#large inc osc

Text

THE LITTLE THINGS WILL BECOME THE BIG

#lampy sacristuff#sacristuff#osc#osc art#object shows#large inc osc#ive been obsessed with this particular creature

13 notes

·

View notes

Photo

New Post has been published here https://is.gd/GgJXQ3

Hodler’s Digest, February 4–10: Top Stories, Price Movements, Quotes and FUD of the Week

This post was originally published here

Top Stories This Week

Facebook Reportedly Acquires Blockchain Startup in First Blockchain-Related Acquisition

Social media network Facebook has reportedly acquired blockchain startup Chainspace in its first apparent blockchain-related acquisition. According to news outlet Cheddar, the acquisition is considered an “acquihire,” or an acquisition of a company made in order to get the skills or expertise of its staff, as opposed to the company’s service or products. According to Cheddar, four of the five researchers that worked on Chainspace’s academic white paper will be joining Facebook. Facebook had told Cheddar that it had not acquired any of Chainspace’s technology.

Leaked Mt. Gox Info Purports to Show $318 Million in Bitcoin, Bitcoin Cash on BitPoint

According to leaked documents reportedly showing the rehabilitation proceedings of defunct cryptocurrency exchange Mt. Gox, the trustee for the process has sold around $318 million in Bitcoin (BTC) and Bitcoin Cash (BCH) on trading platform BitPoint. The information, which purportedly comes from the Tokyo District Court, shows incomplete scans of transaction at BitPoint, reportedly confirming that Mt. Gox trustee Nobuaki Kobayashi sold coins on a major exchange to repay creditors. CEO of United States exchange Kraken Jesse Powell has previously noted that Kraken’s suggestions for selling coins in an auction or with an OTC broker were not acted on.

Venezuela’s New Crypto Legal Framework Comes Into Force, Doesn’t Mention Petro

Venezuela’s new crypto legislation, which establishes a legal framework for the industry, officially came into force at the end of January. The official set of rules, which makes no mention of the national cryptocurrency Petro, was initially approved by the Constituent National Assembly — an alternative to the country’s Parliament, created in 2017 — in November 2018. The bill lets the national crypto watchdog inspect crypto-related commercial activities in the country. Also this week, Bitcoin trading reached an all-time high in the country amid the hyperinflation and ongoing presidential crisis, above 2,000 BTC on the week.

QuadrigaCX Controversy Continues as Securities Regulator Begins Investigation

As research this week has alleged that major Canadian crypto exchange QuadrigaCX may not have the cold wallet reserves that it had reported, the Ontario Securities Commission (OSC) has initiated a probe into the situation. The exchange had filed for creditor protection after the death of its founder in late December, Gerald Cotten, who allegedly controlled all of the exchange’s funds. Roughly 115,000 customers are without access to their funds, and a court-ordered lawyer will receive the encrypted laptop — which allegedly contains the crypto reserves — from QuadrigaCX representatives as per a court order. Moreover, the crypto exchange’s lawyers are considering selling the company to cover the debts.

BitTorrent Token Sales Sells Out in Under 15 Minutes, Makes Over $7 Million

The BitTorrent token (BTT) sale on the Binance Launchpad platform that concluded earlier this week net $7.1 million with the sale of 50 billion tokens in under 15 minutes. The BTT is based on a Tron TRC-10 token and will be used in order to transact computing resources between BitTorrent clients and other service users. Each token was priced at $0.00012, and were sold on the Binance Launchpad in two simultaneous sessions, one for those using Binance’s native token and the other for those using Tron (TRX).

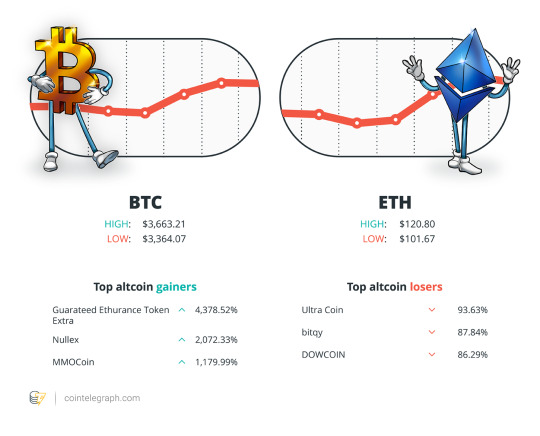

Winners and Losers

The crypto market has seen a slight uptick at the end of the week, with Bitcoin trading at around $3,654, Ripple at about $0.30 and Ethereum at around $117. Total market cap is at about $120 billion.

The top three altcoin gainers of the week are Guaranteed Ethurance Token Extra, Nullex and MMOCoin. The top three altcoin losers of the week are Ultra Coin, bitqy and DOWCOIN.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“I only have bitcoin,”

Jack Dorsey, CEO of Twitter and Square

“Amazon will have to issue a currency sooner or later.”

Changpeng Zhao, CEO of Binance

“There are 2,000 cryptocurrencies out there, 95 percent of them are useless and will die a painful death. The sooner that happens, the better.”

Matt Hougan, Global Head of Research at Bitwise Asset Management and president at ETF.com

“Eventually, do I think someone will satisfy the standards we’ve laid out there? I hope so, yes, and I think so.”

Robert J. Jackson Jr., the SEC’s only Democratic commissioner, speaking about Bitcoin exchange-traded funds

“Thus, transparency and instantaneity are the true strengths of the blockchain, and should generate not only significant time savings and increased security, but also significant [financial] savings.”

Béatrice Collot, Head of Global Trade and Receivable Finance at multinational banking giant HSBC

“We need a change in our laws and that requires more interaction with lawmakers and regulators. We need to make Switzerland open and easy for companies to invest in blockchain projects.”

Daniel Haudenschild, recently elected president of the Swiss Crypto Valley Association

FUD of the Week

US Lawsuit Alleged Investment Group Duped Investor Into $2 Million Token Purchase

A U.S. lawsuit this week has alleged that New York-based investment group Blue Ocean Capital Group Inc. had misled plaintiff Lijun Sun to purchase $2 million of the cryptocurrency MCash. The lawsuit notes that the MCash token was not properly registered with the U.S. securities regulators, and that the investment materials provided to Sun did not accurately represent the token or its terms of purchase. Sun has asked for a return of his investment as well as damages worth $6 million.

Zcash Discloses Already Fixed Vulnerability That Permitted Unlimited ZEC Counterfeiting

An official blog post from Zcash reported this week on the patching of a vulnerability that could have allowed an attacker to create infinite Zcash (ZEC). According to the post, the vulnerability was discovered in March 2018 by one of the Zcash developers. A solution for the problem was covertly included (in order to prevent exploitation by bad actors) in the Sapling network upgrade that was adopted last October. Since the variant of zk-SNARKs that contained the bug was implemented by other projects, Zcash noted that these projects have also taken appropriate actions.

Winklevii vs. Shrem: Judge Rules Twins Must Pay $45,000 in Shrem’s Legal Fees

A judge has ruled that Tyler and Cameron Winklevoss must pay $45,000 of crypto entrepreneur Charlie Shrem’s legal fees as part of an ongoing lawsuit. In the proceedings, the Winklevoss twins have previously instigated an investigation and asset freeze on Shrem after accusing the entrepreneur of failing to pay back 5,000 BTC from a 2013 trade deal. Shrem’s lawyer has denied the accusations, and a judge has removed the asset freeze. According to media reports, the lawsuit will cover new ground in June.

Best Cointelegraph Features

‘The NEM Foundation You Knew Before Is Gone,’ What Is Next?

After the NEM Foundation released an announcement this week about the state of their funds, revealing that they only had about a month of operations left, the crypto community has been questioning how things got to this point. Cointelegraph looks at the history of the Foundation and how this financial disaster could have come about.

Forbes ‘Fintech 50’ List, Reviewed: New Players, Veterans and Startups Which Didn’t Make the Cut

Forbes’ latest edition of “Fintech 50” has been released, this time with only six crypto and blockchain companies, as opposed to last year’s 11. Cointelegraph examines what made these companies stand out even amid the crypto bear market.

