#home loan in dubai for nationals

Text

How to Manage Your Home Loan Repayments Effectively as a National in Dubai

Managing your home loan repayments in Dubai effectively as a national is important to ensure that you stay on top of your finances and avoid defaulting on your loan. Here are some tips to help you manage your home loan repayments effectively:

Create a budget: Make a budget that takes into account all of your expenses and income. This will help you identify areas where you can cut back on spending and allocate more funds towards loan repayments.

Set up automatic payments: Set up automatic payments for your home loan so that your payments are made on time each month. This will help you avoid late payments or missed payments, which can negatively impact your credit score.

Consider making prepayments: If you have extra funds, consider making prepayments towards your home loan. This will help you reduce your interest burden and shorten your loan tenure.

Refinance your home loan: If you find that your home loan repayments are becoming unmanageable, consider refinancing your loan. This can help you get a lower interest rate or longer repayment tenure, which can help reduce your monthly repayments.

Avoid taking on additional debt: Try to avoid taking on additional debt while you are still repaying your home loan. This will help you avoid overburdening your finances and ensure that you can focus on repaying your existing debt.

Communicate with your lender: If you are experiencing financial difficulties or are unable to make your home loan repayments, communicate with your lender. They may be able to offer you a repayment plan or restructuring that can help you avoid defaulting on your loan.

By following these tips, you can effectively manage your home loan repayments as a national in Dubai and avoid defaulting on your loan.

0 notes

Video

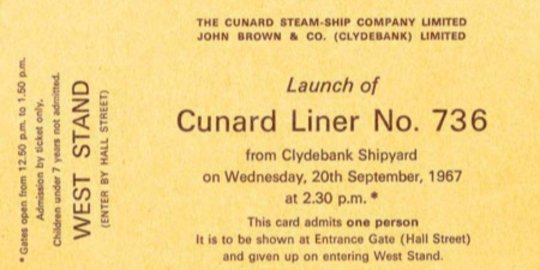

On 20th September, 1967, the QE2 launched from John Brown’s yard in Clydebank.

By the end of the 1950s, discussion over the replacement of the Queen Mary and Queen Elizabeth was taking place. The decision to replace the ‘Queens’ was deemed to be of national importance and as such a special committee, known as the Chandos Committee was created to advise the Government and to determine whether such a project was economically viable. Originally Cunard had wanted to build two new liners with the help of a Government subsidy, however the committee’s report proposed that the Government loan Cunard £18 million towards the construction of one vessel. The project became known as ‘Q3’ and six British shipyards were asked to tender – this prestigious project was a huge opportunity for home based shipbuilders to construct a transatlantic liner.

The new ship, code-named was built by John Brown & Company Ltd, Clydebank (later Upper Clyde Shipbuilders Ltd) and scheduled for May 1968. On 20th September 1967 the keel was launched by Queen Elizabeth II and the ship was named Queen Elizabeth 2. She was the last Atlantic Ocean Liner of it’s kind to be built in the UK.

QE2’s maiden transatlantic crossing set sail on 2 May 1969. She was well received by the American public, and became a profitable ship in her early years of service. During her first season, Cunard were able to repay £2.5 million of the Government loan. Her dual purpose design had allowed QE2 to thrive where her transatlantic counterparts could not.

In January 1971 while cruising in the Caribbean, QE2 received a distress call from the French liner Antilles. Antilles had run aground off the coast of Mustique in the Grenadines and caught fire. Being a fast ship in close proximity to the Antilles, QE2 went to her assistance.

However, by the time the QE2 arrived the passengers had been taken ashore. Antilles passengers and crew were brought aboard QE2 and taken to Barbados. As a testament to the quality of service offered aboard QE2, some of the Antille’s passengers booked subsequent cruises on the Cunarder.

In May 1972, while at sea during a transatlantic crossing, Captain William Law received notification that there was a bomb aboard QE2. Cunard took this threat very seriously and alerted the British Government who sent a bomb disposal unit out to the ship. Bomb disposal experts parachuted into the sea close to the ship and were brought aboard by QE2’s tenders. After a full sweep of the ship, the all clear was given as it turned out to be a hoax.

Later the FBI arrested the culprit for making similar threats against Pan American Airways. The bomb disposal teams were awarded the Queen’s Commendation for Brave Conduct.

As QE2’s cruising popularity increased and in response to the ongoing decline in shipping traffic on the North Atlantic, Cunard reduced the number of transatlantic crossings that QE2 took. The company maintained a strong summer presence on the Atlantic, however shifted the focus for the ship towards cruising. This saw QE2 undertake her first world cruise, an event that was well received – QE2 undertook a further 25 world cruises during her career.

Queen Elizabeth 2 was retired from active Cunard service in November 2008. She had been acquired by the private equity arm of Dubai World, which planned to begin conversion of the vessel to a 500-room floating hotel moored at the Palm Jumeirah, Dubai.

Following a multi-million-dollar investment programme, the 13-deck ship has been restored to her former glory and today serves as a world-class entertainment, tourism, hotel and dining destination in Dubai.

14 notes

·

View notes

Text

Gen. Pervez Musharraf, Pakistan’s former president, died at age 79 in Dubai on Sunday after a long illness, according to a statement by the Pakistani military.

Musharraf’s military colleagues in Pakistan often praised him as daring, forthright, and brave—yet the primary legacy he leaves behind will feature none of those adjectives. Pakistan’s 10th president since independence will be remembered instead as a divisive, constitution-shredding military dictator who set Pakistan back decades.

When Musharraf took charge after a military coup in October 1999, Pakistan was not dissimilar from its neighbors China and India—countries with large populations but little economic vitality at the time. China and India, however, soon enjoyed massive growth as their economies opened up to the world and investments poured in and exports flowed out. Pakistan grew too—but not because of any changes in how Musharraf managed the economy. Instead, infusions of cash from the United States to help finance the so-called global war on terrorism bolstered solid (though unspectacular) macroeconomic numbers.

By the end of Musharraf’s tenure in 2008, Pakistan was a regional economic laggard. The country took yet another massive loan from the International Monetary Fund just weeks after he resigned. More importantly, however, insurgencies and violent political crises had engulfed three of Pakistan’s four provinces.

Democratic-minded Pakistanis often blame the United States for bolstering the country’s military dictators, and for good reason. Throughout the three extended periods when generals have run Pakistan—the 1960s, the 1980s, and the 2000s—they did so with vital political and economic support from Washington. That is what helped shore up every military dictator Pakistan has ever had to endure.

But Musharraf’s assistance to U.S. President George W. Bush’s war efforts reached a whole new level and made him something of a celebrity in the United States. In 2006, he became the first foreign head of state to appear on The Daily Show With Jon Stewart. It was a somewhat awkward appearance. Asked how he balanced the wishes of the United States and Pakistan, Musharraf said, “I’ve had to learn the art of tightrope-walking many times, and I think I’ve become quite an expert of that.”

He got a few laughs. But there was nothing funny about the mess he was trying to hide back home as he sought to further secure his grip on power by marketing himself as the sole Pakistani counterterrorism partner whom Americans could count on.

Born in 1943 to a middle-class household that migrated to Pakistan from India just four years later, Musharraf benefited from being in a well-educated and socially prominent family. His father worked for the government and eventually became a diplomat posted to Ankara, Turkey, where Musharraf spent seven years learning Turkish and growing fond of Mustafa Kemal Ataturk, the founding father of a sovereign and secular Turkey. At age 18, Musharraf joined the Pakistan Military Academy, from which he graduated with a bachelor’s degree in 1964.

He saw his first combat in Pakistan’s 1965 war with India, and he was also involved in combat operations in the 1971 war that led to the breakup of Pakistan (and the founding of Bangladesh). Musharraf came to be seen as a star officer and became a member of the elite Special Services Group of commandos in the Pakistan Army. He later taught at the Command and Staff College in Quetta and in the War Wing of the National Defence College.

