Text

The Sweetener Aisle

by Kristina Seals

Introduction

Sweeteners have a long and storied connection to America. Honey and maple syrup/sugar were the primary sweeteners in early British colonies of North America. (Warner 2011) This changed as the North American colonies gained access to trade with the West Indies and increased their usage of cane sugar and molasses. Taxes imposed on cane sugar by Britain helped fuel the desire for American independence. As New Englanders established a highly lucrative triangle of trade in which they sent rum to Africa and brought back slaves to the West Indies in exchange for molasses, they saw how profitable it could be to operate outside of the mercantile system. (Mintz 1985) Once America formed an independent nation, it funded its new federal government primarily through tariffs on cane sugar. As America expanded, it gained territory capable of growing and producing sugar cane. The labor-intensive process of harvesting sugar cane and turning it into granular sugar was carried out largely through forced labor and created an economy that was heavily dependent on slavery. Other sweeteners, such as maple and beet sugar, became popular in abolitionist movements as a means to lessen America’s dependence on slave labor. Changes in technology and chemical discoveries throughout the 19th and 20th century affected the sweetener industry, which in turn impacted Americans: at home, in the workplace, in political affairs, and in their laws. Americans’ desire for sweetness did not decrease as they entered the 21st century but questions regarding its effect on public health have seemingly increased. How does the complicated history and politics surrounding sweeteners impact Americans’ purchases and use of different sweetening agents? How does this manifest itself in the American grocery store? To answer this question, I examined the store shelves of five grocery stores in the North-West quadrant of Washington D.C., a fitting location given it is the place where many of the political and legal controversies surrounding different sweeteners have played out in America.

Field Visits

Five stores were visited and either one or two aisles were looked at in each store. In some stores, syrups or liquid forms of sweeteners were on a separate aisle from powdered versions of sweeteners. The majority of sweeteners, especially powdered versions, were located in an aisle of baking goods. They were generally adjacent to flours and other items used in baking. Syrups and honeys were often adjacent to peanut butter and jam. The stores visited were: a Whole Foods Market, a Trader Joes, a Walmart Superstore, a Safeway, and an independent deli/neighborhood convenience store. As different store types try to appeal to differing types of shoppers or provide different types of shopping experiences, I wanted to see if the store type had any effect on what sweeteners were sold and how they were displayed. Then collectively, I wanted to know which sweeteners seem to be the most popular with D.C. consumers based on overall shelf space given to specific products throughout all five stores.

The first store visited was the Whole Foods market in the Foggy Bottom neighborhood of D.C. Sweeteners were found in two different aisles as syrups and liquid sweeteners were on their own aisle. The other sweetener aisle had five shelves of sweetening agents. One and a half of these shelves were devoted to sixteen stevia based products. There were six white granular cane sugar products and two confectioners. There were also four brown sugar products and two turbinado sugar products. They also carried sugar cubes and colored decorative sugar. This was the only store where I found date sugar. They also carried two erythritol products, one in granular form and the other in confectioners form. The other aisle contained: honey, maple syrup, molasses, agave syrup, brown rice syrup, coconut nectar, and corn syrup. They also carried a “vegan honey” that was made from apple juice. Out of the five stores visited, Whole Foods carried the largest variety of honey and syrups. Three shelves were devoted to agave products. The brands of sweeteners carried at Whole Foods all had very detailed labels with stories about how they are made, their benefits, and instructions on how to use them.

The next store I visited was a small neighborhood store, the Palisades Deli, which labels itself as a deli and gourmet grocer. They had ten items which were grouped together on the middle of the top shelf facing back of store. The majority of items were cane sugar based. They had traditional granulated white sugar in an opaque bag but also carried organic sugar and demerara sugar. They had brown sugar and powdered/confectioners white sugar in clear plastic bags laid flat on the shelf. They carried the three major brands of artificial sweeteners: Sweet and Low, Equal, and Splenda. These came in boxes which contained little pouches with two teaspoons of product. They also carried honey but in a powdered form designed to be used like granulated sugar. The labels for these products generally contained recipes or a picture of a beverage that could be made with the product. The organic sugar did contain details about its manufacturing process.

On aisle two of the Safeway on MacArthur Blvd, one can find cane sugar in a variety of forms including organic. Also on this aisle are: maple syrup, corn syrup, molasses, and honey. They carried a few artificial sweeteners which they placed next to their liquid stevia and monk fruit products. They also had a couple of interesting liquid hybrid products mixing honey or agave with stevia and monk fruit. Syrups were directly next to powdered sweeteners but honey was further down next to jellies and peanut butters. Packaging contained a mixture of environmental claims, health claims, how to use instructions, and recipes.

At Trader Joe’s in Georgetown, I found all types of sweeteners on one aisle. They had them separated into four sections: stevia, honey, syrup, and granulated sugar. All sugar was labeled as either organic or free trade and came in bags that allowed you to peek inside. Most sweeteners were the store brand including all the sugar and stevia products. They carried a lot of honey and pure maple syrup products. They also had shelf labels which carried additional information about the sweetener. Also, I did find agave syrup both on this aisle and then again above some frozen food.

For my final store, I visited Walmart on H St NW. They had their syrups and honey on a separate aisle than their other sweeteners. They had a wide variety of sweeteners and had generic store brand counterparts to most name brand sweeteners. This included store brand versions of: sucralose, stevia, saccharin, and aspartame. The generic versions used the same colored packaging as the name brand and were placed right next to each other. They had a lot of hybrid products some of which combined sugar with a sugar alternative which were labeled for baking so one could get some of the qualities of sugar needed when baking such as browning while still being fewer calories or just less sugar overall.

Raw Sugar

One product that was universally carried at all grocery stores visited was cane sugar. It came in various types of packaging and varieties but it appears cane sugar is still a staple in the majority of American pantries. Refined white granular sugar usually came in an opaque paper sack or in a box. At a couple of stores it also came in opaque plastic canisters. In addition to refined white sugar, there were a lot of less refined cane sugar products. These products came in bags which allowed you to see the sugar. They varied in color from blonde to deep brown. The less refined nature of these sugars was touted as a positive attribute on packaging. From the price and the difference in labeling, these appeared to be more of a luxury item than the sacks of refined white sugar. It appears DC consumers are willing to pay a premium for these items. This is an interesting development given that in 1861 Congress had determined the amount of tariff paid on sugar would be determined based on the Dutch Color Standard. (Warner 2011) The Dutch Color Standard was based on jars containing sugar ranging from dark brown to almost white. The lighter the color, the higher the number. Those that were highest on this scale paid the largest tariff. The lighter color was assumed to be correlated with purity, because the refining process removed the microscopic sugar beetles present in raw sugar. However, some sugar makers from the Demerara region of British Guiana, figured out how to make high purity sugar with a middling color and continued doing so because color alone was being used to determine the tariff. This style of sugar, with its pale amber color, is still found on store shelves today and is called demerara sugar. The mid-nineteenth century view of raw sugar as dirty, no longer seems to be prevalent today. This is evident in the use of the brand name “Sugar in the Raw” on a turbinado sugar product. These sugar products explain how they are more natural with the subtext being that the more natural a product is, the healthier it is. Not sure what turbinado sugar is? Just pick up a package of turbinado sugar at Trader Joe’s and it will explain the process of spinning sugar crystals in a turbine and that there is no coloring, blending or chemical refining involved. In addition to cane sugar products emphasizing being less refined, the label on a coconut sugar product boasted that it was “pure and unrefined” and that it was “unrefined but just as civilized”.