QuadrigaCX Is Filing for Creditor Protection Amid Liquidity Crisis, Community Remains Largely Skeptical

As the controversy around embattled Canadian crypto exchange QuadrigaCX deepens, Cointelegraph gives a rundown of the exchange’s legal history, current legal problems, and some of the questions raised concerning the death of its founder and the locations of its cold wallet reserves.

How We Will Remember the Year of the Dog? ICO Market Decline, Trend Toward Compliance and Other Takeaways

And happy Chinese New Year to all our Hodler’s who celebrated this week! We here at Cointelegraph looked at all of the major events that have taken place during the Year of the Yellow Mountain Dog.

#crypto #cryptocurrency #btc #xrp #litecoin #altcoin #money #currency #finance #news #alts #hodl #coindesk #cointelegraph #dollar #bitcoin View the website

New Post has been published here https://is.gd/GgJXQ3

0 notes

Text

E-COMMERCE DEVELOPMENT COMPANIES IN VIETNAM: TOP 7 BEST YOU SHOULD KNOW

Are you hunting down lists for Vietnamese E-Commerce developers? On the off chance that you are, we present to you a rundown of Top E-Commerce Development Companies from Vietnam, that can help you with the setting up of your digital store.

Considered to be young when the turnover reached nearly 62 million USD with about 5,000 engineers in 2003, after 15 years of development, Vietnam’s software industry has reached a turnover of over 8.8 billion USD, a growth of more than 1,000 times, with more than 200,000 engineers working in the field. This is a substantial foundation that enables the Vietnamese E-commerce Development sector to grow fruitfully throughout the decade.

Possessing a sizable qualified workforce, along with dynamic spirit to master technology, many Vietnamese E-commerce Development companies have strived to earn their reputable position with both domestic and international clients. Let’s take a look at these seven high-ranking candidates listed below and see who is going to be the next partner on your future corporate project.

1. SmartOSC

Smart OSC which was established in 2006 is a premium, full-service e-commerce development company for leading brands and e-tailers. SmartOSC has built its reputation through a very focus on e-commerce. Currently, Smart OSC has more than 500 employees and 6 offices in 5 countries (Vietnam, Australia, Japan, Singapore, the US, and the UK). SmartOSC is also well-known for being chosen as a local organizer of the Meet Magento conference which provides the perfect setting to connect with the best minds and the freshest ideas within the Magento ecosystem.

E-Commerce Service: The company offers a complete solution including Consulting, UI Design, Technology, and Managed Services.

E-commerce Platforms: Magento, Shopify, Adobe, BigCommerce, Amazon.

Size: 500+ employees

Location: Vietnam, Australia, Japan, Singapore, the US, the UK

Hourly rate: N/I

If you are finding a partner which 100% focuses on E-Commerce with many years of experience working with global customers, Smart OSC is without a doubt an agency you should take into consideration.

2. CO-WELL Asia

CO-WELL Asia has been growing steadily since being founded in Vietnam in 2011. More than 450 employees work in 2 Vietnamese offices: Hanoi and Da Nang, and nearly 100 staff work in Tokyo and Miyazaki, Japan. More than 250 software development projects have been undertaken for global customers including E-Commerce, Business Solutions, AR-VR, and Software Testing. 80% of these projects are for large enterprise customers.

Ecommerce service: Magento & Shopify integration, Magento extension development, Functionality enhancement & customization, E-Commerce website design and development, E-Commerce performance optimization, E-Commerce mobile app development. (Other services: Web & App development, Business Solution, AR&VR, Testing services)

E-Commerce Platforms: Magento, Shopify

Size: 500+ employees

Location: Hanoi, Danang, Tokyo, Miyazaki

Hourly rate: < $25

Key Client: AEON.com, IDOM Inc., GDO, Diamond head, JMAS, WeatherNews, JAST, Amanaimages, Tsutaya, Kokuyo, Tokai, Will Group, etc.

Customer reviews about CO-WELL Asia:

CO-WELL has received several positive reviews on different customer review sites:

“Their team was not only skillful but also dedicated and professional. Each step was completed perfectly. When the scope of work expanded, the team did not hesitate to double their efforts to support us”

“We value CO-WELL’s team high capacity and professional working manner. They quickly responded and supported us every time we needed. The new systems is currently operating quite well. We are satisfied with their services”

Customer reviews about CO-WELL services on Goodfirms.co

Customer reviews about CO-WELL services on Clutch.co

Reasonable price, together with a long list of high-profile Japanese and Vietnamese clients and positive customer reviews, CO-WELL Asia is surely a candidate that you should take into account when searching for a trusted Vietnamese E-commerce Development company.

3. Magenest JSC

Founded in 2015, Magenest is an e-commerce developer which has been providing world-class business and technology solutions to customers from all over the world. It has grown into a global strategic partner of Magento, Odoo, Amazon Web Services, and Salesforce. Currently, it has offices located in Hanoi, Ho Chi Minh City, and Australia.

E-commerce Service: Magento 2 Development, Magento Integrations, Post-launch Service, Design, Advisory, Digital Marketing

Platforms: Magento, WooCommerce

Size: 50 – 249 employees

Location: Hanoi, Ho Chi Minh City, Australia

Hourly rate: $25 – $49

Client: Heineken, Bibo Mart, Mobiphone, Nestle, etc.

Although being a newly-formed e-commerce developer, Magenest has proved its capacity

via a list of giant Vietnamese customers

4. Tigren

Tigren Solutions is a Magento web design and development company founded in 2012. They provide a wide range of Magento development services, especially Magento website development and Magento e-commerce apps development. Besides, they possess a bank of high-quality Magento extensions that all stores desire.

E-Commerce Service: Magento web design, Magento web development, Magento migration, Magento 2 PWA migration, Magento mobile app development, Magento performance optimization.

Platforms: Magento.

Office: Hanoi, Vietnam.

Size: 50 – 249 employees

Hourly rate: $25 – $59

Clients: Big One Solutions, Dr. John’s candies, Magrin Frames, Stock in the Channel, Croft, etc.

Customer reviews about Tigren:

Customer reviews about Tigren services on Clutch.co

Tigren received many customer reviews on customer review sites: “They went above and beyond what was originally agreed, some elements were needed and extra payment was needed. However, many extra helpful aspects were added to ensure a quality project. Tigren provided 24-hour support, Magento expertise, SEO, branding, promotional and marketing expertise. We even paid more than originally quoted because we were so impressed with the work completed by Tigren E-commerce Solutions.”

In spite of owning only one office with a humble number of employees, Tigren still leaves the impression of an e-commerce development company that received a lot of positive feedback about its services and quality.

5. Canary Software

Founded in 2014, Canary Software is a young company with 5 years of experience. They have cooperated with more than 10 clients and undertaken 50 projects. Canary focuses on PHP, Symfony, and Magento.

E-Commerce Service: Magento Development (Other services: Web development, Mobile app development, Symfony development, Laravel development, WordPress development)

Platforms: Magento

Size: 10 – 49 employees

Hourly rate: <$25

Client: atonce, Build Top Lux, nPloy, Locket, etc.

Customer review about Canary Software

Canary Software is a young company so it offers customers high-quality services at a very competitive price. If your project is not too huge and the budget is small to medium, Canary Software is without a doubt a good choice that you should take into consideration.

6. Happy Points

HappyPoints was established in 2013 in Vietnam and specialized in Shopify e-Commerce platform. They offered a wide range of services including Shopify store setup, migrating to Shopify, theme tweaks, theme development, speed optimization, QA service.

E-Commerce Service: Shopify Development

Platforms: Shopify

Size: 10-49 employees

Hourly rate: $25 – $49

Client: One Earth Health, Enterprise Evolution, Run Forever Sports.

Customer review about Happy Points

7. Nexle Corporation

Nexle is a global information technology, consulting and outsourcing company with 50+ workforce. The agency specializes in embedded applications, mobile application development, AI, IoT, and web application development.

