#Equity Markets

Text

Exploring the Significance of Dividends in Equity Markets

Dividends as a Cornerstone of Investment

Understanding the role of dividends in equity markets is crucial for investors aiming to build robust portfolios. Dividends, essentially portions of a company's profit paid out to shareholders, play a vital role in the investment landscape. This article delves into the significance of dividends and their impact on equity markets, offering insights into why they are more than just a source of income for investors.

The Role of Dividends in Enhancing Returns

One of the key aspects of dividends is their contribution to total investment returns. Historically, dividends have formed a significant portion of the long-term returns for many equity indices, such as the S&P 500. This is particularly true in stable, well-established companies that have a consistent record of paying out dividends. Over time, these dividends can accumulate and significantly enhance the overall return of an investment portfolio.

Dividends also offer a measure of stability in the volatile world of stock investing. While stock prices can fluctuate widely, dividends tend to be more stable, providing a regular income stream. This can be particularly appealing in uncertain market conditions or during economic downturns, where they can offer a cushion against falling stock prices.

Fundamental Analysis and Dividend Metrics

Beyond their contribution to total returns, dividends are also a valuable tool in the fundamental analysis of stocks. When assessing the value and potential of a stock, dividends offer a tangible measure of a company's financial health and profitability. A consistent or growing dividend pay-out can be a sign of a company's underlying strength and its ability to generate cash flow.

This aspect of dividends is crucial for investors who base their investment decisions on fundamental analysis. Dividend metrics, such as dividend yield and pay-out ratio, provide insights into a company's performance that might not be immediately apparent from its stock price alone. Therefore, dividends can serve as an additional layer of analysis, aiding investors in making more informed decisions.

Reducing Portfolio Risk and Volatility

Another significant advantage of dividends is their role in reducing overall portfolio risk and volatility. Dividend-paying stocks have historically been less volatile than non-dividend-paying stocks. This can be particularly beneficial during market downturns or bear markets, where dividend-paying stocks often outperform their non-paying counterparts.

This risk-reducing characteristic of dividends stems from the regular income they provide, which can mitigate potential losses from stock price declines. Additionally, companies that consistently pay dividends are often seen as more financially stable and less risky, making them attractive to risk-averse investors.

Tax Efficiency of Dividends

Investors often overlook the tax advantages associated with dividends. Qualified dividends, for instance, are taxed at a lower rate compared to ordinary income, making them a tax-efficient source of income. This aspect of dividends can significantly impact the net returns for investors, particularly for those in higher tax brackets.

Inflation and Purchasing Power Preservation

Dividends also play a vital role in preserving the purchasing power of capital. In an environment where inflation erodes the value of money, dividends, especially those that grow over time, can help investors maintain or even increase their purchasing power. This is particularly important for long-term investors who need to ensure that their investments do not lose value in real terms over time.

Long-term Benefits and Diversification

Looking at dividends from a long-term perspective, they are instrumental in driving equity returns. This is evident even in growth-oriented markets, where dividends contribute significantly to total returns over extended periods. For instance, in markets like the US and the UK, a considerable portion of the total returns over the past decades has come from reinvested dividends.

Furthermore, dividends offer an effective way to inflation-proof investment portfolios. Historically, dividend growth has outpaced inflation, providing real growth in income over the long term. This characteristic is especially crucial in periods of high inflation, where preserving the real value of investments becomes a primary concern for investors.

Harnessing the Power of Diversification

Diversification is a fundamental investment principle, and dividends contribute significantly to this aspect. Broad equity index exposures that offer access to diversified dividend distributions can provide a defensive quality to portfolios. This is particularly true during market downturns, where dividends can be reinvested at lower stock prices, potentially amplifying returns when markets recover.

In summary, dividends are a key element in equity investing, offering multiple benefits including enhanced returns, reduced risk, tax efficiency, and inflation protection. They are not just a source of income but also a crucial component in portfolio construction and risk management. Understanding and leveraging the power of dividends can thus be a game-changer for investors looking to build and maintain robust, profitable portfolios.

Harnessing Innovative Platforms in Equity Investing

The evolving landscape of equity investing has seen the emergence of pioneering platforms like Spiking, which have garnered significant attention for their innovative approaches. These platforms represent a new era in financial technology, combining advanced algorithms and data analytics to provide investors with unique insights and tools.

