#gst address change

Text

GST Registration में व्यवसाय का principal place कैसे बदलें - GST address change in GST registration certificate - Tax Guide

GST registration प्राप्त करने के बाद अगर उसमे कुछ परिवर्तन (amendment) करना है, तो किया जा सकता है, जैसे की address में change, बिसनेस के नाम में परिवर्तन, प्रमोटर या पार्टनर की जानकारी में परिवर्तन, GST में जब भी आप के बिज़नस की जानकारी में परिवर्तन होता है, तो उसकी जानकारी GST department को देना अनिवार्य होता है,

#gst#gst registration#gst address change#gst registration amendment#nilesh ujjainkar#taxguidenilesh#Tax guide nilesh

0 notes

Text

Private limited company registration

Legal Services is most important for success of any business. We are the best to provide services like private limited company registration that offering private limited company at minimum and affordable prices only with legal zone. Visit for more Information: https://legalzone.biz/service/private-limited-company

#GST registration#return filling#address change in legal documents#Rental agreement#Consult a lawyer#Talk to lawyer#Consult a CA/CS#consultation to CA#Talk to CA#sale deed#will deed#office rental agreement#document review#agreement and affidavits#gst registration tracking#Company Registration#Trademark#GST Services#Registration of Director#income tax return#EPF Registration#Consumer Complaint#Human Rights Complaint

3 notes

·

View notes

Text

‼️IMPORTANT ANNOUNCEMENT‼️

Hello everyone!

If you applied before April 20, 7AM GST, please read this post!

Based on feedback and a (positively) overwhelming amount of responses to the zine's application, we've made changes regarding the application process and the zine's general schedule.

Fret not! This is just some housekeeping.

✉️EMAIL IN THE APPLICATION FORM✉️

Our first Google form didn't require applicants to provide an email address. This was a mistake. We need your email in order to communicate results properly later on.

If you applied before April 20, 7AM GST please make sure to resubmit the form!

You can access the form here.

📅ZINE TIMELINE📅

Several people expressed concern regarding our rather tight schedule. As such, we decided to revise the timeline to give more time to our future contributors.

Hopefully, this will work better for everyone. Thank you so much for your feedback!

The application period was extended to make up for these last minute changes.

Additionally, we've been receiving a lot of applications and will need a bit more time to go through them all. We truly appreciate your warm response!

We're sorry for the inconvenience and the confusion. However, we need to make these changes now to ensure everything goes well for the rest of the project.

Thank you for your understanding. We'll do our best to learn from this moving forward!

7 notes

·

View notes

Text

How to Select the Right ERP Software for Your Indian Manufacturing Firm: Key Considerations

Introduction

In the dynamic landscape of the Indian manufacturing industry, the integration of an efficient Enterprise Resource Planning (ERP) system is paramount. Selecting the right ERP system for manufacturing industry can significantly impact a firm's operational efficiency, productivity, and overall competitiveness. This article delves into the crucial aspects of choosing the best ERP system tailored for the unique needs of Indian manufacturing firms.

Understanding the Unique Needs of the Indian Manufacturing Industry

1. Regulatory Compliance: Navigating the Complexities

One of the primary considerations for Indian manufacturers is ensuring compliance with local regulations. The selected ERP modules for manufacturing industry should seamlessly align with the Goods and Services Tax (GST) framework, a cornerstone of the Indian taxation system. It is imperative to choose a system that streamlines compliance with industry-specific regulations, safeguarding the manufacturing firm from legal complications.

2. Scalability: Growing with Your Business

As Indian manufacturing firms aspire for growth, scalability becomes a pivotal factor in ERP selection. Opt for a system that can effortlessly adapt to the evolving needs of your business. Scalability is particularly crucial for Indian manufacturers aiming for expansion in a market known for its dynamism and ever-changing demands.

3. Localization: Aligning with the Indian Operational Landscape

ERP software must be tailored to the nuances of the Indian market. Look for solutions offering localization features, including support for multiple languages, adherence to regional accounting standards, and culturally relevant interfaces. This ensures that the Best ERP for manufacturing industry seamlessly integrates into the operational fabric of your Indian manufacturing firm.

Key Features to Consider

1. Supply Chain Management: Navigating the Complex Web

Efficient supply chain management is integral for Indian manufacturers dealing with diverse suppliers and fluctuating market demands. The chosen ERP system should provide real-time visibility into the entire supply chain, encompassing procurement, production, and distribution. This ensures that your manufacturing firm can proactively respond to market changes and optimize resource allocation.

2. Production Planning and Control: Meeting the Complexities Head-On

The intricacies of manufacturing processes in India necessitate a comprehensive production planning and control module within the ERP system. Look for software that offers advanced features such as demand forecasting, capacity planning, and real-time monitoring of production processes. This empowers your manufacturing firm to enhance operational efficiency and meet customer demands with precision.

3. Quality Management: Upholding Excellence

Maintaining high-quality standards is non-negotiable for the success of any manufacturing firm. The ERP for manufacturing industry should include robust quality management modules that facilitate adherence to stringent quality control measures. This ensures that your products meet regulatory requirements and customer expectations, bolstering your reputation in the competitive Indian market.

Best ERP for the Indian Manufacturing Industry

1. Evaluating the Options

Selecting the best ERP for your Indian manufacturing firm involves a meticulous evaluation of available options. Consider industry-specific solutions renowned for their effectiveness in addressing the challenges prevalent in the Indian manufacturing landscape.

2. ERP Modules Specifically Tailored for Manufacturing

Explore ERP systems that offer modules explicitly designed for the manufacturing industry. These modules should cover essential aspects such as material requirements planning (MRP), shop floor control, and advanced planning and scheduling (APS). The seamless integration of these modules enhances operational visibility and control.

