#page 4492

Text

Jane Crocker, Roxy Lalonde, Autoresponder

Act 6, page 4491-4493

gutsyGumshoe [GG] began pestering tipsyGnostalgic [TG]

GG: Heyyy.

GG: Ahem.

GG: Ro-Lal?

TG: oopos sry

TG: was havin important chats

GG: Oh?

GG: With whom?

TG: w yet anather ineligible fuckin bachelor who elfe i have to talk 2

[CONTINUED PREVIOUSLY]

TT: Anyway, if you're still there.

TT: I wouldn't call my "feelings" ironic.

TT: Though evidently, I would enclose them in quotes.

TT: They're more like an echo of feelings once established in a biological context, though perhaps had not particularly well materialized at that point in my life.

TT: Or his life.

TT: Whatever.

TT: They still feel real sometimes, and it can be easy to get carried away with them.

TT: But most of the time they present themselves as dense bodies of abstraction to be evaluated, like any kind of information.

TT: It's fair to say the feelings I have ABOUT my feelings are more genuine expressions of emotion than the ground level feelings themselves.

TT: Does that make sense?

TG: yes

TG: sory distacted

TG: iportant shit gon on w janesy

TT: That's fine.

TT: So to underwhelmingly answer your question, no, I don't think I'm really "into Jake."

TT: Not so much as occasionally being subject to heavily arresting recalls of conflicted, incipient preteen episodes on the subject.

TT: I'm not sure I can be "into" someone in a way you understand.

TT: Not that it would even matter if I was.

TT: I'm glasses.

TG: damn :(

TT: What?

TG: sry im listening 2 u really

TG: but i fucked uuuuup

TG: got to make sure jane doesnt run that file i sent

TT: The virus? You sent it already?

TT: Sneaky.

TG: waahh im such an ass

TT: What are you two talking about?

TG: the bot line is

TG: im a horribule friend :(

TT: You could just tell her you sent an exploding file.

TG: noo then shell think im shitty

TG: and right now she thinks im super NOT shitty

TG: dont want to blow it

TG: id think id rather pull a dirk and propess my UNDYING FEELINGS FOR HER omgomgomg

TT: Wait, you have feelings for Jane?

TG: no you dingnut

TG: was joak

TG: OMFG

TG: if dirk tells jake about his stuff

TG: what about jane

TG: hows she gonna feel

TG: competing wish a friend and all for aguy she cant even get up the nerve to say anythin to

TG: poor jane :C

TT: It seems to be highly probable you are ensared in the throes of one of your human romantic quandaries.

TG: oh stfu up

TG: i need a drink

TT: Are you even talking to her anymore?

TT: It seems like you must be neglecting her side of the conversation.

TG: im in the mipple of a dramantic pause caulm ur fukin tits bobob

TG: RLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLYYYYYYYYYYYYYYYY??????

GG: Sigh.

[CONTINUED PREVIOUSLY]

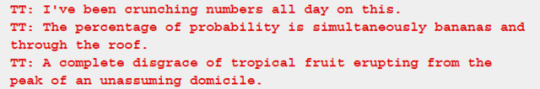

TT: Anyway, I won't distract you for much longer.

TT: I just felt the need to tip you off to this eight hundred ton gorilla dragging its knuckles across the horizon.

TG: will this gorilla

TG: eat thos bonanas

TG: flying out of the roof u said

TT: No airborne fruit will be safe.

TT: I guess this is to be presented as something like a word of caution.

TT: If it's me going through with this, hypothetically,

TT: I'm not dropping some limp wristed shucks buster on his ass, and praying to the horse gods of irony for reciprocation.

TT: There will be no rocking back and forth on pigeon-toed feet, while my face flushes with the blood of a thousand timid bishies.

TT: I will not hold one tentative hand behind my head like a flustered asshole from an Asian cartoon, nor will an oversized bead of sweat overlap ludicrously with my visage.

TT: If it's me, I'm going all out.

TT: Oceans will rise. Cities will fall. Volcanoes will erupt.

TG: uuh

TT: What I'm saying is, it's going to be a scene, and bystanders need to brace themselves.

TG: ok

TG: about when is the big scene happenin

TT: Probably after the game begins.

TT: I expect he'll hold off on playing his hand until he and Jake are in the session.

TT: He's taken certain measures.

TT: For some reason, I think he's latched on to this notion that functioning as the client for a player is customarily a one way pass to makeout city with that player.

TT: Everything with him, and me, is a matter of assiduous tactical forethought. Makin' a play to get his jones on for the J-man is no different.

TG: not sure what any of this quiet means but it sounds spactacular

TG: i cant wait

TG: tho im still kinda torn

TG: about how 2 feel about his chances vs janes chances

TG: what do i say to jane about this???

TG: its hard being as totey sweet a friend as me

TG: its hard and no 1 understanks

TG: *lul

TT: Sorry to hear that.

TT: As ever, I remain an automatonous and dispassionate witness of the oddity that is human interaction, while maintaining no investment in either outcome.

TG: yeah bs

TG: anyway looks like i have to go

TG: i have to proves some shit to jane

TT: Prove what?

TG: oh u know

TG: just subjectin shit to the old madrigogs

TT: It seems you just said madrigogs.

TT: What are madrigogs.

TG: XD

TG: l7r bro

tipsyGnostalgic [TG] ceased pestering timaeusTestified [TT]

TG: janey

TG: it seems 2 me

TG: that there is a (MATHS) % chance of you bein a huge tightass

TG: are u bein a huge tightass on me jane

GG: Oh god dammit.

GG: Take the book! What do I care!!!

TG: yessss thast the spirpit

TG: now u are believin w petrol

GG: I fail to see what offering up a priceless book for your wildly capricious science experiment has to do with my resolution to be less stingy with my beliefs, but alright.

TG: haha will u relax abt the book

TG: im only just teasing cause theres like practically a 100 percant chance this wont wonk like alwasy

TG: * wort work like always

TG: sooooo

TG: ready/

GG: Yes, let's just get on with it.

#homestuck#jane crocker#roxy lalonde#autoresponder#homestuck act 6#page 4491#page 4492#page 4493#homestuck act 6 act 2

