#visanet

Text

Global payment giant Visa is raising its bet on artificial intelligence (AI) in commerce and settlements by setting up a new fund to invest in generative AI ventures.Visa on Oct. 2 announced a new $100 million generative AI initiative to invest in companies focused on developing generative AI technologies and applications related to commerce and payments.The investment will be curated by Visa’s global corporate investment arm, Visa Ventures, which has been working on supporting innovation in payments and commerce since 2007.Generative AI is a type of AI technology that can produce various types of content, including text, imagery, audio and synthetic data. Major AI chatbots like OpenAI’s ChatGPT and Google’s Bard show the capabilities of generative AI to comprehend and produce human-like writing.According to Visa’s chief product and strategy officer Jack Forestell, generative AI has a promising future in the financial world. He said:“While much of generative AI so far has been focused on tasks and content creation, this technology will soon not only reshape how we live and work, but it will also meaningfully change commerce in ways we need to understand.”Visa’s latest move into generative AI comes on the heels of significant efforts to apply AI technology in the company’s ecosystem.Visa says it was one of the first firms in the world to pioneer AI use in payments back in 1993, deploying AI-based technology for risk and fraud management. In 2022, Visa’s real-time payment fraud monitoring solution, Visa Advanced Authorization, reportedly helped prevent an estimated $27 billion in fraud.In 2021, Visa also introduced VisaNet +AI, a suite of AI-based services focused on fixing delays and confusion with managing account balances and other issues of daily settlement for financial institutions.Some of the tools in the VisaNet +AI suite include Smarter Stand-In Processing, which aims to improve payment experiences during outages by mirroring issuer approval decisions. Other such products include Smarter Posting, which helps enable faster consumer payment experiences and reduce confusion from posting delays.Besides actively investing in AI, Visa has also been bullish on using cryptocurrency technology in payments. In April 2021, Visa shared plans for a new crypto product that is designed to drive mainstream adoption of public blockchain networks and stablecoin payments.

0 notes

Text

Visa stabilcoin ödemeleri için bu altcoin ağını kullanma kararı aldı: İşte detaylar...

Business Wire tarafından yayınlanan bir basın bültenine göre küresel ödeme devi Visa, kripto ile deneylerine devam etmek için yeni bir adım atıyor. Bu kez, USDC dolar stablecoini kullanarak stablecoin yerleşim alanını genişletmeyi ve Worldpay ve Nuvei gibi tüccar alıcılarla pilot programlara başlamak için Solana blok zincirini kullanmayı amaçlıyor.

Küresel ödeme şirketi, VisaNet aracılığıyla daha…

View On WordPress

0 notes

Text

Skyscend joins Visa’s Fintech Fast Track Program

Skyscend joins Visa’s Fintech Fast Track Program

By Edlyn Cardoza

Today

B2B Payments

Digital Payments

Fintech Fast Track Program

Skyscend Inc., one of the leading SaaS platform providers for supply chain finance, announced that it has joined Visa’s Fintech Fast Track Program, speeding up the process of integrating with Visa, allowing Skyscend to more easily leverage the reach, capabilities, and security that VisaNet, the company’s global…

View On WordPress

0 notes

Text

Square Taps Visa for Instant Transfers in Canada

Square Taps Visa for Instant Transfers in Canada

Visa is expanding its integration with Square’s instant transfer feature into Canada.Square’s Canadian merchant clients can access their funds in real time, instead of waiting for the next business day.Instant transfers are enabled by Visa Direct, a VisaNet processing capability that facilitates real-time delivery of funds.

One of the themes at FinovateFall earlier this month was how…

View On WordPress

0 notes

Text

Visa перевела услуги и операции «ПриватБанка» в облако

ПриватБанк перешел на платформу подключения Visa Cloud Connect и реализовал новый способ безопасного подключения к сети электронных платежей VisaNet через облако. Основной целью этого решения стало уменьшение зависимости банка от аппаратного обеспечения, расположенного в разных регионах Украины, которое могло быть уничтожено в результате российских обстрелов. Решение Visa Cloud Connect создано для того, чтобы помочь банкам-клиентам и партнерам с

Read the full article

0 notes

Text

#O9C4COM | Community Audience Overview (10 December 2019)

PAGES REPORT (Top Global Topics, Last 30 days)