One such platform, Spiking, has been recognized for its AI-driven capabilities, enabling retail investors to track and analyze the trades of experienced investors in real time. This approach not only democratizes access to financial information but also reduces information asymmetry in the market. By providing retail investors with the same level of data insights as more experienced investors, these platforms level the playing field in the equity markets.

The significance of such platforms lies in their ability to turn vast amounts of data into actionable insights. This is particularly relevant in today's fast-paced financial environment, where timely and informed decision-making is crucial. By offering real-time tracking and analysis, these platforms empower investors to make more informed and strategic investment choices.

Furthermore, the recognition of these platforms by established programs like the IBM Hyper Protect Accelerator underscores their potential impact on the financial industry. Such collaborations open doors to new opportunities and resources, further fueling innovation and growth.

In conclusion, as the equity investing landscape continues to evolve, platforms like Spiking are at the forefront, driving innovation and offering new ways for investors to engage with the market. Their success and recognition highlight the growing importance of technology and data in shaping the future of finance.

dailymotion

0 notes

Text

Global Stocks Fall as Investors Stress Over Recession

cThe S&P 500 file in the US fell 1.1%, the Stoxx Europe 600 list fell 1.2%, and the MSCI Asia Pacific Record fell 1.3%.

The auction was set off by various elements, including:

Worries about the conflict in Ukraine and its effect on the global economy.

Rising expansion and the possibility of additional loan cost climbs from national banks.

A stoppage in monetary development in China and other…

View On WordPress

#Asset values#Bear market#Economic crisis#Economic downturn#Equity markets#Financial markets#Global stocks#Investment#Investor concerns#Market sell-off#Market volatility#Recession#Stock Market#Stock prices

0 notes

Text

S&P 500 scores best day in 3 weeks as bond yields ease back

U.S. stocks finished higher on Wednesday as yields on long government bonds retreated from 16-year highs, helping lift the S&P 500 to its best day in three weeks. The Dow Jones Industrial Index

SPX,

+0.81%

gained about 125 points, or 0.4%, ending near 33,128, according to preliminary FactSet data. The boost, however, failed to push the blue-chip index back into the green for the year, a day after…

View On WordPress

#article_normal#bond markets#BX:TMUBMUSD10Y#BX:TMUBMUSD30Y#COMP#construction#Construction/Real Estate#Consumer Products#debt#Debt/Bond Markets#Derivative Securities#DJIA#Dow Jones Industrial Average#DXY#economic news#Equity Markets#Exchange Traded Funds#investing#Investing/Securities#NASDAQ Composite Index#real estate#S&P 500 Index#securities#SPDR S&P 500 ETF Trust#SPX#spy#U.S. 10 Year Treasury Note#U.S. 30 Year Treasury Bond#U.S. Dollar Index (DXY)

0 notes

Text

💪 Unleash the Power of Sweat Equity in Business ❗

🔰 Sweat Equity is the secret gem of business success. It's the art of exceeding financial investments by valuing skills, dedication, and time. Bringing founders, employees, and partners into a world of mutual growth, our comprehensive blog reveals its secrets. Join us in this synergy of ownership and effort!

Explore more at 👉 here

Download the mobile app👉 here

0 notes

Text

From Bearish to Bullish: Wall Street Analysts Embrace Soft Landing - What It Means for Equities and the Economy!"

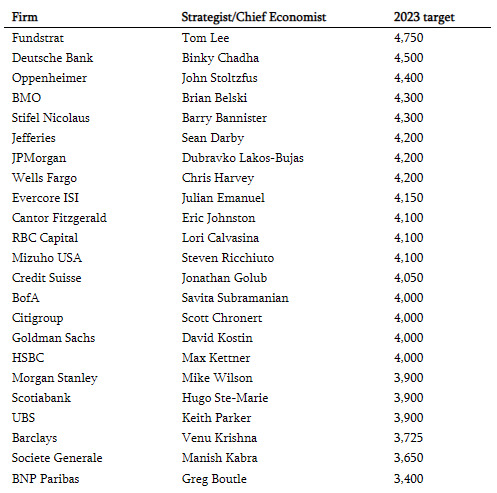

At the beginning of 2023, Wall Street analysts predicted a challenging first half for the equity market, painting a bearish outlook. They saw a number of headwinds, including rising inflation, interest rates, and the war in Ukraine. However, they also believed that the market would rebound in the second half of the year. Mike Wilson of Morgan Stanley predicted that the S&P 500 would fall to 3,000 in the first half of the year and then rebound to 3,900 by the end of the year. JP Morgan’s Dubravo Lakos-Bujas said they expect S&P 500 to re-test Oct 2022 lows in H1 '23. Michael Hartnett of Bank of America said that he stayed bearish on risk assets in H1, likely turning bullish H2; market narrative to shift from Inflation and rates “shocks” of ’22 to recession and credit “shocks” in H1’23. Average 2023 year end target for S&P was 4,080

