#GST Rate

Text

GST Rate and SAC Code for Architects and Engineers

GST Rate for Architects and Engineers:

The GST rate for services provided by architects and engineers in India is 18%. This rate is applicable to the total value of the services rendered, including any service charges, consultancy fees, or other related expenses.

SAC Code for Architectural and Engineering Services:

The SAC (Services Accounting Code) for architectural and engineering services is 998331. This SAC code covers a wide range of services provided by architects, engineers, and related professionals, including:

Architectural design services

Structural engineering services

Civil engineering services

Interior design services

Landscape design services

Urban planning services

Project management consultancy

Feasibility studies and technical consultancy

It's essential for architects and engineers to correctly identify and use the SAC code 998331 when invoicing their services to ensure proper classification under GST. This helps in accurate tax calculation and compliance with GST regulations.

GST Compliance for Architects and Engineers:

Architects and engineers providing services in India are required to comply with GST regulations, including registration, invoicing, payment of taxes, and filing of GST returns. Key compliance requirements include:

GST Registration: Architects and engineers whose aggregate turnover exceeds the threshold limit prescribed by GST law must register for GST.

Invoicing: Proper GST-compliant invoices must be issued for services rendered, including details such as the SAC code, GSTIN of the service provider and recipient, service description, service value, and applicable GST rate.

Payment of Taxes: GST collected on services must be deposited with the government within the specified timelines.

Filing of GST Returns: Regular filing of GST returns, including GSTR-1 (for outward supplies) and GSTR-3B (summary return), is mandatory for architects and engineers.

By adhering to GST compliance requirements and accurately applying the applicable GST rate and SAC code, architects and engineers can ensure smooth operations and avoid any penalties or legal issues related to tax non-compliance. It's advisable to seek guidance from tax professionals or consultants for any specific queries or complexities related to GST compliance in the architectural and engineering sector.

0 notes

Text

Learn about the SAC code for footwear services, understand GST registration, return filing, and conditions for claiming ITC credit.

0 notes

Text

GST Rate Change: Govt may reduce GST on Dairy Products from 12%

GST rate change: The government may propose lowering the current goods and services tax (GST) on ghee and butter to 5% from 12%. To simplify the tax and stop tax leakages, the GST Council removed this exemptions from some dairy products in July of last year 2021-2022.

The animal husbandry and dairying department has requested the finance ministry to include the proposal in the GST fitment…

View On WordPress

0 notes

Text

18% GST On Term & Health Insurance Is Too Heightened! Know More

Health insurance is very essential for medical security seeing the pandemic waves. But in the country, not most people prefer to avail the health insurance due to the high GST rate of 18% and premiums. For more information visit the website.

0 notes

Text

GST Rate Changes: 5% GST exemption will be available on many packaged products including cereals, pulses, flour, know how

GST Rate Changes: 5% GST exemption will be available on many packaged products including cereals, pulses, flour, know how

GST Rate Changes: 5% GST exemption will be available on many packaged products

Food items without branded, pre-packaged and labeled food items such as flour, pulses and cereals will get 5% exemption from such packets Those weighing more than 25 kg will be exempted from Goods and Services Tax (GST). The Central Board of Indirect Taxes and Customs (CBEC) issued a number of questions and answers…

View On WordPress

0 notes

Text

ജൂലൈ 18 മുതൽ നിത്യോപയോഗ സാധനങ്ങളുടെ ജിഎസ്ടി നിരക്ക് വർധന; എന്ത് വില കൂടും?

ജൂലൈ 18 മുതൽ നിത്യോപയോഗ സാധനങ്ങളുടെ ജിഎസ്ടി നിരക്ക് വർധന; എന്ത് വില കൂടും?

നാളെ മുതൽ, ചില ഇനങ്ങൾ വാങ്ങാൻ നിങ്ങളുടെ പോക്കറ്റിൽ നിന്ന് കൂടുതൽ പണം ചെലവഴിക്കേണ്ടി വന്നേക്കാം, കാരണം അവയുടെ ജിഎസ്ടി നാളെ മുതൽ വർദ്ധിക്കുന്നു. കഴിഞ്ഞ മാസം നടന്ന 47-ാമത് ജിഎസ്ടി കൗൺസിൽ യോഗത്തിന് ശേഷം, നിരവധി ഇനങ്ങളുടെയും സേവനങ്ങളുടെയും ചരക്ക് സേവന നികുതി പരിഷ്കരിക്കാൻ സർക്കാർ തീരുമാനിച്ചു. ഇക്കാരണത്താൽ, പുതിയ ജിഎസ്ടി നിരക്കുകൾ ജൂലൈ 18 മുതൽ പ്രാബല്യത്തിൽ വരുന്നതിനാൽ ചില ദൈനംദിന അവശ്യസാധനങ്ങളുടെ…

View On WordPress

0 notes

Text

Open Network for Digital Commerce: GST relief to be a game-changer for ONDC, says Piyush Goyal

Open Network for Digital Commerce: GST relief to be a game-changer for ONDC, says Piyush Goyal

Commerce and industry minister Piyush Goyal said on Thursday that the Goods and Services Tax (GST) Council’s latest decision to exempt small businesses that have adopted e-commerce from compulsory registration will likely be a “game-changer” for the Open Network for Digital Commerce (ONDC) being promoted by his ministry.