In 1998, Musharraf was appointed head of the armed forces, only to be fired in October 1999 when he was traveling abroad. The armed forces, never keen to obey even the most benign orders of elected civilian leaders, refused to carry out the decision. In scenes more fitting for a cheap thriller one might buy at an airport bookshop, the Army took control of Karachi’s airport, helped land Musharraf’s plane as he returned from his foreign trip, and conducted a coup. Musharraf then appointed himself the head of yet another military government.

As president, his straight-talking, unvarnished style was welcomed by Pakistanis unaccustomed to that kind of candor from a public official. For Pakistan’s rising urban middle class, he became a patron of music, television, film, and fashion. But for the rest of the country—the vast majority—Musharraf’s rule was a time of violence, diminished control over their own lives, and the absence of democratic representation.

Musharraf’s most memorable reform effort was Local Government Ordinance 2001, which aimed to transfer many local services from higher tiers of government to more local authorities. The idea was to empower ordinary citizens and make the authorities overseeing municipal water, sanitation, and education services more responsive to the people using those services. For the first few years after it was enacted, the ordinance and the new systems it created seemed to be improving those services across the country.

As with so many of Musharraf’s promises, though, there was no follow-through. Musharraf never delivered the necessary fiscal and political freedoms that would have ensured his reforms would last. He deliberately kept the four provincial governments weak and fiscally dependent on the largesse of the federal government. This ended up embittering ethnic minorities and deepening the suspicions of democrats already wary of Musharraf’s intentions. Both at the provincial and the national levels, Pakistan’s democratic institutions remained weak. And in 2006, Musharraf helped dismantle some of his own reforms to prolong his time as president—conceding changes to Local Government Ordinance 2001 as part of a deal with “elected” civilians who were actually installed to do his bidding. Despite Musharraf’s many protestations to the contrary, he never really favored democracy.

Nor did he respect the rights and multiple identities of his diverse citizenry. In Balochistan—the sparsely populated, poor, yet mineral-rich province that is now the site of some of China’s key investments in Pakistan’s infrastructure—Musharraf laid the foundation for a raging separatist insurgency. He responded to long-standing Baloch demands for greater access to the natural resources extracted from the province with contemptuous rejections. Key political leaders who articulated those demands were branded as traitors.

The tipping point probably came in 2006 when Nawab Akbar Bugti, a onetime government minister in Islamabad and former chief minister of the province, was killed in a standoff with the military. Bugti’s family accused Musharraf of having him assassinated. A 2016 court judgment cleared Musharraf of the charge, but many continue to believe that he was responsible. Even those with a tendency to align themselves with Musharraf blamed him for plunging the entire province into violence.

Meanwhile, the cost of fighting al Qaeda was not borne by Musharraf but by the thousands of Pakistani citizens, police officers, spies, and soldiers who were killed in reprisal attacks that metastasized into a full-blown terrorist insurgency in the north and northwest of the country. Bush understandably praised Musharraf for helping to fight his war, calling Musharraf “a leader with great courage and vision.” But for Pakistan, the fruits of that relationship were ruinous. From the home district of Malala Yousafzai in Pakistan’s northwest to the tribal areas bordering Afghanistan, full-scale military operations displaced and dislocated millions of Pakistani citizens throughout the decade that followed the Musharraf era—operations that were a response to restive and violent conditions that Musharraf, in trying to please Washington, had fostered or created.

Musharraf and his many supporters often cite the absence of better options—suggesting it would have been impossible to support U.S. counterterrorism campaigns in the aftermath of the 9/11 attacks without fueling a terrorist insurgency. And, yes, the challenge of being squeezed between U.S. pressure to conduct a war on terrorism and the domestic complexities of managing that war without igniting internal conflicts and tensions would have been difficult for any leader. Still, Pakistan never had a chance to debate or contemplate how to find a proper balance—Musharraf decided for the whole country.

In the nearly decade and a half between his resignation in 2008 and his death, Musharraf showed little capacity for reflection or remorse. When he did show glimpses of regret, they were transparently self-serving. At the launch of his own political party in October 2010, when questioned about what he did to counter corruption during his time in power, he apologized for having made a 2007 deal to enable former Prime Minister Benazir Bhutto to return to Pakistan. (She was assassinated on his watch as president.) Later that year, during an interview with Indian television, when confronted about how he left Pakistan in political and financial ruin, he expressed regret at having given up the position of chief of army staff too soon. In an interview in December 2013, as momentum was building for a Pakistani Supreme Court case in which he would have been tried for treason, Musharraf said, “Whatever I did, I did it for the country. It could be wrong, but there was no bad intention in it. Even then, if someone thinks that I have committed a mistake, I seek forgiveness for it.”

Those who wonder about the sincerity of his halting contrition need look no further than his actions toward the end of 2007. Growing increasingly weary of the upsurge in political, legal, and social challenges to his rule that had arisen throughout 2006, he tried to fire the country’s chief justice in March 2007. That decision backfired in July of that year when a 13-judge panel from the Supreme Court reinstated the justice. In response, Musharraf arranged to be elected as president by parliament in October. When that gambit backfired—with almost all opposition members either abstaining or resigning from parliament to protest the behavior of the Musharraf regime—he suspended the constitution altogether, declaring a state of emergency. In keeping with the global post-9/11 tradition of using terrorism as a basis for violating laws, he justified the emergency declaration on the basis of the “visible ascendancy in the activities of extremists and incidents of terrorist attacks.”

It’s not only his actions as the leader of the country after 1999 that will leave his legacy in tatters. Perhaps the most egregious violation of his oath as a soldier was not the coup he conducted in 1999, or the sham election he held in 2002, or the judges he tried to fire in 2007, or the emergency he declared in 2007. Rather, it was the Kargil War of 1999—a military entanglement that his supporters laud for its tactical robustness, yet whose strategic cost Pakistan continues to bear to this day.

Contingency plans for taking vulnerable parts of Indian-occupied Kashmir had been part of Pakistani military thinking for decades. In the late 1990s, several senior officers had sought to implement those plans, yet calmer heads had always prevailed, including the army chief who preceded Musharraf, a thoughtful and widely respected general named Jehangir Karamat. But in 1998, then-Prime Minister Nawaz Sharif fell out with Karamat and fast-tracked Musharraf’s appointment as chief of army staff. Among Musharraf’s first acts as military boss was to greenlight the covert infiltration that sparked the Kargil War.

The war was supposed to liberate Kashmir from Indian occupation. Instead, hundreds of Pakistani soldiers were killed, and after an initial shock, India was able to push back and regain the territory it had held. Back home, Pakistan’s elected civilian leadership claimed to have been kept in the dark about the Kargil misadventure—and the resulting bitterness is what eventually led to Musharraf’s coup. At one point, U.S. President Bill Clinton was pulled into the crossfire, both between Musharraf and Sharif and between India and Pakistan. Bitterness and disappointment from Kargil in both Washington (for the dangerous escalation the intervention represented) and Pakistan (for the United States having refused to support Pakistan) led to a strategic falling-out between the United States and Pakistan. Those tensions never fully disappeared.

Recent political upheaval in Pakistan is essentially part of the toxicity that began with the disastrous Kargil misadventure. When disagreements between Pakistani politicians and generals boil over, the United States is the baton they use to beat each other up with. Unpredictability in Pakistani governance now seems like a given—but it wasn’t always this way. Gen. Pervez Musharraf was the gardener who planted and harvested those seeds.

To his credit perhaps, despite all his failings, Musharraf remained to the end a relatable figure for the vast middle class of Pakistan. Unlike so many other Pakistani leaders, including military dictators, his family seemed immune to the voracious appetite for money and power such people tend to have. Neither of his two children is a public figure, and neither stands accused of having benefited from the long period when their father enjoyed unlimited power in Pakistan. Previous dictators have left behind multiple generations of very wealthy, politically active offspring.

