#howard cosell down goes frazier

Text

🎙️ March 25th – Happy Birthday, Howard Cosell!

https://www.pixoplanet.com/post/life-of-howard-cosell

#howard cosell#howard cosel#howard cosell quotes#don meredith and howard cosell#what is howard cosell famous for#howard cosell john lennon#cosell howard#howard cosell and muhammad ali#howard cosell down goes frazier#howard cosell look at that monkey run#what was howard cosell's catchphrase#did howard cosell serve in the military#inspiration#i can#true story#professional#empower#knowledge#news flash#classy

2 notes

·

View notes

Text

January 22, 1973: Triumph and Tragedy

At the 1968 Olympics in Mexico City, a young man from Texas won a gold medal in heavyweight boxing while an old man from Texas proudly watched from the White House in Washington, D.C.

As a teenager growing up in Houston's rough Fifth Ward, George Foreman was spending his days and nights fighting in the streets and committing petty crimes. Foreman had little education, few role models, no direction and found the crippling poverty that he lived in to be unbearable. Then, in 1965, he heard of the Job Corps.

One of the foundations of Lyndon B. Johnson's War On Poverty, the Job Corps was created in 1964 to provide vocational training and technical education, free of charge, to students aged 16 through 24. For many young Americans, the Job Corps as an opportunity. For George Foreman, it was a path to superstardom and success.

After beginning his Job Corps training in Oregon, Foreman was stationed at a center in California where a Job Corps supervisor named Doc Broadus encouraged the 6'4" Texan to consider boxing. Just three years after he signed up for the centerpiece program of LBJ's Great Society, George Foreman was representing his country in the Olympics.

To this day, Foreman credits the Job Corps for saving his life. Later, he would proudly declare that "Job Corps took me from the mean streets and out of a nightmare lifestyle into a mode where the most incredible dreams came true."

Following Foreman's gold medal victory at the 1968 Olympics, he was invited to the White House by President Johnson and became a proud symbol of a Great Society success story. At the White House, President Johnson asked Foreman when he thought he'd win the world championship and Foreman recalled that "I told him I hoped it would be quick, as I needed the money. He laughed about that."

As LBJ headed into retirement in Texas, George Foreman embarked on a successful professional boxing career and with a 37-0 record, he prepared to fight for the undisputed heavyweight championship against the undefeated champion -- Joe Frazier. Foreman started going by the nickname "The Fighting Corpsman", paying tribute to his Job Corps roots because "it had been President Johnson's Job Corps which changed my direction in life. I thought all those Job Corps men out there would see that one among them was making it, and maybe it would help them believe they could as well."

The Fighting Corpsman was a heavy underdog on January 22, 1973 as he challenged Joe Frazier for the world heavyweight championship in Kingston, Jamaica. Most boxing reporters and students of the game thought that the match wouldn't last very long and they were correct. Foreman dominated Frazier, knocking him down six times in two rounds before the referee finally stepped in and stopped the beating. As millions watched the fight on television, sportscaster Howard Cosell made one of the most famous calls in history, "Down goes Frazier! Down goes Frazier! Down goes Frazier!". At just 24 years old, George Foreman -- the Fighting Corpsman -- was the heavyweight champion of the world.

The victory was George Foreman's, but no one would have taken more pride in the results of that fight than the architect of the program that turned Foreman's life around, Lyndon B. Johnson. Sadly, Johnson never saw the fight. Just hours earlier on the very day that Foreman won the title in Jamaica, Lyndon Johnson suffered a fatal heart attack at the LBJ Ranch near Johnson City, Texas. As fans were filing into the arena in Jamaica, Lyndon Johnson died en route to a hospital in Texas.

For the new champion, the victory was bittersweet. "I felt robbed that night while winning it as I had hoped he would be able to read what happened in Jamaica which could never have been possible had he not had that Job Corps idea and that it would include me." In 1983, George Foreman donated the championship belt that he won on the day of LBJ's death to the LBJ Library in Austin, Texas where it is on display today -- a memento from a coincidental day 50 years ago when two Texans were united by accomplishment and cemented in history.

#History#Lyndon B. Johnson#LBJ#President Johnson#George Foreman#Boxing#Presidential History#World Heavyweight Championship#Joe Frazier#Death of Lyndon B. Johnson#LBJ's Death#Death of LBJ#LBJ Library#Great Society#Job Corps#January 22nd#War On Poverty#50th Anniversary#50th Anniversary of LBJ's Death

26 notes

·

View notes

Link

Howard Cosell would have been just as shocked at this latest political development, as he was in the Frazier-Ali fight. https://theblacksphere.net/2018/02/california-democrats-reject-feinstein/?utm_content=buffera0c45&utm_medium=social&utm_source=facebook.com&utm_campaign=buffer

2 notes

·

View notes

Text

‘Up-to-Date’ COT Report: A Maddening Déjà Vu

Source: Michael J. Ballanger for Streetwise Reports 03/10/2019

Precious metals expert discusses recent movements in the markets.

In life, there are a distant events from one’s past that embed themselves in one’s memory banks in a manner and forcefulness that is directly related to their personal or historical importance. The birth of one’s first child, one’s first love affair or an athletic achievement fall into the “personal” category; the end of WWII, the first lunar landing or the assassination of JFK are examples of “historical” events. These events in one’s lives are so crystallized in their vividness that one is many times able to recall sounds and scents from those exact points in time. Stated another way, how many times has a person had a certain song come on the radio and been memory-jogged back 20 or 30 years? In my case, the scent of hot dogs and popcorn bring to life hockey arenas and dressing rooms while the song “The Night They Drove Ol’ Dixie Down” brings me immediately to the old Hamilton Mountain Arena where the Dixie Beehives won the Ontario Junior “B” championship in 1970. Fast-forward to 2019 and there is yet one more memory-etching that is transpiring: the COT report.

Over the years, there have been many financial or mineral exploration events that have occupied the frontal lobes of my cerebral cortex: the Hemlo Gold Discovery of 1981, the Crashes of 1987/2001/2008, most of the major discoveries of the 1990s and a few more far too insignificant to most to recount. There were also weekly reports that over any market cycle became cult-like eventsthe 1980s’ money supply numbers reported every Friday at 4:00 p.m. became a Bloomberg news machine gathering of water cooler vintage. Today’s version of the money supply numbers is the Non-Farm Payrolls or “Jobs” report, which arrives every other Friday morning at 8:30 EST with enormous fanfare, complete with panels of experts and their “guesstimates” along with “post-report analyses” where the panel members pick apart the number and its components in the same way sports commentators analyze a football game or boxing match. The “Down goes Frazier! Down goes Frazier! Down goes Frazier!” mantra from Howard Cosell in the 1970s is now supplanted with “Down goes Leissman!” or “Down Goes Santelli!” or “Down Goes Cramer!” when one of their NFP calls goes wide of the uprights. Circa 2019 and for most gold enthusiasts, the weekly Commitment of Traders or “COT” report has now assumed the role of the “obsessive-compulsive disorder” clarion call for those (like me) completely enrapt with “all things golden.”

