#gst refund singapore

Text

Unlock Business Opportunities in Singapore with a Dependent Pass | InCorp Global

Discover how to expand your business horizons in Singapore by securing a Dependent Pass through InCorp Global. Our expert team provides comprehensive guidance on obtaining this vital visa, enabling you to tap into the city-state's thriving economy while maintaining family ties. Explore the benefits and requirements of Dependent Pass in Singapore, and embark on your journey towards business success in Singapore today.

#dependent pass singapore#business license singapore#gst refund singapore#long term pass singapore#psg grant#singapore pr benefits#company tax rate singapore

0 notes

Text

2024-02-14

Singapore

Police probing two events here related to Israel-Hamas conflict

Ex-flight steward who "slipped on grease patch & fell" on plane sues SIA for $1.78m - Bugger off already, scumbag! He even said he had already noticed the grease patch prior to his fall, so why didn't he take care to avoid it on his own?! Idiot! 🙄

Complaints about monks pestering devotees at temple for alms

Worrying rise in number of young people & women arrested for drug abuse last year

...with repeat drug abusers raising 2-year recidivism rate - highest number of inmates in rehab centres since 2008

Govt to refund $7.5m in GST wrongly collected by 6 agencies over 5 years

Largest single-site rooftop solar panel system to be installed at Changi Airport by next year

Nature

Photos of snake eating ladder gudgeon at Pasir Ris mangrove become 1st record of fish in Singapore since the 1800s

Singapore: Speeding road biker runs over monitor lizard at Gardens By The Bay - scumbag didn't even stop to check on the poor creature! 🤬

Environment

IEA & Singapore to set up regional energy centre to spur Asia’s green transition

Politics

Prabowo on track to becoming Indonesia’s next president, with 75% of sample votes counted - I know he's Jokowi-endorsed, but he looks fat & lazy tbh, & I don't think he'll do a good job 😩

Travel

Bodies of 2 Malaysians recovered after Singapore-owned light plane crashes in Selangor

Entertainment

^ Hello Kitty is now a game

Transport

Survey shows Singapore commuters more satisfied with local taxi & private-hire car services in 2023 than 2022

0 notes

Link

1 note

·

View note

Text

Usb3 p2 card reader

Usb3 p2 card reader upgrade#

Usb3 p2 card reader pro#

For item that are available, a confirmation email will be sent to your registered email to show that your order had been processed and is ready for collection / to be delivered. (gst)/consumers/tourist-refund-schemeĪll items that are available for purchase online are subjected to availability. Visit the following link for GST Guide for Visitors on Tourist Refund Scheme. Please note that only Tourists who have met the Tourist Refund Scheme’s conditions and eligibility criteria can claim for the GST refund. However if you are a tourist visiting Singapore, this GST amount can be refunded at the Changi International Airport Departure Hall GST Refund Centre before departure with goods within 60 days from the date of purchase. For computers without USB 3.0 support, the device is backwards compatible with USB 2.0.ħ% Goods Service Tax (GST) will be imposed over the total invoice value if purchased locally in Singapore. Two USB 3.0 ports are provided on the device one for transferring data and one for powering the device from your computer or an AC adapter. It is compatible with P2 and expressP2 memory cards, as well as microP2 cards when using the optional AJ-P2AD1G adapter. The Panasonic AU-XPD1 P2 Memory Card Drive is a compact, single-slot P2 card reader/writer that uses a USB 3.0 interface, which is fast enough to accommodate expressP2 card data transfer rates up to 2.4 Gb/s. Panasonic reserves the right to deny exchanges for any reason. Panasonic reserves to the right to extend or terminate this program at any time. This offer is only extended to customers who already own an AU-XPD1 drive to be exchanged.

Usb3 p2 card reader upgrade#

In an effort to provide the best and most convenient service to our customers, Panasonic will be providing updated AU-XPD1 Drives in exchange for the original drives free of charge.Ĭustomers who purchase the new B Series Express P2 Cards should contact Panasonic service in order to arrange delivery of a newly updated AU-XPD1 Drive by emailing and using the subject line ?AU-XPD1 Exchange?.Ĭustomers using the original A series Express P2 cards do not need to upgrade their drives. This Express Drive will use the same SKU (AU-XPD1) as the existing drive even though it makes use of upgraded hardware. As a result, an upgraded Panasonic AU-XPD1 has been developed. These new, faster cards, the AU-XP0256B and AU-XP0512B, are not compatible with the current AU-XPD1 Express P2 drive.