Musharraf, who had been living in self-imposed exile in Dubai since 2016, leaves behind an empty home in Islamabad and a few apartments in the Middle East and London. All empty. Just like his contrition, and his promises of uniting and reforming the nation.

3 notes

·

View notes

Text

Are you considering property investment in the UAE while residing in the UK? As a UK resident, securing a home loan or mortgage in UAE is possible. Below, we provide comprehensive guidance for prospective buyers from the UK.

0 notes

Text

The Ultimate Guide to Buy a Luxury Villa in Dubai

Dubai is known for its extravagant architecture, lavish lifestyles, and luxury real estate. For those looking to buy a high-end, luxurious home in this glittering emirate, purchasing a luxury villa should be at the top of the list. From sprawling Arabic-style palaces to modern architectural marvels with amazing amenities, Dubai offers some of the finest luxury villas in the world. This comprehensive guide will provide tips on everything you need to consider when looking to buy a luxury villa in Dubai so that you can find your dream home.

Choosing the Right Area

One of the first things to consider when buying a luxury villa in Dubai is identifying the right area that aligns with your lifestyle and preferences. Key factors to evaluate include:

Accessibility - Consider proximity to key destinations like schools, shopping malls, beaches, airports, and highways. Prime areas include Emirates Hills, Arabian Ranches, and Downtown Dubai.

Amenities - Look at community amenities like gyms, pools, parks, beaches, restaurants, hotels and golf courses nearby. Established communities tend to offer more amenities.

Lifestyle fit - Think about the ambiance you want. For city vibes, Downtown Dubai or Dubai Marina work well. For a neighborhood feel, Jumeirah Islands or Meadows are great options.

Research Developers

In Dubai’s real estate market, the developer behind a luxury villa project plays a pivotal role in determining factors like the quality of construction, design aesthetic, amenities offered, and reliability. When preparing to buy luxury villa in Dubai, extensively researching developers is crucial. Some well-known developers of luxury villas in Dubai include:

Emaar Properties - Behind iconic projects like Downtown Dubai, Dubai Marina, Arabian Ranches, and Emirates Living.

Damac Properties - Known for luxury resort-style living in communities such as AKOYA Oxygen and Just Cavalli Villas.

Azizi Developments - Offering contemporary luxury homes in locations like Creek Views and Riviera.

Dubai Properties - Developments across Dubai like Serena and Villanova give elite living spaces.

When evaluating developers, look at their track record, quality standards, previous projects, and any accolades or awards for their work.

Determining Costs

Buying a luxury villa in Dubai requires extensive budget planning due to the high prices of premium properties in prime locations. On average, luxury villas can range from AED 15 million and upwards. Key costs include:

Purchase Price – Luxury villa prices vary widely depending on location, size, developer, amenities etc. Expect to pay a premium in areas like Palm Jumeirah.

Service & Community Fees – In addition to purchase cost, monthly fees apply for community upkeep and amenities. These typically range from AED 10-20k.

Mortgage Payments – Most buyers require a mortgage loan. Total costs depend on down payment, repayment period etc. Interest rates are competitive.

Taxes - No personal income taxes apply in Dubai but certain sales, tourism and municipality taxes may apply. Check with developers.

When budgeting, work factors like exchange rates, family needs etc. into your planning. Getting pre-approvals from banks can also help estimate costs.

Paying for Your Luxury Villa

You have multiple options when it comes to making payments for luxury villas in Dubai, including:

Cash Buyout - Pay the full cost of the property upfront without needing mortgage financing. This can earn discounts from developers up to 10%.

Mortgage Finance - Banks like ENBD, ADCB and Mashreq offer competitive mortgage loans for non-UAE nationals, usually up to 75% of value. Terms depend on nationality.

Off-plan Installments - Developers provide easy payment plan options spread over construction for villas under construction, with only 5% down initially. This gets you pre-launch prices too. Handover dates tend to be reliable.

Compare all programs to find one that best suits your financial bandwidth and pays in a currency that limits FOREX risks.

Conclusion

This detailed guide has covered all the key factors you need to consider when preparing to buy a luxury villa in Dubai that perfectly caters to your lifestyle needs and budget planning. With the world-class amenities and infrastructure in Dubai, owning a luxury villa here positions you to experience the pinnacle of elite living coupled with smart property investments for the future. Do extensive research, examine all options patiently before making the big purchase decision.

0 notes

Text

This is how blue finance works in Latin America and the Caribbean

Climate change is hitting the region's seas. Blue finance can be a shield to protect them

A combination of climate change, overfishing and pollution is bringing the planet's vibrant oceans to the brink of collapse. The pain inflicted to the oceans by climate change is especially intense in Latin America and the Caribbean, where many economies and the livelihoods of millions of people are closely linked to the sea.

The sea represents 60% of the territory in 22 countries in the region, with a coast that extends for more than 70,000 km. In Latin America alone, 25% of the population lives in coastal areas, while almost 100% do so in the Caribbean.

The looming crisis facing the oceans will be a key point in the COP28 discussions taking place at the end of November in Dubai, where world leaders will seek to deploy an arsenal of initiatives to confront the challenge of climate change. One of the pillars of these efforts will likely be a nascent set of financial tools, including blue bonds and blue loans[1], which have already taken their first steps in the region and contain enormous potential in the battle against climate change.

These instruments raise funds for water-related projects, such as preserving access to clean water, wastewater treatment plants, plastic recycling, restoration of marine ecosystems, sustainable shipping, eco-tourism and offshore renewable energy.

Similarly, investments in sustainable salmon production in Chile represent an investment potential of $5 billion and could help increase sector income, boost exports and support local jobs, while preserving natural resources.

Some countries are already paving the way for the development of blue finance in the region. This is, for example, Ecuador, where Banco Internacional became the first bank in the region in 2022 to issue blue bonds. The issue, which had the support of the International Finance Corporation (IFC)[2], could be a benchmark in a country that is home to the largest small-scale artisanal fishing fleet in the southeastern Pacific Ocean and which also has enormous growth potential in the blue economy. The Ecuadorian fishing sector contributes around 1.5% of the country's Gross Domestic Product and 13% of its non-oil exports, and employs 108,000 people.

Since 2020, IFC has provided more than $1.3 billion in loans and blue bonds to financial institutions and private sector companies. In Colombia, one of the five most diverse nations on the planet, BBVA[3] became, with the support of IFC, the first financial entity in the country to issue blue bonds. This is a first tranche for 50 million dollars destined to finance projects for the construction of water and sewage treatment plants, preservation of the oceans and protection of lakes, moors and mangroves.

In the middle of last year, IFC granted a loan of $150 million to the Companhia de Saneamento Básico do Estado de São Paulo (SABESP)[4], one of the largest water and sanitation companies in the world. The impact of the loan is huge, as it will be used to finance investments focused on improving water quality and expanding wastewater collection and treatment in the poorest neighbourhoods of São Paulo.

Despite these cases, there are still many tasks to be accomplished for blue finance to take root in the region. It is key, for example, to develop duly defined taxonomies, certifications and standards so that blue finance becomes tools that meet its impact expectations. The Blue Finance Guidelines[5], a document developed by IFC that identifies eligibility criteria for blue projects, seeks precisely to translate the general principles of blue economy financing into guidelines for blue bond issuances and blue loans.

This story is not only an opportunity for growth, but also a commitment to the preservation of our environment. Investing in the blue economy, supported by strong financial institutions and regulations, can make a difference in preserving our oceans and fighting climate change.

According to an estimate by the Organization for Economic Cooperation and Development (OECD), the blue economy represents about 2.5% of global GDP. Likewise, its scope can provide a substantial change in problems such as the scarcity of fresh water or the use of renewable energy, thereby promoting a better quality of life for people who live linked to the sea.