When the U.S. government shut itself down back at midnight December 22, 2018, it was decided that the delivery of a vast portion of all government statistics would be delayed until things resumed to normal. Of course, the major source of ad-revenue-creating financial newsthe Jobs reportwould be exempted from such nonsense as they deemed it far too important an interventionalist’s tool to be delayed. However, as the COT numbers were unavailable to the public, the only thing some of us could look at was the open interest figures in gold futures, which still showed up on a daily basis from the end-of-day numbers. So, when open interest exploded in December, one could only speculate that the Commercial tradersthe bullion bank behemothswere once again spinning their web of subterfuge into the headline news of a “dovish Fed policy reversal” and “inevitable crash in the dollar.”

Surely as the sun rises every morning, when the COT numbers began to play “catch-up” when the government shutdown ended on January 22, it was sorely and sickenly evident that the aggregate short position held by the bankster bozos was on the rise from the day before the government shutdown at 92,675 net shorts to the last week’s number at 166,477. “The bastards are at it again!,” I was thinking back in January as gold was advancing nicely into the $1,300s so with open interest ballooning each day and with each advance, you just KNEW that the bullion banks were going to rip the foundation out of the advance at a moment’s notice and with not a shred of warning and as noted here and more than a few times, I sent out via Twitter the “call-to-action” on Feb. 20 with gold at $1,344.80 to “Dump all leveraged positions.” The rest as they say is “history.” $50 per ounce straight down with not so much as a peep out of anyone (of a regulatory moniker).

Friday morning’s NFP vigil was reminiscent of the money-supply watch of yore; everyone was gathered around, smiling and laughing and sipping their lattes making their jobs guesses (as if no one cared) when out came the number and it was a whoppingly large miss as the myriad of 200,000+ guesses vaporized into tiny molecular misfires when it was reported that only 20,000 new jobs were created. Everyone, especially CNBC’s Steve Leissman, went to the defense with the CNBC “chief economic commentator” said that the report was “wrong” (but January’s upside blowout number was, of course, absolutely “fine”). The markets responded as they should have, with stocks plummeting and gold and bonds spiking and the CNBC crowd rushing to change their knickers. As the day wore on, stocks recovered from a 26 point S&P plunge to close down only 5.86 but gold and silver held on to decent gains with the Miners (HUI) going out near the highs for the day.

Accordingly, I go into next week modestly short (S&P and Goldman Sachs) but considerably overweight the leveraged precious metals positions mentioned on March 6 with the missive entitled ” PM Reentry Time.” NUGT, JNUG and calls on GLD and SLV were all replaced on Wednesday the 6, the day after the $1,282 lows were in place. We had the benefit of an unremarkable day with the lows being seen just after the opening with gold at $1,284.30 so most of the JNUG and NUGT were added to that day, which marked the lows for both for the move. With averages at JNUG $9.45 and NUGT $18.35, Friday’s pop in the miners now marks the beginning of the move to test the highs and, as I said earlier this past week, an RSI at 35-40 is not ideal but it is a far cry from the 75 level on Feb. 20 when we pulled the pin on them.

So once again, we are sitting in front of the computer screens, mesmerized by the rearrival of déjà vuthat surreal feeling that we have seen this all before or have visited this space in another lifetime of portion of this lifetime. Over and over and over again, the Commercial traders relieve the CTAs and hedge fund managers and big trading houses of tens of millions of dollars by having an unlimited supply of phony, paper gold “inventory” with which to soften advances; massage support and resistance levels; and intervene at critical points in the trading cycle. Their illicit and unnatural supply of paper gold, which should have no bearing on the pricing process for gold that is physically delivered, has the uncanny ability to affect the fortunes of millions upon millions of retail and institutional investors around the world whose livelihood depends upon true, full, and plain disclosure of price.

That the bullion banks are allowed and able to access a fictional supply of gold and silver with the objective being to control price is a distortion of the spirit and intent of transparency and a violation of the veracity of price discovery. So, how on earth can one trade any market when regulators and justice departments turn a blind eye to both of these tenets so absolutely critical to the survival of the free market system?

The answer, at least for me, is quite simple: one must ALWAYS look behind the wizard’s curtain. I do NOT trust ANYTHING that is offered by bloggers or amateur technical analysts as “gospel truth.” I must have heard the term “Golden Cross” over 100 times in late January and early February as a reason to mortgage the farm and buy gold, but gold eventually returned last Tuesday to a mere $5 per ounce above the levels where the cross occurred. To have any chance of being successful in the trading universe, one must “Follow the Money” and in the gilded pits of the Crimex Paper Gold Transfer Station, I make it my life’s mission to attempt to be on the same side as the criminals, at least as far as positioning is concerned.

For far too many years, I would charge into the calls of Barrick or Newmont on the strength of a “technical breakout” in gold prices, only to see those infamous “journal entries with zero value” show up on my month-end statement as my reward for identifying a technical pattern. The Commercial traders not only see those breakouts coming; they actually massage prices to CREATE the breakouts, seizing gargantuan mittfuls of paper gold to satiate the demand created by these patterns and in so doing, actually conjure up repeated occurrences of the deadliest technical patterns of all, “FAILED breakouts” and “FAILED breakdowns”, the combination of both constitutes the derivative of the word “INSOLVENCY.”

As comforting for stock market bulls as was the Powell-Mnuchin “policy shift” that happened during the final week of 2018, the same “policy shift” seen with this week’s COT is equally as comforting for precious metals bulls. If “Follow the Money” serves as a reminder of what NOT to do when trading, those “fighting the Fed” are no different than those that have been “fighting the Commercials.” Both of these entities have proven to be, over time, the drivers behind short-term (and even long-term) price movements. How many times have we read the words of our goldbug friends that point to the “MASSIVE SHORT POSITION HELD BY THE BULLION BANKS” as proof of an impending squeeze and price explosion? Dozens? Hundreds? Thousands? Now, how many times have we seen a short squeeze in ANYTHING that is government sanctioned? Answer: Perhaps silver in the last decade in its move through $50/ounce but it was brief and it ended in tears and no bullion bank went under or came anything close to “in trouble.” At worst, there was only “discomfort” that was greeted with “elation” with the April 2013 Sunday Night Massacre that finally bailed them all out with a vengeful retribution of the most-foul manner.

