#how to register for efiling

Text

The PAN card is a fundamental document for taxpayers in India, playing a crucial role in the ITR filing process. It not only serves as a means of identification but also aids in preventing tax evasion and ensuring transparency in financial transactions. Therefore, it is imperative for individuals and entities to obtain and maintain an active PAN card for their financial activities. Read More

#itr filing#income tax return filing#benefits of filing income tax return#nri income tax return filing in india#benefits of itr filing in hindi#use of pan card in hindi#how to file itr in case of no income#income tax filing#benefits of itr filing#income tax filing in tamil#itr 1 filing online 2022-23#nri tax in india#inoperative pan card itr filing#nri tax filing india#how to register for efiling#tax filing school

0 notes

Text

Filing Income Tax Returns in India: A Comprehensive Guide with Ensurekar

Introduction

Filing your income tax return (ITR) in India can seem daunting, but with the right information and guidance, it can be a smooth and efficient process. This guide provides a comprehensive overview of e-filing income tax returns in India, including registration, types of returns, filing procedures, and crucial details for the Assessment Year (AY) 2023-24.

What is eFiling Income Tax Return?

The Income Tax Department of India offers a convenient online platform for electronically filing your ITR. This e-filing portal eliminates the need for physical visits to tax offices and streamlines the entire process.

Why File Your ITR?

Individuals falling under specific tax slabs are mandated to file their returns. Here are some reasons why filing your ITR is important:

Fulfilling Tax Obligations: It ensures compliance with tax regulations and avoids potential penalties for non-filing.

Claiming Refunds: If you've paid excess taxes through TDS (Tax Deducted at Source), filing your ITR is necessary to claim a refund.

Loan and Visa Applications: Many financial institutions and embassies require a clean tax filing history for loan approvals and visa processing.

Carrying Forward Losses: If you've incurred losses under a specific income head, filing your return allows you to carry them forward and offset future income.

Building a Credit History: A consistent record of timely ITR filing can positively impact your creditworthiness.

Types of eFiling Income Tax Returns

There are two main ways to file your ITR electronically:

Self-e-Filing: This involves filing your return directly through the Income Tax Department's e-filing portal. You'll need to fill out the ITR form with all necessary information, attach required documents, and submit it online.

Assisted ITR Filing: You can opt for assistance from authorized professionals like tax consultants, chartered accountants, or online tax-filing platforms. These intermediaries will handle the entire filing process, from collecting information to submitting your return online.

Benefits of eFiling Income Tax Return (ITR):

Convenience: Eliminates the need for physical visits and saves time and effort.

Security: The online process protects sensitive information with secure protocols.

Timely Processing: E-filing leads to faster processing and quicker refunds compared to paper returns.

Accuracy: The online platform helps with accurate tax calculations and reduces the chances of errors.

Environmentally Friendly: E-filing reduces paper usage and contributes to a greener environment.

How to File an eFiling Income Tax Return

Step 1: Registration

New users need to register on the Income Tax Department's e-filing portal using their PAN card details.

Step 2: Gather Documents

Collect all relevant documents like PAN card, Aadhaar card, Form 16 (salary certificate), TDS certificates, bank statements, investment proofs, and any other income or deduction-related documents.

Step 3: Choose the Right ITR Form

The appropriate ITR form depends on your income sources and category. Common forms include ITR-1 (for income up to ₹50 lakhs) and ITR-2 (for income with capital gains or foreign assets). For AY 2023-24, ensure you use the most recent versions of the forms.

Step 4: Fill and Verify the ITR Form

Fill out the chosen ITR form with accurate details about your income, deductions, and exemptions. Carefully review the entries to avoid errors. You can verify the return electronically using Aadhaar OTP or EVC (Electronic Verification Code), or by sending a signed physical copy of ITR-V to the Centralized Processing Center (CPC) within 120 days of filing.

Step 5: File the Return Online

Log in to the e-filing portal, navigate to the 'e-File' section and select 'Income Tax Return.' Upload the prepared ITR form or XML file and submit it.

Step 6: Keep Records for Reference

Maintain copies of the filed return, acknowledgment receipt, and supporting documents for future reference.

How Ensurekar Can Help

At Ensurekar, we understand the complexities of tax filing. We offer a comprehensive range of services to ensure a smooth and efficient ITR filing experience:

Expert Guidance: Our experienced tax professionals can guide you through the entire process, from choosing the right ITR form to maximizing deductions and claiming refunds.

Accurate Calculations: We ensure accurate tax calculations to minimize any tax liabilities or penalties.

Timely Filing: We help you meet all deadlines and avoid late filing penalties.

Stress-Free Experience: We take the stress out of tax filing, allowing you to focus on other important matters.

Additional Information:

Penalty for Late Filing of ITR: Filing your ITR after the due date can attract penalties and interest charges on the tax payable.

Steps to File ITR without Form 16: If you don't have Form 16, you can still file your ITR by gathering income proofs from various sources, calculating your TDS using Form 26AS, and claiming eligible deductions.

Conclusion:

Filing your income tax return is a crucial responsibility. By leveraging the benefits of e-filing and potentially seeking professional assistance from Ensurekar, you can ensure a smooth, accurate, and timely filing process.

0 notes

Text

Are you a busy Law Firm #lawfirm or corporation that needs help to electronically file #efile court documents, process serve documents or need #privateinvestigation skip tracing services?

You can electronically file your documents using E-FILE Expert™ as your electronic service provider (EFSP) or we can file your documents in-person ourselves.

E-FILE Expert™

730 Arizona Avenue, Ste. 200

Santa Monica, CA 90401

Call Us 800-765-6920

#california#efiling#CourtFiling#Filingdocuments#alamedacounty#SuperiorCourt#CourtFilingServices#efilingservices#instantefiling

Is eFiling mandatory?

Beginning January 1, 2022, eFiling will be mandatory for parties represented by counsel, unless counsel has obtained a court order for exemption.

If I am an attorney, how do I request an exemption from electronic filing?

If you are an attorney who cannot use the eFiling system, you may request an exemption from mandatory electronic filing using Judicial Council forms EFS-007 and EFS-008 and submit those forms to the court for review.

If I am representing myself (pro per), is eFiling mandatory?

No, if you are a self-represented litigant (pro per), eFiling is optional.

If I am a self-represented litigant (pro per), and choose not to use eFiling, what are my other filing options?

If you are self-represented and choose not to use eFiling, the other filing options available are by visiting a clerk’s office at the courthouse, by U.S. mail, or by placement in a drop box at the courthouse.

Is eSubmit still available?

Beginning January 1, 2022, eSubmit will no longer be available for unlimited civil, including complex, limited civil, unlawful detainers and small claims cases. eSubmit will still be available for Family Law, Probate, Juvenile, Criminal and Traffic cases.

youtube

What are the filing hours for eFiling?

You may submit your filings electronically 24 hours a day. Any eFiling received by the court before midnight will be deemed received or filed on the same business day if accepted. Any eFiling submitted after midnight or on weekends/holidays will be deemed received or filed as of the next business day if accepted.

How does eFiling work?

Electronic filing of court documents occurs through an electronic filing service provider (EFSP). The user creates an account through their selected EFSP and the eFiling system manages the flow of the documents and fees to and from the court. The filer will submit the documents to the EFSP for submission to the court. The court will accept or reject the documents. The documents are returned to the EFSP for return to the filer through the EFSP’s electronic filing portal.

Do I have to use an EFSP?

Yes, the Judicial Council has mandated that all courts accepting electronically filed documents use independent EFSPs. Pursuant to Code of Civil Procedure Section 1010.6(e) the court may not accept electronic filings directly. You can choose any approved EFSP listed on the court’s website.

Can I change my EFSP after I have chosen and registered with one?

Yes, you may choose any EFSP. You may change to a different service provider at any time. Selecting and using an EFSP is similar to using an ‘attorney service’ for filings, except the types of filings processed are electronic.

Who can I speak with if I have a question about an electronic filing?