Today, the blue economy has already confirmed its potential by generating palpable benefits in some cases such as the decarbonization of maritime transport in Brazil, support for sustainable tourism in Chile, the protection of marine biodiversity in the Eastern Caribbean and the Galapagos Islands, the restoration coralline in Belize and the preservation of species in the Mar del Plata in Argentina, to mention a few.

There is no sustainable horizon without private innovation

Efforts to combat climate change will not succeed without massive increases in private capital to developing economies, which account for more than 60% of global decarbonization investment needs. According to its annual report[6] (Building a Better Future), IFC committed a record global amount of $14.4 billion in climate finance by 2023. Starting July 1, 2023, 85% of all new IFC investments will be consistent with the goals of the Paris Agreement, increasing to 100% on July 1, 2025, meaning it will include climate mitigation and adaptation. climate change in all investment decisions. Mere financing is not enough: innovation also plays a fundamental role, especially in protecting the planet's carbon reserves. In the field of blue finance, for example, IFC published a study[7] this year that detects opportunities to finance projects that contribute to safeguarding the carbon stored in the world's coastal ecosystems. In Latin America and the Caribbean, the safeguarding of so-called blue carbon - that which is stored in the form of biomass and sediments in coastal ecosystems - will be one of the main areas to explore in terms of blue finance in the years to come.

Source

Grupo Banco Mundial, Así funcionan las finanzas azules en América Latina y el Caribe, in:El Pais, 16-11-2023; https://elpais.com/america/termometro-social/2023-11-16/asi-funcionan-las-finanzas-azules-en-america-latina-y-el-caribe.html

[1] Blue bonds are debt issues that are intended to preserve and protect the oceans and their ecosystems. They seek, through the mobilization of public and private capital, to promote projects that have a favourable impact on the achievement of the Sustainable Development Goals (SDG) and the blue economy. https://www.bbva.com/es/sostenibilidad/que-son-los-bonos-azules-y-por-que-son-importantes/

[2] The International Finance Corporation (IFC) is an international financial institution that offers investment, advisory, and asset-management services to encourage private-sector development in less developed countries. The IFC is a member of the World Bank Group and is headquartered in Washington, D.C. in the United States.

[3] Banco Bilbao Vizcaya Argentaria, S.A., better known by its initialism BBVA, is a Spanish multinational financial services company based in Madrid and Bilbao, Spain. It is one of the largest financial institutions in the world, and is present mainly in Spain, Portugal, Mexico, South America, Turkey, Italy and Romania

[4] Sabesp is a Brazilian water and waste management company owned by the state of São Paulo. It provides water and sewage services to residential, commercial and industrial users in São Paulo and in 363 of the 645 municipalities in São Paulo State, typically under 30-year concession contracts. It provides water to 26.7 million customers, or 60% of the population of the state. It is the largest water and waste management company in Latin América. It provides basic sanitation services, which include all phases (abstraction, treatment, processing, distribution) and the collection, treatment and reuse of sewage. The São Paulo Metropolitan Region and the Regional Systems accounted for 74.5% and 25.5% of the sales and services rendered during the year ended December 31, 2004 respectively. Sabesp also supplies water on a bulk basis to municipalities in the São Paulo Metropolitan Area, in which it does not operate water systems to local operators.

[5] Blue Finance is an emerging area in Climate Finance with increased interest from investors, financial institutions, and issuers globally. It offers tremendous opportunities and helps address pressing challenges by contributing to economic growth, improved livelihood, and the health of marine ecosystems. The ocean economy is expected to double to $3 trillion by 2030, employing 40 million people, as compared to 2010. Innovative financing solutions are key to enhancing ocean and coastal preservation and increasing clean water resources, and Blue Finance has a huge potential to help realize these goals. This document identifies eligible blue project categories to guide IFC’s investments to support the blue economy, in line with the Green Bond Principles and Green Loan Principles. The market has been seeking guidance on project eligibility criteria, translating general Blue Economy Financing Principles, such as the Sustainable Blue Economy Principles and the Sustainable Ocean Principles, towards guidelines for blue bond issuances and blue lending. https://www.ifc.org/en/insights-reports/2022/guidelines-for-blue-finance

[6] In FY23, IFC committed a record $14.4 billion in climate finance, mobilizing $6.8 billion of additional capital alongside our own investment of $7.6 billion to help client countries address the climate crisis. This represented a record 46 percent of the total of long[6]term investments for our own account. Our work accelerates an inclusive transition by catalysing green growth, supporting private companies to decarbonize and manage risks, and supports societies adapting to a warmer planet. As a result, we help create markets and jobs so that countries continue to reduce poverty and improve living standards while increasing resilience and shifting to a low-carbon world. https://www.ifc.org/en/insights-reports/annual-report/download

[7] Deep Blue: Opportunities for Blue Carbon Finance in Coastal Ecosystems. https://www.ifc.org/en/insights-reports/2023/blue-carbon-finance-in-coastal-ecosystems

0 notes

Text

Mortgage Buyout Dubai

Mortgage Buyout Dubai

About

Might you want to ease up the weight of your Home loan today ? Transfering your home money to Resource Collusion assists you with relieving this burden with a superior supporting rate and more helpful residencies, giving you inner harmony to partake in your home significantly more

Benefits

Supporting upto AED 30 million for Nationals and Ostracizes

Benefit rates as low as 2.49% per

Unique rate for funding handover installments to engineers

Supporting upto 80% of property estimation

No Early Settlement Expenses

Property Protection

Required Documents

Salaried:

Substantial Visa and Emirates ID duplicate

Substantial home visa duplicate (Expats inhabitants As it were)

Compensation Endorsement

3-month bank proclamation

Obligation Letter (if pertinent)

Property proprietorship archives

Self Employee

Legitimate Visa and Emirates ID duplicate

Legitimate home visa duplicate (Expats occupants As it were)

Organization possession archives

3-month bank explanation

Responsibility Letter (if material)

Property possession reports

Eligibility

Salaried:

Month to month compensation AED 10,000 for Pay Move and AED 15,000 for Non-Pay Move clients

Min age 21 years at the hour of utilization and max age 70 years for UAE Public and 65 years for Expat at the hour of money development

Properties situated in all emirates

Self Employee

Yearly turnover of AED 3,000,000

Min age 30 years at the hour of utilization and max age 70 years at the hour of money development

Properties situated in Abu Dhabi and Dubai as it were

Contact us: +971-555394457

0 notes

Text

A Crucial Guide to Discover the Best Home Mortgage Loan Companies in Dubai

Owning a home is a dream cherished by many, and in the vibrant city of Dubai, this dream is often realized through the assistance of home mortgage loans. Dubai's real estate market offers a plethora of options for individuals looking to purchase property, but finding the right home mortgage loan company is crucial to ensure a smooth and successful home buying journey. This comprehensive guide aims to help prospective homebuyers navigate the landscape of home mortgage loan companies and make informed decisions that align with their financial goals and aspirations.

Understanding Home Mortgage Loans in Dubai

Dubai's real estate market is renowned for its diversity, offering a range of properties from luxurious villas to modern apartments. However, most individuals require financial assistance to make these property purchases. The best home loan in uae serves as the bridge between a prospective homebuyer's aspirations and the reality of property ownership. These loans allow individuals to borrow a significant portion of the property's value, with the property itself serving as collateral.

Key Factors to Consider When Choosing a Home Mortgage Loan Company

Interest Rates and Fees

Interest rates are a fundamental aspect of the best home loan in uae. They determine the cost of borrowing and can significantly impact monthly payments. Exploring different loan providers to compare interest rates and associated fees is essential to secure a favorable deal.

Loan Repayment Terms

The duration of the loan repayment term plays a vital role in determining the overall affordability of the mortgage. Shorter terms may have higher monthly payments but lower overall interest costs, while longer terms may result in lower monthly payments but higher overall interest.

