#the modern books will have to be bought/ borrowed and given the current prices of books. i guarantee you those are the books which will

Text

One of my 2023 resolutions is to read all 32 books/ stories from my reading list—classics, recommendations, and titles which caught my attention ᕦ(ò_óˇ)ᕤ

Idk if I’ll accomplish it within the year, but I just finished Book 4 and I highly recommend “A Long Fatal Love Chase” by Louisa May Alcott :>

#god bless the free book websites#the modern books will have to be bought/ borrowed and given the current prices of books. i guarantee you those are the books which will#break my resolution huhu#it was very nostalgic to read the steadfast tin soldier#and from the script alone i’m enchanted by the blue bird of happiness#i also have carmilla. sappho’s poetry. and grimm’s fairytales on the list so this should be a fun year xD#jessamine rambles#shooting stars

24 notes

·

View notes

Text

Thriving in an Economic Bubble during Anarchy

4. The Christian Succession – What a fun week

A few items from the secular world this week:

1. The NFL (yes, the National Football League) announced this week it it is Gay, Lesbian, Bisexual, and Transgender. Does that make you “Ready for some Football”?

2. The new Miss Nevada is a transgender person. So, allow me to rephrase those judges’ decision. The most beautiful, most talented, most ideal young women in Nevada is a biological male who thinks he is a female.

Give our Lord and Savior the credit for the great awakening that is happening before our eyes. Satan is being exposed and confronted. Hallelujah. Amen. Here are just a few examples:

1. Trump held his first rally in months, had an overflow crowd in Ohio, and was watched by over 3 Million viewers on line. That viewership easily eclipsed the total number of all Bidenharris events beginning with the basement campaign last year to present. But we are supposed to be stupid enough to believe Bidenharis won the election. If you believe Bidenharris won, I have a bridge in New York City for you to buy. It used to have a lot of traffic before the Demented Marxist (DM) Mayor turned his city into a third world country equivalent.

2. I have lost count of the Americans who are black that have spoken out against the Critical Race Theory (CRT) equating it to the teachings of the Ku Klux Klan. Numerous states have outlawed it from their schools. Virginia does not have any adult legislators.

3. Did you read that the Republican candidate for Governor in Arizona has pledged to finish building their section of border wall? The rebellion is bubbling.

4. The Arizona hand count of the ballots has been completed. There are two other steps in the audit that have not been completed so it may be August before there is a report given.

5. As many as 20 other states are discussing election audits. All of the states should be audited. Every nonprofit organization has an annual audit, publicly traded companies get audited, how come it is not standard procedure to audit our elections? Where are Virginia’s Republicans? Hiding under their blankies?

6. There were even more reports of Moms becoming vocal and organized in their opposition to the Critical Race Theory and the LGBT agenda. Watch this trend. An entire generation of children are at risk because school systems are more concerned with chasing the phantom of “social justice” than with teaching math, science, and western history. I expect the Momma Bears to win this debate. A positive from the Pandemic.

Meanwhile, our “elected” officials and the media are primarily focused on a contest of words as they vie to outdo each other with cute turns of phrase, etc. Is there a new Olympic sport called Word Jousting with some umpire tracking the points earned by being more outrageous as talking heads compete with meaningless words. Most of our elected officials are champions at talking and strutting. I long for real American leadership.

There are some quite serious issues that need to be addressed. No, Climate Change is not one of them despite the media demonstrating they are universally poor with both math and science. Climate Change can be summed up with fact that the Ice Age did not end because millions of years ago some Neanderthal ancestor of mine started driving an SUV.

I am reading a great book which is a thorough analysis of Climate Change written by Steven E. Koonin called “Unsettled”. Mr. Koonin is a true expert, candid in his disdain for the media’s distortion of the facts that have been and are issued on the topic of Climate Change. It is easy to see that the media types are either clueless about science or severely slanted in their view because they never let the facts stand in the way of a good story.

While our “faux leaders” talk and strut about foolishness such as Critical Race Theory (all whites are racists) and Modern Monetary Theory (governments can borrow all the money they want without damaging that country’s economy), the Chinese have built a country with modern technology, become a mercantile state that controls a number of global industries, bought our officials, own 20 square miles of Texas adjacent to our air force base, and acquired Africa along with most of the rest of the world using their Fools Gold currency. The USA is now just a slave of China because they produce our stuff and own our government, universities, sports teams, and media.

The legacy media is full of meaningless talk devoid of fact but full of opinion and acting as if word jousting accomplishes something. As a capitalist, I find it fascinating to watch the dying so called mainstream media being replaced by new sources of information. CNN is reportedly on the block to be sold and the market will ultimately impact other enormous organizations like Facebook, Twitter, etc. Since they are controlled by China, they should move there.

Are you watching the electricity shortage in California and Texas? Highest cost and lowest reliability is the reality of an electric grid dependent on solar panels and bird slicers called windmills. Virginia better get some adults in leadership or we are going to be in the same fix as California and Texas. Brownouts are not my idea of good government.

Economic trends over the last week saw stock markets struggling to price in the announcements of The Fed about tapering Quantitative Easing (QE) and the effects on interest rates. The increased mortgage interest rates from The Demented Marxists (DMs) gaining control of our government have already slowed the housing market. The peak of this real estate cycle was this past January – February. The Fed now owns such a large percentage of the Treasury market that it is causing mixed signals in the markets. Do not be fooled, as The Fed tampers QE interest rates will rise and the economy will slow. The impact will be determined by a matrix of factors that will be impacted by the actions of The Fed. The highest probability is that this will be a brutal economic event.

About the only supply chain that is not disrupted is toilet paper. It is in surplus. Major supply chain problems are being reported in China and India due to the spread of a variant of the Wuhan Virus. The current twin negatives are the shortage of parts and the shortage of employees. The 20+ Conservative states that have cut back on the unemployment payments are recovering faster and better than the misnamed Progressive states that continue to pay folks not to work.

Totally lacking leadership, Virginia continues to pay folks not to work. Help wanted signs are everywhere. Every business head I talk with has had to cut back on their business operation because they cannot find anyone to hire. That is not hard to understand when you calculate that by not working, the “unemployed” reportedly receive $60,000 that is not taxable. These distortions are causing inflation. When supply chains get closer to demand, prices will be “sticky”, if they decline.

The current forecast is that oil will hit $100 per barrel by the end of this year. That means $4 per gallon gas. Biden destroyed our energy independence and returned the USA to being energy dependent on OPEC and Russia. Do you find it interesting that China and Russia are prospering with the DMs in control in the USA? Increased gasoline and diesel prices affect the cost of everything, another source of inflation.

Counting the one that is coming in 2022, during my career I will have been through seven recessions caused by one of the following – (1) increased energy prices, (2) interest rates being raised to combat inflation, and (3) increased taxes. The recession coming next year will be the result of a combination of all three of those forces. Get prepared…now.

170 days into the DM’s Coup, each day more details emerge regarding the fraudulent election last November. Eventually, we will know all the facts. Pray for the patriot attorney in Antrim County, Michigan who called for the Secretary of State to resign or be impeached and the election to be De-Certified. Another county in Michigan has voted to audit its election. Keep watching the Arizona Audit. The Secretary of State in Georgia decided to investigate the chain of custody of some of the mail in ballots to CYA. As the election audits spread and the terabytes of information from Mr. Dong bubble, you can smell the fear of the DMs.

A great piece of land remains The Best investment long term. Capitalism builds wealth, Marxism/Socialism consumes it in self destruction. Pray for a return to honest and audited elections in the USA. God is in control. Men make plans, but God ALWAYS wins.

“Rejoice in hope, be patient in suffering, persevere in prayer.”

(Romans 12:12) New Revised Standard Version, Oxford University Press)

Stay healthy,

Ned

July 1, 2021

Copyright Massie Land Network. All rights Reserved.