The first point of contact for any question should be your EFSP E-FILE Expert™

youtube

#Riverside County Court E-filing Services#los angeles county superior court efiling#contra costa county superior court efiling#fresno county superior court efiling#kings county superior court efiling#Youtube

0 notes

Text

Prerequisite for Individuals to Register on Income Tax Portal

Income Tax Login: It is mandatory for every tax payer in India to register as a account on the Income tax department's website.

As a registered user one is able to access prior years' income tax return, e-verify the income tax returns as well as check the status of refunds and so on.

Click here:the tax log in com

Income Tax Login: IT Department Efiling Login

First Step: Go to the website of the Income Tax Department

To get access to for access to the Indian Income Tax log-in page go to the official website. You will find an icon on the upper-right side with the option to log in to sign-up users.

Step 2: Enter the Details

After you click the button, you'll be directed to the login page on which you must fill in your username for income tax login and proceed to continue.

Note that to login for income tax your username refers to the PAN card number.

After that, select skip to take your to the Dashboard page.

If you're not been registered yet using the income tax portal, here's the procedure for registration.

Prerequisite for Individuals to Register on Income Tax Portal

Before registering for the portal for income tax One must make sure they are registered with the following details:

Valid PAN

Valid Mobile Number

Valid Current Address

An email address that is valid, but at least your own

Irresponsible, minor, or lunatic and those barred by the Indian Contract Act, 1872 are not qualified to sign up on the tax portal for income.

Step-by-Step Process on Registering on the Income Tax Department Website

1. Go to the Income Tax department's portal

On the home page of the portal for government you can click "Register" at the top right right side on the homepage.

Step 3: Enter the Basic Details

Input basic information such as initial name, middle name, and the last name. Select gender as well as residential status.

Sixth Step: Check the information entered.

After having verified the OTP after which you will be presented with an additional window that will allow you to check the entered details.If you'd like to make corrections, return to the previous screen, make the needed corrections, and then verify that same information using the OTPs you received.

Step 7: Set password.

After verification, you can set an account password and then set up a secure login. The password must consist of upper and lower case letters, as well as special characters.

You'll need your username and password for your ITD income tax portal login. If, however, you are making use of the ITD mobile app , or ...

The etax payment - tax Payment allows the payment of directly tax payments through the web by those who pay taxes. ... Once you have successfully login you can enter the payment information on the bank's website.

Do you need help in taxes preparation? Go to H&R Block's website for a variety in taxes preparation services that will ensure you receive the highest refund.

Sign up with your credentials for the Income Tax Login to complete your IT tax return for the assessment year, and also to verify the tax refund for income tax If it is applicable, learn the steps to.

Dutch taxes returns for expatriates. Professional service. Fast results.Also Mortgage refund. Experienced Professionals. Low Prices. Quick Turnaround.

The Portal is designed for the submission of complaints by taxpayers as well as other stakeholders. They are able to submit a Complaint on the Portal indicating any the issue or issues they face ...

Learn how to register and login to the Income Tax Department's Online Portal in India.Complete Step by Step instruction to register your account with the IT

Login. The Tax Institute logo. The Tax Institute is Australia's top professional association and teacher in tax, offering the most comprehensive tools,

1 note

·

View note

Photo

Quick Filing Work With Class 3 Digital Signature Certificate

Digital Signature Certificates are being adopted by various government agencies and are now a statutory requirement in various applications.

Being a registered Certifying Authority in India Under CCA, we offer different classes of certificates to help organizations and individuals to secure online transactions and keep their Digital Identities safe. Capricorn DSC follow the x.509 standards of Public Key Infrastructure (PKI) in India wherein additionally these are issued as per IVG and IOG guidelines issued by the office of CCA.

How Does A Class 3 help in making your filing work easy?

These days a considerable amount of documentation is done in electronic arrangement and Digital Signatures are needed to help build up the personality of the sender. Online cycles, for example, Income Tax E-recording, LLP fuse, organization consolidation, and so on, are approved utilizing DSC.

In any event, for the unfamiliar people or the Indian public abroad, having a paperless Class 3 DSC for Organizational and enlisting their association at different government entrances, turns into an order for the clients.

As per the newest CCA guidelines, only the class 3 digital signature became legal and valid to be used. A Digital Signature has validity from 1 to three years. The user can purchase or BUY DSC or they will renew it after the validity expires. Having a bulk signer can make your pdf signing work less hectic and safe.

However, during this blog of ours, we'll be talking about Class 3 Digital Signature which is the most secured DSC for an online procedure.

Key Highlights Of Organizational And National DSCs

Digital Signature is protected and can be utilized to sign electronic archives, for example, solicitations and other PDF records. Authorized CA issues DSC subsequent to confirming the character of the candidate.

The paperless cycle is accessible for Individual DSC enlistment. There is no compelling reason to print any application structure. There is no compelling reason to send any records by post or dispatch.

Class-3 DSC for both unfamiliar nationals and associations accompanies a legitimacy of 2 or 3 years. After the expiration of the legitimacy time frame, Certifying Authority should confirm the character again to reestablish the Digital Signature.

Usage Of Class 3 Paperless DSCs

Class-3 DSC for Foreign Nationals can be utilized for eTenders, Patents enlistment, GST, Income Tax, Import Export Code, Signing Invoices, entryways of Ministry of Corporate Affairs (MCA), PDF Signing, brand name enrollment, and different other Indian government gateways that acknowledge Digital Signature.

Additionally, the approved signatory can get or apply for the unfamiliar hierarchical DSCs to satisfy the e-documenting administrations at the public authority entry for their individual association:

GST and Income Tax eFiling

MCA21 - Ministry of Corporate Affairs

Transfer of eForms

Make Payments

Yearly e-Filing

Government Tenders

Licenses Filing

Noise - Director Identification Number

IEC - Import Export Code

Receipt Signing (Tally, or another bookkeeping programming)

Chief eKYC

PDF Signing

Brand names Registration

Benefits Of Using DSC:

DSC authenticates personal information.

It reduces excess cost and usage time.

No physical presence of the DSC holder is required to conduct business.

The signed document cannot be altered or edited after signing.

Digitally signed documents help the receiver to be assured of the signer’s authenticity.

According to our main concern, the residents of the Indian public abroad and residents of different countries or their endeavors can purchase DSC for organizations or individuals, so they can make secure exchanges in the country.

Likewise, the entire cycle is fast and when confirmed, you can download those DSCs in only 15 minutes on your framework or USB token.

0 notes

Photo

Truckers, the IRS Tax Form 2290 and Schedule 1 are now due for the Tax Year that started in July 2021 through June 2022. August 31, 2021 is the due date, choose electronic filing to report and pay the Federal Heavy Vehicle Use Taxes with the IRS. TaxExcise.com bring you the best service, our support agents are working round the clock to guide you through your 2290 reporting process. Act fast and you just have couple of weeks to have this done.

Form 2290 eFiling - August 31, 2021 - Due Date

Electronic filing for the federal heavy highway vehicles is easy, simple and fast. no other source of filing can get you the Schedule 1 copies as fast as we deliver, we know how these Schedule 1 Proof of Payments are essential for a trucker to have your vehicle registered or renewed with the Federal Agencies.

#Tax 2290 efile for 2021#tax 2290 online for 2021#tax 2290 electronic filing for 2021#tax 2290 efiling for 2021

0 notes

Text

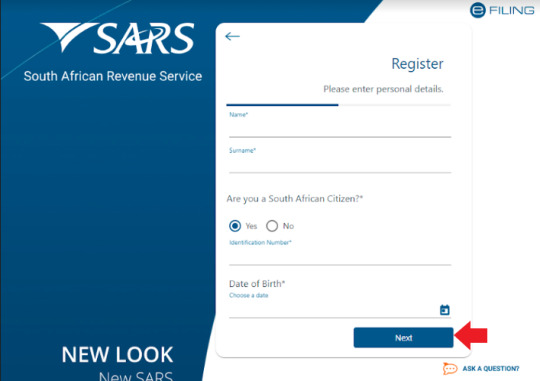

How Do I Register for Tax? See Methods

How Do I Register for Tax? See Methods

There are three ways to register for tax:

– Auto registration for Personal Income Tax

When you register for SARS eFiling for the first time and you do not yet have a personal income tax number, SARS will automatically register you and issue a tax reference number. Note that you must have a valid South African ID.