I try to live by the “All is not what it appears” mantra and it took over 35 years to allow the osmosis of cranial capitulation to take effect. My only fear in doing so is the same fear which manifests itself in the minds of those detectives in the hunt for serial murderersthat they will actually BECOME a serial killer, but I think I am safe because the revulsion I fear at the thought of becoming a banker remains sufficient (we hope).

This week I look for a continuation of the precious metals advance and a fierce skirmish between the stock market bulls and bears as that big red candle you see in the above chart of the $SPX is only the second since 2019 arrived. Eight of ten weeks have been straight up and with a friendly Fed and a mountain full of “cash-on-the-sidelines,” the eventual retest of the December lows is not going to happen without more than a few back-alley punch-ups. The manner in which “THEY” were able to levitate the market in the latter part of Friday gives rise to an early-week attempt for the bulls to reassert control. Whether that impacts the miners favorably or not remains to be seen, but as long as I carry an ample degree of both humility and cynicism into battle each and every day, I at the least stand a chance of coming home with my net worth intact. As distasteful as it may be, thinking like a bullion bank thief allows me to mount at once both a respectable defense AND psychological advantage so critical in posturing and positioning one’s capital. In addition and equally vital lies the presence of amply-stocked liquor cabinets and indecently armed medicine chests with which to cope, both necessary evils within a very necessary battle.

Onward.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Goldman Sachs. My company has a financial relationship with the following companies referred to in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

from The Gold Report – Streetwise Exclusive Articles Full Text https://ift.tt/2tY62qq

from WordPress https://ift.tt/2HeNpam

0 notes

Text

‘Up-to-Date’ COT Report: A Maddening Déjà Vu

Source: Michael J. Ballanger for Streetwise Reports 03/10/2019

Precious metals expert discusses recent movements in the markets.

In life, there are a distant events from one’s past that embed themselves in one’s memory banks in a manner and forcefulness that is directly related to their personal or historical importance. The birth of one’s first child, one’s first love affair or an athletic achievement fall into the “personal” category; the end of WWII, the first lunar landing or the assassination of JFK are examples of “historical” events. These events in one’s lives are so crystallized in their vividness that one is many times able to recall sounds and scents from those exact points in time. Stated another way, how many times has a person had a certain song come on the radio and been memory-jogged back 20 or 30 years? In my case, the scent of hot dogs and popcorn bring to life hockey arenas and dressing rooms while the song “The Night They Drove Ol’ Dixie Down” brings me immediately to the old Hamilton Mountain Arena where the Dixie Beehives won the Ontario Junior “B” championship in 1970. Fast-forward to 2019 and there is yet one more memory-etching that is transpiring: the COT report.

Over the years, there have been many financial or mineral exploration events that have occupied the frontal lobes of my cerebral cortex: the Hemlo Gold Discovery of 1981, the Crashes of 1987/2001/2008, most of the major discoveries of the 1990s and a few more far too insignificant to most to recount. There were also weekly reports that over any market cycle became cult-like eventsthe 1980s’ money supply numbers reported every Friday at 4:00 p.m. became a Bloomberg news machine gathering of water cooler vintage. Today’s version of the money supply numbers is the Non-Farm Payrolls or “Jobs” report, which arrives every other Friday morning at 8:30 EST with enormous fanfare, complete with panels of experts and their “guesstimates” along with “post-report analyses” where the panel members pick apart the number and its components in the same way sports commentators analyze a football game or boxing match. The “Down goes Frazier! Down goes Frazier! Down goes Frazier!” mantra from Howard Cosell in the 1970s is now supplanted with “Down goes Leissman!” or “Down Goes Santelli!” or “Down Goes Cramer!” when one of their NFP calls goes wide of the uprights. Circa 2019 and for most gold enthusiasts, the weekly Commitment of Traders or “COT” report has now assumed the role of the “obsessive-compulsive disorder” clarion call for those (like me) completely enrapt with “all things golden.”

When the U.S. government shut itself down back at midnight December 22, 2018, it was decided that the delivery of a vast portion of all government statistics would be delayed until things resumed to normal. Of course, the major source of ad-revenue-creating financial newsthe Jobs reportwould be exempted from such nonsense as they deemed it far too important an interventionalist’s tool to be delayed. However, as the COT numbers were unavailable to the public, the only thing some of us could look at was the open interest figures in gold futures, which still showed up on a daily basis from the end-of-day numbers. So, when open interest exploded in December, one could only speculate that the Commercial tradersthe bullion bank behemothswere once again spinning their web of subterfuge into the headline news of a “dovish Fed policy reversal” and “inevitable crash in the dollar.”

Surely as the sun rises every morning, when the COT numbers began to play “catch-up” when the government shutdown ended on January 22, it was sorely and sickenly evident that the aggregate short position held by the bankster bozos was on the rise from the day before the government shutdown at 92,675 net shorts to the last week’s number at 166,477. “The bastards are at it again!,” I was thinking back in January as gold was advancing nicely into the $1,300s so with open interest ballooning each day and with each advance, you just KNEW that the bullion banks were going to rip the foundation out of the advance at a moment’s notice and with not a shred of warning and as noted here and more than a few times, I sent out via Twitter the “call-to-action” on Feb. 20 with gold at $1,344.80 to “Dump all leveraged positions.” The rest as they say is “history.” $50 per ounce straight down with not so much as a peep out of anyone (of a regulatory moniker).

Friday morning’s NFP vigil was reminiscent of the money-supply watch of yore; everyone was gathered around, smiling and laughing and sipping their lattes making their jobs guesses (as if no one cared) when out came the number and it was a whoppingly large miss as the myriad of 200,000+ guesses vaporized into tiny molecular misfires when it was reported that only 20,000 new jobs were created. Everyone, especially CNBC’s Steve Leissman, went to the defense with the CNBC “chief economic commentator” said that the report was “wrong” (but January’s upside blowout number was, of course, absolutely “fine”). The markets responded as they should have, with stocks plummeting and gold and bonds spiking and the CNBC crowd rushing to change their knickers. As the day wore on, stocks recovered from a 26 point S&P plunge to close down only 5.86 but gold and silver held on to decent gains with the Miners (HUI) going out near the highs for the day.

Accordingly, I go into next week modestly short (S&P and Goldman Sachs) but considerably overweight the leveraged precious metals positions mentioned on March 6 with the missive entitled ” PM Reentry Time.” NUGT, JNUG and calls on GLD and SLV were all replaced on Wednesday the 6, the day after the $1,282 lows were in place. We had the benefit of an unremarkable day with the lows being seen just after the opening with gold at $1,284.30 so most of the JNUG and NUGT were added to that day, which marked the lows for both for the move. With averages at JNUG $9.45 and NUGT $18.35, Friday’s pop in the miners now marks the beginning of the move to test the highs and, as I said earlier this past week, an RSI at 35-40 is not ideal but it is a far cry from the 75 level on Feb. 20 when we pulled the pin on them.