Usb3 p2 card reader pro#

USB C Dock has been fully tested for functionality on the 2018+ iPad Pro (mirroring only)/MacBook Air/iMac and iMac Pro/MacBook and MacBook Pro/Google Pixelbook/Dell XPS 13 & XPS 15/Lenovo Thinkpad/HP Spectre x360/Samsung DeX capable devices/Surface Laptop 3 and Surface Go/and many other systems which support USB-C DP Alt Mode.Panasonic AU-XPD1 Memory Card Drive “P2 Drive” Compatibility: Plug and Play installation on any Chromebook/Windows/Mac/Linux hosts which support DisplayPort Alternate Mode (Alt Mode) video output functionality.$5 promotional gift card w/ purchase, limited offer (87) Wavlink USB C Triple Display 4K 12 in 1 USB C Docking Station With DP & HDMI &VGA,100W PD3.0 Charging(85W for PC) USB 3.0 & 2.0 Ports, SD TF Card Reader, Gigabit Ethernet, Audio For Mac/Windows Wireless Range Extender/Media Bridge (7).External CD / DVD / Blu-Ray Drives (33).Cell Phone Bling / Charm Accessories (21).Airsoft Tactical Gear, Safety & Accessories (1).Accessories - Controller cards Add-on cards Ect (29).

1 note

·

View note

Text

Benefits of Goods and Services Tax (GST) for businesses in Singapore

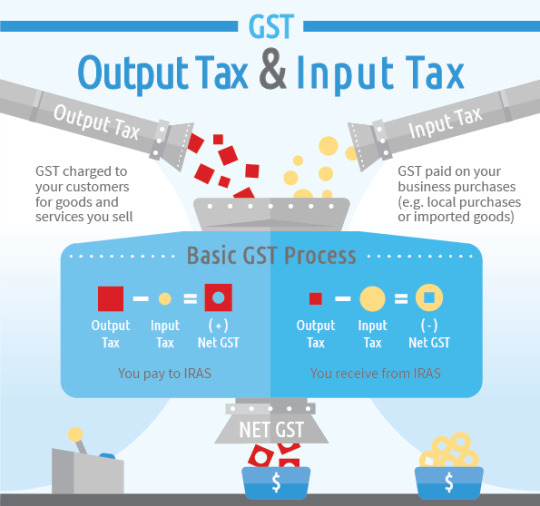

Consumption of goods and services is subject to the Goods and Services Tax in Singapore. In Singapore, the GST, sometimes referred to as the Value-Added Tax (VAT) in other nations, is now charged at a rate of 7%. The IRAS receives it from the GST-registered companies once they have collected it from their clients (Inland Revenue Authority of Singapore).

To decrease the burden of direct taxes like corporate and individual income taxes, the GST, an indirect tax based on consumption, was created. Whoever uses the goods and services pays for them. Additionally, Singapore's imports of products and services are subject to it.

GST Registration Singapore

Businesses in Singapore that have or anticipate having a taxable turnover of more than S$1 million for the last 12 months or S$1 million for the upcoming 12 months are required to register for GST in Singapore. Others may voluntarily sign up for it as well.

GST Schemes for the Benefit of Registered Businesses

A list of GST programs from which a registered company can benefit is shown below.

· Scheme for Cash Accounting

· Scheme for a Discounted Sale Price

· The Gross Margin Plan

· Scheme for Hand-Carried Exports

· Import GST Deferral Program

· Large Exporter Program

· Scheme for Tourist Refunds

· GST-Free Warehouse Program

Businesses must first obtain IRAS approval to take part in programs like the Major Exporter Scheme and the Discounted Sale Price Scheme.

Because the government is stringent about it, accurate Singapore tax filing is a sought-after thing. However, they are even stricter in the case of businesses that try to avoid GST filing or who overcharge their customers in the name of collecting GST.Are you looking for GST submissions Services in Singapore? DAVID CHEW & CO is an audit firm in Singapore established in 1981. It has leading experts offering their services for accounting and financial services. Our proven process reengineering methodologies, process management expertise, and technology application capabilities can help you simultaneously improve service performance and drive down transaction costs.

