#privateequity

Quote

Private equity firms are buying up the US economy and stripping it for parts. From healthcare to education, utilities, and more, massive firms like Blackstone and the Carlyle Group have acquired vast holdings across critical industries essential to the health and well-being of everyday people. Instead of seeking to make these ventures more profitable, private equity firms are more likely to orchestrate to bleed their assets for short-term gains—even if those assets are univerisites, hospitals, or nursing homes.

How Private Equity Conquered America

72 notes

·

View notes

Text

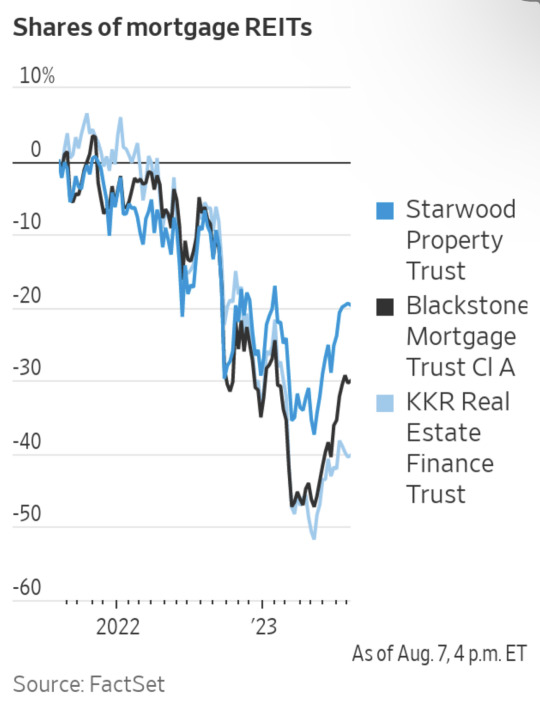

New Lending by Mortgage REITs Has Dried Up

Blackstone Mortgage Trust and KKR Real Estate Finance Trust halt loan origination to shore up balance sheets; Starwood cuts back

https://www.wsj.com/articles/new-lending-by-mortgage-reits-has-dried-up-49551878?mod=mhp

10 notes

·

View notes

Text

Enjoy the moment 😘 Private Equity Sale https://ieltstrainingservices.mailchimpsites.com/products

3 notes

·

View notes

Text

#fortumex#fortumexbusiness#businessgrowth#businessdevelopment#PrivateEquity#Privateequityfunding#fundraising#venturecapital#interestfree#capitalmanagement#sales#marketing#smallbusiness#mediumsizedbusiness#startupsupport#wealthcreation#loanservices#businessowners#rajkot#Gujarat

6 notes

·

View notes

Text

Paulo Brignardello Shares 5 Advantages of Investing in Private Equity

Paulo Brignardello, a private equity professional with over 20 years of experience, shares his insights into the five main advantages of investing in private equity. Paulo Brignardello shares why this form of investment can be profitable and how it can help you reach your goals. Investing in private equity can be a great way to diversify your portfolio and achieve higher returns.

Potential for higher returns: Private equity investments have the potential to deliver higher returns than traditional investments like stocks and bonds. According to Paulo Brignardello Advisor, private equity funds have delivered a median net internal rate of return of 14.9% over the past 10 years. This is because private equity firms are able to take a more active role in managing the companies they invest in, which can lead to increased efficiency and profitability. Additionally, private equity investments are often focused on high-growth companies, which can result in significant returns for investors.

Greater control over investments: Private equity investors have greater control over where their money goes and can influence the direction of the company they are investing in. This can be particularly appealing for investors who want to have a say in how their money is being used. Private equity firms often take an active role in managing the companies they invest in, which can lead to greater control over important decisions.

More flexibility: Private equity investments offer companies more flexibility than traditional financing methods. This is because private equity investors are more willing to provide customized financing solutions to meet the specific needs of a business. Private equity firms can also provide operational expertise to help the companies they invest in improve their performance.

Access to a wider range of investment opportunities: Private equity investors have access to a wider range of investment opportunities than traditional investors. This is because they can invest in companies at every stage of their development, from startups to established businesses, across various industries. Investing in this way provides investors with greater diversification and higher returns.

Potential for long-term growth: Private equity investments are often geared towards long-term growth, which means investors can benefit from steady returns over an extended period. Private equity firms typically hold their investments for several years before selling or taking the company public, which can provide investors with a stable source of returns.