0 notes

Text

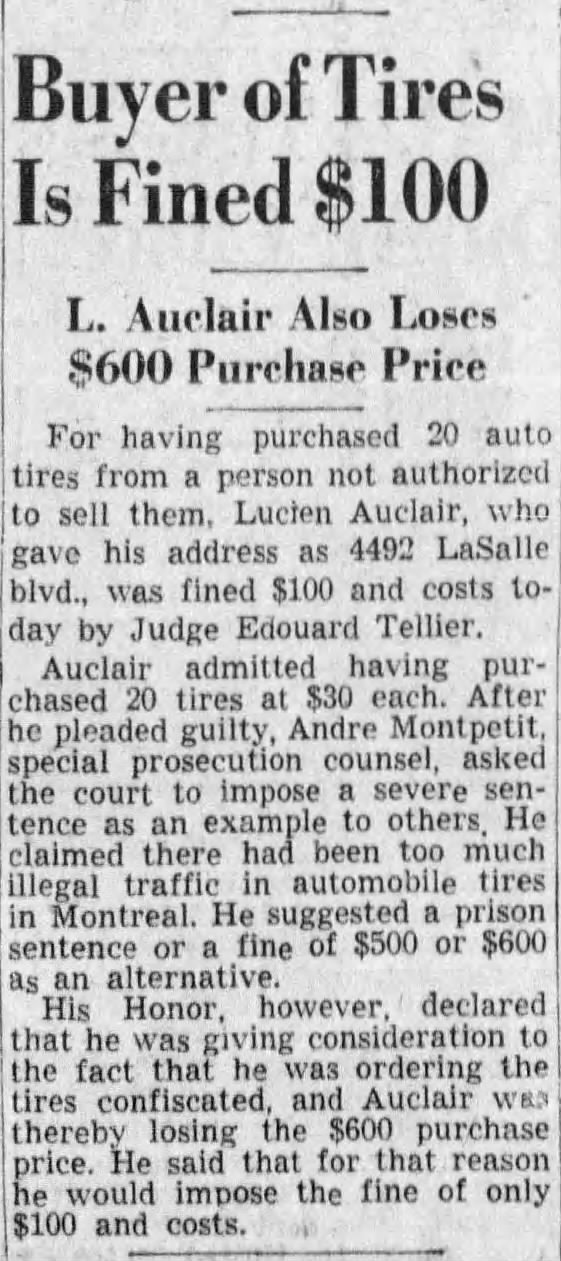

"Buyer of Tires Is Fined $100," Montreal Star. May 12, 1943. Page 3.

---

L. Auclair Also Loses $600 Purchase Price

---

For having purchased 20 auto tires from a person not authorized to sell them, Lucien Auclair, who gave his address as 4492 LaSalle blvd., was fined $100 and costs to-day by Judge Edouard Tellier.

Auclair admitted having purchased 20 tires at $30 each. After he pleaded guilty, Andre Montpetit, special prosecution counsel, asked the court to impose a severe sentence as an example to others. He claimed there had been too much illegal traffic in automobile tires in Montreal. He suggested a prison sentence or a fine of $500 or $600 as an alternative.

His Honor, however, declared that he was giving consideration to the fact that he was ordering the tires confiscated, and Auclair was thereby losing the $600 purchase price. He said that for that reason he would impose the fine of only $100 and costs.

#montreal#receiving stolen goods#stolen tires#black market#wartime rationing#rubber rationing#buying stolen goods#fines and costs#canada during world war 2#crime and punishment in canada#history of crime and punishment in canada

0 notes

Text

For My Birthday...

Friends,

For my birthday this year (45), I would like for the country to join us in spreading holiday cheer through our Christmas light installation business. Here at Kingdom Christmas Lights, our new slogan is "Your Christmas Experience Starts Here" because of the following reasons...

1. You can schedule residential or commercial Christmas lighting services on our website.

2. We have a zip code checker that manages clients in our local service area. In the event that your property is out of our installation service area, we have created an alternate solution for them to have a Kingdom Experience on some level. (Look for yourself)

3. In the event that you're not in our service area, you will have an opportunity to purchase our "Self Install Kit" anywhere in the country, receive "Free Training" in English or Spanish and/or find a local Christmas contractor in your area. Who else is doing that? #KingdomXmas

4. We've also connected the dots on God's vision for our life to Educate, Employ and Empower our men into leadership. You can see that when you get to our ministry page. (Start with Kingdom Christmas Lights)

5. We now have Kingdom Radio and have been interviewing the Best and Brightest minds in the lighting industry. Let us know if you would like to be featured in one of our shows.

6. We have created a "Contractor Network" platform for the entire state of Texas that offers "FREE BUSINESS LISTINGS". Share your favorite contractors there and help someone else out.

7. We are now selling commercial grade materials and can offer UNBEATABLE DEALS for contractors and homeowners alike across the country.

8. Laura Diane Robey and I will employ over 50 people this year with our Kingdom Business Platforms. #Strong

9. We started a Christmas Light Installers Mastermind Facebook group for people to network all across the country in our industry. #ironsharpensiron

10. We just purchased this 5 acre commercial "BRICK and MORTAR" location in Plantersville, TX and are ready for God's vision for our lives to come to pass. #Amen

Everything starts with https://kingdomchristmaslights.com and your gift to me was reading this message! Thanks for the gift of your time. -Ron

Kingdom Christmas Lights

346-291-4492

KingdomChristmasLights.com

#KingdomXmas

"Your Christmas Experience Starts Here"

0 notes

Photo

#Page 4490#Page 4492#Homestuck#Homestuck Screenshots#Homestuck Quotes#Hal Strider#Auto Responder#Roxy Lalonde

52 notes

·

View notes

Text

WK 4: Optimizing Social Media Profiles

I’ve recently been assigned to watch the instructor's lecture and respond to the following questions:1) What, in your view, are the most important qualities for a social media consultant to have? 2) If you were acting as a social media consultant to yourself, what plans and strategies would you advise improving your professional social media presence?3) What have you done so far, and what could you do in the future?

First of all, there are many important qualities to have for a social media consultant. With that being said, consulting means helping. Someone is willing to pay you for something they cannot do themselves. However, unlike other industries, consulting relies on the creative application of knowledge to a specific problem or opportunity. The most important qualities for a social media consultant to have is problem-solving since most clients don’t know what the clear problem is. In most cases, a client has been told or only knows a problem exists. For example, a small business owner knows their business needs a social media presences of some kind but doesn’t have the expertise of what is needed. Therefore, a social media consultant can work with that owner to figure out who they are trying to reach and what approached will be most effective. Additionally, as stated in The Social Organization, many business and organizations do not use social media effectively because they have not developed the expertise (Melton). https://chipcast.hosted.panopto.com/Panopto/Pages/Viewer.aspx?id=c179ac90-6eb7-4492-b72a-687a941e24b0

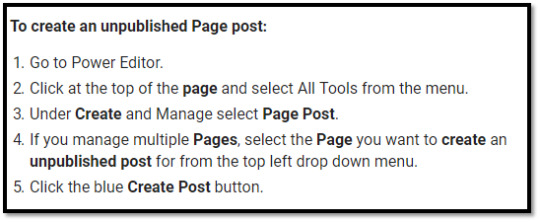

Furthermore, if you were acting as a social media consultant to yourself, I would have many plans and strategies to improve your professional social media presence. As a social media consultant, most of your work is to be an educator and advisor. You are there to help your clients understand problems and opportunities and give them the tools to move forward. Therefore, if I were acting as a social media consultant to myself, I would recommend writing a strong bio that specifically states purpose. A strong bio could include the main location of your business to connect with followers, or links to other social media platforms for followers to further their interaction with the business. Another tactic that can be utilized for Twitter is the likes tab. Strategically liking things that relate to your brand and products makes the likes tab more useful to any follower and will automatically ensure that you are a reliable source. You could simply add a call-to-action button, as shown below, to gain more follower interaction. https://www.quora.com/How-do-I-change-unpublished-Facebook-posts-to-published

Lastly, I have taken the necessary actions to develop my social media in a professional manner. Thus far, I have optimized my Twitter, LinkedIn, Facebook, and Instagram. In the future I could, create an easily recognizable profile picture, create a logo/header, and use keywords that describe the

4 notes

·

View notes

Text

Social Media Consultant

Entering into this summer course, we were given the task to become social media consultant’s for a small organization or business. although at first this seemed to be a daunting task, I have found a lot of useful tips for my future as well as the business I decided to work with. The one word used to describe consulting in this week’s lecture was “helping”. Consulting to me is someone willing to pay someone else to help them with aspects they are unable to accomplish. The more dictionary definition would be “the creative application of knowledge to a specific problem or opportunity”.