Easy Steps:

Go to http://www.sars.gov.za

Select ‘Register Now’

Follow the…

View On WordPress

0 notes

Text

Trump Administration Pushes through Massive Immigration Fee Increase

The next wave of Trump administration policy designed to reduce immigration is here. U.S. Citizenship and Immigration Services (USCIS) will impose major increases in the immigration fee structure effective October 2, 2020. The USCIS immigration fee increase would nearly double the cost of some applications. However, there are some minor reductions for other types of applications.

The Trump administration is simultaneously squeezing immigrants with a new public charge rule and changes to the fee waiver rules that make it more difficult for low-income immigrants and their families. To add insult to injury, some of the new fees will go to pay for Immigration and Customs Enforcement (ICE).

The new immigration fee schedule increases the costs for several family-based petitions and applications and would even add new types of fees. The proposal was initially published in the Federal Register on Thursday, November 14, 2019. That rule has now been finalized and will go into effect on October 2, 2020.

Fee Increase Affect on Adjustment Applicants

At a glance, the fee for Form I-485 will go down by $10, but this can be deceiving. Currently, USCIS waives certain fees for adjustment of status applicants. In most cases, the fee for Form I-765 (employment authorization document) and I-131 (advance parole travel document) are waived with a pending I-485 application. The agency’s immigration fee increase returns to a model of charging separate fees for Forms I-485, I-765, and I-131. Unfortunately, this is drastically increasing the cost for nonimmigrant visitors to adjust status to permanent resident. Instead of paying $1,760 in fees for the typical family-based adjustment case, the combined fees are hiked to $2,860 (if an EAD and advance parole document are needed). This will also affect many U.S. citizens. A large percentage of adjustment cases are for the foreign national spouses of U.S. citizens.

What’s more, USCIS has removed the reduced fee for children filing with parents. In the previous fee schedule, children receive a reduced fee if filing Form I-485 with a parent. USCIS is removing the $390 savings. Child applicants must now pay the same fees as adults.

RECOMMENDED: Green Card through Adjustment of Status

Naturalization Fee Hike

Applicants for U.S. citizenship are some of the hardest hit by the USCIS immigration fee increases. The new fee for Form N-400, Application for Naturalization, is $1,170. That’s 83% more than the current $640 fee. Additionally, fee waivers could be taken away in the future.

The $530 increase will make it increasingly difficult for permanent residents to become citizens through the naturalization process. The move could reverse the efforts made in previous years to make the process more accessible. In the 1990s, the naturalization filing fee was under $100.

DACA Fee Increase Averted

The administration’s initial rule had proposed a new $275 fee for requests to renew DACA (Deferred Action for Childhood Arrivals). However, the final rule did not include this fee. Thus, the fee the renewal DACA will continue to be a combined $495. The combined fee includes a $410 filing fee for Form I-765 plus $85 biometrics services fee.

If your DACA status expires within the next six months, you are already encouraged to renew as soon as possible.

New USCIS Filing Fees for Common Forms

The immigration fee increase affects most forms. In some cases, there is actually a small improvement in the fee. We’ve listed some of the most commonly used USCIS forms:

FormCurrent FeeNew Fee$ Change% ChangeI-90$455$415($40)(9%)I-129F$535$510($25)(5%)I-130$535$560$255%I-131$575$590$153%I-131A$575$1,010$43576%I-4851$1,140$1,130($10)(1%)I-751$595$760$16528%I-7652$410$550$14034%N-400$640$1,170$53083%N-565$555$545($10)(2%)N-600$1,170$1,000($170)(15%)1 Final rule also removes reduced fee for children under 14. Additionally, there is a $1,080 fee for certain asylum applicants.

2 Increase in filing fee does not apply to EAD requests based on a grant of DACA.

This is not a comprehensive forms or fee changes. For the complete all forms, please refer to the final rule in the Federal Register.

USCIS Fees Will Not Pay for ICE

USCIS officials have said that the immigration fee increase would help pay for an “overextended system.” Generally, the purpose of fee increases is to fund the operations of USCIS operations. However, the proposed rule gave the agency room to use the fee hike for other activities.

The USCIS immigration fee proposal was written to allocate more than $207 million in filing fees to ICE operations, including ICE immigration benefit fraud investigations and enforcement. This is counter to how USCIS has previously operated. The immigration agency charges fees to pay for the services provided to petitioners and applicants. Fortunately, the final rule declined to use funds collected by USCIS for enforcement operations.

Other Obstacles for Immigrants

Over the last year, the Trump administration introduced other measures to limit legal immigration. All appear designed to make it more difficult for lower income immigrants to qualify for benefits.

In January, USCIS finalized changes to a new public charge rule. The modification requires intending immigrants to submit a new, onerous form that dives into the financial background of green card applicants. Combined with stricter guidelines, it would make it more difficult for low-income applicants to qualify. Multiple court injunctions temporarily halted this policy. However, the administration may be able to implement it in the future.

RECOMMENDED: Public Charge Rule, Explained

Additionally, the agency removed one of the principal methods to qualify for a USCIS fee waiver. Fee waivers enable certain immigrants obtain benefits for a reduced fee or no fee at all. Many applicants have used means-tested benefits as a qualifying factor. USCIS took away this criterion, meaning that applicants may generally qualify only after submitting substantial amounts of tax return information or other documents to prove income level. Consequently, this measure puts a larger burden of work hours on USCIS to screen applicants. The increased costs get passed on to everyone else.

Online Filing

USCIS is offering a small incentive to those who use the efile system for certain forms. Individuals who file online will receive $10 off the filing fee.

USCIS Immigration Fee Increase Goes Into Effect October 2, 2020

Applicants still have time to seek immigration benefits prior to the new immigration fee increase.

The final rule was published July 31, 2020. USCIS is providing a grace period of up to 60 days in which they will accept both the previous and the new versions of certain forms as long as payment of the new, correct fees accompanies the forms. Applicants and petitioners must use the new or revised form by October 2, 2020.

The fee changes arrive as USCIS is facing a significant budget shortfall and possible furloughs for employees. Unlike most federal agencies, USCIS receives most of its funding from fee collection. The agency closed offices and paused most in-person services due to the COVID-19 pandemic.

About CitizenPath

CitizenPath provides simple, affordable, step-by-step guidance through USCIS immigration applications. Individuals, attorneys and non-profits use the service on desktop or mobile device to prepare immigration forms accurately, avoiding costly delays. CitizenPath allows users to try the service for free and provides a 100% money-back guarantee that USCIS will approve the application or petition. We provide support for Adjustment of Status (Form I-485), the Citizenship Application (Form N-400), Green Card Renewal (Form I-90), and several other immigration services.

Source: Federal Register

(function(d){var s=d.createElement('script');s.type='text/javascript';s.src='https://a.omappapi.com/app/js/api.min.js';s.async=true;s.dataset.campaign='tavd1gp5dt5ux3pmbhmp';s.dataset.user='12316';d.getElementsByTagName('head')[0].appendChild(s);})(document);

The post Trump Administration Pushes through Massive Immigration Fee Increase appeared first on CitizenPath.

Trump Administration Pushes through Massive Immigration Fee Increase published first on https://ordergcmsnotescanada.tumblr.com/

0 notes

Link

As entrepreneurs, we often think about protecting our assets by taking out insurance, getting bonded or creating a Tax ID number, but one thing that many business owners forget to do is to protect their intellectual property.

The World Intellectual Property Organization (WIPO) describes intellectual property (IP) as “creations of the mind, such as inventions; literary and artistic works; designs; and symbols, names and images used in commerce.” IP can be a concern if you have developed or are in the process of developing a product, service, process or concept that you wish to take to market, and if you want to protect your business’ name and identity.

Trademarks, patents and copyrights protect different types of IP. A trademark typically protects logos and brand names used on goods and services; a patent protects an invention; and a copyright protects an original literary or artistic work. For example, if you invent a new type of air conditioner, you would need to apply for a patent to protect the invention itself. Then, you would need to register a trademark to protect the brand name of the air conditioner. Finally, you might want to register a copyright for the jingle you used in a TV commercial marketing the air conditioner.