0 notes

Text

&amp;amp;amp;amp;amp;amp;lt;blockquote&amp;amp;amp;amp;amp;amp;gt;&amp;amp;amp;amp;amp;amp;lt;p&amp;amp;amp;amp;amp;amp;gt;Currency Market&amp;amp;amp;amp;amp;amp;lt;/p&amp;amp;amp;amp;amp;amp;gt; &amp;amp;amp;amp;amp;amp;lt;p&amp;amp;amp;amp;amp;amp;gt; <blockquote class="wp-block-quote"><p>The International Currency Market, or FOREX, is an over-the-counter market where banks, central banks, sharks, investment management firms, hedge funds, and brokers buy and sell currencies. In general, the key drivers of FOREX are Central Bank Interest Rates, Central Bank Intervention, Options, Fear and Greed, and News.</p></blockquote> <hr class="wp-block-separator"/> <p></p> <!-- TradingView Widget BEGIN --> <div class="tradingview-widget-container"> <div id="tradingview_6cb2c"></div> <div class="tradingview-widget-copyright"><a href="https://www.tradingview.com/symbols/INDEX-DXY/" rel="noopener noreferrer" target="_blank"><span class="blue-text">DXY Chart</span></a> by TradingView</div> <script type="text/javascript" src="https://s3.tradingview.com/tv.js"></script> <script type="text/javascript"> new TradingView.widget( "width": 980, "height": 819, "symbol": "INDEX:DXY", "timezone": "Etc/UTC", "theme": "Light", "style": "1", "locale": "en", "toolbar_bg": "#f1f3f6", "enable_publishing": false, "range": "12m", "allow_symbol_change": true, "studies": [ "HV@tv-basicstudies", "MAExp@tv-basicstudies", "StochasticRSI@tv-basicstudies" ], "container_id": "tradingview_6cb2c" ); </script> </div> <!-- TradingView Widget END --> <h4>Technical analysis in the Currency Market</h4> <p>Technical analysis is widely used among traders and financial professionals operating in the currency market. In the 1960s and 1970s, it was widely dismissed by academics; however, in a recent review, Irwin and Park reported that 56 of 95 modern studies found it produces positive results, but noted that many of the positive results were rendered dubious by issues such as <a href="https://www.bamboos-consulting.com/quantitative-trading/">data snooping</a>. Academics such as Eugene Fama say the evidence for technical analysis is sparse and is inconsistent with the weak form of the efficient-market hypothesis. However, technical trading strategies were found to be effective in the Chinese marketplace by a recent study that states, “Finally, we find significant positive returns on buy trades generated by the contrarian version of the moving average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0.50 percent”.</p> <h4>The Determinants of Currency Fluctuations</h4> <p>In general, it does not exist a single theory explaining why and how currencies change. However, the traditional balance of payments model can be augmented considering various factors influencing the market.</p> <p>The <strong>Balance of Payments</strong> is broken down into three important sub-components which sum-up to zero: </p> <ul><li>the current account balance consists of the goods balance, the service balance, net income receipts, and net international transfers. The sum of the goods balance and service balance is called the trade balance; such a measure provides a quick look at the international competitiveness of the country. Specifically, the trade balance is calculated by subtracting all imports of goods and services (M) from the exports of goods and services (X). If a country’s imports exceed its exports (X-M<0) it is said to be running a trade deficit. In general, most developed nations exhibit a surplus in the services balance.</li></ul> <figure class="wp-block-image"><img src="https://www.bamboos-consulting.com/wp-content/uploads/2019/08/CA_accounts-1024x520.png" alt="" class="wp-image-3213" srcset="https://www.bamboos-consulting.com/wp-content/uploads/2019/08/CA_accounts-1024x520.png 1024w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/CA_accounts-300x152.png 300w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/CA_accounts-768x390.png 768w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/CA_accounts-469x238.png 469w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/CA_accounts-532x270.png 532w" sizes="(max-width: 1024px) 100vw, 1024px" /><figcaption>IMF Data</figcaption></figure> <ul><li>the capital account balance keeps track of all the flow of non-produced and non-financial assets, such as the transfer of ownership in natural resources, intellectual property rights, franchises and leases, capital transfers of migrants, and debt forgiveness.</li><li>the financial account balance tracks financial flows coming in and going out of the economy. Foreign direct investment consisting of long-term financial investment abroad, characterized by large ownership stakes (over 10 percent) in foreign firms. Portfolio investment composed of more liquid financial investments, generally undertaken in the form of stocks, bonds, and bank balances. Note that financial investment in the US increases as the interest rate rises, whereas capital investment decreases as the interest rate rises since the cost of amortizing the loan to purchase the asset increases.</li></ul> <p>Finally, the <strong>official reserve transactions</strong> tracks the international currency dealings of a country’s central bank. The central bank interacts not only with the domestic bond and money markets, but also with international currency markets, with foreign central banks, and with international institutions like the International Monetary Fund, and the World Bank. Indeed, as part of its task of conducting monetary policy at the national level, the central bank may hold a diversified international portfolio that includes international currency reserves and foreign government bonds. However, the central bank does not issue government debt, such as US treasury bills which are issued by the treasury department and recorded under government assets, in the category called other than official reserve assets.</p> <p>The balance of payments theory states that exchange rates should be at their equilibrium level, which is the rate that produces a stable current account balance. Capital flows and trade flows quantify the amount of demand for a currency over a given period of time. If the trade flow balance is negative, the country imports exceed exports and vice-versa. The capital flow balance is positive if foreign inflows of physical or capital investments exceed outflows and vice-versa. Note that when the equity market is rising, the flow of capital increases determining a correlation to the exchange rate movement; the same is true for the fixed-income market in times of global uncertainty.</p> <figure class="wp-block-image"><img src="https://www.bamboos-consulting.com/wp-content/uploads/2019/08/bop_imf-1024x673.png" alt="Balance of Payments" class="wp-image-3162" srcset="https://www.bamboos-consulting.com/wp-content/uploads/2019/08/bop_imf-1024x673.png 1024w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/bop_imf-300x197.png 300w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/bop_imf-768x505.png 768w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/bop_imf-401x264.png 401w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/bop_imf-411x270.png 411w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/bop_imf.png 1075w" sizes="(max-width: 1024px) 100vw, 1024px" /><figcaption>IMF</figcaption></figure> <p>Other determinants of the exchange rate include:</p> <ul><li>The money supply, expected future money supply, and the growth rate of the money supply. Countries experiencing a stable monetary policy see their currencies appreciating and vice-versa. </li><li>Higher interest rates result in appreciation and vice-versa because of more attractive investments.</li><li>The flow of funds into the financial assets of a country increases the demand for that country’s currency (and vice-versa).</li><li>Economic data releases have a varying impact accordingly to the economic factors relevant at the announcement date. In general employment, monetary policy decisions, and inflation data remain the most market-moving releases.</li><li><a rel="noreferrer noopener nofollow" aria-label="Quantitative easing (opens in a new tab)" href="https://corporatefinanceinstitute.com/resources/knowledge/economics/quantitative-easing/" target="_blank">Quantitative easing</a> has a strong impact. For instance, each FED round triggered a sharp rise in EURUSD.</li></ul> <h4>Plotting BoP data with Python</h4> <p>US BoP data is available from a number of sources. However, among the others, the most reliable and easy to manipulate is IMF.</p> <embed src="https://www.bamboos-consulting.com/wp-content/uploads/2019/08/IMF-1.pdf" type="application/pdf" width="774" height="500"></embed> <p> </p> <h4>The Exchange Rate</h4> <p>Whenever the BoP registers a purchase of a foreign asset or a sale of a domestic commodity abroad, this implicitly indicates that there is a change in the demand for or in the supply of the foreign currency. Any change in the BoP sets off by definition a change in the market for foreign currency. For instance, the <strong>nominal exchange rate</strong> is simply the number of dollars you have to pay to get one British pound; the <strong>real exchange rate</strong> accounts for inflation in both countries. To obtain the real exchange rate we first divide the number of dollars we have to pay by the US price level and the number of British pounds we receive (£1) by the UK price level. The real exchange rate is thus simply the nominal £exchange rate times an adjustment for the relative change in prices abroad and at home. The real exchange rate is a measure of the international competitiveness of a country: changes in the international competitiveness depend not only on changes in the nominal exchange rate but also on changes in the relative price level in the two countries. A real depreciation that can be caused either by a nominal depreciation or a decrease in the domestic price level or an increase in the foreign price level (or some combination of these) will enhance a country’s international competitiveness while a real appreciation will have the opposite impact.</p> <p>To measure a country’s overall export competitiveness it is often employed a general measure that extends such a bilateral measure into a multilateral measure. This multilateral measure accounts for the fact that trade occurs with many countries. This measure is called the <strong>effective exchange rate</strong> and is defined as the weighted sum of all bilateral exchange rates. The weight for a bilateral exchange rate is simply the fraction of total trade that the domestic economy conducts with the country. The effective exchange rate can also be adjusted when we are interested in real rather than nominal variables. All we have to do is to sum over all real exchange rates (in index form) rather than the nominal exchange rates.</p> <h4>Trading the Currency Market</h4> <p>Mid-term currency trading offers lower transaction costs and swap earnings (interest paid on the currency borrowed and earned on the one bought) without a substantial risk of losing capital unless very risky crosses are selected. However, the requirements include a deep understanding of market fundamentals, the ability to sustain the short-term and medium-term movements of the currency market, and a sizable account to trade with. An important aid in positon trading derives from the correlations occurring with other financial instruments and resulting from relatively predictable capital flows. </p> <ul><li>Swap and fly strategy. The forex market is closed on Saturdays and Sundays, so no swap rate is incurred or earned over the weekend. However, most liquidity providers still apply the swap rules over the weekend. To balance the effect of non-trading activities over the weekend, the forex market books three days of swap on Wednesday. Hence, if you hold a trade over 5 P.M. on a Wednesday evening, you will either incur or earn three times the normal rates.</li><li>Siamese Twins. Take a long position on AUD/USD immediately after China announces better-than-expected data. Indeed, China will start to import more raw materials from Australia. This increase in business gives rise to a stronger AUD. Moreover, good data from China tend to increase speculation on higher-yielding currencies (AUD is one of the highest among the G20 nations) because China has substantially a positive effect on the global economy. </li><li>Oil Correlation with USDCAD. Canada, as one of ten world’s oil producers, exports most of its oil and its economy is severely hit when oil prices decline. Thus, the price of oil may predict the movement of the Canadian dollar. However, remember oil prices can be very volatile.</li><li>Spot Gold against Dollar Index. The U.S. Dollar Index is an exchange-traded index representing the value of the U.S. dollar in terms of a basket of six major foreign currencies( Euro (57.6%), yen (13.6%), pound (11.9%), Canadian dollar (9.1%), Swedish krona (4.2%), Swiss franc (3.6%)). This strategy seeks to exploit the inverse relationship between the Dollar Index and the price of gold.</li><li>Interest Rate Differentials. The correlation between interest rate differentials and currency pairs can be very useful. Interest rate differentials can be calculated by subtracting the yield of the second currency in the pair from the yield of the first. For instance, the interest rate differentials in GBPUSD should be the 10-year gilt rate minus the U.S. 10-year rate. The trade is based on the fact the majority of international investors are yield seekers.</li></ul> <h4>References</h4> <p>Lien, K. (2012). Day Trading and Swing Trading the Currency Market</p> <p>International Economic Accounts, Bureau of Economic Analysis, US Department of Commerce (http://www.bea.gov/international/index.htm#bop)</p> <p>The Balance of Payments of the United States, Concepts, Data Sources, and Estimating Procedures, April 1990, Robert A. Mosbacher and Michael R. Darby, Under Secretary for Economics Affairs, Bureau of Economic Analysis.</p> <p>How BEA Aligns and Augments Source Data From the U.S. Treasury Department for Inclusion in the International Transactions Accounts, July 2006, Survey of Current Business, Bureau of Economics Analysis.</p> <p>International Monetary Fund, Balance of Payments Yearbook, Washington DC: IMF annual.</p> <p>International Monetary Fund, International Financial Statistics, Washington DC: IMF monthly.</p> <p>Balance of Payments Manual, International Monetary Fund, Washington DC. (www.imf.org/external/np/stat/bop/BOPman.pdf)</p> &amp;amp;amp;amp;amp;amp;lt;/p&amp;amp;amp;amp;amp;amp;gt;&amp;amp;amp;amp;amp;amp;lt;/blockquote&amp;amp;amp;amp;amp;amp;gt;&amp;amp;amp;amp;amp;amp;lt;p&amp;amp;amp;amp;amp;amp;gt; See https://is.gd/IqGJXv for more&amp;amp;amp;amp;amp;amp;lt;/p&amp;amp;amp;amp;amp;amp;gt;