0 notes

Text

Peter Leow Consulting Pte. Ltd. - Best Solutions For Growing Businesses

"Peter Leow Consulting (PLCO) is a professional firm based in Singapore that provides Accounting, Corporate Tax, Secretary and Audit Services. Prior to establishing PLCO, our founder, Peter Leow, spearheaded and groomed a team of Accounting Professionals who served a thousand clients in the compliance arena over half a decade.

His drive and energy eventually created a turnaround for a low-performing consulting firm to one that is of a good repute.

When it comes to choosing the right professional service provider, you deserve a company that offers tailored, cost-effective and friendly service with a reputation for delivering exceptional results. You deserve Peter Leow Consulting!

Address: 20 McCallum St, #19-01 Tokio Marine Centre, Singapore 069046

Phone: +65 6823 8265"

1 note

·

View note

Text

Mistakes in Singapore tax filing can harm your business branding

The experts advise business owners not to make any mistakes in their Singapore tax filing. However, the fact is they do happen. Singapore tax filing is a sensitive issue, and even genuine errors in it can get you hauled in front of authorities and tarnish your business's brand image, customer relationship, revenue, and growth potential.

The due dates and tasks related to statutory compliance give small business owners sleepless nights. It stresses them no end. It is the reason why many of them enlist reliable providers of taxation services in Singapore. Let us see a few commonly occurring mistakes in Singapore tax filing that you, as a business owner, must avoid.

Not Separating Your Business and Personal Expenses

It is a good practice to separate your personal and business expenses. Because you are required to pay taxes on their revenue received from the sale of services and products. However, you need to deduct profit, business costs, and allowable business expenses from the revenue. This gives you the final figure.

However, sole business owners and self-employed individuals often get personal and business expenses confused. Then, they go and claim personal expenses as deductible business expenses in their tax return. It is a mistake you can avoid by simply keeping detailed records of all your income and expenses.

Reporting Less Income than What it Actually Is

Reporting less income than what it actually is is one of the common mistakes that you, as a small business owner, should avoid at your Singapore tax filing. It happens when you forget to include a few receipts or invoices in your return.

It puts you in a dangerous spot as it smells like you are trying to evade paying your full tax amount. And it is a mistake that you won't find your taxation services Singapore committing. These professionals documents each of your business's financial transaction.

Not Reporting Rental Income

Money earned through rental is also part of your income. Maybe you have rented out one of your office spaces to another small company, the money you earned is taxable, and you should report it in your tax return.

However, many owners fail to do so and commit one of the most common tax filing errors. Here you need to report the total gross rent. And there are certain aspects of rental income like improvement costs or commission paid to an agent that only an experienced taxation services Singapore can take care of in full.

Goods and Services - GST Filing

If your annual revenue has crossed S$1Million during the last 12 months, you need to register your company for GST. Not doing so will be your first mistake in this regard.

Afterward, you will need to charge and collect 7% of GST from your customers and pay it to IRAS. Not doing so as per the schedule will be another mistake you can commit. GST filing is a time-consuming task better left to your taxation services Singapore.

Your taxation services Singapore can assist you in regular bookkeeping and accounting of your books. It is essential for ensuring your business' statutory compliance. Updated and digitized financial data is easy to process to prepare various financial statements and reports. It also brings accuracy to your Singapore tax filing. Do not forget to maintain these records for at least five years as is recommended by ACRA.

#Taxation services Singapore#Taxation services#Taxation#taxationtips#gst filing#gst registration#gst refunds#gst return