Loan Eligibility and Requirements

The best home loan in uae providers may have varying eligibility criteria and documentation requirements. Understanding these requirements beforehand ensures a smoother application process.

Customer Service and Support

Excellent customer service is crucial when dealing with complex financial transactions. Choosing the best home loan in dubai company with a reputation for prompt, reliable, and helpful customer support can alleviate stress and provide clarity throughout the process.

Loan Types and Flexibility

Dubai's real estate market offers various types of properties, each requiring different financing options. The best home loan in dubai company offers flexibility in terms of loan types to cater to different property types and buyer preferences.

Top Home Mortgage Loan Companies in Dubai

Money Dila

Money Dila is a top home mortgage loan company in Dubai that offers competitive rates and flexible terms. With a wide range of loan products and services, Money Dila is well-equipped to meet the needs of its clients.

Money Dila offers competitive rates and flexible terms to help clients purchase their dream homes in Dubai. The company has a variety of loan products, including fixed-rate mortgages, adjustable-rate mortgages, and jumbo loans. They also offer more specialized loan options such as self-employed mortgages, foreign national mortgages, and non-conforming mortgages. Money Dila is committed to helping clients find the most competitive terms for their loan needs.

Money Dila provides personalized service to help clients navigate the home loan process. The experienced team can help clients with every step of the process, from pre-qualifying for a loan to closing. They offer guidance on loan options, help clients compare rates and fees, and provide advice on the best way to finance a home. Money Dila also provides assistance with the home buying process, including helping clients find the perfect home and negotiating the best price.

Steps to Secure the Best Home Mortgage Loan in Dubai

Research and Compare

Begin by researching the various home mortgage loan companies available in Dubai. Compare interest rates, fees, and terms to identify the best options that align with your financial situation.

Check Eligibility

Review the eligibility criteria of the shortlisted mortgage loan companies. Ensure you meet their requirements before proceeding with the application.

Gather Documentation

Prepare all necessary documentation, including proof of income, identification, and property details. Having these documents readily available streamlines the application process.

Seek Professional Advice

Consulting with financial advisors or mortgage brokers can provide valuable insights into the best mortgage loan options available based on your financial goals.

Application Process

Initiate the application process with your chosen mortgage loan company. Fill out the required forms and submit the necessary documents.

Review and Approval

The mortgage loan company will review your application, verify the provided information, and assess your creditworthiness. Upon approval, you'll receive an offer outlining the terms of the loan.

Negotiate if Necessary

If you believe there is room for negotiation, don't hesitate to engage in discussions to secure more favorable terms.

Finalize the Deal

Once you're satisfied with the terms of the mortgage loan, finalize the deal by signing the necessary agreements.

Conclusion

Choosing the best home mortgage loan companies in Dubai is a significant decision that requires thorough research, careful consideration of your financial situation, and a clear understanding of your property ownership goals. With a variety of reputable mortgage loan providers available, prospective homebuyers have the opportunity to secure a home loan that aligns with their preferences and offers a path towards fulfilling their dream of property ownership in this dynamic and thriving city.

MoneyDila

2507 - 2508, Burlington Tower, Al Abraj Street, Opposite Oberoi Hotel, Business Bay, Dubai, UAE (28173)

971-4332 0030

0 notes

Text

Islamabad — In the tiny, remote village of Bandli, high up in the mountains of Pakistan-administered Kashmir, local officials were circulating a grim list on Friday. On it are the names of 11 missing men. They are believed to be among the hundreds of people who were crammed by human traffickers onto an old fishing boat that sank off the coast of Greece last week, thousands of miles from their homes, as they tried to make it to European soil.

It was one of the deadliest maritime disasters in Europe in decades.

The men from Bandli were among an estimated 400 to 750 people from Pakistan, Egypt, Syria and other countries packed onto the fishing boat when it sank about 50 miles from the southern Greek town of Pylos on June 14.

Pakistan has grappled for months with a complete economic meltdown, spurring more and more people to risk their lives to reach Europe in search of a better future.

CBS News' partner network BBC sent a team from its World Service, Urdu channel to Bundli, where they met Raja Anwar standing on the roof of his house, staring vacantly at the gate to his property.

His 38-year-old son Abdul sent Anwar a message to say he was getting on the boat in Libya just before it set off on June 14.

"We had to take a huge loan of 22 lakhs ($8,000) from our extended family to pay for his journey," Anwar told the BBC.

He said his village had lost a young generation of men, including his son and four nephews, the youngest of whom, Owais Tariq, was only 19. All the men but one were married with young children, he said.

The boat the would-be migrants were on had a capacity for far fewer people, and when it became clear that it was capsizing, the captain reportedly abandoned ship and left them to their fate. Of the hundreds who were on the boat – which one group said may have included many children – only 104 were rescued. Greek authorities have recovered 82 bodies so far.

Pakistan appears to have had the highest number of nationals on board the doomed vessel. The country's Interior Minister, Rana Sanaullah, told parliament Friday that at least 350 Pakistanis were on the boat, adding that a total of 281 families had contacted the government to seek help and information.

Another 193 Pakistani families have already been DNA-tested to match with the remains of victims found, or to keep on file with so many people still officially missing after the shipwreck.

Pakistan has arrested several alleged human traffickers and their agents, who have told authorities their ringleader was based in Libya, from which the boat set sail on the North African coast.

These human smugglers allegedly charged around $8,000 per person to illegally take the Pakistani nationals to Europe across the Mediterranean from Libya – a dangerous sea crossing that has become busier as European nations have worked to seal their land borders. The migrants had been flown legally to Dubai, Egypt and directly to Libya, authorities said.

An official inquiry was underway to identify and arrest any others involved in the human smuggling, Sanaullah said, adding that Pakistan's government was also working to recommend amendments to laws to increase the likelihood of convictions in such cases.

The interior minister said not a single human trafficker had been convicted in Pakistan in more than five years, adding that it was mostly due to victims' families agreeing to pardons in exchange for money.

Given Pakistan's deep economic woes, it's unclear what effect any efforts to tackle irregular migration could have in the country.

Pakistanis are grappling with inflation at an almost unfathomable rate of 38%. A rapidly depreciating currency and external deficit led the government to adopt drastic measures over the past year to avoid a national default.

But those measures dealt a huge blow to domestic growth and jobs. The industrial sector, Pakistan's economic engine, has contracted almost 3% in the current financial year according to provisional data. That has put a huge strain on a nation with a population of over 230 million and a generally young population that's pushing 2 million new people into to the labor force every year.

Official unemployment data have not been published in two years. But Hafeez Pasha, a former finance minister and economist renowned for his work on Pakistan's labor issues, has put the unemployment rate at a record "11-12%, conservatively."

Behind only Egypt and Bangladesh, Pakistan has the most nationals currently being registered as arriving asylum seekers in Italy, the European border agency Frontex told the Reuters news agency.

Of the arrivals this year through May, a record 4,971 Pakistanis tried to make the central Mediterranean crossing in a single year, according to Frontex data recorded since 2009.

Legal migration opportunities are limited, and that stark figure represents those who have actually made it to Italy.

Many, like the hundreds of people now lost from the boat off southern Greece, see no option but to try to make arrangements through agents who often present illegal routes as a quicker, cheaper, or even the only way to reach Europe, according to the Migrant Resource Centre, a EU-funded organization that provides information and counseling to migrants.

In the village of Bandli, 11 desperate families were left clinging to hope Friday that they might still get word their loved ones were among the lucky ones rescued.

That hope was fading fast, and pain was already etched on the faces of the mothers, fathers and other relatives wondering if their loved ones were among the 12 Pakistani nationals who Greek officials say were pulled out of the water alive.