Currency Market

The International Currency Market, or FOREX, is an over-the-counter market where banks, central banks, sharks, investment management firms, hedge funds, and brokers buy and sell currencies. In general, the key drivers of FOREX are Central Bank Interest Rates, Central Bank Intervention, Options, Fear and Greed, and News.

DXY Chart by TradingView

new TradingView.widget( "width": 980, "height": 819, "symbol": "INDEX:DXY", "timezone": "Etc/UTC", "theme": "Light", "style": "1", "locale": "en", "toolbar_bg": "#f1f3f6", "enable_publishing": false, "range": "12m", "allow_symbol_change": true, "studies": [ "HV@tv-basicstudies", "MAExp@tv-basicstudies", "StochasticRSI@tv-basicstudies" ], "container_id": "tradingview_6cb2c" );

Technical analysis in the Currency Market

Technical analysis is widely used among traders and financial professionals operating in the currency market. In the 1960s and 1970s, it was widely dismissed by academics; however, in a recent review, Irwin and Park reported that 56 of 95 modern studies found it produces positive results, but noted that many of the positive results were rendered dubious by issues such as data snooping. Academics such as Eugene Fama say the evidence for technical analysis is sparse and is inconsistent with the weak form of the efficient-market hypothesis. However, technical trading strategies were found to be effective in the Chinese marketplace by a recent study that states, “Finally, we find significant positive returns on buy trades generated by the contrarian version of the moving average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0.50 percent”.

The Determinants of Currency Fluctuations

In general, it does not exist a single theory explaining why and how currencies change. However, the traditional balance of payments model can be augmented considering various factors influencing the market.

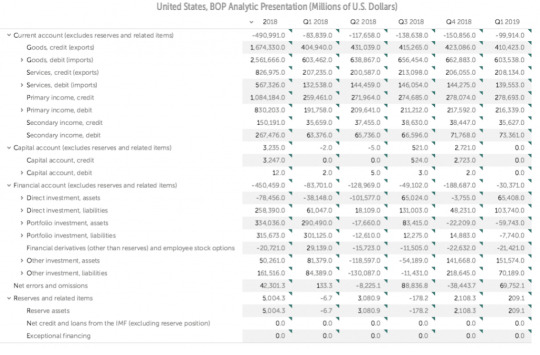

The Balance of Payments is broken down into three important sub-components which sum-up to zero:

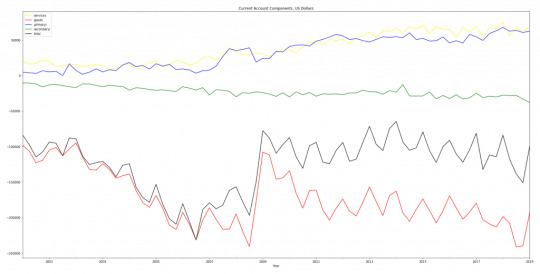

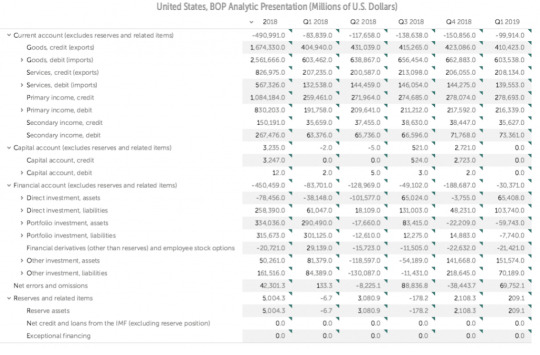

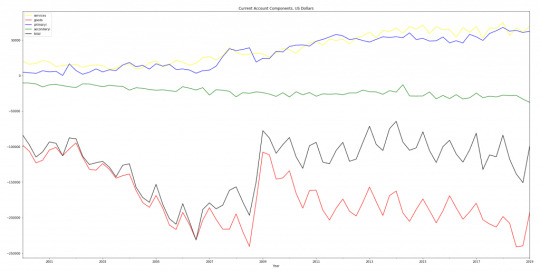

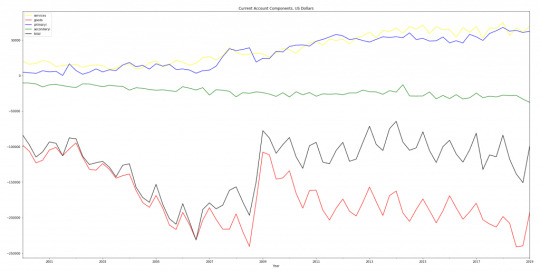

the current account balance consists of the goods balance, the service balance, net income receipts, and net international transfers. The sum of the goods balance and service balance is called the trade balance; such a measure provides a quick look at the international competitiveness of the country. Specifically, the trade balance is calculated by subtracting all imports of goods and services (M) from the exports of goods and services (X). If a country’s imports exceed its exports (X-M<0) it is said to be running a trade deficit. In general, most developed nations exhibit a surplus in the services balance.