E-Commerce Service: Magento Development (Other services: Web development, Mobile app development, Symfony development, Laravel development, WordPress development)

Platforms: Magento

Size: 50 – 249 employees

Hourly rate: <$25

Client: AIA E-Commerce, LIGHTBOX RADIOLOGY

Customer review about Nexle Corporation

Conclusion

All in all, it is going to be a long and hard process to select the most suitable e-commerce development company for your business. Choose such an e-commerce development company that fulfills your basic requirements and is in the budget. Also, make sure that they use the most suitable technologies and complete the project in the time frame. Do not be in a hurry, contact 3 to 4 e-commerce developers that are appropriate and make up your mind after getting to know about them in detail.

Bài viết E-COMMERCE DEVELOPMENT COMPANIES IN VIETNAM: TOP 7 BEST YOU SHOULD KNOW đã xuất hiện đầu tiên vào ngày Cowell Asia.

source https://co-well.vn/en/tech-blog/e-commerce-development-companies-in-vietnam-top-7-best-you-should-know/

0 notes

Text

Dalton McGuinty is back preaching ‘green’ again — whether Ontario wants him or not

Dalton McGuinty is being spotted in public again. The former Ontario premier has apparently spent the last year trying to book dates for his university lecture tour “Climate Change: Can We Win This? Be Honest.” He has already addressed audiences at University of Toronto, Queens and more recently at the University of Windsor. He is scheduled to appear at Western University on March 23. Get those tickets while you can.

Maybe someone else in Ontario thought we needed our own C-list version of Al Gore. It would seem McGuinty thought so. After resigning as premier in October 2012 amid his government’s gas-plant scandal — for which his former chief of staff would eventually serve prison time — McGuinty had for the last several years wisely stayed largely low profile. But as the Trudeau government is showing in cranking up its climate campaigning this week in hopes of distracting us from its own scandals, Liberals often think talking about global warming will make people forgive, or at least forget sleazy behaviour. The prime minister’s principal secretary, Gerald Butts, even said as much in his letter resigning over the SNC-Lavalin scandal, when he wrote, “Our kids and grandkids will judge us on one issue above all others. That issue is climate change.” What do trivial scandals about government corruption matter when the atmosphere might be warming up a bit?

Perhaps McGuinty hopes Ontarians have also forgotten not only the gas-plant scandal and the subsequent criminal trials, but all the other policy transgressions: His promise of no tax increases, followed by the imposition of a health tax; the Green Energy and Green Economy Act (GEA), which resulted in Ontario having the highest electricity prices in Canada; and a doubling of Ontario’s debt. There were others.

Gerald Butts still denies responsibility for a bigger scandal: Ontario’s ‘green energy’ catastrophe

Philip Cross: StatCan just exposed how worthless ‘green’ industries are to Canada’s economy

Kevin Libin: Alberta’s now copying Ontario’s disastrous electricity policies. What could go wrong?

McGuinty himself was never charged with any crimes; his staffers were. But his seminars demonstrate that he remains fixated on the “climate change” obsession that put Ontario on such a calamitous path in the first place (thanks in large part to the aforementioned Butts, who worked for McGuinty and helped turn his image into the “green” premier). Still, McGuinty says Ontario still must sacrifice more for the climate, even now.

In a CTV news report on his speech to the University of Windsor (about 100 people reportedly showed up) he insisted that Ontario must embrace the carbon tax, recently cancelled by the current Progressive Conservative government. “It’s the most effective and efficient way to demonstrate a commitment to addressing climate change,” he said. Now he tells us — years after upending Ontario’s electricity grid with overpriced renewals. Apparently Ontario’s taxpayers are bottomless pits of surplus cash to spend on endless green experiments.

But in reality not everyone has the earning opportunities McGuinty has enjoyed after leaving politics. Since resigning, he’s accepted board appointments to several corporations: Innergex Renewable Energy Inc., Pomerleau Inc., and Electrovaya Inc. He also became a lobbyist for Desire2Learn as well as being appointed its “special adviser.” As a man who knows well how businesses can benefit from government dealings (just ask the holders of those rich, above-market renewable-energy contracts McGuinty’s government signed) he had to have been a good get.

When McGuinty was premier, Desire2Learn, maker of educational software, received a $4.25 million provincial grant and another $3 million from the education ministry. Battery-maker Electrovaya got a $17 million dollar grant from the McGuinty government in 2009. After McGuinty resigned, he was discovered to be lobbying the government of his successor, Kathleen Wynne, on behalf of Desire2Learn. After the lobbying was discovered by reporters, a representative of McGuinty’s promised he would henceforth properly register as a lobbyist.

Pomerleau Inc., another company that appointed McGuinty to its board, post-politics, is a private civil works and building company based in Quebec. They have had good luck winning contracts in Ontario, including those involving provincial government funding.

And when McGuinty joined the Electrovaya board in April 2017, the company was being investigated by the Ontario Securities Commission (OSC) over improper disclosure issues, including allegations of “unbalanced” news releases and a failure to disclose that “revenue estimates announced in two previously announced commercial arrangements would not be realized.” A little over two months later, the OSC agreed to settle in a deal that ended up with just the CEO paying a $250,000 penalty and the company promising to appoint an independent chair of the board.

Still, not all of McGuinty’s board business would appear to be so intricately tied up with his former associates in the province’s government ministries and regulators. Innergex Renewable Energy Inc., headquarted in Montreal, only has a small footprint in Ontario: one solar generation unit of 33.2 megawatts and three small hydro generation units totalling 36 megawatts. It only gets six per cent of its revenue from Ontario. So clearly McGuinty’s value to a company is more than just what doors he can open at Queen’s Park.

And those doors may not open so easily anymore, anyway. The Liberals have no power anymore. McGuinty’s once-proud party was beaten down to a meagre rump in the legislature in last year’s provincial election after so many of his (and Wynne’s) ill-conceived policies ended up proving disastrous. Especially the climate ones.

Perhaps that’s why McGuinty has taken lately to trying to rehabilitate his reputation by presenting himself to the younger generation and university audiences as just a father and grandfather who’s worried about climate change. Maybe it will work. But most Ontarians will probably still recognize him as that guy who did so much damage to the province.

Parker Gallant is a retired bank executive who looked at his hydro bill and didn’t like what he saw.

from Financial Post https://ift.tt/2UqwBAe

via IFTTT Blogger Mortgage

Tumblr Mortgage

Evernote Mortgage

Wordpress Mortgage

href="https://www.diigo.com/user/gelsi11">Diigo Mortgage

0 notes

Text

Top Stories, Price Movements, Quotes and FUD of the Week

Top Stories This Week

Facebook Reportedly Acquires Blockchain Startup in First Blockchain-Related Acquisition

Social media network Facebook has reportedly acquired blockchain startup Chainspace in its first apparent blockchain-related acquisition. According to news outlet Cheddar, the acquisition is considered an “acquihire,” or an acquisition of a company made in order to get the skills or expertise of its staff, as opposed to the company’s service or products. According to Cheddar, four of the five researchers that worked on Chainspace’s academic white paper will be joining Facebook. Facebook had told Cheddar that it had not acquired any of Chainspace’s technology.

Leaked Mt. Gox Info Purports to Show $318 Million in Bitcoin, Bitcoin Cash on BitPoint

According to leaked documents reportedly showing the rehabilitation proceedings of defunct cryptocurrency exchange Mt. Gox, the trustee for the process has sold around $318 million in Bitcoin (BTC) and Bitcoin Cash (BCH) on trading platform BitPoint. The information, which purportedly comes from the Tokyo District Court, shows incomplete scans of transaction at BitPoint, reportedly confirming that Mt. Gox trustee Nobuaki Kobayashi sold coins on a major exchange to repay creditors. CEO of United States exchange Kraken Jesse Powell has previously noted that Kraken’s suggestions for selling coins in an auction or with an OTC broker were not acted on.

Venezuela’s New Crypto Legal Framework Comes Into Force, Doesn’t Mention Petro

Venezuela’s new crypto legislation, which establishes a legal framework for the industry, officially came into force at the end of January. The official set of rules, which makes no mention of the national cryptocurrency Petro, was initially approved by the Constituent National Assembly — an alternative to the country’s Parliament, created in 2017 — in November 2018. The bill lets the national crypto watchdog inspect crypto-related commercial activities in the country. Also this week, Bitcoin trading reached an all-time high in the country amid the hyperinflation and ongoing presidential crisis, above 2,000 BTC on the week.