0 notes

Text

Real Estate Challenges, Key Players, Market Segments, Development, Opportunities, Forecast Report 2031

Real Estate Market Research, 2031

The global real estate market was valued at $28,917.7 billion in 2021, and is projected to reach $48,923.3 billion by 2031, registering a CAGR of 5.3% from 2022 to 2031. The real estate market includes buying and selling of residential, commercial, and industrial properties such as flats, bungalows, offices and villas.

The real estate industry is mainly driven by urbanization in developing countries. People from small villages and towns are migrating to cities to improve their living standards. Increase in industries around large cities has led to expansion of cities. In addition, governments of several nations such as the U.S. and Australia offer real estate loans at lower rates for long term and concession for first time home buyers, respectively. In addition, governments of several other nations such as Poland, the U.S., and Canada offer schemes such as Golden Visa and affordable housing schemes to encourage buyers. Moreover, large number of tourist destinations in countries such as France, the Netherlands, Dubai, Singapore, and Malaysia also attract real estate buyers. Furthermore, The market has witnessed significant growth over the past decade, owing to increase in the land-related real estate transaction in the commercial, industrial, and residential projects around the globe.

However, there has been a very low rate of growth in the residential real estate market in developed nations as major cities have reached saturation considering expansion, which acts as a restrain for the market growth.

In addition, during the outbreak of the COVID-19 pandemic, construction, manufacturing, hotel, and tourism industries were majorly affected. Manufacturing activities were halted or restricted. This led to decline in construction activities, thereby restraining the growth of the real estate market. Conversely, industries are gradually resuming their regular manufacturing and services. This is expected to lead to re-initiation of real estate companies at their full-scale capacities, that helped the real estate market to recover by end of 2021.

On the contrary, governments in several developing nations such as India have planned new cities such as Dream City in Gujarat and New Kanpur, which would have commercial, industrial, and residential zones, which is expected to provide lucrative opportunities for the market growth.

Get Free Sample:-https://www.alliedmarketresearch.com/request-sample/6394

https://lh3.googleusercontent.com/ZeRR8WgOMBFIJmqaIOQP_S7mOluh8hnonrThv2xKGdJCXlc-YvRjVSaGuUBfOsMylgzy4n3ViCf38gQ9qKI18U0=w1280

The real estate market forecast is made on the basis of type, property, business and region. By type, the real estate market is bifurcated into land and buildings. By property, the market is categorized into residential, commercial, and industrial. By business, the market is divided into sales and rental. By region, the real estate market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Italy, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

On the basis of type, in 2021 the buildings segment dominated the real estate market, in terms of revenue, and is expected to witness growth at the highest CAGR during the forecast period. As per property, in 2021, the residential segment led the real estate market and is expected to exhibit highest CAGR in the near future. By business, the sales segment led the market in 2021, in terms of revenue and is anticipated to register highest CAGR during the forecast period. Region-wise, Asia-Pacific garnered the highest revenue in 2021; however, LAMEA is anticipated to register highest CAGR during the forecast period.

COMPETITION ANALYSIS

The key players having significant real estate market share included in the report are American Tower, AvalonBay Communities, Ayala Land Inc., Gecina, Link REIT, Prologis, Segro, Simon Property Group, Sinar Mas Land, and Welltower.

Major companies in the market have adopted business expansion, agreement and acquisition as their key developmental strategies to offer better products and services to customers promoting real estate market growth.

Full Report With TOC:-https://www.alliedmarketresearch.com/real-estate-market-A06029

0 notes

Text

Navigating the paperwork and requirements for a home loan as a UAE national in Dubai"

For UAE nationals in Dubai, obtaining a home loan can be an important step towards purchasing a property. However, navigating the paperwork and requirements can be a daunting task. Here's a guide to help you understand the process of obtaining a home loan as a UAE national in Dubai.

Check your eligibility

Before you start the application process, it's important to make sure you are eligible for a home loan. This may include requirements such as minimum age, income, and credit score. You can check with different lenders to determine their specific eligibility criteria.

Gather the required documents

To apply for a home loan, you will need to provide a range of documents, including your Emirates ID, passport, salary certificate, bank statements, and property documents. Make sure you have all the necessary paperwork ready before you start the application process.

Determine your loan amount

Before you start searching for properties, it's important to determine the amount you can afford to borrow. This will depend on factors such as your income, expenses, and other debts. Consider consulting with a financial advisor to help you determine the right loan amount for your situation.

Shop around for the best deal

Once you have determined your loan amount, it's important to shop around for the best deal from different lenders. Compare interest rates, loan terms, and other fees to find the best option for your needs.

Apply for the loan

After you have selected a lender, you can start the loan application process. You will need to provide all the necessary documents and complete the application form. The lender will review your application and determine if you are approved for the loan.

Complete the paperwork

If you are approved for the loan, you will need to complete the necessary paperwork to finalize the loan. This may include signing the loan agreement, providing proof of insurance, and other requirements.

0 notes

Text

How to open a bank account in the United Arab EmiratesBanking in the UAE

How to open a bank account in the United Arab EmiratesBanking in the UAE

How to open a bank account in the United Arab EmiratesBanking in the UAE

The UAE has a hearty financial area that is managed by a national bank laid out in 1980. There are around 50 neighborhood and unfamiliar banks in the country. The rating organization Moody's characterizes the UAE banking framework as steady because of the banks' strong capital levels and liquidity supports. Banks in the UAE are basically store financed. Besides, their solid capital levels give a huge, misfortune retaining buffer.There are four sorts of banks that work in the UAE, as follows:

Business banks

Venture banks

Modern banks

Islamic banks

As of late, banks in the UAE have extended their administrations to take special care of shoppers aware of Islamic monetary necessities with Shari'a banking administrations. There are eight undeniable Islamic banks and 23 Islamic windows set up by traditional banks in the UAE. By and large, these establishments represent 19% of the all out financial area resources. Banks in the UAE have embraced a few worldwide principles, including the Global Bookkeeping Standard, the Worldwide Monetary Revealing Norms, and most as of late, the capital sufficiency guidelines in accordance with Basel III guidelines. All banks working in the UAE offer administrations in English and Arabic.

Do you really want a financial balance in the UAE?

While it is feasible to deal with your cash utilizing an abroad record, most expats benefit from having a nearby financial balance in the UAE. For a certain something, managers might expect you to have a nearby record. Also, albeit the UAE's financial framework is very much associated with different nations, neighborhood lenders may not move cash abroad on account of the great charges included. Third, a neighborhood account facilitates the most common way of getting Mastercards and taking out a vehicle credit or a home loan.

Sorts of financial balances in the UAE

Similarly as with different nations, banks in the UAE offer a few distinct sorts of individual records for occupants and non-occupants the same.

Current account

These are perfect for regular exchanges and moves. They likewise accompany checkbooks, which you'll require to give present dated lease keeps an eye on your landowner. Regularly, banks in the UAE offer two sorts of current records, with and without compensation moves. Assuming you're utilized, it's a good idea to open a record with your organization's financiers. This is to guarantee that you get the compensation when it's moved. With another bank, moves can require a little while longer.

saving accounts

On the off chance that you believe your cash should work for you, get some information about a bank account. These regularly offer higher financing costs than current records, however may have restricted admittance to reserves, and assume punishments for withdrawals. Investment accounts can offer a fixed or variable financing cost. You can decide to name them in dirhams, US dollars, euros or pounds authentic. Investment account likewise fill in as compensation accounts, however commonly convey the advantage of a checkbook.

investment accounts

Banks working in the UAE additionally offer venture administrations. You can open a venture account on consenting to a speculation arrangement with the bank. Such agreements might run from a year to five or 10 years or more. Such arrangements cover the administration of your assets with a base guaranteed return of 3 to 7% or more each year. Least venture adjusts, be that as it may, differ from one bank to another.