So whether you’ve invented something, developed a software code, written a book or even crafted a jingle, you need to legally protect your work.

What is a Trademark?

As defined by the United States Patent and Trademark Office (USPTO), “A trademark is a word, phrase, symbol and/or design that identifies and distinguishes the source of the goods of one party from those of others.” A service mark affords the same protection rights to services, rather than goods. The word “trademark” is typically used in reference to both trademarks and service marks. Trademarks can be used for brand names, slogans and logos, among other things.

In simple words, a trademark helps people differentiate between the goods or services of one company from those of other companies. Trademarks date back to ancient times, when artisans used to put their mark or signature on their products.

In general, marks fall into one of four categories: fanciful or arbitrary, suggestive, descriptive or generic. The category your mark falls into significantly impacts both its registrability and your ability to enforce your rights in the mark. The strongest and most easily protectable types of marks are fanciful marks and arbitrary marks, because they are inherently distinctive and essentially have no dictionary meaning.

Registered Trademark: While registering a trademark is not mandatory, a federally-registered trademark has several advantages, including a legal presumption of ownership nationwide, the exclusive right to use the mark on or in connection with the goods or services set forth in the registration and a notice to the public of the registrant’s claim of ownership of the mark. The USPTO has only 45 trademark classes for goods and services. This means that similar items are usually combined into a class.

There are three commonly used trademark symbols: “TM,” “SM” and “®.” The federal registration symbol “®” can only be used once federal registration is granted, and it can only be used in connection with goods and services listed in the federal registry. It has many legal benefits as opposed to the “TM” or “SM” symbols, which have very little legal significance. However, you can use the “TM” and “SM” symbols to indicate that you have adopted these as “common law” trademarks or service marks.

It is a good practice to use the correct symbol on your trademarked words, phrases, symbols and/or designs. If registered, use the ® symbol (either as a subscript or superscript) after the mark. But if unregistered, use TM for goods or SM for services, to indicate that you have acquired this as a trademark or service mark, respectively, regardless of whether you have filed an application with the USPTO.

How to Register a Trademark:

This is an overview of the steps of how to apply for federal registration of your trademark with the USPTO:

Select the mark you wish to trademark. Remember that not every mark is registrable with the USPTO, nor is every mark legally protectable.

Prepare and file your trademark application online through the Trademark Electronic Application System (TEAS).

After the USPTO decides that you have met the minimum filing requirements, an application serial number is assigned to your case. Your application is then forwarded to an examining attorney, who reviews your application to determine whether it complies with all applicable rules and statutes, and includes all required fees. Work with the examining attorney and promptly respond to any queries they may have.

If the examining attorney raises no objections to your registration, your mark will be approved for publication in the Official Gazette of the USPTO. You will also receive a notice of publication stating the date of publication. Any party who believes it may be damaged by registration of the mark has 30 days from the publication date to file either an opposition to registration or a request to extend the time to oppose.

If you receive a notice of allowance, you need to file a statement of use (SOU) within six months, along with evidence showing that you’ve used the mark. You also need to pay a filing fee with the SOU.

Once the examining attorney approves the SOU, your mark will be registered and a certificate of registration will be issued.

To keep the registration active, you need to file specific maintenance documents. Failure to do so may result in cancellation and/or expiration of the registration, and you will have to start the entire process all over.

The whole process may take a number of months. Monitor the progress of your application through the Trademark Status and Document Retrieval (TSDR) system. Check the status of your application at least every three months to ensure you don’t miss a filing deadline.

How Long it Lasts: The USPTO defines that “rights in a federally-registered trademark can last indefinitely if you continue to use the mark and file all necessary maintenance documents with the required fee(s) at the appropriate times.” The documents required for maintaining a trademark registration are:

Declaration of Continued Use or Excusable Nonuse under Section 8

Combined Declaration of Continued Use and Application for Renewal under Sections 8 and 9

What is a Patent?

A patent is a limited duration property right relating to an invention, granted by the USPTO in exchange for public disclosure of the invention or discovery. Patentable materials include machines, manufactured articles, industrial processes and chemical compositions.

These are the three types of patents:

Utility patents, which may be granted to anyone who discovers or invents any new and functional machine, process, article of manufacture or compositions of matters, or any new useful improvement thereof. Most applications filed at the USPTO are for utility patents.

Design patents, which may be issued to anyone who invents a new, original and ornamental design for an article of manufacture.

Plant patents, which may be granted to anyone who discovers or invents, and asexually reproduces any new and distinct variety of plant.

The statute states that as long as a patent is valid, it grants the holder of the patent “the right to exclude others from making, using, offering for sale or selling” the invention or discovery in the US or “importing” the invention into the US.

How to Obtain a Patent: It is advisable to hire an experienced patent attorney when filing for a patent, in order to avoid mistakes that could cost you later on. But in general, here are the steps.

Search the USPTO to ensure that your work hasn’t already been patented.

Determine the type of patent you need — utility, design or plant.

File a provisional patent application. This will protect you in case someone claims that they had the idea before you did. The US patent law works on the basis of the First to File system, and not First to Invent.

Sign up to become a Registered eFiler. The easiest way to do this is online, but you can also file your patent application by mail or by fax.

Collect and submit all relevant information for your formal application. This includes an abstract, background, summary, a detailed description and your conclusion, including the ramifications and scope. You also need to define the legal scope of your patent.

Complete and review your formal application. The average time for a patent application to process is one to three years. Make sure you get it as close to right as possible the first time.

A patent examiner will be assigned to your case. They will communicate with you for any requests, concerns or information. Respond as promptly as possible.

If the examiner finds your application satisfactory, you will receive a notice of allowance. This notice lists the issue fee and the publication fee that you need to pay before the patent is issued.

Pay the maintenance fee, which is needed to maintain the patent in force beyond f. Non-payment of the maintenance fee or any applicable surcharge can lead to the expiration of the patent.

How Long it is Valid: According to the USPTO, utility and plant patents expire 20 years from the date on which the application was filed in the US or, in special cases, from the date an earlier related application was filed.

Design patents expire 15 years after the date they are granted for applications filed on or after May 13, 2015, or 14 years from the date of issuance if filed before May 13, 2015. Under certain circumstances, patent term extensions or adjustments can be made.

What is a Copyright?

According to The US Copyright Office of the Library of Congress, “Copyright is a form of protection grounded in the US Constitution and granted by law for original works of authorship fixed in a tangible medium of expression.” This means that any creative work can be copyrighted if it can be saved in some permanent (tangible) way, so that it can be communicated to someone else at another time.

Original works of authorship include literary, dramatic, musical and artistic works, such as poetry, novels, movies, songs, computer software and architecture. Copyright covers both published and unpublished works. It, however, does not protect facts, ideas, systems or methods of operation, although it may protect the way these things are conveyed.

A copyright comes into existence as soon as a product/service is created, whether it is registered with the US Copyright Office or not. However, registering it with the federal government grants federal protection to your IP. The symbol for copyright is “©.”

Copyright protections extend to many other countries other than the US. The federal government maintains copyright agreements with several other nations, which state that the governments will respect the IP of each others’ citizens.

How to Register Your Copyright: To register a copyright, submit the following to the US Copyright Office:

A completed application form

Filing fee

Copies of the work you are registering

Once your work is certified by the Registrar of Copyrights and sealed with the seal of the Copyright Office, it is admissible as prima facie evidence in all courts without further proof or production of the original, as per Chapter X of The Copyright Act of 1957.

How Long it Applies: The Copyright Act of 1976 states that copyright protections expire after the author’s lifetime plus 70. 95 or 120 years, depending on the nature of authorship.

Whether you need a trademark, a patent or a copyright depends on the type of IP you’re trying to protect. So whether it’s a new product, logo or creative work, registering your idea with the appropriate body can help ensure you enjoy the fruits of your labor.

