#$qqq

Text

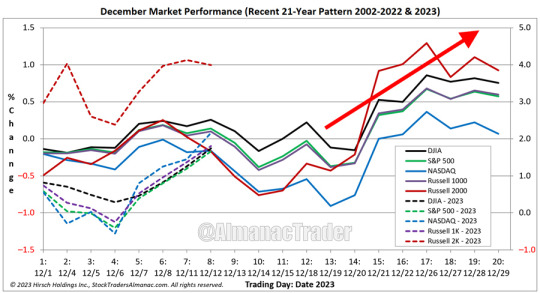

Moderating Inflation & Final Fed Meeting Clear Path for late-December Surge

This week’s CPI and PPI releases showed the moderating trend of inflation continues. Prices are still rising just at a slower pace and the rate of change could finally fall back before the Fed’s target of 2% next year. In response to and in anticipation of lower interest rates, the market has enjoyed above average gains in December.

As of the close on December 12, DJIA was up 1.74%, S&P 500 +1.66%, NASDAQ +2.16% and Russell 2000 up an impressive 3.99% (right side vertical axis of chart above). The market did experience some typical early December weakness this year after bucking the trend of weakness on the first trading day. Even though the market has already enjoyed above average gains this month, we still anticipate more to come with the potential for a new all-time closing high from DJIA before year end.

26 notes

·

View notes

Text

What to expect from the stock market this week

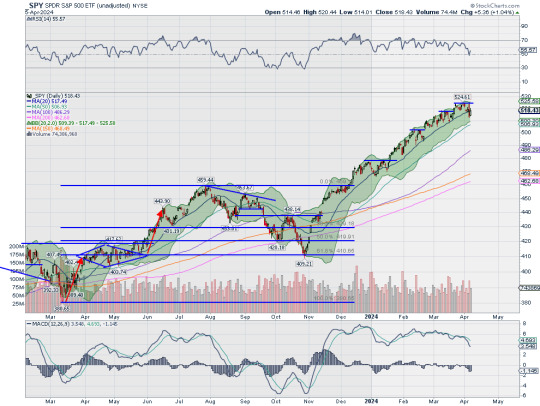

Last week, the review of the macro market indicators saw with the first week of April in the books, equity markets looked in need of a rest. Elsewhere looked for Gold ($GLD) to continue its record run higher while Crude Oil ($USO) continued its move to the upside as well. The US Dollar Index ($DXY) continued to short term trend to the upside while US Treasuries ($TLT) might resume their downtrend. The Shanghai Composite ($ASHR) looked to continue the short term move higher while Emerging Markets ($EEM) consolidated under long term resistance.

The Volatility Index ($VXX) looked to remain low making the path easier for equity markets to the upside. Their charts also looked strong, especially on the longer timeframe. On the shorter timeframe the $QQQ was at risk for some downside with the $IWM in a messy short term uptrend and the $SPY the strongest but also seeing some profit taking show up.

The week played out with Gold continuing it run of record highs while Crude Oil met resistance and consolidated at 5½ month highs. The US Dollar found strength and pushed to 5½ month highs as well while Treasuries made new 4 month lows before a bounce Friday. The Shanghai Composite pulled back from a lower high while Emerging Markets broke down out of the rising short term channel.

Volatility rose up from a short term consolidation to the top of a rising wedge. This put pressure on equities late in the week and they responded by moving lower. This resulted in the IWM back at support which was prior resistance for 2 years, the QQQ continuing sideways in consolidation near the highs and the SPY touching a 1 month low. What does this mean for the coming week? Let’s look at some charts.