Customization and Integration: A Prerequisite for Success

1. Tailoring the ERP System to Your Needs

No two manufacturing firms are identical, and the chosen ERP system should accommodate this diversity. Look for software that allows customization to align with the unique processes and requirements of your Indian manufacturing firm. This ensures that the ERP system becomes an asset tailored to your specific needs rather than a one-size-fits-all solution.

2. Integration with Existing Systems

The ERP system should seamlessly integrate with existing software and systems within your manufacturing firm. This includes compatibility with Customer Relationship Management (CRM) software, Human Resource Management Systems (HRMS), and other relevant applications. A well-integrated ERP system for manufacturing industry streamlines data flow, minimizing redundancies and enhancing overall efficiency.

User-Friendly Interface and Training

Ensuring Adoption and Efficiency

An ERP system is only as effective as its adoption by the end-users. Prioritize user-friendly interfaces that facilitate easy navigation and understanding. Additionally, invest in comprehensive training programs to ensure that your team is proficient in utilizing the ERP system to its full potential. This approach maximizes the benefits derived from your ERP investment.

Cost Considerations: Balancing Investment and Returns

1. Calculating the Total Cost of Ownership (TCO)

While the initial cost of ERP implementation is a crucial consideration, it's equally essential to assess the Total Cost of Ownership (TCO) over the long term. Evaluate not only the upfront costs but also ongoing expenses related to maintenance, upgrades, and potential customization. This holistic approach ensures that the chosen ERP system aligns with your budgetary constraints without compromising on functionality.

2. Return on Investment (ROI): Ensuring Long-Term Value

Consider ERP implementation as a strategic investment rather than a mere expense. Calculate the anticipated Return on Investment (ROI) based on enhanced operational efficiency, reduced lead times, and improved customer satisfaction. A thorough ROI analysis ensures that the chosen ERP system delivers long-term value and contributes to the overall success of your Indian manufacturing firm.

Vendor Reputation and Support

1. Choosing a Reliable Partner

Selecting an ERP vendor with a proven track record in the manufacturing industry is crucial. Research and assess the reputation of potential vendors, considering factors such as the number of successful implementations, customer reviews, and the vendor's financial stability. A reliable vendor ensures ongoing support and updates, safeguarding your investment and providing peace of mind.

2. Support and Training Services

Evaluate the support and training services offered by the Best ERP for manufacturing industry. Responsive customer support and comprehensive training programs contribute to a smooth implementation process and ongoing success. Prioritize vendors that prioritize customer satisfaction and offer tailored support to address the unique needs of your Indian manufacturing firm.

Conclusion

In conclusion, choosing the right ERP software for manufacturing industry requires a strategic approach that considers the unique challenges and opportunities in the dynamic Indian market. By prioritizing regulatory compliance, scalability, localization, and key features such as supply chain management, production planning, and quality control, you can identify an ERP solution that aligns seamlessly with the needs of your manufacturing operations. Additionally, evaluating customization options, integration capabilities, user-friendliness, cost considerations, and the reputation of ERP software providers ensures a well-informed decision that propels your Indian manufacturing firm toward enhanced efficiency, productivity, and long-term success.

#ERP for manufacturing industry#ERP system for manufacturing industry#ERP software for manufacturing industry#Best ERP for manufacturing industry#ERP modules for manufacturing industry#India#Gujarat#Vadodara#STERP#shantitechnology

7 notes

·

View notes

Text

Virtual office in Delhi

With a virtual office you can access the services and address of a professional business center without having to physically sit outside that property. Virtual office drastically saves costs because you don't have to own the property and with a low monthly subscription you can take advantage of the services of postal address, GST registration address or company registration address. Further more professional receptionist services can be used, such as answering calls or simply transferring calls, or booking meeting rooms and meeting rooms on an hourly basis.

Since the 19-Covid pandemic occurred, our lives have changed completely. By changing the way we travel, we dress the way we work, nothing is the same. The pandemic has pushed the economy into recession and many businesses have been hit by the recession. Although we are on track to economic recovery, we still have a long way to go before things are back to normal on the right track.

Most companies have moved to a working from home model, where employees have the flexibility to work from home without having to come to the office. This is where virtual offices have an advantage over traditional office locations.

So, in these uncertain times, virtual office becoming more popular day by day. Virtual office concept is not only a way to run your business efficiently, but also the perfect balance between traditional office space and working from home, even in current pandemic. This is a step towards keeping employees safe and healthy. Virtual offices are regularly sanitised and cleaned and there is a strict adherence to social distance standards.

#virtual office address in delhi#virtual office for rental#best virtual office in delhi#virtual office for gst registration

2 notes

·

View notes

Text

Complete F&Q All e-Invoicing Software

Q-1: What is e-Invoicing?

Answer: Electronic invoicing or e-invoicing is an invoicing process that allows other software to access invoices generated by software, eliminating the need for re-entry of data or errors. In less difficult words, it is an invoice created in a standard format, whereby the electronic information of the invoice can be shared with other people, which guarantees the compatibility of the information.

Q-2: What is the electronic invoicing process?

Answer: There aren't many changes; Companies can continue to generate their invoices from their existing software. To ensure a certain level of standardization, only one standard format is used, the e-invoicing schema. These systematic invoices are prepared by the taxpayer. When creating the invoices, you must report them to the GST Invoice Registration Portal (IRP). The portal then generates a unique invoice reference number and adds the digital signature along with the QR code to the e-invoice. The QR code contains all the information required for the electronic invoice. After this process, the electronic invoice is sent back to the taxpayer via the portal. IRP will also send a copy of the signed invoice to the seller's registered email address.

Q-3: Will the electronic invoice format be the same for all categories?

Answer: All companies/taxpayers that must pay GST must issue electronic invoices using the same scheme established by GSTN. The format has required and non-required fields. All taxpayers must complete the required fields and non-required fields are used as required.

Q-4: Is e-invoicing mandatory?

Answer: Electronic invoicing is mandatory for all companies with an annual turnover of Rs. Rs. 100 crores or more from 1st January 2021. Previously it applied to companies with a turnover above the limit of Rs. 500 million crores.