IMF Data

the capital account balance keeps track of all the flow of non-produced and non-financial assets, such as the transfer of ownership in natural resources, intellectual property rights, franchises and leases, capital transfers of migrants, and debt forgiveness.

the financial account balance tracks financial flows coming in and going out of the economy. Foreign direct investment consisting of long-term financial investment abroad, characterized by large ownership stakes (over 10 percent) in foreign firms. Portfolio investment composed of more liquid financial investments, generally undertaken in the form of stocks, bonds, and bank balances. Note that financial investment in the US increases as the interest rate rises, whereas capital investment decreases as the interest rate rises since the cost of amortizing the loan to purchase the asset increases.

Finally, the official reserve transactions tracks the international currency dealings of a country’s central bank. The central bank interacts not only with the domestic bond and money markets, but also with international currency markets, with foreign central banks, and with international institutions like the International Monetary Fund, and the World Bank. Indeed, as part of its task of conducting monetary policy at the national level, the central bank may hold a diversified international portfolio that includes international currency reserves and foreign government bonds. However, the central bank does not issue government debt, such as US treasury bills which are issued by the treasury department and recorded under government assets, in the category called other than official reserve assets.

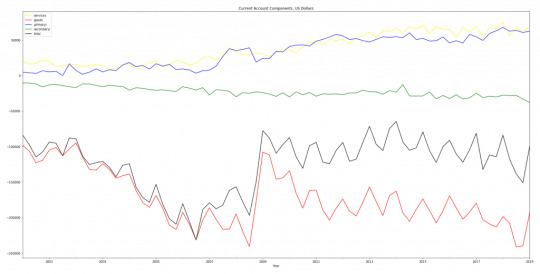

The balance of payments theory states that exchange rates should be at their equilibrium level, which is the rate that produces a stable current account balance. Capital flows and trade flows quantify the amount of demand for a currency over a given period of time. If the trade flow balance is negative, the country imports exceed exports and vice-versa. The capital flow balance is positive if foreign inflows of physical or capital investments exceed outflows and vice-versa. Note that when the equity market is rising, the flow of capital increases determining a correlation to the exchange rate movement; the same is true for the fixed-income market in times of global uncertainty.

IMF

Other determinants of the exchange rate include:

The money supply, expected future money supply, and the growth rate of the money supply. Countries experiencing a stable monetary policy see their currencies appreciating and vice-versa.

Higher interest rates result in appreciation and vice-versa because of more attractive investments.

The flow of funds into the financial assets of a country increases the demand for that country’s currency (and vice-versa).

Economic data releases have a varying impact accordingly to the economic factors relevant at the announcement date. In general employment, monetary policy decisions, and inflation data remain the most market-moving releases.

Quantitative easing has a strong impact. For instance, each FED round triggered a sharp rise in EURUSD.

Plotting BoP data with Python

US BoP data is available from a number of sources. However, among the others, the most reliable and easy to manipulate is IMF.

The Exchange Rate

Whenever the BoP registers a purchase of a foreign asset or a sale of a domestic commodity abroad, this implicitly indicates that there is a change in the demand for or in the supply of the foreign currency. Any change in the BoP sets off by definition a change in the market for foreign currency. For instance, the nominal exchange rate is simply the number of dollars you have to pay to get one British pound; the real exchange rate accounts for inflation in both countries. To obtain the real exchange rate we first divide the number of dollars we have to pay by the US price level and the number of British pounds we receive (£1) by the UK price level. The real exchange rate is thus simply the nominal £exchange rate times an adjustment for the relative change in prices abroad and at home. The real exchange rate is a measure of the international competitiveness of a country: changes in the international competitiveness depend not only on changes in the nominal exchange rate but also on changes in the relative price level in the two countries. A real depreciation that can be caused either by a nominal depreciation or a decrease in the domestic price level or an increase in the foreign price level (or some combination of these) will enhance a country’s international competitiveness while a real appreciation will have the opposite impact.

To measure a country’s overall export competitiveness it is often employed a general measure that extends such a bilateral measure into a multilateral measure. This multilateral measure accounts for the fact that trade occurs with many countries. This measure is called the effective exchange rate and is defined as the weighted sum of all bilateral exchange rates. The weight for a bilateral exchange rate is simply the fraction of total trade that the domestic economy conducts with the country. The effective exchange rate can also be adjusted when we are interested in real rather than nominal variables. All we have to do is to sum over all real exchange rates (in index form) rather than the nominal exchange rates.

Trading the Currency Market

Mid-term currency trading offers lower transaction costs and swap earnings (interest paid on the currency borrowed and earned on the one bought) without a substantial risk of losing capital unless very risky crosses are selected. However, the requirements include a deep understanding of market fundamentals, the ability to sustain the short-term and medium-term movements of the currency market, and a sizable account to trade with. An important aid in positon trading derives from the correlations occurring with other financial instruments and resulting from relatively predictable capital flows.

Swap and fly strategy. The forex market is closed on Saturdays and Sundays, so no swap rate is incurred or earned over the weekend. However, most liquidity providers still apply the swap rules over the weekend. To balance the effect of non-trading activities over the weekend, the forex market books three days of swap on Wednesday. Hence, if you hold a trade over 5 P.M. on a Wednesday evening, you will either incur or earn three times the normal rates.

Siamese Twins. Take a long position on AUD/USD immediately after China announces better-than-expected data. Indeed, China will start to import more raw materials from Australia. This increase in business gives rise to a stronger AUD. Moreover, good data from China tend to increase speculation on higher-yielding currencies (AUD is one of the highest among the G20 nations) because China has substantially a positive effect on the global economy.

Oil Correlation with USDCAD. Canada, as one of ten world’s oil producers, exports most of its oil and its economy is severely hit when oil prices decline. Thus, the price of oil may predict the movement of the Canadian dollar. However, remember oil prices can be very volatile.

Spot Gold against Dollar Index. The U.S. Dollar Index is an exchange-traded index representing the value of the U.S. dollar in terms of a basket of six major foreign currencies( Euro (57.6%), yen (13.6%), pound (11.9%), Canadian dollar (9.1%), Swedish krona (4.2%), Swiss franc (3.6%)). This strategy seeks to exploit the inverse relationship between the Dollar Index and the price of gold.

Interest Rate Differentials. The correlation between interest rate differentials and currency pairs can be very useful. Interest rate differentials can be calculated by subtracting the yield of the second currency in the pair from the yield of the first. For instance, the interest rate differentials in GBPUSD should be the 10-year gilt rate minus the U.S. 10-year rate. The trade is based on the fact the majority of international investors are yield seekers.

References

Lien, K. (2012). Day Trading and Swing Trading the Currency Market

International Economic Accounts, Bureau of Economic Analysis, US Department of Commerce (http://www.bea.gov/international/index.htm#bop)

The Balance of Payments of the United States, Concepts, Data Sources, and Estimating Procedures, April 1990, Robert A. Mosbacher and Michael R. Darby, Under Secretary for Economics Affairs, Bureau of Economic Analysis.

How BEA Aligns and Augments Source Data From the U.S. Treasury Department for Inclusion in the International Transactions Accounts, July 2006, Survey of Current Business, Bureau of Economics Analysis.

International Monetary Fund, Balance of Payments Yearbook, Washington DC: IMF annual.

International Monetary Fund, International Financial Statistics, Washington DC: IMF monthly.