QuadrigaCX Controversy Continues as Securities Regulator Begins Investigation

As research this week has alleged that major Canadian crypto exchange QuadrigaCX may not have the cold wallet reserves that it had reported, the Ontario Securities Commission (OSC) has initiated a probe into the situation. The exchange had filed for creditor protection after the death of its founder in late December, Gerald Cotten, who allegedly controlled all of the exchange’s funds. Roughly 115,000 customers are without access to their funds, and a court-ordered lawyer will receive the encrypted laptop — which allegedly contains the crypto reserves — from QuadrigaCX representatives as per a court order. Moreover, the crypto exchange’s lawyers are considering selling the company to cover the debts.

BitTorrent Token Sales Sells Out in Under 15 Minutes, Makes Over $7 Million

The BitTorrent token (BTT) sale on the Binance Launchpad platform that concluded earlier this week net $7.1 million with the sale of 50 billion tokens in under 15 minutes. The BTT is based on a Tron TRC-10 token and will be used in order to transact computing resources between BitTorrent clients and other service users. Each token was priced at $0.00012, and were sold on the Binance Launchpad in two simultaneous sessions, one for those using Binance’s native token and the other for those using Tron (TRX).

Winners and Losers

The crypto market has seen a slight uptick at the end of the week, with Bitcoin trading at around $3,654, Ripple at about $0.30 and Ethereum at around $117. Total market cap is at about $120 billion.

The top three altcoin gainers of the week are Guaranteed Ethurance Token Extra, Nullex and MMOCoin. The top three altcoin losers of the week are Ultra Coin, bitqy and DOWCOIN.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“I only have bitcoin,”

Jack Dorsey, CEO of Twitter and Square

“Amazon will have to issue a currency sooner or later.”

Changpeng Zhao, CEO of Binance

“There are 2,000 cryptocurrencies out there, 95 percent of them are useless and will die a painful death. The sooner that happens, the better.”

Matt Hougan, Global Head of Research at Bitwise Asset Management and president at ETF.com

“Eventually, do I think someone will satisfy the standards we’ve laid out there? I hope so, yes, and I think so.”

Robert J. Jackson Jr., the SEC’s only Democratic commissioner, speaking about Bitcoin exchange-traded funds

“Thus, transparency and instantaneity are the true strengths of the blockchain, and should generate not only significant time savings and increased security, but also significant [financial] savings.”

Béatrice Collot, Head of Global Trade and Receivable Finance at multinational banking giant HSBC

“We need a change in our laws and that requires more interaction with lawmakers and regulators. We need to make Switzerland open and easy for companies to invest in blockchain projects.”

Daniel Haudenschild, recently elected president of the Swiss Crypto Valley Association

FUD of the Week

US Lawsuit Alleged Investment Group Duped Investor Into $2 Million Token Purchase

A U.S. lawsuit this week has alleged that New York-based investment group Blue Ocean Capital Group Inc. had misled plaintiff Lijun Sun to purchase $2 million of the cryptocurrency MCash. The lawsuit notes that the MCash token was not properly registered with the U.S. securities regulators, and that the investment materials provided to Sun did not accurately represent the token or its terms of purchase. Sun has asked for a return of his investment as well as damages worth $6 million.

Zcash Discloses Already Fixed Vulnerability That Permitted Unlimited ZEC Counterfeiting

An official blog post from Zcash reported this week on the patching of a vulnerability that could have allowed an attacker to create infinite Zcash (ZEC). According to the post, the vulnerability was discovered in March 2018 by one of the Zcash developers. A solution for the problem was covertly included (in order to prevent exploitation by bad actors) in the Sapling network upgrade that was adopted last October. Since the variant of zk-SNARKs that contained the bug was implemented by other projects, Zcash noted that these projects have also taken appropriate actions.

Winklevii vs. Shrem: Judge Rules Twins Must Pay $45,000 in Shrem’s Legal Fees

A judge has ruled that Tyler and Cameron Winklevoss must pay $45,000 of crypto entrepreneur Charlie Shrem’s legal fees as part of an ongoing lawsuit. In the proceedings, the Winklevoss twins have previously instigated an investigation and asset freeze on Shrem after accusing the entrepreneur of failing to pay back 5,000 BTC from a 2013 trade deal. Shrem’s lawyer has denied the accusations, and a judge has removed the asset freeze. According to media reports, the lawsuit will cover new ground in June.

Best Cointelegraph Features

‘The NEM Foundation You Knew Before Is Gone,’ What Is Next?

After the NEM Foundation released an announcement this week about the state of their funds, revealing that they only had about a month of operations left, the crypto community has been questioning how things got to this point. Cointelegraph looks at the history of the Foundation and how this financial disaster could have come about.

Forbes ‘Fintech 50’ List, Reviewed: New Players, Veterans and Startups Which Didn’t Make the Cut

Forbes’ latest edition of “Fintech 50” has been released, this time with only six crypto and blockchain companies, as opposed to last year’s 11. Cointelegraph examines what made these companies stand out even amid the crypto bear market.

QuadrigaCX Is Filing for Creditor Protection Amid Liquidity Crisis, Community Remains Largely Skeptical

As the controversy around embattled Canadian crypto exchange QuadrigaCX deepens, Cointelegraph gives a rundown of the exchange’s legal history, current legal problems, and some of the questions raised concerning the death of its founder and the locations of its cold wallet reserves.

How We Will Remember the Year of the Dog? ICO Market Decline, Trend Toward Compliance and Other Takeaways

And happy Chinese New Year to all our Hodler’s who celebrated this week! We here at Cointelegraph looked at all of the major events that have taken place during the Year of the Yellow Mountain Dog.

window.fbAsyncInit = function() { FB.init({ appId : '1922752334671725', xfbml : true, version : 'v2.9' }); FB.AppEvents.logPageView(); }; (function(d, s, id){ var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) {return;} js = d.createElement(s); js.id = id; js.src = "http://connect.facebook.net/en_US/sdk.js"; js.async = true; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk')); !function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)}; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '1922752334671725'); fbq('track', 'PageView');

This news post is collected from Cointelegraph

Recommended Read

New & Hot

The Calloway Software – Secret Weapon To Make Money From Crypto Trading (Proofs Inside)

The modern world is inextricably linked to the internet. We spend a lot of time in virtual reality, and we're no longer ...

User rating:

9.6

Free Spots are Limited Get It Now Hurry!

Read full review

Editors' Picks 2

BinBot Pro – Its Like Printing Money On Autopilot (Proofs Inside)

Do you live in a country like USA or Canada where using automated trading systems is a problem? If you do then now we ...

User rating:

9.5

Demo & Pro Version Get It Now Hurry!

Read full review

The post Top Stories, Price Movements, Quotes and FUD of the Week appeared first on Review: Legit or Scam?.

Read more from → https://legit-scam.review/top-stories-price-movements-quotes-and-fud-of-the-week-5

0 notes

Link

Persistence Market Research has published a new report titled “Automotive Condenser Market: Global Industry Analysis (2012 – 2016) and Forecast (2017 – 2025)” that tracks the performance of the global automotive condenser market for a period of eight years from 2017 to 2025. According to this report, manufacturers are focusing on the introduction of new application-specific product offerings in order to better address customer specific requirements. Moreover, market players are found to be directing their efforts towards strengthening their distribution channels while focusing on direct sales. One of the key insights from the report focuses on the strategies employed by market companies to enhance product quality by implementing new technologies and adopting new, tough and long lasting materials with added features at a competitive price point, while at the same time maintaining a steadfast focus on vehicle safety. The global automotive condenser market is anticipated to grow at a CAGR of 4.9% during the projected period.