0 notes

Photo

. . Man cave imperatives- A beautiful Late Vintage Cannon shaped Cigar gas lighter, Exceptional detailing and workmanship makes it an exact miniature replica of the original Lage 10 pounder British Cannon on Wheels, the Fuse area conceals the Input feeder hosing for filling gasoline, while the end of Cannon has the lighter switch, still the charge works perfect, just need a refill of Fuel, Handmade using wood, bakelite, copper, brass fittings. Makes a best addition to Men's cave and also a table display prop, coffee table accent etc.. . . Dimensions Barons cannon 9.5 inches long 4.5 inches tall 5 inches wide . . Provenance- From a Singapore based Chettiar family settled back in Kongunadu . . . 🛒Now on Sale 🛃Check📏 Dimensions for size 📮 DM for 🏷 Fair Price ✅Booking on full payment only 🚚Free Shipping all🇮🇳 ✈Safe Shipping 📦 Worldwide 🌎 ❌ No Returns-Exchange-Refunds . . Shop for New Arrivals, Special Offers & Featured products at out our website www.indiantiquest.com . . . INDIANTIQUEST ®️ GST, MSME, IEC, ®️ ™️ ©️ Certified All Images ©️ Copyright Protected . . . #indiantiquest #indianantiques #homedecor #antiques #collectables #antiquedecor #cannon #art #antiqueshop #antiquekitchen #antiquedealersofinstagram #lighter #antiqueshopping #antiquesforsale #cigarlighter #interiordecor #antiquefarmhouse #curiocollection #vintagevignettes #mancave #roomstylingprops #decorphotoprops #vintageprops #indiandecor #indianhomedecor #interiordesign #decorativeantiques #vintageshop #antiquestore #auction https://www.instagram.com/p/CVKVW9UPElk/?utm_medium=tumblr

#indiantiquest#indianantiques#homedecor#antiques#collectables#antiquedecor#cannon#art#antiqueshop#antiquekitchen#antiquedealersofinstagram#lighter#antiqueshopping#antiquesforsale#cigarlighter#interiordecor#antiquefarmhouse#curiocollection#vintagevignettes#mancave#roomstylingprops#decorphotoprops#vintageprops#indiandecor#indianhomedecor#interiordesign#decorativeantiques#vintageshop#antiquestore#auction

1 note

·

View note

Text

Singapore Tax and Accounting Services

How would you confront Judgment Day – the day you settle your specified expenses and present or assess your records? Do you do it in isolation or utilize an expert Singapore charge and bookkeeping firm to do as such?

As an accomplished individual who needs to zero in on business, you realize that a great deal relies upon the responses to these inquiries. Taxation services in Singapore firms offer an assortment of expense and bookkeeping-related administrations. It is additionally significant for each organization to guarantee that they are having sound bookkeeping records set up. The target of this review is to give total data on the bookkeeping and expense administrations in Singapore. If it’s not too much trouble, pause for a minute to survey our full line of duty and bookkeeping administrations as recorded beneath.

Singapore tax and accounting services

Singapore Personal Income Tax – It is applied to the pay procured locally. No expense is applied to pay underneath S$20,000, and pay above S$320,000 is burdened with the most elevated pace of 20%. Singapore occupants over 60 years old get half expense help, and those under 60 years get 30% of the assessment refund. Non-inhabitants pay individual duty in Singapore at a level pace of 15%. This is clearly stated by the tax planning Singapore agencies

Singapore Corporate Tax – It remains at a level pace of 17%. Organizations can go to FIS Business Services Pte. Ltd. for corporate assessment recording, charge arranging, and arrangement of Form C.

Singapore Property Tax – It applies to all non-private properties for example modern and business structures and private land. It is set at a level local charge pace of 10%. Proprietor involved homes with years’ worth of S$47,000 – S$130,000 in addition, draws in charge rates between 4% – 15%. For Non-proprietor involved homes esteemed at S$30,000 – S$90,000 yearly, welcomes charge rates between 10% – 19%. There are charge discounts accessible as well.

Singapore Withholding Tax – It is a piece of the instalment paid by a Singapore-based organization to an unfamiliar organization or a person. This sum is paid to the Inland Revenue Authority of Singapore (IRAS) as a retaining charge. For unfamiliar organizations the expense rate changes from 2% – 20% relying upon the administrations. For non-occupants, it is at a level of 15%.

GST Singapore or Goods and Services Tax – GST at 7% is applied to the utilization of a wide range of merchandise and utilization of administrations. Business elements gathering S$1million by selling available administrations and merchandise during the last 4 quarters, or those hoping to do likewise over the time of the next 4 quarters, are required to enlist and pay labour and products charge (GST). Fares to global business sectors are absolved from this expense.