So once again, we are sitting in front of the computer screens, mesmerized by the rearrival of déjà vuthat surreal feeling that we have seen this all before or have visited this space in another lifetime of portion of this lifetime. Over and over and over again, the Commercial traders relieve the CTAs and hedge fund managers and big trading houses of tens of millions of dollars by having an unlimited supply of phony, paper gold “inventory” with which to soften advances; massage support and resistance levels; and intervene at critical points in the trading cycle. Their illicit and unnatural supply of paper gold, which should have no bearing on the pricing process for gold that is physically delivered, has the uncanny ability to affect the fortunes of millions upon millions of retail and institutional investors around the world whose livelihood depends upon true, full, and plain disclosure of price.

That the bullion banks are allowed and able to access a fictional supply of gold and silver with the objective being to control price is a distortion of the spirit and intent of transparency and a violation of the veracity of price discovery. So, how on earth can one trade any market when regulators and justice departments turn a blind eye to both of these tenets so absolutely critical to the survival of the free market system?

The answer, at least for me, is quite simple: one must ALWAYS look behind the wizard’s curtain. I do NOT trust ANYTHING that is offered by bloggers or amateur technical analysts as “gospel truth.” I must have heard the term “Golden Cross” over 100 times in late January and early February as a reason to mortgage the farm and buy gold, but gold eventually returned last Tuesday to a mere $5 per ounce above the levels where the cross occurred. To have any chance of being successful in the trading universe, one must “Follow the Money” and in the gilded pits of the Crimex Paper Gold Transfer Station, I make it my life’s mission to attempt to be on the same side as the criminals, at least as far as positioning is concerned.

For far too many years, I would charge into the calls of Barrick or Newmont on the strength of a “technical breakout” in gold prices, only to see those infamous “journal entries with zero value” show up on my month-end statement as my reward for identifying a technical pattern. The Commercial traders not only see those breakouts coming; they actually massage prices to CREATE the breakouts, seizing gargantuan mittfuls of paper gold to satiate the demand created by these patterns and in so doing, actually conjure up repeated occurrences of the deadliest technical patterns of all, “FAILED breakouts” and “FAILED breakdowns”, the combination of both constitutes the derivative of the word “INSOLVENCY.”

As comforting for stock market bulls as was the Powell-Mnuchin “policy shift” that happened during the final week of 2018, the same “policy shift” seen with this week’s COT is equally as comforting for precious metals bulls. If “Follow the Money” serves as a reminder of what NOT to do when trading, those “fighting the Fed” are no different than those that have been “fighting the Commercials.” Both of these entities have proven to be, over time, the drivers behind short-term (and even long-term) price movements. How many times have we read the words of our goldbug friends that point to the “MASSIVE SHORT POSITION HELD BY THE BULLION BANKS” as proof of an impending squeeze and price explosion? Dozens? Hundreds? Thousands? Now, how many times have we seen a short squeeze in ANYTHING that is government sanctioned? Answer: Perhaps silver in the last decade in its move through $50/ounce but it was brief and it ended in tears and no bullion bank went under or came anything close to “in trouble.” At worst, there was only “discomfort” that was greeted with “elation” with the April 2013 Sunday Night Massacre that finally bailed them all out with a vengeful retribution of the most-foul manner.

I try to live by the “All is not what it appears” mantra and it took over 35 years to allow the osmosis of cranial capitulation to take effect. My only fear in doing so is the same fear which manifests itself in the minds of those detectives in the hunt for serial murderersthat they will actually BECOME a serial killer, but I think I am safe because the revulsion I fear at the thought of becoming a banker remains sufficient (we hope).

This week I look for a continuation of the precious metals advance and a fierce skirmish between the stock market bulls and bears as that big red candle you see in the above chart of the $SPX is only the second since 2019 arrived. Eight of ten weeks have been straight up and with a friendly Fed and a mountain full of “cash-on-the-sidelines,” the eventual retest of the December lows is not going to happen without more than a few back-alley punch-ups. The manner in which “THEY” were able to levitate the market in the latter part of Friday gives rise to an early-week attempt for the bulls to reassert control. Whether that impacts the miners favorably or not remains to be seen, but as long as I carry an ample degree of both humility and cynicism into battle each and every day, I at the least stand a chance of coming home with my net worth intact. As distasteful as it may be, thinking like a bullion bank thief allows me to mount at once both a respectable defense AND psychological advantage so critical in posturing and positioning one’s capital. In addition and equally vital lies the presence of amply-stocked liquor cabinets and indecently armed medicine chests with which to cope, both necessary evils within a very necessary battle.

Onward.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Goldman Sachs. My company has a financial relationship with the following companies referred to in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

from The Gold Report – Streetwise Exclusive Articles Full Text https://ift.tt/2tY62qq

from WordPress https://ift.tt/2UvK2ij

0 notes

Text

'Up-to-Date' COT Report: A Maddening Déjà Vu

Source: Michael J. Ballanger for Streetwise Reports 03/10/2019

Precious metals expert discusses recent movements in the markets.

In life, there are a distant events from one's past that embed themselves in one's memory banks in a manner and forcefulness that is directly related to their personal or historical importance. The birth of one's first child, one's first love affair or an athletic achievement fall into the "personal" category; the end of WWII, the first lunar landing or the assassination of JFK are examples of "historical" events. These events in one's lives are so crystallized in their vividness that one is many times able to recall sounds and scents from those exact points in time. Stated another way, how many times has a person had a certain song come on the radio and been memory-jogged back 20 or 30 years? In my case, the scent of hot dogs and popcorn bring to life hockey arenas and dressing rooms while the song "The Night They Drove Ol' Dixie Down" brings me immediately to the old Hamilton Mountain Arena where the Dixie Beehives won the Ontario Junior "B" championship in 1970. Fast-forward to 2019 and there is yet one more memory-etching that is transpiring: the COT report.