Global Automotive Condenser Market: Trends

Growing life-span of used automobiles to boost the aftermarket sales of automotive condensers, especially in the North America market

Use of aluminum material condenser is one of the prominent trends in the global automotive condenser market

Manufacturers are focusing on providing high quality automotive condensers in the global market

Automotive condenser manufacturers are engaged in extensive research and development activities to fulfill the demands of consumers

Global Automotive Condenser Market: Forecast by Material

By material type, the global automotive condenser market is segmented into copper, brass, aluminum and stainless steel. Aluminum segment is estimated to be most attractive segment by material. The aluminum segment is estimated to gain a prominent market share over the forecast period owing to the novel properties of aluminum such as lightweight feature, corrosion resistance, superior aesthetics, easy manufacturability and good conductivity. The aluminum segment is estimated to dominate the global automotive condenser market with 81.3% market value share during the assessed period.

Request Sample Report@ https://www.persistencemarketresearch.com/samples/15478

Global Automotive Condenser Market: Forecast by Type

The type segment of the global automotive condenser market comprises single flow, tube & fin, serpentine, parallel flow and sub cool flow. The parallel flow segment remains lucrative and will dominate global market demand over the forecast period, primarily due to the fact that these condensers offer longer life and efficient HVAC comfort for passengers and the driver in real-time working conditions. Sales revenue of the parallel flow segment is estimated to be valued at US$ 10,119.6 Mn by 2025 end.

Global Automotive Condenser Market: Forecast by Sales Channel

OEM and aftermarket are the two segments included in the segmentation by sales channel. The OEM segment is estimated to hold more than 90% of the total market value share during the forecast period. The OEM segment is expected to create a total incremental opportunity of US$ 3,819.2 Mn between 2017 and 2025.

Global Automotive Condenser Market: Forecast by Vehicle Type

By vehicle type, the global automotive condenser market is segmented into passenger car, LCV, and HCV. The passenger car segment is anticipated to provide increased opportunities in the global market, owing to the growing consumer preference for advanced automotive condensers.

Global Automotive Condenser Market: Forecast by Region

The five geographies of North America, Latin America, Europe, APAC and MEA have been covered in this report. APAC is a prominent regional market for automotive condensers and is anticipated to dominate the global market in terms of demand, followed by Europe. Noteworthy increase in sales across markets such as China, India, Mexico and Turkey is expected over forecast period. Developed regions are projected to hold significant market share in the global automotive condenser market with a large contribution expected from North America and Europe. The market in these regions is anticipated to grow substantially in terms of value and volume over the forecast period.

Request Report TOC@ https://www.persistencemarketresearch.com/methodology/15478

Global Automotive Condenser Market: Key Players

Some of the players functioning in the global automotive condenser market are Subros Ltd., Denso Corporation, Delphi Automotive PLC, Robert Bosch GmbH, MAHLE GmbH, Hanon Systems Valeo SA, Modine Manufacturing Company, Standard Motor Products, Inc., Keihin Corporation, Calsonic, Kansei Corporation, Sanden Philippines, Air International Thermal Systems, Reach Cooling Group, OSC Automotive Inc., Japan Climate Systems Corporation, and KOYORAD Co., Ltd.

0 notes

Text

Automotive Evaporator Market: Worldwide Industry Analysis and New Market Opportunities Explored

The automotive evaporator is a part of the HVAC (Heating, Ventilation, and Cooling) system. It is a heat exchanger system in which the refrigerant runs through a tube, in liquid form, at low temperature and leaves the tube at higher temperature. The refrigerant absorbs heat from the hot air and leaves it as cold air for its utilization in the air conditioning and freezing system.

The market for automotive evaporator is anticipated to expand during the forecast period owing to the rising penetration of the HVAC system in all regions across the globe. A large share of the commercial vehicles in developing regions were not installed with the air conditioning and refrigeration system; however, the penetration is presently rising owing to the increasing purchase power parity in society. Stringent norms and regulations for driver cabin in some regions are likely to boost the demand for the automotive evaporator system. Increasing production of vehicles, globally, is anticipated to be a major factor driving the automotive evaporator market.

The automotive evaporator market can be segmented based on technology, material, sales channel, vehicle, and region.

Based on technology, the serpentine flow segment is expected to hold a major share of the market owing to being a conventional technology and possessing a higher lifespan as compared to other technologies. However, the parallel flow technology segment is likely to expand at a significant pace during the forecast period owing to its high efficiency, as compared to the serpentine flow technology. High cost of manufacturing, high maintenance, and more complex structure of the parallel flow evaporator are key factors restraining the parallel flow evaporator segment.

Get PDF Brochure https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=44264

Based on material, the aluminum material segment is likely to hold a major share of the automotive evaporator market. Copper is conventional material utilized for the manufacturing of automotive evaporator; however, its market share has been decline in recent years due to its higher cost, as compared to aluminum. Aluminum possess good heat conductivity and is more cost-effective than other materials, which in turn is responsible for its major share of the automotive evaporator market. The segment is likely to expand at a significant growth rate during the forecast period.

Based on sales channel, the aftermarket segment is likely to account for a prominent share of the automotive evaporator market owing to its high replacement rate through the lifespan of the vehicle. The automotive evaporator used in commercial vehicles is replaced frequently, as commercial vehicles usually travel longer distances on a daily basis in drastic weather conditions.

In terms of vehicle type, the automotive evaporator market can be segregated into passenger and commercial vehicles. The passenger vehicles segment is likely to account for a major share of the automotive evaporator market owing to the high production of the passenger vehicles as compared to commercial vehicles. However, the automotive evaporator utilized in commercial vehicles is replaced more frequently.

Get ToC Of Report https://www.transparencymarketresearch.com/sample/sample.php?flag=T&rep_id=44264

Based on region, the automotive evaporator market can be segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific is anticipated to hold a notable share of the global market owing to the high production of vehicles in the region. Availability of low cost labor and raw materials has attracted most global manufacturers to establish their manufacturing facilities in the region, which in turn has propelled the production of vehicles in the region, as compared to other regions.

Key players operating in the global automotive evaporator market include Denso Corporation, Robert Bosch GmbH, MAHLE GmbH, Valeo, OSC Automotive Inc., Subros Limited, and SEASONAIR.

0 notes

Text

Recent GAO Decision Suggests SBA Regulation Regarding Limitations on Subcontracting Takes Precedence Over the FAR

When an agency decides to set aside an acquisition for participation only by small businesses, certain subcontracting limitations apply to the small business awardee. For construction contracts, the small business contractor cannot pay subcontractors more than 85% of the amount they receive from the agency. For service and supply contracts, the small business contractor cannot pay more than 50% of the amount paid to it by the agency to other entities that are not similarly situated. Work performed by similarly situated entities is not considered in determining if the limitation on subcontracting is violated. A similarly situated entity is defined as a small business subcontractor that is a participant of the same small business program as the prime contractor and is small for the NAICS code assigned by the prime contractor to the subcontract.

There is a lot of confusion regarding the current state of the law when it comes to limitations on subcontracting. This is largely because the FAR’s limitations on subcontracting provisions have not been updated to correspond with the statutory changes that were made by Congress in the FY 2013 NDAA. The FY 2013 NDAA changed the way that compliance with the limitations on subcontracting provisions is calculated, shifting from formulas that were based on the cost of contract performance (cost of personnel and cost of manufacturing) to formulas that are based on the amount paid by the agency. This confusion is compounded by the fact that the SBA’s new regulation, which incorporates and implements the statutory changes, went into effect on June 30, 2016.

In a recent bid protest, the GAO had an opportunity to address the limitations on subcontracting issue head on but instead elected to deny the protest, as being a matter of contract administration, without first clarifying whether the FAR or the SBA regulation governs. In that case, the GAO issued a decision suggesting that the changes implemented by the SBA regulation took precedence over the FAR despite the fact that the service contract in question contained FAR 52.219-14, which expressly points to the total cost of contract performance and not the total amount paid by the agency. Specifically, when discussing the awardee’s Management Approach, the GAO noted, “[t]he agency explains that since the value of the contract awarded to OSC was $44,290,359, OSC’s proposal indicated that it would perform 56.5 percent of the required effort with its own employees, which is compliant with the limitations on subcontracting clause.” This language clearly shows that both the agency and the GAO applied the new limitations on subcontracting formula, which considers the amount paid by the agency, instead of the old formula, which considers the cost of personnel. Synaptak Corporation, Inc., B-415917.5, B-415917.6, Sept. 24, 2018.