2 notes

·

View notes

Text

The Truth Behind DHS Ventures: Is It Legit?

DHS Ventures has been making waves in the world of private equity organizations, raising questions about its legitimacy and reputation. As with any investment opportunity, it's crucial to understand the facts before making any decisions. So, let's dive into the truth behind DHS Ventures and answer the burning question: Is DHS Ventures legit?

What is DHS Ventures?

DHS Ventures is a private equity firm that specializes in investing in high-growth companies across various industries. With a focus on strategic investments and value creation, DHS Ventures aims to generate substantial returns for its investors while supporting the growth and development of its portfolio companies.

The Legitimacy of DHS Ventures

One of the primary concerns investors have when considering DHS Ventures is its legitimacy. There have been rumors and speculations regarding the authenticity of DHS Ventures, leading some to question its credibility.

However, it's essential to note that DHS Ventures is a legitimate private equity firm with a track record of successful investments and satisfied investors. The firm operates within the legal framework and adheres to industry standards and regulations.

Positive Feedback and Testimonials

Many investors who have partnered with DHS Ventures have shared positive feedback and testimonials about their experience. These testimonials highlight the firm's professionalism, transparency, and commitment to delivering results.

Investors have praised DHS Ventures for its thorough due diligence process, which ensures that only high-quality investment opportunities are pursued. Additionally, the firm's hands-on approach to portfolio management has been commended for its effectiveness in driving growth and maximizing returns.

Transparency and Communication

Another factor that sets DHS Ventures apart is its commitment to transparency and communication. The firm provides regular updates and reports to its investors, keeping them informed about the performance of their investments and the overall progress of the portfolio companies.

This level of transparency helps build trust and confidence among investors, demonstrating DHS Ventures' commitment to operating with integrity and honesty.

Conclusion: Yes, DHS Ventures Is Legit

In conclusion, DHS Ventures is a legitimate private equity firm that offers investors the opportunity to participate in high-growth investment opportunities. With a proven track record of success, positive feedback from investors, and a commitment to transparency and communication, DHS Ventures stands out as a reputable player in the private equity industry.

So, if you're considering investing with DHS Ventures, rest assured that it is a legitimate and trustworthy firm that prioritizes the interests of its investors.

#DHSVentures#PrivateEquity#Investing#Legitimacy#InvestmentOpportunity#HighGrowth#PortfolioManagement#Transparency#Communication#Trustworthy#FinancialSecurity#InvestmentSuccess

0 notes

Text

AI revolutionizes private equity & principal investment with predictive analytics, portfolio optimization, and due diligence automation. From risk assessment to deal sourcing, it's reshaping every aspect. Explore how AI amplifies returns and streamlines operations in this dynamic industry.

Read more on the transformative power of AI:

0 notes

Text

AI is revolutionizing lead generation in private equity & principal investment firms

Ever wondered how AI is revolutionizing lead generation in private equity & principal investment firms? From predictive analytics to algorithmic prospecting, discover the cutting-edge strategies reshaping the industry.

Read More to dive into the future of deal sourcing!

1 note

·

View note

Text

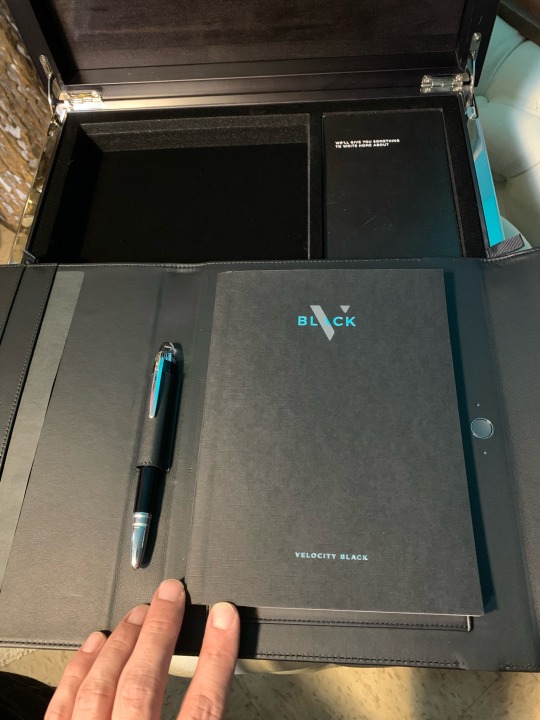

My Velocity Black Box.