Environmental and Labor Labeling

Another trend observed was that a lot of packaging for sweeteners emphasized the methods employed in their production which lowered their environmental impact and their improved farming methods. The consumer interest appears to be substantial based on how much space on labels is devoted to text to convey this message and products paying for the right to use certification logos which signify meeting certain standards in these areas. One certification that appeared quite odd at first was the carbon free logo claimed on some bags of Domino’s brand cane sugar. How can sugar be carbon free, given that the chemical formula for table sugar is: C12H22O11? According to Domino, these specially marked packages have been certified as having a carbon neutral footprint by Carbonfund.org. The Domino sugar label claims to accomplish this by converting sugar cane and recycled wood waste into electricity. Why might Domino’s pay to have this certification on their product? According to Carbonfund.org, Customers are seeking to purchase products from companies which take care of the environment and their certification is a meaningful and transparent way to differentiate their brand as being environmentally-friendly to create loyal customers and increase market share. The Domino’s brand is owned by the American Sugar Refining company, who also owns the Florida Crystals brand. The products I found by this brand were: demerara cane sugar, raw cane sugar, and organic raw cane sugar. Their motto that is printed boldly on the front of their packaging reads, “Earth Friendly. Uniquely Delicious.” They explain their sustainable farming practices on their packaging and on their company website they state they are “Sweet to Mother Nature!”. (Florida Crystals) The development of sugar producers, particularly in Florida, wanting to be seen as stewards of the environment might be their way of changing their image after having made headlines for being fined millions of dollars for violating hazardous waste disposal laws or being seen as forced into responsibility for improving water in the Everglades. (Feder, 1991) Another popular certification found on a variety of different sweeteners is USDA Organic, which signifies that the product has went through an accreditation process to verify that they follow organic farming methods and have paid to be able to show that on their label. One product at Whole Foods carrying this label which caught my attention was Biodynamic Cane Sugar, produced by the Wholesome Sweeteners. In addition to the organic certification, it also certified as biodynamic by Demeter. Demeter Association is a non-profit established in 1985 to promote farming using biodynamic practices. (Demeter USA) According to the Whole Foods website, this is the first biodynamic sugar on the market and it is exclusively carried by Whole Foods. Biodynamic farming is a kind of early organic farming method, dating back to the 1920’s, that seeks to be in tune with the rhythms of nature that is based on the ideas of Rudolf Steiner. (Paull 2013) So far there is only this one product in the sweetener aisle that is Biodynamic; but given the popularity of the organic label it is quite possible this may be the next trend in positive environmental impact labeling.

In addition to environmental practices being highlighted, I also found packages which highlighted their labor practices. This was most evident in Whole Foods where there was an abundance of products carrying a certification of following fair trade practices. Only at Whole Foods did I find products which described this in more detail to explain how the farmers were paid. I did not find fair trade certifications on stevia products. This is interesting in light of the fact that the US recently confiscated a shipment of Stevia from China under the Trade Facilitation and Trade Enforcement Act of 2015, which bans the importation of products into the US made with forced labor. (Pentice 2016) The product was suspected to have been made via prison labor in China. This led to Coca-Cola having to prove that their stevia products did not come from the same source. It is possible that some companies may want to go through the third-party certification process as a way to help them make certain they are dealing with global partners who are not breaking these new labor laws. Companies who want to see their products on the shelves of Whole Foods might be motivated to seek fair trade certification because Whole Food Shoppers are often believed to be ethical consumers who in part seek to create positive social change through being mindful of how they spend their money. (Johnson 20007)

Non-nutritive Sweeteners

In addition to a variety of sugar products being found in the sweetener aisle, it carries non-nutritive or low to zero calorie sweeteners also. These are sometimes referred to as sugar substitutes or in the case of ones that are chemically made, artificial sweeteners. The artificial sweetener that I found with the longest history is Saccharin, which is sold under the Sweet and Low brand name. Saccharin was originally discovered in 1878 by Constatine Fahlberg. It is a derivative of coal tar. It was cheaper than sugar due to being 500 times as sweet. When sugar became scarce during World War II it was used in place of sugar. However, its value has been questioned since it does not contain carbohydrates like sugar but it has long been seen as being valuable for those who suffer from obesity or diabetes. For a time it had to be labeled that it was intended for “those persons who, on account of disease must abstain from the use of sugar”. (Warner 2011) I did not find this on today’s packages. I also only found this product at 3 of the five stores I visited. It along with Aspartame, another artificial sweetener developed in the 1960’s, did not receive much shelf space. Sucralose, a more recently developed artificial sweetener, came in a lot more forms than Saccharine and Aspartame thereby gaining more shelf space. This came under the brand name Splenda. Due to it being heat stable it promotes itself as being a good choice for cooking or baking with. It also came in packages where it was mixed with sugar into a 50/50 product. It appears that shoppers are interested in making baked goods that have less calories but are ok with it having some sugar. However, the non-nutritive sweetener with the most overall shelf space and found at all five stores is: stevia.

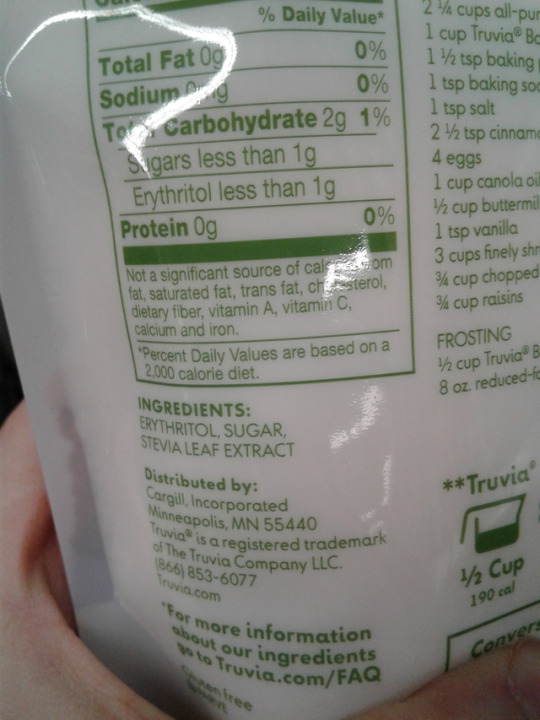

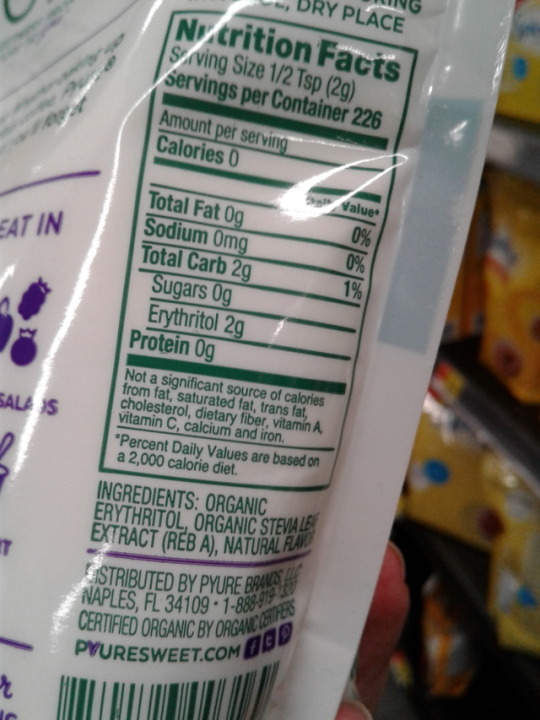

Stevia comes in a wide variety of formats including liquid stevia and stevia mixed with other sweeteners. At Safeway and Walmart, the majority of stevia products came under the Truvia brand. At Trader Joe’s it only came in a form touted to be pure stevia powder. These two type of stevia products appear quite differently. This is due to one being a highly-processed extract version of stevia, as is the case with Truvia, and the other being derived from the plant as a whole. To be approved as a food additive by the FDA stevia must be in the tested extract form. It has not been approved by the FDA in the non-extract form but is approved to be sold as supplement the way other herbs are. This is why the label on the product at Trader Joe’s tell you to take a teaspoon daily and does not contain a regular nutrition label. It appears Trader Joe’s and Whole Foods shoppers want the more natural version of stevia, whereas shoppers at grocery stores which sale artificial sweeteners seem onboard with the extracted version. The Truvia brand which is a product of the Coca-Cola company was the first to make it to market with the approved extracted form. Like Splenda, they provide multiple formats and are also willing to mix it with other sweeteners including sugars. I found it mixed with cane sugar and honey.

Conclusion

The limited scope of this observational study was able to provide some insight into what sweeteners are popular with consumers in Washington DC and what type of marketing strategies are being employed to get them to pick a particular sweetener. However, without seeing which items people pull off the shelves and how long they look at packages before buying most insight gleaned is speculative. It would be informative to survey those who purchase sweeteners to discuss what elements went into their decision. Again, the different types of stores could be used to further assess if certain stores truly attract shoppers who are more likely to base their shopping decisions on ethical considerations.