Over the years, there have been many financial or mineral exploration events that have occupied the frontal lobes of my cerebral cortex: the Hemlo Gold Discovery of 1981, the Crashes of 1987/2001/2008, most of the major discoveries of the 1990s and a few more far too insignificant to most to recount. There were also weekly reports that over any market cycle became cult-like eventsthe 1980s' money supply numbers reported every Friday at 4:00 p.m. became a Bloomberg news machine gathering of water cooler vintage. Today's version of the money supply numbers is the Non-Farm Payrolls or "Jobs" report, which arrives every other Friday morning at 8:30 EST with enormous fanfare, complete with panels of experts and their "guesstimates" along with "post-report analyses" where the panel members pick apart the number and its components in the same way sports commentators analyze a football game or boxing match. The "Down goes Frazier! Down goes Frazier! Down goes Frazier!" mantra from Howard Cosell in the 1970s is now supplanted with "Down goes Leissman!" or "Down Goes Santelli!" or "Down Goes Cramer!" when one of their NFP calls goes wide of the uprights. Circa 2019 and for most gold enthusiasts, the weekly Commitment of Traders or "COT" report has now assumed the role of the "obsessive-compulsive disorder" clarion call for those (like me) completely enrapt with "all things golden."

When the U.S. government shut itself down back at midnight December 22, 2018, it was decided that the delivery of a vast portion of all government statistics would be delayed until things resumed to normal. Of course, the major source of ad-revenue-creating financial newsthe Jobs reportwould be exempted from such nonsense as they deemed it far too important an interventionalist's tool to be delayed. However, as the COT numbers were unavailable to the public, the only thing some of us could look at was the open interest figures in gold futures, which still showed up on a daily basis from the end-of-day numbers. So, when open interest exploded in December, one could only speculate that the Commercial tradersthe bullion bank behemothswere once again spinning their web of subterfuge into the headline news of a "dovish Fed policy reversal" and "inevitable crash in the dollar."

Surely as the sun rises every morning, when the COT numbers began to play "catch-up" when the government shutdown ended on January 22, it was sorely and sickenly evident that the aggregate short position held by the bankster bozos was on the rise from the day before the government shutdown at 92,675 net shorts to the last week's number at 166,477. "The bastards are at it again!," I was thinking back in January as gold was advancing nicely into the $1,300s so with open interest ballooning each day and with each advance, you just KNEW that the bullion banks were going to rip the foundation out of the advance at a moment's notice and with not a shred of warning and as noted here and more than a few times, I sent out via Twitter the "call-to-action" on Feb. 20 with gold at $1,344.80 to "Dump all leveraged positions." The rest as they say is "history." $50 per ounce straight down with not so much as a peep out of anyone (of a regulatory moniker).

Friday morning's NFP vigil was reminiscent of the money-supply watch of yore; everyone was gathered around, smiling and laughing and sipping their lattes making their jobs guesses (as if no one cared) when out came the number and it was a whoppingly large miss as the myriad of 200,000+ guesses vaporized into tiny molecular misfires when it was reported that only 20,000 new jobs were created. Everyone, especially CNBC's Steve Leissman, went to the defense with the CNBC "chief economic commentator" said that the report was "wrong" (but January's upside blowout number was, of course, absolutely "fine"). The markets responded as they should have, with stocks plummeting and gold and bonds spiking and the CNBC crowd rushing to change their knickers. As the day wore on, stocks recovered from a 26 point S&P plunge to close down only 5.86 but gold and silver held on to decent gains with the Miners (HUI) going out near the highs for the day.

Accordingly, I go into next week modestly short (S&P and Goldman Sachs) but considerably overweight the leveraged precious metals positions mentioned on March 6 with the missive entitled " PM Reentry Time." NUGT, JNUG and calls on GLD and SLV were all replaced on Wednesday the 6, the day after the $1,282 lows were in place. We had the benefit of an unremarkable day with the lows being seen just after the opening with gold at $1,284.30 so most of the JNUG and NUGT were added to that day, which marked the lows for both for the move. With averages at JNUG $9.45 and NUGT $18.35, Friday's pop in the miners now marks the beginning of the move to test the highs and, as I said earlier this past week, an RSI at 35-40 is not ideal but it is a far cry from the 75 level on Feb. 20 when we pulled the pin on them.

So once again, we are sitting in front of the computer screens, mesmerized by the rearrival of déjà vuthat surreal feeling that we have seen this all before or have visited this space in another lifetime of portion of this lifetime. Over and over and over again, the Commercial traders relieve the CTAs and hedge fund managers and big trading houses of tens of millions of dollars by having an unlimited supply of phony, paper gold "inventory" with which to soften advances; massage support and resistance levels; and intervene at critical points in the trading cycle. Their illicit and unnatural supply of paper gold, which should have no bearing on the pricing process for gold that is physically delivered, has the uncanny ability to affect the fortunes of millions upon millions of retail and institutional investors around the world whose livelihood depends upon true, full, and plain disclosure of price.

That the bullion banks are allowed and able to access a fictional supply of gold and silver with the objective being to control price is a distortion of the spirit and intent of transparency and a violation of the veracity of price discovery. So, how on earth can one trade any market when regulators and justice departments turn a blind eye to both of these tenets so absolutely critical to the survival of the free market system?

The answer, at least for me, is quite simple: one must ALWAYS look behind the wizard's curtain. I do NOT trust ANYTHING that is offered by bloggers or amateur technical analysts as "gospel truth." I must have heard the term "Golden Cross" over 100 times in late January and early February as a reason to mortgage the farm and buy gold, but gold eventually returned last Tuesday to a mere $5 per ounce above the levels where the cross occurred. To have any chance of being successful in the trading universe, one must "Follow the Money" and in the gilded pits of the Crimex Paper Gold Transfer Station, I make it my life's mission to attempt to be on the same side as the criminals, at least as far as positioning is concerned.

For far too many years, I would charge into the calls of Barrick or Newmont on the strength of a "technical breakout" in gold prices, only to see those infamous "journal entries with zero value" show up on my month-end statement as my reward for identifying a technical pattern. The Commercial traders not only see those breakouts coming; they actually massage prices to CREATE the breakouts, seizing gargantuan mittfuls of paper gold to satiate the demand created by these patterns and in so doing, actually conjure up repeated occurrences of the deadliest technical patterns of all, "FAILED breakouts" and "FAILED breakdowns", the combination of both constitutes the derivative of the word "INSOLVENCY."

As comforting for stock market bulls as was the Powell-Mnuchin "policy shift" that happened during the final week of 2018, the same "policy shift" seen with this week's COT is equally as comforting for precious metals bulls. If "Follow the Money" serves as a reminder of what NOT to do when trading, those "fighting the Fed" are no different than those that have been "fighting the Commercials." Both of these entities have proven to be, over time, the drivers behind short-term (and even long-term) price movements. How many times have we read the words of our goldbug friends that point to the "MASSIVE SHORT POSITION HELD BY THE BULLION BANKS" as proof of an impending squeeze and price explosion? Dozens? Hundreds? Thousands? Now, how many times have we seen a short squeeze in ANYTHING that is government sanctioned? Answer: Perhaps silver in the last decade in its move through $50/ounce but it was brief and it ended in tears and no bullion bank went under or came anything close to "in trouble." At worst, there was only "discomfort" that was greeted with "elation" with the April 2013 Sunday Night Massacre that finally bailed them all out with a vengeful retribution of the most-foul manner.