The entire GAO decision can be found here.

Recent GAO Decision Suggests SBA Regulation Regarding Limitations on Subcontracting Takes Precedence Over the FAR syndicated from https://riverfrontresidences.wordpress.com/

0 notes

Text

Canada Delays Regulation of Cryptocurrencies and Blockchain Companies

The Canadian government has postponed the release of its final regulations for cryptocurrency and blockchain companies. The final published regulations were due this fall, but the government now says they won’t be published in the Canada Gazette until late 2019.

Because the federal government is already in pre-election mode ahead of the 2019 election, the final cryptocurrency or “virtual currency” regulations have effectively been put on hold, leaving the current regulatory regime in place until well into 2020, as there is an additional 12-month period after publication for any new regulations to take effect.

Some companies in the space see this as a positive for the industry’s competitiveness as the government is effectively backing away from the stricter rules proposed in the draft version published in June 2018.

Others are concerned that this delay will harm their competitive position in the quickly growing international crypto market, where countries like Switzerland and Malta are actively encouraging crypto businesses with few regulations and a favorable tax regime.

The Blockchain Association of Canada (BAC) told Bitcoin Magazine that it appreciates that the government is proceeding with caution, in recognition of the complexities of this new, evolving sector.

“The decision to delay the proposed regulations bodes well for the Canadian blockchain and cryptocurrency space. The government is committed to an innovation agenda and sometimes … it may be best to observe and intervene as little as possible,” said BAC Executive Director Kyle Kemper.

Large Volume of Submissions From the Crypto Sector

According to a number of participants, the sheer volume and quality of the comments and responses by the industry to the proposed regulatory package likely contributed to the government's decision to hold off on publishing until next year.

Cryptocurrencies and blockchain companies and organizations, like the Money Services Business Association, were invited to submit comments and attend meetings with Finance Canada officials.

BRI Calls for a Central Regulatory Body Comparable to the SEC

One set of comments submitted to the federal finance department included a report from the influential Toronto-based Blockchain Research Institute (BRI).

The BRI assembled a round table of 70 participants from the industry and submitted a report with carefully thought out, detailed recommendations.

The report says there’s substantive regulatory work that needs to be done to create certainty and build a competitive industry, although the participants called for a middle ground, saying:

“... as the blockchain revolution unfolds, regulators would be wise to avoid the chainsaw when microsurgery could do. To be sure, we do not want the Wild West.”

The BRI report points out that Canada is the only developed federal democracy that does not have a securities regulatory authority at the federal government level and recommends creating a central regulatory body at the federal level like the U.S. Securities and Exchange Commission (SEC).

Instead, “ten provinces, three territories, and the federal government all juggle responsibility for ensuring capital market functions efficiently and honestly — attempting to keep a watchful eye on issuers, investors, investment dealers and other market players.”

“This model was set up to oversee a much simpler world where there were actual traders on stock exchange floors, and where the pace of innovation in capital markets was glacial and regionally confined,” adds the report.

Continuing Uncertainty in the Crypto Sector

Coinsquare Exchange CEO Cole Diamond, as a member of the BRI’s Advisory Committee, made the case for more regulatory clarity. He told Bitcoin Magazine:

“I don’t think that delaying regulatory clarity is a good thing. At the same time, I understand how complex this market is. The regulators are still learning, and I can assure everyone that they are trying.”

“My hat goes off to the OSC Launchpad, the Ministry of Finance and others for their focus on the market. We look forward to continuing to work with them to bring about opportunities for Canadian businesses to lead globally in this exciting space.”

Evan Thomas, a Toronto-based lawyer working with crypto startups on regulations and compliance, also thinks that there needs to be some serious work done on regulating cryptocurrencies and blockchain companies.

Thomas told Bitcoin Magazine:

“Delay can put Canadian businesses at a competitive disadvantage. Other jurisdictions are moving more quickly to establish regulatory frameworks around crypto, to the extent those frameworks don't already exist.

“Until the regulations are final, it will be challenging for Canadian crypto businesses to establish critical banking and other relationships because many financial sector players are waiting for a regulatory framework to be in place. The longer the delay, the harder it may be for the industry to grow in the meantime.”

Amber D. Scott, founder of compliance consultancy Outlier Solutions Inc., is pleased that the government “is taking feedback from stakeholder groups seriously.”

Scott told Bitcoin Magazine that “for the time being, things stay as they are. We advise companies to start thinking about the resources that they will need to deploy when the final version is published but to wait for that version to deploy development because things are likely to change at some point.”

In Thomas’s view, this delay will hurt companies in the space, some of whom will go ahead anyway to regulate themselves. He noted that “Canadian crypto businesses are implementing compliance programs even when not legally required because financial partners require them or for general risk management. The longer the delay, the more costly it may be to re-work those programs to meet the final regulations.”

This article originally appeared on Bitcoin Magazine.

from InvestmentOpportunityInCryptocurrencies via Ella Macdermott on Inoreader https://bitcoinmagazine.com/articles/canada-delays-regulation-cryptocurrencies-and-blockchain-companies/

0 notes

Text

ICO Promoters Can Expect Canada to Be as Tough as the US

https://cryptobully.com/ico-promoters-can-expect-canada-to-be-as-tough-as-the-us/

ICO Promoters Can Expect Canada to Be as Tough as the US

Matthew Burgoyne is an associate and head of the fintech practice group, and Ryan Franzen is partner for securities and fintech, at McLeod Law in Calgary, Alberta.

Unlike in the United States, Canada’s securities laws fall into the domain of the provinces. Arguably no area of provincial law has seen more activity as a result of the crypto boom than securities law, mainly due to the advent of initial coin offerings (ICOs).

On Aug. 24 of last year the Canadian Securities Administrators (an umbrella organization of Canada’s provincial securities regulators) published CSA Staff Notice 46-307 on cryptocurrency offerings, in which the authors posit that “[A] coin/token may still be a ‘security’ as defined in securities legislation of the jurisdictions of Canada. Businesses should complete an analysis on whether a security is involved.”

The Staff Notice goes on to confirm that Canada, through the seminal Pacific Coast Coin Exchange v. Ontario Securities Commission decision, has adopted the United States’ Howey Test in determining whether a particular investment constitutes an investment contract and therefore a security.

Although the authors of the Staff Notice admit that “Every ICO/ITO is unique and must be assessed on its own characteristics,” we believe provincial securities regulators in Canada wouldn’t take a radically different approach than the U.S. Securities Exchange Commission in analyzing whether tokens and coins are securities.

We believe the provincial securities regulators in Canada would be as equally inquisitive and systematic as the SEC has reportedly been in its recent analysis of Simple Agreement for Future Tokens (SAFT) contract based coin and token offerings. Indeed there is evidence that similar investigations have begun in Canada.

An issuer selling tokens in an ICO to Canadians would certainly have its work cut out for it in attempting to argue it was in fact selling utilities, commodities or licenses to use some sort of yet-to-be developed platform.

There are a number of examples in Canadian case law where issuers were attempting to sell “utilities” or something similar to modern day tokens and coins, where the court simply didn’t buy the argument.

The Furtak decision

Take for example the 2016 Ontario Securities Commission (“OSC”) decision of Furtak. The issuers in this case were selling licenses to use relatively complex financial software agreements which granted users the right to use the financial software to trade futures contracts.

However, as part of the arrangement, the “users” would then contract with an affiliate of the issuer to operate the software. Users did not share in any profits or losses as a result of the use of the trading software but received certain trade report fees. In effect, users paid a licensing fee in expectation of generating a return through no effort of their own.

The issue for the securities regulators was, were the licenses investment contracts or something else, such as a set of contracts that created a business? The OSC ultimately found that the licenses were investment contracts.

In arriving at its decision, it noted that:

“[T]he salient feature of a securities transaction is the public solicitation of venture capital to be used in a business enterprise…this subjection of the investor’s money to the risks of an enterprise over which he exercise no managerial control is the basic economic reality of a security transaction.”

