#preleasing

Text

#businesspark#springlease#springtxcre#supportlocal#supportsmallbusiness#nowleasing#preleasing#flexspace#officespace#3rdgd#thirdgeneration#thirdgenerationdevelopment#smallbusiness

0 notes

Text

Best Property Investment, Investing in Real Estate and Best Real Estate Investments - PropReturns

Find the best real estate investments that will bring immense profit in the future. Here are the real estate opportunities that are safe and hassle-free.

Website : https://www.propreturns.com/investments

#best property investment#best real estate investments#commercial properties for investment#commercial property#commercial property for sale#commercial real estate#good real estate investments#invest in real estate online#investing in real estate#investment property#investment property for sale#land for sale#pre leased bank property for sale in mumbai#pre leased property for sale in delhi#preleased property for sale in mumbai#property investment company#real estate investment mumbai#real estate opportunities

4 notes

·

View notes

Text

Land For Sale | Investing in Real Estate | Commercial Property and Much More only at PropReturns

Invest in rent-generating Commercial properties with detailed financial analysis through PropReturns. With PropReturns, make sound investment decisions backed by data. PropReturns offers an end to end solution for investors: from placing an instant offer on a high ROI investment property, to conducting the entire deal flow and paperwork through our platform.

Link : https://www.propreturns.com/sales

#investing in real estate#commercial real estate#commercial property for sale#land for sale#investment property#commercial property#preleased property for sale in mumbai#investment property for sale#best real estate investments#property investment company#invest in real estate online#best property investment#good real estate investments#real estate investment mumbai#pre leased bank property for sale in mumbai#pre leased property for sale in delhi#real estate opportunities

2 notes

·

View notes

Text

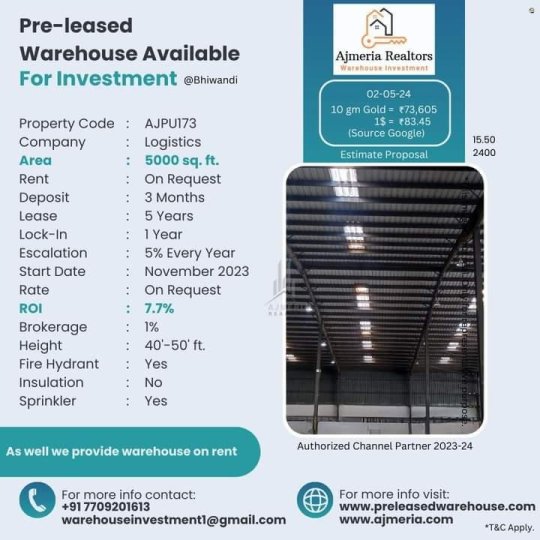

5000SQ FT WAREHOUSE PROPERTY OPTION AVAILABLE FOR INVESTMENT IN BHIWANDI FOR HIGH RETURN RENTAL INCOME

#preleased #warehouse #investment #commercial #highreturn Property code : AJPU173Company : logisticsArea : 5000 sq ft Rent : on request Deposit : 3 monthsLease : 5 years Lock-in : 1 yearEscalation : 5% every year Start date : November 2023 Rate : on request ROI : 7.7%Brokerage : 1%Height : 40′-50′ ft Fire hydrant : yes Insulation : no Sprinkler : yesThis is Ajmeria from warehousespace, I can help…

View On WordPress

0 notes

Text

preleased property for sale in pune

good roi %

2400 sq.ft

📲 : 9175991701

VISIT:=https://anvreealty.com/…/2400-SqFt…/PP091220-1155558286

#anvreealty#SHOP#PRELEASED#koregaonpark#UNDRI#WANOWRIE#SHIVAJINAGARk#pune#PuneRealEstate#PuneProperty#RealEstateInvesting#PuneCommercialProperty#punebusinesses

0 notes

Text

If you're interested in investing in pre-leased properties, the team at RES Management can help you identify the best investment options and guide you through the investment process.

