#tata consultancy services share

Text

TCS Recruitment 2022 | 1000 Automation Tester Vacancy

TCS Recruitment 2022 | 1000 Automation Tester Vacancy

#TCS #MNC #Jobtamizhan #Privatejobs

TCS Recruitment 2022: Tata Consultancy Service (TCS) has recently released the notification for the recruitment Automation Tester Recruitment and the candidates who are interested and have the prescribed qualification , those candidates should go through the notification before applying the TCS form online and read it like that Eligible Candidate Apply Vacancies And Apply Online Starting Date…

View On WordPress

#Automation Tester#tata consultancy service#tata consultancy services#tata consultancy services (business operation)#tata consultancy services careers#tata consultancy services exam#tata consultancy services interview#tata consultancy services kya hai#tata consultancy services salary#tata consultancy services share#tata consultancy services stock#tata consultancy services stock new#TCS Recruitment 2022#what does tata consultancy services do#what is tata consultancy services

0 notes

Text

How to make TCS Gap Affidavit?

What is TCS gap Affidavit?

TCS gap affidavit for education or career is required to submit to the TCS authority before joining.

Where Can I found TCS gap affidavit format?

Dont Worry! We have the exact format for TCS gap Affidavit. It is online and you can view or Download in PDF format. For the Privacy and security reason we cannot share the final copy of gap affidavit format for TCS. Please remember this is only a template and for the indication purpose only, final copy will be different.

Download Gap Affidavit format for TCS

When to submit TCS Career Gap Affidavit?

It is mandatory to declare the gaps, if any, during your academic and/or work experience. Break in education should not be due to extended education. Any break in education/work experience should not exceed 24 months and is permissible only for valid reasons. Relevant document proof, as applicable, will be checked for gaps in education.

Only Full time courses will be considered (Part Time/Correspondence courses will not be considered).

When to submit TCS Education Gap Affidavit?

If the employee has a gap in education for a period of six or more months, then the employee is required to submit a GAP certificate that is notarized , made on a Rs. 100 Non Judicial stamp paper states the employee’s name, year of GAP and the reason for GAP.

In case of medical reasons, copy of the medical certificate attested by a gazetted officer must be attached to the affidavit. GAP Affidavit is to be made in English and the original is to be submitted along with the BGC form at the time of joining.

What will be Stamp Duty for TCS Gap Affidavit?

TCS education gap affidavit or Career gap Affidavit needs to be printed on Rs. 100 Non-Judicial Stamp paper.

Is Notarization Mandatory for TCS education Gap Affidavit?

Yes! It is required. Every education Gap Affidavit or Career gap Affidavit of Tata Consultancy Service (TCS) needs to be Notarized with Notarial Stamps and Red Ink Rubber Stamps with red emblem duly Signed of a Notary Public with an identified Lawyer. Notary Public will issue a serial number and it will be mentioned in the top of the document.

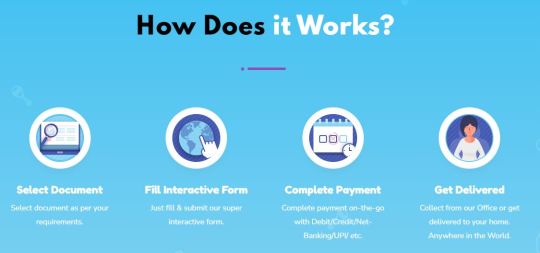

How to Create TCS Gap Affidavit Online?

Create TCS Gap Affidavit online through very east Steps. Just Fill the form and make payment rest leave it to us. You can come to our office or we can ship to your address.

Create Now

What information is required to create gap Affidavit Online?

Name

Father’s Name / Legal guardian Name

Age

Address

Gap Period/s

Reason for Gaps

How do we Ship Documents?

We have partnership with multiple shipping vendors, so reachability is not an issue for us. You can order it from anywhere in India.

How does it Work?

Related Topic:

TCS Non-Criminal Affidavit

TCS Service Agreement

#tata consultancy services#tcs share price#education#career#work from home jobs#resume#online jobs#recruitment#jobsearch#job portal#apply#eligibility#employment#employers#employees#self employed

0 notes

Text

TCS Q1 Review: Analysts Cautious Even As Deal Wins Drive Revenue Growth

TCS Q1 Review: Analysts Cautious Even As Deal Wins Drive Revenue Growth

Tata Consultancy Services Ltd. (TCS) revenue rose on deal wins but analysts are cautious as margin pressure persists and the company hinted at recession worries among clients.