Americans are said to consume an average of 130 pounds of sugar a year a large increase from the average of less than 20 pounds in 1820. (Walton 2012) Given that the majority of food consumed by Americans is processed food, most of this sugar is not coming from the sweetener aisle but rather found in items throughout the store. It would be interesting to compare which sweeteners are popular with commercial food producers and contrast it with the sweetener aisle. One way to do this is start with one food area at a time. One area that gets a lot of attention for its use of sugar and even its use of artificial sweeteners is the beverage aisle. If I were to continue my study that would be my next target.

In 2018, the FDA has ordered that a new food label be used which identifies added sugars in grams and percent of daily value. (Center for Food Safety and Applied Nutrition) It would be interesting to do a study before, shortly after implementation, and a year or two after to see if there is any change to shopping behavior and if that then impacts how much sugar is used by commercial food producers or in how the package is designed.

References

Center for Food Safety and Applied Nutrition. (n.d.). Labeling & Nutrition - Changes to the Nutrition Facts Label. Retrieved April 25, 2017, from https://www.fda.gov/Food/GuidanceRegulation/GuidanceDocumentsRegulatoryInformation/LabelingNutrition/ucm385663.htm

Demeter U.S.A. Retrieved April 18, 2017, from http://www.demeter-usa.org/about-demeter/

Feder, B. J. (1991, December 02). Sugar Growers Seek Cleaner Image. Retrieved April 11, 2017, from http://www.nytimes.com/1991/12/03/business/sugar-growers-seek-cleaner-image.html?pagewanted=all

Florida Crystals. (n.d.). Retrieved April 11, 2017, from https://www.floridacrystals.com/

Johnston, J. (2007, December 30). The citizen-consumer hybrid: ideological tensions and the case of Whole Foods Market. Retrieved April 25, 2017, from https://link.springer.com/article/10.1007/s11186-007-9058-5 Paull, John (2013) "Koberwitz (Kobierzyce); In the footseps of Rudolf Steiner'", Journal of Bio-Dynamics Tasmania, 109 (Autumn), pp. 7-11.

Peña, C. T. (2010). Empty Pleasures: The Story of Artificial Sweeteners from Saccharin to Splenda. University of North Carolina Press.

Prentice, C. (2016, June 01). U.S. impounds PureCircle stevia under new forced labor law. Retrieved April 20, 2017, from http://www.reuters.com/article/usa-stevia-imports-idUSL1N18T26J

Product Certification. (n.d.). Retrieved April 11, 2017, from https://carbonfund.org/product-certification/

Mintz, S. W. (1985). Sweetness and power: the place of sugar in modern history. New York: Penguin.

Walton, A. G. (2012, August 30). How Much Sugar Are Americans Eating? [Infographic]. Retrieved April 23, 2017, from https://www.forbes.com/sites/alicegwalton/2012/08/30/how-much-sugar-are-americans-eating-infographic/#3fcb60894ee7

Warner, D. J. (2011). Sweet stuff: an American history of sweeteners from sugar to sucralose. Washington, D.C.: Smithsonian Institution Scholarly Press in cooperation with Rowman & Littlefield .

Whole Foods Market. (n.d.). Only at Whole Foods Market: Wholesome! Biodynamic Cane Sugar. Retrieved April 11, 2017, from http://media.wholefoodsmarket.com/news/only-at-whole-foods-market-wholesome-biodynamic-cane-sugar

N3bmRHt�/{??

#KristinaSeals#Grocerystore#sweeteneraisle#sugar#artificialsweeteners#rawsugar#ethicalshopping#wholefoods#traderjoes#safeway#walmart#sugarcane#syrups#honey#stevia#splenda#Truvia#anthropology

0 notes

Text

Beverage Luxuries at Your Local Grocery

Certain grocery stores take on a unique shopper’s convenience method: implementing pop-up coffee shops within the overall space. Separate from the coffee/tea aisles, pop-up style shops that feature a slightly different menu and a generally smaller operation. When I first observed this new trend, I enjoyed it as a luxury or perk rather than a necessity. I used my previous casual observations as a cornerstone for my grocery store project. The focus of this observation was on the purpose and consumer utilization of this extra convenience. A traditional stand-alone coffee shop features a range of seating options to encourage patrons to spend time in the shop outside of the purchase of the coffee. Grocery store coffee shops sometimes add seating to imitate this tradition, but is it as successful as its stand-alone counterparts? With coffee shop structures built into the larger grocery store floor plan, with seating included, this traditional coffee shop mindset can easily be adjusted to fit a different purpose.

This observational assignment took me to stores that identified as either grocery or gourmet shops. Giant, Safeway, Little Red Fox, Whole Foods, and Dean & Deluca were included in this study. Giant and Safeway featured Starbucks shops within their structures, and the remaining three used their own brand to create a coffee shop. From store to store, there were multiple similarities and differences, in terms of seating, patronage, and layout. To create a constant, I chose to make each visit during the “afternoon pick me up” time, between 2-3 PM.

Being the only observation in the middle of a college campus, the visit to Whole Foods Market in Foggy Bottom featured a unique situation. Usually in the later afternoon, Whole Foods is packed with patrons rushing to get some healthier fast food. Since the waiting line is usually very long, the line for the coffee shop serves an unspoken purpose of being the store’s express line. To the left of the coffee shop is a variety of hot food options, and the Whole Foods has a large cafeteria-like seating area for any patrons of the store, coffee shop included. For this reason, my observation of the seating area lead me to the conclusion that most patrons of Whole Foods Market use the seating area to eat a meal rather than sip a cup of coffee with an acquaintance, although I did see that at one or two tables, but it wasn’t trending. Other stores in this project had similar observational conclusions in terms of what the seating areas were used for.

Giant and Safeway both had smaller Starbucks shops located within the stores, and the design of the two shops were fairly similar, likely due to the fact that both coffee shops were the same company. Both stores were originally grand in size, with a small coffee shop positioned near the entrance to attract potential customers. In terms of seating usage, both shops had sparsely utilized seating, but in observing the passersby between the aisles, shoppers used their convenient shopping cart cup holders to sip a freshly made beverage while they shop. Where the two Starbucks visits differed greatly was in their seating arrangements. The Giant I chose to visit in Mclean, VA, had two tables and four chairs, while the Safeway in Georgetown, DC had multiple tables and chairs both adjacent to the counter and in a separate area outside the automatic sliding doors directly to the left of the Starbucks. Considering the notion of a grocery store being a very mobile and kinetic chore, the seating areas weren’t used as much as your average standalone coffee shop would be.

Both stores under the category of “gourmet” (Little Red Fox and Dean & Deluca) had prepared food as well as drink options, in separate areas of the store. For this reason, the seating areas provided are unspokenly present for anyone who purchases something made-to-order. At Little Red Fox--the smallest of the store visits--there was a real cozy and community focused nature that shone through in the rest of the store’s layout. For this reason, this store featured the most patrons drinking only beverages, instead of being accompanied by food, or eating food only. Dean & Deluca had a beautifully laid out espresso bar, with an exclusively outdoor seating area to accommodate the older, original layout of the building in this downtown area. Unique in comparison to the other stores was Dean & Deluca’s outdoor only seating. When the weather’s temperature rises, the espresso bar seating is an oasis-like destination for passing tourists. This seating area was also the most used of all five stores.

This project could have yielded deeper results if interacting with patrons and customers was possible. Making assumptions about those I observed wasn’t as ideal as getting the chance to ask them questions about how having the option of ready-made beverages helps or potentially hurts their overall grocery shopping experience.

0 notes

Text

Thinking Inside the Box

Breakfast cereal is a staple component of the morning meal in America. It is also a frequent snack and can even be eaten as an afternoon or evening meal. Capitalizing on the role that breakfast cereal plays in the American diet, producers compete for buyers using a variety of mechanics including colorful packaging, third party certifications (non-GMO project, USDA Organic, 100% Whole Grain, etc.), statements about nutritional information and quality on packaging, and other marketing techniques. Due to the versatility of cereal, it comes in a vast variety of brands, types, and flavors ranging from sugar sweetened cereals made from refined grains and vibrant food dyes to health cereals full of nuts and whole grains and everything in between. Thus, grocery stores ranging from small corner stores to high-end natural markets, often have a large aisle devoted to the display and sale of cereal. I examined the grocery store cereal aisles at four locations by conducting field visits to the stores. I gave attention to the location of the cereal in the store, layout of the cereal aisle, and marketing of the cereal by its own packaging in order to analyze how this staple product’s marketing, variety, and distribution at different locations.