Source: StreetInsider.com

Source: Cnbc.com

Source: Cnbc.com

Shift to a soft landing

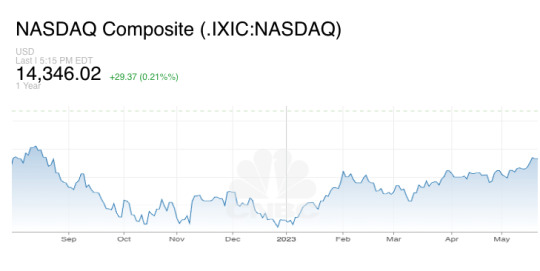

As the equity market has performed unexpectedly well, the analysts who once predicted a rough ride have now rallied behind the notion of a soft landing. This shift in sentiment can be attributed to several positive indicators that have emerged since the beginning of the year.

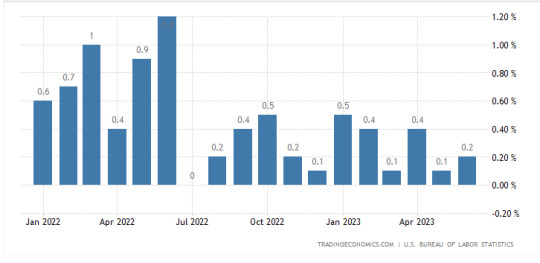

One reason is that inflation has started to come down. The Consumer Price Index (CPI) rose 9.1% in Oct 2022, but it has since come down to 3.0% in June 2023.. This is still above the Fed's target of 2%, but it is a sign that inflation is starting to ease

Another reason is that the US consumer is still strong. Consumer spending accounts for about 70% of the US economy, and it has remained strong even in the face of rising inflation. This suggests that consumers are still willing to spend, which is a good sign for the economy.

The labor market is also strong. The unemployment rate is at a 50-year low, and there are more job openings than there are unemployed people. This means that businesses are still hiring, which is a good sign for economic growth

As a result of these factors, Goldman Sachs has reduced its probability of a recession to 20%. Mike Wilson of Morgan Stanley has also thrown in the towel, saying that he was wrong about the market, and most of the equity analysts on Wall street have revised their year end targets upwards

Other analysts who have changed their tune include David Kostin of Goldman Sachs, who now believes that the economy will avoid a recession, and Peter Oppenheimer of Goldman Sachs, who now believes that the Fed will be able to engineer a soft landing. Even Fed Chair Jerome Powell has changed his tone. In a recent press conference, he said that the Fed's staff does not expect a recession, which is a significant change from his previous tone.

What to expect with a soft landing?

The biggest question is what the change in tone of equity analysts and Fed Chair Jerome Powell means for the equity markets and economy? Answer is nothing. In fact, it could be a red flag. There are a number of examples of this. In Feb 2007, Fed Chairman Ben Bernanke, after increasing the Fed Fund rate, expressed broad satisfaction that the nation remains on track for a "soft landing," a modest slowdown in growth that would reduce upward pressure on prices without aggravating unemployment. What followed was one of the worst financial crises in 2007-09. Fed did pull off soft landing in 1994-95, but inflation wasn’t very high during that period.

As you can see, there is no guarantee that a soft landing will be achieved, even if equity analysts and Fed Chairs change their tone. Investors should be aware of the risks and be prepared for the possibility of a recession. The risks to the equity markets are now higher than they were at the start of 2023.