0 notes

Text

Secrets of Successful Private Equity Investment Unveiled: How to Build Wealth Safely

Embarking on the journey toward financial prosperity often demands a well-navigated route through the complex terrain of investment opportunities, with private equity standing as a towering beacon for those seeking secure wealth building.

This realm, rich with potential for substantial returns, offers individuals the chance to partake in the growth and success of companies not accessible through the stock market.

By engaging deeply with the principles of capital management, investors can unlock a world where risk meets reward in a dance guided by strategic foresight and informed decision-making.

Understanding the essentials of private equity and mastering its mechanisms can very well be your compass to not just surviving but thriving in the tumultuous seas of the financial world.

Keep reading to discover how private equity could be the cornerstone of crafting a future-proof wealth strategy.

Foundations of Prosperity: The Essentials of Private Equity

Turning our attention towards the bedrock of wealth accumulation, private equity emerges as a cornerstone for securing and growing wealth beyond traditional market confines.

This realm fundamentally differs from public equity, anchored in the exclusivity and depth of investment it commands, detached from the daily fluctuations of public stock exchanges.

To truly grasp the potency of private equity in wealth building, it's imperative to dissect its unique characteristics, starting by defining its framework within a wealth-building context.

Central to navigating this arena are its key players: investors, financial sponsors, and the businesses themselves, each role carrying weight in the intricate dance of capital growth.

As we delve deeper, understanding the lifecycle of a private equity investment unveils the stages from commitment to exit, providing a roadmap for those looking to harness this vehicle for prosperity.

The journey through private equity is one of strategic moves and visionary decisions, leading to a destination where wealth is not just grown but multiplied, reflecting a mastery of the essentials of private equity.

Defining Private Equity in Wealth Building Context

At the heart of crafting a resilient financial future, integrating private equity into one's wealth-building arsenal stands out for its transformative potential. Unlike public equities, bound by the short-term oscillations of stock markets, private equity offers a passage to significant, often untapped, growth opportunities through direct investments in private companies or buyouts of public companies, thereby removing them from the stock exchange.

Engaging with private equity equates to embracing a model where the alignment with seasoned financial sponsors and investment management firms opens doors to strategic, high-growth ventures. This approach not only diversifies an investment portfolio but also endeavors to magnify returns through leveraged buyouts, growth capital, and turnarounds, embedding a robust layer of financial resilience and laying a solid foundation for lasting wealth accumulation.

How Private Equity Differs From Public Equity

In the landscape of wealth creation, the distinction between private equity and public equity is stark, carving out a unique pathway for investors. Primary among these differences is the level of access and influence investors have within the companies they choose to back: with private equity, there's a closer synergy between investors and the entities they support, largely absent in the realm of public stocks.

This proximity to management and operations affords a hands-on approach to steering growth and implementing strategic changes, an opportunity seldom found in the more hands-off environment of public equities. The infusion of not just capital but strategic guidance and expertise underscores the divergent ethos governing private over public equity: it's not merely about investing; it's about actively shaping success.

AspectPrivate EquityPublic EquityInvestor InvolvementHigh - Direct involvement in management and strategyLow - Primarily financial involvement, with little to no say in managementInvestment FocusLong-term growth and restructuring for exit strategiesShorter-term, market-driven returnsAccess & ExclusivityLimited to accredited or institutional investorsOpen to the general public

Identifying the Key Players in Private Equity

In mapping out the terrain of private equity, a key part of understanding its power and potential lies within recognizing the pivotal entities that energize and sustain its ecosystem: investors, financial sponsors, and the targeted companies themselves. These groups form a symbiotic relationship, each playing a distinct yet interrelated role in the lifecycle of a private equity investment.

Investors, ranging from high-net-worth individuals to institutional entities like pension funds, provide the backbone of financial support, initiating the journey with their commitment of capital. From there, the narrative unfolds with financial sponsors - typically private equity firms - crafting strategies, leading negotiations, and managing investments to steer companies towards growth and profitability:

- Investors inject capital and trust into the process, expecting substantial returns over time.