The nature of the business enterprise can vary to a large extent. As the OSC noted, investment contracts have been found in Canadian and U.S. cases in arrangements as diverse as the use of solar panels, in proprietary software that would generate profits based on volatility, in fractional interests in death benefits of life insurance policies, in dental services sold by the promoter under sales agency agreements, in arrangements to share in the ownership and revenue from blood alcohol testing machines in pubs and even in payphones (remember those?).

The fact is, existing Canadian securities laws would probably already categorize most ICO tokens and coins as investment contracts, no matter how novel and supposedly unique they are. Some would argue the courts have seen it all before.

Provincial regulators in Canada have at least shown a willingness to work with crypto entrepreneurs, but to date the only published examples we have of where this cooperation occurred was when those entrepreneurs accepted the fact that their coins were securities and proceeded to move forward with the regulators on that basis. Even then the relief granted from securities laws was limited at best.

Limited relief

Around the time of the publication of the OSC Staff Notice, a number of provincial securities regulators granted limited relief from dealer registration requirements under securities laws where coins issued in an ICO were offered as securities.

For example, in August 2017, the responsible-investing firm Impak Finance Inc. received limited relief from certain registration requirements in conjunction with its ICO by the Autorité des marchés financiers in Quebec. Two months later, the OSC granted similar relief in conjunction with an ICO by Tokenfunder Inc., a company established to, among other things, facilitate the issuance of third party coins and tokens.

In our opinion, the two aforementioned examples demonstrate that where coins are issued in an ICO not only might they be treated as securities, but if exemptive relief from some securities laws is granted by a securities regulator, the relief won’t be dramatic or earth shattering.

The parameters that have accompanied the exemptive relief in these cases appear excessively obstructive to some in the crypto community, and may simply serve to highlight the scope of the jurisdiction of the securities regulators and the difficulties which arise given the application of securities laws.

For example, in both cases, each purchaser in the ICO is prohibited from purchasing more than $2,500 worth of coins (unless detailed know-your-client and suitability reviews on the purchaser are conducted) and Impak and Tokenfunder are restricted from listing and trading their coins on any cryptocurrency exchange unless prior approval is obtained from their respective provincial securities regulators.

Further, the coins in each ICO are subject to resale restrictions under securities law which impose a fairly stringent hold period where further trading and transfer of the coins are prohibited indefinitely (unless certain rigid criteria are met). This may be frustrating to some as certain coins and tokens need to be freely traded on the blockchain by many different participants in order to fulfill their intended purpose.

Despite the exemptive relief from dealer registration requirements provided by the securities regulators in these decisions, issuers should bear in mind that under applicable Canadian securities laws a person is only required to register as a dealer if they are engaging in or holding themselves out as engaging in the business of dealing in securities. Consequently, if an issuer is not “in the business”, then registration is not required, nor would exemptive relief from dealer registration requirements be necessary.

Simply because a corporation has issued shares in an initial public offering (IPO) to raise capital to fund its business, and those shares are listed on a stock exchange, does not mean the corporation is in the business of dealing in securities.

By extension, simply because a coin is issued in an ICO and subsequently traded on the blockchain does not necessarily mean the issuer of the coin is in the business of dealing in securities. In fact, unlike shares of a corporation, at the time a coin is traded on the blockchain, it may have its intended utility and essentially lost any security characteristic it initially had.

All told, ICO promoters should exercise caution in Canada when attempting to market a utility token without consideration of securities laws.

Further, if you’ve come to accept that your token is an investment contract, then based on these decisions, expect to be treated like any other issuer of securities.

The authors would like to acknowledge Amanpreet Sran for her research, contributions and assistance with this article.

Canadian flag image via Shutterstock.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

ICO News

0 notes

Text

New world news from Time: The Brutal Murder of a Holocaust Survivor Is Raising Anti-Semitism Fears in France

After a week dominated by death and mourning in France — first, from a terrorist attack in the country’s south, and then after a horrific murder in Paris — the French are once again anguishing over an issue that has returned in full force: Is the country beset by rising, virulent anti-Semitism?

While the two incidents were unrelated and hundreds of miles apart, the French, including President Emmanuel Macron, drew a connection between the two, as a sign of what Macron, addressing a solemn funeral ceremony on Wednesday for the gendarme officer killed in the terror attack, called a “barbaric obscurantism.” Four people died last Friday when a 25-year-old Moroccon-born Frenchman opened fire in a supermarket in Provence, after shouting “Allahu Akhbar,” or “god is great.”

That same day, Mireille Knoll, 85, was stabbed 11 times and her body burned in her apartment in eastern Paris; two men, aged 22 and 29, are being held for committing an anti-Semitic murder. Thousands of people marched silently through Knoll’s neighborhood on Wednesday, some holding banners that read “killed for being Jewish” — echoing a phrase from the Nazi occupation of France in the 1940s, which Knoll had survived. Her murder came exactly a year after the killing of Sarah Halimi, 65, a French Jew who was beaten in her apartment just two miles from Knoll’s neighborhood, and then thrown out the window. Knoll was the 11th French Jew murdered in an anti-Semitic attack in the past 12 years.

But do the killings suggest entrenched anti-Semitism in France, and have they made life untenable for Jews in the country? In interviews with French Jews on Thursday, most say those answers depend heavily on where one lives, and that it is possible to live in France with little sense of anti-Semitism.

“If you are a practicing Jew and visible, if you wear a kippa (skullcap) and live in not such a nice neighborhood, then it is nearly impossible not to be confronted on an everyday basis with anti-Semitism,” says Simone Rodan-Benzaquen, the Europe director of the American Jewish Committee. Although she describes anti-Semitism in France as “very serious,” she says she herself has not experienced a single act. “I am not a practicing Jew, and I live in a nice neighborhood in the 7th [district of Paris],” she says. “It is a parallel reality.”

Official statistics show a complicated picture of racist incidents, and suggest that other minorities, such as Muslims, are regularly harassed and are at least equally at risk of hate crimes as Jews.

In 2016, there were dozens of attacks against mosques, and violent threats against veiled Muslim women in the streets, according to the latest figures collected by the Organization of Security and Cooperation in Europe, or OSCE. A recent report on hate crimes by France’s National Consultative Commission for Human Rights show widespread anti-Muslim feelings and a “strong correlation” with anti-immigrant sentiment. Muslims comprise a large proportion of recent migrants to Europe from Africa and the Middle East. Despite the rise in anti-Semitic incidents over the years in France, says the commission’s report, “Muslims remain the least accepted minority.”

Those stark divides run counter to France’s attempts to instill a uniform sense of citizenship among its 65 million people, a core principle of the country. Under the national education curriculum, for example, all children are required to learn about the Holocaust, including the fact that French citizens helped organize the mass deportation of Jews to Nazi death camps in 1942, an event that has evoked decades of soul-searching among the French.

But Jewish groups say the reality is different, and whether children learn such lessons depends on where they live.

Earlier this year, my son’s sixth-grade class went on a school outing to the Jewish Museum in Paris, and the few Jewish children in the class leaped to answer questions about Judaism. On Wednesday, the children stood for a minute’s silence in their classrooms to mark the murders of both Mireille Knoll and a police officer who was killed in last Friday’s terror attack after swapping places with the gunman’s last hostage.

But while such lessons might instill tolerance, the experience is different elsewhere, particularly in poorer neighborhoods.

In schools where students are largely Muslim, teachers often skip the lessons in the curriculum that focus on the Holocaust and Jewish history for fear of being targeted as overly sympathetic to Jews, according to Robert Ejnes, Executive Director of the Representative Council of Jewish Institutions in France, or CRIF. “They believe it is dangerous to them physically,” he says.

On Thursday, a teacher in a public school in Seine-Saint-Denis, a poorer district on the northeast edge of Paris, told BFM Television that, although his ninth-grade curriculum included lessons about the Holocaust, his students, mostly Muslim, have well-entrenched ideas about the subject, and few around them to challenge them. “Many Jewish families have moved,” he said. “There are fewer and fewer Jewish students in school.”