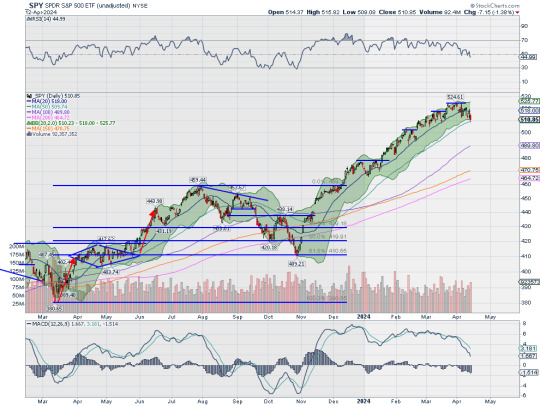

SPY Daily, $SPY

The SPY came into the week holding at the 20 day SMA on the daily chart after a pullback from the top. It held there Monday and Tuesday and then dropped below Wednesday in a reaction to the hotter than expected CPI print. Thursday saw it rise to retest the 20 day SMA and then fall back Friday to touch the 50 day SMA for the first time since the beginning of November. Price ended at the lower of the Bollinger Bands® with the RSI heading toward the bottom of the bullish zone and the MACD positive but dropping and approaching zero.

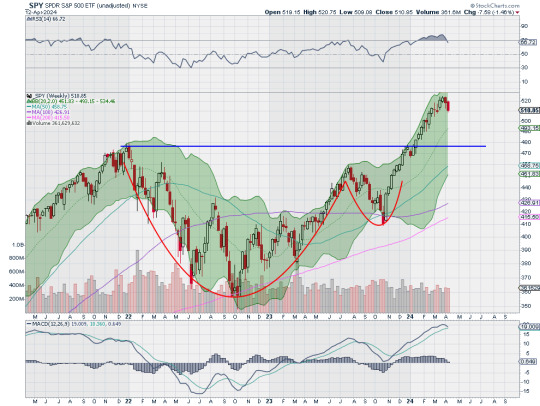

The weekly chart shows a second week headed lower, this one with a longer red candle. The RSI on this timeframe has dropped out of overbought territory with the MACD about to cross down. There is support lower at 510 and 503.50 then 501.50 and 498.50 before 495 and 491.50 with the retest of the Cup and Handle breakout at 476.75 lower. Resistance above is at 513.50 and 517.50 then 520.50 and 524.50. The 138.2% extension of the retracement of the 2022 pullback is above at 530 and then the Cup and Handle target at 560. Pullback in Uptrend.

SPY Weekly, $SPY

Heading into the April options expiration, equity markets showed some cracks in the uptrends. Elsewhere look for Gold to continue its uptrend, but with perhaps a short term pause while Crude Oil consolidates the move higher. The US Dollar Index looks to break to the upside while US Treasuries resume their downtrend. The Shanghai Composite looks to consolidate in its move higher while Emerging Markets consolidate in a broad channel.

The Volatility Index looks to continue to slow move higher keeping pressure on equity markets. The QQQ looks the strongest, especially on the longer timeframe as it consolidates while the SPY digests its strong move with a pullback. The IWM seems to have given up any chance of breaking out of the long consolidation as it falls back into the channel. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview April 12, 2024