Duty for Non-Residents – This assessment varies relying upon how long these experts work in Singapore. There is no duty for an expert working in Singapore for just 60 days. On the off chance that he labours for 183 days ceaselessly, the charge is 15% of the gross pay, or inhabitant rates are applied. Chiefs and experts are charged 20% of their expenses.

ECI Singapore – Each and every organization, toward the finish of its monetary year, should report its admirable chargeable pay, ECI Singapore, to IRAS (Inland Revenue Authority of Singapore). ECI proclamation should be documented with IRAS within 90 days from the finish of the organization’s monetary year and should incorporate the organization’s fundamental type of revenue. Income from an offer of fixed resources isn’t relied upon to be remembered for it.

Twofold Tax Treaties – The Singapore government with specialists from other exchanging countries signs these arrangements. These deals save the citizen from paying the expenses twice, once in Singapore and once in the country, where the sum is dispatched.

Notwithstanding taxation services Singapore likewise offers bookkeeping and accounting administrations. The bookkeeping administrations in Singapore incorporate XBRL documenting, accumulation of budget summaries, legal bookkeeping, and arrangement of chief’s report, corporate bookkeeping administrations, and expert bookkeeping administrations. The bookkeeping rehearses are agreeable with the administrative system of ACRA and IRAS.

1 note

·

View note

Text

The Essential Guide To Corporate Secretarial Services For Startups In Singapore

In Singapore's bustling economic landscape, startups are burgeoning at an impressive pace, necessitating a thorough understanding of corporate secretarial services. These services are not merely a formality; they are a pivotal aspect of a company's operational framework. They ensure compliance with local regulations and aid in smoothly running corporate governance. As we delve into this guide, we'll explore an essential guide to corporate secretarial services in Singapore and its role in establishing a startup. This discussion will highlight Singapore's dynamic business environment and extend to maintenance aspects.

#tax filing singapore#accounting services singapore#bookkeeping services singapore#double taxation agreement singapore#gst refund singapore#long term pass singapore#starting a business in singapore as a foreigner#corporate secretary singapore#corporate secretarial services singapore

0 notes

Text

2022-03-31

Health

With COVID-19 vaccines being delivered to growing numbers of young people, researchers are looking again at myocarditis risk

Gossip

Bruce Willis not acting anymore due to aphasia - does this condition explain why he’s been such an a$$hole in the past?

Will Smith refused to leave Oscars after being asked by President of the Academy & CEO

Society

Philadelphia teen fatally shot in head while grabbing water from car outside his home - appears to be a random shooting linked to 2 attempted robberies in the area; no suspects identified nor arrests made ...so how would having a gun have protected him in a scenario like that?!

Singapore

Jail for woman who cheated 75 victims of nearly $600K to fund her breast enlargement treatments - they didn’t even work, lol!!!

Employers who terminate contract of domestic helpers within 6 months can get refund

Electricity tariffs have risen by about 10% amid Ukraine war

300K public transport vouchers remain unclaimed - each with value of $30

950K HDB households to receive GST Voucher U-Save rebates in April

Nature

Do not eat the nightshade berry!!!

Singapore: Monitor lizard filmed eating koi @ Gardens By The Bay - the fish had probably been killed by otters & it was just feasting on their remains

Travel

Travel insurance for short-term visitors to Singapore no longer a must

0 notes

Link

These are JPG about Best iras singapore

Best iras singapore

Download

New Best iras singapore digital inkjet printing technology utilizing ultraviolet (UV) cured inks are being used for customized wallpaper production. Very small runs might be made, even a single wall. Best iras singapore Pictures or digital artwork are output onto blank wallpaper material. Common installations are company lobbies, restaurants, athletic facilities, and home interiors. This provides a clothier the power to offer an area the precise feel and look Best iras singapore desired.