(more…)

View On WordPress

#Analysis#Analysts On TCS#Stock Market#Tata Consultancy Services Ltd#TCS#TCS Share Price#TCS Shares#TCS Stock Price

1 note

·

View note

Text

टाटा ने रचा इतिहास! दुनिया के टॉप-100 ब्रैंड में शामिल होने वाली इकलौती कंपनी

टाटा ने रचा इतिहास! दुनिया के टॉप-100 ब्रैंड में शामिल होने वाली इकलौती कंपनी

नमक से सॉफ्टवेयर तक बनाने वाली कंपनी को लंदन बेस्ड कंस्लटेंसी ब्रैंड फाइनैंस ने सूची में 86वें नंबर पर रखा है. कंपनी 2018 में इस सूची में 104 नंबर पर थी. ग्लोबल टॉप-100 में यह एकमात्र भारतीय कंपनी है.

Source link

View On WordPress

#10 लाख करोड़ रुपये का हुआ टाटा ग्रुप#n chandrasekhar#tata consultancy services#TATA Group#Tata group total value#tata group value#tata m-cap#tata market cap#Tata Motors#Tata Steel#TCS#tcs share price#टाटा की ताजा खबर#टाटा ग्रुप ने बनाया रिकॉर्ड#टाटा ने रचा इतिहास#टाटा स्टील#टीसीएस

0 notes

Text

TCS and Infosys leap after brokerage Bernstein updates goals for the largest IT companies

Shares of Infosys and Tata Consultancy Services (TCS) saw an increase on Tuesday, November 21, following the publication of divergent target prices for the IT companies’ stocks by brokerage Bernstein.

At 10:09 am on Monday, the BSE saw a 0.22 percent increase in TCS shares, or Rs 7.70, at Rs 3527.00 a share, and a 0.52 percent increase in Infosys stock, or Rs 7.40, at Rs 1443.70.

View On WordPress

2 notes

·

View notes

Text

Nifty, Sensex End Higher For Fourth Day Led By ICICI Bank, Kotak Bank: Market Wrap

India's benchmark stock indices ended higher for the fourth session on Wednesday, led by gains in Kotak Mahindra Bank Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd. The NSE Nifty 50 ended 34.40 points or 0.15% higher at 22,402.40, and the S&P BSE Sensex gained 114.48 points or 0.16% to close at 73,852.94. Intraday, the NSE Nifty 50 rose 0.48% to 22,476.45, and the S&P BSE rose 0.52%. "Late selling at higher levels erased the majority of the Nifty 50 gains to settle at 22,402.40, with gains of 34.40 points," said Aditya Gaggar, director, Progressive Shares. "Nothing has changed in Nifty50, and we continue to stick to our view, i.e., we need to fill the 22,430–22,500 gap zone to extend its uptrend, while a level of 22,200 (50DMA) will continue to act as support." "Indian markets lagged the Asian peers as Q4 earnings remained largely subdued, with weak results from IT and a few index heavyweights also disappointed. However, buoyed by strong manufacturing and service sectors, the Indian composite PMI hit a multi-year high, reflecting domestic resilience and bringing some buoyancy to the broad market. Globally, investor sentiment improved with easing tensions in the Middle East and declining oil prices," said Vinod Nair, head of research at Geojit Financial Services.

Kotak Mahindra Bank Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., Tata Steel Ltd., and HDFC Bank Ltd. contributed to the index. Reliance Industries Ltd., Tata Consultancy Services Ltd., Bharti Airtel Ltd., and Infosys Ltd. limited gains in the index. On NSE, eight sectors advanced and four declined. The NSE Nifty Metal index was the top gainer, while the NSE Nifty IT index was the top loser

0 notes

Text

Exploring the Rise of Tata 1mg Share Price

Introduction:

The upward surge in Tata 1mg Share Price has captured the attention of investors and market observers alike. This article delves into the factors propelling this remarkable ascent in Tata 1mg Share Price and evaluates the implications for both investors and the company. Tata 1mg stands as a prominent healthcare platform in India, offering an extensive array of services designed to cater to diverse healthcare needs. Originally conceived with a focus on providing comprehensive information about medicines and promoting safe and effective medication usage, the platform has evolved significantly over the years. In 2016, Tata 1mg ventured into the online pharmacy domain, followed by the launch of its diagnostics business in 2017, marking significant milestones in its journey.