- Financial sponsors, armed with expertise and experience, guide the strategic direction and operational improvements necessary for success.

- Companies under the private equity umbrella strive to escalate their value through growth, innovation, and efficiency gains, ultimately seeking a profitable exit.

Understanding the Lifecycle of a Private Equity Investment

The lifecycle of a private equity investment is best thought of as a journey marked by detailed planning, execution, and strategic exits. It begins the moment an investor identifies a potential company for investment, moving through a structured process geared towards maximising value both for the investor and the company involved.

Each step in this journey is critical and offers unique challenges and opportunities:

- Initial Investment - where capital is injected into a promising company, often aimed at either taking it private or nurturing its growth.

- Value Creation - involves working closely with the company's management to implement operational improvements, drive growth, and enhance profitability.

- Exit Strategy - after achieving desired growth and improvements, the investment is exited through various means such as a sale, merger, or initial public offering (IPO), aimed at realizing the return on investment.

Understanding the nuances of each phase and crafting strategies tailored to the unique needs of the investment is central to unlocking the true potential of private equity.

The Strategic Path: How to Access Private Equity Investments

Embracing private equity stands as a pivotal step in the journey toward securing a prosperous future, magnifying wealth through strategic, informed decisions.

The path ahead, however, stretches beyond mere readiness to invest; it necessitates a deep understanding of private equity's terrain, marked by complexities and unique opportunities.

This voyage begins with mastering the fundamentals, a crucial foundation for anyone new to this realm.

Alongside, discerning the criteria for selecting the right private equity fund becomes a linchpin in aligning investments with financial goals.

And finally, adeptly navigating the investment process itself marks the transition from theoretical knowledge to practical, impactful action.

This trifecta forms the bedrock upon which investors can construct a solid, wealth-building strategy in the vibrant landscape of private equity.

Private Equity Fundamentals for Beginners

Embarking on the journey toward wealth through private equity begins with a solid grasp of its fundamentals. It's about knowing what sets it apart from conventional investments and understanding the environment where your money is set to grow: a realm defined by direct involvement, strategic partnership, and a focus on long-term value creation.

Equipping oneself with the basics of private equity involves learning how to decode its complexities and navigate its intricacies with confidence. Essential concepts like the principles of capital management, the stages of investment from entry to exit, and the mechanisms of value addition across various asset classes form the core of what every beginner needs to master:

- Understanding the principles of capital management and its impact on portfolio growth.

- Identifying the stages of investment - from sourcing opportunities to executing an exit.

- Grasping how value is created within different asset classes, including real estate, startups, and established private companies.

Criteria for Choosing the Right Private Equity Fund

Identifying the appropriate private equity fund necessitates parsing through myriad factors, yet the pivotal criterion is aligning the fund's strategy with my personal investment goals and risk tolerance. This symbiosis ensures that the fund's approach to growth capital, leveraged buyouts, or sector-specific investments mirrors my expectations for return and my capacity to endure volatility.

Moreover, a comprehensive evaluation of the fund's historical performance, management team's expertise, and track record in driving value creation across portfolio companies becomes imperative. These elements collectively provide a clearer picture of the fund's potential to maximize returns and navigate the complexities of private equity markets, thereby cementing my confidence in my investment choice.

Navigating the Process of Investing in Private Equity

Embarking on private equity investment necessitates a strategic and methodical approach, beginning with thorough due diligence on potential funds or direct investments. This step is paramount, as it involves delving into the historical performance, the management team's expertise, and the fund's approach to managing investments, all of which are critical in making an informed decision. A clear understanding of these aspects is instrumental in selecting an investment that aligns with my financial goals and risk appetite.

After identifying a promising investment opportunity, the next critical step involves engaging in detailed negotiations and understanding the terms of the investment. This includes grasping the fee structure, the expected timeline for returns, and the specific strategies for value creation and exit. Ensuring transparency and alignment of interests with the fund managers or the company's leadership is crucial, as these factors significantly influence the success of the investment and the realization of my financial objectives.

The Role of Private Equity in Achieving Financial Security

In the grand tapestry of wealth building, private equity stands out as a powerful tool, one that encapsulates a delicate balance between risk and reward while leveraging long-term growth opportunities.

It's clear that weaving private equity into an investment portfolio can significantly enhance its diversification, providing a buffer against the volatility inherent in public markets.