#real estate#commercial property#res management#commercial property consultant#preleased commercial properties#preleased residential properties

0 notes

Text

Unlock the potential of prime office spaces with Yieldspace. Our platform offers a diverse array of premium office spaces strategically located in the heart of Bangalore's bustling commercial districts. Explore immediate income opportunities, enjoy stable returns, and mitigate risk by investing in these established, income-generating properties. With Yieldspace, navigating the realm of preleased commercial properties in Bangalore becomes a seamless and rewarding experience. Unlock the doors to lucrative real estate investments today! Visit Yieldspace for a seamless real estate experience!

0 notes

Text

HighYield Fortune's Portfolio Diversification: Beyond Traditional Real Estate Investments

Welcome to the realm of strategic wealth building with HighYield Fortune! In today’s blog, we embark on a journey to explore the unparalleled benefits of portfolio diversification, transcending the confines of conventional investment avenues. Join us as we delve into the world of HighYield Fortune’s unique projects, guiding you towards a diversified portfolio that promises not only financial stability but the potential for exponential growth.

Understanding Portfolio Diversification: The HighYield Advantage

Portfolio diversification is the cornerstone of a robust investment strategy. It involves spreading your investments across different asset classes to mitigate risk and enhance overall returns. HighYield Fortune takes this concept to the next level by introducing a dynamic range of real estate projects that serve as a distinct asset class, providing investors with an opportunity to diversify beyond the typical stocks and bonds.

Breaking Free from Traditional Norms

In a world where traditional investments can sometimes yield predictable results, HighYield Fortune beckons you to break free from the norm. We advocate for a departure from the mundane and encourage investors to explore the unique landscape of real estate, where every property holds the potential for high yields and long-term appreciation.

Navigating the HighYield Fortune Portfolio

We’ll explore the distinctive features of these projects and how they contribute to the overall diversification of your investment portfolio.

Risk Mitigation: The HighYield Approach

One of the key advantages of diversification is risk mitigation, and HighYield Fortune understands this principle well. We’ll delve into how our real estate projects, strategically located in the burgeoning Mulshi region, offer a resilient investment option. With a focus on stable markets and carefully chosen properties, HighYield Fortune aims to provide investors with a level of security that goes beyond the norm.

The HighYield Fortune Difference: More Than Just Returns

While traditional investments often revolve around expected returns, HighYield Fortune introduces a new paradigm. We’ll discuss how our projects contribute not only to financial gains but also to a sense of community, sustainable living, and a lasting impact on the environment. Investing with HighYield Fortune is an invitation to be part of something greater than just a financial portfolio — it’s an investment in a vision for a thriving future.

Empowering Investors for Long-Term Success

As we conclude our exploration, we’ll leave you with actionable insights on how to integrate HighYield Fortune’s projects into your investment portfolio effectively. By diversifying beyond the ordinary, you position yourself for long-term success, creating a financial landscape that can weather the storms and capitalize on the opportunities that arise.

Join us on this transformative journey as we redefine portfolio diversification with HighYield Fortune. Your financial future awaits, and it’s time to go beyond traditional investments.

for more information visit: https://highyield.in

Social links

instagram:https://www.instagram.com/highyieldfortune/

facebook:https://www.facebook.com/highyieldfortune

linkedin:https://www.linkedin.com/uas/login?session_redirect=https%3A%2F%2Fwww.linkedin.com%2Fcompany%2F79994778%2Fadmin%2F

0 notes

Text

M3M The Line offers ultra-luxury retail shops and studio apartments at Sector 72, Noida.

✅ Get 12% Assured Rental + Lease Guarantee*

✅ Prime Location Opposite Medanta Hospital

✅ Payment Plan: 50:25:25

✅ Fully equipped Studio Apartments

✅ Excellent Connectivity to IT Hub Sec 62 Noida

✅ Directly opposite Metro Station sector 51

✅ Assured best deals. Inquire now!