One reason for this is the base effect. In the first half of 2023, inflation was declining due to the base effect. This means that the comparison to inflation in the same period of the previous year was lower, making inflation appear to be lower than it actually was. However, in the second half of 2023, the base effect will reverse, and inflation will likely increase

Source: Tradingeconomics.com

Another reason for the increased risks is the extremely low equity risk premium. The equity risk premium is the difference between the expected return on stocks and the risk-free rate. Importantly, the equity risk premium—or the extra return an investor can expect for investing in the stock market instead of risk-free 10-year Treasuries—is at its lowest level in about 20 years given P/E has expanded from 16 to 20

Finally, the positioning of portfolio managers has also changed. At the start of 2023, most portfolio managers were positioned very conservatively. However, as the markets have rallied, they have become more aggressive. Bloomberg's Global Equity Positions Index shows that the average equity exposure of global equity funds has increased from 56.7% at the start of 2023 to 61.2% as of July 2023

These factors suggest that the risks to the equity markets are now higher than they were at the start of 2023. The longer the Fed keeps the current hawkish stance of higher for longer, the higher the probability of an economic accident. The equities markets are not priced for a material economic accident, and the risk-reward ratio is worse right now. One factor that is working in favor of equity markets is momentum and it is a very strong factor for short-term. In the last five instances when inflation peaked above 5% (1970, 1974, 1980, 1990 and 2008), a recession followed. Will it be different this time?

Disclaimer:

The information presented in this blog post is for informational purposes only and should not be considered as investment advice. Readers are advised to conduct their own research before making any financial decisions. The author assumes no responsibility for the accuracy or relevance of the cited data and comments in this blog.

About the Author:

Aman Deep Singh Ahuja is a seasoned professional with a background in finance and technology. Currently working at Google. His prior experience includes serving as an Associate Partner at McKinsey & Company in New York. He holds an MBA from Darden School of Business, B.Tech from IIT Bombay and has cleared all three levels of CFA Connect with him on LinkedIn at Aman Ahuja

1 note

·

View note

Text

Markets extend correction from life-time peaks

Foreign fund outflows and crude oil prices hovering above USD 80 per barrel also weighed on equity markets.

MUMBAI: Equity benchmark indices declined in early trade on Monday, extending corrections from their life-time peaks for the second consecutive session, dragged down by index heavyweight Reliance Industries after the company missed street estimates due to weak performance in oil-to-chemicals (O2C) business.

Foreign fund outflows and crude oil prices hovering above USD 80 per barrel also weighed on equity markets as traders were awaiting the US Federal Reserve’s monetary policy decision to be announced this week.

The 30-share BSE Sensex declined 87.24 points or 0.13 to 66,597.02.

The broader NSE Nifty fell 10.65 points or 0.05 per cent to 19,734.35.

From the Sensex pack, Kotak Mahindra tanked more than 3 per cent and Reliance tumbled close to 2 per cent in the initial trade.

“RIL Q1 Results misses street estimates due to weak performance in oil-to-chemicals (O2C) business on account of a sharp reduction in crude oil prices and lower price realisation of downstream products,” said Prashanth Tapse, Sr VP Research analyst at Mehta equities Ltd.

JSW Steel, Tata Steel and Tech Mahindra were other laggards.

On the other hand, Mahindra & Mahindra and Larsen & Toubro gained more than 1 per cent.

IndusInd Bank, Axis Bank and Tata Motors were among other gainers.

Of the 30 stocks, 18 were trading in green while on the 50-stock index Nifty, 27 were in positive territory.

“The near-term market trend will be influenced by a host of factors like the recent Q1 results, some major results expected this week and policy decisions like the Fed meeting outcome on Wednesday,” V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said in his market outlook.

Vijayakumar further noted that the Fed is likely to raise the rate by 25 bp on Wednesday, but the market movement will be decided by the commentary of the Fed chief regarding future inflation and rate trends.

Investors may wait and watch these events unfold.

On Friday, both the indices settled more than 1 per cent lower in the previous session, snapping their six-day record-breaking rally.

The BSE benchmark tumbled 887.64 points or or 1.31 per cent to settle at 66,684.26 on Friday.

NSE Nifty fell by 234.15 points or 1.17 per cent to end at 19,745.In Asian markets, Nikkei 225 was up 1.38 per cent, while the stock markets in Hong Kong and Shanghai were not trading.

The US markets ended broadly higher on Friday.

Global oil benchmark Brent crude was trading 0.14 per cent lower at USD 80.96 a barrel.

Foreign Institutional Investors (FIIs) were sellers on Friday as they sold equities worth Rs 1,998.77 crore, according to exchange data.

0 notes

Text

Weekly Overview: Global productivity gains sound the alarm. FOMC minutes due out this week.

In this week's market update, we'll be taking a closer look at the recent performance of the NASDAQ, the impact of inflation and monetary policies in the US and China, and how all of this could shape the future of the equity markets and commodities. We'll also discuss the upcoming US labor data and its significance in assessing the state of the economy.