Originally published at https://blog.escalon.services

#trademark#Intellectual Property#Patent Registration#Trademark Registration#Copyright Registration#entrepreneurs

0 notes

Text

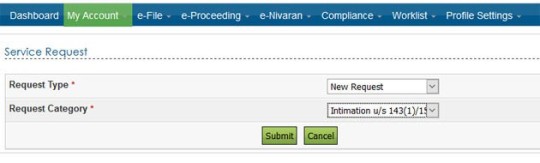

ITR Filing: Know All About Intimation Notice by the Income Tax Department U/S 143(1)

After the Income Tax Department has processed the income tax return, it will send an intimation notice to taxpayers under section 143(1) of the Income Tax Act 1961. The individuals who have filed their Income Tax Return for the financial year 2018-19 will receive the intimation on the registered e-mail Address same as registered in the e-filing account. The notice will inform you whether the income tax computation in the ITR filed by you matches as per the record.

This process includes the estimation of any errors, internal and external inconsistencies, tax & interest calculation and verification of tax payment, etc. Therefore, it is more like a prima facie valuation by the tax officials to check whether the information is accurate or not. This whole process is called an assessment, in such cases, if there is any mismatch or the department is unable to verify the content and information, it may issue a notice. Previously, these notices were sent by post but currently, they are mailed and also uploaded on the e-filing portal.

If any taxpayers who have applied for ITR filing and do not receive the intimation notice, it means, your tax return acknowledgment will serve as the department’s acceptance of your return.

What to do when you receive an intimation notice?

You might be wondering about what you should do when you receive intimation notice. Well! First, the tax assessee should check if there is any difference in the reports or whether the department has accepted the income and tax numbers filed by you. There are certain steps through which you can check the faults. In case you haven't found any difference then no action required. However, if the figures do not watch, you should carefully check the line in which you have entered the amount considered by the department differs from what you have submitted.

Here are the steps about how to get the intimation notice-

Step 1: Visit income tax india efiling login (www.incometaxindiaefiling.gov.in)

Step 2: Log in to your account. The user ID is your PAN number.

Step 3: In the 'My Account' tab select, the service request option

Highlights of what intimation notice will show under section 143(1)-

Intimation notice received by you under section 143(1) will show some of the discussed points in the below-

· Your income details, deductions claimed and tax calculations match with the tax department's assessments and calculations: In this case the notice will show both tax payable and refundable as zero.

· Additional tax demand notice: When, as per the tax department's assessment, you have not added a particular

· As per the income tax department's assessment, if you have paid additional taxes compared to your actual tax liability, a income tax refund is due to you.

Meanwhile, in case you have not received the intimation by the tax department, the taxpayers can file a complaint on the efiling of income tax return website. Likewise, if your ITR is processed but you can't find the intimation notice in your email, then you can raise a service request for the same.

#itr filing#online income tax return#income tax return filing#efiling of income tax return#income tax online#file income tax return#efile income tax return#income tax e-filing#income tax india e-filing#e-filing of income tax online#e-file income tax#e-filing income tax return#efilingitr#income tax efiling#efiling income tax return#filing ITR online#income tax refund status

0 notes

Text

How to verify ITR without login to your E-filing account?

To make Income Tax Return e-filing procedure more convenient and relaxed, the income tax department has launched e-verify Return for the purpose of e-verification of ITR without login. According to this, the itr filing in indirapuram can be accessed by clicking e-verify return button which is present in the home page under the quick links without logging-in to your account. Before this update, the CBDT has launched the lighter version of e-filing ITR, which is named as “efiling Lite” with a major focus on to make income tax filing easier for the taxpayers.

This is one of the major steps that has been initiated by the income tax authority to make itr filing in indirapuram procedure easier for the individuals. Under Income Tax provisions, the ITR verification is one of the mandatory last steps for the ITR process. After you have filed the tax return, it is mandatory to verify it latest within 120 days. In case your ITR has not been verified, this will not be considered valid and would not be considered for further processing.

Here is a step-by-step guide on verifying the gst filing in indirapuram without login to your e-filing account -

Step 1 – Firstly, you need to visit Income Tax India Efiling Login website (www.incometaxindiafiling.gov.in)

Step 2 – Then you need to go to the ‘Quick Links” tab, and then select the ‘e-verify return’ option.

Step 3 – Then you need to enter the details which are mandatorily required such as PAN, acknowledgement number of ITR filing. Once you have entered all the information, you need to click “Continue”.

Step 4 – There are three options which will appear on your screen – you can pick any of the options which are stated above and then verify your tax return online. If you wish to verify your return through Aadhaar OTP, then you need to ensure that your mobile number is registered with the Aadhaar as well. Likewise, if you do not have to EVC, then you have the option of generating your pre-validated bank account or Demat account.

Meanwhile, with the extension of the tax filing due date for the financial tear 2018-19, tax filers can complete the procedure within August 31 in order to avoid any tax department’s attention or legal notice.

Summary

ITR filing is necessary for every professional and CA Gaurav firm offers a quick solution of itr filing in indirapuram on your behalf. Apart from ITR filing, CA Gaurav firm also offers the services of gst filing in indirapuram for your business.

Source By : https://www.evernote.com/shard/s400/sh/ca45e145-c35c-4bb7-a11b-0340f28c6bd9/8c83ae5b5dba573ecd41434aacf8b83d

0 notes

Link

• HOW CAN A TAXPAYER OPT FOR COMPOSITION?

To opt for Composition Scheme a Taxpayer has to file FORM GST CMP-02. This can be done online. Also, furnish a statement in FORM ITC-03 within 60days of filing GST CMP-02 to declare ITC claimed earlier that has to be reversed.

A taxpayer who wanted to opt for Composition scheme for a Financial Year during middle of such financial year then such person has to inform the GOVERNMENT about their choice. They also required to file GST CMP-02.

If filed the rules applicable will be same and applicable from month immediately succeeding the month in which FORM GST CMP-02 filed.

For example: - if one file form in month of MAY the same will be applicable from JUNE.

• PROCEDURE FOR FILING FORM GST CMP-02:-

• LOGIN TO GST PORTAL

• GO TO SERVICES • REGISTRATION

• CLICK ON APPLICATION TO OPT FOR COMPOSITION LEVY

• ON THIS WINDOW READ COMPOSITION DECLARATION & VERIFICATION AND TICK ON TICKBOX.

• CHOOSE AUTHORISED PERSON & ENTER PLACE & DO SAVE.

• IF YOU WANT TO SUBMIT AT THAT TIME, THEN; o SUBMIT IT WITH DSC/EVC/E-SIGNATURE.

• IF YOU WISH TO SUBMIT IT LATER, THEN; o LOGIN - SERVICES -USER SERVICES -MY SAVED APPLICATION - AND SUBMIT WITH DSC/EVC/E-SIGNATURE.

• AFTER THIS,ONE POPUP WILL BE OPEN

• CLICK TO PROCEED

• ACKNOWLEDGEMENT WILL BE GENERATED.

• FORM GST CMP-03:-

After submitting FORM GST CMP-02, stock details are required to be submitted with FORM GST CMP-03 in which following details need to be intimated:

• Details of STOCK held

• Inward supply of GOODS received from unregistered person held by him person who fill above forms on the date preceding the day of exercise of option.

• RETURNS:- The payment can be done quarterly with declaration and return will be filed annually.

Social site link

1)https://www.facebook.com/HelloTaxIndia/

2)https://hellotaxindia.tumblr.com/

3)https://twitter.com/HelloTaxIndia/

4)https://plus.google.com/u/0/112271030...

5)https://www.linkedin.com/company/hell...

6)https://www.instagram.com/hellotax_in...

7)https://www.youtube.com/channel/UCcIX...

Google play store link

1)https://play.google.com/store/apps/de... (HelloTaxIndia) 2)https://play.google.com/store/apps/de... (ITR Efiling)

Website link

1)http://www.hellotaxindia.in/ (for more video)

2)https://hellotax.co.in/ (ITR EfilingHelloTax )

#CompositionScheme#CompositionSchemeUnderGST#GST#HelloTax#HelloTaxIndia#WealthManagement#SmallBusinessGST

0 notes

Link

If you are yet to file your income tax returns for the financial year 2017-2018, you still have few hours left as the deadline ends on March 31. If you fail to file your tax return, the government reserves the right to take legal action against you.

Though the last date for filing Income tax ended on August 31, 2018, the I-T department later allowed people to file their income tax returns till March 31, 2019, provided they also submit a late fee of Rs 10,000.