The platform boasts a comprehensive range of offerings, encompassing prescription medicines, over-the-counter drugs, health supplements, and an array of diagnostic tests including blood tests, urine tests, and imaging procedures. Moreover, Tata 1mg's e-consultation service facilitates seamless online appointments with healthcare professionals across various specialties, enabling users to seek expert medical advice remotely.

As a subsidiary of Tata Digital Limited, which is a part of the esteemed Tata Group, Tata 1mg benefits from the backing of one of India's largest and most respected conglomerates. The acquisition of a majority stake by Tata Digital in December 2020 led to the rebranding of the platform as "Tata 1mg," further solidifying its position in the healthcare landscape.

With a customer base exceeding 10 million and a vast inventory of over 1,00,000 medicines and healthcare products, Tata 1mg has emerged as a trusted destination for healthcare solutions. The platform collaborates with over 10,000 partner pharmacies across India, ensuring widespread accessibility of its services to users nationwide.

Founded in 2015 by Prashant Tandon, Gaurav Agarwal, and Vikas Chauhan, Tata 1mg initially operated under the name HealthKartPlus, offering information about medicines and their substitutes. Over time, the platform rebranded itself as "1mg" to underscore its broader focus on delivering holistic healthcare solutions encompassing medicines, health information, and diagnostic services.

Committed to the mission of making healthcare accessible, understandable, and affordable for all Indians, Tata 1mg continues to spearhead innovation and customer-centric initiatives in the healthcare sector. The platform has been lauded for its innovative services and has received accolades such as the "Best Healthcare Company" award at the India Digital Awards 2022, underscoring its commitment to excellence.

With a robust presence in over 1,000 cities across India, Tata 1mg operates from its registered office located at Level 3, Vasant Square Mall, Pocket V, Sector B, Vasant Kunj, New Delhi, South Delhi, DL 110070, serving as a beacon of transformation in the Indian healthcare landscape.

Strategic Partnership with Tata Group:

A significant catalyst behind the surge in Tata 1mg's share price is its strategic partnership with the renowned Tata Group. The collaboration has provided Tata 1mg with access to Tata's extensive resources, brand recognition, and market expertise. This association has instilled confidence among investors, driving optimism about Tata 1mg's growth potential and fueling the rise in its share price.

Expansion of Healthcare Services:

Tata 1mg's expansion of healthcare services has played a pivotal role in driving its share price higher. The company has diversified its offerings beyond online pharmacy services to include teleconsultation, diagnostic tests, and health-related products. This expansion has positioned Tata 1mg as a comprehensive healthcare platform, attracting a broader customer base and enhancing shareholder value.

Digital Transformation and Technological Innovation:

The embrace of digital transformation and technological innovation has been instrumental in Tata 1mg's share price rally. The company has leveraged advanced technologies to streamline its operations, enhance user experience, and offer personalized healthcare solutions. This focus on innovation has differentiated Tata 1mg in the competitive landscape, driving investor confidence and contributing to its share price growth.

Focus on Quality and Compliance:

Tata 1mg's unwavering commitment to quality and compliance has bolstered investor trust and contributed to its rising share price. The company adheres to stringent quality standards and regulatory requirements, ensuring the safety and efficacy of its products and services. This dedication to quality assurance has positioned Tata 1mg as a trusted healthcare provider, attracting investors seeking stability and reliability.

Strategic Acquisitions and Partnerships:

Tata 1mg's strategic acquisitions and partnerships have further fueled its share price rally. The company has made strategic investments in complementary businesses and forged partnerships with healthcare providers, pharmaceutical companies, and technology firms. These collaborations have expanded Tata 1mg's market reach, diversified its revenue streams, and enhanced its competitive position, driving investor interest and share price appreciation.