1. ONLINE \ OFFLINE RECEIVER (T2T, PUNCHING, FACE TO FACE SWIPING, CARD LOADING) RECEIVER ACCOUNTS AVAILABLE FOR MT103

2. Receivers for IPIP/IPID/FX4/S2S/FX4/VISANET/POS/ALLIANCE LITE2

3. IPIP/IPID, MT103/MT103-202/TT/MT103-MT104, FX4, DTC,SWIFT.Com Manual Download, VISA NET, offline On-line, etc.

4. Indonesia Business Groups (WhatsApp group)

5. I HAVE RECEIVER FOR MT103/202 MANUAL DOWNLOAD ALLIANCELITE2 AND SWIFTNET

6. We have a VisaNet receiver

7. DUBAI BUSINESS 2020 (WhatsApp group)

8. We need direct receiver.

9. WE ARE A GENUINE AND TRUSTWORTHY VISANET RECEIVER

10. MT103/202 SWIFTNET

0 notes

Photo

Vi presento la mia versione di pane Idorau Farcito con guanciale,pecorino e lattuga fritta . Una bontà ottima per aperitivo o seconda portata . Ricetta sulla mia pagina Facebook. #chefgrz #fattoincasapervoi #cottoemangiato #laprovadelcuoco #cottoepostato #cicinaitaliana #sardegnaisoladagustare #neve #sardegnadagustare #sardegnaverde #visanet #mediocampidanonline https://www.instagram.com/p/Bs74zUelVpK/?utm_source=ig_tumblr_share&igshid=1llr2nv3sorsx

#chefgrz#fattoincasapervoi#cottoemangiato#laprovadelcuoco#cottoepostato#cicinaitaliana#sardegnaisoladagustare#neve#sardegnadagustare#sardegnaverde#visanet#mediocampidanonline

0 notes

Text

VisaNet potencia su solución de e-commerce Pago Link

VisaNet potencia su solución de e-commerce Pago Link

– A través de la nueva plataforma Pago Link, se podrá generar un enlace web para cada venta y establecerle una vigencia determinada, así como administrar la cantidad de veces que el link puede ser usado, para controlar el stock.

– Estos beneficios tienen como propósito responder la demanda tecnológica de los usuarios, y asegurarles la interacción con la plataforma de una manera sencilla,…

View On WordPress

0 notes

Text

Visa will now use payment processors to facilitate cross border transactions via the USDC Stablecoin on Solana Pay.

Solana’s SOL token rose on Tuesday following News that Visa will begin expanding its Stablecoin services, via USDC, to the Solana blockchain, in collaboration with payment solutions providers Worldpay and Nuvei. The SOL token jumped 6% at one point but later fell to 4.39%, trading at $20.25, according to data from Coin Metrics. As of writing time, CoinMarketCap data shows SOL at $19.81.

In an News/home/20230905549860/en/Visa-Expands-Stablecoin-Settlement-Capabilities-to-Merchant-Acquirers" target="_blank" rel="nofollow noopener">official statement, Visa said its intention is to make cross-border transactions more efficient. According to Visa’s Head of Crypto Cuy Sheffield:

“By leveraging stablecoins like USDC and global blockchain networks like Solana and Ethereum, we’re helping to improve the speed of cross-border settlement and providing a modern option for our clients to easily send or receive funds from Visa’s treasury. Visa is committed to being at the forefront of Digital Currency and Blockchain Innovation and leveraging these new technologies to help improve the way we move money.”

The statement explains how Visa cards facilitate payments between the user’s bank (the issuer) and the merchant’s bank (the acquirer), which involves clearing and settling several billion transactions every day. Visa says it has already launched live pilots with a few issuers and acquirers. The pilots have helped Visa move several million USDC over the Ethereum and Solana networks. The giant payment processor explains that pilots were used to settle fiat-denominated payments over VisaNet.

Visa Continues Crypto Efforts via USDC Settlement

The development allows Visa to process USDC through acquirers Nuvei and Worldpay, where the payments are then routed to the merchant banks. This process connects the Cryptocurrency space with the traditional finance system and significantly reduces transaction settlement durations.

This development continues Visa’s push into Crypto as the company tries to connect both worlds effectively. Last month, Visa announced that users will be able to pay Ethereum gas fees using their debit or credit cards. This means that Crypto users can transact on the blockchain without an ETH balance. According to Visa, this process could “redefine blockchain-based transactions”.