Methods

I conducted field research at four grocery stores with a repeat visit to one of the stores. During the visits, the cereal aisle was located and its surroundings were recorded taking note of where the aisle was located within the store, any labels marking the aisle, and the other items in the aisle. Then, the cereal brands carried by the store were recorded. After recording the cereal brands, stream of consciousness observations about the cereal aisle and its content were made and recorded. Attention was given to finding patterns in the layout of the aisle, differences in children’s and adults cereals, and the presence and marketing of non-GMO and organic cereals. Visits were unstructured and observations were primarily noted based on what the store was emphasizing in its displays. Photographs of the cereal aisle, displays, and anything of note were taken at each grocery store. Visits lasted approximately one hour. Following a store visit the data was reviewed and a summary of observations along with relevant photographs were posted on this Tumblr page.

Grocery Stores

Four grocery stores, all located within northwest Washington, D.C. were visited. The Whole Foods Market in Foggy Bottom was visited first and again fifth. It is a high-end organic market in a compact, urban location that is near a residential neighborhood, a private university, and a business district. The second store visited was the Virginia Avenue CVS Pharmacy in Foggy Bottom. Although it is primarily a pharmacy, this CVS location also functions as a corner store where a small selection of grocery items can be bought. The CVS is a compact urban store located near businesses, hotels, and a private university. The third store visited was the Foggy Bottom Trader Joe’s Market. It is a friendly market with a warm inviting interior, handwritten labels, and chatty employees. It carries primarily store-branded products and is located in an urban environment near a residential neighborhood and a business district. The fourth store visited was Safeway on Macarthur Boulevard, which is a compact, urban branch of one of the largest chain grocery stores in the Unites States. It is located near a residential neighborhood alongside several shops and restaurants.

Findings

The location of the cereal aisle varied by store due to differences in the store’s layouts, but the cereal aisle was always located in a well trafficked area of the store either near the center or off to the side surrounded by other staple goods. Within the same aisle, other breakfast foods including granola, oatmeal, and cereal/granola bars were also present. Also, cereal was in the same aisle as baking goods in all the stores visited except Trader Joe’s. These pairings could indicate that grocery stores cluster breakfast foods together and cluster staple foods together for the ease of the customer.

Within the cereal aisle, organization of the cereal varied by store. Whole Foods organized its cereal by brand with no clear pattern to the ordering of the brands except that children’s cereal focused brands like Envirokids and Annie’s were clustered together at the beginning of the aisle. Trader Joe’s was organized by brand with the five not store-brand cereals grouped together. Most cereal at Trader Joe’s is store brand so store brand cereals were organized by cereal type and were arranged in such a way that the box colors and patterns gave the appearance of variety. The cereal at CVS was primarily organized by brand except for Kellogg’s cereal which was spread throughout the aisle and the children’s cereal was primarily located on the bottom shelf. The cereal at Safeway was not organized by brand, but was arranged in a spectrum going from children’s cereal to everyday adult’s cereal to health cereal to natural cereal.

All the stores visited had non-GMO and organic options available. Whole Foods had the largest variety within these options with all but one of its cereal brands being labeled as non-GMO. At Whole Foods and Trader Joe’s, organic cereals were integrated with the other cereal options with little marketing distinctions between the two which seemed to elevate the appearance of the surrounding non-organic products. CVS and Safeway did separate their organic cereals and these cereals were packaged in more neutral tones with lighter backgrounds. This allowed customers a distinct choice, but did not mark either choice as recommended over the other.

As briefly mentioned in the organization discussion above, the treatment of children’s cereal varied by store. In Whole Foods, three children’s cereal brands with colorful packaging and cartoon images were grouped together while the other three brands with children’s cereal, marked by smaller differences in packaging, had the children’s cereal integrated with the adult’s cereal. Similarly, Trader Joe’s which had very few types of children’s cereal, did not place this cereal in a special location. The children’s cereal at CVS and Safeway was grouped together. This could indicate that natural food markets tend to de-emphasize the differentiation of children’s and adult’s cereals, or could reflect differences in shopper tendencies to buy children’s cereal at natural food markets.

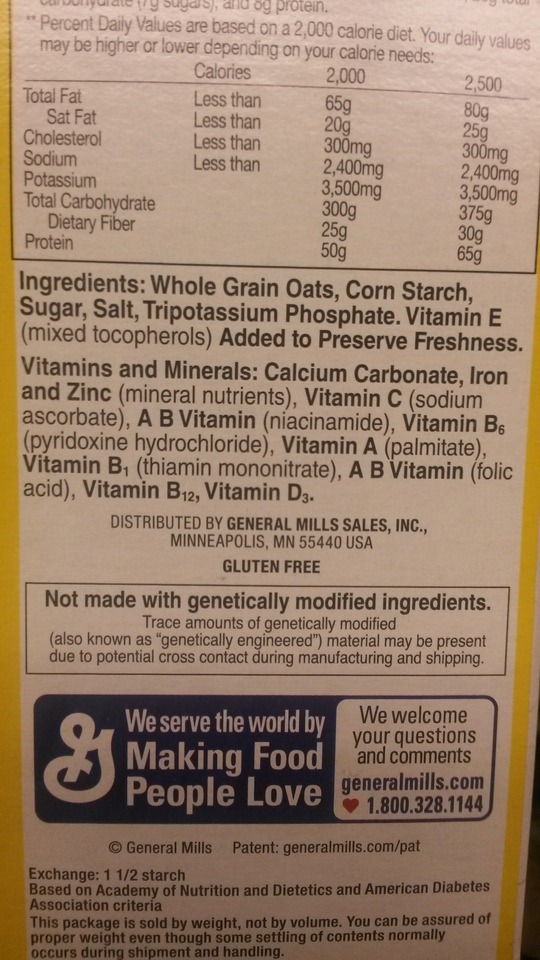

Before my second visit to Whole Foods, General Mill’s Honey Nut Cheerio’s “Bring Back the Bees” campaign was brought to my attention and with it a new attention to the cereal aisle. During this visit, I noticed that two other brands of cereal also have bee related campaigns with Cascadian Farms having “Bee Friendlier” statement on all its cereal boxes and One Degree having a “BeeSmart” statement on its Honey O’s. This experience shows that marketing a company’s sustainable practices can make consumers more aware of those practices in their general shopping and could be used as a method to help push consumers to actively buy more sustainable products.

Several aspects of this study indicate that ideas of ethical consumerism are present in the breakfast cereal aisle. The marketing on cereal boxes often shows nutritional and environmentally friendly messages that encourage consumers to make choices for ethical reason including feeding yourself and your family the healthiest food and consuming the food that was produced in the most environmentally friendly way. The marketing and organization in Whole Foods and Trader Joe’s seems to encourage more environmentally sustainable ethical consumerism. This is seen by their attention organic and non-GMO cereals while deemphasizing differences between children’s cereals and healthy cereals. CVS and Safeway seem to encourage more health centered ethical consumerism by separating sugar sweeten children’s cereal from cereals high in fiber and promoted as healthy.

Future Recommendations

The major limitation of this study is that it is purely observational due to the short-term nature of the assignment and the accessibility limitations of students. As a purely observational study, no information on the perspectives of the customers or the intentions of the store’s management were obtained so any analysis related to these perspectives and intentions are speculative and cannot be stated with any level of certainty. Including participant-observation and interviews could help to reveal these customer perspectives and management intentions and future research using these methods could be used for a more in-depth study. Such a study could examine questions such as what types of cereals are people choosing to buy and what factors influence these purchasing decisions? And how does customer’s cereal purchasing patterns influence the organization of stores’ cereal aisles?

Purely observational studies do, however, have some advantages including accessibility as no special access or relationships are necessary, a high level of trust in the data as it is all gathered from direct observation with no added uncertainty as to whether participants are being wholly truthful or not, and the ability to freely gather large amounts of data. These strengths make a purely observational study an ideal method for a short-term student project as it gives students access to a wealth of data without the need for time consuming planning, obtaining permission, and arranging and conducting interviews.