Balance of Payments Manual, International Monetary Fund, Washington DC. (www.imf.org/external/np/stat/bop/BOPman.pdf)

0 notes

Text

What Exactly Is Going on Between Chrissy Teigen and Alison Roman on Twitter added to Google Docs

What Exactly Is Going on Between Chrissy Teigen and Alison Roman on Twitter

NBC/Getty Images

After making some critical comments about Teigen and Marie Kondo in an interview, rising star Roman faces her first big backlash

In These Trying Times, we reach for the things that get us through our monotonous days. Zoom calls with family. A perfectly risen sourdough loaf. And of course, Twitter gossip about popular-but-niche food personalities. You may have seen a dust-up over the weekend involving food world ingenue Alison Roman and model, cookbook author, and “Queen of Twitter” Chrissy Teigen, resulting in Teigen locking her Twitter account, and Roman making a public apology. Allow us to distract you from the state of the world by explaining this unholy mess.

Who are the key players?

You are likely more familiar with Teigen, an Asian-American model who is married to musician John Legend. She hosts multiple TV shows, has run various food blogs for nearly a decade, published two best-selling cookbooks, and in general is a hoot on Twitter. She has built her brand on the juxtaposition of her beauty and her TMI social media persona, inspiring lists like “20 Life-Changing Things Chrissy Teigen Tweeted in 2019” that round up her various dunks on people, including her husband, and ever-relatable sentiments like “I am so stupid and so tired please stop expecting things from me.” She also yells at Donald Trump a lot.

Alison Roman is the “it” girl of the food world. She has worked as a pastry chef at Momofuku Milk Bar and Quince, and is currently a columnist at the New York Times. She has also published two cookbooks, and her recipes have a tendency to become so popular they earn mononyms like “The Cookies” and “The Stew.” Her most recent viral creation is a very good pasta with shallots and anchovies. Roman has come to represent a modern version of the “domestic goddess” archetype, demonstrating how you too can cook more with less. Her whole vibe is that of your coolest friend who effortlessly throws the best dinner parties. She has also received criticism for the way her recipes, particularly her turmeric-and-coconut chickpea stew, whitewash non-European traditions. But as fans of hers will attest, her recipes are often worth the hype.

So what happened?

In a softball interview in the New Consumer, Roman managed to piss off a lot of people. She used the interview to announce a collaboration with Material, a limited-edition capsule collection of “a few tools that I designed that are based on tools that I use that aren’t in production anywhere.” But almost immediately, she pivoted to criticizing people who leverage their popularity to produce consumer goods... just as she has.

Roman brought up Marie Kondo, author of The Life-Changing Magic of Tidying Up, which espouses her KonMari method of doing away with items in your home that don’t “spark joy.” Kondo’s method has been widely misunderstood by many, especially in the West, as getting rid of all your belongings, but really is more about encouraging you to only keep things you actually want. Kondo recently came out with a line of products, which Roman criticizes, saying she “decided to capitalize on her fame and make stuff that you can buy, that is completely antithetical to everything she’s ever taught you.”

Speaking on Kondo’s product line, Roman joked, “For the low, low price of $19.99, please to buy my cutting board!,” something many readers interpreted as mocking Kondo’s Japanese accent. However, Roman says that she was making an inside joke about an Eastern European cookbook she owns, and Dan Frommer, who conducted the interview, says she was not doing any kind of mock Asian accent during the conversation.

Seemingly unprompted, Roman also brought up Teigen as an example of someone who’s used a bit of success to create a personal brand empire. “What Chrissy Teigen has done is so crazy to me,” she said. “She had a successful cookbook. And then it was like: Boom, line at Target. Boom, now she has an Instagram page that has over a million followers where it’s just, like, people running a content farm for her.”

“That horrifies me and it’s not something that I ever want to do,” Roman, who is now writing her third book, remarked.

That seems sort of hypocritical, right?

Indeed, one of the initial criticisms was that a “capsule collection” of recreated-vintage spoons is not much different from a line of cookware at Target, and that Roman has done plenty to capitalize on her brand, including being in the middle of producing a new TV show (more on that in a second). Also, some say her claims of not making much money are a bit disingenuous, aimed to drum up sympathy for someone who is likely making at least some money off royalties and said TV show. Roman responded to this early criticism with a tweet bemoaning “when women bully other women,” to which journalist Lauren Oyler (who had initially subtweeted Roman’s money claims) responded that criticism and bullying are not the same.

Oh please. I’m not “bullying” you, I’m saying we both know how it works and your comments misrepresent it. Sorry I generalized by saying “speaking gigs” so that my comments applied to other people as well, I should have made the subtweet more explicit by saying “content creation” https://t.co/XtRsKy1uGM

— Lauren Oyler (@laurenoyler) May 8, 2020

Roman’s “bullying” claims seemed to have backed her into a corner, seeing as a large chunk of her now-viral New Consumer interview was spent criticizing Kondo and Teigen. She could have just said “branding isn’t for me” — which would have been a lie, sure, but at least would have managed not to narrow in on two women of color. The “lifestyle” space is notoriously white, and for Roman to single out Teigen and Kondo comes off as pointed, given that there are so many white people (like Gwyneth Paltrow) doing the same thing. Chrissy Teigen and Marie Kondo are both wildly successful and certainly not beyond criticism. But given that Roman has already been criticized for using Asian flavors in her recipes without acknowledging where those flavors came from, her use of Teigen, who is of Thai descent, and Kondo, who is Japanese, as examples of what she doesn’t want to be strengthens accusations that she needs to better acknowledge her white privilege.

Alison Roman singles out Marie Kondo / Chrissy Teigen as sellouts, yet takes no issue w/ white women capitalizing on lifestyle content, asking "Does the world need another Goop?" when reflecting on her own brand. Says a lot about who she thinks is allowed to build global empires https://t.co/HJYIvtQZBP

— Michelle da Silva (@michdas) May 8, 2020

Alison Roman coming after Marie Kondo for being successful and making a lot of money is pure Karen energy. There are so few Asians in this lifestyle influencer space anyway and I wonder why she feels the need to drag women of color down just because she doesn’t like competition.

— Eugene Gu, MD (@eugenegu) May 9, 2020

okay so alison roman having such an issue with marie kondo and chrissy teigen making money off of their passions and interest but has no problem with whatever the fuck gwyneth paltrow is doing says a lot

— horrible goose (@meatl0aff) May 9, 2020Okay, but Twitter dust-ups happen all the time. Does it get messier?

It would be one thing if Roman had nothing but Twitter goodwill to lose by criticizing Teigen’s consumerist impulses. But in a now-protected tweet, Teigen wrote of Roman’s remarks: “[T]his is a huge bummer and hit me hard. I have made her recipes for years now, bought the cookbooks, supported her on social and praised her in interviews. I even signed on to executive produce the very show she talks about doing in this article.” She later wrote, “Anyhow. now that that’s out there, I guess we should probably unfollow each other @alisoneroman.”

Did Roman at least apologize?

She did. On Twitter, Roman said she had emailed Teigen privately, but also wanted to publicly apologize. “I’m genuinely sorry I caused you pain with what I said,” she wrote. “I shouldn’t have used you/your business (or Marie’s!) as an example to show what I wanted for my own career.” She also reiterated “being a woman who takes down other women is absolutely not my thing.”

Being a woman who takes down other women is absolutely not my thing and don’t think it’s yours, either (I obviously failed to effectively communicate that). I hope we can meet one day, I think we’d probably get along.

— alison roman (@alisoneroman) May 9, 2020

Teigen locked her Twitter account, and announced to her millions of followers that she is taking a break due to the drama and the abuse she received in the wake of her and Roman’s interactions. “I really hate what this drama has caused this week,” Teigen wrote, according to the Daily Beast. “Calling my kids Petri dish babies [Teigen’s children were both conceived through IVF] or making up flight manifests with my name on them to ‘Epstein island,’ to justify someone else’s disdain with me seems gross to me so I’m gonna take a little break.”

So where does this leave us? Am I not allowed to make that pasta anymore?

Roman may have summoned the monkey’s paw when she tweeted, on April 7, “Dear lord please let me get through this pandemic without a backlash, my shallot pasta popularity is all I have in these dark times.” A lot of people are pissed at Roman right now, which is bolstered by a low-level resentment that’s been bubbling for some time. Some of it is the usual backlash that comes whenever anyone becomes popular. She has a cool job that she is very good at, she’s experiencing an influx of opportunity, and you probably have one friend who won’t shut up about her. Of course, some contrarians are going to roll their eyes.