IRAS Goods and Services Tax (GST): What It Is and How It Works

Download

IRAS Goods and Services Tax (GST): What It Is and How It Works New forms of wallpaper lower than development or getting into the market in the early 21st century incorporate IRAS Goods and Services Tax (GST): What It Is and How It Works wallpaper that blocks sure mobile phone and WiFi signals, within the interest of privacy. The wallpaper is lined with a silver ink which forms crystals that block outgoing signals

IRAS WANTS TO COLLECT INCOME TAX FROM DECEASED. COME I CLAP FOR YOU

Download

IRAS WANTS TO COLLECT INCOME TAX FROM DECEASED. COME I CLAP FOR YOU In 2012, scientists at the Institute of Stable Creation and Construction Material Technologies at the Karlsruhe Institute of Technology announced that they'd constructed a wallpaper which may assist maintain a masonry wall from failing in an earthquake. IRAS WANTS TO COLLECT INCOME TAX FROM DECEASED. COME I CLAP FOR YOU the wallpaper uses glass fibre reinforcement in countless directions and a distinct adhesive which forms a strong bond with the masonry whilst dry

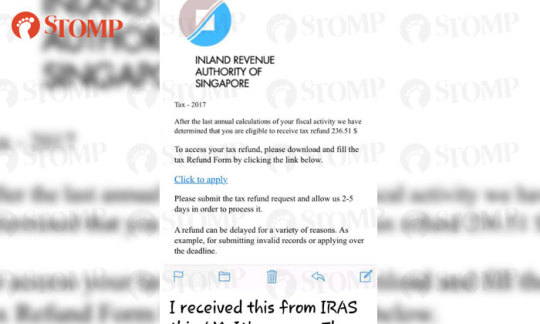

Scam email claims to be from IRAS, offers tax refund and wants your credit card details - Stomp

Download

Scam email claims to be from IRAS, offers tax refund and wants your credit card details - Stomp best-known painters, creates large-scale wallpaper installations that evoke the floral designs of William Morris in a mode that has emerge as referred to as word-art installation.

0 notes

Photo

GST Refund Refunds of GST tax reduces costs of goods for travellers, encouraging the movement of capita to Singapore.

1 note

·

View note

Text

Just a quick update, the tank starts to have diatoms covering the sand in the 3rd week. Now almost into 4 weeks, most of diatoms have disappear and still no sale of fish are allowed. Have to wait until phase 2 :(.

Anyway, sigh, there are some issues with the shipping of my cabinet from china. It ended up delaying for 2 weeks, today then it reach the logistic forwarder. Please don't use taobao's direct shipment to singapore for heavy stuff, there's a certain weight limit. My cabinet was rejected at the overseas sorting warehouse due to the weight and size limit and they only inform me 1 week plus later. End up, I have to arrange another logistic forwarder to ship to singapore.

My seller was a bit irresponsible, I got ask him to check beforehand if the overseas logistic can accept my order. End up still like and it still took another 1 week plus to deliver back to the seller after it got rejected. I keep want to refund but the thought of I need to wait another two weeks to custom made another one and another two weeks to ship it to Singapore. Errrr..forget it even though I found better quality cabinet but also a bit more expensive. I will leave it for next time I guess.

Hope that my tank will arrive next week. I used two different logistic forwarder, ezship for my cabinet and another logistic company from china for my tanks, my sis display cabinet and some other fish equipments.

I could ship all of them together but I decide not to wait for the cabinet and send out the tanks first. Shun bian test water to see which shipping company better. I used sea shipment for both, the price are comparable. Ezship is slightly cheaper, 60 for 1 cbm but it doesn't include the shipping in Singapore, have topup additional if you want them to ship to your house. I paid like 35 for my 30 kg cabinet but self collection and with gst is around 41. The sea shipment for ezship is by weight or volume weight, whichever is heavier. Whereas the china logistic company is by volume weight.

For my tanks, I paid around 118 in total inclusive of gst. The shipping fee is around 90 plus per cbm without gst and they ship to your house. Minimum is 1 cbm, anything below 1 cbm will still be 1 cbm price. For my tank, I used around 0.6 cbm. I bought two tanks, one tall display cabinet, some pvc pipes and some other smaller stuff. We still can buy more and ship them together to make the money more well spent. I see good reviews for their air shipment as well, less than a week reach already. I will review again once I receive my tanks, hope they will turn up fine.

0 notes

Photo

The Taste with Vir: Covid is a crisis not Armageddon - more lifestyle

https://www.liveindiatimes.com/the-taste-with-vir-covid-is-a-crisis-not-armageddon-more-lifestyle/

I am always a little intrigued by the casual ease with which politicians discuss the fate of the hospitality industry. When the industry does pop up in their consciousness it is nearly always in the context of safety. This is a valid concern (and more about that later) but it’s strange that hospitality is rarely discussed in terms of the jobs that are at stake or the potential damage to the economy.