There are a handful of important qualities that are targeted for a social media consultant to have in order to be successful. Having a social media presence for your own business is a crucial step in most cases to grow your cliental, as well as bringing in more people that could increase revenue. Social media has become a large part of society. With that being said, it is so important to grow as a company by being on social media because like I mentioned everybody is scrolling through the media for a majority of their free time. As a consultant you’re not only an educator, but also an advisor on what would work best for the company to benefit them in the end.

As a consultant, you’re the person the head of the company looks to in order to understand what the problem is. Like mentioned in the lecture video, you’re picked as the consultant because the business itself needs help, but they don’t know what the problem is exactly. This is where someone comes in and figures out the underlying problem and begins the recommendations to find the best solution to fix the dilemma. The problem isn’t normally upfront and easily recognized. Some recommendations will be implemented immediately within the company, whereas other clients are more difficult to work with and that all comes with the territory of the job description. Some qualities that are important to succeed as a social media consultant include the willingness to adapt quickly as well as being creative. Some times they’ll be faced with difficult clients and it is their job to understand that you have to have the proven ability to accomplish the task at hand.

If I were acting as a social media consultant for myself, there are a few tips and steps I would be advised to do. I believe your social media presence is very important, especially ensuring that it is professional. Seeing how I am in college, I would say that making sure appropriate content is only being shared. When I think about graduating in a year, I am aware that potential employers will be viewing how profiles and I want to make sure that my best presence is being seen. I remember growing up that was always an important lesson that was shared by people I looked up to, to not share every detail of your life on social media because even when erased it can be found if searched for hard enough. I created a LinkedIn in the beginning of my college career and that is an important professional platform to be present on. Plenty of employers visit your page and that could make or break your future with a certain company if they see something they don’t like or it appears unprofessional. I want to continue to ensure that my presence on social media is kept professional and appealing to future potential employers.

https://chipcast.hosted.panopto.com/Panopto/Pages/Viewer.aspx?id=c179ac90-6eb7-4492-b72a-687a941e24b0

1 note

·

View note

Text

Down to the final week...

Still undecided about what will become of this page after the 17th, but here are a few things that are certain:

Twitter: @DeadEndFriend_ (NSFW, pretty much what I've been doing on here)

Discord: DeadEndFriend#4492

Switch: SW 1328 1963 5404

Feel free to give any of these a follow/add! 👍

2 notes

·

View notes

Text

Social Media Consulting

https://www.linkedin.com/pulse/20140520100045-33491082-good-consultants-need-to-possess-10-qualities

Important qualities

Base on Professor’s lecture, which shows an important define, what is a consultant? mean that “help”. So consultants should pay attention to help, help customers, and help other something. If I want to help other, a consultant must have a quality, which is patience. When they work, they will meet a lot of problems, and many customers need them to help. There is an article “Good Consultants need to possess 10 Qualities” which show two qualities. First of all, the most important quality of a consultant is to be professional all the time with a client relationship. At the same time, they should have good communication skills, If as a consultant you cannot share your ideas, surely Consultancy is not your life. An excellent oral and written communication skills are vital for a good consultant.

https://chipcast.hosted.panopto.com/Panopto/Pages/Viewer.aspx?id=c179ac90-6eb7-4492-b72a-687a941e24b0

Consulting Myself

If I was acting as a social media consultant to myself, I focus improve good listening skills. As a consultant, excellent listening skills are really important as it will help the client to talk freely. In addition, a consultant has a responsibility, which is “help”. Also, good listening skill can let all to talk freely, which cause more information sharing. At the meanwhile, I will pay attention to professionalism, because professionalism can help me to get high level, and work better, become a good consultant. So, the consultant would always charge for more work, if the consultant has good professionalism.

2 notes

·

View notes

Photo

https://activity.alibaba.com/page/live.html?topic=aadba7a1-4492-47df-9793-0bf5d546abd8

0 notes

Text

UAE Elevator & Escalator Maintenance & Repair Services to Grow at Steady Rate During Forecast Period

Changing dynamics of the construction industry and need for infrastructure with modern amenities to drive the growth of UAE elevator & escalator maintenance & repair services market

According to TechSci Research report, “UAE Elevator & Escalator Maintenance & Repair Services Market By Type, By Elevator Technology, By Components, By End User, By Elevator Door Type, By Region, Forecast & Opportunities, 2025”, the UAE elevator & escalator maintenance & repair services market is expected to grow at a steady rate of during the forecast period on account of the increasing demand for smart elevators in various enterprises. Additionally, integration of IoT in maintenance of elevators & escalators reduces downtime and improves service efficiency, thereby propelling the market in the country. However, increase in number of accidents inside elevators can hamper the growth of market during forecast period. These accidents may further pose threat to the personnel engaged in their maintenance and service. As a result, stringent safety regulations for elevators and escalators may pose a threat to the market's growth during the forecast period.

Browse market data Tables and Figures spread through Pages and an in-depth TOC on " UAE Elevator & Escalator Maintenance & Repair Services Market"

https://www.techsciresearch.com/report/uae-elevator-escalator-maintenance-and-repair-services-market/4492.html

The UAE elevator & escalator maintenance & repair services market is segmented based on type, elevator technology, components, end user, elevator door type, company and region. Based on end user, the market can be segmented into residential, commercial, institutional, infrastructural and others. The commercial segment is expected to grow at a significant pace during forecast period attributable to the growing requirement for high performance elevators, low break down situations, smooth operation in commercial spaces, along with the beautiful aesthetics elevators.

AG MELCO Elevator Co. L.L.C., Hitachi, Ltd., Middle East Branch, Kone Middle East LLC, Otis LLC, Schindler Middle East, Al-Futtaim Engineering, Nigma Lifts Installation & Maintenance Co (LLC), Thyssenkrupp Elevator, Euro Elevator Escalators Maintenance Company, Alnas Elevator and others are some of the leading players operating in UAE elevator & escalator maintenance & repair services market.

Download Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=4492

Customers can also request for 10% free customization on this report.

“UAE elevator & escalator maintenance & repair services market is expected to witness significant growth during the forecast years, owing to the growth of the residential, commercial, institutional and infrastructure industries in the country. Additionally, the joint ventures among domestic companies and international players are creating a constructive environment, favorable for the growth of elevators and escalators maintenance & repair services market in the country.” said Mr. Karan Chechi, Research Director with TechSci Research, a research based global management consulting firm.

“UAE Elevator & Escalator Maintenance & Repair Services Market By Type, By Elevator Technology, By Components, By End User, By Elevator Door Type, By Region, Forecast & Opportunities, 2025” has evaluated the future growth potential of UAE elevator & escalator maintenance & repair services market and provides statistics & information on market size, structure and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges and opportunities in UAE elevator & escalator maintenance & repair services market.