Visa’s work with USDC began in 2021 when the company worked with Crypto.com to test Stablecoin settlement. The pilot used USDC on the Ethereum blockchain to receive Crypto.com cross-border payments. Before then, these cross-border transactions required a few days of currency conversions. In addition, completing the process accumulated transaction fees.

As the traditional-to-Crypto push continues, Coinspeaker recently reported that Canadian e-commerce giant Shopify (NYSE: SHOP) is letting users make instant payments with USDC via a Solana Pay integration. Shopify has previously incorporated several other Crypto services for payments, including Crypto.com, Bitpay, and Coinbase. While USDC is the first Crypto Shopify is using via Solana Pay, reports suggest that the plan is to add support for several other assets. The collaboration is likely to be of significant benefit to Solana Pay since Shopify’s presence in the e-commerce sector is heavy. The company sees at least 10% of e-commerce transactions in the US, worth more than $444 billion.

Thank you!

You have successfully joined our subscriber list.

0 notes

Photo

Visanet Peru - Wordpress Woocommerce - Plugin El plugin de Visanet Perú creado para wordpress woocommerce le permitirá conectar la pasarela de pago de Visanet Peru con tu tienda virtual online en minutos. Podrá realizar una integración profesional sin conocimientos avanzados de programación, esa pasarela de pagos visanet Peru wordpress wooco... Nota Completa >> Visanet Peru - Wordpress Woocommerce - Plugin

0 notes

Text

Women's Credit Card - How To Be One Step Ahead Of Credit Card Companies

Female's Credit Card - Compare Female's Credit Card and discover what's very low balance and APR transfer credit cards.

Have you ever thought about the reason why you receive credit card has in mail if you haven't even produced a request for it. If the name of yours and address is in info system that is public than at this point you should have received numerous credit cards offers. Each giving much better proposal than other competing charge card company.

With plenty of info to process is going to lead to confusion as well as incorrect validation of credit cards. Selecting a correct bank card is a challenging job, it requires closer scrutiny and careful analysis of good points created in tiny fonts. Special attention must be provided to charge card rates, when new greater prices will apply. Give value to reading terms and problems of credit cards. You are going to get brand new understanding of exactly how credit cards work. Before you begin applying for credit cards you have to learn few crucial phrases employed in credit card. By learning these terms are going to help you applying for a proper credit card.

Credit Cards

As you know little plastic card known as charge card would be in dimension of 85.60 X 53.98 mm. As the name suggest moneyon credit is gotten by you or perhaps you purchase items in industry on credit. The charge card varies from Debit card because whenever you make purchase by making use of your credit card it does not get rid of cash out of your bank account. where as if you do buy utilizing Debit card it removes cash from your account after each transaction you make.

When you try to make transaction by using credit card the charge card company lends income to merchant in which you did shopping. Typically you obtain 1 billing cycle cash on credit with no interest getting charged for you.

All is needed from you is usually to pay full sense of balance before date that is due to stay away from interest charges. Just in case you've made lots of purchase which you are able to pay in total in one month, consider paying off balance as soon you are able to to stay away from a lot more interest charges. Assuming you're unable to pay cash to credit card company please make certain you spend a minimum of minimum balance required by date that is due. Usually this amount is small and it will help you to maintain the account of yours in standing that is good. Ideally this alternative needs to be stayed away from as it is going to pile interest amount in your borrowed total and quickly your borrowed money will begin swelling.

Credit card company problems credit card to operator after his/her request for software have been authorized.

Every credit card company is going to set credit cap for each customer dependent on his/her credit toughness The credit card pc user can make purchases by making use of issued credit card.

The charge card typically would be in dimension of 85.60 x 53.98 mm

Every credit card has quantity created on it by which your bank account is determined.

Several of the acknowledged credit card companies: Chase - Bank of America - Citigroup - Wells Fargo - American exhibit - find out etc. Basically every major bank problems its charge card to people.

When you make buy at every merchant you sign a little receipt acknowledging you are going to pay exact same amount to the credit card company of yours.

Few of the transactions could be done over phone, like airlines plus hotel booking, giving the credit card number of yours and expiration date etc. Remember to be care full when making such transactions. Ensure you are doing such transactions with reliable parties.

Just about all store or merchants owners have charge card verification process, while you swipe the card of yours for payment it's examined in experience for fraud or perhaps missing card status.The charge card transaction terminal or perhaps Point of Sale (POS) structure will help store owners to complete verification with issuing credit card company's program.

The security code of charge card is printed on rear of charge card.