However, e-invoicing does not apply to the categories listed below, regardless of commercial invoicing, as per CBIC Notice No. 13/2020- Central Rate:

. An insurance company or a banking company or financial institution, including an NBFC

. A Freight Transport Company (GTA)

. A registered person offering passenger transportation services.

. A registered person who provides services by way of admission to the exhibition of motion pictures in multiplex services

. One SEZ unit (excluded by CBIC Report No. 61/2020 – Central Tax)

Q-5: What are the advantages of electronic invoicing?

Answer: These are some of the benefits of electronic invoicing:

. Report B2B invoices once during generation, reducing reporting in multiple formats.

. Most of the data on the GSTR-1 form can be kept ready to send while using the electronic billing system.

. E-Way invoices can also be easily created with electronic invoice data.

. There is a minimal data reconciliation between the books and the GST returns submitted.

. Real-time tracking of invoices generated by a supplier can be enabled, along with faster availability of input tax credits. It will also reduce input tax

credit verification problems.

. Better management and automation of the tax declaration process.

. Reduced fraud as tax authorities also has real-time access to data.

. Elimination of false GST invoices that are generated.

Q-6: What deliveries are currently covered by e-invoicing?

Answer: Electronic invoicing currently applies to:

. Deliveries to registrants (i.e. B2B deliveries),

. Deliveries to ZEE (with/without payment of taxes),

. Exports (with/without payment of taxes) and

exports considered,

made by the Class of Notified Taxpayers.

Q-7: How will the e-invoicing model work?

Answer: Under the e-invoicing model, companies will continue to issue invoices in their respective ERPs, as has been the case in the past. Only the standard, schema, and format for creating invoices are specified to ensure a certain level of standardization and machine-readability of these invoices. The preparation of the invoice is the responsibility of the taxpayer.

As it is generated, it must be reported to the GST Invoice Registration Portal (IRP). The IRP generates a unique invoice reference number (IRN) and adds the digital signature for the e-invoice along with the QR code. The QR code contains important parameters of the electronic invoice and sends it back to the taxpayer who created the document. The IRP also sends the signed e-invoice to the seller to the registered email id.

Q-8: What types of fields are there in an electronic invoice?

Answer: The data of the fields marked as "required" must be entered.

. A required field that has no value can be reported as null.

. Fields marked as "Optional" may or may not be filled out. They are only relevant to certain companies and only relate to certain scenarios.

. Some sections of the electronic invoice marked as "Optional" may contain mandatory fields.

For example, the E-Way Billing Details section is marked as Optional.

However, in this section, the Transport Type field is required.

Q-9: Does the e-invoice need to be signed again by the supplier?

Answer: The provisions of Rule 46 of the Central Goods and Services (CGST) Rules, 2017 apply here. According to Rule 46, the signature/digital signature of the supplier or his authorized representative is required while issuing invoices. However, a proviso to Rule 46 states that the signature/digital signature shall not be required in the case of issuance of an electronic invoice that is by the provisions of the InformationTechnology Act, 2000. Hence, it has been interpreted that in the case of e-invoices, a supplier will not be required to sign/digitally sign the document.

Q-10: What are the options for receiving electronic invoices registered in the IRP?

Answer: Several ways to record electronic invoices are provided in the Invoice Registration Portal (IRP). Some of the suggested modes are-

. Web-based,

. API based,

. Based on offline tools and

. based on GSP.

Q-11: What is the final threshold for e-invoicing?

Answer: In a bid to step up measures against tax evasion, the government announced last week that GST e-invoicing will be mandatory for companies with a turnover of more than Rs 10 crore from October 1, down from the current Rs 20 crore, which will bring in another 0.36 million businesses in digital reporting.

2 notes

·

View notes

Text

Navigating the Maze: A Complete Roadmap for Import-Export Registration in Bangalore

Introduction:

Embarking on the journey of Import export registration can be a lucrative venture, but it’s not without its challenges. One of the foremost tasks is navigating the intricate process of registration. Understanding the regulatory landscape and following the right steps is crucial for smooth operations. In this comprehensive guide, we’ll walk you through the complete roadmap for import-export registration in Bangalore, empowering you to kickstart your business with confidence.

Understanding Import-Export Registration:

Before delving into the specifics, it’s essential to grasp the significance of import-export registration. In Bangalore, like in any other city in India, this process involves obtaining various licenses and permits from relevant authorities to legally conduct international trade activities. Compliance with these regulations not only ensures legality but also establishes credibility in the global market.

Key Steps in Import-Export Registration:

1. Acquiring Importer Exporter Code (IEC):

The Importer Exporter Code (IEC) is a mandatory prerequisite for engaging in import-export activities. To obtain an IEC, applicants must submit the required documents, including PAN card, identity proof, and address proof, to the Directorate General of Foreign Trade (DGFT).

2. Registering with GST:

Goods and Services Tax (GST) registration is compulsory for businesses involved in the supply of goods or services, including import-export. Once you have acquired your IEC, registering for GST with the GST Network (GSTN) is the next step. This registration facilitates seamless tax compliance and enables you to claim input tax credits.

3. Choosing the Appropriate Customs Port:

Selecting the customs port through which you’ll be importing or exporting goods is crucial. Bangalore offers several customs ports, including the Kempegowda International Airport, Inland Container Depot (ICD) Whitefield, and Bengaluru Air Cargo Complex. Each port has its own procedures and regulations, so make sure to choose one that best suits your business needs.

4. Filing Custom Documents:

Once you’ve selected the customs port, you’ll need to prepare and file the necessary customs documents for clearance of goods. These documents include the Bill of Entry for imports and the Shipping Bill for exports. Working closely with a customs clearing agent can streamline this process and ensure compliance with customs regulations.