Speaking at an event, Goyal said: “This is a major decision which will help…

View On WordPress

0 notes

Text

GST Council meeting: दरों में बदलाव पर चर्चा संभव, राज्यों को क्षतिपूर्ति टॉप एजेंडा

GST Council meeting: दरों में बदलाव पर चर्चा संभव, राज्यों को क्षतिपूर्ति टॉप एजेंडा

GST Council meeting: इस सप्ताह चंडीगढ़ में होने वाली जीएसटी परिषद की बैठक (GST Council meeting) में कुछ वस्तुओं की जीएसटी दरों में बदलाव किया जा सकता है, जबकि 215 से अधिक वस्तुओं की दरों में यथास्थिति बनाए रखने के लिए फिटमेंट समिति की सिफारिशों को मान लिया जाएगा। केंद्रीय वित्त मंत्री निर्मला सीतारमण की अध्यक्षता में और सभी राज्यों एवं केंद्र शासित प्रदेशों के प्रतिनिधियों की जीएसटी परिषद की 47…

View On WordPress

#Business News#Business News In Hindi#GST#gst council meeting#gst rate#Hindi News#Hindustan#News in Hindi#Union Finance Minister Nirmala Sitharaman#केंद्रीय वित्त मंत्री निर्मला सीतारमण#जीएसटी#जीएसटी परिषद की बैठक#जीएसटी रेट#हिन्दुस्तान

0 notes

Text

i've always said that daisy would make a great dentist

#dale thomas#bless#he needs to open his own dental clinic#he stops by bunnings and purchases a drill 'yeah i'm becoming a dentist!!!'#munching on a sausage while twirling the drill around in his hands#he's got all the tools: superglue and a drill and some spirit level to keep the ghosts away#he'll fix any problem#YES I'M DOING AN ADVERTISEMENT FOR DAISY'S DENTAL CLINIC SHUT UP#now he'll fix any problem (he's a fixer)#he'll rip out your dead tooth with his bear hands#he'll fill any hole (in your teeth) (but also other holes if you ask politely)#he's got his trusty assistant Alex Fasolo filling your mouth up with water until you choke and die#he'll do a full search of your clothes for candy when you enter and then give the candy to his son Cody#he'll do your dental work for the low low price of $99.95 (plus GST)#per tooth#actually that's still really cheap#$1999.95 plus GST per tooth YES THAT'S MORE LIKE A NORMAL DENTIST'S RATE#all proceeds go to carlton to help them lure their next midfielder

3 notes

·

View notes

Text

GST Rates on Labour Charges

This blog post delves into GST rates on labour charges in India, exploring agreements under GST law, exemptions, and impacts on various contract types. It highlights nuances, calculations, and the transition's benefits.

0 notes

Text

Adopted pro-poor approach in implementing GST, kept tax rates low on essential commodities - Finance Minister

New Delhi. Finance Minister Nirmala Sitharaman said on Monday that the government has announced the Goods and Services Tax. (GST) Adopted a ‘pro-poor stance’ while implementing GST and despite lower tax rates, revenues as a percentage of gross domestic product (GDP) have reached pre-GST levels. Sitharaman wrote on the social media platform ‘X’ that the combined revenue of the states from the…

View On WordPress

#Adopted#approach#business news#business news in hindi#commodities#essential#finance#FM nirmala Sitharaman on gst#Goods and Service tax#GST#GST news#implementing#Minister#propoor#rates#tax#Tax rates in GST#what is GST

0 notes

Text

#Gst Input Tax Credit Example#Refund of Service Tax Input Credit#What is Service Tax Input Credit#itc#GST Input Tax Credit#Input Tax Credit#Input Tax Credit under GST#itc in gst#input tax credit rate#what is input tax credit#input tax credit meaning eligible and ineligible#input tax credit claim#Share

0 notes

Text

Unlock Business Opportunities in Singapore with a Dependent Pass | InCorp Global

Discover how to expand your business horizons in Singapore by securing a Dependent Pass through InCorp Global. Our expert team provides comprehensive guidance on obtaining this vital visa, enabling you to tap into the city-state's thriving economy while maintaining family ties. Explore the benefits and requirements of Dependent Pass in Singapore, and embark on your journey towards business success in Singapore today.