But some of it is because of her refusal to acknowledge the way she borrows flavors without credit. In an interview in Jezebel last year, Roman said that, being white, she has “no culture.” White people often like to position themselves as some sort of default, and though she may not feel any particular connection to the “vaguely European” countries her forbearers came from, whiteness is indeed a culture — the dominant one. And yet a certain set of people associate turmeric and coconut milk mainly with her. Roman can hardly be solely blamed for white supremacy in the food industry, and it’s of course not as though white people aren’t allowed to cook curries. But it’s the whole picture — of a white woman making a name for herself off South Asian ingredients with which she joyfully admits she has no particular expertise, while simultaneously criticizing women of color who are making a living doing almost exactly what she’s doing — that’s so frustrating to many.

The backlash also reveals the limits of what Kristin Wong calls Roman’s “too cool to care” persona. In the New Consumer, Roman brags that she runs her own social media and communications, however sloppily. “The Internet loves authenticity and admitting you’re a creative mess who doesn’t understand business reads as authentic,” Wong writes. “By shunning how it all works, you’re raging against the capitalist machine, which only makes you more appealing to it.”

But at a certain point, Roman reached the level of fame in which her persona is at direct odds with how her life now looks. She may have begun as a 20-something clueless girl who was just really good at cooking, but now she has books, TV deals, and a line (sorry, capsule collection) of products. Any attempt at “relatability” rings false, because little about her life is relatable to most people. Her positioning of not being into the whole marketing thing reads more as a result of her privilege, not a cute quirk. “For people of different ethnic and racial backgrounds, the ‘money is bad/I don’t care about success/business is stupid’ narrative just doesn’t hit the same,” writes Wong. “When you grow up with generational poverty, as so many immigrant families and marginalized groups do, you don’t have the luxury of not giving a shit about money.”

Roman’s fans will largely remain Roman fans and her detractors will likely remain detractors. Other than horrid Twitter trolls, Teigen has received an outpouring of support from cooking industry all-stars like José Andrés. I made The Cookies last week and they were pretty good.

Disclosure: Chrissy Teigen is producing shows for Hulu in partnership with Vox Media Studios, part of Eater’s parent company, Vox Media. No Eater staff member is involved in the production of those shows, and this does not impact coverage on Eater.

Disclosure: John Legend is a board member of Vox Media, Eater’s parent company.

via Eater - All https://www.eater.com/2020/5/11/21254554/chrissy-teigen-alison-roman-twitter-fallout-explained

Created May 12, 2020 at 03:18AM

/huong sen

View Google Doc Nhà hàng Hương Sen chuyên buffet hải sản cao cấp✅ Tổ chức tiệc cưới✅ Hội nghị, hội thảo✅ Tiệc lưu động✅ Sự kiện mang tầm cỡ quốc gia 52 Phố Miếu Đầm, Mễ Trì, Nam Từ Liêm, Hà Nội http://huongsen.vn/ 0904988999 http://huongsen.vn/to-chuc-tiec-hoi-nghi/ https://drive.google.com/drive/folders/1xa6sRugRZk4MDSyctcqusGYBv1lXYkrF