🌐 www.commercialdekho.com/m3m-the-line

Call for Site Visit: +91 9911668551

0 notes

Text

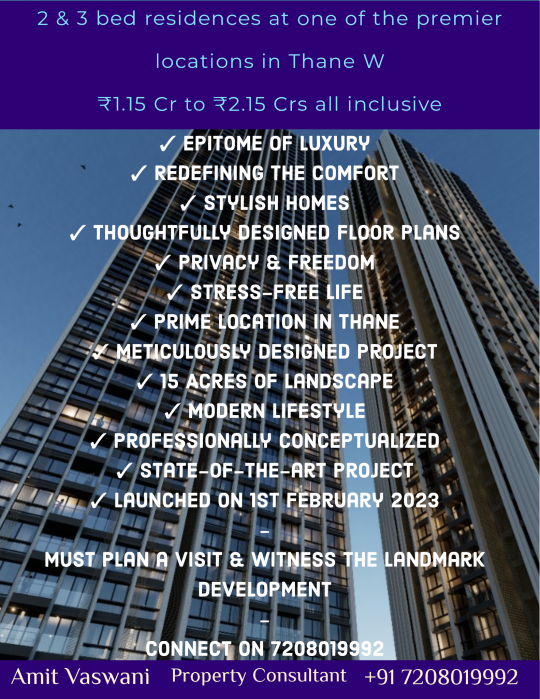

#realestate#returnoninvestment#investment#mutualfunds#2bhk#3bhk#apartment#residential#commercial#preleased#properties#thanecity

0 notes

Text

Prime Pre-Leased Retail Property in Gurgaon | Excellent Investment Opportunity

Explore this exceptional pre-leased retail property for sale in Gurgaon on BusinessDeals. Guaranteed rental income with a high-yield investment in a thriving commercial hub. Don't miss out!

0 notes

Text

Types of Real Estate Investments

Investing in real estate can be a wise decision in the pursuit of building a diversified portfolio and generating lucrative returns. Not only does it help you secure your present, but also builds wealth for the future. Plus, the availability of different types of real estate investment options makes wealth creation possible for different segments of the population.

But there are chances you might get stuck somewhere. Where? When it boils down to selecting a suitable investment category for yourself.

Choosing one real estate type can be difficult as today, there are many choices available for an investor. These choices differ based on the utility and purpose of the investor. Wait. you will understand better when we briefly go through the overview of types of real estate investments. Let’s get started.

The Different Types of Real Estate Investments

Mainly, real estate investment options can be divided into two categories:

Physical real estate investments that include options like Pre-leased properties, fractional properties, rental properties, etc.

Other real estate investments where physical participation is minimal or not required: REITs, Real Estate Crowdfunding, ETFs, REIT Mutual Funds, etc.

While this information will help you get familiar with all the real estate types, it won’t help you briefly understand their benefits. For that, we will have to dive deeper. Let’s do it without delaying further:

Pre-leased properties

Pre-leased properties ensure fixed rental returns as they have existing tenants during the time of sale. After the sale of the property, the tenant is transferred to the new buyer. Due to the same, these properties generate returns from the first day itself.

Plus, these properties are considered one of the safest investment options due to the low risk associated. And liquidity ensures that you can sell the property whenever there’s an urgent capital requirement. With time, you also get the benefit of capital appreciation.

If you are an investor new to the real estate landscape, pre-leased properties can be a safe and profitable investment option to consider.

2. Fractional ownership

Till now you would have believed that all high-end properties can only be owned by high net-worth individuals, right? But what if you got to know about a real estate category where investing in such luxurious and expensive assets is possible even for an extensive category of investors?

Fractional ownership is that lucrative investment category that allows you the comfort of owning high-end properties. In this category, you invest your capital and get percentage ownership in the property along with other like-minded investors. Due to the same, the financial burden is divided amongst multiple investors.