5. Obtaining Additional Licenses and Permits:

Depending on the nature of your import-export business, you may require additional licenses and permits from regulatory authorities such as the Food Safety and Standards Authority of India (FSSAI), Plant Quarantine Authority, and Drug Controller General of India (DCGI). Conduct thorough research to identify any specific requirements applicable to your industry.

6. Complying with Foreign Trade Policy:

Bangalore import-export businesses must adhere to the regulations outlined in the Foreign Trade Policy (FTP) issued by the DGFT. Familiarize yourself with the latest FTP provisions, including export promotion schemes and import restrictions, to optimize your trade operations and leverage available benefits.

7. Ensuring Compliance with Legal Standards:

Maintaining compliance with legal standards and regulations is non-negotiable in the import-export business. Stay updated on changes in import-export laws, tariffs, and trade agreements to avoid potential penalties and disruptions to your operations.

Conclusion:

Navigating the maze of Import export registration in Bangalore requires diligence, attention to detail, and a thorough understanding of regulatory requirements. By following this complete roadmap, you can navigate the complexities with confidence and establish a solid foundation for your import-export business. Remember, compliance is not just a legal obligation but also a strategic advantage in the competitive global market landscape.

0 notes

Text

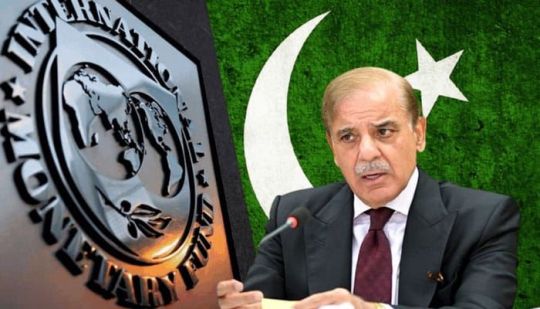

🔴BREAKING NEWS: There is hope for Pakistan!

It might get a new loan from the IMF soon!!

🤔 What happened?

▪ Pakistan had recently completed a short-term $3 billion loan program with the International Monetary Fund (IMF), which was crucial in helping the country avoid a sovereign debt default. This program provided Pakistan with much-needed financial stability and averted a potential economic crisis by ensuring that the country could meet its debt obligations.

▪ After the successful completion of the initial loan program, Pakistan immediately opened discussions with the IMF to secure a new, larger loan facility. This move was aimed at further strengthening the country’s financial position and addressing ongoing economic challenges. The larger loan facility would provide Pakistan with additional resources to support economic reforms and stabilize its economy.

▪ Now, the IMF has announced that significant progress has been made towards reaching a staff-level agreement between the lender and Pakistan. This agreement is an important step in the process of securing the new loan facility, indicating that both parties are aligned on the key terms and conditions. The staff-level agreement will pave the way for formal approval and disbursement of funds, which will further aid Pakistan in its economic recovery efforts.

🧐 Why?

▪ Pakistan is reportedly seeking a fresh loan of $6-8 billion to stimulate economic growth and support its financial stability. The additional funds are intended to boost the country's economic development, address fiscal imbalances, and provide a cushion against external economic shocks.

▪ However, obtaining this loan may prove challenging as the IMF has mandated stringent policy reforms as a condition for the funding. These reforms are aimed at ensuring long-term economic stability and sustainability, but they come with significant demands on the Pakistani government and economy.

▪ Pakistan has been asked to implement measures to raise revenues, which likely means higher taxes. The IMF has emphasized the need for Pakistan to increase its tax base and enhance tax collection efforts. Additionally, the country has been instructed to trim expenditures, which involves cutting down on government spending and reducing fiscal deficits. The IMF is also pushing for structural reforms to improve the efficiency and effectiveness of Pakistan's economic policies and institutions.

▪ Some of the controversial demands from the IMF include increasing the General Sales Tax (GST) rate to 18%, which would raise the cost of goods and services for consumers. Another contentious requirement is the imposition of taxes on monthly pensions above PKR 100,000, which could affect retirees and those on fixed incomes.

▪ Furthermore, the IMF insists that all these reform and policy actions receive parliamentary approval. This means that the Pakistani government must secure the backing of its legislative body for the proposed changes, ensuring that there is broad political support and legitimacy for the reforms. This step is crucial for the successful implementation and sustainability of the agreed measures.

😲Interestingly:

▪ 40% of Pakistani citizens are now in poverty.

▪ Yet, Pak PM Shehbaz Sharif and his team have assured the IMF mission that they would implement all its conditions!

❓Pakistan has already received 23 bailout programs from the IMF and several loans from other countries! Can it survive without begging for money??

Follow Jobaaj Stories (the media arm of Jobaaj.com Group for more)

0 notes

Text

Which is the Top-Rated GST Registration Consultancy in Delhi?

When it comes to navigating the complex landscape of GST registration in Delhi, EfilingCompany stands out as the top-rated service provider. With a reputation built on trust, efficiency, and customer satisfaction, they offer seamless GST registration services that cater to businesses of all sizes. Here’s why EfilingCompany is your go-to partner for GST registration in Delhi and a comprehensive guide on what you need to know.

Why Choose EfilingCompany for GST Registration?

1. Expertise and Experience

EfilingCompany boasts a team of seasoned professionals who are well-versed in the intricacies of GST laws and regulations. Their expertise ensures that your GST registration process is smooth, accurate, and compliant with the latest legal requirements.

2. Hassle-Free Process

The GST registration process can be daunting, but EfilingCompany simplifies it with a user-friendly approach. From document preparation to submission and follow-up, every step is handled with precision, minimizing the hassle for you.

3. Transparent Pricing

No hidden costs or surprise fees—EfilingCompany believes in transparent pricing. You get quality service at competitive rates, making it a cost-effective choice for businesses.

4. Timely Service

Time is crucial for businesses, and EfilingCompany understands that. Their prompt service ensures that your GST registration is completed within the stipulated time, allowing you to focus on your core business activities.