5 notes

·

View notes

Text

HOLA MUNDO

ey buenas a todos guapisimos, aqui vegetta777 en un nuevo videoblog comentando

6 notes

·

View notes

Text

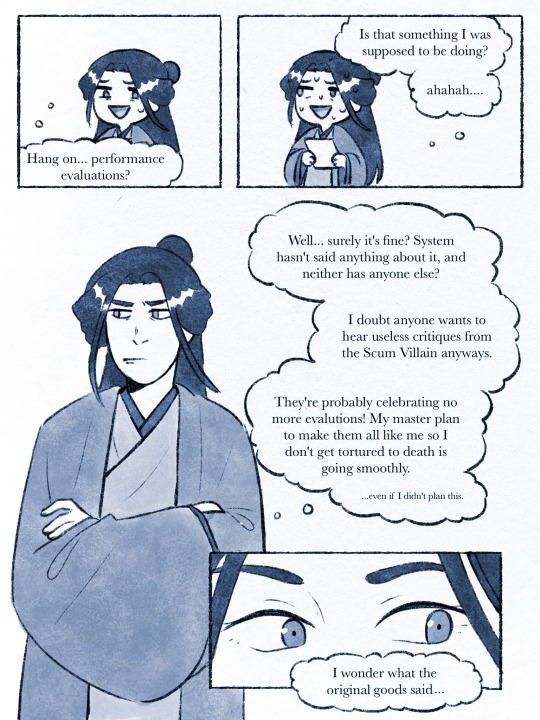

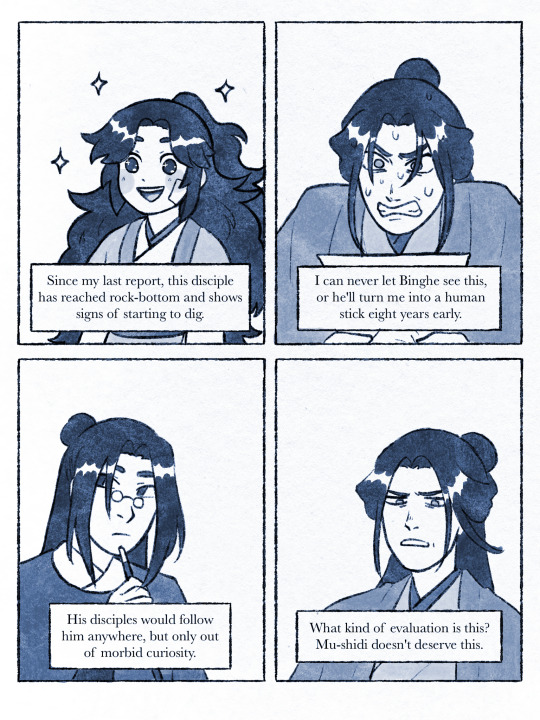

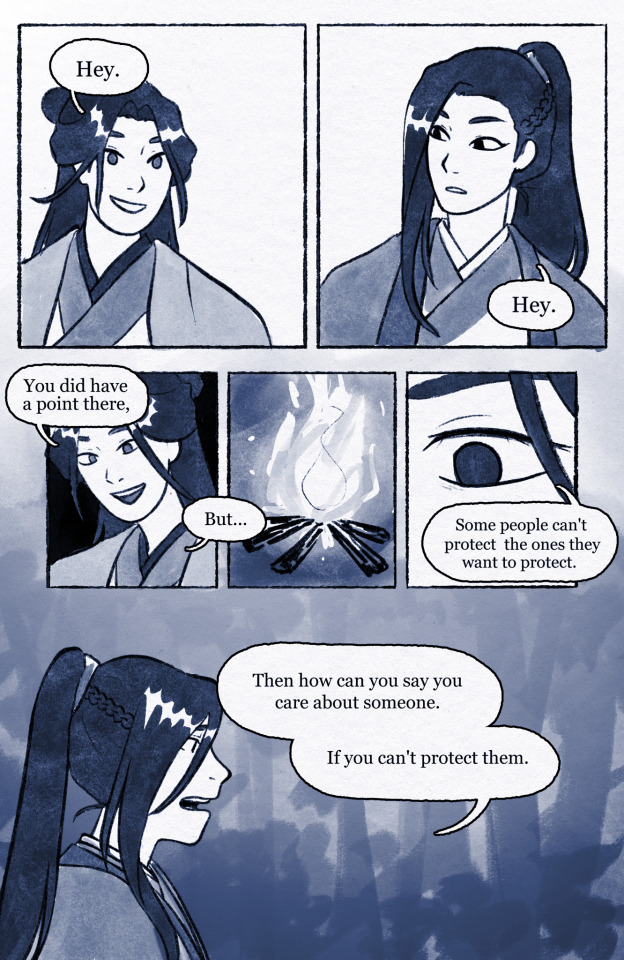

Local dumbasses insult their colleague

Aka the monthly peak lord meeting

#svsss#svsss fanart#shang qinghua#scum villian self saving system#shen qingqiu#mxtx svsss#svsss sqh#liu qingge#qi qingqi#svsss shen yuan#svsss qi qingqi#sqq looks so feral in this and I am all for it#qqq is a shit stirrer one hundred percent#and I am so gay for her lmao#these 4 are may favorite characters#mxtx#scum villain#i love drawing these guys