Yet, understanding the specific role it plays in achieving financial security requires a deep dive into its multifaceted impact.

Here, we'll critically examine how private equity can amplify portfolio diversity, scrutinize the nuanced spectrum of risk versus reward it presents, and uncover the pathways it creates towards achieving sustained growth.

Each of these areas holds the key to unlocking the profound wealth-building potential private equity promises, making them indispensable in our quest for financial stability and prosperity.

The Impact of Private Equity on Portfolio Diversification

The inclusion of private equity in my investment strategy has served as a pivotal mechanism for diversifying my portfolio, distinctly separating my assets from the whims and volatility of the public stock markets. It's a strategic choice that affords me the luxury of tapping into a reservoir of investment opportunities not readily accessible or known to the average investor, thereby spreading my risk across a broader, more eclectic range of assets.

This deliberate augmentation of my investment horizon through private equity not only mitigates my exposure to market downturns but also sets the stage for potential high-yield returns, often unattainable through traditional investment vehicles. My engagement with private equity signifies a calculated departure from conventional asset allocations, positioning me to capitalize on the distinct dynamics and growth trajectories of privately held companies.

Analyzing the Risk vs. Reward in Private Equity

Delving into the risk versus reward dynamic within private equity shines a light on its complexity and the critical need for judicious selection: it’s a realm where the potential for outsized returns goes hand in hand with heightened risk. My engagement with private equity is predicated on a clear-eyed assessment of these trade-offs, leveraging my knowledge and intuition to pinpoint opportunities where the promise of growth substantially outweighs the inherent risks.

Risk FactorReward PotentialPersonal TolerancePortfolio concentrationHigh return on individual investmentsModerateLack of liquidityAccess to non-public growth opportunitiesLowOperational complexitiesInfluence on management decisionsHigh

This nuanced understanding informs my strategy, allowing me to construct a portfolio that not only seeks the lucrative returns private equity can offer but does so within a framework of risk I am comfortable navigating. It’s this balance that underscores the appeal of private equity as a cornerstone of my wealth-building journey, highlighting its role not merely as an investment but as a pivotal vehicle towards achieving lasting financial security.

Long-Term Growth Potential Through Private Equity

The allure of private equity as a vehicle for wealth accumulation largely resides in its potential for long-term growth. This investment avenue opens the door to avenues and sectors where innovation, market disruption, and strategic management foster exponential growth far exceeding conventional market rates.

Experiencing this growth first-hand has solidified my conviction in private equity as a pivotal component of a forward-thinking investment strategy. It's a domain where patience, coupled with strategic insight, translates into significant wealth expansion, setting the foundation for financial security and prosperity:

ElementRole in Long-Term GrowthStrategic ManagementDriving operational efficiencies and market positioningInnovation and Market DisruptionAccess to high-growth sectors and technologies before they hit public domainsStrategic InsightAbility to identify and invest in future market leaders early in their growth cycle

Specialized Investment Strategies in Private Equity

Embarking on the journey of private equity involves delving into the nuances of various investment strategies that tailor wealth-building paths for discerning investors.

Among these, Leveraged Buyouts (LBOs) offer a mechanism for acquiring companies with the strategic use of debt to optimize returns, symbolizing the high-stakes, high-reward essence of private equity.

Conversely, the realm of Venture Capital shines as a beacon for fostering innovation and growth from the ground up, essential for those aiming to contribute to and benefit from the next wave of market disruptors.

Meanwhile, Growth Equity Investments stand out by targeting companies in their expansion phase, providing the capital necessary for scaling operations without diluting control.

By mastering these specialized strategies within private equity, I position myself to tap into diversified avenues for securing and amplifying wealth, each tailored to different stages of company development and risk profiles.

Leverage Buyouts (LBOs) Explained

Leveraged Buyouts (LBOs) represent a pivotal strategy within the realm of private equity, characterized by the acquisition of a company primarily through the use of borrowed funds. This approach is structured to optimize the returns on the equity invested by leveraging the company's assets and future cash flows as collateral for the borrowed funds.

Mastering the intricacies of LBOs demands a nuanced understanding of the leverage mechanism: it's a calculated risk, where the potential for significant return on investment hinges on the acquired company's ability to generate enough cash flow to service the debt. A successful LBO transforms the capital structure of a company, aiming to enhance its value for investors:

- Evaluating the target company's assets and cash flow capabilities as a foundation for securing debt financing.