It is symptomatic of this attitude that while Civil Aviation gets bright ministers (Jayant Sinha and Hardeep Puri are two recent examples), Tourism is usually left to the dullards (with a few notable exceptions like KJ Alphons in the last government). Somehow, we think the Tourism Ministry doesn’t really matter.

But, of course it does.

By some estimates, the hospitality sector accounts for around 10 per cent of our GDP. That’s travel (including airlines) restaurants, tourism, hotels, etc.

That estimate is based on a figure of ten million tourist arrivals a year. It sounds like a lot but Spain has 85 million arrivals a year. Even Singapore (which is just one city) gets 19.1 million visitors. The city of Bangkok got 22.7 million visitors last year.

So ten million tourist is peanuts. And yet that accounts for ten per cent of our GDP.

Obviously, if the city of Bangkok can get 22.7 million tourists to our 10 million, there is massive scope to grow. And while we have been fortunate to have outstanding civil servants who understand this (Amitabh Kant is the obvious example), the political establishment really could not care less.

I can’t understand why this should be so.

Tourism earns us revenue. It is labour intensive so it gives people jobs. Unlike manufacturing, where more and more jobs will be lost to mechanisation and robotics, tourism will remain an employment generator for the future. And it is an example of India’s soft power — a way of spreading goodwill.

Imagine for a moment that Tourism/hospitality boomed even slightly — say by two million. Think of the effect it would have on GDP, on the jobs it would create and the overall addition to national prosperity.

Unfortunately no government sees it that way. Which is one reason why no one is bothering to help the hotel and restaurant sector.

Unlike the airline sector which wants cash aid and official sanction for ripping off passengers by refusing them refunds, hotels don’t seem to want much. All the requests I have seen are for things like GST waivers, interest moratoriums and the like.

These are not necessarily cheap (for the government in revenue terms) but they are not demands for cash bailouts either and as far as I can tell, most hotel chains are not ripping off guests in the way that airlines are. (For the record, my view is that even airlines should be bailed out but after they guarantee salaries and refunds and pledge their shares in return for cash bailouts.)

What’s worse is the conviction among many people who count that the hotel and restaurant industries are done for and that tourists will stop coming to India.

This view is just silly.

Yes, if you force hotels to close and shut down your airports, then everybody is in trouble. But once you begin gradually re-opening the economy (in the case of the hospitality sector, between June and July, I reckon) things will begin to improve quickly.

The first big mistake we make while looking at the hospitality sector is in assuming that the world will stay static. It won’t. Things will get better.

All pandemics end. China seemed finished after SARS but it bounced back in six months. Even the Spanish Flu pandemic of 1918, which killed five per cent of India’s population, eventually ended. And today it is not even mentioned in many history books. (Did you even read about it in school?)

Covid will end sooner than we think. A drug that treats the disease should be available by the end of the year. (As I write, Remdesivir, a drug developed by Gilead is faring well in trials.)

A vaccine developed by Oxford University has worked well in monkeys and is currently being tested on humans. The most optimistic predictions talk about it being available by September. (Drug companies are so confident that they have already been manufacturing and stockpiling the vaccine).

Another vaccine, developed by Pfizer seems promising — it could be ready by the autumn. And at least six other vaccines are under development.

Vaccine development is a notoriously difficult business. But you would have to be a super pessimist to believe that all of these projects will fail and that no vaccine will be developed.

So a likely scenario is that guests who want to travel will be vaccinated by the spring. (Think of it like the Yellow Fever vaccines we had to take when we went to Africa.) And judging by the quantities in which the vaccine will be manufactured, availability may not be a problem .

After that, we will be as scared of Covid as we now are of polio, TB, smallpox, mumps, typhoid, chicken pox or God alone knows what else. The disease may not disappear. But it will not be a pressing concern either.

Once that happens, hotels, planes and restaurants are back in business. So, the logical worst case scenario is a financial crisis for the hotel/hospitalities sector from July (when establishments start to re-open) till April next year.

It’s bad. But it is hardly an end of the world scenario.

