Text

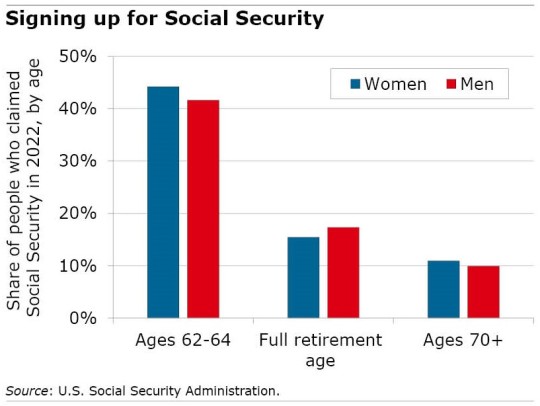

The complex process of applying for the Social Security benefit combined with doubts about being successful are often deterrents.

0 notes

Text

Part D plans to ramp up restrictions on medications. The biggest change has been the growing number of drugs that are completely excluded from insurers’ lists of covered medications.

0 notes

Text

COVID, with its unusually high death rate, left many retirees struggling with financial difficulties after their loss.

0 notes

Text

Most low-income workers don't save for retirement. But if they are given access to an employer plan, the improvement is significant.

0 notes

Text

Blue-collar workers can't always delay retirement to increase their monthly benefits, even if it’s in their financial interest to do so.

0 notes

Text

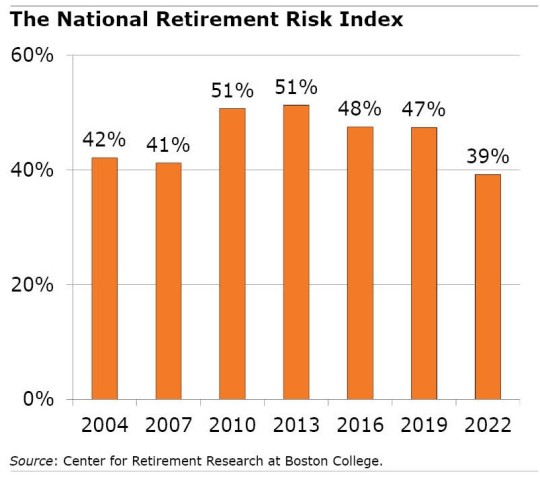

Rising house prices during COVID were the single biggest reason for the increase in workers’ wealth. But they rarely tap their home equity once they retire.

0 notes

Text

Efforts to vet applicants and prevent fraud are keeping eligible people from accessing government assistance.

0 notes

Text

The brief’s key findings are:

Our 2023 Small Business Retirement Survey looks at why some small firms offer a retirement savings plan and others do not.

Factors that affect whether small firms offer a plan include firm size, wages, and industry, as well as beliefs on whether it will help attract workers.

The main barriers to offering a plan are concerns about the stability/size of the firm and the perceived costs of a plan.

Concerns about costs are driven by misperceptions; many firms are unaware of lower-cost options for employers and tax credits.

The results also suggest that state auto-IRA programs are more likely to encourage than discourage firms from offering their own plan.

0 notes

Text

During COVID, a shortage of nurses and aides meant nursing homes hired more expensive outside staff, compromising the quality of residents’ care.

0 notes

Text

With the virus still raging, older people who were laid off or chose not to work had to weigh whether to sign up for Social Security or apply for disability benefits.

0 notes

Text

Many retirees have little in savings and can't really afford their payments. This is especially true of Black and Hispanic homeowners.

0 notes

Text

In videos, three women explain how they have reordered their lives to care for their parents.

0 notes

Text

A more generous Social Security formula for calculating retirement benefits for low-income workers would be the most effective option.

0 notes

Text

Automatically enrolling workers in a retirement plan increases saving. But they don’t reduce spending to fully compensate for the money they are saving.

0 notes

Text

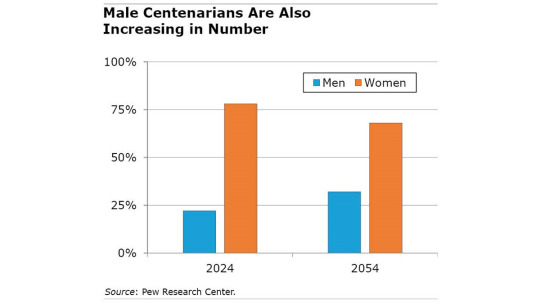

The number of people over age 100 will quadruple by 2054. This will require action on several policy fronts.

0 notes

Text

With fewer job options after being released from prison, former inmates have been more likely to apply for Social Security's disability benefits.

0 notes

Text

Blacks and Hispanics are more likely to be laid off. If a foreclosure of their home results, it can wipe out much of their wealth.

0 notes