#dependent pass singapore#business license singapore#gst refund singapore#long term pass singapore#psg grant#singapore pr benefits#company tax rate singapore

0 notes

Text

What became costlier and cheaper after 50th GST Council Meet?

50th GST Council meeting: On 11th July, the 50th Goods and Services Tax (GST) Council meeting held by Union Finance Minister Nirmala Sitharaman. The council made a number of changes in the existing GST slabs for various goods and services. Here is a detailed list of all the items that become costlier and cheaper after the crucial meeting.

Also Read: Full details of 50th GST Council Meeting: Read…

View On WordPress

0 notes

Text

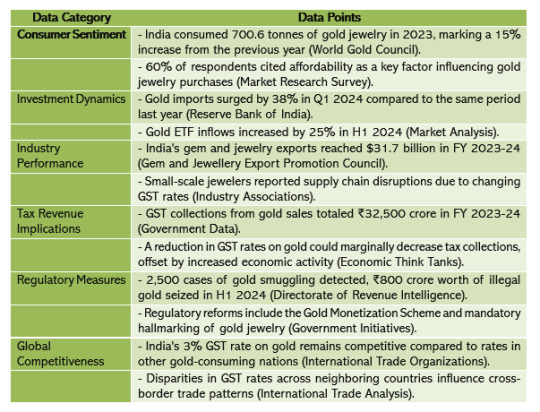

GST on Gold: Effects of Gold GST Rate in India 2024

In 2024, the effects of the Goods and Services Tax (GST) rate on gold continue to resonate throughout India's economy, impacting various stakeholders from consumers to industry players. Let's delve into the implications of the gold GST rate and how it shapes the landscape of the precious metal market:

Consumer Sentiment: The GST rate directly influences the final price of gold for consumers. A lower GST rate makes gold more affordable, encouraging higher demand for jewelry, coins, and bullion among consumers. Conversely, a higher GST rate may deter purchases, particularly among price-sensitive buyers, impacting consumer sentiment and spending patterns.

Investment Dynamics: Gold is revered as a traditional investment asset and a hedge against economic uncertainties. The GST rate affects its attractiveness as an investment avenue. A lower GST rate enhances the appeal of gold investments, attracting investors seeking portfolio diversification and wealth preservation. Conversely, a higher GST rate may prompt investors to explore alternative investment options with potentially higher returns.

Industry Performance: The gold industry, encompassing miners, refiners, jewelers, and retailers, is intricately linked to the prevailing GST rate. A lower GST rate spurs demand for gold jewelry and ornaments, benefiting jewelers and retailers. However, fluctuating GST rates can disrupt supply chains, inventory management, and pricing strategies within the industry, posing challenges for stakeholders.

Tax Revenue Implications: The GST rate on gold significantly contributes to government tax revenues. While a lower GST rate stimulates demand and economic activity in the gold sector, it may lead to a reduction in tax collections. Conversely, a higher GST rate boosts government revenues but could dampen consumer spending and industry growth, necessitating a delicate balance between revenue generation and economic stimulus.

Regulatory Measures: Policymakers continuously monitor and adjust the gold GST rate to achieve broader economic objectives, address inflationary pressures, and ensure fiscal sustainability. Changes in the GST rate are often accompanied by regulatory measures aimed at curbing illicit activities such as smuggling and tax evasion, thereby safeguarding government revenue and market integrity.

Global Competitiveness: The GST rate on gold in India is juxtaposed with rates in other countries, influencing international competitiveness and trade dynamics. Disparities in GST rates between nations can incentivize cross-border trade, impacting domestic markets and necessitating policy responses to maintain a level playing field for industry participants.

In summary, the GST rate on gold in India is a critical determinant of consumer behavior, investment trends, industry dynamics, and government revenues. As policymakers navigate economic challenges and strive to foster growth, they must calibrate the gold GST rate judiciously, balancing the interests of stakeholders while ensuring fiscal prudence and regulatory effectiveness, you need the advice of experts such as efiletax Indeed.

#GST on Gold#Gold GST Rate#Gold GST Rate in India 2024#efiletax#taxes#gst services#gst filing chennai#gst update india#india gst#gold#gst filing

0 notes

Text

It takes a lot of study to purchase your ideal home, including investigating the area, climate, interior design, and accessibility. While often disregarded, the financial component of purchasing real estate is equally crucial. Numerous modest and large payments might make a considerable difference in the property's price. The terms "Registration Charges," "Stamp Duty," "Loan Processing Charges," "Technical Appraisal Charges," "Franking Charges," and so forth may have been mentioned during discussions with the seller. In order to prevent defaults and guarantee a seamless home-buying experience, it is critical to comprehend the meaning of these costs.