2K notes

·

View notes

Text

or: the one where shen qingqiu stumbles on a bunch of compiled evidence from qi qingqi that he is Not The Same Person as shen jiu

#scum villains self saving system#svsss#shen qingqiu#shen yuan#shen jiu#luo binghe#mu qingfang#liu qingge#yue qingyuan#ning yingying#ming fan#wei qingwei#shang qinghua#pippart#as far as i know#there's nothing in canon to indicate that qqq hated sj before lqg died#so it's my firm belief that the two of them were the mean girls of cqq and qqq thought sj was hilarious.#like they weren't friends but they did love being judgmental together#qqq thinks sy is fine but she just wishes he was openly mean more often. its very fun to watch him interact with sqh#i meant to make sj transparent but i forgot. anyways that's his ghost judging sy

4K notes

·

View notes

Text

This is the best day of head disciple yue qingyuan's life!!!!!! (don't tell him that the only reason this happened was bc shen jiu accidentally breathed in sleep inducing pollen and didn't bother telling anybody)

drawn for @slough_art's request for SJ falling asleep on YQY shoulder :)

bonus yqy fangirling in his diary when they get back to the sect:

#yes that's qqq bullying sqh in the front#head disciples mission!!!!#yue qingyuan#original shen qingqiu#scumbag self saving system#svsss#shen jiu#my art#qi qingqi#shang qinghua

2K notes

·

View notes

Text

#Happy birthday Dean Winchester#spn#dean winchester#spn fanart#supernatural#dean bbcita#tendría que haberle puesto una coronita qqq#acá ahora sí ya son las 12#mine

3K notes

·

View notes

Note

I think the top tweet is a bad faith interpretation of this sign. These protestors aren't telling Jewish people they should be in hell. They're talking to the Israeli invading force. The soldiers that have been bombing them.

I disagree. All Jews, even ones you don’t like, are indigenous to the Levant.

IDF soldiers don’t deserve antisemitism for being “bad.”

No Jews deserve antisemitism for being “bad.”

Muslims don’t deserve Islamophobia for being “bad.”

Hamas terrorists don’t deserve Islamophobia or anti-Arab hatred for for being “bad.”

People of any marginalized group do not deserve to face bigoted discrimination for being “bad.”

When you criticize people who you dislike from a marginalized group while weaponizing that group’s identity against them, then you are insulting all members of that group. Not just the ones you don’t like.

Bigotry is not ok. Ever. Period.