I try to live by the "All is not what it appears" mantra and it took over 35 years to allow the osmosis of cranial capitulation to take effect. My only fear in doing so is the same fear which manifests itself in the minds of those detectives in the hunt for serial murderersthat they will actually BECOME a serial killer, but I think I am safe because the revulsion I fear at the thought of becoming a banker remains sufficient (we hope).

This week I look for a continuation of the precious metals advance and a fierce skirmish between the stock market bulls and bears as that big red candle you see in the above chart of the $SPX is only the second since 2019 arrived. Eight of ten weeks have been straight up and with a friendly Fed and a mountain full of "cash-on-the-sidelines," the eventual retest of the December lows is not going to happen without more than a few back-alley punch-ups. The manner in which "THEY" were able to levitate the market in the latter part of Friday gives rise to an early-week attempt for the bulls to reassert control. Whether that impacts the miners favorably or not remains to be seen, but as long as I carry an ample degree of both humility and cynicism into battle each and every day, I at the least stand a chance of coming home with my net worth intact. As distasteful as it may be, thinking like a bullion bank thief allows me to mount at once both a respectable defense AND psychological advantage so critical in posturing and positioning one's capital. In addition and equally vital lies the presence of amply-stocked liquor cabinets and indecently armed medicine chests with which to cope, both necessary evils within a very necessary battle.

Onward.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Goldman Sachs. My company has a financial relationship with the following companies referred to in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

from The Gold Report - Streetwise Exclusive Articles Full Text https://ift.tt/2tY62qq

0 notes

Text

'Up-to-Date' COT Report: A Maddening Déjà Vu

Source: Michael J. Ballanger for Streetwise Reports 03/10/2019

Precious metals expert discusses recent movements in the markets.

In life, there are a distant events from one's past that embed themselves in one's memory banks in a manner and forcefulness that is directly related to their personal or historical importance. The birth of one's first child, one's first love affair or an athletic achievement fall into the "personal" category; the end of WWII, the first lunar landing or the assassination of JFK are examples of "historical" events. These events in one's lives are so crystallized in their vividness that one is many times able to recall sounds and scents from those exact points in time. Stated another way, how many times has a person had a certain song come on the radio and been memory-jogged back 20 or 30 years? In my case, the scent of hot dogs and popcorn bring to life hockey arenas and dressing rooms while the song "The Night They Drove Ol' Dixie Down" brings me immediately to the old Hamilton Mountain Arena where the Dixie Beehives won the Ontario Junior "B" championship in 1970. Fast-forward to 2019 and there is yet one more memory-etching that is transpiring: the COT report.

Over the years, there have been many financial or mineral exploration events that have occupied the frontal lobes of my cerebral cortex: the Hemlo Gold Discovery of 1981, the Crashes of 1987/2001/2008, most of the major discoveries of the 1990s and a few more far too insignificant to most to recount. There were also weekly reports that over any market cycle became cult-like eventsthe 1980s' money supply numbers reported every Friday at 4:00 p.m. became a Bloomberg news machine gathering of water cooler vintage. Today's version of the money supply numbers is the Non-Farm Payrolls or "Jobs" report, which arrives every other Friday morning at 8:30 EST with enormous fanfare, complete with panels of experts and their "guesstimates" along with "post-report analyses" where the panel members pick apart the number and its components in the same way sports commentators analyze a football game or boxing match. The "Down goes Frazier! Down goes Frazier! Down goes Frazier!" mantra from Howard Cosell in the 1970s is now supplanted with "Down goes Leissman!" or "Down Goes Santelli!" or "Down Goes Cramer!" when one of their NFP calls goes wide of the uprights. Circa 2019 and for most gold enthusiasts, the weekly Commitment of Traders or "COT" report has now assumed the role of the "obsessive-compulsive disorder" clarion call for those (like me) completely enrapt with "all things golden."

When the U.S. government shut itself down back at midnight December 22, 2018, it was decided that the delivery of a vast portion of all government statistics would be delayed until things resumed to normal. Of course, the major source of ad-revenue-creating financial newsthe Jobs reportwould be exempted from such nonsense as they deemed it far too important an interventionalist's tool to be delayed. However, as the COT numbers were unavailable to the public, the only thing some of us could look at was the open interest figures in gold futures, which still showed up on a daily basis from the end-of-day numbers. So, when open interest exploded in December, one could only speculate that the Commercial tradersthe bullion bank behemothswere once again spinning their web of subterfuge into the headline news of a "dovish Fed policy reversal" and "inevitable crash in the dollar."

Surely as the sun rises every morning, when the COT numbers began to play "catch-up" when the government shutdown ended on January 22, it was sorely and sickenly evident that the aggregate short position held by the bankster bozos was on the rise from the day before the government shutdown at 92,675 net shorts to the last week's number at 166,477. "The bastards are at it again!," I was thinking back in January as gold was advancing nicely into the $1,300s so with open interest ballooning each day and with each advance, you just KNEW that the bullion banks were going to rip the foundation out of the advance at a moment's notice and with not a shred of warning and as noted here and more than a few times, I sent out via Twitter the "call-to-action" on Feb. 20 with gold at $1,344.80 to "Dump all leveraged positions." The rest as they say is "history." $50 per ounce straight down with not so much as a peep out of anyone (of a regulatory moniker).

Friday morning's NFP vigil was reminiscent of the money-supply watch of yore; everyone was gathered around, smiling and laughing and sipping their lattes making their jobs guesses (as if no one cared) when out came the number and it was a whoppingly large miss as the myriad of 200,000+ guesses vaporized into tiny molecular misfires when it was reported that only 20,000 new jobs were created. Everyone, especially CNBC's Steve Leissman, went to the defense with the CNBC "chief economic commentator" said that the report was "wrong" (but January's upside blowout number was, of course, absolutely "fine"). The markets responded as they should have, with stocks plummeting and gold and bonds spiking and the CNBC crowd rushing to change their knickers. As the day wore on, stocks recovered from a 26 point S&P plunge to close down only 5.86 but gold and silver held on to decent gains with the Miners (HUI) going out near the highs for the day.