"Taxpayers can still file their Income Tax Return for the assessment year 2018-19 (the financial year 2017-18) by March 31, 2019, with a late fee," the I-T department wrote on Twitter.

You can still file your Income Tax Return for A. Y. 2018-19 ( F. Y. 2017-18 ) by 31st March, 2019 with late fee if you have not filed yet. pic.twitter.com/3ug7yCc76B

— Income Tax India (@IncomeTaxIndia) March 29, 2019

Despite being a Sunday, income tax offices are open today to facilitate the filing of tax returns by the taxpayers.

Taxpayers can use the I-T department's online portal to file their returns from the comfort of their home.

ALSO READ: Not filing your income tax returns on time? You could be prosecuted

Before you sit down to file your income tax returns, here are some important documents that you need to keep handy with you:

1. PAN card, valid email account, valid mobile number, Aadhaar number

2. Form 16/16A: These forms will help you provide proof of tax deduction on the payments you have made.

3. Investment proof: Proof of tax-saving investments made, medical cover taken, donations made, etc, are all required for helping you claim deductions under Section 80C, 80D and 80G respectively.

4. Bank details: Even if you know that you don’t have a refund this year, you should provide all your bank account details along with the IFSC code in your income-tax return.

Is it mandatory to file I-T return?

Filing income tax return is mandatory for -

1. Individuals and HUFs having income more than Rs 2.5 lakh (Rs 3 lakh for senior citizens aged 60-80 years and Rs 5 lakh for those above 80)

2. All companies, firms, LLPs

3.

Trusts, associations, political parties (whose income prior to the claim of exemptions exceed the minimum chargeable to tax)

You can follow these steps to file your returns through I-T department's official website:

Step 1: Go to e-filing website - http://www.incometaxindiaefiling.gov.in

Step 2: Users not registered on the website need to register on the website. Those already having an account can login.

Step 3: Go to e-File and select Income Tax Returns

Step 4: Select assessment year, ITR form, submission and verification mode

Step 5: Fill the form using details from Form-16

Step 6: Preview and submit

Another way to file income tax return is through the online portal of ClearTax. Here's a step-by-step guide:

Income tax returns Fill in your personal details along with your address in the first step

Income tax returns If you have other means of income, click on the other boxes shown beside the section 'salary'

Income tax returns You can claim a deduction of up to Rs 150,000 by providing the details shown below. In case you have further deductions, click on the bar 'More deductions' or 'Other deductions'

Income tax returns Provide details of your TDS (tax deducted at source) between April 1, 2017 and March 31, 2018.

Income tax returns This is the last step of filing your income tax return. Provide your bank account number — this is where you will receive your refund, if applicable.

Income tax returns Congratulations! You have now completed all the steps in filing your income tax return. Just review all the information filled out and you are good to go

First Published: Sun, March 31 2019. 12:07 IST

READ MORE ON

INCOME TAX RETURN

TAX

INCOME TAX RETURNS

EFILING

INCOME TAX INDIA EFILING

INCOME TAX INDIA

PAN CARD AADHAR CARD LINK

WWW.INCOMETAXINDIAEFILING.GOV.IN

INCOMETAX

INCOME TAX PAYMENT

FILING ITR

INCOME TAX RETURN FILING PROCESS

ATE FEE INCOME TAX RETURN

INCOME TAX EFILING

INCOME TAX FILING LAST DATE

ONLINE PAYMENT INCOME TAX

INCOME TAX FILING

INCOME TAX LATE FEE

PF

PREVIOUS STORY

NEXT STORY

Be prepared to pay for advice while doing financial planning. Here's why

Luxury malls or private clubs? Shop till you drop in a personalised way

Reassess your investment portfolio and your insurance needs

Irdai's approval to new regulations for life insurance products

Planning an education loan? PSBs cheaper, but they don't fund all courses

Members of JetPrivilege should avoid panic spending of air miles: Expert

Realty check: Current rates, unit sizes in Rs 30-50 lakh price range

Buying a used vehicle? What you should know about transferring insurance

Tipping point: Is this a good time to enter banking sector funds?

Solutions to lack of transmission

RECOMMENDED FOR YOU

Advertisements

Luxury Homes at Dr.Rajkumar Rd. Starting @9.5Cr*

BeSpoke Homes at Dr.Rajkumar Rd - Starts @9.5Cr*

Phoenix Kessaku in Bangalore - Starting @9.5Cr*

Luxury Homes at Dr.Rajkumar Rd. Starting @9.5Cr*

LATEST NEWS

IN THIS SECTION

ALL

Aadhaar-PAN linking

PAN-Aadhaar linking deadline ends today: Here's how you link both the cards

Income tax returns

Last day to file delayed income tax return for FY18: A step-by-step guide

advisors

Be prepared to pay for advice while doing financial planning. Here's why

Shopping is no longer only about the transaction. Instead, it is about creating an atmosphere and experience

Premium Content Luxury malls or private clubs? Shop till you drop in a personalised way

Advertisement

More >

MOST POPULAR

READ

SHARE

COMMENTED

jet airways

Jet Airways clears pending December salary, pilots say not enough

Nirav Modi

Meet Nirav's A-Team that may have helped him pull off Rs 14,000-cr scam

IPL 2019, RCB

IPL 2019, SRH vs RCB Preview: Virat Kohli's RCB still in search of 1st win

GST

GST rule change to aid businesses with better cash flow management

Advertisement

0 notes

Link

Centralized Prcessing Center sending mails to the Employees and Teachers confirming that their Income Tax Returns for the Assessment year 2018-19 eFiling confirmed ( Processed ) or Not and sending text messages to Registered Mobile Numbers to check and asking to download PDF File protected with password.

0 notes

Text

Vote Now: Help Pick the Startup Alley Finalists for ABA TECHSHOW 2020

We need your vote! Help pick the legal technology startups that will be selected for the fourth-annual Startup Alley at ABA TECHSHOW 2020. Fifteen companies will be selected to face off in a pitch competition on TECHSHOW’s opening night and to exhibit in a special portion of the conference’s exhibition hall.

In September, we issued a call for entries. From all the entries we received, a panel of judges whittled the applications down to 26. Now your votes will select the final 15. The 15 startups with the most votes will get the opportunity to be featured at TECHSHOW, which will be held Feb. 26-29, 2019, in Chicago.

Below are the contenders, listed in alphabetical order. Read their pitches, check out their websites, then vote. For those that have a demo video, I’ve included the link.

Deadline for voting is Dec. 6, 2019, at 11:45 p.m. Eastern time. Winners will be announced on Dec. 9, 2019.

BALLOT IS ON THE NEXT PAGE. Trouble with the ballot? Go directly to Survey Monkey.

ADR Notable

Founded: 5/20/2015.

Headquarters: Columbus, Ohio.

Elevator pitch: ADR Notable is the first SaaS platform to provide mediators with a single, complete tech solution. Case management tools are combined with “in the room” features that include prep checklists; time tracking; notes captured by party and type that can be edited, combined, sorted, and searched; document access; saved forms/clauses to draft final terms; and digital signature, all with an intuitive UI that won’t distract the mediator. Variable note deletion and secure storage complete the process.

How we’re unique: ADR Notable is a technology platform for mediators, an underserved part of the legal market. Its core replaces the legal pad with a novel note-taking feature the mediator uses to capture the note content, party and note type, then manage them logically by topic and edit notes into final terms of agreement. This feature resides within a secure cloud-based case-management system for the mediator’s entire practice, with an intuitive UI for ease of use that avoids distraction during sessions.

Demo video (if any): https://vimeo.com/369975500.

Pricing: $39.99 per month per user for unlimited cases or $34.99 per case for infrequent users.

Outside funding: No outside funding.

AXDRAFT

Founded: 10/31/2017.

Headquarters: HQ: New York, N.Y.; Development office: Kyiv, Ukraine.

Elevator pitch: AXDRAFT helps enterprises draft and approve legal documents 10 times faster, avoid mistakes and safely delegate more to non-legal teams. Customers include Carlsberg, British American Tobacco, Louis Dreyfus Company, Glovo and five financial institutions, including bank of BNP Paribas group.