0 notes

Text

Simply Out-Of-Reach

For my fieldwork assignment, I was asked to go to various local stores and decide on a topic to research. It was challenging trying to figure out exactly what I wanted to study because there are so many things you can zone in on at grocery stores. After a couple of days, I decided that I wanted to explore the things that are inaccessible in our local markets and shops on campus. I wanted to explore this topic because it’s fascinating to see the items that are considered valuable or need to be handled carefully in these stores. I want to figure out if it’s based on the articles and location of the stores. The stores I decided to study were Whole Foods, GWU Deli, CVS, FoBoGro, and Safeway.

According to class guidelines, I started my field work study at Whole Foods Market. Our local Whole Foods Market is located at 22nd and I street northwest. Whole foods is one of our local campus markets and a lot of students go there because it is so close to our school and the accept Gworld (Colonial Cash provided for students) which is easier on students. Whole Foods is also known for their organic products and fresh produce. Which attracts college students and consumers in the area and want to seek a healthier path. The Whole Foods Market is a very spacious place that has two levels. The first tier, ground level I would say is dedicated to your regular grocery shopping. While the second level, top floor is designated for you quick grab items and things that need to be prepared. Also, I was exploring Whole Foods and looking for things that were out of reach I noticed that the atmosphere was different compared to a typical grocery store. This might sound silly, but it felt like an actual market. When I think of a market I think of a place that very intimate. There is an intense relationship between the employees and the customers and the customers and the items being sold. The name wasn’t just added to make the store seem more appealing. As I was walking around the store, I pretty much had a full range of everything I didn’t feel like I was being hounded or watched over. There is only one security guard at the door, but he or she normally greets you. Everything was pretty much open ranges except for things that have to handle a specific way or things that have to be specially prepared. On the lower level they have the seafood, meats, and cheeses behind the case that requires you ask for help and makes the items unobtainable but what stood out to me was that they had the seafood in the case, but it is not entirely closed. I believe that Wholes Food does this to add more stuff to the case and so that the custom can get a good look and what they’re purchasing. On the upper level of Whole Foods hosts mostly the things that need to be cooked and prepared. There is a bakery section where you have all your different cakes, cupcakes, custards and things of that nature in a glass case and the baker normally takes the orders and distributes the items in the case. On the other side, you have your different categories of food such as pizza, burgers, sushi, etc. Based on your food choice you will have a designated cook to prepare your food in front of you behind glass. Basically, in Whole Foods, the item you desire is only out of reach until you ask. I think this provides Whole Foods with a trustworthy environment and forces the consumer and workers to interact with each other.

Next stop was the GW Delicatessen located on 21st and G North West.

Gw Deli is pretty popular and well known for their bacon, egg, and cheese sandwiches. this deli was the place that inspired me to choose my fieldwork topic. Everyone knows that the GW Deli is a subtle hole in the wall, but it has any and everything that you could ask for. This place has food, drinks, and medicine, which are all, you would need to survive, as a college student because of it is convenient. The deli sales plenty of other things but I believe that is dedicated to a college student because it is very convenient. When I went to the deli, I went in the morning around 8 am because I knew there was going to be a long line, which is standard for the deli. I hopped in line and decided to order a sandwich that way it would be easier to take pictures of my findings. When I got into the from of the line, I noticed a case full of food such as coleslaw, egg salad, tuna pasta, potato salad and more served upon request along with the specially prepared food. After I had received my sandwich, I continued to wait in line until it was time to pay and as I was waiting I looked to see what items they were selling from behind the counter. Behind I noticed that there were a lot of unnecessary things, for instance, why are there a soccer ball and an ice hockey mask behind the counter? Also, they had a lot of restocking supplies behind the counter which causes me to wonder how often do the usually restock and if your guys don’t have room for it why sell it you know. Along with the other items, they have the typical things you keep behind the counter due to age requirements such as lighter cigarettes and medicine, which is normal. Also while visiting the deli, I didn’t have that trustworthy environment like I had with Whole Foods. There were cameras everywhere and the store severely overcrowded with stuff. This store wants to provide everything that a college student whole possibly need for everyday survival.

For my third visit, I decided to stop by the local CVS located on 20th Pennsylvania Avenue, Northwest. Just like the previous two stores, this CVS is convenient for GW students as well as for other consumers in the area. As I was studying CVS, I notice that a lot of things as far as food are pretty much obtainable but what took me by surprise is that the Dove soap was locked. You would have to get a CVS worker to get you a single pack of Dove soap. This is shocking to me because there are things that are more expensive than Dove soap that is unlocked and is accessible to the consumer that forced me to do additional research as to why the soaps are locked. I figured out why CVS has Dove soap secured and it is because people steal the soaps and sell them. Soap is a high demand items. No one is ever going to not need soap. Which is why it is easy to sell on the street. I believe the decision to lock the dove soaps away was made due to the location of the store. The store is never located a college campus, college students love dove soap and due to a lot of traffic in that area. This forces CVS to be caution.

For my next stop, I decided to go to FoBoGro located on 21st and F street northwest. Just like the GW Deli, FoBoGro is pretty much a whole in the wall. It’s a small little store known for their snacks if you have the munchies and drinks for when you want to have a real time. The store is pretty small the store clerk sits behind the counter and has a view of everything that’s going on so even if you thought of stealing you would get caught. I proceeded to look behind the counter and notice that the only things that were out of reach were their cigarettes. I believe this place was designed for the college campus especially when everything is closed and you are hungry or want a drink such as wines, beers and things of that nature FoBoGro is accessible and convenient.

For my final visit, I decided to go to my local Safeway, which is located on MacArthur Boulevard in northwest DC. This particular Safeway is small compared to other Safeways due to the location. I noticed that this Safeway is set up like Whole Foods because they also had their seafoods, meats, and cheeses behind glass cases. Also, they had a small section where you could order and get food served to go. I believe this serves the store a useful purposes because of the size and it allows the workers to interact with customers. When I typically visit the store one or few employees always ask where have I been. I normally don’t go to the store every week so it’s nice to know that remember and recognize me. Which makes me feel superb and I’m sure others feel the same.

To conclude, during my research I was able to recognize the different items that were out of reach to the consumer. It was compelling to what each store valued and thought it was best to keep away from buyers and the reasons why. If I were to do this project again, I would look at more stores and markets. Or possibly research the same stores but study them in different area and compare them.

0 notes

Text

Checking out the checkouts

Grocery stores employ many marketing methods to entice customers to part with money with the final temptations being in the immediate vicinity of the checkout. It is in this area that last minute impulse purchases happen as customers become, quite literally, a captive audience waiting to be served. Associated with candy and other unhealthy snacks, the checkout line is often the scene of parent/child disagreements as fractious children demand the easily reached products. Do the items offered vary in different types of grocery store? Are there notable differences between high-class retailers versus traditional supermarkets? For the purposes of this study, five grocery stores were visited – Whole Foods Market, Safeway, Trader Joe’s, Giant Food, and Dean & DeLuca – all located within Washington, DC, and all visited during the afternoon between 3-5 pm. Although a small sample group, the type of grocery store varied and can be divided into three broad categories:

1. Traditional: wide variety of goods, lower price points, family and weekly shopping

2. Natural: offering mainly ethically-produced, additive free and organic goods

3. Upmarket: high price points, appealing to an elite clientele.

The two grocery stores that fit into the traditional category are Safeway and Giant Food, both are part of American supermarket chains established in 1915 and 1936 respectively. The stores visited were located in residential neighborhoods and offered ample, free parking areas. These were the only two grocery stores that had more than one method of customer checkout available: self-service, 15 items or less, conveyor belt with cashier.

At both stores, the checkouts were almost identical in layout as well as the range of products displayed. Each lane had an endcap which was either a refrigerator of sodas, items on special promotion, or seasonal goods (for example, St Patrick’s Day balloons, Easter eggs and candy). The “corridor” leading up to and beside the conveyor belt was laden with brightly packaged, high-calorific items displayed from eye to ankle-level. Chocolate, candies, chips and other low nutrition snacks are temptations within children’s reach. Safeway and Giant also displayed a number of non-food goods at the checkout, for example, greeting cards, batteries, and magazines. The self-service areas had a limited amount of impulse items due, in most part, to the lack of space as these checkouts are mainly used by basket-only shoppers.