Accordingly, I go into next week modestly short (S&P and Goldman Sachs) but considerably overweight the leveraged precious metals positions mentioned on March 6 with the missive entitled " PM Reentry Time." NUGT, JNUG and calls on GLD and SLV were all replaced on Wednesday the 6, the day after the $1,282 lows were in place. We had the benefit of an unremarkable day with the lows being seen just after the opening with gold at $1,284.30 so most of the JNUG and NUGT were added to that day, which marked the lows for both for the move. With averages at JNUG $9.45 and NUGT $18.35, Friday's pop in the miners now marks the beginning of the move to test the highs and, as I said earlier this past week, an RSI at 35-40 is not ideal but it is a far cry from the 75 level on Feb. 20 when we pulled the pin on them.

So once again, we are sitting in front of the computer screens, mesmerized by the rearrival of déjà vuthat surreal feeling that we have seen this all before or have visited this space in another lifetime of portion of this lifetime. Over and over and over again, the Commercial traders relieve the CTAs and hedge fund managers and big trading houses of tens of millions of dollars by having an unlimited supply of phony, paper gold "inventory" with which to soften advances; massage support and resistance levels; and intervene at critical points in the trading cycle. Their illicit and unnatural supply of paper gold, which should have no bearing on the pricing process for gold that is physically delivered, has the uncanny ability to affect the fortunes of millions upon millions of retail and institutional investors around the world whose livelihood depends upon true, full, and plain disclosure of price.

That the bullion banks are allowed and able to access a fictional supply of gold and silver with the objective being to control price is a distortion of the spirit and intent of transparency and a violation of the veracity of price discovery. So, how on earth can one trade any market when regulators and justice departments turn a blind eye to both of these tenets so absolutely critical to the survival of the free market system?

The answer, at least for me, is quite simple: one must ALWAYS look behind the wizard's curtain. I do NOT trust ANYTHING that is offered by bloggers or amateur technical analysts as "gospel truth." I must have heard the term "Golden Cross" over 100 times in late January and early February as a reason to mortgage the farm and buy gold, but gold eventually returned last Tuesday to a mere $5 per ounce above the levels where the cross occurred. To have any chance of being successful in the trading universe, one must "Follow the Money" and in the gilded pits of the Crimex Paper Gold Transfer Station, I make it my life's mission to attempt to be on the same side as the criminals, at least as far as positioning is concerned.

For far too many years, I would charge into the calls of Barrick or Newmont on the strength of a "technical breakout" in gold prices, only to see those infamous "journal entries with zero value" show up on my month-end statement as my reward for identifying a technical pattern. The Commercial traders not only see those breakouts coming; they actually massage prices to CREATE the breakouts, seizing gargantuan mittfuls of paper gold to satiate the demand created by these patterns and in so doing, actually conjure up repeated occurrences of the deadliest technical patterns of all, "FAILED breakouts" and "FAILED breakdowns", the combination of both constitutes the derivative of the word "INSOLVENCY."

As comforting for stock market bulls as was the Powell-Mnuchin "policy shift" that happened during the final week of 2018, the same "policy shift" seen with this week's COT is equally as comforting for precious metals bulls. If "Follow the Money" serves as a reminder of what NOT to do when trading, those "fighting the Fed" are no different than those that have been "fighting the Commercials." Both of these entities have proven to be, over time, the drivers behind short-term (and even long-term) price movements. How many times have we read the words of our goldbug friends that point to the "MASSIVE SHORT POSITION HELD BY THE BULLION BANKS" as proof of an impending squeeze and price explosion? Dozens? Hundreds? Thousands? Now, how many times have we seen a short squeeze in ANYTHING that is government sanctioned? Answer: Perhaps silver in the last decade in its move through $50/ounce but it was brief and it ended in tears and no bullion bank went under or came anything close to "in trouble." At worst, there was only "discomfort" that was greeted with "elation" with the April 2013 Sunday Night Massacre that finally bailed them all out with a vengeful retribution of the most-foul manner.

I try to live by the "All is not what it appears" mantra and it took over 35 years to allow the osmosis of cranial capitulation to take effect. My only fear in doing so is the same fear which manifests itself in the minds of those detectives in the hunt for serial murderersthat they will actually BECOME a serial killer, but I think I am safe because the revulsion I fear at the thought of becoming a banker remains sufficient (we hope).

This week I look for a continuation of the precious metals advance and a fierce skirmish between the stock market bulls and bears as that big red candle you see in the above chart of the $SPX is only the second since 2019 arrived. Eight of ten weeks have been straight up and with a friendly Fed and a mountain full of "cash-on-the-sidelines," the eventual retest of the December lows is not going to happen without more than a few back-alley punch-ups. The manner in which "THEY" were able to levitate the market in the latter part of Friday gives rise to an early-week attempt for the bulls to reassert control. Whether that impacts the miners favorably or not remains to be seen, but as long as I carry an ample degree of both humility and cynicism into battle each and every day, I at the least stand a chance of coming home with my net worth intact. As distasteful as it may be, thinking like a bullion bank thief allows me to mount at once both a respectable defense AND psychological advantage so critical in posturing and positioning one's capital. In addition and equally vital lies the presence of amply-stocked liquor cabinets and indecently armed medicine chests with which to cope, both necessary evils within a very necessary battle.

Onward.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Goldman Sachs. My company has a financial relationship with the following companies referred to in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

from https://www.streetwisereports.com/article/2019/03/10/up-to-date-cot-report-a-maddening-d-j-vu.html

0 notes

Photo

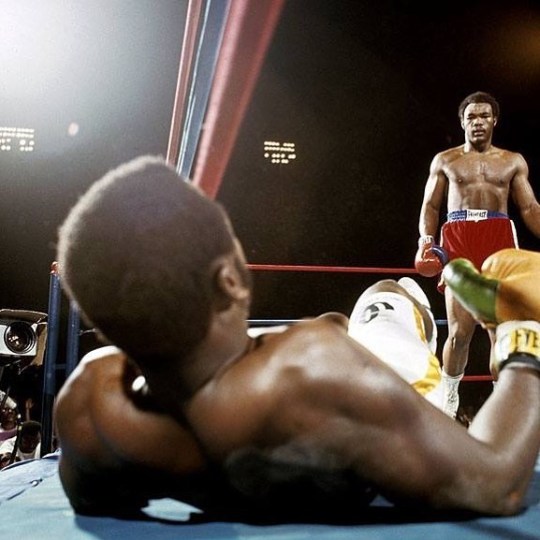

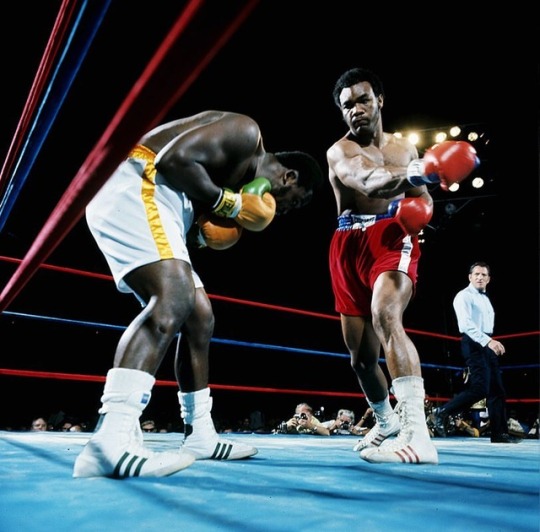

"Down goes Frazier!" Howard Cosell’s memorable call to George Foreman’s shocking two-round destruction of Joe Frazier in Kingston, Jamaica, on Jan. 22, 1973. (at College Park, Georgia)