5. Comprehensive Support

EfilingCompany offers ongoing support even after the GST registration is complete. Whether you need help with filing returns, understanding compliance requirements, or any other GST-related queries, their support team is always ready to assist.

Steps to Register for GST with EfilingCompany

Contact EfilingCompany: Reach out to their team via phone, email, or their website to initiate the process.

Document Submission: Provide the necessary documents such as PAN card, Aadhaar card, business address proof, and bank account details.

Application Preparation: EfilingCompany’s experts will prepare your GST registration application, ensuring all details are accurate.

Application Submission: Your application will be submitted to the GST portal for processing.

GSTIN Issuance: Once approved, you will receive your GST Identification Number (GSTIN).

FAQs About GST Registration

Q1: Who needs to register for GST?

Any business with an annual turnover exceeding Rs. 20 lakhs (Rs. 10 lakhs for special category states) is required to register for GST. Additionally, certain businesses, such as those involved in inter-state supply, e-commerce, and casual taxable persons, must register regardless of turnover.

Q2: What documents are required for GST registration?

The primary documents required include:

PAN card of the business and its owner(s)

Aadhaar card of the owner(s)

Proof of business address (e.g., utility bill, rent agreement)

Bank account details (cancelled cheque or bank statement)

Digital signature (for companies and LLPs)

Q3: How long does the GST registration process take?

The registration process typically takes 2-6 working days, provided all documents are in order and there are no discrepancies.

Q4: Can I make changes to my GST registration details?

Yes, changes to GST registration details can be made by filing an amendment application through the GST portal. EfilingCompany can assist you with this process as well.

Q5: What are the benefits of registering for GST?

Registering for GST allows businesses to legally collect tax, claim input tax credits, expand their market reach, and improve their compliance rating. It also enhances the credibility of your business.

Conclusion

EfilingCompany is committed to making GST registration in Delhi a hassle-free experience. With their expert team, transparent pricing, and comprehensive support, you can be assured of a smooth and efficient registration process. Whether you're a small business or a large enterprise, EfilingCompany is your trusted partner for all GST-related services.

Contact EfilingCompany today to start your GST registration process and ensure compliance with the latest tax regulations. Your business deserves the best, and EfilingCompany is here to deliver just that.

0 notes

Text

Legal Compliance and Tax Benefits Associated with Udyog Aadhar Registration

When it comes to the business ecosystem of India, Small and Medium Enterprises play a crucial role in driving economic growth. However, it can be a daunting task for you to navigate through tax regulations and legal frameworks.

Fortunately, with the advent of initiatives such as Udyog Aadhar Registration, you can expect a ray of hope to shine upon you. So, it's time to talk about how Udyog Aadhar Registration can ensure legal compliance and offer tax benefits to your business.

What is Udyog Aadhar?

A government initiative, namely Udyog Aadhar Registration was introduced to simplify the registration process for enterprises like medium, small, and micro. Generally, it comes with a unique identity that facilitates the ease of doing business. It can streamline a range of processes and avail benefits offered by the government schemes.

Legal Compliance of Udyog Aadhar Registration

1) Eligibility for Government Schemes

With Udyog Aadhar Registration, you can expect doors to get opened for various government benefits and schemes designed mainly for MSMEs. Such kinds of schemes cover technology support, marketing, finance, and credit. Thus, it can foster your growth.

2) Statutory Recognition

There is an Act namely, Micro, Small, and Medium Enterprises Development Act, 2006 through which you can gain statutory recognition. It ensures that your enterprise operates within the legal framework defined for MSMEs.

3) Compliance with Regulatory Authorities

Such kind of registration aids in fulfilling compliance requirements with regulatory authorities like the GST department. As a result, smooth business operations can be enabled without the fear of legal repercussions.

Tax Benefits of Udyog Aadhar Registration

1) Reduced Custom Duty

If you're registered MSMEs, you can avail of several benefits, like reduced customs duty on imported goods for your business purposes. It can be translated into cost savings and boost your enterprise's competitiveness in the market.

2) Income Tax Exemption

Now, your enterprise is eligible for income tax exemption under the act, namely the Income Tax Act, of 1961. Such exemption comes with much-needed relief to small businesses, which lets them reinvest their earnings for expansion and growth.

3) GST Benefits

Udyog Aadhar Registration can simplify your GST compliance as it will provide you with certain concessions and exemptions. With this, your tax burden can be reduced, and administrative hassle linked with tax filings can be minimized.

Steps to Obtain Udyog Aadhar Registration

Step 1: Online Registration

It is a simple process to obtain your Udyog Aadhar Registration. Even you can register online, as the Ministry of Micro, Small, and Medium Enterprises has provided the official portal for it. However, there is a need to provide basic details related to your business, like business name, type of enterprise, Aadhar number, and address.

Step 2: Document Submission

Along with your online application, you'll be required to submit certain documents like business address proof, PAN card, and Aadhar card for your verification purposes. When you're done with the document verification, your registration certificate will be issued electronically.

Step 3: Validity and Renewal

In the case of Udyog Aadhar Registration, there is no such scene of an expiry date. As it remains valid unless your enterprise exceeds the specified turnover or investment limits. However, it would be better to update your registration in case of any changes made in business details. Thus, it will ensure uninterrupted benefits for you.

Conclusion

In India, Udyog Aadhar Registration acts as a catalyst for your growth and sustainability as it

ensures legal compliance and comes with attractive tax benefits. Thus, you can embrace this initiative to thrive in a competitive environment and contribute to the economic development of our nation.

0 notes

Text

India is not regarded as a lone bright spot in the world economy for nothing, rhymes with reason

With a forecasted growth rate of 9.5% in 2021–22, India is one of the main economies that is expanding the quickest in the globe. When you consider the financial impact the COVID-19 pandemic has had on economies all over the world, this growth rate is considerable. In this blog, we'll look at India's reputation as a worldwide economic ray of hope as well as the difficulties it has maintaining growth.