In effect though, the hospitality industry has about eight months (or less) that it needs to worry about. And hotels are preparing for how they will handle the situation in this short to middle term scenario before a vaccine or new drugs are created.

I asked Nakul Anand of ITC, who is now the doyen of the hotel industry (after Biki Oberoi, of course) how bad he thought things would get. Anand believes that during the pre-vaccine phase, there will be a recovery that will take several stages.

First of all, he says, people may be reluctant to hang around at crowded airports or to take long flights. During that phase, guests may prefer destinations they can drive to or those that are a short flight away. If you live in Delhi, you might drive to Jaipur, to Agra, or if you are happy with longer drives, Shimla or Mussoorie. From Bombay, the hill stations in the Western Ghats are an obvious choice. And if you don’t mind a short flight, then Goa (where Covid rates are astonishingly low). From Bangalore you could drive to Coorg. And so on.

Nakul Anand, Executive Director, ITC Ltd

Secondly, Anand explains, we know that millions of Indians travel abroad. (Some estimates say we have 26-30 million outbound travellers). Many of those travellers will be reluctant to go abroad now for a variety of reasons: fear, the higher cost of air travel etc. .And yet, many of these people will want to holiday at some stage, over the next few months. (Don’t you feel you deserve a break after this traumatic lockdown?)

The Indian hotel industry (at all price levels) will target these guests. Yes, we will lose a large portion of the ten million tourists who came to India from abroad. But there are at least 26 million (probably more) Indians who can make up for this.

Anand’s analysis is shared by much of the hotel industry. I spoke to Neeraj Govil, Senior VP and boss of Marriott International for India and South Asia. He said, “The domestic market and associated business opportunities in rooms and local F&B will recover first, followed by international travel.”

Until vaccines or cures are discovered, all hotel guests will be obsessive about hygiene. “Travellers are likely to demonstrate preferences for hotels that have and are able to effectively communicate enhanced sanitation and hygiene protocols,” adds Govil.

Marriott has prepared new SOPs for when the hotels re-open which make significant departures from current practices. All rooms will be left empty for a day after guests check out so that they can be properly sanitized, restaurant tables will be kept far apart, guests will be able to check in and check out with no physical touch points with staff, and if demand is not massive (which it won’t be in the next few months) then rooms next door to those occupied by guests will be kept empty and so on.

Neeraj Govil. Head of Marriott in India

Anand and ITC have an advantage because the group has always been the most environment and hygiene conscious chain (its symbol, since the 1970s has been a namaste, not a handshake or anything more personal) so the new post-Covid hygiene rules come easily.

Apart from Neeraj Govil and Nakul Anand, I spoke to other heads of hotel chains. Everyone has written the next two months off. But they are all set for the end of the lockdown. And nobody seriously doubts that by next spring, some semblance of normalcy will have returned.

It’s a crisis, not Armageddon.

To read more on The Taste With Vir, click here

Follow more stories on Facebook and Twitter

Source link

0 notes

Text

GCC gold market to benefit as India set to hike import duty

The shine of gold and jewellery markets in the GCC is to get added sparkle in the form of increased demand from Indian expatriates going on summer vacation following a proposal in the Indian budget to increase custom duty on gold and other precious metals from 10 per cent to 12.5 per cent.

"The proposal to increase the custom duty on gold and precious metals will spike gold prices in India, where prices are already at multi-year highs on the back of a weak rupee and higher international prices. However for Gold markets in the GCC, it will prove to be an unexpected boon during the holiday season," said Joy Alukka, Chairman of Joyallukkas Jewellery Group.

Alukka said in India gold attracts a GST of three per cent. The proposal to hike the impart duty from 10 per cent to 12.5 per cent will there bode bad for India's jewellery trade and buyers alike.

Shamlal Ahamed, Managing Director, International Operations of Malabar Gold, said the additional import duty for gold will hurt India's domestic gold and jewellery market and promote illegal gold businesses which is detrimental to the economy. "This, however, will lead to further price advantage in prominent neighbouring jewellery markets like the GCC, Singapore, etc. The price advantage along with VAT refunds for tourists will definitely lead to the GCC and Singapore benefiting from jewellery tourism," said Ahamed.

Read the full article

0 notes