0 notes

Photo

45 years ago today, Howard Cosell famously calls, DOWN GOES FRAZIER! DOWN GOES FRAZIER! DOWN GOES FRAZIER! Photograph by Neil Leifer

0 notes

Text

AWE Wages Picture is Worse Than It Looks; Why Is The Curve Still So Flat?

“Down Goes Frazier! Down Goes Frazier! Down Goes Frazier!” --Howard Cosell

I used to have a colleague that would giddily exclaim, “Down Goes Frazier!” anytime he was short a bond that flashed, “HIT” on the broker screens. Since he was pretty good at his job, it became so ubiquitous on the desk that it was easy to forget where it originated.

Those of us that grew up in the 90s remember George Foreman as a lovable middle aged man that made a living beating up mediocre boxers and selling indoor grilling equipment. But in the 70s, he was a total badass. Foreman pummelled the champ into virtual submission, knocking him down six times before the ref stopped the fight midway through the second round.

So that was the phrase that went through my head when I saw that negative NFP print. The unthinkable has come true….A seven year streak of positive prints is over.

An awful number, even looking through the noise from the hurricane? Not by a long shot. UE continued lower, indicating there was no easing of labor market conditions. More importantly, average hourly earnings grew faster than expected, and continued a trend higher that has been intact since early this year.

I’m always a little suspect of YoY numbers since they are by definition dependent on what happened a year ago--a look at annualized AHE over the last three months, seasonally adjusted paints a rather surprising picture:

.

Pretty clear picture there. Three periods of recent history--2010 to 2015, when wages bumbled around 2%....2015 to early 2017, when they bounced around 2.5%. Now one could reasonably infer wages are set to find a new range at or above 3%.

And yes, the Fed has hiked interest rates, and has the torpedoes armed and ready to deploy in December. Yet the curve remains amazingly flat--no doubt in part because of this year’s low headline inflation prints implying we may be near the end of the economic cycle. But with the recent prints in payrolls/wages and some good arguments for why headline CPI is understating financial conditions, seems like 2/5s should be a little closer to the steeps than the flats, when there is little evidence the Fed is going to waterboard the economic recovery with an aggressive hiking cycle.

And we all know what USD has done this year--until the past few weeks anyway.

Why does the curve refuse to steepen? This chart is from Kashkari’s diatribe last week. The FOMC’s most dovish voice says,

“I believe the most likely causes of persistently low inflation are additional domestic labor market slack and falling inflation expectations…..I will argue that the FOMC’s policy to remove monetary accommodation over the past few years is likely an important factor driving inflation expectations lower.”

I think the above evidence takes an ax to the first leg of Kashkari’s labor market argument. And the second? The clear implication is that the combination of tapering asset purchases, hiking rates, and eliminating SOMA re-investments (that is, reducing the balance sheet) has over-tightened monetary conditions.

I think Kashkari has misidentified the source of lower inflation expectations. Market-implied inflation expectations fall by definition when there are buyers of nominal rate bonds relative to inflation linkers. Without kicking the hornet’s nest of term premium arguments, the NY Fed’s ACM term premium model shows a steady if unspectacular increase in short-term forward rates with the term premium still solidly in negative territory.

Source: New York Fed

The bottom line is that there is a ton of demand for assets relative to the marginal propensity to consume. Global investors want to buy more long-duration assets relative to the quantity being issued by either the government, or corporate borrowers, forcing down future returns. That doesn't foreshadow lower inflation. It illustrates easy financial conditions.

That demand for assets extends not only to foreign corporations and individuals, but also to central banks. Remember a year ago when smart people we saying there was a floor below which the PBOC’s foreign reserves could not sustainably fall? If it ever existed, it is nearly $100 billion in the rear-view mirror now.

And the Chinese aren’t the only ones--the US current account deficit combined with resurgent manufacturing demand has put foreign central banks into overdrive to limit the appreciation of their domestic currencies. Foreign central banks have purchased roughly $200 billion of treasuries this year.

One might think that reflected a global interest in buying US Treasuries--but foreign private investors have added a modest $24 billion this year. Any chance that money is going into spread product???

Which brings us nicely back to this:

The Economist gives us about one of these per year. It just shouts out “contrary indicator”. Twitter practically had kittens.

Take the time to read through the article, it’s actually pretty good. They go through a number of arguments for how we got here and what might happen next. Only one did I find rather dubious--the suggestion that we are near the endgame because there are more people in developed markets starting to retire, and as they burn off assets real interest rates will be forced to rise.

That ignores billions of people in emerging markets. Not only are they in a better demographic situation--they are living longer as their standard of living increases.

A recent paper by the San Francisco Fed shows that it is actually life expectancy rather than demographics that has driven real rates lower over the past thirty years.That means as people in EM countries increase their living standards, they are not only making more money, they are hoarding more of it in anticipation of living a long and fruitful life, which pushes global real interest rates lower. More on this subject later this week.

We can parse this market in practically any way we like--bemoaning the lust for cov-lite, sub-investment grade bonds, Argentine bonds with comically long times to maturity, levered short vol positions, or private equity, but at the end of the day there is a ton of money chasing assets, and not enough scary stuff happening in the world to convince them to change course.

History tells us these trends don’t end well. But we don’t know when the music stops. The Fed doesn’t want to be the villain that breaks the market--but there’s a ton of evidence I’ve noted here that argue financial conditions are too loose, and even by its own measures, core inflation isn’t telling the whole story. I just can’t get away from the memory of 2004-2006, when the fed hiked 25bps every meeting for three years and still armed the greatest financial weapon of mass destruction history has ever seen.

To the Fed Governors...I know you guys love your jobs but look at your own numbers...to borrow from Reagan…”Doctor Yellen, Steepen this Curve!”

0 notes

Video

youtube

Down Goes Frazier, down goes Frazier, down goes Frazier!!!