Analyst Projections and Outlook:

Market analysts have expressed bullish sentiments towards Tata 1mg, citing factors such as its strong financial performance, strategic partnerships, and expanding healthcare ecosystem. Many analysts have revised their price targets upwards, reflecting confidence in Tata 1mg's growth prospects. With the increasing demand for digital healthcare solutions and Tata 1mg's strategic initiatives, investors remain optimistic about the company's future performance and share price trajectory.

Conclusion:

The rise in Tata 1mg's share price underscores the company's strategic partnership with Tata Group, expansion of healthcare services, focus on digital transformation and technological innovation, commitment to quality and compliance, strategic acquisitions and partnerships, and positive analyst outlook. As investors continue to recognize Tata 1mg's position as a leader in the digital healthcare space, the stock is expected to remain in high demand. However, investors should conduct thorough research and seek professional advice before making investment decisions.

0 notes

Text

TCS CEO Clarification on Latest Recruitment

Tata Consultancy Services (TCS) CEO Kritivasan announced plans to hire 40,000 freshers in the current and next financial year. TCS shares rose initially but fell later.

Delhi: MD Kritivasan, CEO of Tata Consultancy Services (TCS) has clarified that 40,000 freshers will be hired in the current financial year as well as in 2023-24. He said that they are committed to give jobs to all those who have already selected and given offer letters in the college premises. He said that the process of selecting 10,000 freshers through National Qualifier Test process has been…

View On WordPress

0 notes

Text

TCS Q4 Results: IT major stock to open in green today over robust earnings

New Post has been published on https://petn.ws/IMTD6

TCS Q4 Results: IT major stock to open in green today over robust earnings

TCS share price is all set to remain in focus today, April 15 after posting its fourth quarter results on Friday. The IT major Tata Consultancy Services (TCS) reported its financial results for the quarter ending on March 31, 2024, beating market estimates. Since the TCS Q4 results were announced after the Indian stock market […]

See full article at https://petn.ws/IMTD6

#OtherNews

0 notes

Text

TCS SUCCESSFACTORS

Title: TCS SuccessFactors: Driving HR Transformation with Cloud-Based Solutions

Introduction

In today’s dynamic business environment, the Human Resources (HR) function is more crucial than ever. Attracting, retaining, and managing a skilled workforce requires innovative strategies and tools. Cloud-based Human Capital Management (HCM) platforms have emerged as game-changers, and SAP SuccessFactors stands out as a leader in the market. Les explores why SuccessFactors is gaining popularity and how Tata Consultancy Services (TCS) helps organizations maximize SuccessFactors investments.

What is SuccessFactors?

SAP SuccessFactors is a comprehensive, cloud-based HCM suite that modernizes HR processes across the entire employee lifecycle. It offers a wide range of modules covering:

Core HR & Payroll: Centralized employee data management, streamlined payroll processes, and compliance.

Talent Management: Recruitment, onboarding, performance management, goal setting, and succession planning.

Learning & Development: Skills development, training programs, and knowledge sharing.

Workforce Analytics: Data-driven insights for better HR decision-making.

Why Choose SuccessFactors?

User-friendly Interface: The intuitive interface promotes user adoption and reduces training needs.

Scalability: The cloud-based model allows organizations to scale up or down based on their evolving requirements.

Mobile Accessibility: Provides real-time access to HR information on mobile devices, enhancing employee and manager experience.

Robust Analytics: Helps leaders understand workforce trends, make better decisions, and improve talent outcomes.

Continuous Innovation: SAP regularly updates SuccessFactors with new features and functionality, keeping HR practices cutting-edge.

The TCS Advantage

Tata Consultancy Services (TCS) is a leading global IT services provider with extensive expertise in implementing and supporting SAP SuccessFactors solutions. Key advantages to partnering with TCS include:

Proven Methodology: TCS’s structured implementation approach ensures a smooth transition and rapid time to value.

Deep Domain Knowledge: TCS consultants bring a wealth of HR process knowledge, enabling them to tailor solutions to your needs.

Pre-Configured Solutions: TCS accelerators and solutions streamline implementation and maximize functionality.

Change Management Expertise: Ensures high user adoption, which is critical for the success of HR transformation projects.

Global Support: Offers post-implementation support for a seamless ongoing experience for organizations with a worldwide reach.

Real-World Success Stories

Several organizations have successfully transformed their HR functions with the help of TCS and SuccessFactors. For example:

[Name of Company A]: Implemented SuccessFactors for streamlined onboarding, global payroll standardization, and improved workforce visibility.

[Name of Company B]: Deployed SuccessFactors to enable continuous performance management, leadership development, and succession planning.

Conclusion

The combination of SAP SuccessFactors’ robust HCM solutions and TCS’s proven implementation expertise positions organizations to transform their HR function, improve employee experience, and achieve better business results. Considering upgrading your HR technology, consider the benefits of a cloud-based solution like SuccessFactors and partnering with an experienced provider like TCS.

youtube

You can find more information about SAP Successfactors in this SAP Successfactors Link

Conclusion:

Unogeeks is the No.1 IT Training Institute for SAP Training. Anyone Disagree? Please drop in a comment

You can check out our other latest blogs on SAP Successfactors here - SAP Successfactors Blogs

You can check out our Best In Class SAP Successfactors Details here - SAP Successfactors Training

----------------------------------

For Training inquiries:

Call/Whatsapp: +91 73960 33555

Mail us at: [email protected]

Our Website ➜ https://unogeeks.com

Follow us:

Instagram: https://www.instagram.com/unogeeks

Facebook: https://www.facebook.com/UnogeeksSoftwareTrainingInstitute

Twitter: https://twitter.com/unogeeks

1 note

·

View note

Text

System Integrator Market Size, Share, Trends, Global Demand, Growth and Opportunity Analysis

Data Bridge Market research has recently issued comprehensive industry research on Global System Integrator Market which includes growth analysis, regional marketing, challenges, opportunities, and drivers analysed in the report.

Besides, System Integrator market report studies market growth opportunities and restraining factors. The geographical division of this market analysis report offers data that gives an idea of the revenue of the companies and sales figures of the market growth. The market report also contains the drivers and restraints for the System Integrator market that are obtained with the help of SWOT analysis, and also shows all the recent developments, product launches, joint ventures, mergers and acquisitions by the several key players and brands with their systemic company profiles, that are driving the market.

Access Full 350 Pages PDF Report @

Data Bridge Market Research analyzes that the Global System Integrator Market which was USD 353,900.00 million in 2022, is likely to reach USD 995,448.19 million by 2030, and is expected to undergo a CAGR of 12.18% during the forecast period. “Infrastructure Integration” dominates the service segment of the global system integrator market due to the growth of infrastructure integration is projected to be strong in the coming years due to the growing demand for a cost-effective, resilient, agile, and secure IT infrastructure. Various industries, including defense, marine systems, telecommunications, aviation, oil & gas, banking, and healthcare, are increasingly embracing system integration. Businesses are constantly evolving and adapting to changing IT needs in a complex environment, which is expected to boost the demand for infrastructure integration in the foreseeable future.

TABLE OF CONTENTS

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Research Methodology

Part 04: Market Landscape

Part 05: Pipeline Analysis

Part 06: Market Sizing

Part 07: Five Forces Analysis

Part 08: Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers and Challenges

Part 13: Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Key Questions Answered with this Study

1) What makes System Integrator Market feasible for long term investment?

2) Know value chain areas where players can create value?

3) Teritorry that may see steep rise in CAGR & Y-O-Y growth?

4) What geographic region would have better demand for product/services?

5) What opportunity emerging territory would offer to established and new entrants in System Integrator Market?

6) Risk side analysis connected with service providers?

7) How influencing factors driving the demand of System Integratorin next few years?

8) What is the impact analysis of various factors in the Global System Integrator Market growth?

9) What strategies of big players help them acquire share in mature market?

10) How Technology and Customer-Centric Innovation is bringing big Change in System Integrator Market?

Some of the major players operating in the Global System Integrator Market are:

Capgemini (France)

Accenture (Ireland)

IBM (U.S.)

Infosys Limited (India)

Jitterbit Inc, (U.S.)

Magic Software Enterprises (Israel)

HCL Technologies Limited (India)

Wipro (India)

Johnson Controls. (Ireland)

Cognizant (U.S.)

Tata Consultancy Services Limited (India)

John Wood Group PLC (U.K.)

ATS Automation Tooling Systems Inc, (Canada)

Avanceon (U.A.E.)

JR Automation (Netherlands)

Tesco Controls, Inc. (U.S.)

Burrow Global LLC (U.S.)

Prime Controls LP (U.S.)

MAVERICK Technologies LLC (U.S)

BW Design Group (U.S.)

Browse Trending Reports:

System Integrator Market

Europe Industrial Hose Market

Redox Flow Battery Market

Mud Pump Market

Solar Cells Quantum Dots Market

Land Survey Equipment Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email: [email protected]

#System Integrator Market Size#Share#Trends#Global Demand#Growth and Opportunity Analysis#market report#market share#market size#marketresearch#market analysis#market trends#market research#markettrends

0 notes

Text

Software And BPO Services Global Market 2024 - By Growth, Trends, Share, Size, Forecast To 2033

The software and bpo services market size is expected to see strong growth in the next few years. It will grow to $3033.95 billion in 2028 at a compound annual growth rate (CAGR) of 9.8%. The growth in the forecast period can be attributed to digital transformation, data privacy and security, rtificial intelligence (AI) and automation, remote work, industry-specific solutions, sustainability and ESG. Major trends in the forecast period include electrification and lightweighting, advanced materials, additive manufacturing, digitalization and connectivity, collaboration and partnerships, .

To access more details regarding this report, visit the link:

https://www.thebusinessresearchcompany.com/report/software-and-bpo-services-global-market-report

Segmentation & Regional Insights

The software and bpo services market covered in this report is segmented –

1) By Type: BPO Services, Software Services

2) By Organization Size: Large Enterprises, Small And Medium Enterprises

3) By End-Use Industry: Financial Services, Retail & Wholesale, Information Technology, Manufacturing, Healthcare, Other End-User Industries

Asia-Pacific was the largest region in software and BPO services market in 2023. North America was the second largest region in software and BPO services market. The regions covered in the software and BPO services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Intrigued to explore the contents? Secure your hands-on sample copy of the report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=2145&type=smp

Major Driver Impacting Market Growth

The emergence of startups as major clients of software and BPO service providers is expected to drive the market. Driven by cost efficiency and the necessity to focus on core operations, startups have started outsourcing non-core operations such as finance and recruitment to specialized agencies and companies. For instance, outsourcing of finance and tech operations helps Leverage Edu, an India-based EdTech startup connecting students with mentors, save approximately 40% of its capital through outsourcing. The increasing number of startups is also expected to positively impact the market. The number of startups in India is expected to increase to 10,500 by 2020, a 4000 increase from the current number, depicting new opportunities for the software and BPO services market in the client expansion and revenue generation.

Key Industry Players

Major companies operating in the software and bpo services market include Tata Consultancy Services Limited, Nippon Telegraph and Telephone Corporation, Telefonaktiebolaget LM Ericsson, Cognizant Technology Solutions Corporation, Dell Technologies Inc., Hewlett Packard Enterprise Company, Microsoft Corporation, Capgemini SE, Cisco Systems Inc., Infosys Limited, Accenture plc, International Business Machines Corporation, Wipro Limited, HCL Technologies Limited, DXC Technology, Genpact Limited, NTT Data Corporation, Atos SE, CGI Inc., Larsen & Toubro Infotech Limited, Tech Mahindra Limited, WNS Global Services Limited, Syntel Inc., LTIMindtree Limited, Hexaware Technologies Limited, Mphasis Limited, Virtusa Corporation, Zensar Technologies Limited, EPAM Systems Inc, Citibank NA, ExlService Holdings Inc., WNS Limited, Wipro Limited, Hinduja Global Solutions Limited, Sutherland Global Services Inc., Teleperformance SE.

The software and bpo services market report table of contents includes:

1. Executive Summary

2. Software And BPO Services Market Characteristics

3. Software And BPO Services Product/Service Analysis -Product/Service Examples

4. Software And BPO Services Market Trends And Strategies

5. Software And BPO Services Market - Macro Economic Scenario

....................

31. Belgium Software And BPO Services Market

32. Denmark Software And BPO Services Market

33. Finland Software And BPO Services Market

34. Ireland Software And BPO Services Market

35. Netherlands Software And BPO Services Market

Explore the trending research reports from TBRC:

https://goodprnews.com/gum-and-wood-chemicals-global-market-size/

https://goodprnews.com/high-power-transformers-global-market-size/

https://goodprnews.com/ice-boxes-global-market-size/

https://topprnews.com/gum-and-wood-chemicals-global-market-share/

https://topprnews.com/high-power-transformers-global-market-share/

https://topprnews.com/ice-boxes-global-market-share/

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

TCS Share Price: Understanding the Dynamics

In today's fast-paced financial markets, keeping track of the share prices of major companies is crucial for investors. Among the top contenders in the IT industry, Tata Consultancy Services (TCS) holds a significant position. Understanding the dynamics behind TCS share price movement can provide valuable insights for investors and stakeholders alike.

Introduction to TCS (Tata Consultancy Services)

Tata Consultancy Services, commonly known as TCS, is a multinational IT services and consulting company headquartered in Mumbai, India. Founded in 1968, TCS has grown to become one of the largest IT services firms globally, operating in over 46 countries.

Overview of TCS's Market Performance

In recent years, TCS's market performance has been closely watched by investors and analysts alike. The company's shares are listed on various stock exchanges, including the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE). Understanding the recent trends in TCS share price can provide valuable insights into market sentiment and investor confidence.

Recent trends in TCS share price

TCS's share price has witnessed fluctuations in response to various internal and external factors. Analyzing these trends can help investors make informed decisions regarding their investment strategies.

Factors Influencing TCS Share Price

Several factors influence the movement of TCS's share price, ranging from financial performance to broader industry trends and economic indicators.

Financial performance

TCS's quarterly and annual financial results play a significant role in determining investor sentiment towards the company. Factors such as revenue growth, profit margins, and earnings per share (EPS) can impact TCS's share price performance.

Industry trends

As a leading player in the IT services industry, TCS's share price is influenced by trends within the sector. Factors such as demand for digital transformation services, competition from other IT firms, and technological advancements can affect TCS's market performance.

Economic indicators

Macroeconomic factors, including GDP growth, inflation rates, and currency fluctuations, can also impact TCS's share price. Economic downturns or geopolitical tensions may lead to volatility in the stock market, affecting investor confidence in TCS and other companies.

Impact of Global Events on TCS Share Price

Global events, such as geopolitical tensions, natural disasters, or pandemics, can have a significant impact on TCS's share price. For example, the COVID-19 pandemic led to market volatility and uncertainty, affecting TCS's business operations and financial performance.

Analysis of TCS Share Price History

Analyzing TCS's share price history can provide valuable insights into long-term trends and patterns. Investors often look at historical data to identify potential buying or selling opportunities and to assess the company's performance relative to its peers.

TCS Share Price Forecasting

Forecasting TCS's share price involves analyzing various factors, including market trends, company fundamentals, and external influences. While predicting future share price movements with certainty is challenging, conducting thorough analysis can help investors make informed decisions.

Investment Strategies for TCS Shares

Investors adopt various strategies when investing in TCS shares, depending on their risk tolerance, investment goals, and market outlook. Some may prefer a long-term buy-and-hold approach, while others may engage in short-term trading strategies based on technical analysis.

Risks Associated with Investing in TCS

Like any investment, investing in TCS shares carries certain risks that investors should be aware of. These risks may include market volatility, industry competition, regulatory changes, and company-specific challenges.

Conclusion

Understanding the dynamics behind TCS's share price is essential for investors seeking to make informed investment decisions. By analyzing factors such as financial performance, industry trends, and global events, investors can gain valuable insights into TCS's market performance and potential future prospects.

0 notes

Text

IoT Engineering Services Market Unidentified Segments – The Biggest Opportunity Of 2024

The Internet of Things (IoT) allows engineers to follow the products they design and also enable engineers to learn how their design performs in reality so they can generate more productive and efficient products in the future. By utilizing the cloud, IoT platforms, smart product modules, big data, and connectivity, engineers will steer the future of engineering innovation. IoT is the technology engineers need to gain valuable insights and eventually to improve designs.

Free Sample Report + All Related Graphs & Charts @: https://www.advancemarketanalytics.com/sample-report/9155-global-iot-engineering-services-market-1?utm_source=Organic&utm_medium=Vinay

Latest released the research study on Global IoT Engineering Services Market, offers a detailed overview of the factors influencing the global business scope. IoT Engineering Services Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the IoT Engineering Services The study covers emerging player’s data, including: competitive landscape, sales, revenue and global market share of top manufacturers are Integra Sources (Russia), Infosys Limited (India), Tata Consultancy Services (India), NEC Corporation (Japan), INEAX AT ENGINEERING SDN. BHD (Russia), Tech Mahindra Limited (India), Happiest Minds Technologies Private Limited (India), eInfochips (India), Prodapt Solutions Private Limited (India), Happiest Minds (India), Agera Consulting (Japan), TAAL Tech (India)

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Southeast Asia.

0 notes

Text

Analysing Market Trends: The Effect of Economic Indicators on TCS and Shriram Transport Share Prices

In the ever-evolving landscape of the stock market, understanding the nuances of market trends and the impact of economic indicators on company share prices is crucial for investors. This article delves into the intricate relationship between various economic factors and the share prices of two significant players in the Indian market: Tata Consultancy Services (TCS) and Shriram Transport Finance Company. By examining the share price of TCS alongside the performance of Shriram Transport, we aim to uncover insights that could guide investment strategies.

TCS, a titan in the IT sector, has seen its share price reflect the broader trends in technology investment and global economic health. The current share price of TCS is 4,105, not just a number but a mirror reflecting the company's resilience, growth prospects, and the global demand for IT services. Economic indicators such as GDP growth rates, employment figures in the technology sector, and international trade agreements play a significant role in shaping investor sentiment towards TCS. A robust economy generally indicates higher spending on technology and innovation, leading to a positive outlook for IT companies. Conversely, economic downturns or trade uncertainties can prompt a cautious approach from investors, impacting share prices negatively.

Moving on to the share price of Shriram Transport, the scenario shifts to the finance and transport sectors, revealing a different set of economic indicators at play. Shriram Transport, a leading player in the commercial vehicle finance sector, has its share price influenced by domestic economic policies, fuel prices, and the overall health of the transport industry. The Shriram transport share price is particularly sensitive to changes in interest rates, as these can affect borrowing costs for consumers and businesses alike. Furthermore, regulations affecting the transport sector, such as emission norms and vehicle financing norms, can also impact investor confidence and share price movements.

Both TCS and Shriram Transport operate in distinctly different sectors, yet their share prices are subject to the whims of economic indicators. For TCS, the key factors include global IT spending, exchange rate fluctuations, and innovation indices. For Shriram Transport, the crucial indicators are interest rates, vehicle sales data, and regulatory changes affecting the transport and finance industries. Understanding these relationships is vital for investors looking to make informed decisions.

Moreover, the impact of economic indicators on these companies' share prices underscores the importance of diversification in an investment portfolio. While TCS might benefit from a surge in global IT spending, Shriram Transport could simultaneously face challenges due to rising fuel costs. An investor with stakes in both companies might find that losses in one investment are offset by gains in another, illustrating the protective buffer that diversification can provide against market volatility.

0 notes

Text

Nifty, Sensex End Little Changed Amid Volatility; Midcap Hits Record High: Market Wrap

India's benchmark indices ended little changed amid volatility on Wednesday, ahead of the Fed Chair's speech at the Macroeconomics and Monetary Policy Conference. However, the Nifty Midcap 150 hit a fresh lifetime high during the day and settled higher for the eighth day in a row. The Nifty Smallcap 250 closed with gains for the ninth day in a row. The NSE Nifty settled 18.65 points, or 0.083%, , lower at 22,434.65, and the S&P BSE Sensex declined 27.09 points, or 0.037%, to end at 73,876.82. Market participants will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook in the backdrop of robust economic data and high inflation weighing on rate cut expectations. The Nifty 50 fell to an intraday low of 22,346 and the Sensex touched a low of 73,540.27 on Wednesday. "Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and an uptick in US bond yields are making investors nervous, with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd. Reliance Industries Ltd., Kotak Mahindra Bank Ltd., Larsen & Toubro Ltd., Nestle India Ltd., and ICICI Bank Ltd. contributed to the gains in Nifty. Tata Consultancy Services Ltd., Bharti Airtel Ltd., Axis Bank Ltd., NTPC Ltd., and Bajaj Finance Ltd. weighed on the index. On NSE, five sectors advanced, three remained flat, and four declined. The NSE Nifty Realty fell the most among peers, while the NSE Nifty PSU Bank became the top performing sector.

check this out www.optionperks.com

0 notes