The next grocery stores surveyed were in the natural category of which two were visited. Trader Joe’s (TJ) and Whole Foods Market (WFM) are more recent additions to the American chain supermarkets and both stores place an emphasis on organic, non-additive, healthy, fresh food items with recyclable packaging where possible. The natural stores visited were in downtown locations (office/professional areas), only offered limited free parking, and catered mainly for the basket-only customer. Checkouts were centralized in both stores with shoppers joining one line leading to the cashiers. There were no conveyor belt style checkouts.

One of the most noticeable differences in the checkout line at TJ’s versus WFM was the number of last-minute items customers placed in their baskets or carts while waiting in line. WFM’s checkout line offered items similar to those in the traditional grocery stores, albeit with healthier foods on offer. Nuts, protein bars, chocolate and magazines dominated the area leading to the cashiers, and a number of body-related products were offered, for example, bath salts, hand cream, etc. all with an implied marketing message of “healthy” and “ethical.” It was observed that when conducting the field work no shopper made impulse purchases with most simply flicking through the magazines before dumping them in a pile at the end! TJ’s offered the largest range of goods among all five stores surveyed. Attractively displayed fresh fruit, bread, muffins, “homemade” pies (TJ’s marketed the baked goods as “Just like Mom used to make”), and wine supplemented the standard checkout line fare resulting with most shoppers adding a last-minute item while waiting to reach the cashiers. Both stores had seasonal items as impulse temptations although these were more obvious in WFM.

The final category of store is upmarket of which Dean & DeLuca (D&D) is a prime example. The most temptingly attractive store visited as part of this project, D&D offers true fantastical shopping opportunities. Exposed brickwork, stylish metal open shelving and good lighting makes the store welcoming. D&D is a basket-only store catering to well-heeled locals and tourists visiting Georgetown. The checkouts are discreet, without signage and the staff wear chef’s “whites” adding to the exclusive atmosphere of the store. The checkouts were laden with last minute items for purchase with the emphasis on artisan chocolates, candy, cookies and own brand goods. Pricing was very different to the other stores, for example, a small tin of artisan cookies was $24, and $8 for a snack-sized bar of chocolate. There were large, attractive displays of seasonal goods, which at the time of the visit were for Easter.

All five of the stores surveyed offered a wide range of confectionary (candy, chocolate) and salted snacks (chips, nuts) at the checkouts. It could be argued that the range at the traditional stores were far more unhealthy with higher calorific value. Nevertheless, last minute temptations were on display in all and most within reach of children. In a survey conducted about checkouts in supermarkets in Melbourne, Australia it was noted:

Only 7% of all checkouts had their display of foods or drinks out of the physical reach of children. At 87% of checkouts, children could reach these products from a trolley, which at 86% of checkouts children could reach food or drink from ground level.

In 2003, due to complaints from parents, the UK Food Commission launched a campaign to remove these items from the checkout area as they believed that supermarkets deliberately “attempt to activate ‘pester power’ and increase sales of these unhealthy products.” It took ten years before another initiative was started, a joint venture between the British Diabetic Association and the Children’s Food Campaign called “Junk Free Checkouts” which named and shamed supermarkets who did not removed unhealthy items from the checkout area. The campaign has been remarkably successful resulting in one of the largest UK retailers, Tesco, removing all confectionary from its checkout areas with other stores following suit.

The placement of high-calorific items in checkout areas can be viewed as adding to obesity risk as consumers’ resistance to such snacks “wanes when distracted, or tired, …and people are more likely to choose foods high in sugar and fat.” Grocery stores use product placement at checkouts to entice customers to purchase these items, indeed this location can “increase their sales by as much as a factor of five.” It is thought that “more than 70% of confectionary is bought on impulse,” a statistic that stores utilize to their advantage at the checkout. All of the stores surveyed for this project were guilty of using the checkout area to tempt consumers to purchase last minute high sugar/high fat items. Trader Joe’s was the only store which offered fresh fruit and, although it could be argued that the range of chocolate and candy at Whole Foods Market and Dean & DeLuca were of higher quality, nevertheless the placement is “both particularly influential and difficult to resist.”

The five stores surveyed are an extremely small sample but still showed the use of checkouts as a valuable placement area for impulse purchases. Differences were not so much in the variety of goods but in the quality and price point with traditional stores offering the unhealthiest snacks at the lowest cost. An observational survey of this kind produces very limited results and it would be greatly enhanced by interviewing store managers about the strategy they use when placing items for sale in the checkout aisle. Does the individual store decide or is it a head office directive? Interviewing customers both before and after checkout to see whether they had succumbed to temptations offered at checkout is key as listening to the actual consumers as to what should be available to purchase at checkout is crucial as without consumer pressure retailers are unlikely to change.

by Helen Jackson

Sources used:

Helen Dixon, Maree Scully, and Kristiina Parkinson, “Pester power: snackfoods displayed at supermarket checkouts in Melbourne, Australia,” Health Promotion Journal of Australia, vol. 7, no. 2 (August 2006)

Alex Delmar-Morgan, “Parents vet frustration at checkout aisles full of junk food in survey to kickstart new campaign,” Independent, September 15, 2013.

Deborah A. Cohen and Susan H Babey, “Candy at the Cash Register – A Risk Factor for Obesity and Chronic Disease,” The New England Journal of Medicine, 367.15 (October 11, 2012)

0 notes

Text

Ethnic, International, and Foreign: Authenticity and Appropriation of Global Cuisines in DC Metro Area Grocery Stores

My Armenian-American grandmother brought me to various Armenian food markets during my childhood in the Boston suburbs. Lahmajoun and boereg were special treats that we could only find in one of these specialty shops. I roamed the aisles examining labels written in some combination of Armenian, Arabic, Greek, and Turkish. Going with my grandmother was one of the few times I would hear her speak Armenia, which I would pretend to understand as I would nod in silence. Even so, these were times when I felt wholly Armenian.

Grocery stores have an immense capacity to create cultural spaces for their patrons. My study of grocery stores and their “ethnic food” options in the Washington D.C. area stems from my own experiences growing up. However, shopping at supermarkets has also spurred further questions of what makes certain groceries “ethnic.” Nearly every supermarket, especially chain stores, has an “international aisle” where customers can find various products that are traditionally not American. I use Claude Lévi-Strauss’ theory of structuralism. Structuralism proposes that people think in set binaries that are culturally dictated. Binaries oppose each other and define it’s opposite. My observational study of five grocery stores examines how markets create and perform ethnicity, which produces a binary of ethnic authenticity and appropriation of implicated cultures mediated by the target consumers of the store.

For the purposes of my research, it was necessary to define my terms such as “ethnic,” “international,” and “American.” Because “international aisles” are so often labelled, it is easy to take this definition for granted. However, they do serve a purpose of creating defined spaces in the grocery store. Anything inside the international aisle and on its shelves is automatically not American, thus ethnic. By the same logic, everything in the rest of the store is American. What is particularly interesting about this classification is that a customer could pick up raw ingredients from all over the store and create food sold in the international aisle, but it is exactly how this labelling has become so powerful to the everyday consumer. Putting ethnicity on a shelf immediately commodifies it and makes it something one could buy and sell. The commodification of ethnicity is integral to its understanding in the context of the DC/Metro area study. American is the default, generic, standard that occupies the rest of the store. Being American does not have to be labelled.

Determining authenticity is complicated and contentious. In creating an international aisle, Grocery stores unknowingly navigate this tricky conversation and negotiate what “counts” as authentic ethnic food and what does not. Despite this ambiguity, it was necessary for me to evaluate a grocery store’s determination of what it markets as authentic and ethnic, which I found incredibly difficult. In fact, the word “authentic” itself is problematic in that it assumes there is only a single, true, iteration of a certain culture. For example, “Authentic Indian Food” would only mean one thing; there can be no variation, nor any deviation from a set of strict, hard and fast recipes. Assigning authenticity is a teleological approach to perceiving culture and ignores globalizing processes as well as internal cultural changes. Not only have societies exchanged ideas, concepts, and art across national borders for centuries, but food, too, has been shared and changed through these same processes.

However difficult it is to measure authenticity, it is necessary to do so to some degree when juxtaposed with cultural appropriation. Cultural appropriation is the adoption of certain aspects of one culture by another without honoring or respecting the original culture. It is all too easy for grocery stores to appropriate ethnic food and misrepresent or essentialize the culture of origin in order to make it more American, and therefore widely marketable. Authenticity and appropriation are a binary opposition because they cannot exist together. Because it is almost impossible to determine authenticity based on arbitrary factors in an observational study, those who do not appropriate culture will be considered authentic.