Every month charge card company is going to send month statement to charge card users. The statement is going to include details of transaction from credit card user. The key details are going to be visible like day of transaction, merchant's title, etc was paid by amount. This info helps you to cross confirm purchases made with quantity energized on credit card.

The charge card statement likewise provides additional info like billing cycle, date that is due (transaction date), complete sense of balance and minimum payment you are able to make.

The grace period will be the amount of times making payment to charge card company from the day time he/she made purchase.

The charge card companies form associations, as well as numerous bank, be part of these charge card associations. The recognized associations are VISA, AMERICAN EXPRESS etc, MASTERCARD,DISCOVER.

Electronic transaction processing system, that enable electric transaction to work through sound system. Below are very few companies that are in this business. NDC Atlanta, Vital, Paymentech, Omaha, Nabanco, Cardnet, Nova, VisaNet and Concord EFSnet.

Secure credit card: Some charge card companies problems secure credit card after candidate has deposited ten % of credit cap into his/her account. This particular account type is for new owners with very little credit reputation to show.

Pre-Paid Credit Card: This's not actually a charge card, because no amount is borrowed from lender. This particular kind of credit card is utilized by pupils when their parents deposit needed quantity into consideration for their shopping. This particular kind of credit card will come with VISA/MASTECARD logo thus is known as pre paid credit card

Security of credit card depends upon the amount on credit card. Not many merchants are going to allow specific kinds of sale by simply getting credit card number. Ensure you do not compromise security of charge card.

You are able to also withdraw cash through credit card at ATM's making use of your safe pin number Annual percentage fee (APR): Learn what's APR and just how it's calculated.The annual percentage rate will be the interest you'll be spending on borrowed cash to lender.

The APR rate applied to the account of yours is going to differ from the rate that had been given as introductory, partially due to few month introduction rate along with other charges get put into ultimate interest calculation.

In easy terms APR is month interest multiplied by twelve months will lead to annual APR rate. This assumes there's simply no additional fees involved.

Balance transfer: Why might you transfer debit quantity in your charge card to other card. why might be much better interest rate and terms. several of the charge card companies offer introductory offers like zero interest on balance transfer for six months to two years.

These offers are actually good when higher interest rate is being payed by you or perhaps you've excessive harmony on credit cards and you're trying to find cool time to address your debits.

Exactly how crucial is to maintain your Credit Card

This tiny plastic card which you have in your wallet is extremely important somewhat more than the jewelry of yours you wear on the body of yours. The protection of credit card must be taken very seriously. Once the credit card of yours is stolen, the account of yours info is acknowledged to others, it is going to take time that is very good before you'll obtain all those charged taken out of your bank account.

Meanwhile your credit rating is going to take hit if there's big charge on the credit card of yours and you're unable to settle those charges. take each and every attempt to safe guard protection of your respective on line security and identity of credit card.

Few security tips: Always maintain the credit card of yours in place that is secure when not using.

Do not expose your credit card numbers to others.

Attempt to stay away from giving the credit card info of yours on phone.

Any loss of charge card should be instantly educated to issuing credit card business.

In case you're using on line access to check out the credit card account of yours, please use secure solutions to safeguard the identity of yours as well as credit card etails.

Install "fire wall" as well as good spyware and virus scanner on the pc of yours.

Change your on line account passwords periodically.

2 notes

·

View notes

Text

A melhor maquininha de cartão

Qual é a melhor maquininha de cartão? Eu preciso de uma maquininha de cartão? Qual devo comprar? Devo comprar ou alugar?

Estas perguntas são apenas variantes daquela que é a “Pergunta do Milhão” e só você conseguirá responder corretamente. Na verdade, você está querendo saber qual a melhor maquininha de cartão para o seu negócio. Para tanto, você não tem os universitários para ajudar, mas tem o simulador de maquininha de cartão que o Educando seu Bolso lhe oferece. Esta pergunta só pode ser respondida porque, em função do seu perfil de uso, uma maquininha de cartão pode ser melhor que outra. Em outros casos a situação se inverte. Ou até uma terceira maquininha desponta como vencedora desta enorme corrida pelo seu negócio!

Resolvi escrever diante destas perguntas que temos recebido desde que começamos a abordar a difícil tarefa de se escolher a melhor maquininha de cartão de crédito aqui no Educando seu Bolso. Espero, então, com este texto que é quase um FAQ (Frequently Asked Question ou, em português, Perguntas Frequentes) que você consiga sanar a maior parte das suas dúvidas e ainda criar novas. Afinal, nada supera a criatividade humana…

Maquininha de cartão: o que é?