#US inflation#foundation for investments#global productivity#productivity gains#economic growth#major growth#positive productivity#equity markets#unemployment rate.#Consumer price index#inflation rate#Investment strategies#portfolio management#Productivity trends

0 notes

Text

How to Select Stocks and Manage Risk in Equity Intra-Day Trading

Introduction

Equity intra-day trading is a form of trading where you buy and sell stocks within the same trading day. It is a popular way of making profits from the fluctuations in the stock market. However, it also involves a high level of risk and requires a lot of skill and discipline.

If you are interested in equity intra-day trading, you need to understand how to select stocks, manage risk involved, and determine the best entry and exit positions. This article will answer these questions and provide you with some useful tips and tricks.

Before you start trading, you'll need to open an online Demat account with a reliable brokerage firm. A demat account is an account where your stocks are held electronically. It makes trading faster, easier, and safer. You can open a demat account online with Goodwill, one of the leading brokerage firms in India.

Goodwill offers low brokerage fees, advanced trading platforms, and expert guidance. To open a demat account online with Goodwill, visit their website and fill out a simple form.

How Do I Select Stocks for Equity Intra-day Trading?

Selecting stocks for equity intra-day trading is not an easy task. You need to do a lot of research and analysis before you decide which stocks to buy and sell. Some of the factors to consider are:

Liquidity: Choose stocks with high trading volumes and low bid-ask spreads. This ensures quickly and fair price transactions.

Volatility: Look for stocks with significant price movements and fluctuations. This will give you more opportunities to make profits from the changes in the market.

Trend : Select stocks that are following a clear uptrend or downtrend. This helps identify the market direction and trade accordingly.

Fundamentals: Focus on stocks with strong financial performance and growth potential. It will ensure that you are investing in quality companies that can generate consistent returns.

To help you select the best stocks for equity intra-day trading, you can use Goodwill's stock brokerage calculator. This tool helps you to calculate your brokerage fees, taxes, and profits for each trade. You can use it to compare different stocks and find out which ones are more profitable for you. To use the stock brokerage calculator, visit Goodwill's website and enter the details of your trade.

Conclusion

Equity intra-day trading can be a rewarding but risky way of making money from the stock market. You need a clear strategy, good knowledge of the market, and strong discipline to succeed in this type of trading. In this article, we have answered some of the common questions that you may have about equity intra-day trading, such as how to select stocks, how to manage risk, and how to time the market.

If you are ready to start your equity intra-day trading journey, you'll need to open a demat account with a trustworthy brokerage firm. A demat account is an essential requirement for stock market trading as it allows you to hold your stocks electronically and trade them conveniently and securely. Start your equity intra-day trading with Goodwill and enjoy the benefits of the stock market.

0 notes

Text

Equity Market

Understanding the Dynamics of the Equity Market: A Comprehensive Guide

An essential part of the global financial system is the equity market, commonly referred to as the stock market or the share market. It functions as a marketplace for people and organizations to purchase and sell shares in publicly traded corporations. The distribution of capital, the facilitation of investments, and the generation of possibilities for riches all depend heavily on the equity market. We shall delve into the nuances of the equities market, its varieties, and its operation in this essay.

What is Equity Market?

A marketplace where buyers and sellers can exchange shares or ownership interests in publicly traded corporations is referred to as a "equity market". By selling a portion of their ownership to investors, it gives businesses a way to raise money for growth, R&D, and other business endeavors. Through capital gains and dividends, investors have the chance to contribute to a company's expansion and profit margins.

Understanding the Equity Market:

It's crucial to become familiar with a few fundamental ideas in order to understand the equities market's dynamics:

Shares/Stocks: Shares and stocks are ownership stakes in a corporation. Investors who buy shares become shareholders and are entitled to a share of the company's assets and profits.

Stock Exchange: Stock exchanges are regulated marketplaces for the listing and trading of equities. Examples include the Tokyo Stock Exchange (TSE) in Japan, the London Stock Exchange (LSE) in the UK, and the New York Stock Exchange (NYSE) and Nasdaq in the United States.

Stock Indices: Benchmark indices that give an overview of the overall performance of the equity market include the S&P 500, Dow Jones Industrial Average, and FTSE 100.

Types of Equity Market:

Primary Market: The primary market is where corporations issue new shares in order to raise capital. When a private firm goes public, this is often accomplished through an Initial Public Offering (IPO). Investors can engage in the primary market by purchasing fresh shares from the issuing firm directly.