Four of my five stores are in Northwest Washington D.C.; the fifth is located in Arlington, Virginia but was only a short distance outside the city proper. The Foggy Bottom location of Whole Foods acted as a control for my study since it is a busy location of a popular chain supermarket. My second store was the Lebanese Taverna Market in Arlington, Virginia. Lebanese Taverna is a D.C. area restaurant chain but the Arlington location is the only one with a grocery store attached. My third store was the Mediterranean Way in DuPont Circle, a small storefront advertised as a gourmet specialty store. I went to Foggy Bottom Trader Joe’s for my fourth store as another example of a chain supermarket but without an explicit “international aisle.” Finally, I went to Rodman’s, an independent supermarket in the more residential neighborhood Friendship Heights. To conduct the analysis, I mostly examined products themselves, their labels, and placement. I also noted location of the aisle if applicable, decorations (i.e. flags, etc.), and organization of the products. As this was strictly an observational study, I did not conduct any interviews or collect any data on customers or employees.

The chosen stores for my study appear to fall into one of two categories: general supermarket and specialty stores. The Lebanese Taverna Market and the Mediterranean Way are specialty stores whereas Whole Foods, Trader Joe’s and Rodman’s are general supermarkets. Rodman’s does occupy a special liminal space between the two categories as it is not a mainstream chain like Whole Foods and Trader Joe’s, but still has an extremely wide array of products including food, pharmaceuticals, liquor, and even housewares. It is important to note Rodman’s status as being structurally similar to a supermarket but not entirely a part of this category because it greatly affects how it treats ethnic food and imports. Specialty stores cater to a very specific market of consumers. In some ways, this allows for more freedom for the store’s products, but is also very limiting. While they a national headquarters does not dictate what they stock, by labeling themselves as a certain cuisine or specialty, they restrict themselves to a potentially small product selection. Additionally, they are beholden to the whims of the local consumers, which could also potentially be limiting.

These two categories of store do not explicitly dictate the treatment of ethnic food, but it does create two entirely different environments in which ethnicity is produced. They carry implicit expectations which adhere to the authenticity and appropriation binary. Since large supermarkets are stereotypically American, I would expect more appropriation of ethnic food. Since specialty stores brand themselves as selling a niche cuisine, I would expect them to be provide more authentic groceries. Large supermarkets, such as Whole Foods and Trader Joe’s, want to only be authentic enough to still be able to sell large quantities of products to a wide audience. Smaller specialty stores are already working with a smaller consumer base and may not be as concerned with appealing to a mass public. These expectations do not necessarily map onto reality.

Trader Joe’s and Whole Foods presented the most culturally appropriated “ethnic” products. Trader Joe’s uses the store name as the brand on nearly every product (i.e. “Trader Joe’s Vanilla Ice Cream,” there is no Ben & Jerry’s or other name brands). However, on Chinese, Italian, and Mexican themed products, “Trader Joe’s” is replaced by “Trader Ming’s,” “Trader Giotto’s,” and “Trader José’s,” respectively. It’s puzzling at first glance why they do this and why it only applies to these three cuisines. In fact, Trader Joe’s carries other international cuisines and labels them as such (“Indian Chicken Tikka Masala,” “Indian Fare: Jaipur Vegetables”) but continues to use the traditional branding. I propose that the blatant appropriation of Chinese, Italian, and Mexican foods arises from an American sentiment of comfort with these cultures. These three examples are popular cuisines in the U.S. almost universally. They have been heavily “Americanized” for decades. This becomes especially apparent in Whole Foods where Italian food, mostly just pasta and various sauces, has its own aisle separate from the “international” aisle. If Trader Joe’s attempted to rebrand other ethnic cuisines the same way they did with Chinese, Italian, Mexican then they might be criticized for appropriation more openly and publicly. Most consumers perceive Trader Ming’s, Trader José’s, and Trader Giotto’s as clever and witty but not offensive or indicative of appropriation because those cuisines are almost American in their own right. Though my study was observational and I did not interview or include interlocutors, Trader Joe’s markets itself as a truly American grocery experience, based on the common American name similar to the saying “just an average Joe” and the theme of the store being Californian.

The Whole Food’s “international” aisle is mostly made of East Asian, Southeast Asian, and Mexican fare. The Asian and Southeast products are mostly boxed, pre-made, add water, instant dinner meals. Very few of them had a language other than English on the labels. The Mexican shelf had ingredients, but only for stereotypical Mexican dishes that fell in line with the “Trader José” products at Trader Joe’s. This includes tacos, burritos, fajitas, and enchiladas. Most of the brands for all of the International Aisle products were American brands producing “international” foods. Both in the case of Trader Joe’s and Whole Foods, labeling products a certain culture creates a restricted and reductionist view. Thai food is not just Pad Thai in a fake take-out box; Mexican food is not just tacos. Whole Foods and Trader Joe’s stock what they know people will buy, and people buy what they are most familiar with. Of course, this method makes sense in terms of making the largest profit, but it constrains our ideas of ethnicity. Alternatively, Rodman’s, which has the size and breadth of products that other mainstream supermarkets have, avoids this appropriation. Though it does have a defined “international” aisle, marked by flags from around the world on top of the shelves, it does not limit its definition of cultures to one trademark item. Rodman’s carries novelty items and hard to find treats. Additionally, it had the largest range of cultures represented. Despite having a dedicated aisle, imports lined the shelves all over the store, sorted by type of product and not just where it came from. Rodman’s is an independent grocery store in a residential neighborhood in Washington, D.C., which has its fair share of international transplants. Friendship Heights is also fairly close to the Embassy Row and other diplomatic outposts. It’s possible that a combination of these factors contributes to Rodman’s overcoming appropriation that has become standard in large supermarkets.

The Lebanese Taverna Market and Mediterranean Way, despite both being small specialty stores, represent two sides of the binary opposition. It is worth noting that the Lebanese Taverna Market is part of a small chain of restaurants in the Washington D.C.-Metro area but the Arlington location is the only fast casual restaurant with a “market.” Many of the products were imports with predominant labels in Arabic. Interestingly, there was a cookie shelf with British shortbreads and others. As per class discussion, the presence of these was probably a result of British dominance in the region for decades that left a demand for British goods. This is a great example of how authenticity is a complicated label; British cookies are not “authentic” Lebanese food, but through global processes have become a popular treat. Also, the market had mostly ingredients, as opposed to instant or pre-made meals, in the market section, unlike Whole Foods or Trader Joe’s. The market was filled with customers eating at the adjoining café or doing light shopping on the weekend afternoon when I visited. The Mediterranean way, however, was deserted. There were some imported spices and coffees but they were displayed in fake import crates and the prices were prohibitively expensive. Olive oil and balsamic vinegar stations advertised expensive bottles, but they were not specialty brands or imports. The store had very few products all in all, and did not appear to be targeting a niche market for specific cuisines. Rather, they used a vague label of “Mediterranean” to sell a few expensive imports and generic, stereotypical food items, such Greek Spanakopita or Turkish Coffee that one would expect from a supermarket. The Lebanese Taverna Market may not have been a perfect representation of Lebanese market, but it lacked the cultural appropriation presented in the Mediterranean Way.

My research on ethnicity in grocery stores would have been strengthened by participant observation, interviews, and perhaps surveys. Individuals make up ethnic groups, and lacking voices from these groups leaves out what they might think about representation in grocery stores. Specialty stores and supermarkets shape ethnicity, but to what degree is hard to determine without the perspectives of shoppers. Appropriation of cultures has become a rampant problem in large and small stores that simplifies and reduces what it means to be a part of that culture. Though more “authentic” stores might create an inclusive identity, they still control the definition and evaluate what it means to be authentic.

#MerulloNicole#anthropology#food#anthro#foodanthro#foodanthropology#grocerystores#groceries#internationalaisle#ethnicity

0 notes

Text

Snacks Anyone?