Fractional ownership of properties also allows you to invest in multiple high-end properties and diversify your investment portfolio. If you feel that placing all your eggs in a single basket might be dangerous, you explore this category and diversify your risk.

Fractional ownership still lacks awareness and isn’t yet that popular compared to other properties in the subcontinent. But the word is now spreading fast, and you may want to avail its benefits.

3. Residential Real Estate

This category includes properties that are used for residential purposes. Moreover, unlike other passive investment options, residential real estate is an active investment. It requires huge upfront costs and active involvement from the investor.

Furthermore, these properties can be further subdivided into other categories like

a. Long-term Residential Property

This is one of the most common real estate investment types. You buy a residential property with a long-term horizon in mind and rent it out to tenants. Furthermore, you have the liberty to invest either in a posh multi-family housing unit that can be rented out to tenants, or even a vacation rental in a tourist spot where you have a high tourist footfall throughout the year.

Through these properties, you can generate consistent rental returns in a good rental market. And if you feel the time is right, you can sell the property and get a great return on your initial investment.

b. House flipping

In house flipping, you invest in a property that needs some minimal repair and renovation before it is leased out to a tenant. Also, house flipping can turn out to be expensive for an investor as the upgrades can cost quite a lot. And, apart from the initial expenses, you might need cash flow for sudden issues.

c. ADU

Accessory dwelling units (ADUs) are additional living units on a property rented out to tenants or even acquaintances. Some common examples of ADUs include the conversion of unused spaces like sheds, garage spaces, etc. to living spaces for the tenants. Plus, if you have always found maintaining other property units tiring and complicated, and expensive, ADUs are going to surprise you on the positive side. These properties are easy and cost-intensive to maintain, which makes them one of the prime options for a passive income stream.

4. Real Estate Investment Trust (REIT)

REITs are companies that own or either operate other income-generated properties. As an investor, you can invest in the stocks of these companies on a stock exchange, and be a passive investor. Through the same, you invest in the properties these trusts own or operate. So, you are an investor and invest in different real estate properties, without directly involving.

REITs are good if you are exploring low-risk investment options that appreciate gradually over time. Plus, you also create in the form of dividend yield. If you are an aggressive investor looking for high returns within a quick time, then REITs might disappoint you.

5. Crowdfunding

If you have always looked forward to an online investing strategy, where you can pool your funds along with other like-minded people, then real estate crowdfunding is for you. You meet other investors online and invest in properties where sole proprietorship isn’t feasible.

Crowdfunding is beneficial for those who aren’t looking to cash in a major portion of their capital in one go. As you invest with others, the financial burden is divided equally and you are never burdened alone! Plus, it involves less effort and allows you to diversify your investment portfolio.

The Bottom Line

There are different real estate categories that you can explore and invest in. But before that due diligence is advised. Due diligence will ensure that you are knowledgeable about the market, and know which real investment type will be suitable for you. Moreover, returns in real estate often depend more on how you choose to get involved.

If you are an active investor, then you can go ahead and invest in pre-leased or fractional properties. But if you wish to have passive involvement where gradual returns are sufficient for you, you can look forward to other real estate investment categories like REITs and Crowdfunding. All of it depends on you, and how you wish to participate in the sector.

Spend time with research, prepare a plan, and invest wisely!

#Prelease Property#Prelease Property for Sale#Prelease Property Near Me#Prelease Property in India#Commercial Prelease Property#Fractional Prelease Property

0 notes

Text

4000SQ FT PEB SHED PRE-LEASED WAREHOUSE AVAILABLE FOR INVESTMENT IN BHIWANDI FOR HIGH RETURN RENTAL INCOME

#property #warehouse #preleased #income #bhiwandi Property code : AJPR55Company : logistics Area : 4000 sq ftRent : 18/- per sq ft Deposit : 3 months Lease : 5 years Lock-in : 1 yearEscalation : 5% every yearStart date : 01-oct-23Rate : On Request ROI : 7.2%Brokerage : 1%Height : 40′-50′ ft Fire hydrant : yes Insulation : yes Sprinkler : yes Other : MMRDA APPROVED This is Ajmeria from…