Maquininha de cartão, seja de crédito, débito, refeição ou alimentação, é qualquer equipamento que possa ser usado para fazer pagamento físico com cartão de crédito. Portanto, compras virtuais não utilizam máquinas de cartão conforme este conceito.

Ou seja, nem tudo que permite pagamento com cartão pode ser considerado maquininha de cartão. Apesar de cada vez mais o universo virtual avançar para cima de nós, ainda não vamos tratar disto aqui.

Não descarto, todavia, tratar futuramente também dos aplicativos para compras virtuais. Só não vou arriscar agora falar sobre isso porque meu conhecimento do assunto não é suficiente. Não que eu considere que meu conhecimento de maquininha de cartão seja. Seria muita pretensão minha achar isto. Mas meu desconhecimento quanto ao funcionando dos aplicativos virtuais é ainda maior, acredite!

Para que maquininha de cartão?

Isto posto, vamos à utilidades de uma máquina de cartão. Não: não estou pensando – neste momento – em utilizar como peso de papel. Não neste momento. Estou pensando em uma maquininha de cartão operando para pagamentos utilizando… BINGO! Cartões! Sejam cartões de crédito ou débito, que são os mais conhecidos e comuns, sejam de alimentação ou refeição, apenas como exemplos. Existem também outras modalidades, ainda menos utilizadas, como vale combustível, que não trataremos aqui. Não que não sejam úteis ou importantes, mas como a escala de utilização não é tão significativa e a aplicação é muito específica, fica para a próxima…

Vale lembrar que é crescente o uso de cartões no país. Maior segurança, maior comodidade, mais controle de gastos, não necessariamente nesta ordem, são alguns dos benefícios advindos do uso do cartão pelo brasileiro.

Assim, cada vez mais o comércio se flexiona ao uso dos cartões e, por conseguinte, de maquininha de cartão. Se você é comerciante e não tem uma maquininha de cartão, talvez seja interessante começar a pensar nisso.

Toda maquininha de cartão é igual?

Não! Definitivamente não! As principais diferenças estão nas taxas e nas bandeiras que são aceitas por cada maquininha de cartão . Mas não são as únicas diferenças. Há maquininhas que evitam a bitributação, por exemplo. Tem maquininha de cartão que tem impressora e tem maquininha que não tem. A forma de suporte técnico do fornecedor de maquininha de cartão varia conforme o fornecedor. E às vezes até entre as maquininhas de cartão de um mesmo fornecedor. Há suporte com 0800 e suporte só com telefonia convencional. Tem suporte com call center, por e-mail, pelo site, por chat, etc. Enfim, a diversidade é enorme. Sugerimos não considerar apenas taxas e bandeiras ao definir qual melhor máquina de cartão de crédito para o seu negócio.

Simulador de Maquininhas de Cartão

O Educando Seu Bolso lançou o Simulador de Máquinas de Cartão! Agora, com apenas um clique você fica sabendo qual a melhor maquininha de cartão para o seu negócio. Não deixe de conhecer. E bons negócios!

Quais as bandeiras aceitas?

Boa parte delas aceita apenas Mastercard/Maestro ou Visa/Visanet. Outras aceitam também Elo, Hipercard, dentre tantas outras bandeiras que o mercado oferece. Em supermercados (além de mercearias e correlatas), é comum encontrarmos maquininha de cartão que aceita cartões alimentação com bandeiras como Visa Vale, Sodexo, VR, apenas para citar três dentre tantas outras bandeiras.

O mesmo podemos falar em relação aos cartões refeição: neste caso, a maquininha de cartão é encontrada em restaurantes (também em bares, padarias, etc.).