410 notes

·

View notes

Text

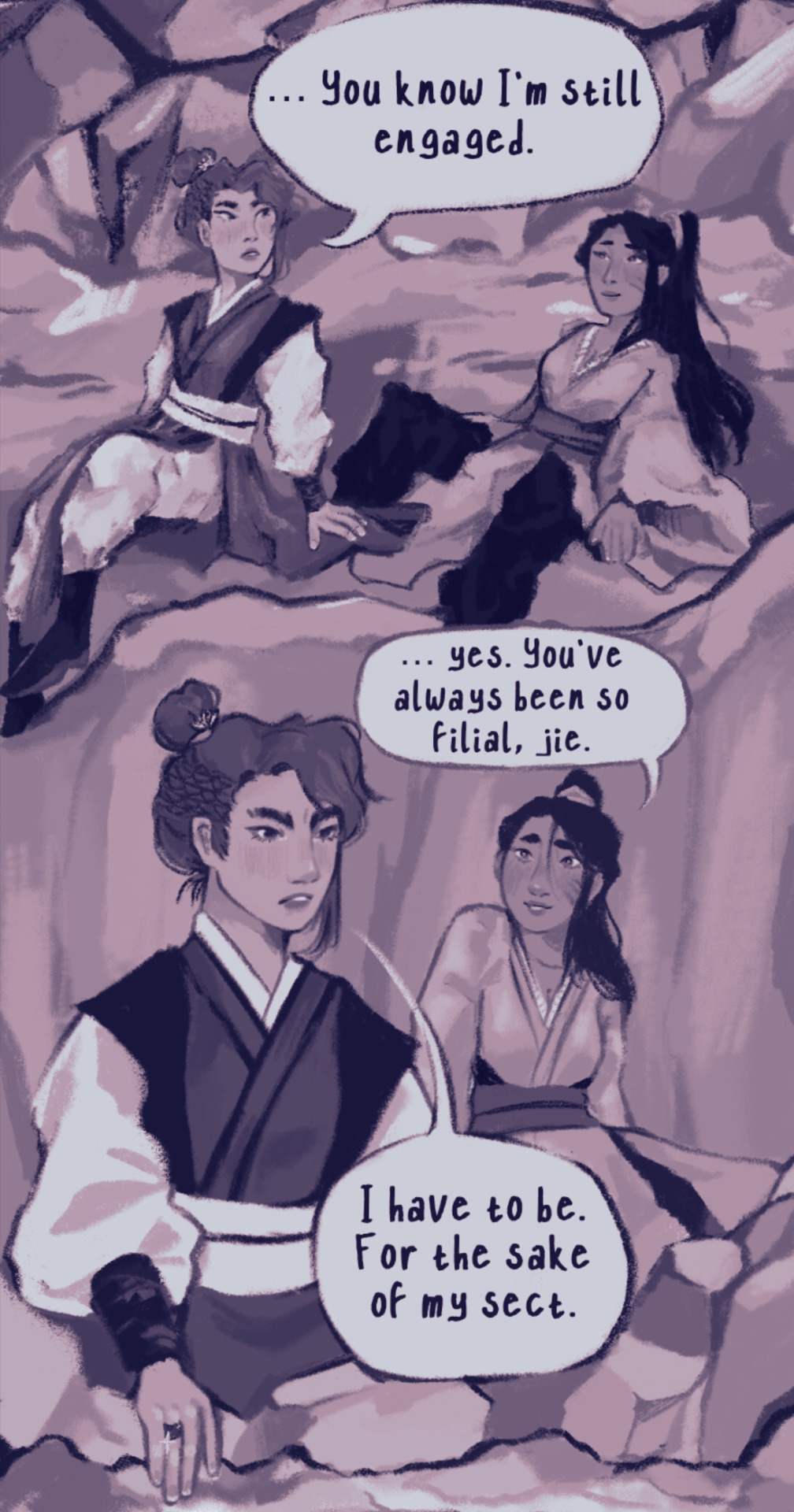

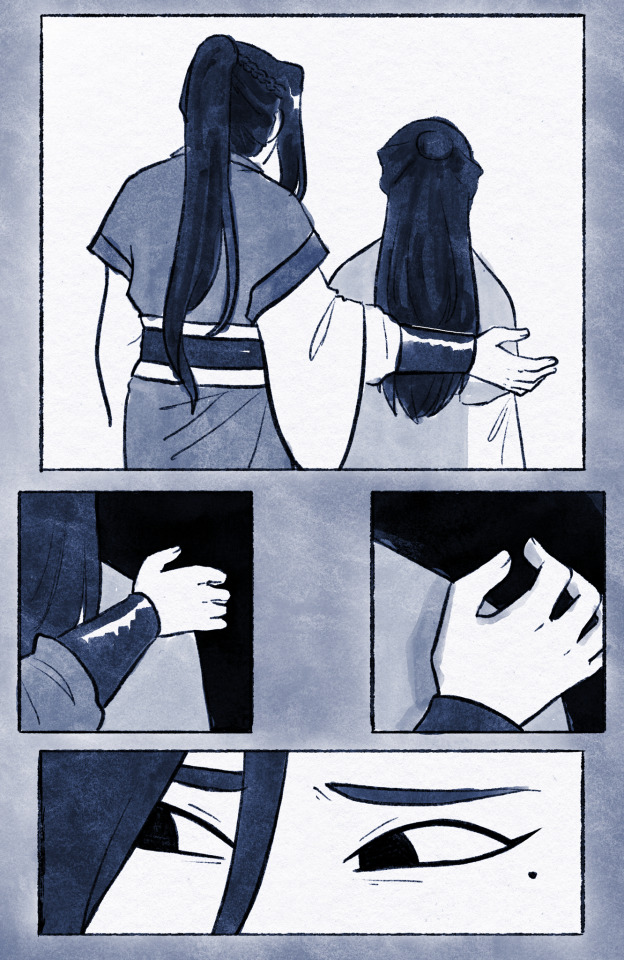

[Qi Qingqi x Yu Ziyuan] What could have been

(alt text)

#for the toxic yuri warriors#its so cringe you can see the parts i drew 2 yrs ago versus today right next to each other#😭😭 improvement I guess but the first few old panels are so hard to read what was i thinking fr#but i hope you enjoy.. go forth and make rarepairs#yzy#yu ziyuan#qi qingqi#qqq#mdzs#svsss#scum villain's self saving system#mo dao zu shi#my art

507 notes

·

View notes

Text

May Almanac: Historically Poor in Election Years

May has been a tricky month over the years, a well-deserved reputation following the May 6, 2010 “flash crash”. It used to be part of what we once called the “May/June disaster area.” From 1965 to 1984 the S&P 500 was down during May fifteen out of twenty times. Then from 1985 through 1997 May was the best month, gaining ground every single year (13 straight gains) on the S&P, up 3.3% on average with the DJIA falling once and NASDAQ suffering two losses.

In the years since 1997, May’s performance has remained erratic; DJIA up fourteen times in the past twenty-six years (four of the years had gains exceeding 4%). NASDAQ suffered five May losses in a row from 1998-2001, down –11.9% in 2000, followed by fourteen sizable gains of 2.5% or better and seven losses, the worst of which was 8.3% in 2010 followed by another substantial loss of 7.9% in 2019.

