes