#tata consultancy services (business operation)

Text

TCS Recruitment 2022 | 1000 Automation Tester Vacancy

TCS Recruitment 2022 | 1000 Automation Tester Vacancy

#TCS #MNC #Jobtamizhan #Privatejobs

TCS Recruitment 2022: Tata Consultancy Service (TCS) has recently released the notification for the recruitment Automation Tester Recruitment and the candidates who are interested and have the prescribed qualification , those candidates should go through the notification before applying the TCS form online and read it like that Eligible Candidate Apply Vacancies And Apply Online Starting Date…

View On WordPress

#Automation Tester#tata consultancy service#tata consultancy services#tata consultancy services (business operation)#tata consultancy services careers#tata consultancy services exam#tata consultancy services interview#tata consultancy services kya hai#tata consultancy services salary#tata consultancy services share#tata consultancy services stock#tata consultancy services stock new#TCS Recruitment 2022#what does tata consultancy services do#what is tata consultancy services

0 notes

Text

What are the Top 10 Chabot Development Companies in India?

Here are ten Chabot development companies in India known for their expertise and quality services:

OnGraph: OnGraph Solutions is a leading Chabot Development Company in India and USA, offering AI-powered Chabot development services for businesses across various industries.

Haptik: Haptik is a conversational AI platform that provides chatbot development solutions for enterprises, helping them automate customer support, sales, and marketing processes.

Yellow Messenger: It offers AI-powered Chabot services for enterprises, helping them automate customer engagement and support across multiple channels.

Acuvate: This company develops chatbots and virtual assistants for enterprises, enabling them to automate processes, improve productivity, and enhance customer experiences.

Tata Consultancy Services (TCS): It is Software development Company that offers chatbot solutions as part of its digital transformation and AI solutions for businesses looking to implement conversational AI technologies.

WotNot: WotNot is a Chabot development company in India that provides AI-powered Chabot solutions for businesses in industries like healthcare, e-commerce, and finance.

Cogito Tech: Cogito Tech offers Chabot Development Services using AI and natural language processing (NLP) technologies to help businesses improve customer service and streamline operations.

Appinventiv: Appinventiv is a mobile app development company that also offers chatbot development services, helping businesses builds conversational AI solutions for various use cases.

Kore.ai: Kore.ai provides Chabot development platforms and services for enterprises, enabling them to build and deploy AI-powered chatbots for customer service, sales, and internal processes.

#hirededicatedwordpressdeveloper#wordpressdevelopmentcompanyindia#hirewordpressdeveloperindia#wordpressdevelopmentservice#dedicatedwordpressdeveloper#customwordpressdevelopmentcompany#wordpresswebdevelopmentservices#customwordpressdevelopmentservices#wordpresswebsitedevelopmentservices#wordpressdevelopmentservices

0 notes

Text

Exploring the Rise of Tata 1mg Share Price

Introduction:

The upward surge in Tata 1mg Share Price has captured the attention of investors and market observers alike. This article delves into the factors propelling this remarkable ascent in Tata 1mg Share Price and evaluates the implications for both investors and the company. Tata 1mg stands as a prominent healthcare platform in India, offering an extensive array of services designed to cater to diverse healthcare needs. Originally conceived with a focus on providing comprehensive information about medicines and promoting safe and effective medication usage, the platform has evolved significantly over the years. In 2016, Tata 1mg ventured into the online pharmacy domain, followed by the launch of its diagnostics business in 2017, marking significant milestones in its journey.

The platform boasts a comprehensive range of offerings, encompassing prescription medicines, over-the-counter drugs, health supplements, and an array of diagnostic tests including blood tests, urine tests, and imaging procedures. Moreover, Tata 1mg's e-consultation service facilitates seamless online appointments with healthcare professionals across various specialties, enabling users to seek expert medical advice remotely.

As a subsidiary of Tata Digital Limited, which is a part of the esteemed Tata Group, Tata 1mg benefits from the backing of one of India's largest and most respected conglomerates. The acquisition of a majority stake by Tata Digital in December 2020 led to the rebranding of the platform as "Tata 1mg," further solidifying its position in the healthcare landscape.

With a customer base exceeding 10 million and a vast inventory of over 1,00,000 medicines and healthcare products, Tata 1mg has emerged as a trusted destination for healthcare solutions. The platform collaborates with over 10,000 partner pharmacies across India, ensuring widespread accessibility of its services to users nationwide.

Founded in 2015 by Prashant Tandon, Gaurav Agarwal, and Vikas Chauhan, Tata 1mg initially operated under the name HealthKartPlus, offering information about medicines and their substitutes. Over time, the platform rebranded itself as "1mg" to underscore its broader focus on delivering holistic healthcare solutions encompassing medicines, health information, and diagnostic services.

Committed to the mission of making healthcare accessible, understandable, and affordable for all Indians, Tata 1mg continues to spearhead innovation and customer-centric initiatives in the healthcare sector. The platform has been lauded for its innovative services and has received accolades such as the "Best Healthcare Company" award at the India Digital Awards 2022, underscoring its commitment to excellence.

With a robust presence in over 1,000 cities across India, Tata 1mg operates from its registered office located at Level 3, Vasant Square Mall, Pocket V, Sector B, Vasant Kunj, New Delhi, South Delhi, DL 110070, serving as a beacon of transformation in the Indian healthcare landscape.

Strategic Partnership with Tata Group:

A significant catalyst behind the surge in Tata 1mg's share price is its strategic partnership with the renowned Tata Group. The collaboration has provided Tata 1mg with access to Tata's extensive resources, brand recognition, and market expertise. This association has instilled confidence among investors, driving optimism about Tata 1mg's growth potential and fueling the rise in its share price.

Expansion of Healthcare Services:

Tata 1mg's expansion of healthcare services has played a pivotal role in driving its share price higher. The company has diversified its offerings beyond online pharmacy services to include teleconsultation, diagnostic tests, and health-related products. This expansion has positioned Tata 1mg as a comprehensive healthcare platform, attracting a broader customer base and enhancing shareholder value.

Digital Transformation and Technological Innovation:

The embrace of digital transformation and technological innovation has been instrumental in Tata 1mg's share price rally. The company has leveraged advanced technologies to streamline its operations, enhance user experience, and offer personalized healthcare solutions. This focus on innovation has differentiated Tata 1mg in the competitive landscape, driving investor confidence and contributing to its share price growth.

Focus on Quality and Compliance:

Tata 1mg's unwavering commitment to quality and compliance has bolstered investor trust and contributed to its rising share price. The company adheres to stringent quality standards and regulatory requirements, ensuring the safety and efficacy of its products and services. This dedication to quality assurance has positioned Tata 1mg as a trusted healthcare provider, attracting investors seeking stability and reliability.

Strategic Acquisitions and Partnerships:

Tata 1mg's strategic acquisitions and partnerships have further fueled its share price rally. The company has made strategic investments in complementary businesses and forged partnerships with healthcare providers, pharmaceutical companies, and technology firms. These collaborations have expanded Tata 1mg's market reach, diversified its revenue streams, and enhanced its competitive position, driving investor interest and share price appreciation.

Analyst Projections and Outlook:

Market analysts have expressed bullish sentiments towards Tata 1mg, citing factors such as its strong financial performance, strategic partnerships, and expanding healthcare ecosystem. Many analysts have revised their price targets upwards, reflecting confidence in Tata 1mg's growth prospects. With the increasing demand for digital healthcare solutions and Tata 1mg's strategic initiatives, investors remain optimistic about the company's future performance and share price trajectory.

Conclusion:

The rise in Tata 1mg's share price underscores the company's strategic partnership with Tata Group, expansion of healthcare services, focus on digital transformation and technological innovation, commitment to quality and compliance, strategic acquisitions and partnerships, and positive analyst outlook. As investors continue to recognize Tata 1mg's position as a leader in the digital healthcare space, the stock is expected to remain in high demand. However, investors should conduct thorough research and seek professional advice before making investment decisions.

0 notes

Text

Empowering Pune Businesses with Microsoft 365 Business Plans

In the bustling city of Pune, where innovation meets tradition, businesses are constantly striving to stay ahead in the digital age. With the ever-increasing reliance on technology, the adoption of Microsoft 365 Business Plans has emerged as a crucial step for Pune businesses to streamline their operations, enhance productivity, and foster collaboration. As an authorized channel partner of Tata Tele Business Services, Zipcrest Consulting Services Pvt Ltd is dedicated to empowering Pune businesses with tailored Microsoft 365 solutions designed to meet their unique needs and propel them towards success.

Enhancing Productivity with Office Apps:

Microsoft 365 Business Plans offer a comprehensive suite of Office applications including Word, Excel, PowerPoint, and Outlook. These familiar tools empower Pune businesses to create, collaborate, and communicate seamlessly, regardless of their size or industry. With the flexibility to access documents from anywhere and on any device, Pune businesses can enhance productivity and streamline their workflows, driving efficiency across the organization.

Fostering Collaboration with Microsoft Teams:

In a dynamic business environment like Pune, where remote work and virtual collaboration are becoming increasingly prevalent, Microsoft Teams serves as a hub for teamwork and communication. Integrated into Microsoft 365 Business Plans, Teams enables Pune businesses to conduct virtual meetings, chat in real-time, and collaborate on documents from anywhere, fostering teamwork and driving innovation.

Ensuring Security and Compliance:

Data security is paramount for Pune businesses, especially in light of stringent regulatory requirements and the rising threat of cyberattacks. Microsoft 365 Business Plans come equipped with advanced security features such as threat protection, data encryption, and identity management, helping Pune businesses safeguard their sensitive information and maintain compliance with industry regulations.

Tailored Solutions for Pune Businesses:

At Zipcrest Consulting Services Pvt Ltd, we understand that every Pune business is unique, with its own set of challenges and objectives. That's why we offer tailored Microsoft 365 Business Plans designed to meet the specific needs of each business. Whether it's a startup looking to scale up or an established enterprise seeking to modernize its operations, our team works closely with Pune businesses to identify their requirements and implement customized solutions that drive growth and success.

Conclusion:

As Pune continues to evolve as a hub of innovation and entrepreneurship, the adoption of Microsoft 365 Business Plans has become indispensable for businesses looking to thrive in the digital age. With Zipcrest Consulting Services Pvt Ltd as their trusted partner and authorized channel partner of Tata Tele Business Services, Pune businesses can harness the full potential of Microsoft 365 solutions to streamline their operations, enhance collaboration, and stay ahead of the competition. Together, we can empower Pune businesses to achieve their goals and unlock new opportunities for growth and success.

0 notes

Text

System Integrator Market Size, Share, Trends, Global Demand, Growth and Opportunity Analysis

Data Bridge Market research has recently issued comprehensive industry research on Global System Integrator Market which includes growth analysis, regional marketing, challenges, opportunities, and drivers analysed in the report.

Besides, System Integrator market report studies market growth opportunities and restraining factors. The geographical division of this market analysis report offers data that gives an idea of the revenue of the companies and sales figures of the market growth. The market report also contains the drivers and restraints for the System Integrator market that are obtained with the help of SWOT analysis, and also shows all the recent developments, product launches, joint ventures, mergers and acquisitions by the several key players and brands with their systemic company profiles, that are driving the market.

Access Full 350 Pages PDF Report @

Data Bridge Market Research analyzes that the Global System Integrator Market which was USD 353,900.00 million in 2022, is likely to reach USD 995,448.19 million by 2030, and is expected to undergo a CAGR of 12.18% during the forecast period. “Infrastructure Integration” dominates the service segment of the global system integrator market due to the growth of infrastructure integration is projected to be strong in the coming years due to the growing demand for a cost-effective, resilient, agile, and secure IT infrastructure. Various industries, including defense, marine systems, telecommunications, aviation, oil & gas, banking, and healthcare, are increasingly embracing system integration. Businesses are constantly evolving and adapting to changing IT needs in a complex environment, which is expected to boost the demand for infrastructure integration in the foreseeable future.

TABLE OF CONTENTS

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Research Methodology

Part 04: Market Landscape

Part 05: Pipeline Analysis

Part 06: Market Sizing

Part 07: Five Forces Analysis

Part 08: Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers and Challenges

Part 13: Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Key Questions Answered with this Study

1) What makes System Integrator Market feasible for long term investment?

2) Know value chain areas where players can create value?

3) Teritorry that may see steep rise in CAGR & Y-O-Y growth?

4) What geographic region would have better demand for product/services?

5) What opportunity emerging territory would offer to established and new entrants in System Integrator Market?

6) Risk side analysis connected with service providers?

7) How influencing factors driving the demand of System Integratorin next few years?

8) What is the impact analysis of various factors in the Global System Integrator Market growth?

9) What strategies of big players help them acquire share in mature market?

10) How Technology and Customer-Centric Innovation is bringing big Change in System Integrator Market?

Some of the major players operating in the Global System Integrator Market are:

Capgemini (France)

Accenture (Ireland)

IBM (U.S.)

Infosys Limited (India)

Jitterbit Inc, (U.S.)

Magic Software Enterprises (Israel)

HCL Technologies Limited (India)

Wipro (India)

Johnson Controls. (Ireland)

Cognizant (U.S.)

Tata Consultancy Services Limited (India)

John Wood Group PLC (U.K.)

ATS Automation Tooling Systems Inc, (Canada)

Avanceon (U.A.E.)

JR Automation (Netherlands)

Tesco Controls, Inc. (U.S.)

Burrow Global LLC (U.S.)

Prime Controls LP (U.S.)

MAVERICK Technologies LLC (U.S)

BW Design Group (U.S.)

Browse Trending Reports:

System Integrator Market

Europe Industrial Hose Market

Redox Flow Battery Market

Mud Pump Market

Solar Cells Quantum Dots Market

Land Survey Equipment Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email: [email protected]

#System Integrator Market Size#Share#Trends#Global Demand#Growth and Opportunity Analysis#market report#market share#market size#marketresearch#market analysis#market trends#market research#markettrends

0 notes

Text

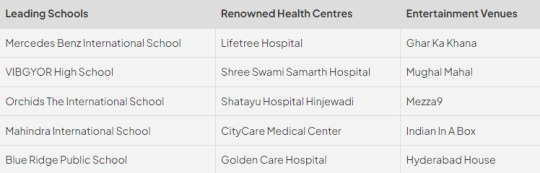

Best Residential Projects in Hinjewadi

Explore the best residential projects in Hinjewadi with Houssed, your trusted real estate partner. Don't miss out on the opportunity to own a piece of paradise in Hinjewadi - start your search for your dream home today with Houssed!

Hinjewadi, Pune

Situated near the Dehu-Katraj Bypass, in the outskirts of Pune, is the posh suburb of Hinjewadi. On the Mumbai Highway (NH-48), it is well situated between Wakad, Baner, Tathawade, and Balewadi. It is home to the Rajiv Gandhi Infotech Park, a hub for several IT companies.

With a population of 38,858 and a total area of around 33.91 square kilometres, Hinjewadi is made up of residential, business, and industrial zones. It has connections to key Pune areas via Hinjewadi-Aundh Road, the Mumbai Highway (NH-48), and Dange Chowk Road. The neighbourhood has gated communities, fine dining restaurants, hip cafes, vibrant bars, excellent road networks, and excellent medical services. It also offers a wide range of food alternatives, including delectable street food and chic cafes.

Beyond being known as a centre for business, Hinjewadi has several fascinating tourist spots. Prominent features including the Mulshi Dam, Bhatghar Dam, Chaturshringi Mata Temple, Mhatoba Hill, and the Shri Shiv Chhatrapati Sports Complex add to its allure.

Why Should You Invest in Hinjewadi Residential Projects?

Hinjewadi is a desirable destination for investors because of its constantly rapid appreciation of property values. Pune's thriving IT hub, Hinjewadi, is still growing, which is contributing to the continuous demand for real estate. The ideal location near the city centre and the NH-4 Mumbai-Bangalore highway makes it a more desirable investment. Surprisingly, Hinjewadi offers apartments with a net rental return of around 46.5%, and an average monthly price range of Rs. 7,700 to Rs. 1,10,000 per square foot.

The noteworthy presence of well-known developers like Mittal Brothers, Godrej Properties, MJ Group, Pride Purple Group, VTP Realty, and Rajluckxmi Realcon further distinguishes Hinjewadi. Their active involvement demonstrates a strong foundation and reputation in the sector, which instills trust in potential investors.

Price Trends in Hinjewadi

Below is the statistical data to understand the price trends in Hinjewadi, Pune:

Disclaimer: The costs shown above are just estimates based on information gathered from various sources and may not represent the real cost. The price mentioned above may change depending on the developer, the area, and the amenities.

Top 5 Reasons to Invest in Hinjewadi Residential Projects

1: Great Connectivity

Hinjewadi's main thoroughfares include Marunji Road, Hinjewadi-Aundh Road, Maan Road, and Dange Chowk Road. The location is around 9 km from Chinchwad Railway Station and only 19 km from Pune Junction Railway Station.

• About 25 miles separate the Pune International Airport from the surrounding area via the Hinjewadi-Aundh road.

• The Mumbai-Pune Motorway (NH-48) makes it simple to go into the city and between its environs.

• Pune Mahanagar Parivahan Mahamandal Limited (PMPML) operates buses in Hinjewadi, providing a useful mode of public transit.

2: Leading Hinjewadi Residential Projects

Godrej Woodsville

Park Titan

Park Connect

VTP Bellissimo

Mittal Sky High

Kohinoor Sportsville

3: Best Infrastructure

Hinjewadi boasts a well-planned, modern infrastructure with a network of conveniences, renowned medical facilities, excellent schools, and efficient recreation places.

4: IT Hub and Employment Opportunities

Hinjewadi, the epicentre of Pune's IT sector, is home to several IT parks and tech companies, attracting skilled personnel and creating a vibrant economic climate in the process.

Hinjewadi, a major employment area, is home to notable employers like Infosys, Cognizant, Wipro Technologies, Capgemini, Tata Consultancy Services, and Synechron Technologies.

Other notable employment areas in the area include Rajiv Gandhi IT Park, Embassy Techzone, Quadron Business Park, and Qubix SEZ Blue Ridge.

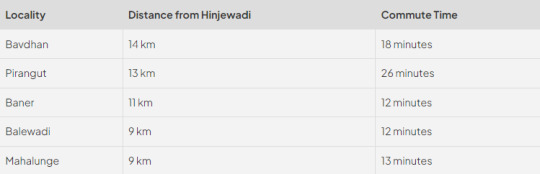

5: Nearest Commute

Pune's western suburb of Hinjewadi enjoys convenient access to the NH-4 Mumbai-Bangalore highway. Among the nearby settlements are Bavdhan, Pirangut, Baner, Balewadi, and Mahalunge. The table below provides a quick overview of the travel times and distances from Hinjewadi to nearby locations:

0 notes

Text

Software And BPO Services Global Market 2024 - By Growth, Trends, Share, Size, Forecast To 2033

The software and bpo services market size is expected to see strong growth in the next few years. It will grow to $3033.95 billion in 2028 at a compound annual growth rate (CAGR) of 9.8%. The growth in the forecast period can be attributed to digital transformation, data privacy and security, rtificial intelligence (AI) and automation, remote work, industry-specific solutions, sustainability and ESG. Major trends in the forecast period include electrification and lightweighting, advanced materials, additive manufacturing, digitalization and connectivity, collaboration and partnerships, .

To access more details regarding this report, visit the link:

https://www.thebusinessresearchcompany.com/report/software-and-bpo-services-global-market-report

Segmentation & Regional Insights

The software and bpo services market covered in this report is segmented –

1) By Type: BPO Services, Software Services

2) By Organization Size: Large Enterprises, Small And Medium Enterprises

3) By End-Use Industry: Financial Services, Retail & Wholesale, Information Technology, Manufacturing, Healthcare, Other End-User Industries

Asia-Pacific was the largest region in software and BPO services market in 2023. North America was the second largest region in software and BPO services market. The regions covered in the software and BPO services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Intrigued to explore the contents? Secure your hands-on sample copy of the report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=2145&type=smp

Major Driver Impacting Market Growth

The emergence of startups as major clients of software and BPO service providers is expected to drive the market. Driven by cost efficiency and the necessity to focus on core operations, startups have started outsourcing non-core operations such as finance and recruitment to specialized agencies and companies. For instance, outsourcing of finance and tech operations helps Leverage Edu, an India-based EdTech startup connecting students with mentors, save approximately 40% of its capital through outsourcing. The increasing number of startups is also expected to positively impact the market. The number of startups in India is expected to increase to 10,500 by 2020, a 4000 increase from the current number, depicting new opportunities for the software and BPO services market in the client expansion and revenue generation.

Key Industry Players

Major companies operating in the software and bpo services market include Tata Consultancy Services Limited, Nippon Telegraph and Telephone Corporation, Telefonaktiebolaget LM Ericsson, Cognizant Technology Solutions Corporation, Dell Technologies Inc., Hewlett Packard Enterprise Company, Microsoft Corporation, Capgemini SE, Cisco Systems Inc., Infosys Limited, Accenture plc, International Business Machines Corporation, Wipro Limited, HCL Technologies Limited, DXC Technology, Genpact Limited, NTT Data Corporation, Atos SE, CGI Inc., Larsen & Toubro Infotech Limited, Tech Mahindra Limited, WNS Global Services Limited, Syntel Inc., LTIMindtree Limited, Hexaware Technologies Limited, Mphasis Limited, Virtusa Corporation, Zensar Technologies Limited, EPAM Systems Inc, Citibank NA, ExlService Holdings Inc., WNS Limited, Wipro Limited, Hinduja Global Solutions Limited, Sutherland Global Services Inc., Teleperformance SE.

The software and bpo services market report table of contents includes:

1. Executive Summary

2. Software And BPO Services Market Characteristics

3. Software And BPO Services Product/Service Analysis -Product/Service Examples

4. Software And BPO Services Market Trends And Strategies

5. Software And BPO Services Market - Macro Economic Scenario

....................

31. Belgium Software And BPO Services Market

32. Denmark Software And BPO Services Market

33. Finland Software And BPO Services Market

34. Ireland Software And BPO Services Market

35. Netherlands Software And BPO Services Market

Explore the trending research reports from TBRC:

https://goodprnews.com/gum-and-wood-chemicals-global-market-size/

https://goodprnews.com/high-power-transformers-global-market-size/

https://goodprnews.com/ice-boxes-global-market-size/

https://topprnews.com/gum-and-wood-chemicals-global-market-share/

https://topprnews.com/high-power-transformers-global-market-share/

https://topprnews.com/ice-boxes-global-market-share/

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

TCS Share Price: Understanding the Dynamics

In today's fast-paced financial markets, keeping track of the share prices of major companies is crucial for investors. Among the top contenders in the IT industry, Tata Consultancy Services (TCS) holds a significant position. Understanding the dynamics behind TCS share price movement can provide valuable insights for investors and stakeholders alike.

Introduction to TCS (Tata Consultancy Services)

Tata Consultancy Services, commonly known as TCS, is a multinational IT services and consulting company headquartered in Mumbai, India. Founded in 1968, TCS has grown to become one of the largest IT services firms globally, operating in over 46 countries.

Overview of TCS's Market Performance

In recent years, TCS's market performance has been closely watched by investors and analysts alike. The company's shares are listed on various stock exchanges, including the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE). Understanding the recent trends in TCS share price can provide valuable insights into market sentiment and investor confidence.

Recent trends in TCS share price

TCS's share price has witnessed fluctuations in response to various internal and external factors. Analyzing these trends can help investors make informed decisions regarding their investment strategies.

Factors Influencing TCS Share Price

Several factors influence the movement of TCS's share price, ranging from financial performance to broader industry trends and economic indicators.

Financial performance

TCS's quarterly and annual financial results play a significant role in determining investor sentiment towards the company. Factors such as revenue growth, profit margins, and earnings per share (EPS) can impact TCS's share price performance.

Industry trends

As a leading player in the IT services industry, TCS's share price is influenced by trends within the sector. Factors such as demand for digital transformation services, competition from other IT firms, and technological advancements can affect TCS's market performance.

Economic indicators

Macroeconomic factors, including GDP growth, inflation rates, and currency fluctuations, can also impact TCS's share price. Economic downturns or geopolitical tensions may lead to volatility in the stock market, affecting investor confidence in TCS and other companies.

Impact of Global Events on TCS Share Price

Global events, such as geopolitical tensions, natural disasters, or pandemics, can have a significant impact on TCS's share price. For example, the COVID-19 pandemic led to market volatility and uncertainty, affecting TCS's business operations and financial performance.

Analysis of TCS Share Price History

Analyzing TCS's share price history can provide valuable insights into long-term trends and patterns. Investors often look at historical data to identify potential buying or selling opportunities and to assess the company's performance relative to its peers.

TCS Share Price Forecasting

Forecasting TCS's share price involves analyzing various factors, including market trends, company fundamentals, and external influences. While predicting future share price movements with certainty is challenging, conducting thorough analysis can help investors make informed decisions.

Investment Strategies for TCS Shares

Investors adopt various strategies when investing in TCS shares, depending on their risk tolerance, investment goals, and market outlook. Some may prefer a long-term buy-and-hold approach, while others may engage in short-term trading strategies based on technical analysis.

Risks Associated with Investing in TCS

Like any investment, investing in TCS shares carries certain risks that investors should be aware of. These risks may include market volatility, industry competition, regulatory changes, and company-specific challenges.

Conclusion

Understanding the dynamics behind TCS's share price is essential for investors seeking to make informed investment decisions. By analyzing factors such as financial performance, industry trends, and global events, investors can gain valuable insights into TCS's market performance and potential future prospects.

0 notes

Text

Unveiling the Competitive Landscape of Birlasoft Ltd.: Exploring Key Competitors

Introduction: Understanding Birlasoft Ltd.

In the realm of IT services and solutions, Birlasoft Ltd. stands as a prominent player, known for its innovation and client-centric approach. To gain deeper insights into the company's position in the market, it's imperative to explore its competitive landscape. In this analysis, we delve into the key competitors of Birlasoft Ltd. and examine their respective strengths and market positioning.

The Evolution of Birlasoft Ltd.

With a rich heritage and a legacy of excellence, Birlasoft Ltd. has evolved into a global leader in digital transformation and technology consulting. Since its inception, the company has been at the forefront of driving innovation and delivering value to its clients across various industry verticals. With a focus on harnessing emerging technologies and fostering a culture of collaboration, Birlasoft Ltd. continues to redefine the boundaries of possibility in the digital era.

To know about the assumptions considered for the study, Download for Free Sample Report

Identifying Birlasoft Ltd.'s Competitors

To gain a comprehensive understanding of Birlasoft Ltd.'s competitive landscape, it's essential to identify key players operating in the same space. Some of the notable competitors of Birlasoft Ltd. include:

1. Infosys Ltd.

As one of the largest IT services companies globally, Infosys Ltd. poses significant competition to Birlasoft Ltd. With a diverse portfolio of services ranging from application development to consulting, Infosys Ltd. commands a strong market presence and is known for its commitment to innovation and client satisfaction.

2. Tata Consultancy Services (TCS)

Tata Consultancy Services (TCS) is another formidable competitor of Birlasoft Ltd., offering a comprehensive suite of IT services and solutions to clients worldwide. With a focus on leveraging digital technologies to drive business transformation, TCS competes with Birlasoft Ltd. across various industry verticals.

3. Wipro Limited

Wipro Limited is a leading global information technology, consulting, and business process services company, competing with Birlasoft Ltd. in the digital transformation space. With a strong focus on innovation and customer-centricity, Wipro Limited presents stiff competition to Birlasoft Ltd. in key markets worldwide.

Analyzing the Competitive Landscape

In assessing the competitive landscape, it's crucial to consider various factors that differentiate Birlasoft Ltd. from its competitors. These factors may include:

Domain Expertise: Birlasoft Ltd. boasts deep domain expertise across industry verticals, allowing it to offer specialized solutions tailored to the unique needs of its clients.

Innovation and Technology Adoption: Birlasoft Ltd. prides itself on its commitment to innovation and the adoption of cutting-edge technologies such as artificial intelligence, cloud computing, and blockchain, enabling it to stay ahead of the curve in a rapidly evolving digital landscape.

Client Relationships: Birlasoft Ltd. places a strong emphasis on building long-term relationships with its clients, focusing on delivering value and driving business outcomes through its solutions and services.

Conclusion: Birlasoft Ltd.'s Competitive Advantage

In conclusion, while Birlasoft Competitors from industry giants such as Infosys, TCS, and Wipro, its focus on innovation, domain expertise, and client-centric approach gives it a competitive edge in the market. As the digital transformation journey continues to unfold, Birlasoft Ltd. remains well-positioned to navigate the challenges and seize opportunities, driving value for its clients and stakeholders alike.

0 notes

Text

Analysing Market Trends: The Effect of Economic Indicators on TCS and Shriram Transport Share Prices

In the ever-evolving landscape of the stock market, understanding the nuances of market trends and the impact of economic indicators on company share prices is crucial for investors. This article delves into the intricate relationship between various economic factors and the share prices of two significant players in the Indian market: Tata Consultancy Services (TCS) and Shriram Transport Finance Company. By examining the share price of TCS alongside the performance of Shriram Transport, we aim to uncover insights that could guide investment strategies.

TCS, a titan in the IT sector, has seen its share price reflect the broader trends in technology investment and global economic health. The current share price of TCS is 4,105, not just a number but a mirror reflecting the company's resilience, growth prospects, and the global demand for IT services. Economic indicators such as GDP growth rates, employment figures in the technology sector, and international trade agreements play a significant role in shaping investor sentiment towards TCS. A robust economy generally indicates higher spending on technology and innovation, leading to a positive outlook for IT companies. Conversely, economic downturns or trade uncertainties can prompt a cautious approach from investors, impacting share prices negatively.

Moving on to the share price of Shriram Transport, the scenario shifts to the finance and transport sectors, revealing a different set of economic indicators at play. Shriram Transport, a leading player in the commercial vehicle finance sector, has its share price influenced by domestic economic policies, fuel prices, and the overall health of the transport industry. The Shriram transport share price is particularly sensitive to changes in interest rates, as these can affect borrowing costs for consumers and businesses alike. Furthermore, regulations affecting the transport sector, such as emission norms and vehicle financing norms, can also impact investor confidence and share price movements.

Both TCS and Shriram Transport operate in distinctly different sectors, yet their share prices are subject to the whims of economic indicators. For TCS, the key factors include global IT spending, exchange rate fluctuations, and innovation indices. For Shriram Transport, the crucial indicators are interest rates, vehicle sales data, and regulatory changes affecting the transport and finance industries. Understanding these relationships is vital for investors looking to make informed decisions.

Moreover, the impact of economic indicators on these companies' share prices underscores the importance of diversification in an investment portfolio. While TCS might benefit from a surge in global IT spending, Shriram Transport could simultaneously face challenges due to rising fuel costs. An investor with stakes in both companies might find that losses in one investment are offset by gains in another, illustrating the protective buffer that diversification can provide against market volatility.

0 notes

Text

How Investing in Tata Capital Unlisted Shares Can Power Up Your Portfolio

Introduction To Tata Capital

Tata Capital is a renowned financial institution that offers a wide range of financial products and services to individuals and businesses. With a strong focus on customer satisfaction and innovation, Tata Capital has established itself as a trusted name in the finance industry.

Understanding The Potential Of Unlisted Shares In Your Investment Portfolio

Unlisted shares refer to the shares of a company that are not listed on any stock exchange. These shares can be an excellent addition to your investment portfolio, as they offer unique opportunities for growth and diversification. Investing in unlisted shares allows you to invest in companies that are not yet available to the general public, providing you with the potential to earn significant returns.

Benefits of Investing in Tata Capital Unlisted Shares

Investing in Tata Capital unlisted shares can offer several benefits to investors. Firstly, by investing in Tata Capital, you gain exposure to a well-established and reputable financial institution with a strong track record of success. This can provide you with a sense of security and confidence in your investment.

Secondly, investing in Tata Capital unlisted shares allows you to participate in the growth and success of the company. As Tata Capital continues to expand its operations and deliver strong financial performance, the value of its unlisted shares is likely to increase. This can result in capital appreciation and higher returns on your investment.

Furthermore, investing in Tata Capital unlisted shares can provide you with a unique opportunity to diversify your investment portfolio. Adding unlisted shares to your portfolio can reduce the risk associated with investing in traditional listed stocks and bonds. This diversification can help protect your portfolio from market volatility and potentially enhance your overall returns.

Factors to Consider Before Investing in Tata Capital Unlisted Shares

While investing in Tata Capital unlisted shares can be a lucrative opportunity, it is essential to consider certain factors before making an investment decision. Firstly, you should evaluate the financial performance of Tata Capital. This includes analyzing the company's revenue, profitability, and growth prospects. By assessing these factors, you can gain insights into the company's financial health and its potential for future growth.

Additionally, it is crucial to analyze the Tata Capital share price. Understanding the historical performance of the share price can provide you with valuable information about the company's stock performance and market sentiment. By evaluating the share price trends, you can make informed decisions about the timing of your investment in Tata Capital unlisted shares.

Lastly, seeking expert opinions and recommendations on Tata Capital unlisted shares can provide you with valuable insights and guidance. Consulting with financial advisors or investment professionals who have experience in the field can help you navigate the complexities of investing in unlisted shares. Their expertise can assist you in making well-informed investment decisions and optimizing your portfolio.

Evaluating the Financial Performance of Tata Capital

To evaluate the financial performance of Tata Capital, it is essential to analyze key financial indicators such as revenue, profitability, and growth. By examining the company's revenue trends, you can gain insights into its ability to generate income and sustain its operations. Additionally, assessing the profitability of Tata Capital can help you determine its ability to generate returns for its shareholders.

Furthermore, analyzing the growth prospects of Tata Capital is crucial in understanding its potential for future success. Examining factors such as market opportunities, competitive landscape, and strategic initiatives can provide insights into the company's growth trajectory. By evaluating these factors, you can assess the long-term viability and profitability of Tata Capital.

Analyzing the Tata Capital Share Price

Analyzing the Tata Capital share price is an essential step in understanding the investment potential of its unlisted shares. By examining historical share price trends, you can identify patterns and fluctuations in the market. This analysis can help you determine the optimal entry and exit points for your investment in Tata Capital unlisted shares.

Additionally, it is crucial to consider the factors that influence the Tata Capital share price. These factors can include market conditions, industry trends, and company-specific news. By staying informed about these factors, you can make informed decisions about your investment in Tata Capital unlisted shares.

Expert Opinions and Recommendations on Tata Capital Unlisted Shares

Seeking expert opinions and recommendations on Tata Capital unlisted shares can provide valuable insights and guidance for your investment decisions. Financial advisors and investment professionals can offer expert analysis and advice based on their industry knowledge and experience.

It is advisable to consult with multiple experts to gain a holistic understanding of Tata Capital's investment potential. By comparing and contrasting their opinions and recommendations, you can make well-informed investment decisions that align with your financial goals and risk appetite.

Conclusion and Final Thoughts

Investing in Tata Capital unlisted shares can be a powerful addition to your investment portfolio. By understanding the potential of unlisted shares and considering the benefits of investing in Tata Capital, you can make informed investment decisions that have the potential to deliver significant returns.

However, it is crucial to carefully evaluate the financial performance of Tata Capital and analyze the share price trends before investing. Seeking expert opinions and recommendations can further enhance your decision-making process.

In conclusion, investing in Tata Capital unlisted shares can unlock the potential to power up your investment portfolio. By harnessing the growth opportunities offered by Tata Capital and diversifying your portfolio, you can position yourself for long-term financial success.

0 notes

Text

Healthcare IT Outsourcing Market Share, Trends, Top Companies, Forecast 2024-2032

IMARC Group, a leading market research company, has recently releases report titled “Healthcare IT Outsourcing Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032” offers a comprehensive analysis of the industry, which comprises insights on the healthcare IT outsourcing market share. The global market size reached US$ 50.3 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 100.6 Billion by 2032, exhibiting a growth rate (CAGR) of 7.9% during 2024-2032.

Request For Sample Copy of Report For More Detailed Market insight: https://www.imarcgroup.com/healthcare-it-outsourcing-market/requestsample

Factors Affecting the Growth of the Healthcare IT Outsourcing Industry:

Cost Reduction and Efficiency Improvement:

The rising need for cost reduction and efficiency enhancement in healthcare operations represents one of the crucial factors impelling the market growth. Outsourcing information technology (IT) services enable healthcare providers to save substantially on operational costs, including expenses related to staffing, training, and maintaining an in-house IT team. Moreover, IT outsourcing firms often bring in advanced technologies and expertise that can streamline healthcare processes, leading to improved patient care and administrative efficiency. This dual benefit of cost savings and enhanced efficiency is particularly appealing in sectors where cost control is a constant challenge and where the efficient handling of data directly influences patient outcomes.

Core Healthcare Competencies:

Healthcare providers are recognizing the significance of focusing on their core competencies, including patient care and treatment, rather than dividing their attention with complex IT operations. Outsourcing IT tasks to external experts allows healthcare institutions to concentrate on their primary objectives without the distractions and complexities of managing IT infrastructure and services. This specialized focus is essential for enhancing the quality of patient care, as it ensures that medical professionals can devote their full attention and resources to clinical tasks. Healthcare providers can maintain a clear focus on delivering excellent patient care by entrusting IT operations to external experts.

Technological Advancements:

Technological advancements, such as electronic health records (EHR), telemedicine, artificial intelligence (AI), and data analytics, are positively influencing the market. The need to stay updated with these advancements is encouraging the adoption of outsourcing IT services to specialized vendors. These outsourcing services are adept at these technologies, which allows healthcare organizations to stay at the forefront of innovation without the need to invest heavily in new technologies and training. These vendors bring in expertise in the latest healthcare IT solutions, ensuring that healthcare providers benefit from cutting-edge technology, which is crucial in the industry to stay updated with technology for delivering high-quality care.

Competitive Landscape:

The competitive landscape of the market has been studied in the report with the detailed profiles of the key players operating in the market.

Accenture plc

Allscripts Healthcare Solutions Inc

Dell Technologies Inc.

Infosys Limited

International Business Machines

Koninklijke Philips N.V.

Optum Inc. (UnitedHealth Group Incorporated)

Siemens Healthineers AG

Tata Consultancy Services

Wipro Limited

Xerox Corporation

Healthcare IT Outsourcing Market Report Segmentation:

By Type:

Payers HCIT Outsourcing

Hospital Information System (HIS)

Laboratory Information System (LIS)

Radiology Information System (RIS)

Electronic Medical Records (EMR)

Others

Providers HCIT Outsourcing

Revenue Cycle Management (RCM) System

Healthcare Analytics

Payers HCIT outsourcing represents the largest segment attributed to the rising demand for IT outsourcing services among healthcare payers due to the need for cost-effective solutions and streamlined operations.

By End User:

Healthcare Provider System

Biopharmaceutical Industry

Clinical Research Organization

Others

Healthcare provider system accounts for the majority of the market share on account of the growing reliance of healthcare providers on IT outsourcing to enhance their patient care, administrative processes, and overall efficiency.

Regional Insights:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America dominates the market, which can be accredited to significant investments in healthcare IT, advanced infrastructure, and a robust healthcare ecosystem.

Global Healthcare IT Outsourcing Market Trends:

The increasing digitalization is making healthcare organizations more vulnerable to cyber threats, risking patient data and operational continuity. Outsourcing cybersecurity management to specialized IT service providers offers healthcare organizations access to advanced security measures, regular updates, and expert monitoring. These providers are adept at navigating the complex landscape of cyber threats and ensuring compliance with data protection regulations, thereby safeguarding sensitive patient information and reinforcing the overall trust in healthcare systems.

Besides this, the growing adoption of cloud computing in the healthcare sector is offering a favorable market outlook. Cloud-based solutions offer scalability, flexibility, and cost-effectiveness, enabling healthcare providers to manage large volumes of data efficiently and securely. Outsourcing IT services to cloud-based providers allows healthcare organizations to benefit from advanced data analytics, improved data sharing and collaboration, and reduced IT infrastructure costs.

Other Key Points Covered in the Report:

COVID-19 Impact

Porters Five Forces Analysis

Value Chain Analysis

Strategic Recommendations

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC Group’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

0 notes

Text

Top 10 Procurement Outsourcing Companies in 2019 | SpendEdge

Originally Published on: SpendEdge |Top 10 Procurement Outsourcing Companies in 2019 | SpendEdge

Procurement BPO services are increasingly adopted across industries globally. The leading procurement outsourcing companies have seen robust growth driven by IT advancements. Procurement BPO streamlines business processes, enhances operational efficiencies, reduces costs, and improves supply chain management.

#ProcurementOutsourcing #BPO #SpendEdge

Understanding Procurement BPO

Procurement BPO involves outsourcing the procurement process, from identifying suppliers to integrated supply chain management. This service addresses the labor, time, and cost-intensive nature of procurement, particularly in a dynamic marketplace.

Key Benefits of Procurement BPO

Outsourcing procurement processes enables better resource allocation, core focus, and access to BPO expertise. It leads to cost reduction, efficiency gains, and improved resource management, fostering business growth.

#CostReduction #Efficiency #ResourceAllocation

Global Procurement Outsourcing Market Overview

The global procurement BPO market is poised for significant growth, with a projected CAGR of over 17% from 2018 to 2022. Market trends include automation adoption in BPO operations, enhancing sustainability. Service providers emphasize reusable platforms and software tools for scalability and flexibility.

#GlobalProcurementMarket #BPOGrowth #MarketTrends

Top 10 Procurement Outsourcing Companies in the World 2019

Accenture: Offers source-to-pay BPO services, including analytics and digital procurement.

Infosys: Provides sourcing and procurement solutions, including strategic sourcing.

IBM: Offers procurement services such as strategy consulting and risk management.

DXC Technology: Utilizes analytics for optimal sourcing decisions and spend savings.

Capgemini: Provides strategic sourcing and category management through its Global Enterprise Model.

Genpact: Offers end-to-end procurement solutions with deep domain expertise.

Tata Consultancy Services: Manages dynamic supply chains using digital technologies.

Wipro: Combines automation, analytics, and AI for streamlined procurement.

HCL Technologies: Facilitates cost reduction and process overhauls for supply chain transformation.

SYNNEX: Provides IT supply chain services focused on optimal solutions delivery.

#ProcurementOutsourcingCompanies #Top10 #2019

For deeper insights into global procurement dynamics, including category spend and regional trends, connect with SpendEdge's Procurement Market Intelligence experts and request a free trial.

Contact us.

0 notes

Text

Six sigma Green belt in Chennai

Six sigma Green belt in Chennai

Six sigma Green belt in Chennai iceqbs- Innovative Consultants for End to End Quality Business Solution.

Organizations who believe that “there is always a scope for improvement” grow exponentially.

We, at iceqbs, help such organizations in both Manufacturing and Service sector to achieve their ambitious business goals by improving their business processes

Our core competency is solving business problems by implementing process improvement techniques and methodologies to improve operational efficiency and effectiveness

We implement powerful methodology like Lean Six Sigma toachieve desired business results through systematic process improvement

Iceqbs stands for Innovative Consultants for End to End Quality Business Solutions.

Iceqbs offers services on High Quality Six Sigma Training and Implementation of Lean Six Sigma in Manufacturing & Service sectors and Lean management in Manufacturing & Retail sectors.Iceqbs was started in 2015 by C.Annamalai after 30 years of rich experience in Production and Quality functions in both the manufacturing and service sectors

Client list includes prestigious companies like Roquette (France based leading Starch manufacturer), Amazon (India), Abraj Energy Services (Oman),TUV (Germany), DISYS (India), L&T Valves, Chennai, Tata Communications, Mahindra and Mahindra Finance, Standard Charted Bank, Pfizer Healthcare India Pvt Ltd etc.Six sigma methodologies focus on reducing the variation in the outputs by reducing the variations in the inputs and the process conditions so that we always get consistent quality of products and servicesSix sigma methodologies help us to tackle variation due to the common causes and hence help in solving chronic process problems nagging us for a longer period of time. Special cause (Assignable) variation should be arrested before trying to reduce common cause variation.

Read the full article

0 notes

Text

Fintech Market Size, Trends, Growth, Analysis Report 2024-2032

IMARC Group, a leading market research company, has recently releases report titled “Fintech Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032” The global fintech market size reached US$ 187.1 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 764.4 Billion by 2032, exhibiting a growth rate (CAGR) of 17% during 2024-2032.

Request For Sample Copy of Report: https://www.imarcgroup.com/fintech-market/requestsample

Factors Affecting the Growth of the Fintech Industry:

Increasing Consumer Demand:

People are increasingly looking for digital and hassle-free financial services. Fintech firms offer user-friendly apps and platforms for activities, such as online payments, budgeting, investing, and peer-to-peer lending, aligning with preferences of people for convenience and accessibility. Fintech companies use advanced data analytics to offer tailored financial services in the country. This personalization resonates with individuals who appreciate solutions that cater to their individual financial goals and circumstances. Fintech solutions often provide cost-effective alternatives to traditional banking services. People are attracted to lower fees, competitive interest rates, and transparent pricing models offered by many fintech providers.

Enhanced Tech Infrastructure:

The enhanced tech infrastructure allows people to have access to high-speed internet. This widespread connectivity ensures that fintech services can reach a broad audience, enabling seamless online interactions between consumers and financial platforms. The proliferation of smartphones and the availability of 4G and 5G networks are creating a mobile-friendly environment. Fintech companies leverage this trend by developing mobile apps and platforms, catering to people who prefer conducting financial transactions on their mobile devices.

Cybersecurity Awareness:

Rising awareness about cybersecurity instills trust and confidence among consumers and businesses when using fintech services. People are more conscious about the importance of data protection, and fintech companies are responding by implementing robust security measures. This includes encryption, secure authentication methods, and data encryption technologies to safeguard sensitive information. Cybersecurity awareness is leading to the introduction of stringent regulations in the fintech sector. Fintech companies are required to comply with cybersecurity standards and regulations, further enhancing the security of financial transactions and data.

Leading Companies Operating in the Global Fintech Industry:

Adyen N.V.

Afterpay Limited (Block Inc.)

Avant LLC

Cisco Systems Inc.

Google Payment Corp.

International Business Machines Corporation

Klarna Bank AB

Microsoft Corporation

Nvidia Corporation

Oracle Corporation

Paypal Holdings, Inc.

Robinhood Markets Inc.

SoFi Technologies Inc

Tata Consultancy Services

Fintech Market Report Segmentation:

By Deployment Mode:

On-premises

Cloud-based

On-premises represented the largest segment as some financial institutions and businesses prefer to maintain control over their data and infrastructure, especially for sensitive financial transactions.

By Technology:

Application Programming Interface

Artificial Intelligence

Blockchain

Robotic Process Automation

Data Analytics

Others

On the basis of technology, the market has been segmented into application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

By Application:

Payment and Fund Transfer

Loans

Insurance and Personal Finance

Wealth Management

Others

Payments and fund transfer exhibit a clear dominance in the market on account of the growing consumer demand for convenient and efficient payment solutions.

By End User:

Banking

Insurance

Securities

Others

Banking holds the largest market share as traditional banks increasingly collaborate with fintech companies to offer digital services.

Regional Insights:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America enjoys the leading position in the fintech market due to the growing number of fintech startups and financial institutions.

Global Fintech Market Trends:

Governing agencies of several countries are implementing open banking regulations, which allow people to share their financial data securely with third-party fintech providers. The adoption of digital payment solutions and mobile wallets is rising due to increasing consumer demand for convenient and contactless payment methods. Robo-advisors and wealthtech platforms are gaining traction, offering automated investment advice and portfolio management services. This trend aligns with consumers seeking simplified and cost-effective investment options.

Moreover, interest in cryptocurrencies and blockchain technology is growing, with fintech companies exploring applications beyond traditional finance, such as supply chain management and digital identity verification.

Other Key Points Covered in the Report:

COVID-19 Impact

Porters Five Forces Analysis

Value Chain Analysis

Strategic Recommendations

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC Group’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

0 notes

Text

Navigating Cloud Horizons: Understanding the Diverse Cloud Computing Services with Zipcrest Consulting Services Pvt Ltd

In the ever-expanding realm of digital transformation, cloud computing stands as a cornerstone, revolutionizing the way businesses operate and manage their IT infrastructure. As an authorized channel partner of Tata Tele Business Services, Zipcrest Consulting Services Pvt Ltd offers profound insights into the diverse spectrum of cloud computing services. This blog post explores the types of cloud services and the strategic guidance that Zipcrest provides to businesses venturing into the cloud.

Also Read - Managed Security Services Provider

Infrastructure as a Service (IaaS):

Zipcrest Consulting Services Pvt Ltd guides businesses through the foundational layer of cloud services – Infrastructure as a Service (IaaS). With IaaS, businesses can access virtualized computing resources over the internet, including servers, storage, and networking. Zipcrest ensures that businesses leverage IaaS to scale their infrastructure seamlessly, reducing the need for physical hardware investments.

Platform as a Service (PaaS):

As businesses seek to streamline application development and deployment, Zipcrest introduces them to Platform as a Service (PaaS). This cloud service provides a platform that includes tools and services for building, testing, and deploying applications. With PaaS, businesses can accelerate their development cycles, enhance collaboration, and achieve greater agility in responding to market demands.

Software as a Service (SaaS):

Zipcrest's expertise extends to Software as a Service (SaaS), a cloud computing model that delivers software applications over the internet. Whether it's email services, customer relationship management (CRM), or collaborative tools, Zipcrest ensures that businesses harness the benefits of SaaS to access powerful applications without the burden of managing the underlying infrastructure.

Managed Cloud Services:

Understanding the complexities of cloud management, Zipcrest introduces businesses to Managed Cloud Services. This approach involves outsourcing certain cloud management tasks to a service provider, allowing businesses to focus on their core competencies while Zipcrest handles critical aspects such as security, monitoring, and optimization of cloud resources.

Strategic Cloud Migration:

Zipcrest Consulting Services Pvt Ltd recognizes that cloud adoption is not a one-size-fits-all approach. As businesses contemplate migrating to the cloud, Zipcrest offers strategic guidance on the most suitable cloud service models based on their unique needs, ensuring a seamless and strategic transition to the cloud.

Quoting Ajit, Marketing head at Zipcrest Consulting Services Pvt Ltd:

"At Zipcrest, we view cloud computing not just as a technology shift but a strategic transformation. Our role is to guide businesses through the diverse cloud computing services, ensuring they make informed decisions that align with their goals, optimize resources, and enhance overall operational efficiency."

Conclusion:In the dynamic landscape of cloud computing, businesses require more than just services – they need strategic guidance to navigate the vast possibilities effectively. Zipcrest Consulting Services Pvt Ltd, as an authorized channel partner of Tata Tele Business Services, emerges as a trusted ally in this journey. Whether it's IaaS, PaaS, SaaS, or Managed Cloud Services, Zipcrest ensures that businesses not only understand these cloud computing types but also leverage them strategically to propel their digital transformation forward. In choosing Zipcrest, businesses gain a partner committed to unlocking the full potential of cloud computing and guiding them toward a future of enhanced efficiency and innovation.

0 notes