Browse Related Reports

Global Elevator & Escalator Market By Type (Elevator, Escalator and Moving Walk Ways), By Service, By Elevator Technology, By End-User, By Elevator Door Type, By Region, Competition Forecast & Opportunities, 2013 – 2023

https://www.techsciresearch.com/report/global-elevators-and-escalators-market/2461.html

China Smart Elevator Market By Component (Control Systems (Security Control System, Elevator Control System, Access Control system), and Communication Systems), By Application (Residential, Commercial, Industrial, Institutional, Others), By Service (New Installation, Modernization, Maintenance), By Region, Competition, Forecast & Opportunities, 2024

https://www.techsciresearch.com/report/china-smart-elevator-market/4308.html

Saudi Arabia Elevator & Escalator Market By Type (Elevator, Escalator and Moving Walkways), By Service (Maintenance & Repair, New Installation and Modernization), By Elevator Technology (Traction, Hydraulic and Machine Room-Less Traction), By End-User (Residential, Commercial, Institutional, Infrastructural and Others), By Elevator Door Type (Automatic and Manual), Competition, Forecast & Opportunities, 2024

https://www.techsciresearch.com/report/saudi-arabia-elevator-escalator-market/4392.html

Contact

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: [email protected]

#Elevator & Escalator Maintenance & Repair Services Market#Elevator & Escalator Maintenance & Repair Services Market size#Elevator & Escalator Maintenance & Repair Services Market Share#Elevator & Escalator Maintenance Market#Elevator & Escalator Repair Services Market

0 notes

Link

Check out company post that’s on the @whykingdomministries page. We’re excited about being the top rated roofing contractor that provides roof replacement services in the great Houston, Katy and Richmond Texas area. If you’re looking for a free estimate, give us a call at 346-291-4492 or visit us online at kingdomroofandfence.com. #KingdomRoof #BusinessWHY #AskWHYKingdom

0 notes

Text

Pair of Compasses

Spare a thought for the hundred generations of people who were taught at school to draw circles with a pair of compasses. With computers to do it quicker and smarter, it's a bit pointless nowadays, but in its time it was an essential skill. Recently I noticed Calcidius, writing about 400 CE, boasting he could even draw spirals with his compasses by slowly moving the legs during the turns.

Among the codices just digitized at the Vatican Library is Vat.lat.4571, Gerard of Cremona's Latin translation from Arabic of what appears to be the lost Greek textbook on spheres by Menelaus of Alexandria. This includes several pages of very fine drawings like this, all done by see hand:

Go admire. It is one of 66 new items online in the last week:

Ross.5,

Ross.81,

Ross.84,

Ross.91 (Upgraded to HQ), book of hours?

Ross.109,

Ross.113,

Ross.178,

Ross.257 (Upgraded to HQ),

Ross.272,

Ross.296,

Urb.lat.339,

Urb.lat.428,

Urb.lat.435,

Urb.lat.477, Officium Beatae Mariae Virginis

Urb.lat.516,

Urb.lat.522,

Urb.lat.523,

Urb.lat.550,

Urb.lat.571,

Urb.lat.576,

Urb.lat.577,

Urb.lat.617,

Urb.lat.618,

Urb.lat.620,

Urb.lat.621,

Urb.lat.764,

Urb.lat.862,

Vat.lat.2395,

Vat.lat.2444.pt.1, Nicolai Florentini

Vat.lat.4082 (Upgraded to HQ), dated 1401, compilation of 23 works on mathematics and astronomy, see Jordanus and eTK

Vat.lat.4171,

Vat.lat.4435,

Vat.lat.4446, medical texts including an item by Bertrucius of Bologna, see eTK

Vat.lat.4456 (Upgraded to HQ), Gentile da Foligno on science, see eTK

Vat.lat.4462,

Vat.lat.4468,

Vat.lat.4481 (Upgraded to HQ), mid 13th century, Latin translations of Avicenna (Mirabile)

Vat.lat.4484,

Vat.lat.4492,

Vat.lat.4500,

Vat.lat.4520,

Vat.lat.4521,

Vat.lat.4525 (Upgraded to HQ),

Vat.lat.4531,

Vat.lat.4532,

Vat.lat.4534 (Upgraded to HQ), Trabezon's translations of Aristotle, see Mirabile

Vat.lat.4536 (Upgraded to HQ),

Vat.lat.4537,

Vat.lat.4549 (Upgraded to HQ), Averroes on Aristotle, see Mirabile

Vat.lat.4550 (Upgraded to HQ), Averroes on Aristotle's Meteorology, from Hebrew. See Mirabile

Vat.lat.4551,

Vat.lat.4554 (Upgraded to HQ),

Vat.lat.4556,

Vat.lat.4557,

Vat.lat.4559,

Vat.lat.4562,

Vat.lat.4564 (Upgraded to HQ),

Vat.lat.4565,

Vat.lat.4568 (Upgraded to HQ), about 1500, William of Morebeke's translation of Proclus

Vat.lat.4571, Menelaus? (above), however Jordanus gives the work and author as De figuris spericus by Mileus

Vat.lat.4572, Almanach Planetarum ab anno Domini 1243 usque ad 1303, see Jordanus

Vat.lat.4573, continuation: almanac from 1306 on, and astronomy, see Jordanus

Vat.lat.4578 (Upgraded to HQ), apocryphal texts, 14th century, with Evangelium Nicodemi, ff. 35v-37v Evangelium Thomae de infantia Salvatoris, ff. 37v-44r Liber de ortu beatae Mariae et infantia Salvatoris, ff. 32r-35r (see Mirabile); also includes a mathematical text, see Jordanus

Vat.lat.4587 (Upgraded to HQ),

Vat.lat.4589,

Vat.lat.8193.pt.2 (Upgraded to HQ), notes from 1655 in Innocent X's court on papabile

This is Piggin's Unofficial List number 192. Thanks to @gundormr for harvesting. If you have corrections or additions, please use the comments box below. Follow me on Twitter (@JBPiggin) for news of more additions to DigiVatLib.

via Blogger http://bit.ly/2VZ0yZ8

0 notes

Text

Stop Jefferson Capital Systems, LLC Debt Harassment

Debt collectors like Jefferson Capital Systems, LLC cannot harass you over a debt. You have rights under the law, and we will stop the harassment once and for all.

THE BEST PART IS…

If Jefferson Capital Systems violated the law, you will get money damages and Jefferson Capital Systems will pay your attorneys’ fees and costs. You won’t owe us a dime for our services. Plus, some of our clients also receive debt relief and cleaned-up credit reports. You have nothing to lose!Call us today at 888-572-0176 for a free consultation.

Who is Jefferson Capital Systems, LLC?

Jefferson Capital Systems is a debt collection agency based in St. Cloud, Minnesota, and former subsidiary of “Atlanticus Holdings Corporation,” based in Atlanta, Georgia. Founded in 2002, Jefferson Capital Systems has been accredited by the Better Business Bureau since December 2005, but has received over 1,100 negative reviews and complaints via the BBB in the past three years, most of which are for billing/collection problems and sales/advertising problems.