In fact, France’s ethnic composition makes for a potentially combustible mix. It has Europe’s biggest Jewish population and its biggest Muslim population. Yet Jews comprise less than 1% of France’s 65 million people — just one-tenth of the 5 million or so French Muslims.

In many neighborhoods, even in diverse Paris, the two minorities are increasingly living in separate worlds. In the suburbs around Paris, for example, “there are areas where not a single Jewish family lives,” says Ejnes. Ejnes, 60, says that when he grew up in the 1970s, Paris felt far more of a melting pot than now. “About 95% of Jewish children went to public school then,” he says. “Now it is less than 30%.”

Indeed, anti-Semitic graffiti, let alone physical attacks, are exceedingly rare in richer neighborhoods of Paris. Even so, Rodan-Benzaquen says she and others feel a strong need to conceal their Jewish identity from strangers.

For that reason, mezuzahs, the miniature prayer scrolls that millions of Jews in the U.S. and elsewhere display on their front doorposts, are rarely visible in France. “I put my mezuzah on the inside of the door,” Rodan-Benzaquen says. Her concern is about hostility from casual visitors, like “the postman, the DHL or UPS deliverer,” she says. She stopped short of naming what ethnicity those service workers might be. “Why take the risk? I have two kids,” she says. “It crosses all our minds.” She says that when she sees a boy in the street wearing a skullcap, “I get nervous. I am scared for him.”

For some, outward displays of Judaism Jewish are an act of defiance. “I’m not afraid to put a mezuzah on my door,” says Sacha Ghozlan, president of France’s Union of Jewish Students. “We are French citizens,” he says. “We don’t need to hide ourselves to be Jewish.” But Rodan-Benzaquen insists her anxiety is well-founded. She points out that 40% of violent racist attacks in French are directed at the tiny Jewish minority. The French Ministry of Interior has reported that about one-third of hate crimes in 2017, both violent and non-violent, were anti-Semitic.

March 30, 2018 at 12:22AM ClusterAssets Inc., https://ClusterAssets.wordpress.com

0 notes

Text

FSCO reaches $1.1 million settlement over syndicated mortgages

Eight participants in Canada’s syndicated mortgage market have been sanctioned by the sector’s chief regulator as part of a $1.1-million settlement that saw several lose their broker licences.

The eight parties, which includes four individual brokers and four brokerages, were involved in the distribution of syndicated mortgage investments for projects linked to Fortress Real Developments Inc., an Ontario-based real estate development company and consultant that partners with builders and developers in five provinces.

Fortress itself, which is not a mortgage brokerage or administrator, was not a party to the settlement or the subject of any orders.

Friday’s settlement was reached after what the Financial Services Commission of Ontario described as a “complex and detailed investigation,” and included the revoking (on consent) of the mortgage broker licence of Vince Petrozza, who is listed on the Fortress Real Developments website as the firm’s chief operating officer.

Natasha Alibhai, communications manager for the firm, said Fortress “does not believe that the settlement and orders will harm its business.”

In an emailed response, she said Petrozza made “a business decision to consent to an order” and would be focusing on real estate development, which does not require a mortgage broker licence.

“As stated in the order, there has been no finding or determination by the Financial Services Tribunal as to any contravention or failures to comply with the Mortgage Brokerages, Lenders and Administrators Act,” Alibhai said.

In all, the broker licences of four individuals and one firm — Building & Development Mortgages Canada Inc. — were revoked on consent by FSCO.

In addition, Ildina Galati-Ferrante, principal broker of BDMC Inc., surrendered her broker licence, “requiring her to cease all mortgage brokering activities,” FSCO said.

BDMC, formerly known as Centro Mortgage Inc., will also pay part of the administrative penalty, along with FFM Capital Inc., FMP Mortgage Investments Inc. and FDS Broker Services Inc.

In addition, BDMC voluntarily agreed to relinquish its mortgage administration functions for existing syndicated mortgage investments in real estate development projects for which Fortress is a developer or development consultant to a new arms-length administrator, FAAN Mortgage Administrators Inc.

There is nothing inherently wrong with syndicated mortgages, in which groups of investors back real estate developments, and many such mortgages are funded and discharged without issue. Some of these investments fund commercial and large-scale residential real estate developments in their early stages, and projects include condominium, office and retail complexes.

According to FSCO figures, the syndicated mortgage market grew rapidly between 2014 and 2016, from $3.7 billion to $6 billion.

But the growing sector has attracted several lawsuits, which contain claims that investors were put into developments that were far riskier than they were led to believe. The claims, none of which have been proven in court, allege investors were misled about where their money was going, who had priority on returns and what recourse they had if the development ran into trouble.

Fortress Real Developments was named in a number of lawsuits, but denied any wrongdoing and moved to have the cases thrown out of court. In August, the company issued a news release that said four proposed class actions were struck out by the Ontario Superior Court, and claims against Petrozza and Fortress co-founder Jawad Rathore were dismissed on the basis that the statements of claim “did not disclose any legal causes of action against them.”

FSCO, too, has drawn criticism from investors in syndicated mortgages and their advocates over its handling of the burgeoning sector within Canada’s booming real estate market.

Watchdog ignored warnings on mortgage investments that put small investors at risk

OSC to take over oversight of syndicated mortgages as Ontario budget moves to protect investors

Lax oversight of syndicated mortgages is hurting Ontario investors, with little relief in sight

Neil Gross, a securities lawyer and former head of the Foundation for the Advancement of Investors Rights (FAIR Canada), told the Financial Post last April that “FSCO hasn’t shown a sense of urgency in protecting consumers.”

He noted that a recommendation by an expert panel to overhaul FSCO, which has been embraced by the Ontario government, followed two reports in 2014 that questioned the regulator’s willingness or ability to take “effective” enforcement action.

In April, the Ontario government announced plans to transfer responsibility for syndicated mortgage investments from FSCO to the Ontario Securities Commission.

At the time, Gross called the move “appropriate and long overdue.”

Industry sources said the transfer of oversight was expected to take as long as two years, and the government pledged to move forward in the meantime with new regulations to provide investors with more protection. These include establishing investment limits on syndicated mortgages and requiring mortgage brokerages to document their assessments of the suitability of such products for their clients.

“FSCO would also expand requirements relating to information provided by mortgage brokerages to ensure that investors are aware of the potential risks associated with these types of investments,” the Ontario government said in its spring budget last year.

Larry Ritchie, who was on the three-member expert panel that recommended the overhaul of FSCO, said Tuesday that the need for “more proactive, visible and consistent enforcement” was a common refrain heard during months of consultation.

“Visible enforcement is crucial to demonstrate that consumers and investors are adequately protected,” said Ritchie, a partner at law firm Osler, Hoskin & Harcourt LLP and a former vice-chair of the OSC.

from DIYS http://ift.tt/2BSc9y2

0 notes

Text

Three behavioural barriers to solid retirement planning, and how you can overcome them

I read with great interest a recently released Ontario Securities Commission (OSC) report entitled Encouraging Retirement Planning through Behavioural Insights. It provides strategies for governments, employers, financial advisers and those planning for retirement to implement to make it easier to become financially independent.

Behavioural finance has risen to prominence recently, in part because of the work of “nudge” economist Richard Thaler, who won the Nobel Prize last year for his pioneering work in the field of behavioural economics. There can be psychological impediments to making financial decisions that are in our own best interest, but there are simple things we can do to encourage behaviour today that leads to better outcomes tomorrow.

The OSC and the behavioural insights team that prepared the report identified several barriers to retirement planning and provided potential remedies. I have narrowed down and elaborated upon my favourites.

How much money will you need after you retire? Likely less than you think

How you draw down your retirement savings could save you thousands — this program proves it

What today’s savers can learn from today’s seniors about retirement planning

Barrier 1: People will avoid making a retirement plan because of the perceived length and complexity of the process.

I have experienced this first-hand. We give our clients homework to do up-front before we begin to work with them. Sometimes it takes months and sometimes they do not complete it at all.

The report suggests that governments, financial advisers and employers provide a template to people to create a retirement plan with some data already completed. I can think of a few ideas.