0 notes

Text

&amp;amp;amp;amp;amp;amp;lt;blockquote&amp;amp;amp;amp;amp;amp;gt;&amp;amp;amp;amp;amp;amp;lt;p&amp;amp;amp;amp;amp;amp;gt;Currency Market&amp;amp;amp;amp;amp;amp;lt;/p&amp;amp;amp;amp;amp;amp;gt; &amp;amp;amp;amp;amp;amp;lt;p&amp;amp;amp;amp;amp;amp;gt; <blockquote class="wp-block-quote"><p>The International Currency Market, or FOREX, is an over-the-counter market where banks, central banks, sharks, investment management firms, hedge funds, and brokers buy and sell currencies. In general, the key drivers of FOREX are Central Bank Interest Rates, Central Bank Intervention, Options, Fear and Greed, and News.</p></blockquote> <hr class="wp-block-separator"/> <p></p> <!-- TradingView Widget BEGIN --> <div class="tradingview-widget-container"> <div id="tradingview_6cb2c"></div> <div class="tradingview-widget-copyright"><a href="https://www.tradingview.com/symbols/INDEX-DXY/" rel="noopener noreferrer" target="_blank"><span class="blue-text">DXY Chart</span></a> by TradingView</div> <script type="text/javascript" src="https://s3.tradingview.com/tv.js"></script> <script type="text/javascript"> new TradingView.widget( "width": 980, "height": 819, "symbol": "INDEX:DXY", "timezone": "Etc/UTC", "theme": "Light", "style": "1", "locale": "en", "toolbar_bg": "#f1f3f6", "enable_publishing": false, "range": "12m", "allow_symbol_change": true, "studies": [ "HV@tv-basicstudies", "MAExp@tv-basicstudies", "StochasticRSI@tv-basicstudies" ], "container_id": "tradingview_6cb2c" ); </script> </div> <!-- TradingView Widget END --> <h4>Technical analysis in the Currency Market</h4> <p>Technical analysis is widely used among traders and financial professionals operating in the currency market. In the 1960s and 1970s, it was widely dismissed by academics; however, in a recent review, Irwin and Park reported that 56 of 95 modern studies found it produces positive results, but noted that many of the positive results were rendered dubious by issues such as <a href="https://www.bamboos-consulting.com/quantitative-trading/">data snooping</a>. Academics such as Eugene Fama say the evidence for technical analysis is sparse and is inconsistent with the weak form of the efficient-market hypothesis. However, technical trading strategies were found to be effective in the Chinese marketplace by a recent study that states, “Finally, we find significant positive returns on buy trades generated by the contrarian version of the moving average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0.50 percent”.</p> <h4>The Determinants of Currency Fluctuations</h4> <p>In general, it does not exist a single theory explaining why and how currencies change. However, the traditional balance of payments model can be augmented considering various factors influencing the market.</p> <p>The <strong>Balance of Payments</strong> is broken down into three important sub-components which sum-up to zero: </p> <ul><li>the current account balance consists of the goods balance, the service balance, net income receipts, and net international transfers. The sum of the goods balance and service balance is called the trade balance; such a measure provides a quick look at the international competitiveness of the country. Specifically, the trade balance is calculated by subtracting all imports of goods and services (M) from the exports of goods and services (X). If a country’s imports exceed its exports (X-M<0) it is said to be running a trade deficit. In general, most developed nations exhibit a surplus in the services balance.</li></ul> <figure class="wp-block-image"><img src="https://www.bamboos-consulting.com/wp-content/uploads/2019/08/CA_accounts-1024x520.png" alt="" class="wp-image-3213" srcset="https://www.bamboos-consulting.com/wp-content/uploads/2019/08/CA_accounts-1024x520.png 1024w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/CA_accounts-300x152.png 300w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/CA_accounts-768x390.png 768w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/CA_accounts-469x238.png 469w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/CA_accounts-532x270.png 532w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/CA_accounts.png 1783w" sizes="(max-width: 1024px) 100vw, 1024px" /><figcaption>IMF Data</figcaption></figure> <ul><li>the capital account balance keeps track of all the flow of non-produced and non-financial assets, such as the transfer of ownership in natural resources, intellectual property rights, franchises and leases, capital transfers of migrants, and debt forgiveness.</li><li>the financial account balance tracks financial flows coming in and going out of the economy. Foreign direct investment consisting of long-term financial investment abroad, characterized by large ownership stakes (over 10 percent) in foreign firms. Portfolio investment composed of more liquid financial investments, generally undertaken in the form of stocks, bonds, and bank balances. Note that financial investment in the US increases as the interest rate rises, whereas capital investment decreases as the interest rate rises since the cost of amortizing the loan to purchase the asset increases.</li></ul> <p>Finally, the <strong>official reserve transactions</strong> tracks the international currency dealings of a country’s central bank. The central bank interacts not only with the domestic bond and money markets, but also with international currency markets, with foreign central banks, and with international institutions like the International Monetary Fund, and the World Bank. Indeed, as part of its task of conducting monetary policy at the national level, the central bank may hold a diversified international portfolio that includes international currency reserves and foreign government bonds. However, the central bank does not issue government debt, such as US treasury bills which are issued by the treasury department and recorded under government assets, in the category called other than official reserve assets.</p> <p>The balance of payments theory states that exchange rates should be at their equilibrium level, which is the rate that produces a stable current account balance. Capital flows and trade flows quantify the amount of demand for a currency over a given period of time. If the trade flow balance is negative, the country imports exceed exports and vice-versa. The capital flow balance is positive if foreign inflows of physical or capital investments exceed outflows and vice-versa. Note that when the equity market is rising, the flow of capital increases determining a correlation to the exchange rate movement; the same is true for the fixed-income market in times of global uncertainty.</p> <figure class="wp-block-image"><img src="https://www.bamboos-consulting.com/wp-content/uploads/2019/08/bop_imf-1024x673.png" alt="Balance of Payments" class="wp-image-3162" srcset="https://www.bamboos-consulting.com/wp-content/uploads/2019/08/bop_imf-1024x673.png 1024w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/bop_imf-300x197.png 300w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/bop_imf-768x505.png 768w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/bop_imf-401x264.png 401w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/bop_imf-411x270.png 411w, https://www.bamboos-consulting.com/wp-content/uploads/2019/08/bop_imf.png 1075w" sizes="(max-width: 1024px) 100vw, 1024px" /><figcaption>IMF</figcaption></figure> <p>Other determinants of the exchange rate include:</p> <ul><li>The money supply, expected future money supply, and the growth rate of the money supply. Countries experiencing a stable monetary policy see their currencies appreciating and vice-versa. </li><li>Higher interest rates result in appreciation and vice-versa because of more attractive investments.</li><li>The flow of funds into the financial assets of a country increases the demand for that country’s currency (and vice-versa).</li><li>Economic data releases have a varying impact accordingly to the economic factors relevant at the announcement date. In general employment, monetary policy decisions, and inflation data remain the most market-moving releases.</li><li><a rel="noreferrer noopener nofollow" aria-label="Quantitative easing (opens in a new tab)" href="https://corporatefinanceinstitute.com/resources/knowledge/economics/quantitative-easing/" target="_blank">Quantitative easing</a> has a strong impact. For instance, each FED round triggered a sharp rise in EURUSD.</li></ul> <h4>Plotting BoP data with Python</h4> <p>US BoP data is available from a number of sources. However, among the others, the most reliable and easy to manipulate is IMF.</p> <embed src="https://www.bamboos-consulting.com/wp-content/uploads/2019/08/IMF-1.pdf" type="application/pdf" width="774" height="500"></embed> <p> </p> <h4>The Exchange Rate</h4> <p>Whenever the BoP registers a purchase of a foreign asset or a sale of a domestic commodity abroad, this implicitly indicates that there is a change in the demand for or in the supply of the foreign currency. Any change in the BoP sets off by definition a change in the market for foreign currency. For instance, the <strong>nominal exchange rate</strong> is simply the number of dollars you have to pay to get one British pound; the <strong>real exchange rate</strong> accounts for inflation in both countries. To obtain the real exchange rate we first divide the number of dollars we have to pay by the US price level and the number of British pounds we receive (£1) by the UK price level. The real exchange rate is thus simply the nominal £exchange rate times an adjustment for the relative change in prices abroad and at home. The real exchange rate is a measure of the international competitiveness of a country: changes in the international competitiveness depend not only on changes in the nominal exchange rate but also on changes in the relative price level in the two countries. A real depreciation that can be caused either by a nominal depreciation or a decrease in the domestic price level or an increase in the foreign price level (or some combination of these) will enhance a country’s international competitiveness while a real appreciation will have the opposite impact.</p> <p>To measure a country’s overall export competitiveness it is often employed a general measure that extends such a bilateral measure into a multilateral measure. This multilateral measure accounts for the fact that trade occurs with many countries. This measure is called the <strong>effective exchange rate</strong> and is defined as the weighted sum of all bilateral exchange rates. The weight for a bilateral exchange rate is simply the fraction of total trade that the domestic economy conducts with the country. The effective exchange rate can also be adjusted when we are interested in real rather than nominal variables. All we have to do is to sum over all real exchange rates (in index form) rather than the nominal exchange rates.</p> <h4>Trading the Currency Market</h4> <p>Mid-term currency trading offers lower transaction costs and swap earnings (interest paid on the currency borrowed and earned on the one bought) without a substantial risk of losing capital unless very risky crosses are selected. However, the requirements include a deep understanding of market fundamentals, the ability to sustain the short-term and medium-term movements of the currency market, and a sizable account to trade with. An important aid in positon trading derives from the correlations occurring with other financial instruments and resulting from relatively predictable capital flows. </p> <ul><li>Swap and fly strategy. The forex market is closed on Saturdays and Sundays, so no swap rate is incurred or earned over the weekend. However, most liquidity providers still apply the swap rules over the weekend. To balance the effect of non-trading activities over the weekend, the forex market books three days of swap on Wednesday. Hence, if you hold a trade over 5 P.M. on a Wednesday evening, you will either incur or earn three times the normal rates.</li><li>Siamese Twins. Take a long position on AUD/USD immediately after China announces better-than-expected data. Indeed, China will start to import more raw materials from Australia. This increase in business gives rise to a stronger AUD. Moreover, good data from China tend to increase speculation on higher-yielding currencies (AUD is one of the highest among the G20 nations) because China has substantially a positive effect on the global economy. </li><li>Oil Correlation with USDCAD. Canada, as one of ten world’s oil producers, exports most of its oil and its economy is severely hit when oil prices decline. Thus, the price of oil may predict the movement of the Canadian dollar. However, remember oil prices can be very volatile.</li><li>Spot Gold against Dollar Index. The U.S. Dollar Index is an exchange-traded index representing the value of the U.S. dollar in terms of a basket of six major foreign currencies( Euro (57.6%), yen (13.6%), pound (11.9%), Canadian dollar (9.1%), Swedish krona (4.2%), Swiss franc (3.6%)). This strategy seeks to exploit the inverse relationship between the Dollar Index and the price of gold.</li><li>Interest Rate Differentials. The correlation between interest rate differentials and currency pairs can be very useful. Interest rate differentials can be calculated by subtracting the yield of the second currency in the pair from the yield of the first. For instance, the interest rate differentials in GBPUSD should be the 10-year gilt rate minus the U.S. 10-year rate. The trade is based on the fact the majority of international investors are yield seekers.</li></ul> <h4>References</h4> <p>Lien, K. (2012). Day Trading and Swing Trading the Currency Market</p> <p>International Economic Accounts, Bureau of Economic Analysis, US Department of Commerce (http://www.bea.gov/international/index.htm#bop)</p> <p>The Balance of Payments of the United States, Concepts, Data Sources, and Estimating Procedures, April 1990, Robert A. Mosbacher and Michael R. Darby, Under Secretary for Economics Affairs, Bureau of Economic Analysis.</p> <p>How BEA Aligns and Augments Source Data From the U.S. Treasury Department for Inclusion in the International Transactions Accounts, July 2006, Survey of Current Business, Bureau of Economics Analysis.</p> <p>International Monetary Fund, Balance of Payments Yearbook, Washington DC: IMF annual.</p> <p>International Monetary Fund, International Financial Statistics, Washington DC: IMF monthly.</p> <p>Balance of Payments Manual, International Monetary Fund, Washington DC. (www.imf.org/external/np/stat/bop/BOPman.pdf)</p> &amp;amp;amp;amp;amp;amp;lt;/p&amp;amp;amp;amp;amp;amp;gt;&amp;amp;amp;amp;amp;amp;lt;/blockquote&amp;amp;amp;amp;amp;amp;gt;&amp;amp;amp;amp;amp;amp;lt;p&amp;amp;amp;amp;amp;amp;gt; See https://is.gd/IqGJXv for more&amp;amp;amp;amp;amp;amp;lt;/p&amp;amp;amp;amp;amp;amp;gt;

Currency Market

The International Currency Market, or FOREX, is an over-the-counter market where banks, central banks, sharks, investment management firms, hedge funds, and brokers buy and sell currencies. In general, the key drivers of FOREX are Central Bank Interest Rates, Central Bank Intervention, Options, Fear and Greed, and News.