Since 1950, election-year Mays rank rather poorly, #9 DJIA and S&P 500, #8 NASDAQ and Russell 2000 and #7 Russell 1000. Average performance in election years has also been weak ranging from a 0.4% DJIA loss to a 0.6% gain by Russell 2000. Aside from DJIA, the frequency of gains in election year Mays is bullish, but down Mays have tended to be big losers. In 2012, DJIA, S&P 500, NASDAQ, Russell 1000 and 2000 all declined more than 6%.

5 notes

·

View notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the First Quarter of the year in the books, equity markets exhibited strength. Elsewhere looked for Gold ($GLD) to continue its uptrend while Crude Oil ($USO) built on its move higher. The US Dollar Index ($DXY) continued to drift to the upside in consolidation while US Treasuries ($TLT) consolidated in their downtrend. The Shanghai Composite ($ASHR) looked to reverse the short term uptrend while Emerging Markets ($EEM) consolidated in a broad range.

The Volatility Index ($VXX) looked to remain very low and stable making the path easier for equity markets to the upside. Their charts looked strong, especially the $SPY on both timeframes. The $QQQ was showing some momentum divergence that could lead to more consolidation or a pullback while the $IWM looked to step up as it broke to 2 year highs.

The week played out with Gold continuing to the upside, printing 4 new all-time highs and ending the week at one while Crude Oil also continued higher making 5 month highs. The US Dollar met resistance and then held in a tight range while Treasuries continued to flirt with a new move lower. The Shanghai Composite jumped to resistance and held there through Wednesday before closing for the week while Emerging Markets are threatening to break the rising channel to the downside.