Tanto para aceitar cartão alimentação quanto cartão refeição, o estabelecimento (respectivamente supermercado ou restaurante) devem ser previamente cadastrados como tais. Lembrando que estas duas variantes de cartões tem finalidades específicas, quais sejam, comprar alimentos. Bebidas alcoólicas, cigarros, dentre tantas outras coisas, estão excluídas deste rol de possibilidades. Nem cerveja sem álcool pode. Muito menos crédito para o celular. Ou pelo menos não conheço estabelecimento que aceite. Se descobrir algum, conte para nós…

Comparação de taxas de máquinas de cartão

Pelo menos taxa é tudo igual? Realmente, se você achava que já estava difícil escolher, agora é que o bicho pega de vez! Cada fornecedor cobra de uma forma, e as taxas são as mais diversas possíveis. Tem maquininha de cartão que é alugada. Tem maquininha que é vendida (você faz um investimento inicial maior mas não precisa pagar aluguel). Tem fornecedor de maquininha de cartão que cobra juros por dentro. Tem fornecedor que cobra juros por fora. Qual a maquininha com a menor taxa do mercado? Depende de alguns fatores, como por exemplo seu faturamento. Descubra qual a máquina de cartão com menor taxa de juros para o seu negócio através do nosso simulador de maquininhas de cartão.

Ranking de maquininhas mais clicadas no Comparador!

Parcelamento e Antecipação de Recebíveis

Digamos que você seja Micro Empreendedor Individual (MEI), então é só contratar uma maquineta de cartão e pronto? Mais uma vez, muita calma nesta hora. Mesmo que esteja decidido em contratar a melhor maquininha de cartão, você ainda terá que escolher se quer alugar ou comprar, para ficar com uma maquininha de cartão sem mensalidade. E ainda deverá estar atento sobre as opções de parcelamento e antecipação de recebíveis, caso precise de capital de giro.

Repare bem que a taxa da antecipação, que infelizmente a maioria dos pequenos negócios acaba usando rotineiramente, por falta de acesso a boas linhas de capital de giro, não é para qualquer cliente. Ela é sujeita à análise de crédito, e dependendo da maquininha de cartão, essa antecipação já é automática! Quer saber mais sobre essa tal antecipação? Tiramos várias dúvidas neste post e detalhamos vários exemplos que podem te ajudar.

Existem maquininhas de cartão diferentes?

Nossa… Se há! E é briga de cachorro grande pelo filé enquanto sobra até para os menores players neste mercado. Aliás, no mercado financeiro como um todo, como você já deve ter percebido com a chegada das chamadas Fintech. Mas isso já é outra história…

Na busca pela melhor maquininha de cartão, você já deve ter ouvido falar da Cielo, PagSeguro, Rede, Mercado Pago, Pago, Moderninha, Vermelhinha, da Azulzinha, Payleven, SumUp… Já deve ter ouvido falar de outras. De muitas outras. Se fizer uma pesquisa, descobrirá muitas, mas muitas mesmo.

E o pior: cada uma com condições comerciais bem distintas. Você já deve ter ouvido falar também de maquininha de cartão sem mensalidade, sem anuidade, sem impressora,

Então, como comparar tantas opções de maquininhas de cartão?

Vou te contar um segredo… Mas é um segredo que, se você quiser, pode contar pra todo mundo. O Educando seu Bolso tem um simulador de maquininha de cartão gratuito, que fica no site público, disponível para simulações 24 horas por dia, 7 dias por semana para você se divertir à vontade comparando as taxas que são publicadas. Use e compartilhe! Dali você pode até ir direto para o site de comercialização da maquininha de cartão de alguns dos principais fornecedores.

Por fim, vale a pena ter mais de uma maquininha de cartão?

Olha, esta é uma pergunta muito interessante! Às vezes vale, sim, a pena ter mais de uma maquininha de cartão para o seu negócio. Principalmente quando o volume de vendas é mais alto. Há estabelecimentos que usam determinada maquineta de cartão para determinadas bandeiras, ou tipo de venda (cartão de crédito, cartão de débito, cartão alimentação, etc.). Sei de casos em que o estabelecimento tem 5 maquininhas de cartão diferentes, de diversos fornecedores, cada uma com uma aplicação. Claro: trata-se de um estabelecimento maior, com volume de transações em cartões muito elevado. Mas avalie com carinho. Faça as contas. Pode ser interessante sim. E conte com o Educando seu Bolso.

Espero ter sido útil. Até a próxima!

1 note

·

View note

Text

How to Apply For a Bank Consumer Service Provider (CSP) Online?

If you’re looking to apply online for bank CSP (Consumer Service Provider) account, you’ll need to know what information you’ll need to fill out the application and what your responsibilities are as a CSP before submitting your application. In this guide, we’ll walk you through the steps involved in bank CSP apply online, the types of information needed, and how long the process can take. If you have questions that aren’t answered in this guide, contact your bank directly with any remaining questions or concerns you may have after reading through this article.