Jefferson Capital Systems’s Address, Phone Number, and Contact Information

Jefferson Capital Systems is located at 16 McLeland Road, St. Cloud, MN 56303. The main telephone number is 833-851-5552 and the main website is www.myjcap.com/. The corporate website is https://www.jeffersoncapitalinternational.com/us/

Phone Numbers Used by Jefferson Capital Systems

Like many debt collection agencies, Jefferson Capital Systems may use many different phone numbers to contact debtors. For an advanced search, visit www.agrussconsumerlaw.com/ and click “Number Search” in the “Lookup” dropdown menu. Here are some phone numbers Jefferson Capital Systems may be calling you from:

320-229-8095

320-300-4492

800-348-3381

866-608-5902

866-805-9214

Jefferson Capital Systems Lawsuits

If you want to know just how unhappy consumers are with Jefferson Capital Systems, take a look at the lawsuits filed against the agency on the Public Access to Court Electronic Records (“PACER”). PACER is the U.S.’s federal docket which lists federal complaints filed against a wide range of companies. A search for the agency will display over 5,400 lawsuits filed across the U.S., most of which involve violations of consumer rights and/or the Fair Debt Collection Practices Act (FDCPA).

Jefferson Capital Systems Complaints

The Fair Debt Collection Practices Act (FDCPA) is a federal law which applies to everyone in the United States. In other words, everyone is protected under the FDCPA, and this Act is a laundry list of what debt collectors can and cannot do while collecting a debt, as well as things they must do while collecting debt. If Jefferson Capital Systems is harassing you over a debt, you have rights under the FDCPA.

The Telephone Consumer Protection Act (TCPA) protects you from robocalls, which are those annoying, automated, recorded calls that computers make all day long. You can tell it’s a robocall because either no one responds on the other end of the line, or there is a delay when you pick up the phone before a live person responds. You can receive $500 per call if Jefferson Capital Systems violates the TCPA.Have you received a message from this agency that sounds pre-recorded or cut-off at the beginning or end? These are tell-tale signs that the message is pre-recorded, and if you have these messages on your cell phone, you may have a TCPA case against the agency.

The Electronic Fund Transfer Act (EFTA) protects electronic payments that are deducted from bank accounts. If Jefferson Capital Systems took unauthorized deductions from your bank account, you may have an EFTA claim against the agency. Jefferson Capital Systems, like most collection agencies, wants to set up recurring payments from consumers; imagine how much money it can earn if hundreds, even thousands, of consumers electronically pay them $50 – $100 or more per month. If you agreed to this type of reoccurring payment, the agency must follow certain steps to comply with the EFTA. Did Jefferson Capital Systems continue to take electronic payments after you told them to stop? Did they take more money from your checking account than you agreed to? If so, we can discuss your rights and potential case under the EFTA.

The Fair Credit Reporting Act (FCRA) works to ensure that no information reported to your credit report is false. In essence, it gives you the right to dispute those inaccuracies that you find on your credit report. We’ve handled many cases in which a debt collection agency reported debt on a consumer’s credit report to obtain leverage over the consumer. If Jefferson Capital Systems is on your credit report, they may tell you that they’ll remove the debt from your credit report if you pay it;this is commonly known as “pay for delete.”If the original creditor is on your report rather than the debt collector, and you pay off the debt, both entities should accurately report this on your credit report.

Several states also have laws to provide its citizens an additional layer of protection. For example, if you live in California, Florida, Michigan, Montana, North Carolina, Pennsylvania, Texas, or Wisconsin, you may be able to add a state-law claim to your federal law claim above. North Carolina, for example, has one of the most consumer-friendly statutes in the country: if you live in NC and are harassed over a debt, you may receive $500 – $4,000 in damages per violation. We work with a local counsel in NC and our NC clients have received some great results in debt collection harassment cases. If you live in North Carolina and are being harassed by a debt collector, you have leverage to obtain a great settlement.

How do we Use the Law to Help You?

We will use state and federal laws to immediately stop Jefferson Capital Systems’s debt collection. We will send a cease-and-desist letter to stop the harassment today, and if Jefferson Capital Systems violates the FDCPA, EFTA, FCRA, or any state law, you may be entitled to money damages. For example, under the FDCPA, you may receive up to $1,000 in damages plus actual damages. The FDCPA also has a fee-shift provision, which means the debt collector will pay your attorneys’ fees and costs. If you have a TCPA case against the agency, we will handle it based on a contingency fee and you won’t pay us a dime unless you win.

THAT’S NOT ALL…

We have helped thousands of consumers stop phone calls and we know how to stop the harassment and get you money damages. Once again: you will not pay us a dime for our services. We will help you based on a fee-shift provision and/or contingency fee, and the debt collector will pay your attorneys’ fees and costs.

What if Jefferson Capital Systems is on my Credit Report?

Based on our experience, some debt collectors may credit-report, which means one may mark your credit report with the debt they are trying to collect. In addition to or instead of the debt collector, the original creditor may also be on your credit report in a separate entry, and it’s important to properly identify these entities because you will want both to update your credit report if or when you pay off the debt.

THE GOOD NEWS IS…

If Jefferson Capital Systems is on your credit report, we can help you dispute it. Mistakes on your credit report can be very costly: along with causing you to pay higher interest rates, you may be denied credit, insurance, a rental home, a loan, or even a job because of these mistakes. Some mistakes may include someone else’s information on your credit report, inaccurate public records, stale collection accounts, or even being a victim of identity theft. If you have a mistake on your credit report, there is a process to dispute it, and my office will help you obtain your credit report and dispute any inaccurate information.

REMEMBER…

If a credit reporting agency violates its obligations under the Fair Credit Reporting Act (FCRA), you may be entitled to statutory damages up to $1,000, and the credit reporting agency will be required to fix the error. The FCRA also has a fee-shift provision, which means the credit reporting agency will pay your attorneys’ fees and costs. You won’t owe us a dime for our services. We have helped hundreds of consumers fix inaccurate information on their credit reports, and we’re ready to help you, too.

Complaints against Jefferson Capital Systems

If you’re on this page, chances are you are just like the hundreds of consumers out there being harassed by Jefferson Capital Systems. Here are some of theBBB reviews and complaints against Jefferson Capital Systems:

“Received a notice from this “company” demanding payment of $1446 on an old debt. I sent them a letter well within the 30 days required requesting that they provide proof that they are authorized to collect on this debt. I will not pay to a slimy company without proof as there is no guarantee that it will resolve the debt and not them scamming the money. I received nothing. It is also impossible to reach them by phone and if you do finally get a pickup, you sit forever on hold (burning my cell minutes). Yes, I became unemployed after an auto accident and got behind in bills, but I refuse to be bullied by this shady company when they refuse to provide the proof I requested months ago!”

“I check my credit on a regular basis, and this company just reported to the three top credit reporting agencies that I owe them $265 from a utility company I haven’t done business with in about 8 years. My utilities have been included in my rent for the last 5 years. I also have not received anything in the mail from them, ever. They don’t even have my address. My credit score just dropped 50 points due to this act of fraud. I might sue them.”

“They have a fraudulent system of collections, where they send new information to credit bureaus with false dates and update their internal systems with false dates to make debts appear to be recent even if well over a decade old. Such systems make it difficult to collect from customers who fear the debt actually being recorded and submitted to credit bureaus due to their trademark fraudulent “changing” information techniques, which may also be applied to paid-off debts. They are a high lawsuit risk for companies who utilize them as a collection agency.”

Based on 100+ reviews on Google, Jefferson Capital Systems receives a 1.4-out-of-5 rating. Here are some of the reviews on Google:

“They seemed nice at first, but it was all a front! I was told that they were calling me about a debt I owed, but the last four of the SSN they asked me to confirm was not mine! I told them this and they said they would mark it down, but it is still on my credit report and there’s no remarks about it anywhere.”