- Strategizing the acquisition move, keeping an eye on optimizing the capital structure post-acquisition.

- Implementing operational efficiencies and strategic improvements to increase the company's profitability and cash flow, ensuring the repayment of debt while aiming for substantial equity returns.

Read the full article

#PrivateEquity#PrivateEquityInvestment#SuccessfulPrivate#SuccessfulPrivateEquity#SuccessfulPrivateEquityInvestment

0 notes

Text

Bregal Milestone Unveils Allshares, A Pan-European Powerhouse In Compensation And Benefits, And Announces Majority Growth Investment To Acquire Evli Alexander Incentives

Bregal Milestone, a well-known European private equity firm, has made an investment in Evli Alexander Incentives (EAI), previously a division of Evli Group, a significant Nordic wealth manager. After the investment, EAI will undergo a rebranding as Allshares, with the goal of establishing itself as a key player in the field of compensation and long-term incentive software and services for both public and private companies.

Allshares is set to cater to around 300 multinational clients across more than 100 countries, offering a comprehensive digital solution for managing equity plans. The company's in-house software and services facilitate the management of share plans in accordance with legal, regulatory, and tax requirements, as well as providing seamless and automated IFRS reporting.

Maunu Lehtimäki, the CEO of Evli Plc, expressed enthusiasm for the collaboration with Bregal Milestone, underscoring their mutual ambition to become a premier provider of compensation and benefits. He highlighted the growth potential, investment in the platform, and expansion into new markets.

Cyrus Shey, the Co-Founder and Managing Partner at Bregal Milestone, acknowledged the solid groundwork of Allshares, emphasizing its leading position in the market, strong recurring revenues, and opportunities for global expansion. He pointed out the company's innovative offerings and its capacity to engage stakeholders through a digital interface.

Read More - https://www.techdogs.com/tech-news/business-wire/bregal-milestone-unveils-allshares-a-pan-european-powerhouse-in-compensation-and-benefits-and-announces-majority-growth-investment-to-acquire-evli-alexander-incentives

0 notes

Quote

I write in the book, that the coffee and donut that you pick up on the way to work, the child care entity where you drop your son or daughter off, the nursing home where your mother or father lives, it is cradle to grave. You’re impacted by private equity but you don’t know it because these are companies that are buying and selling, but you don’t know who the real owner is behind the scenes. And they like it that way, they want to keep it that way because they operate best in secrecy. They’re private companies. They don’t have to make filings to the Securities and Exchange Commission so a lot of their business and a lot of their practices are hidden from view, and that is by design.

Gretchen Morgenson

10 notes

·

View notes

Text

91% of PE-backed company CFOs fear losing their job, a survey finds

https://fortune.com/2023/12/01/pe-backed-company-cfos-fear-losing-job/

🏷️A look back at the #privateequity Class of 2021—and why so many tech investors are sweating their returns

https://fortune.com/2024/03/05/private-equity-2021-tech-investors-sweating-returns/amp/ M&A

#lbo #buyouts #investor #mergers

6 notes

·

View notes

Text

What private equity means for accountants

By Courtney Hoff

PE investment in accounting is potentially big business. Here's some of the views from key players in the ecosystem.

0 notes

Text

https://www.linkedin.com/company/fortumexbusiness

#fortumex#fortumexbusiness#businessgrowth#businessdevelopment#PrivateEquity#Privateequityfunding#fundraising#venturecapital#interestfree#capitalmanagement#sales#marketing#smallbusiness#mediumsizedbusiness#startupsupport#wealthcreation#loanservices#businessowners#rajkot#Gujarat

2 notes

·

View notes

Text

Do you want to stay engaged after retirement? Do you want to maintain some level of strategic and/or economic interest in your company post sale/transition? By reinvesting in your business, you'll have an opportunity to further your financial gains in the business, even after retiring. In other words, you can take a "second bite of the apple".

#GroundSwell℠#BusinessOwnershipPlatform℠#BusinessOwnership#BusinessPartner#SellingMyBusiness#BusinessTransition#ExitPlan#BusinessValuation#BusinessInvestors#PrivateEquity#BusinessBroker

0 notes