Volatility rose to 5 month highs and held there Friday. This put pressure on equities mid week and they responded with a move lower. The SPY joined the QQQ pulling back from recent tops with the IWM looking like a possible failed break out. What does this mean for the coming week? Let’s look at some charts.

SPY Daily, $SPY

The SPY came into the week just pennies off the all-time high it set the day before. It held there Monday but then gapped down Tuesday to the 20 day SMA. It held there Wednesday and then opened higher in the typical bounce Thursday back at the all-time high. But that did not hold up as 4 Fed Presidents delivered the message that rate hikes will be delayed. It fell back and printed a bearish engulfing Marubozu candle, a potential reversal. Friday, however, did not deliver another move lower, but instead an inside day to the upside had it close back over the 20 day SMA. The RSI is moving back higher after a touch at the midline with the MACD leveling and positive.

The weekly chart, however, printed a bearish engulfing candle. This comes with the RSI overbought but now pulling back and the MACD starting to roll over after a 6 month move higher. The Bollinger Bands® do continue to point higher though. There is resistance at 520.50 and 524.50 with the 138.2% extension of the retracement of the 2022 pullback at 530 then the Cup and Handle target at 560. Support lower is at 517.50 and 513.50 then 510 and 503.50 before 501.50 and 498.50. Uptrend.

SPY Weekly, $SPY

With the first week of April in the books, equity markets are looking in need of a rest. Elsewhere look for Gold to continue its record run higher while Crude Oil continues its move to the upside as well. The US Dollar Index continues to short term trend to the upside while US Treasuries may resume their downtrend. The Shanghai Composite looks to continue the short term move higher while Emerging Markets consolidate under long term resistance.

The Volatility Index looks to remain low making the path easier for equity markets to the upside. Their charts also look strong, especially on the longer timeframe. On the shorter timeframe the QQQ is at risk for some downside with the IWM in a messy short term uptrend and the SPY the strongest but also seeing some profit taking show up. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview April 5, 2024

2 notes

·

View notes

Text

let sqh and qqq bitch together more

#this is from peerless melons vs the patriarchy but you can imagine what you like#shang qinghua#qi qingqi#sqh#qqq#svsss#scum villain

906 notes

·

View notes

Quote

I guarantee your soul is telling you exactly what you should be doing. The question is whether or not you’re listening.

Mel Robbins

#Mel Robbins#listening#active listening#soul#the soul#spirit#spiritualjourney#spiritualpath#spiritualgrowth#spirituality#spiritualinspiration#spiritual development#truth#true#reality#real#quote#quotes#qqq

3K notes

·

View notes

Text

Ngl I just wanted an excuse to draw lqg and qqq, but can’t imagine them saying any of the batshit insane things that this hellsite’s users come up with

#shang qinghua#svsss#svsss fanart#shen qingqiu#scum villian self saving system#qi qingqi#liu qingge#my head is pounding and I feel like I’m gonna throw up#I’m not sick tho#this took a lot longer to draw than I thought it would#I take it back sqh is not my favorite character#that honor goes to qqq#I love her sm I would totally date her#I love drawing her sm#sqq is so done with sqh’s shit#mxtx svsss#mxtx#svsss shen yuan#svsss sqh

1K notes

·

View notes

Text

i haven't been able to stop thinking about this thread from @dcyiyou so i finally sat down and drew it in a fit of possessed derangement. a lot of the dialog comes from them!!

#svsss#my wrist hurts but i gotta run to raid now LOL#liushen#shen yuan#shen qingqiu#liu qingge#qi qingqi#mu qingfang#wei qingwei#brief cameo from yqy#not pictured: all of the other disciples spying on these two#qqq is concocting a tragic backstory for sqq in her head but in reality he's just sad about the fact that binghe doesn't exist yet LOL#pippart#disciples era au#i tried to add an image alt to twitter but ran out of character spaces. sad day for me.

393 notes

·

View notes