“I keep getting a notice every month staying I owe a certain amount. First the amounts are never the same, they won’t tell me who the original is, and how old the debt is. Funny thing, I only have 2 things in collections and neither amount matches. Fake debt to get me to pay over $1,000. You can always rely on them not answering and when they do, they treat you like you are lying. Don’t pay them a dime!”

“[Jefferson Capital Systems] are criminals that are engaging in illegal collection activities. They buy old debt for pennies on the dollar, and then use illegal, strong arm tactics to try and force you to pay. Do not pay them, for they will not remove it from your credit.”

Cases We’ve Handled against Jefferson Capital Systems

I THINK YOU’LL AGREE WITH ME WHEN I SAY…

I think you’ll agree when we say that threats and harassment from collection agencies can be pretty intimidating. However, we can stop the harassment and get you money damages under the law, and the collection agency will pay your attorneys’ fees and costs. Here is one case we’ve handled against Jefferson Capital Systems:

Jeremy U. v. Jefferson Capital Systems, LLC – In August 2015, Jeremy of Milam County, Texas, filed a complaint against Jefferson Capital Systems for violations of the Fair Debt Collection Practices Act (FDCPA). Complaints included using “false representations or deceptive means” to attempt to collect a debt and/or personal information from the plaintiff and failing to report a disputed debt to the major credit bureaus. The case was settled in September 2015 and Jeremy was compensated for the damages.

What Our Clients Say about Us

Agruss Law Firm has over 790 outstanding client reviews through Yotpo, an A+ BBB rating, and over 100 five-star reviews on Google. Here’s what some of our clients have to say about us:

“Michael Agruss handled two settlements for me with great results and he handled them quickly. He also settled my sister’s case quickly and now her debt is clear. I highly recommend Michael.”

“Agruss Law Firm was very helpful, they helped me solved my case regarding the unwanted calls. I would highly recommend them. Thank you very much Mike Agruss!”

“Agruss Law Firm was very helpful to me and my veteran father! We were harassed daily and even called names for a loan that was worthless! Agruss stepped in and not only did they stop harassing, they stopped calling all together!! He even settled it so I was paid back for the problems they caused!”

Can Jefferson Capital Systems Sue Me?

Although anyone can sue anyone for any reason, we have not seen Jefferson Capital Systems sue consumers, and it’s likely that the agency does not sue because they don’t always own the debt they are attempting to collect, and would also need to hire a lawyer, or use in-house counsel, to file a lawsuit. It’s also likely that the agency collects debt throughout the country, and it would be quite difficult to have lawyers, or a law firm, licensed in every state. However, there are collection agencies that do sue consumers; for example, Midland Credit Management is one of the largest junk-debt buyers, and it also collects and sues on debt. Still, it is less likely for a debt collector to sue you than for an original creditor to hire a lawyer or collection firm to sue you. If Jefferson Capital Systems has threatened to sue you, contact Agruss Law Firm, LLC as soon as possible.

Can Jefferson Capital Systems Garnish my Wages?

No, unless they have a judgment. If Jefferson Capital Systems has not sued you, then the agency cannot get a judgment. Barring limited situations (usually involving debts owed to the government for student loans, taxes, etc.), a company must have a judgment in order to garnish someone’s wages. In short, we have not seen this agency file a lawsuit against a consumer, so the agency cannot garnish your wages, minus the exceptions listed above. If Jefferson Capital Systems has threatened to garnish your wages, contact our office right away.

Jefferson Capital Systems Settlement

If you want to settle a debt with Jefferson Capital Systems, ask yourself these questions first:

Do I really owe this debt?

Is this debt within the statute of limitations?

Is this debt on my credit report?

If I pay this debt, will Jefferson Capital Systems remove it from my credit report?

If I pay this debt, will the original creditor remove it from my credit report?

If I pay this debt, will I receive confirmation in writing from Jefferson Capital Systems for the payment and settlement terms?

These are not the only things to consider when dealing with debt collectors. We are here to help you answer the questions above, and much more. Whether it’s harassment, settlement, pay-for-delete, or any other legal issue with Jefferson Capital Systems, we at Agruss Law Firm are here to help you.

Share your Complaints against Jefferson Capital Systems Below

We encourage you to post your complaints about Jefferson Capital Systems. Sharing your complaints against this agency can help other consumers understand what to do when this company starts calling. Sharing your experience may help someone else!

HERE’S THE DEAL!

If you are being harassed by Jefferson Capital Systems over a debt, you may be entitled to money damages – up to $1,000 for harassment, and $500 – $1,500 for illegal robocalls. Under state and federal laws, we will help you based on a fee-shift provision and/or contingency fee, which means the debt-collector pays your attorneys’ fees and costs. You won’t owe us a dime for our services. We have settled thousands of debt collection harassment cases, and we’re prepared to help you, too. Contact Agruss Law Firm at 888-572-0176 to stop the harassment once and for all.

Are you being harassed by Jefferson Capital Systems, LLC over a debt? Stop the harassment and get money, all without paying for our services. You are protected under the Fair Debt Collection Practices Act (FDCPA), whether or not you owe the debt.

The FDCPA has protected consumers since 1977. This federal law protects you from unfair or abusive debt collection practices through clear rules about what debt collectors may and may not do while collecting a debt, as well as things they must do under law.

Jefferson Capital Systems, LLC is a collection agency that is based in Saint Cloud, MN. The company was established in 1999. This company is a limited liability corporation with several employees.

According to Public Access to Court Electronic Records, over 200 cases have been filed against Jefferson Capital Systems, LLC.

The Better Business Bureau has accredited Jefferson Capital Systems, LLC since 2005. In the last 3 years, the BBB has had 474 complaints against the company, and has closed 176 of these complaints in the last year. Of these 474 complaints, 440 were dealing with billing/collection issues.

Phone numbers associated with Jefferson Capital Systems, LLC are:

320-300-4492, 320-229-8095, 866-805-9214, 800-348-3381, 866-608-5902

Agruss Law Firm, LLC, has helped thousands of consumers stop debt collection harassment. We would like to help you, too. Under the law, we can get the collector to stop harassing you, and get you money damages. Plus, the collector will be responsible for our attorney’s fees and costs. You won’t owe us a dime for our services. Contact us today. We look forward to speaking with you.

The post Stop Jefferson Capital Systems, LLC Debt Harassment appeared first on Agruss Law Firm, LLC.

Stop Jefferson Capital Systems, LLC Debt Harassment published first on https://agrusslawfirmllc.tumblr.com

0 notes

Text

Stop Jefferson Capital Systems, LLC Debt Harassment

Debt collectors like Jefferson Capital Systems, LLC cannot harass you over a debt. You have rights under the law, and we will stop the harassment once and for all.

THE BEST PART IS…

If Jefferson Capital Systems violated the law, you will get money damages and Jefferson Capital Systems will pay your attorneys’ fees and costs. You won’t owe us a dime for our services. Plus, some of our clients also receive debt relief and cleaned-up credit reports. You have nothing to lose!Call us today at 888-572-0176 for a free consultation.

Who is Jefferson Capital Systems, LLC?