India's vast and expanding population, which offers a sizable workforce and a customer base, is one of the main factors contributing to the country's economic success. India currently has a population of approximately 1.3 billion people, and the World Bank predicts that the number will increase to 1.5 billion by 2030. Its big population has helped the country's manufacturing and services industries, which have been important growth drivers for the economy, expand.

The government's emphasis on economic reforms, notably the adoption of the Goods and Services Tax (GST) and the Insolvency and Bankruptcy Act, is another factor boosting India's economic growth (IBC). These changes have improved the economic climate and increased foreign investment in the nation. In the most recent fiscal year, India received about $81 billion in FDI, according to the Ministry of Commerce and Industry.

Another element that supports India's economic development is the country's thriving startup ecosystem. With more than 50,000 firms across diverse industries, India has become the third-largest startup ecosystem in the world. Startup India, Digital India, and Atmanirbhar Bharat are just a few of the government-sponsored programs that have helped the nation's startup ecosystem expand.

Yet, India also faces a number of issues that endanger its ability to prosper economically. The COVID-19 epidemic, which has had a major effect on the Indian economy, is one of the main difficulties. The economy shrank by 7.7% in the fiscal year 2020–2021 as a result of the epidemic, and the recovery has been gradual.

India also has to deal with a high rate of unemployment, particularly among young people. The Centre for Monitoring Indian Economy estimates that in August 2021, the unemployment rate in India was 8.8%. The National Career Service and Skill India are two government-sponsored programs that aim to give young people access to work possibilities and skill development in order to address this issue.

A large section of the people in India is employed in the agricultural sector, which is confronting its own set of difficulties. Low productivity, shoddy infrastructure, and insufficient access to capital and technology are all problems for this industry. To address these issues and encourage the expansion of the agricultural sector, the government has introduced a number of initiatives, including the Pradhan Mantri Fasal Bima Yojana and the Pradhan Mantri Krishi Sinchai Yojana.

In conclusion, the big population, economic reforms, and a thriving startup ecosystem all contribute to India's economic growth. The COVID-19 pandemic, a high unemployment rate, and issues in the agricultural sector are just a few of the challenges the nation is currently facing. Government, business, and society as a whole must work together to address these issues and maintain the nation's economic prosperity. India's economy continues to be a bright spot in the global economy despite these difficulties, with a lot of room for expansion and improvement.

Fox&Angel is an open strategy consulting eco-system, put together by a top-line core team of industry experts, studded with illustrious success stories, learnings, and growth. Committed to curate bespoke business & strategy solutions for each of your challenges, we literally handpick consultants from across the globe and industries who fit the role best and help you on your path to success.

This post was originally published on: Foxnangel

#Business expansion#business growth#FDI in India#Foreign Direct Investment#FoxNAngel#Grow with India#Growing economy#India market entry#Indian growing economy#Indian market#Invest in India

0 notes

Text

#legalzone#Legal Zone#Legal Zone India#GST registration#return filling#address change in legal documents#Rental agreement#Consult a lawyer#Talk to lawyer#Consult a CA/CS#consultation to CA#Talk to CA#sale deed#will deed#office rental agreement#document review#agreement and affidavits#gst registration tracking#Company Registration#Trademark#GST Services#Registration of Director#income tax return#EPF Registration#Consumer Complaint#Human Rights Complaint#Private Limited Company Registration Online#Limited Liability Partnership registration#LLP Registration In India#One Person Company registration

1 note

·

View note

Text

How GST Compliance Solutions Can Make Your Life Easier

Tired of drowning in a sea of paperwork and struggling to keep up with the ever-changing tax laws? If so, you are not alone. Many business owners are surprised by the complexities of Goods and Services Tax (GST) compliance. Fortunately, there is a solution: a GST compliance solutions. In this comprehensive guide, we explore how these solutions can streamline your workflow and make your life easier.

To understand GST compliance

Before delving into the benefits of GST compliance solutions, let us first understand what GST compliance entails. GST is a tax on most goods and services consumed in a country. GST was introduced in India to replace the cumbersome system of multiple indirect taxes with the aim of simplifying the tax system and removing loopholes

There are various duties related to GST compliance, e.g.

i]. GST returns: Companies must file regular GST returns, detailing their sales and purchases during a particular period.

ii]. Record Keeping: Detailed accounting of invoices, purchases and expenses must be maintained to ensure accurate tax reporting.

iii].Tax rate compliance: GST is levied in different taxes on different goods and services, thus requiring careful classification and calculation.

GST compliance challenges

While GST aims to simplify taxes, compliance can be difficult for businesses, especially small and medium enterprises (SMEs). Some common complications are:

i]. Complex Laws: The GST laws are complex and change frequently, making compliance a complex task.

ii]. Manual processes: Many businesses still rely on manual processes to comply with GST, leading to errors and inefficiencies.

iii]. Resource availability: SMEs often lack the dedicated resources or expertise to effectively manage GST compliance.

How GST compliance solutions can help

Now, let’s explore how GST compliance solutions can address these challenges and transform your business operations:

1. Automatic compliance

GST compliance solutions use automation to simplify routine tasks such as data entry, invoice generation and return submission. By automating these processes, companies can reduce the margin of error and ensure timely compliance.

2. Real-time updates

The leading GST compliance solution provides real-time updates on changes in tax laws, ensuring businesses stay informed and compliant. This approach minimizes the risk of compliance penalties and avoids last-minute scrambling to update policies.

3. Integration of materials

Integrating GST compliance solutions with existing accounting or ERP systems simplifies data exchange and provides seamless operations. Companies can eliminate manual data entry and achieve greater tax reporting accuracy.

4. Options available

Each business has unique tax requirements and business plans. GST compliance solutions provide flexible mechanisms to suit specific business requirements, ensuring compliance without disrupting existing systems.