When first presented with the field work assignment, I automatically knew what route I wanted to go in for the remaining of the semester. Typically, when going grocery shopping in various stores I never think too much about the social/cultural characteristics of that specific store. However, I have noticed how different the packaging is when comparing healthy and organic food to “regular” cuisine. I shop in the snack aisle frequently, not because snacks are my primary dietary source; but because the aisle as a whole contains very colorful packaging which ultimately draws me in. I figured that this topic would be great to do my field work on being that it is a matter that I encounter on a weekly basis during my shopping trips.

My overall goal during this field work is to compare and contrast healthy and regular snack items’ packaging, deciphering the different color pallets, and how it may or may not project an imaginary effect of a healthy vs regular snacks depending on the colors utilized. I will also examine the outcome, reasoning, and strategy behind healthy vs regular snack packaging.

My starting point store was the Whole Foods Market, located at 2201 Eye St NW. I decided to execute my store visit at 1 in the afternoon, during a normal lunch rush, in order to see customer activity that may happen in the snack aisle during that time. I wanted to be as inconspicuous as possible while taking pictures of the aisle, as well as taking consistent notes.

Not many people were on the snack aisle however, therefor it was easy to get the work done. I made sure that I photographed the entire aisle (fully framed), as well as smaller sections of it that was broken up in a categorized fashion. The chips were in their own section, separated by specific chip type such as: corn, potato, and tortilla. The different varieties of popcorn were all placed together alongside the chips on both sides of the aisle. The first, and most important thing that I noticed was that majority of the packaging in the snack aisle contained subtle, neutral color pallets. There was mostly tan, white, and powder yellow on the snacks’ packaging. There were some vibrant colors such as red and blue that were on chips widely known for having bright packaging (Lays and Doritos). These chip substitutes obtained the same colors as the original brands in order to appeal to customers who are familiar with these snack items, while still projecting a “healthier” quality based on the stores products as a whole.

Grocery store visit number two was at the CVS located on Pennsylvania Ave, NW.

Some may not think of CVS as being a grocery store however, I do a lot of my grocery shopping there as well. This is the place I go to if I want a variety of snack foods.

This CVS had two snack aisles that contained snack foods however, only one was labeled the “Snack” aisle. It looks as if CVS separated the healthy snack foods from the regular ones. In the aisle that wasn't labeled the “Snack” aisle, but the “Cookie, Water, and Cracker” aisle; obtained Lays, Doritos, Salsa, Oreos, Ruffles, etc— snack foods that are popular and widely known. This aisle overall was very in packaging, and had a range of primary colors such as: yellow, red, and blue. The actual “Snack” aisle was where the healthier options were held. Unlike the cookie and cracker aisle, it was much duller in color. With similarities to the Whole Food’s snack aisle, the packaging has mainly earth-toned colors, and is very simplistic. The material the bags were made from looked as if it contained no plastic/shiny coating.

Field trip three took place at the Safeway located at 1855 Wisconsin Ave, NW. This grocery store happens to be my primary shopping destination. Every time (no matter the time of day), the snack aisle is packed with shoppers. This trip took place at 3 in the afternoon, and the first thing I wanted to observe was the Natural/Gluten Free snack aisle. I can admit, I never once stepped foot down this aisle prior to this assignment. Out of all two stores so far (Whole Food’s and CVS), Safeway’s healthy snack aisle contained the least amount of options. This factor shocked me because the regular snack aisle is noticeably massive. Following this continuous pattern of healthy food having neutral color pallets, this snack aisle also stressed the fact that all of the snacks were natural & organic by placing banners on every other shelf.

Because the normal snack aisle was so large in space, it carries what seems to be, an unlimited amount of snack food. Just like CVS, Safeway’s normal snack aisle contained numerous well-known chip brands, as well as popcorn, pretzels, candy, and sports drinks. Each section is just as vibrant in color as the section beside it. No wonder why this aisle has so much traffic, the packaging is appealing to costumers.

My last trip was at the Foggy Bottom Grocery (FoboGro), located at 2140 F St, NW. FoboGro is a corner grocery store with a downstairs deli, offering many kinds of soups and sandwiches. It also carries freezer food, perishables, and toiletries, while having an acceptable variety of wine and beer. This store is the main place where students go to get the satisfying combination of booze and food.

Surprisingly, Fobo had the smallest selection of normal snack food out of each store I visited. What is also surprising is the fact that they carry no organic/gluten-free options. Since many would consider this to be an after party/ hangout store; it could be possible that there were no healthy snacks because they figure students wouldn’t necessarily be worried about their health after a night out of drinking.. smart thinking. The chip and cookie varieties remained colorful in packaging and were placed right beside the beer fridge for convenience.

In conclusion, I have observed many fascinating details while implementing my field work. I have also thought greatly on why healthy and regular snacks differentiate so much in packaging. But first, it is important to recognize the facts and ideology behind healthy snacks compared to regular ones.

When people think of a food being healthy, they often associate this word with various vegetables/leafy greens and fruits; not so much snack food.

The term “healthy” simply means: benefiting to one’s physical, mental, or emotional state. With that being said, all variations of snacks could potentially be beneficial to a person’s emotional state- food ultimately brings comfort to most.

Therefor, what could be the purpose of packaging snacks separately between healthy and regular options? It all begins with branding. Certain snack brands are widely known, and many customers (including myself) often gravitate towards recognizable items/food. The most popular chip brands in America include: Lays, Tostitos, Doritos, and Ruffles. All of which contain a very vibrant color pallet consisting of yellow, blue, red, and orange. These chip brands aren't considered to be “healthy” however, people are still attracted to them by their familiarity, and the bright packaging.

The stores that I visited (not including Whole Foods) each had their own aisle or section that had one, if not all of the chip brands that I previously listed. Whole Foods Supermarket is a chain that exclusively features foods without artificial preservatives, colors, flavors, and sweeteners. Majority of their products are labeled as having no gluten, and being organic. The snack aisle is no where near as colorful as the ones in Safeway, CVS, and FoboGro. I would say that about 95% of the packaging was all earth-toned and subtle. What was interesting to me was that their “normal” junk food substitutes (Lays, Doritos, and Tostitos) mimicked the same vibrant-colored packaging that the originals obtain, thus adding a healthier version on a familiar concept and product. Being that Whole Foods is against artificial coloring, I now see why their packaging is so simple.

The organic snack foods that are in Safeway and CVS also follows the theme of simplified ingredients being sold in simplified packaging; containing little to no shiny coating on the bags, and earth toned colors.

-AP

#whole foods#cvs#safeway#grocery store#colorful#packaging#snacks#healthy#yummy#anthropology#snack attack#snack foods

0 notes

Text

The Olive Experience: A Grocery Store Perspective

As an Egyptian-American growing up in the United States to immigrant parents, olives have always been a part of my diet. I have vivid memories of the yellow container my father would keep stocked with a particular black olive from the local Middle Eastern grocery store. The container was specifically designed for storing and preserving olives and was present at every meal in our household, but especially at breakfast. Those black olives always accompanied eggs, cheeses, and bread, and I remember clearly their location in that Middle Eastern grocery store where my father would also buy our Bulgarian feta. Today, the yellow container still exists, as does that original shop in Vienna, Virginia. It has now been joined by a proliferation of small Middle Eastern grocery stores in the area, in addition to the chain American grocery stores – all of which sell olives in one form or another.

I have continued to be a lover of olives in all their forms, and as such have noticed their expansion into the realms of many grocery stores beyond the aisles of canned and jarred varieties, which has provided the impetus for the current project. Over the course of two months, I have sought to examine the varieties and placement of olives across five separate grocery stores in the Washington, DC area, based solely on observation. I have conducted strictly optical research at each of the locations, noting where olives are located, how they are presented, the types offered, and their varied price points. Taking full account of the limitations of this particular form of research, I have also used olives as a benchmark in attempting to draw preliminary conclusions about the target consumer base of each of the grocery stores, as well as to determine its intended “ethos” – the character and spirit the store espouses, and the mood and climate it promotes among its customers.

Research Sites

In order to observe the context of olives within grocery stores, I have paid a visit to five separate grocery stores on five separate occasions: Whole Foods in Vienna, VA; Trader Joe’s in Washington, DC; Giant in Vienna, VA; Yas Bakery in Vienna, VA; and The Fresh Market in Vienna, VA. All of the locations are stores I frequent regularly, though never with olives particularly in mind. On all but two of the noted occasions, my research on olives was the primary reason for my visit.

Whole Foods