How we’re unique: AXDRAFT has four main competitive advantages:

Onboarding experience. We onboard any customer in less than two weeks at no cost for the customer and with minimal involvement of the customer.

Security. AXDRAFT stores only your template, while the final sensitive document is created only on user’s machine and never goes to the cloud.

AXDRAFT can automate documents in any language.

AXDRAFT integrates data from public registers and internal databases directly into the document.

Demo video (if any): https://youtu.be/7z3JwWtKtD0.

Pricing: AXDRAFT charges a subscription based on the number of documents created by users in the system. The cost is roughly $10 per document and goes down as the number of documents increases. There are no additional payments. Our subscription includes on-boarding (including automation of customer’s documents), tech and customer support and all document and software updates.

Outside funding: $1M-$5M in outside funding. AXDRAFT is Y Combinator W19 alumni.

Billseye

Founded: 1/12/2018.

Headquarters: HQ: Atlanta, Ga.; Operations Center: Columbia, S.C.; Development Team: Indore, India.

Elevator pitch: Say for instance you’re working out, running an errand, or picking up your daughter from daycare and you receive a call from an important client. Do you stop what you are doing to document the call? I bet you’re too busy to stop and you end up losing hours of billable time as a result. This dilemma can be solved with one touch. Download Billseye for automatic, real-time call tracking, documenting, and billing solutions that can integrate into your existing case management software.

How we’re unique: Our patent-pending client button allows the user to immediately identify incoming and outgoing billable calls. At the end of the call, our software prompts the user to document the call with a text or voice memo. With Billseye, you are one touch away from billing thousands more dollars on mobile calls.

Demo video (if any): http://onetouchbilling.com/media/BillseyePromo2.mp4.

Pricing: A tiered SaaS model.

Outside funding: No outside funding.

CaptureCast Legal

Founded: 4/7/2019.

Headquarters: San Antonio, Texas.

Elevator pitch: CaptureCast Legal is a rich media video documentation platform to automate and streamline litigation support efforts with transcribed HD video captures from local and remote testimonies and legal affairs. It enhances trial strategy for witness preparation and trial practice using video-based capture and replay.

How we’re unique: Laser focus on delivering smart video solutions to automate, enrich, and streamline legal video and transcription services. We offset and enhance litigation support needs by delivering a smart, meta enriched video capture and library backed by AI/ML to enhance case discovery.

Demo video (if any): None.

Pricing: One-time up-front cost, then annually based on transcription and video volume.

Outside funding: No outside funding.

Corvum

Founded: 6/1/2017.

Headquarters: Vancouver, B.C., Canada.

Elevator pitch: Corvum is the first cloud-based communications service designed specifically for lawyers. We understand the unique pressures that lawyers face with time management and work-life balance. Corvum provides the extremely responsive customer support needed for law firms to continue to operate smoothly. Corvum’s service stays online with our three geographically redundant data centers. Corvum’s integration with Clio automatically tracks lawyers’ billable time on calls.

How we’re unique: Telephone providers typically offer “everything to everyone” services, without being able to focus on the needs of any specific user. Corvum is different because of our focus on the needs of lawyers. Legal professionals require more timely and helpful support, they require rock-solid uptime, and they require the tools they need to run their legal practice to all work together.

Demo video (if any): https://www.youtube.com/watch?v=lzatElTvT6U.

Pricing: Monthly fee per user (SaaS/UCaaS).

Outside funding: Debt financing with the Business Development Bank of Canada (https://www.bdc.ca).

Crosselerator

Founded: 1/1/2019.

Headquarters: Exeter, U.K.

Elevator pitch: Turn your everyday email into new income, every day. Crosselerator adds targeted messages to your outgoing emails intelligently and collects the data.

How we’re unique: We are run by a successful ex-partner with 40 years’ professional experience and a long track record of success, not by young techies, so our products are designed with precise needs of practitioners in mind.

Demo video (if any): https://www.youtube.com/watch?v=uGgqR3r1rN4.

Pricing: Approx $25 per month minimum, then by seat at $3 per seat per month.

Outside funding: We have funded all development out of our own funds and profits but will be going into the market for development funding (via Bath University business school) soon.

Discovery Genie

Founded: 6/1/2017.

Headquarters: Denver, Colo.

Elevator pitch: Discovery Genie solves the document production problem facing 750,000+ lawyers and paralegals litigating cases involving 35,000 pages or less: reviewing, producing, organizing and indexing emails, attachments and efiles. The Genie’s lawyer-designed system automates conversion to PDF, Bates numbering, privilege-log generation, and more, saving 75-90% of the time, cost and tedium of using Acrobat — but without the overkill costs and complexity of an e-discovery system. No IT department needed.

How we’re unique: We make document production inexpensive, fast and simple for the 90% of lawyers and paralegals who litigate small- to mid-sized cases (35,000 pages of production or less). Manual document production is slow, soul-crushing, and wasteful of professional talent – but e-discovery platforms, designed for big law, are cost prohibitive and unworkable for the vast majority of lawsuits. Discovery Genie serves the huge overlooked legal market with powerful but simple and affordable document production tools.

Demo video (if any): https://vimeo.com/294695282.

Pricing: On-demand, per document pricing. Custom pricing is available for large jobs, such as one case that involved 380,000 pages of production. (We have partnered with the DC Bar and the Colorado Bar Association to provide discounted services as a member benefit.)

Outside funding: No outside funding.

DueCourse

Founded: 8/11/2019.

Headquarters: San Francisco, Calif.

Elevator pitch: DueCourse is a learning platform that empowers attorneys to take control of their career by helping them map and advance their professional development through personalized learning. We’re building an adaptive learning platform that designs personalized development paths, allows lawyers and professional development teams to track their progress, and pushes incremental, custom content that encourages consistent learning and professional growth.

How we’re unique: Our adaptive learning platform replaces the outdated, impersonal training and development models that rarely fit the busy schedules of distracted learners, and do not meet lawyers in the online mediums where they’re spending most of their time.

Our model also uses real-time data and various accountability methods to provide on-demand learning and help lawyers stay on track with their professional development, rather than leave it up to ad-hoc mentoring and goal setting.

Demo video (if any): None.

Pricing: We have a subscription-based pricing model.

Outside funding: Less than $1M in outside funding.

ECFX

Founded: 1/28/2019.

Headquarters: Los Angeles, Calif.

Elevator pitch: ECFX is a one-stop, enterprise-class solution for electronic court filing (ECF). ECF is a time-consuming and complex process that varies from court to court. ECFX solves this problem by providing a SaaS B2B platform that automates the processing of receipts of service and the filing of documents with the court with firmware administration and control. ECFX obtains huge efficiencies and cost savings for the firm, eliminates the risk of missed receipts, and reduces filing rejections.

How we’re unique: ECFX distinguishes itself over competing solutions by offering a firmwide, enterprise class solution for all of a law firm’s jurisdictions. Firms today must cobble together products from multiple vendors, and that patchwork of products may still be incomplete. ECFX focuses on automating work that falls into the gaps between the other products in the market and provides a consistent user experience across multiple jurisdictions.

Demo video (if any): https://docsend.com/view/ru3gbs6.

Pricing: We charge per transaction for each receipt or filing, with price per transaction depending usage volumes. To obtain discounts, firms can pre-pay for usage bundles on a monthly or annual basis.

Outside funding: Less than $1M in outside funding.

FamilyDocket

Founded: 12/15/2016.

Headquarters: Dallas, Texas.

Elevator pitch: FamilyDocket streamlines communication and evidence gathering for family law cases. Text messages between ex-spouses/co-parents are tracked automatically. Clients can communicate efficiently, and those messages are stored securely in real-time to be used in court, if needed. Important files such as tax documents, pictures, and final decrees can be shared. Lawyers can also assign tasks to be completed, and clients can upload expense items to be reimbursed by their ex-spouse/co-parent.

How we’re unique: We looked at what was missing in the family law market and what the pain points were for both the lawyers and the clients. We developed a simple, easy-to-use, mobile-friendly, web-based application that allows these lawyers, often in small practices, simple case management tools while also tying in co-parenting tools that clients need from the outset of the case. No other tool is tracking these text message communications and that is how most people are communicating in their personal lives.