Secondary Market: The secondary market is where existing shares are exchanged between investors. This covers trading stocks on stock exchanges and over-the-counter (OTC) platforms. The secondary market gives investors liquidity by allowing them to exit or enter holdings at market-determined prices.

How does Equity Market Works:

Brokers, market makers, and computerised trading platforms facilitate a network of buyers and sellers in the equities market. Here's a brief explanation of the procedure:

Investors use their brokerage accounts or trading platforms to place buy and sell orders for stocks.

These orders are forwarded to the stock exchange, where they are matched with orders from other market players.

Market makers or brokers operate as brokers, enabling trade execution by purchasing from sellers and selling to buyers.

Following the execution of a trade, ownership of the shares is transferred, and the transaction is settled electronically.

The market forces of supply and demand influence the prices at which shares are purchased and sold. Stock prices are influenced by factors such as company performance, economic conditions, and investor attitude.

Key Players in the Equity Market:

Investors: Individual and institutional investors actively participate in the equities market, including retail investors, mutual funds, pension funds, and hedge funds. They buy shares in anticipation of capital gains or dividends.

Listed companies: Shares of publicly traded corporations are accessible for trading on stock exchanges. These businesses must comply with regulatory regulations and provide financial information to the public.

Stock Exchange: Equity market transactions take place on stock exchanges such as the New York Stock Exchange (NYSE), the NASDAQ, the London Stock Exchange (LSE), and the Tokyo Stock Exchange (TSE). These exchanges provide a regulated trading platform for securities.

Factors Affecting the Equity Market:

Macroeconomics Conditions: Economic variables such as GDP growth, inflation, interest rates, and unemployment rates have a substantial impact on the equities market. Positive economic data tends to increase investor confidence, which drives market performance.

Company Performance: Individual firms' stock values are influenced by their financial health, profitability, and growth potential. Strong profitability, new products, and effective management can boost investor interest and stock valuations.

Investor Sentiment: Investor sentiment influences market movements and is influenced by factors such as market news, geopolitical events, and public perception. A bullish market can be triggered by positive mood, whereas a bearish market can be triggered by negative sentiment.

Regulatory Environment: Government policies, regulations, and legislative changes can all have an impact on the equities market. Interest rate changes, tax changes, and industry-specific laws, for example, can have a large impact on individual sectors or the total market.

Investment Strategies in the Equity Market:

Fundamental Analysis: Fundamental analysis include reviewing a company's financial health, studying its industry position, and determining its growth prospects. To estimate the intrinsic value of a company's shares, fundamental analysts examine aspects such as earnings, revenue, cash flow, and managerial quality.

Technical Analysis: Technical analysts are interested in price patterns, market movements, and trading volumes. Based on historical price data and market patterns, they employ charts, indicators, and statistical tools to discover buying and selling opportunities.

Diversification: Spreading your investments across numerous companies, industries, or geographic regions helps to reduce risk. A diverse portfolio can mitigate the impact of a bad investment by balancing it with others that perform better.

Conclusion:

To summarize, the equities market is a vital and dynamic component of the global financial system. It allows individuals and institutions to participate in share ownership and investing activities. Understanding how the equity market works, completing extensive research, and taking a disciplined approach are critical to realizing its potential for wealth generation and capital growth. Whether you are a long-term investor or a day trader, the equities market provides an entry point into the exciting world of stocks and investing.

0 notes

Text

Rules to be Followed to do Intraday Trading

Trading stocks intraday may be more profitable during times of market volatility. However, it is a difficult matter overall because there is not enough time to spread the loss out. That's why, if you want to succeed as an intraday trader, you must stick to the basics.

Pick the right stock

In the world of intraday equity tips providers, not all stocks are created equal. Some of its features that make it a good fit are:

The stock can be quickly bought, sold, and turned into cash.

The rate of change in price over time is moderated by its low volatility.

This stock is part of an industry that has been doing well recently.

The stock price tends to move in the same direction as the market as a whole.

Make the proper moves

Contrast this with the approach to long-term investing that is taken in intraday trading. Consider whether this structure is a good fit for your personality before proceeding.

Daily goals are essential for any successful day trader. Keep track of your gains and losses in a journal. You need to figure out if you made money or lost money by the end of the day.