Franking Charges: What Is It?

Stamp duty is a levy that you must pay to the government in order for the acquisition of real estate to be approved. The franking charge is an additional stamp duty-related expense that most purchasers are unaware of. Stamp duty and franking costs are sometimes mistaken for one another. These two charges are typically charged concurrently, which is the main cause of this misconception. They are distinct charges, though, and we will talk about both the meaning of franking and the meaning of franking charges in this article.

Franking: What Is It?

Franking is only the act of franking an agreement. It is a seal that certifies that stamp duty has been paid. Thus, the process of having property documents stamped is called "franking."

Authorized organizations, including banks, offer franking services. We can enlist the assistance of these organizations to place a stamp or a denomination on the document in order to demonstrate its legitimacy.

Sub-registrar offices throughout various Indian states have Franking machines installed in order to complete the Franking process.

Advantages of Franking

The use of franking machines as opposed to stamps has various advantages. Among them are:

Lower Postage Costs: Since you only need to buy postage once, as opposed to for each letter or package, franked mail is less expensive to send than stamped mail. Convenience: You may quickly and easily prepare your mail for dispatch with a franking machine, saving you a trip to the post office. You save time and energy, which are sometimes very valuable resources!

Efficiency: A clean, reliable impression is always produced by a well-maintained franking machine. This facilitates the accurate identification and sorting of your mail by postal workers, ensuring that it gets to its destination as soon as possible.

Why was Franking invented?

Printing the agreement on non-judicial stamp sheets was the previous method of verifying the payment of stamp duty. The government had to put an end to this method since it resulted in stamp paper scams, abuse, and forgeries.

Bank Franking Procedure

Franking must be completed at this stage, prior to signing the paperwork, once all necessary information has been transcribed onto a blank sheet of paper. To approach the relevant body, you or the vendor must fill out an application with the franking details.

Not every bank is permitted to accept stamp duty. Even yet, the authorized institutions will be limited to a specific daily volume and will only be able to open a particular amount of documents each day. It is crucial that you get in contact with the bank early in the day or through a designated representative. It is advised to schedule a prior appointment with the relevant official, as franking necessitates advance planning on the part of the authorities.

The bank that you are using to obtain the home loan will give you the precise information and representatives about particulars.

Charges

The authority franking your documents, such as banks and agencies, must be compensated. State governments set the amount, which differs from state to state. Regardless of the value of the property, some states have a flat cost. Nonetheless, the majority of states charge a fee equal to 0.1% of the loan amount or the entire sale price of the property. Due to the strong correlation between franking charges and stamp duty, franking charges are typically subtracted from stamp duty, and stamp duty is amended to incorporate them.

The Indian states' corresponding franking charges are as follows:

Maharashtra's Franking Charges: 0.1%

In Telangana, fucking charges are 0.1%

For instance, there will be an additional Rs. 8,000 in fees associated with franking charges if you are purchasing a house valued at Rs. 80 lakh. Now, if the franking charge has been paid, you will only be required to pay 5.4% of the property value as stamp duty if the stamp duty in your state is 5.5% of the value. This change won't be performed if you choose to pay stamp duty using a different method. (The stamp duty rates are subject to change and vary across states; the figures shown are only examples.)

Remember that most home loans do not cover stamp duty or franking costs, so be ready for this and keep it in mind when choosing a home loan vendor.

Document Franking

Printing the agreement on plain white paper is necessary when franking a document. You must take the agreement and the supporting documentation to a franking agency or an authorized bank before they are executed or signed. There, they will offer you an application form, you will pay the stamp duty charge, and a stamp will be applied to the document to indicate the amount of stamp duty paid.

How to Calculate Franking Charges

States have different franking fees. The franking costs in Telangana and Maharashtra differ as a result. Usually, it represents 0.1% of the purchase price. For example, the franking charge on a house purchased for Rs. 40 lakhs would be Rs. 4,000. Remember that the franking stamp fee is part of the stamp duty duties as well. Therefore, if the appropriate stamp duty in your state is 6.5 percent, you would have to pay 6.4 percent to the sub-office registrars and the remaining amount to the franking authority.

#Franking Charges#Franking Charges and its advantages#What is franking cost?#What is the meaning of franking?#How do you calculate franking charges?#What is the limit for franking?#Who pay franking charges?#What is a 100% franking rate?#Why is it called franking?#What are the franking rules?#How does franking work?#Why is franking needed?#Is GST applicable on franking charges?#Is franking and stamp paper same?#Real Estate

0 notes