DXY Chart by TradingView

new TradingView.widget( "width": 980, "height": 819, "symbol": "INDEX:DXY", "timezone": "Etc/UTC", "theme": "Light", "style": "1", "locale": "en", "toolbar_bg": "#f1f3f6", "enable_publishing": false, "range": "12m", "allow_symbol_change": true, "studies": [ "HV@tv-basicstudies", "MAExp@tv-basicstudies", "StochasticRSI@tv-basicstudies" ], "container_id": "tradingview_6cb2c" );

Technical analysis in the Currency Market

Technical analysis is widely used among traders and financial professionals operating in the currency market. In the 1960s and 1970s, it was widely dismissed by academics; however, in a recent review, Irwin and Park reported that 56 of 95 modern studies found it produces positive results, but noted that many of the positive results were rendered dubious by issues such as data snooping. Academics such as Eugene Fama say the evidence for technical analysis is sparse and is inconsistent with the weak form of the efficient-market hypothesis. However, technical trading strategies were found to be effective in the Chinese marketplace by a recent study that states, “Finally, we find significant positive returns on buy trades generated by the contrarian version of the moving average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0.50 percent”.

The Determinants of Currency Fluctuations

In general, it does not exist a single theory explaining why and how currencies change. However, the traditional balance of payments model can be augmented considering various factors influencing the market.

The Balance of Payments is broken down into three important sub-components which sum-up to zero:

the current account balance consists of the goods balance, the service balance, net income receipts, and net international transfers. The sum of the goods balance and service balance is called the trade balance; such a measure provides a quick look at the international competitiveness of the country. Specifically, the trade balance is calculated by subtracting all imports of goods and services (M) from the exports of goods and services (X). If a country’s imports exceed its exports (X-M<0) it is said to be running a trade deficit. In general, most developed nations exhibit a surplus in the services balance.

IMF Data

the capital account balance keeps track of all the flow of non-produced and non-financial assets, such as the transfer of ownership in natural resources, intellectual property rights, franchises and leases, capital transfers of migrants, and debt forgiveness.

the financial account balance tracks financial flows coming in and going out of the economy. Foreign direct investment consisting of long-term financial investment abroad, characterized by large ownership stakes (over 10 percent) in foreign firms. Portfolio investment composed of more liquid financial investments, generally undertaken in the form of stocks, bonds, and bank balances. Note that financial investment in the US increases as the interest rate rises, whereas capital investment decreases as the interest rate rises since the cost of amortizing the loan to purchase the asset increases.

Finally, the official reserve transactions tracks the international currency dealings of a country’s central bank. The central bank interacts not only with the domestic bond and money markets, but also with international currency markets, with foreign central banks, and with international institutions like the International Monetary Fund, and the World Bank. Indeed, as part of its task of conducting monetary policy at the national level, the central bank may hold a diversified international portfolio that includes international currency reserves and foreign government bonds. However, the central bank does not issue government debt, such as US treasury bills which are issued by the treasury department and recorded under government assets, in the category called other than official reserve assets.

The balance of payments theory states that exchange rates should be at their equilibrium level, which is the rate that produces a stable current account balance. Capital flows and trade flows quantify the amount of demand for a currency over a given period of time. If the trade flow balance is negative, the country imports exceed exports and vice-versa. The capital flow balance is positive if foreign inflows of physical or capital investments exceed outflows and vice-versa. Note that when the equity market is rising, the flow of capital increases determining a correlation to the exchange rate movement; the same is true for the fixed-income market in times of global uncertainty.

IMF

Other determinants of the exchange rate include:

The money supply, expected future money supply, and the growth rate of the money supply. Countries experiencing a stable monetary policy see their currencies appreciating and vice-versa.

Higher interest rates result in appreciation and vice-versa because of more attractive investments.

The flow of funds into the financial assets of a country increases the demand for that country’s currency (and vice-versa).

Economic data releases have a varying impact accordingly to the economic factors relevant at the announcement date. In general employment, monetary policy decisions, and inflation data remain the most market-moving releases.

Quantitative easing has a strong impact. For instance, each FED round triggered a sharp rise in EURUSD.

Plotting BoP data with Python

US BoP data is available from a number of sources. However, among the others, the most reliable and easy to manipulate is IMF.

The Exchange Rate

Whenever the BoP registers a purchase of a foreign asset or a sale of a domestic commodity abroad, this implicitly indicates that there is a change in the demand for or in the supply of the foreign currency. Any change in the BoP sets off by definition a change in the market for foreign currency. For instance, the nominal exchange rate is simply the number of dollars you have to pay to get one British pound; the real exchange rate accounts for inflation in both countries. To obtain the real exchange rate we first divide the number of dollars we have to pay by the US price level and the number of British pounds we receive (£1) by the UK price level. The real exchange rate is thus simply the nominal £exchange rate times an adjustment for the relative change in prices abroad and at home. The real exchange rate is a measure of the international competitiveness of a country: changes in the international competitiveness depend not only on changes in the nominal exchange rate but also on changes in the relative price level in the two countries. A real depreciation that can be caused either by a nominal depreciation or a decrease in the domestic price level or an increase in the foreign price level (or some combination of these) will enhance a country’s international competitiveness while a real appreciation will have the opposite impact.

To measure a country’s overall export competitiveness it is often employed a general measure that extends such a bilateral measure into a multilateral measure. This multilateral measure accounts for the fact that trade occurs with many countries. This measure is called the effective exchange rate and is defined as the weighted sum of all bilateral exchange rates. The weight for a bilateral exchange rate is simply the fraction of total trade that the domestic economy conducts with the country. The effective exchange rate can also be adjusted when we are interested in real rather than nominal variables. All we have to do is to sum over all real exchange rates (in index form) rather than the nominal exchange rates.

Trading the Currency Market

Mid-term currency trading offers lower transaction costs and swap earnings (interest paid on the currency borrowed and earned on the one bought) without a substantial risk of losing capital unless very risky crosses are selected. However, the requirements include a deep understanding of market fundamentals, the ability to sustain the short-term and medium-term movements of the currency market, and a sizable account to trade with. An important aid in positon trading derives from the correlations occurring with other financial instruments and resulting from relatively predictable capital flows.

Swap and fly strategy. The forex market is closed on Saturdays and Sundays, so no swap rate is incurred or earned over the weekend. However, most liquidity providers still apply the swap rules over the weekend. To balance the effect of non-trading activities over the weekend, the forex market books three days of swap on Wednesday. Hence, if you hold a trade over 5 P.M. on a Wednesday evening, you will either incur or earn three times the normal rates.

Siamese Twins. Take a long position on AUD/USD immediately after China announces better-than-expected data. Indeed, China will start to import more raw materials from Australia. This increase in business gives rise to a stronger AUD. Moreover, good data from China tend to increase speculation on higher-yielding currencies (AUD is one of the highest among the G20 nations) because China has substantially a positive effect on the global economy.

Oil Correlation with USDCAD. Canada, as one of ten world’s oil producers, exports most of its oil and its economy is severely hit when oil prices decline. Thus, the price of oil may predict the movement of the Canadian dollar. However, remember oil prices can be very volatile.

Spot Gold against Dollar Index. The U.S. Dollar Index is an exchange-traded index representing the value of the U.S. dollar in terms of a basket of six major foreign currencies( Euro (57.6%), yen (13.6%), pound (11.9%), Canadian dollar (9.1%), Swedish krona (4.2%), Swiss franc (3.6%)). This strategy seeks to exploit the inverse relationship between the Dollar Index and the price of gold.

Interest Rate Differentials. The correlation between interest rate differentials and currency pairs can be very useful. Interest rate differentials can be calculated by subtracting the yield of the second currency in the pair from the yield of the first. For instance, the interest rate differentials in GBPUSD should be the 10-year gilt rate minus the U.S. 10-year rate. The trade is based on the fact the majority of international investors are yield seekers.

References

Lien, K. (2012). Day Trading and Swing Trading the Currency Market

International Economic Accounts, Bureau of Economic Analysis, US Department of Commerce (http://www.bea.gov/international/index.htm#bop)

The Balance of Payments of the United States, Concepts, Data Sources, and Estimating Procedures, April 1990, Robert A. Mosbacher and Michael R. Darby, Under Secretary for Economics Affairs, Bureau of Economic Analysis.

How BEA Aligns and Augments Source Data From the U.S. Treasury Department for Inclusion in the International Transactions Accounts, July 2006, Survey of Current Business, Bureau of Economics Analysis.

International Monetary Fund, Balance of Payments Yearbook, Washington DC: IMF annual.

International Monetary Fund, International Financial Statistics, Washington DC: IMF monthly.

Balance of Payments Manual, International Monetary Fund, Washington DC. (www.imf.org/external/np/stat/bop/BOPman.pdf)

0 notes