Offshore account

As an expat sanctuary, seaward banks from purviews all around the world proposition portrayals in the UAE, especially in Dubai. Anybody with a legitimate home visa in the UAE can open a seaward ledger to import and commodity reserves. Seaward banking is by and large viewed as steady, dependable, and secure and many seaward records additionally accompany particular monetary and legitimate benefits, for example, lower charge rates.

In the UAE, seaward banking envelops a scope of administrations, including resource security, confidential financial balances, abundance the board, portfolio the executives, charge discussion, legacy arranging, and company development. A portion of the significant banks are HSBC Seaward, Nunnery Public Seaward, ABN Amro, Dresdner, and Barclays. Opening a corporate ledger in the UAE

In the event that you really want a financial balance for business reasons, you'll have to lay out an organization first and afterward open a record. UAE guidelines don't permit you to carry on with work through an individual record. By and large, your corporate record should be an ongoing record to work with a high volume of exchanges. The cycle requires two to about a month.

Expats on the lookout for business accounts require an extra arrangement of archives. While these fluctuate as per the bank and kind of organization, they could include:

Organization exchange permit

Testament of enrollment

Share testaments

Organization update and articles of affiliation

Board goal enabling an organization official to open the record

Identification and visa duplicates for investors and approved signatoriesBanking administrations in the UAE

Expat occupants in the UAE can profit of a scope of administrations from nearby and worldwide banks working inside the country. You can decide to go with your ongoing bank while purchasing these administrations or lay out a relationship with another bank.

Visas

Expats with a base month to month pay of AED 5,000 are qualified for a charge card. The people who don't meet this necessity then you can put down a store of AED 60,000 all things considered. The UAE's intense usage economy implies occupants have a wide decision of installment cards accessible, with advantages including air terminal parlor access, carrier air miles, feasting limits and that's only the tip of the iceberg.

Vehicle credits

Vehicle credits are effectively accessible in a nation where the vehicle you drive is in many cases thought about a sign of your status. All things considered, neighborhood guidelines just permit clients to apply for credits taking care of 80% of the expense of their vehicles. You'll have to pay the last 20% as a store. Thus, assuming you need that nosebleed Lamborghini, you'll in any case have to fork out a fair measure of money. The most extreme reimbursement time frame is 60 months or five years. Briefly hand vehicle, be that as it may, the most extreme reimbursement time frame is three years.

Individual credits

UAE occupants can take out a scope of individual credits. These might be a money advance on the rear of a Visa, or a more conventional bank move got on a visit to the branch. Try not to search for in excess of multiple times your month to month pay - guidelines don't permit it. The most extreme reimbursement time frame is four years or four years.

Worldwide cash moves in the UAE

With a wide cluster of worldwide banks in the UAE, expat occupants can frequently just exchange cash abroad by means of their cell phone. Numerous nearby banks have journalist associations with foundations in different nations, so contingent upon where you need to move your cash, it merits checking about these. Free exchanges to certain nations, like India, are viewed as the standard.

Nonetheless, there are elective cash move answers for banks that can now and again offer simpler and less expensive worldwide exchange choices. The accompanying suppliers offer a scope of worldwide cash move choices:

CurrencyFair offers cash moves to north of 150 nations and has trade rates up to multiple times less expensive than the banks, assisting you with staying away from unnecessary bank charges.

Moneycorp offers unfamiliar trade and worldwide installment administrations to individual and corporate clients in north of 120 monetary forms.

Astute is a worldwide cash move supplier accessible in 59 nations that offers moves between cross-line financial balances up to multiple times less expensive than customary banks.

You can likewise utilize Monito's web-based examination apparatus to save money on expenses, get the best trade rates, and find the least expensive choice for your global cash moves.

Dealing with your ledger in the UAE

Banks in the UAE take care of clients in a wide range of ways. You can pick how you deal with your cash and funds with Emirati banks, whether by means of counter administrations or from a distance.

Face to face: Albeit advanced and versatile banking is currently the standard, clients might in any case need to go to the branch for specific methodology. While banks are gradually moving to branchless banking, a few monetary organizations in the UAE have administration counters at noticeable shopping centers and different areas around the country to more readily arrive at their clients. Arrangements are normally not needed.

online banking: You can appreciate every minute of every day admittance to your record through web based banking. Computerized banking is a critical component of most current banks in the UAE. Most administrations and items, including credits, are likewise accessible on the web and a few banks currently have live internet based talk frameworks to manage issues.

Mobaile banking: Cell phone or versatile banking has taken off in the UAE. Large numbers of its well informed inhabitants presently really like to deal with their funds from one gadgets. Portable just banks offer every one of their administrations through an application; truth be told, they don't utilize actual branches by any means. You can deal with your assets, access administrations, and make a scope of installments all at the hint of a screen.

CONTACT US:

+971555394457

#UAE bank account open#uae bank account for non residents#.#uae bank account without minimum salary#emirates nbd#how to open bank account in uae online#how to open bank account in uae for non residents#can i open a bank account in dubai without emirates id#how to open a bank account in dubai online#minimum age to open bank account in uae

0 notes

Text

Understanding the Best Mortgage Options in Dubai

Buying a house is a huge financial choice that requires cautious thought and planning. In Dubai, the housing market has been thriving, and numerous individuals are looking to invest in properties. Notwithstanding, with the high property costs, the vast majority pick to get a mortgage to finance their buy. This article will investigate the best mortgage options in Dubai and guide you towards making an informed choice.

Fixed-Rate Mortgages

Fixed-rate mortgages are well known in Dubai, and they give borrowers a steady interest rate all through the credit term. This sort of mortgage is great for individuals who favor unsurprising installments and need to stay away from the gamble of fluctuating interest rates. Fixed-rate mortgages regularly have a higher interest rate contrasted with other sorts of mortgages, however they offer true serenity as borrowers can spending plan for their mortgage installments without worrying about future changes in interest rates.

Movable Rate Mortgages

Movable rate mortgages (ARMs) are another well known mortgage choice in Dubai. The interest rate on an ARM vacillates in light of the prevailing business sector rates. This sort of mortgage is great for borrowers who need lower initial regularly scheduled installments and are willing to face the challenge of future interest rate changes. ARMs ordinarily have a lower interest rate during the initial years, yet the interest rate might increase after the initial period closes.

Islamic Mortgages

Islamic mortgages, otherwise called Shariah-agreeable mortgages, depend on Islamic finance principles. In Dubai, Islamic mortgages are becoming increasingly well known as additional borrowers look for financing options that line up with their strict convictions. With Islamic mortgages, the bank doesn't charge interest, however instead, they purchase the property and offer it to the borrower at a greater cost, which is repaid in installments. This plan is called Murabaha and is a type of cost-in addition to financing.

Outsider Mortgages

Outsider mortgages are explicitly intended for non-occupants who need to purchase property in Dubai. These sorts of mortgages have higher interest rates and stricter necessities contrasted with mortgages for occupants. Outsider mortgages for the most part have a lower credit to-esteem proportion, and that implies that borrowers should have a higher initial installment. This is on the grounds that moneylenders consider unfamiliar purchasers as high-risk borrowers who might default on their credits. More info here best mortgage in dubai

UAE Nationals Mortgages

UAE nationals mortgages are planned explicitly for Emirati residents. These mortgages have lower interest rates and better terms contrasted with mortgages for non-nationals. UAE nationals are likewise qualified for government-sponsored mortgages, which deal significantly better terms. The public authority sponsored mortgages are intended to assist UAE nationals with buying their most memorable homes and are dependent upon certain qualification standards.