View On WordPress

0 notes

Text

🔰PRELEASED PROPERTY SHOWROOM FOR SALE / RENT SHIVAJI NAGAR, PUNE💯

✅1630 Sq.Ft

✅BEST ROI%

📲CALL FOR MORE DETAILS

👉PreLease offer : High footfall , premium spot , upmarket locality.

📲 : 9175991701

VISIT:=https://anvreealty.com/p/1630-SqFt-Commercial-Showroom-for-Sale-in-Shivaji-Nagar/SP050623-115349-7035

#anvreealty#SHOP#PRELEASED#koregaonpark#UNDRI#WANOWRIE#SHIVAJINAGARk#pune#PuneRealEstate#PuneProperty#RealEstateInvesting#PuneCommercialProperty#punebusinesses

0 notes

Text

https://www.preleaseproperty.com/blog/pre-leased-commercial-properties-vs-pre-leased-residential-properties/19

Pre-leased properties have become an attractive investment option in the real estate market. But which type of pre-leased properties offer a more promising future: commercial or residential? Both options have advantages, but with this blog, we will examine the key points that set them apart.

1 note

·

View note

Text

Commercial Real Estate fastest growing market in India.

What is CRE?

Commercial real estate (CRE) is a property that is only used for commercial activities or as office space. It might be anything from an office complex to a duplex home, a dining establishment, or a warehouse. Retailers, offices, hotels and resorts, shopping malls, restaurants, and healthcare facilities are just a few of the different types of CRE. Commercial real estate can generate income for people, businesses, and corporate interests by renting it out or by keeping it and reselling it.

CRE takeaways:

Commercial real estate is a form of investment that has the potential to generate profit for the property owner through capital gain or rental income. It is divided into four main classes: office space, industrial space, multifamily rentals, and retail space. Investment in commercial real estate requires more sophistication and larger capital from investors than residential real estate, and publicly traded real estate investment trusts (REITs) are a feasible way for individuals to indirectly invest in it.

Commercial Real Estate types:

Commercial real estate is usually classified into four types depending on its use:

Industrial use: The size of industrial properties can also vary significantly based on their particular use cases.

Office space: Office buildings are also classified as low, mid, or high-rise according to their size, much like multifamily homes.

Similar subcategories exist for office space. Class A, Class B, or Class C are frequently used to describe it:

Class A: In terms of appearance, age, infrastructural quality, and location, Class A buildings are the best.

Class B: These buildings are often older and less expensively competitive than class A structures. These structures are frequently sought after by investors for restoration.

Class C: The oldest buildings are those in the Class C category; they are often older than 20 years old, situated in less desirable regions, and in need of upkeep.

Multifamily: The intermediary between residential and commercial real estate is multifamily buildings. While they can primarily be used as residences, the objective of this kind of property is generally for investment (owner-occupied or not).

Retail: The smaller retail buildings known may or may not have anchor tenants. A bigger retail tenant is known as an anchor tenant and often helps to attract people to the building.

Hotel and resorts: Generally, full-service hotels are found in tourist or central business districts.

Mixed-use: The most typical type of mixed-use structures are retail/restaurant buildings with offices or homes perched on top, particularly in cities.

Shopping malls

Healthcare establishments

With top commercial properties, Res Management provides office spaces for rent/sale in Ahmedabad located in commercial hub spots in order to boost your sales. Let us be your commercial property matchmaker.

#commercial office space for sale in ahmedabad#office for sale in ahmedabad#preleased property in ahmedabad#commercial office for sale in ahmedabad#commercial property for sale in ahmedabad#fully furnished office in ahmedabad

1 note

·

View note