5. Expert assistance

Many GST compliance solutions offer expert support and guidance, helping businesses navigate complex tax issues and resolve compliance issues effectively. This support eases the burden on the contents and creates peace.

Conclusion

GST compliance solutions give life to businesses struggling with tax compliance challenges. By automating processes, providing real-time updates, and integrating existing systems, customization processes and expert support on this solution simplifies GST compliance and makes life easier for business owners Adopting a GST compliance solution is not just about compliance It’s about unlocking functionality, minimizing errors, and delivering you're focused on what's really important—growing your business. So why struggle with GST compliance when you can simplify your operations and reclaim your time with the right solution? Look for GST compliance solutions today and experience the difference for yourself.

0 notes

Text

Streamline Your Business with a GST Registration Consultant in HSR Layout

Navigating the complexities of Goods and Services Tax (GST) can be a daunting task for businesses, especially for those who are new to the system. Ensuring compliance with GST regulations is crucial to avoid penalties and to benefit from the seamless flow of tax credits. This is where the expertise of a GST registration consultant HSR Layout becomes invaluable. For businesses in Bangalore, Kros Chek stands out as a trusted partner in this domain.

Why You Need a GST Registration Consultant in HSR Layout

GST registration is mandatory for businesses whose turnover exceeds a specific threshold. The process involves multiple steps, including document submission, verification, and adherence to various compliance requirements. A GST registration consultant in HSR Layout, such as Kros Chek, provides professional assistance to ensure that your business is registered correctly and promptly.

Kros Chek: Your Trusted GST Consultant

Kros Chek Bangalore is a reputed consultancy firm that specializes in GST services. Their team of experts is well-versed in the latest GST regulations and offers comprehensive support for businesses. Whether you are looking for GST filing consultants HSR layout or need assistance with registration, Kros Chek provides tailored solutions to meet your needs.

Services Offered by Kros Chek

1. GST Registration

Kros Chek offers end-to-end GST registration services, ensuring that all necessary documents are submitted and verified without errors. Their experts guide you through the entire process, making it hassle-free and efficient.

2. GST Return Filing

Regular filing of GST returns is crucial to maintain compliance and avoid penalties. Kros Chek’s GST return filing consultants near me ensure that your returns are filed accurately and on time. They manage the entire process, from data collection to submission, allowing you to focus on your core business activities.

3. Consultation and Advisory

The consultants at Kros Chek provide valuable insights and advice on GST-related matters. They help you understand the implications of GST on your business and guide you on best practices to optimize your tax liabilities.

4. Compliance and Audit Support

Staying compliant with GST regulations requires continuous monitoring and timely updates. Kros Chek offers ongoing support to ensure that your business remains compliant. They also provide audit support to help you prepare for and manage GST audits effectively.

Benefits of Choosing Kros Chek Bangalore

Expertise and Experience

With years of experience and in-depth knowledge of GST laws, Kros Chek Bangalore is equipped to handle all your GST needs efficiently. Their team stays updated with the latest regulatory changes to provide accurate and relevant advice.

Customized Solutions

Every business is unique, and Kros Chek understands this. They offer customized solutions tailored to your specific business requirements, ensuring that you get the best possible service.

Time and Cost Efficiency

By outsourcing your GST registration and filing needs to Kros Chek, you save valuable time and resources. Their streamlined processes and expert handling reduce the risk of errors and delays, ensuring timely compliance.

Personalized Support

Kros Chek provides personalized support to its clients, ensuring that all your queries and concerns are addressed promptly. Their dedicated consultants work closely with you to ensure a smooth and hassle-free experience.

Conclusion

For businesses in Bangalore, particularly in HSR Layout, finding a reliable GST registration consultant is crucial for smooth operations and compliance. Kros Chek Bangalore stands out as a leading consultancy firm, offering a wide range of GST services, including registration, return filing, and advisory. Their expertise, personalized approach, and commitment to client satisfaction make them the preferred choice for businesses looking to navigate the complexities of GST. If you are searching for GST Registration consultants hsr layout bangalore, look no further than Kros Chek to ensure your business’s success and compliance.

More information:

https://www.kros-chek.com/contact-us

365 Shared Space, 2nd Floor,#153, Sector 5,

1st Block Koramangala, HSR Layout,

Bengaluru, Karnataka 560102

#companytaxfilingservicesbangalore#GSTregistrationconsultantHSRLayout#GSTfilingconsultantsHSRlayout#GSTRegistrationconsultantshsrlayoutbangalore#gstreturnfilingconsultantsnearme

0 notes

Text

GST RECONCILIATION & ANNUAL RETURN

GST ANNUAL RETURN FILING

GSTR- 9C

GSTR- 9C is the Reconciliation Statement to be Submitted by those GST Registered Taxpayer whose aggregate Turnover is more than Rs. 5 crore.

GSTR- 9

GSTR- 9 is the Annual Return to be Submitted by every GST Registered Taxpayer. It is Compulsory to file GSTR- 9 whose aggregate Turnover is more than Rs. 2 crore.

Streamline Your Business with Professional GST Reconciliation Services with M.M. Vora & Associates, Chartered Accountants

Introduction: In the dynamic and ever-changing business landscape, complying with Goods and Services Tax (GST) regulations can be a challenging task for any organization. To ensure accuracy, transparency, and adherence to legal requirements, it is crucial to undertake regular GST Reconciliation. At M.M. Vora & Associates, Chartered Accountants, we bring you a team of experienced Chartered Accountants specializing in GST Reconciliation, offering comprehensive solutions to help your business thrive.

Section 1: The Importance of GST Reconciliation

Ensuring Compliance: In today’s regulatory environment, businesses must meticulously adhere to GST laws. A GST Reconciliation serves as a systematic examination of financial records, ensuring that your business is fully compliant with all relevant regulations.

Our skilled professionals at M.M Vora & Associates possess in-depth knowledge of GST laws and policies, enabling them to identify potential risks and rectify any non-compliance issues promptly.