End

While considering a mortgage in Dubai, it's fundamental to comprehend the various options accessible and how they suit your necessities. The best mortgage choice for you will rely upon elements like your financial circumstance, risk resistance, and long haul objectives. Fixed-rate mortgages give solidness and consistency, while ARMs offer lower initial installments yet convey more gamble. Islamic mortgages are great for borrowers seeking Shariah-consistent financing, while outsider mortgages are intended for non-occupants who need to invest in Dubai's housing market. UAE nationals approach better mortgage terms, including government-sponsored mortgages. Understanding these options and working with a respectable loan specialist can assist you with making an informed choice and accomplish your fantasy about owning a home in Dubai.

1 note

·

View note

Text

Real Estate Market Insights

A Jump in the Mortgage Rates

Photo by Karolina Grabowska from Pexels

In February, the housing rebound lost some of its lustre due to higher mortgage rates.

According to the National Association of Realtors, pending house sales increased just 0.8% month over month after a significant increase in January. Sales were down 21.1% compared to February of the year prior. On contracts that have been executed during the month, anticipated sales are premised.

With points declining to 0.62 from 0.66 (including the origination fee) for loans with a down payment of twenty percent, the typical contractual rate of interest for 30-year fixed-interest mortgages with conforming loan balances ($726,200 or less) diminished to 6.45% from 6.48% last week. Within the same week a year prior, the inflation rate was 4.8%.

Despite home prices have dropped substantially since last summer, they continue to be high by historical measures. Due to the sharp increase in consumer demand in January, price reductions may have also halted. Given the continued

5 big questions in the real estate 2023 market

Photo by Oleksandr Pidvalnyi from Pexels

How will the ratio of work to home change?

For many workers, hybrid work is now an absolute necessity, therefore businesses must embrace it and promote productive work that can be done from either the office or at home.

Younger generations and hyper-hybrid workers, who work more than three days a week remotely, tend to be the least committed and have depart their careers or plan to do so at a far greater rate, according to recent JLL data.

What will happen to the economy and investments next?

An unstable investment environment has been created by record-high inflation and rising interest rates, and as the year progresses, there is a chance that the economy may continue to deteriorate.

However, it's important to note that any slowdown will probably be brief and shallow. There is growing evidence that inflation in the United States and possibly in all of Europe has peaked. It is possible that reference rates won't climb as high or quickly as previously anticipated because of ebbing inflation, which has also moderated expectations for central bank rate tightening.

Are businesses going to decarbonize their real estate?

Climate-related projects and goals cannot be furthered by talk alone. The message was clearly heard at COP27, as statistics from the UN showed that emissions from the built environment were at an all-time high.

Key actors will be expecting action and a systematic shift from the real estate sector this year, from shareholders to customers. However, creating a clear action plan and gathering and analysing data proved to be challenges for many businesses.

How should the innovative technology sector evolve?

When the pandemic was at its worst, the tech sector grew tremendously. However, in 2022 there were indications of slowing, and by the fourth quarter, layoffs had taken precedence over rapid expansion in the news.

But the news isn't all bad. According to JLL's Tech Office Trends Outlook, the startup situation in many U.S. markets is promising.

Tech clusters, like those in San Francisco, New England, and New York, are growing, according to industry analysts. Investors are betting on early-stage startups and focused on exits in four to five years rather than the following year as prices decline.

Can real estate benefit the community in any way?

ESG's influence on the real estate sector is expanding beyond sustainability. There is a rising understanding that the built environment can significantly influence society through initiatives to renovate public places, create necessary infrastructure like care facilities, or support environmental aims through green buildings.

Smart cities like Dubai, which has leveraged technological innovation to influence travel, tourism, energy, housing, and security, and Singapore, which employs street lampposts to monitor changes connected to environmental conditions, both provide some effective instances.

Source Links :https://www.cnbc.com/housing/

https://www.us.jll.com/trends-and-insights/

Disclaimer: This website's content is not meant to offer real estate, financial, or legal advice. Any links supplied are for the user's convenience and are solely offered for informational purposes. Before engaging in any real estate transaction, kindly obtain the advice of a legal, accounting, or real estate specialist.

Join our Slack Community for such eventful insights and much more

1 note

·

View note

Text

Pervez Musharraf Dragged His Country Down

The charismatic Pakistani general aimed to be a great national leader but failed by shredding the constitution and recklessly doing Washington’s bidding.

— February 5, 2023 | By Mosharraf Zaidi, a Senior Partner at Tabadlab, an Advisory Services Firm | Foreign Policy

Outgoing President Pervez Musharraf salutes as he leaves the presidential house in Islamabad, Pakistan, on Aug. 18, 2008. Emilio Morenatti/AP

Gen. Pervez Musharraf, Pakistan’s Former President, died at age 79 in Dubai on Sunday after a long illness, according to a statement by the Pakistani military.

Musharraf’s military colleagues in Pakistan often praised him as daring, forthright, and brave—yet the primary legacy he leaves behind will feature none of those adjectives. Pakistan’s 10th president since independence will be remembered instead as a divisive, constitution-shredding military dictator who set Pakistan back decades.

When Musharraf took charge after a military coup in October 1999, Pakistan was not dissimilar from its neighbors China and India—countries with large populations but little economic vitality at the time. China and India, however, soon enjoyed massive growth as their economies opened up to the world and investments poured in and exports flowed out. Pakistan grew too—but not because of any changes in how Musharraf managed the economy. Instead, infusions of cash from the United States to help finance the so-called global war on terrorism bolstered solid (though unspectacular) macroeconomic numbers.

By the end of Musharraf’s tenure in 2008, Pakistan was a regional economic laggard. The country took yet another massive loan from the International Monetary Fund just weeks after he resigned. More importantly, however, insurgencies and violent political crises had engulfed three of Pakistan’s four provinces.

Democratic-minded Pakistanis often blame the United States for bolstering the country’s military dictators, and for good reason. Throughout the three extended periods when generals have run Pakistan—the 1960s, the 1980s, and the 2000s—they did so with vital political and economic support from Washington. That is what helped shore up every military dictator Pakistan has ever had to endure.

But Musharraf’s assistance to U.S. President George W. Bush’s war efforts reached a whole new level and made him something of a celebrity in the United States. In 2006, he became the first foreign head of state to appear on The Daily Show With Jon Stewart. It was a somewhat awkward appearance. Asked how he balanced the wishes of the United States and Pakistan, Musharraf said, “I’ve had to learn the art of tightrope-walking many times, and I think I’ve become quite an expert of that.”

He got a few laughs. But there was nothing funny about the mess he was trying to hide back home as he sought to further secure his grip on power by marketing himself as the sole Pakistani counterterrorism partner whom Americans could count on.

Musharraf gestures during an address to Kashmiri refugees in Muzaffarabad, in Pakistani-administered Kashmir, on Feb. 5, 2001. Saeed Khan/AFP via Getty Images

Born in 1943 to a middle-class household that migrated to Pakistan from India just four years later, Musharraf benefited from being in a well-educated and socially prominent family. His father worked for the government and eventually became a diplomat posted to Ankara, Turkey, where Musharraf spent seven years learning Turkish and growing fond of Mustafa Kemal Ataturk, the founding father of a sovereign and secular Turkey. At age 18, Musharraf joined the Pakistan Military Academy, from which he graduated with a bachelor’s degree in 1964.

He saw his first combat in Pakistan’s 1965 war with India, and he was also involved in combat operations in the 1971 war that led to the breakup of Pakistan (and the founding of Bangladesh). Musharraf came to be seen as a star officer and became a member of the elite Special Services Group of commandos in the Pakistan Army. He later taught at the Command and Staff College in Quetta and in the War Wing of the National Defence College.

In 1998, Musharraf was appointed head of the armed forces, only to be fired in October 1999 when he was traveling abroad. The armed forces, never keen to obey even the most benign orders of elected civilian leaders, refused to carry out the decision. In scenes more fitting for a cheap thriller one might buy at an airport bookshop, the Army took control of Karachi’s airport, helped land Musharraf’s plane as he returned from his foreign trip, and conducted a coup. Musharraf then appointed himself the head of yet another military government.