Fix the entry and exit prices

Stocks should be selected for intraday trading at their lowest prices. Setting sales goals at the time of purchase is a good practice. Stop-loss objectives should also be established. If the price falls below a certain threshold, you've committed to selling it at a loss.

Embrace moderate risk-taking

To put it another way, only gamble with money you can afford to lose. This is a high-stakes, potentially lucrative venture. The profits for the entire month could be wiped out by a single trade.

You should only trade with money you can afford to lose.

Put your feelings aside

Intraday trading, keep in mind, is all about strategy. The potential gain or loss is substantial and rapid. Therefore, it's important to maintain a level head. Neither your success nor your failure should cause you to lose perspective.

0 notes

Text

Is it to be a recession for the Euro area?

This is a curious phase for the issue of the Euro area and recession. It looked at first as though it has been in one at the turn of the year and then that got revised away. A 0% growth rate for the first quarter was enough to achieve that. Then the second quarter saw growth of 0.3% but around half of that was relying on believing that Ireland grew by 3.3%. This morning has seen the PMI survey…

View On WordPress

#bond prices#business#Dax#economy#equity markets#Euro#Finance#Germany#Interest Rates#Italy#PMI#Recession#US

0 notes

Photo

Incepted in 1983, STUDDS Accessories Limited is India's leading manufacturer of helmet and motorcycle accessories; Studds has a presence in more than 50 countries. Grab these private equity shares before it goes out of stock!

0 notes

Text

https://selftrades.in/bank-nifty-prediction-software/

1 note

·

View note

Text

Asian shares follow Wall Street lower after stronger-than-expected data

BANGKOK (AP) — Shares fell Monday in Asia after Wall Street benchmarks closed out their worst week since early December. U.S. futures edged higher while oil prices fell.

Reports on inflation, the jobs market and retail spending have come in hotter than expected, leading analysts to raise forecasts for how high the Federal Reserve will have to take interest rates to slow the U.S. economy and cool…

View On WordPress

#a#article_normal#AU:XJO#C&E Exclusion Filter#CN:SHCOMP#commodity#Commodity markets#Commodity/Financial Market News#COMP#Content Types#Derivative Securities#DJIA#Dow Jones Industrial Average#economic news#Energy markets#Equity Markets#Factiva Filters#financial market news#Hang Seng Index#HK:HSI#JP:NIK#KOSPI Composite Index#KR:180721#n#N/A#NASDAQ Composite Index#nikkei 225 index#S&P 500 Index#S&P/ASX 200 Benchmark Index#Shanghai Composite Index

0 notes

Text

Here are the signs that the bear-market rally in stocks won't last long - Citi

Here are the signs that the bear-market rally in stocks won’t last long – Citi

U.S. stocks have clawed back much of their losses from the first half of the year, but the three major indexes tumbled this week under reviving fears about interest rate rises by the Federal Reserve, and there are signs that the bulk of the bear-market rally is already behind us, said Citigroup’s analysts.

According to strategists at Citi Research, the current bear-market rally is almost in line…

View On WordPress

#article_normal#C&E Exclusion Filter#C&E Industry News Filter#commodity#Commodity/Financial Market News#COMP#Content Types#corporate#Corporate/Industrial News#Derivative Securities#disruptions#DJIA#Dow Jones Industrial Average#Equity Markets#Factiva Filters#financial market news#Financial Performance#Financial Services#industrial news#Industry Profiles#investing#Investing/Securities#marketing#Markets#Markets/Marketing#NASDAQ Composite Index#S&P 500 Index#securities#share price movement#Share Price Movement/Disruptions

0 notes

Text

Will the Federal Reserve kill the stock-market bounce?

Will the Federal Reserve kill the stock-market bounce?

A summer rebound is stirring hopes the bear market in U.S. stocks has seen its lows, but a meeting of Federal Reserve policy makers this coming week might test the nerves of would-be bulls.

“I expect we will continue to see market volatility until investors have seen more convincing evidence that this period of Fed hawkishness is behind us, and I do not expect that to be the message” when central…

View On WordPress

#a#article_normal#bond markets#C&E Exclusion Filter#commodity#Commodity/Financial Market News#COMP#Content Types#debt#Debt/Bond Markets#DJIA#Dow Jones Industrial Average#Economic News#economic performance#Economic Performance/Indicators#Equity Markets#Factiva Filters#financial market news#indicators#n#N / A#NASDAQ Composite Index#S&P 500 Index#SPX

0 notes