Mitigating Risks: Non-compliance with GST regulations can result in severe penalties and legal consequences. Our GST reconciliation services provide a thorough review of your business operations, enabling us to identify areas of potential risk.

By addressing these risks proactively, we help safeguard your business from legal disputes, financial losses, and reputational damage.

Section 2: Our Comprehensive GST Reconciliation Services

Methodical Data Analysis: At M.M Vora & Associates, our team employs advanced analytical tools and techniques to perform a detailed analysis of your financial data. By examining sales, purchases, input tax credits, and other relevant records, we ensure the accuracy of your GST returns and uncover any discrepancies or anomalies that may require attention.

Compliance Verification: Our Chartered Accountants at M.M Vora & Associates meticulously review your tax returns, invoices, and other supporting documents to validate their compliance with GST regulations. We conduct a comprehensive examination of your transactions, ensuring that all necessary disclosures, classifications, and rates are correct and in line with statutory requirements.

Internal Controls Assessment: To enhance the effectiveness and efficiency of your GST compliance framework, we assess your internal control systems at M.M Vora & Associates. Our experts evaluate the robustness of your processes, identifying potential control gaps or weaknesses. By implementing appropriate control measures, we help you minimize errors, fraud, and other operational risks.

Section 3: Benefits of Choosing M.M Vora & Associates for Your GST Reconciliation Needs

Expertise and Experience: With a decade of experience in the industry, our team of Chartered Accountants at M.M Vora & Associates possesses extensive knowledge of GST regulations and reconciliation procedures. We stay updated with the latest changes and ensure that your business remains fully compliant.

Tailored Solutions: We understand that each business is unique, with its own set of challenges. Our professionals at M.M Vora & Associates work closely with you to develop customized reconciliation strategies that align with your specific needs and industry requirements.

Our goal is to provide practical solutions that optimize your GST compliance and minimize disruption to your operations.

Timely and Reliable Service: At M.M Vora & Associates, we value your time and business commitments. We prioritize the timely delivery of our services, ensuring that your GST reconciliation are completed efficiently and within the prescribed timelines.

You can rely on our team to provide accurate and reliable insights that enable you to make informed business decisions.

Contact us today to discuss how we can assist you in streamlining your GST

To know more: https://www.caassociates.in/services/gst-audits/

0 notes

Text

Title: Meeting the Requirements of a Private Limited Company: A Comprehensive Guide

Establishing a private limited company entails fulfilling specific requirements mandated by the governing authorities. These requirements ensure compliance with legal standards and create a structured framework for the company's operations. In this guide, we'll delve into the essential requirements of a private limited company, covering aspects such as formation, governance, and ongoing compliance. #privatelimited #company

Formation Requirements

Forming a private limited company involves several steps and prerequisites to ensure its legal existence and operations. Here are the key requirements: #privatelimited #company

1. Memorandum of Association (MOA) and Articles of Association (AOA)

The Memorandum of Association outlines the company's objectives, powers, and scope of activities. It serves as the company's constitution and must be filed with the Registrar of Companies (ROC) during the incorporation process. The Articles of Association, on the other hand, define the rules and regulations for the internal management and administration of the company. #privatelimited #company

2. Minimum Capital Requirement

While many jurisdictions no longer mandate a minimum authorized capital for private limited companies, some may still require a nominal amount to be specified in the MOA. This capital represents the initial investment in the company and is often symbolic. #privatelimited #company

3. Registered Office Address

A private limited company must have a registered office address within the jurisdiction where it is incorporated. This address serves as the official correspondence address for the company and must be specified in the incorporation documents filed with the ROC.

Governance Requirements

Once formed, a private limited company must adhere to certain governance requirements to ensure proper administration and compliance. Here are the key governance requirements:

1. Appointment of Directors

A private limited company must have at least one director, who may also be a shareholder. Directors are responsible for the management and decision-making of the company. The appointment and removal of directors must comply with the company's Articles of Association and relevant legal regulations. #privatelimited #company

2. Shareholder Meetings

Private limited companies are required to hold annual general meetings (AGMs) to discuss matters such as financial statements, dividend declarations, and appointment of auditors. Additionally, extraordinary general meetings (EGMs) may be convened as needed to address specific issues requiring shareholder approval. #privatelimited #company

3. Maintenance of Statutory Registers and Records

Private limited companies must maintain various statutory registers and records as required by law. These include registers of members, directors, and charges, as well as minutes of shareholder and board meetings. Compliance with record-keeping requirements is essential to demonstrate transparency and accountability. #privatelimited #company

Ongoing Compliance Requirements

In addition to the formation and governance requirements, private limited companies must fulfill ongoing compliance obligations to maintain their legal status and good standing. Here are some key compliance requirements:

1. Annual Filings

Private limited companies are required to file annual returns with the ROC, providing details such as financial statements, shareholding structure, and changes in directorship. Failure to file annual returns within the stipulated timeframe may result in penalties and consequences for the company and its officers. #privatelimited #company

2. Tax Compliance

Private limited companies must comply with various tax obligations, including filing tax returns, payment of corporate taxes, and compliance with goods and services tax (GST) regulations where applicable. Engaging qualified tax professionals or consultants can help ensure accurate and timely tax compliance. #privatelimited #company

3. Regulatory Compliance

Private limited companies must adhere to relevant regulatory requirements applicable to their industry or sector. This may include obtaining licenses, permits, or approvals from regulatory authorities and complying with specific regulations governing their operations.

Conclusion

Meeting the requirements of a private limited company is essential for ensuring legal compliance, effective governance, and ongoing operations. From formation prerequisites to governance and compliance obligations, private limited companies must adhere to a range of statutory requirements to maintain their legal status and credibility. By understanding and fulfilling these requirements, private limited companies can establish a solid foundation for growth and success in the business world. #privatelimited #company

1 note

·

View note