Jefferson Capital Systems is a debt collection agency based in St. Cloud, Minnesota, and former subsidiary of “Atlanticus Holdings Corporation,” based in Atlanta, Georgia. Founded in 2002, Jefferson Capital Systems has been accredited by the Better Business Bureau since December 2005, but has received over 1,100 negative reviews and complaints via the BBB in the past three years, most of which are for billing/collection problems and sales/advertising problems.

Jefferson Capital Systems’s Address, Phone Number, and Contact Information

Jefferson Capital Systems is located at 16 McLeland Road, St. Cloud, MN 56303. The main telephone number is 833-851-5552 and the main website is www.myjcap.com/. The corporate website is https://www.jeffersoncapitalinternational.com/us/

Phone Numbers Used by Jefferson Capital Systems

Like many debt collection agencies, Jefferson Capital Systems may use many different phone numbers to contact debtors. For an advanced search, visit www.agrussconsumerlaw.com/ and click “Number Search” in the “Lookup” dropdown menu. Here are some phone numbers Jefferson Capital Systems may be calling you from:

320-229-8095

320-300-4492

800-348-3381

866-608-5902

866-805-9214

Jefferson Capital Systems Lawsuits

If you want to know just how unhappy consumers are with Jefferson Capital Systems, take a look at the lawsuits filed against the agency on the Public Access to Court Electronic Records (“PACER”). PACER is the U.S.’s federal docket which lists federal complaints filed against a wide range of companies. A search for the agency will display over 5,400 lawsuits filed across the U.S., most of which involve violations of consumer rights and/or the Fair Debt Collection Practices Act (FDCPA).

Jefferson Capital Systems Complaints

The Fair Debt Collection Practices Act (FDCPA) is a federal law which applies to everyone in the United States. In other words, everyone is protected under the FDCPA, and this Act is a laundry list of what debt collectors can and cannot do while collecting a debt, as well as things they must do while collecting debt. If Jefferson Capital Systems is harassing you over a debt, you have rights under the FDCPA.

The Telephone Consumer Protection Act (TCPA) protects you from robocalls, which are those annoying, automated, recorded calls that computers make all day long. You can tell it’s a robocall because either no one responds on the other end of the line, or there is a delay when you pick up the phone before a live person responds. You can receive $500 per call if Jefferson Capital Systems violates the TCPA.Have you received a message from this agency that sounds pre-recorded or cut-off at the beginning or end? These are tell-tale signs that the message is pre-recorded, and if you have these messages on your cell phone, you may have a TCPA case against the agency.

The Electronic Fund Transfer Act (EFTA) protects electronic payments that are deducted from bank accounts. If Jefferson Capital Systems took unauthorized deductions from your bank account, you may have an EFTA claim against the agency. Jefferson Capital Systems, like most collection agencies, wants to set up recurring payments from consumers; imagine how much money it can earn if hundreds, even thousands, of consumers electronically pay them $50 – $100 or more per month. If you agreed to this type of reoccurring payment, the agency must follow certain steps to comply with the EFTA. Did Jefferson Capital Systems continue to take electronic payments after you told them to stop? Did they take more money from your checking account than you agreed to? If so, we can discuss your rights and potential case under the EFTA.

The Fair Credit Reporting Act (FCRA) works to ensure that no information reported to your credit report is false. In essence, it gives you the right to dispute those inaccuracies that you find on your credit report. We’ve handled many cases in which a debt collection agency reported debt on a consumer’s credit report to obtain leverage over the consumer. If Jefferson Capital Systems is on your credit report, they may tell you that they’ll remove the debt from your credit report if you pay it;this is commonly known as “pay for delete.”If the original creditor is on your report rather than the debt collector, and you pay off the debt, both entities should accurately report this on your credit report.

Several states also have laws to provide its citizens an additional layer of protection. For example, if you live in California, Florida, Michigan, Montana, North Carolina, Pennsylvania, Texas, or Wisconsin, you may be able to add a state-law claim to your federal law claim above. North Carolina, for example, has one of the most consumer-friendly statutes in the country: if you live in NC and are harassed over a debt, you may receive $500 – $4,000 in damages per violation. We work with a local counsel in NC and our NC clients have received some great results in debt collection harassment cases. If you live in North Carolina and are being harassed by a debt collector, you have leverage to obtain a great settlement.

How do we Use the Law to Help You?

We will use state and federal laws to immediately stop Jefferson Capital Systems’s debt collection. We will send a cease-and-desist letter to stop the harassment today, and if Jefferson Capital Systems violates the FDCPA, EFTA, FCRA, or any state law, you may be entitled to money damages. For example, under the FDCPA, you may receive up to $1,000 in damages plus actual damages. The FDCPA also has a fee-shift provision, which means the debt collector will pay your attorneys’ fees and costs. If you have a TCPA case against the agency, we will handle it based on a contingency fee and you won’t pay us a dime unless you win.

THAT’S NOT ALL…

We have helped thousands of consumers stop phone calls and we know how to stop the harassment and get you money damages. Once again: you will not pay us a dime for our services. We will help you based on a fee-shift provision and/or contingency fee, and the debt collector will pay your attorneys’ fees and costs.

What if Jefferson Capital Systems is on my Credit Report?

Based on our experience, some debt collectors may credit-report, which means one may mark your credit report with the debt they are trying to collect. In addition to or instead of the debt collector, the original creditor may also be on your credit report in a separate entry, and it’s important to properly identify these entities because you will want both to update your credit report if or when you pay off the debt.

THE GOOD NEWS IS…

If Jefferson Capital Systems is on your credit report, we can help you dispute it. Mistakes on your credit report can be very costly: along with causing you to pay higher interest rates, you may be denied credit, insurance, a rental home, a loan, or even a job because of these mistakes. Some mistakes may include someone else’s information on your credit report, inaccurate public records, stale collection accounts, or even being a victim of identity theft. If you have a mistake on your credit report, there is a process to dispute it, and my office will help you obtain your credit report and dispute any inaccurate information.

REMEMBER…

If a credit reporting agency violates its obligations under the Fair Credit Reporting Act (FCRA), you may be entitled to statutory damages up to $1,000, and the credit reporting agency will be required to fix the error. The FCRA also has a fee-shift provision, which means the credit reporting agency will pay your attorneys’ fees and costs. You won’t owe us a dime for our services. We have helped hundreds of consumers fix inaccurate information on their credit reports, and we’re ready to help you, too.

Complaints against Jefferson Capital Systems

If you’re on this page, chances are you are just like the hundreds of consumers out there being harassed by Jefferson Capital Systems. Here are some of theBBB reviews and complaints against Jefferson Capital Systems:

“Received a notice from this “company” demanding payment of $1446 on an old debt. I sent them a letter well within the 30 days required requesting that they provide proof that they are authorized to collect on this debt. I will not pay to a slimy company without proof as there is no guarantee that it will resolve the debt and not them scamming the money. I received nothing. It is also impossible to reach them by phone and if you do finally get a pickup, you sit forever on hold (burning my cell minutes). Yes, I became unemployed after an auto accident and got behind in bills, but I refuse to be bullied by this shady company when they refuse to provide the proof I requested months ago!”

“I check my credit on a regular basis, and this company just reported to the three top credit reporting agencies that I owe them $265 from a utility company I haven’t done business with in about 8 years. My utilities have been included in my rent for the last 5 years. I also have not received anything in the mail from them, ever. They don’t even have my address. My credit score just dropped 50 points due to this act of fraud. I might sue them.”