Step 1: Understand the Program

The first step in applying for a bank consumer service provider (CSP) account is knowing what that even means. If you don’t have prior experience processing payments with Visa, MasterCard, Discover or American Express — or if you don’t know how card network names differ from brand-to-brand — it’s time to brush up on your merchant processing knowledge. What does interchange mean? How much should I expect to pay in gateway fees? What are MCC codes and why do they matter? Answering these questions will give you a better understanding of how payment processing works, and will help you make an informed decision about which program is right for your business.

Step 2: Determine If You Qualify

Are you an individual, sole proprietor, company, corporation or limited liability company? You need to be one of these entities in order to apply online. If you are not sure what type of entity you are, check with your accountant. When registering as a CSP, if you are unable to determine whether or not you qualify, please contact your service provider and they will assist you. If you need a banking point India, check Pay Point India.

Step 3: Review Requirements

To be eligible, you must be at least 18 years old and active checking account in good standing. You will also need to provide details about your business and answers to questions regarding your experience with electronic payments and customer service.

Step 4: Access Resources

To apply for a banking point, go online and download your application form. Forms are available in PDF format on VisaNet, MasterCard Worldwide and American Express websites. Follow instructions on each form carefully. When you’re ready to fill out your application, select one of these three options: Contact Information—Provide information about yourself and your company. Application Type—Choose from existing card brands to initiate new programs or add services/features.

Step 5: Complete Application Details

Enter banking point information and click next. After you have entered all required details, click on Finish. A new screen will appear which shows you that your application has been successfully submitted. On-screen instructions include: submit application online by 3:00 p.m., MT, on Dec 31st, 2013; attach any documents required by your bank (see application form); and read entire agreement carefully prior to submitting application.

Step 6: Submit CSP Application Form

There are two application options. You can apply as an individual, or you can apply as part of a business partnership with another consumer service provider (CSP). Once you have identified your preferred method of application, log in to your online banking account and select CSP applications.

0 notes

Text

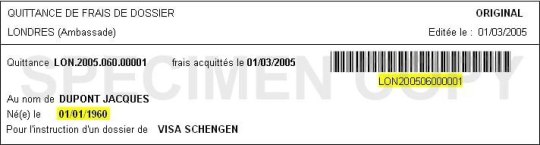

✅پیگیری وضعیت ویزا شنگن _ فرانسه

✅پیگیری وضعیت ویزا شنگن _ فرانسه

https://pastel.diplomatie.gouv.fr/VisaNET-Consultation-Internet/html/frameset/frameset.html

@VFS_Services

View On WordPress

0 notes

Photo

#O9C4COM | Community Audience Overview (10 November 2019)

PAGES REPORT (Top Global Topics, Last 30 days)

Receivers for IPIP/IPID/FX4/S2S/FX4/VISANET/POS/ALLIANCE LITE2

ONLINE \ OFFLINE RECEIVER (T2T, PUNCHING, FACE TO FACE SWIPING, CARD LOADING) RECEIVER ACCOUNTS AVAILABLE FOR MT103

Indonesia Business Groups (WhatsApp group)

IPIP/IPID, MT103/MT103-202/TT/MT103-MT104, FX4, DTC,SWIFT.Com Manual Download, VISA NET, offline On-line, etc.

We have a VisaNet receiver

RECEIVERS MT103/202 CASH TRANSFER/ IPIP/ALLIANCE LITE2

MT103/202 SWIFT.NET

DUBAI BUSINESS 2020 (WhatsApp group)

MT103 (SWIFT message format)

IPIP, Alliance Lite 2 Receivers Wanted

0 notes

Photo

Vi presento la mia versione di pane Idorau Farcito con guanciale,pecorino e lattuga fritta . Una bontà ottima per aperitivo o seconda portata . Ricetta sulla mia pagina Facebook. #chefgrz #fattoincasapervoi #cottoemangiato #laprovadelcuoco #cottoepostato #cicinaitaliana #sardegnaisoladagustare #neve #sardegnadagustare #sardegnaverde #visanet #mediocampidanonline https://www.instagram.com/p/Bs74zUelVpK/?utm_source=ig_tumblr_share&igshid=1c03gwj0z0q5s

#chefgrz#fattoincasapervoi#cottoemangiato#laprovadelcuoco#cottoepostato#cicinaitaliana#sardegnaisoladagustare#neve#sardegnadagustare#sardegnaverde#visanet#mediocampidanonline

0 notes