Demo video (if any): https://www.linkedin.com/company/familydocket/?viewAsMember=true.

Pricing: Yearly subscription-based fee paid either by the law firm or passed on to the client.

Outside funding: Less than $1M in outside funding. We raised money from private investors as well as friends and family. Two of the investors are owners of well-known legal tech companies with different clientele. One, is a payment processor and the other targets in-house legal departments to assist them in analyzing their legal spend.

Faster Law

Founded: 9/1/2015.

Headquarters: Omaha, Neb.

Elevator pitch: We solve the three main problems lawyers face: document management, email management, and time tracking. Our Faster Suite includes email management, passive time tracking, document management, PACER Saver, mass document automation, print tracking, scan-to-Clio, split billing, conflict checker, meeting transcriber, request tracker, invoice reminders, Clio document backup, advanced data export and a whole lot more.

How we’re unique: We make crazy-simple solutions to complex problems. We are the number-one suite of apps for Clio and we have 3,500 paying customers.

Demo video (if any): https://www.youtube.com/watch?v=49HJetclR48.

Pricing: $300 per year per human for every single feature.

Outside funding: No outside funding.

FirmTRAK

Founded: 2/1/2019.

Headquarters: Bloomington, Ill.

Elevator pitch: FirmTRAK seamlessly integrates with your practice management system and other strategic vendors, automatically generating diagnostic and predictive KPI visualizations designed to accelerate performance, increase efficiencies and drive profits.

How we’re unique: We not only have the ability to provide strategic reporting to larger law firms, but we have also unlocked the necessary data for lawyers down market by providing a full set of ready-made reporting at the click of a button. Our motto is to become the one-stop shop for all law firm reporting needs by bringing together practice management system data with accounting, marketing, and other data sets to create dynamic metrics to really move the dial within the business.

Demo video (if any): https://www.youtube.com/watch?v=pz_5kpUZ2PY.

Pricing: Since we are running analytics on all employees tracking time in the practice management system, we base price on total number of employees: 1-3 =$49/month; 4-9 = $129/month; 10-19 = $299/month; 20+ needs to be reviewed as they will tend to have very specific customization requests.

Outside funding: No outside funding.

Hugo Analytics

Founded: 3/3/2017.

Headquarters: Denver, Colo.

Elevator pitch: Hugo enables litigators to test any variety of case theories and strategies using virtual jurors. Litigators can submit material over our JuryMeter website to conduct initial pilot studies and see how 25 mock jurors react to their case. Hugo also provides more customized services that allow litigators to conduct experiments to optimize their case strategies and estimate more precisely the likely outcome of a given case.

How we’re unique: Traditionally, litigators make live presentations to a small number of mock jurors (6-30). Using crowdsourcing, we can recruit more mock jurors at a fraction of the cost. We run pilot studies and obtain initial reactions to cases on our website, www.jurymeter.com. As the numbers of mock jurors increase (think hundreds), we also conduct experiments and use statistical analyses to gain a more scientifically valid estimate of likely outcomes, including both liability and damages.

Demo video (if any): None.

Pricing: For our www.jurymeter.com solution, $500 with volume discounts. For customized experiments, prices as quoted (approximately eight customized experiments for about $50,000).

Outside funding: No outside funding.

Intaker

Founded: 1/2/2019.

Headquarters: Los Angeles, Calif.

Elevator pitch: Intaker uses artificial intelligence to capture and qualify prospective clients for consumer law firms on autopilot and 24/7; saving attorneys time, money and frustration.

How we’re unique: In comparison to traditional live chat solutions, Intaker AI:

Captures 2-3 times more leads.

Qualifies every lead thoroughly using machine intelligence by looking at over 16 million data points.

Is incredibly easy to set up, run and personalize — setup takes 15-20 minutes.

Is much more affordable, while turning better results.

Demo video (if any): https://www.youtube.com/watch?v=KwbhoX5-QfA.

Pricing: Monthly plans: (1) Ignite, (2) Lift-off, (3) Thrust, and (4) Zero Gravity.

All four plans come with unlimited qualified leads (flat-rate pricing) but tiered based on features like multiple languages, instant call, number of websites, number of Intakers, etc. There are some limits on the number of visitors.

Outside funding: No outside funding.

Josef

Founded: 7/1/2019.

Headquarters: Melbourne, Australia.

Elevator pitch: Josef is a legal automation platform that enables lawyers and legal teams to create and launch their own conversational bots. Lawyers have already built more than 5,000 automation tools on the platform to streamline processes, improve client experience and eliminate repetitive tasks. Bots built on Josef automate lawyer-client interactions, draft documents and provide legal guidance and advice.

How we’re unique: Using legal automation platforms usually requires a level of training and expertise that is beyond most lawyers. In law firms and in-house teams, these technologies end up being used exclusively by technical experts. Josef turns that model on its head by driving adoption of its visual logic builder and no-code-document-automation among practitioners across legal organizations. We see adoption and bot-building by everyone from paralegals to partners, assistants to legal operations.

Demo video (if any): None.

Pricing: Customers pay for a subscription to Josef. Subscription levels may vary based on the number of bots launched or distribution of access to the platform.

Outside funding: Less than $1M in outside funding.

Justice For Me

Founded: 1/1/2018.

Headquarters: San Antonio, Texas.

Elevator pitch: Justice for Me (JFM) exists to close the justice gap. JFM removes the financial obstacles that prevent clients and attorneys from connecting, by using technology and a network of lawyers and financial partners that work with clients who cannot afford traditional legal representation. We provide a line of credit that gives clients affordable monthly payments and we pay attorneys quickly and directly, simplifying billing and collections. We enable customers and attorneys to focus on outcomes.

How we’re unique: We are the only company offering payment plans for civil cases in the market today. Justice for Me is opening a new segment in the legal market, those that have not been served to date. Our main mission will continue to be to close the Justice Gap and provide legal assistance to those who cannot access it today.

Demo video (if any): https://www.justiceforme.com.

Pricing: Justice for Me makes money by earning a service fee from the overall engagement. The attorney receives their invoice amount less this service fee. The client pays the full amount plus interest.

Outside funding: Less than $1M in outside funding.

Knovi

Founded: 9/11/2018.

Headquarters: Philadelphia, Pa.

Elevator pitch: Knovi was created by attorneys for attorneys to ease their caseload and bring an influx of valuable leads. Using artificial intelligence, Knovi matches clients with the right legal representation. Knovi then streamlines client communications with messaging and video chat capabilities, all the way from inquiry to settlement. An intuitive, built-in CRM documents the case from start to finish, so attorneys can focus on what truly matters: their client’s case.

How we’re unique: Powered by machine learning, Knovi’s chatbot creates client engagement before the first phone call or meeting. Knovi seamlessly initiates the client-attorney relationship and even starts the process of building the new case — all while providing great customer service, too.

Demo video (if any): None.

Pricing: Knovi costs $150 per month for up to five users. Each additional user is $30 per month with a 10% discount for annual subscribers. These prices are for an unlimited number of chats, which distinguishes Knovi from the competition which charges per completed chat.

Outside funding: No outside funding confirmed at the moment of this application.

LawCo

Founded: 8/15/2017.

Headquarters: Chicago, Ill.

Elevator pitch: LawCo was developed to efficiently and ethically solve the access to justice problem by creating a way to connect live leads to lawyers instantly. LawCo’s platform matches people in need of legal help with lawyers on-demand, in real-time, and at no connecting cost to the consumer. With no monthly commitment fee to the attorney and no lengthy sales pitch, we built LawCo for small firms and solo lawyers, seeking to cost-effectively and rapidly build their books of business.

How we’re unique: LawCo is the only platform available that instantly connects lawyers to live leads. Unlike other lead generation products, LawCo takes out the wait time for connection. Lawyers will find our signup process quick and easy. Lawyers merely visit the website or download the free app, enter name, phone number, email, and ARDC information. They are verified via the ARDC and then approved to use the LawCo platform; instantly getting notified of live leads in real-time. Zero commitment; pay per lead.

Demo video (if any): https://bit.ly/2qczRp1.