“They have a fraudulent system of collections, where they send new information to credit bureaus with false dates and update their internal systems with false dates to make debts appear to be recent even if well over a decade old. Such systems make it difficult to collect from customers who fear the debt actually being recorded and submitted to credit bureaus due to their trademark fraudulent “changing” information techniques, which may also be applied to paid-off debts. They are a high lawsuit risk for companies who utilize them as a collection agency.”

Based on 100+ reviews on Google, Jefferson Capital Systems receives a 1.4-out-of-5 rating. Here are some of the reviews on Google:

“They seemed nice at first, but it was all a front! I was told that they were calling me about a debt I owed, but the last four of the SSN they asked me to confirm was not mine! I told them this and they said they would mark it down, but it is still on my credit report and there’s no remarks about it anywhere.”

“I keep getting a notice every month staying I owe a certain amount. First the amounts are never the same, they won’t tell me who the original is, and how old the debt is. Funny thing, I only have 2 things in collections and neither amount matches. Fake debt to get me to pay over $1,000. You can always rely on them not answering and when they do, they treat you like you are lying. Don’t pay them a dime!”

“[Jefferson Capital Systems] are criminals that are engaging in illegal collection activities. They buy old debt for pennies on the dollar, and then use illegal, strong arm tactics to try and force you to pay. Do not pay them, for they will not remove it from your credit.”

Cases We’ve Handled against Jefferson Capital Systems

I THINK YOU’LL AGREE WITH ME WHEN I SAY…

I think you’ll agree when we say that threats and harassment from collection agencies can be pretty intimidating. However, we can stop the harassment and get you money damages under the law, and the collection agency will pay your attorneys’ fees and costs. Here is one case we’ve handled against Jefferson Capital Systems:

Jeremy U. v. Jefferson Capital Systems, LLC – In August 2015, Jeremy of Milam County, Texas, filed a complaint against Jefferson Capital Systems for violations of the Fair Debt Collection Practices Act (FDCPA). Complaints included using “false representations or deceptive means” to attempt to collect a debt and/or personal information from the plaintiff and failing to report a disputed debt to the major credit bureaus. The case was settled in September 2015 and Jeremy was compensated for the damages.

What Our Clients Say about Us

Agruss Law Firm has over 790 outstanding client reviews through Yotpo, an A+ BBB rating, and over 100 five-star reviews on Google. Here’s what some of our clients have to say about us:

“Michael Agruss handled two settlements for me with great results and he handled them quickly. He also settled my sister’s case quickly and now her debt is clear. I highly recommend Michael.”

“Agruss Law Firm was very helpful, they helped me solved my case regarding the unwanted calls. I would highly recommend them. Thank you very much Mike Agruss!”

“Agruss Law Firm was very helpful to me and my veteran father! We were harassed daily and even called names for a loan that was worthless! Agruss stepped in and not only did they stop harassing, they stopped calling all together!! He even settled it so I was paid back for the problems they caused!”

Can Jefferson Capital Systems Sue Me?

Although anyone can sue anyone for any reason, we have not seen Jefferson Capital Systems sue consumers, and it’s likely that the agency does not sue because they don’t always own the debt they are attempting to collect, and would also need to hire a lawyer, or use in-house counsel, to file a lawsuit. It’s also likely that the agency collects debt throughout the country, and it would be quite difficult to have lawyers, or a law firm, licensed in every state. However, there are collection agencies that do sue consumers; for example, Midland Credit Management is one of the largest junk-debt buyers, and it also collects and sues on debt. Still, it is less likely for a debt collector to sue you than for an original creditor to hire a lawyer or collection firm to sue you. If Jefferson Capital Systems has threatened to sue you, contact Agruss Law Firm, LLC as soon as possible.

Can Jefferson Capital Systems Garnish my Wages?

No, unless they have a judgment. If Jefferson Capital Systems has not sued you, then the agency cannot get a judgment. Barring limited situations (usually involving debts owed to the government for student loans, taxes, etc.), a company must have a judgment in order to garnish someone’s wages. In short, we have not seen this agency file a lawsuit against a consumer, so the agency cannot garnish your wages, minus the exceptions listed above. If Jefferson Capital Systems has threatened to garnish your wages, contact our office right away.

Jefferson Capital Systems Settlement

If you want to settle a debt with Jefferson Capital Systems, ask yourself these questions first:

Do I really owe this debt?

Is this debt within the statute of limitations?

Is this debt on my credit report?

If I pay this debt, will Jefferson Capital Systems remove it from my credit report?

If I pay this debt, will the original creditor remove it from my credit report?

If I pay this debt, will I receive confirmation in writing from Jefferson Capital Systems for the payment and settlement terms?

These are not the only things to consider when dealing with debt collectors. We are here to help you answer the questions above, and much more. Whether it’s harassment, settlement, pay-for-delete, or any other legal issue with Jefferson Capital Systems, we at Agruss Law Firm are here to help you.

Share your Complaints against Jefferson Capital Systems Below

We encourage you to post your complaints about Jefferson Capital Systems. Sharing your complaints against this agency can help other consumers understand what to do when this company starts calling. Sharing your experience may help someone else!

HERE’S THE DEAL!

If you are being harassed by Jefferson Capital Systems over a debt, you may be entitled to money damages – up to $1,000 for harassment, and $500 – $1,500 for illegal robocalls. Under state and federal laws, we will help you based on a fee-shift provision and/or contingency fee, which means the debt-collector pays your attorneys’ fees and costs. You won’t owe us a dime for our services. We have settled thousands of debt collection harassment cases, and we’re prepared to help you, too. Contact Agruss Law Firm at 888-572-0176 to stop the harassment once and for all.

Are you being harassed by Jefferson Capital Systems, LLC over a debt? Stop the harassment and get money, all without paying for our services. You are protected under the Fair Debt Collection Practices Act (FDCPA), whether or not you owe the debt.

The FDCPA has protected consumers since 1977. This federal law protects you from unfair or abusive debt collection practices through clear rules about what debt collectors may and may not do while collecting a debt, as well as things they must do under law.

Jefferson Capital Systems, LLC is a collection agency that is based in Saint Cloud, MN. The company was established in 1999. This company is a limited liability corporation with several employees.

According to Public Access to Court Electronic Records, over 200 cases have been filed against Jefferson Capital Systems, LLC.

The Better Business Bureau has accredited Jefferson Capital Systems, LLC since 2005. In the last 3 years, the BBB has had 474 complaints against the company, and has closed 176 of these complaints in the last year. Of these 474 complaints, 440 were dealing with billing/collection issues.

Phone numbers associated with Jefferson Capital Systems, LLC are:

320-300-4492, 320-229-8095, 866-805-9214, 800-348-3381, 866-608-5902

Agruss Law Firm, LLC, has helped thousands of consumers stop debt collection harassment. We would like to help you, too. Under the law, we can get the collector to stop harassing you, and get you money damages. Plus, the collector will be responsible for our attorney’s fees and costs. You won’t owe us a dime for our services. Contact us today. We look forward to speaking with you.

The post Stop Jefferson Capital Systems, LLC Debt Harassment appeared first on Agruss Law Firm, LLC.

0 notes