#private limited company registration process

Photo

(via Benefits of Converting Proprietorship into Private Limited Registration)

#private limited company registration#pvt ltd company registration#private limited company registration in india#pvt ltd company registration online#pvt ltd registration#private limited company registration process#Private Limited Registration#register pvt ltd company online

0 notes

Text

Private Limited Company Registration Process in India

Simplifying Business Setup: Private Limited Company Registration in India

Setting up a private limited company is a popular choice for entrepreneurs in India due to its numerous benefits, including limited liability, separate legal entities, and access to funding. The process of registering a private limited company in India has been streamlined in recent years, making it easier for start-ups and small businesses to establish themselves.

The first step in a private limited company registration in India is to obtain a Director Identification Number (DIN) and Digital Signature Certificate (DSC) for the proposed directors. Next, the company name must be approved by the Ministry of Corporate Affairs (MCA). Once the name is approved, the Memorandum of Association (MOA) and Articles of Association (AOA) must be drafted and filed with the MCA.

After the MOA and AOA are filed, the company incorporation documents, along with the application for incorporation, must be submitted to the MCA. Once the documents are verified and approved, the company will be issued a Certificate of Incorporation, and it can start its operations.

One of the main advantages of registering a private limited company in India is limited liability protection. This means that the shareholders' liability is limited to the amount of capital they have invested in the company, protecting their personal assets from business debts and liabilities.

Additionally, a private limited company enjoys better access to funding and can easily attract investors and raise capital through the issuance of shares. This makes it an ideal choice for start-ups and businesses looking to expand and grow.

In conclusion, private limited company registration in India offers several benefits, including limited liability protection, separate legal entity status, and access to funding. With the streamlined registration process, entrepreneurs can quickly and easily set up their businesses and focus on achieving their goals.

#private limited company registration process in india#private limited company#Private Limited Company Registration Process#Private Limited Company Registration

0 notes

Text

Title: Meeting the Requirements of a Private Limited Company: A Comprehensive Guide

Establishing a private limited company entails fulfilling specific requirements mandated by the governing authorities. These requirements ensure compliance with legal standards and create a structured framework for the company's operations. In this guide, we'll delve into the essential requirements of a private limited company, covering aspects such as formation, governance, and ongoing compliance. #privatelimited #company

Formation Requirements

Forming a private limited company involves several steps and prerequisites to ensure its legal existence and operations. Here are the key requirements: #privatelimited #company

1. Memorandum of Association (MOA) and Articles of Association (AOA)

The Memorandum of Association outlines the company's objectives, powers, and scope of activities. It serves as the company's constitution and must be filed with the Registrar of Companies (ROC) during the incorporation process. The Articles of Association, on the other hand, define the rules and regulations for the internal management and administration of the company. #privatelimited #company

2. Minimum Capital Requirement

While many jurisdictions no longer mandate a minimum authorized capital for private limited companies, some may still require a nominal amount to be specified in the MOA. This capital represents the initial investment in the company and is often symbolic. #privatelimited #company

3. Registered Office Address

A private limited company must have a registered office address within the jurisdiction where it is incorporated. This address serves as the official correspondence address for the company and must be specified in the incorporation documents filed with the ROC.

Governance Requirements

Once formed, a private limited company must adhere to certain governance requirements to ensure proper administration and compliance. Here are the key governance requirements:

1. Appointment of Directors

A private limited company must have at least one director, who may also be a shareholder. Directors are responsible for the management and decision-making of the company. The appointment and removal of directors must comply with the company's Articles of Association and relevant legal regulations. #privatelimited #company

2. Shareholder Meetings

Private limited companies are required to hold annual general meetings (AGMs) to discuss matters such as financial statements, dividend declarations, and appointment of auditors. Additionally, extraordinary general meetings (EGMs) may be convened as needed to address specific issues requiring shareholder approval. #privatelimited #company

3. Maintenance of Statutory Registers and Records

Private limited companies must maintain various statutory registers and records as required by law. These include registers of members, directors, and charges, as well as minutes of shareholder and board meetings. Compliance with record-keeping requirements is essential to demonstrate transparency and accountability. #privatelimited #company

Ongoing Compliance Requirements

In addition to the formation and governance requirements, private limited companies must fulfill ongoing compliance obligations to maintain their legal status and good standing. Here are some key compliance requirements:

1. Annual Filings

Private limited companies are required to file annual returns with the ROC, providing details such as financial statements, shareholding structure, and changes in directorship. Failure to file annual returns within the stipulated timeframe may result in penalties and consequences for the company and its officers. #privatelimited #company

2. Tax Compliance

Private limited companies must comply with various tax obligations, including filing tax returns, payment of corporate taxes, and compliance with goods and services tax (GST) regulations where applicable. Engaging qualified tax professionals or consultants can help ensure accurate and timely tax compliance. #privatelimited #company

3. Regulatory Compliance

Private limited companies must adhere to relevant regulatory requirements applicable to their industry or sector. This may include obtaining licenses, permits, or approvals from regulatory authorities and complying with specific regulations governing their operations.

Conclusion

Meeting the requirements of a private limited company is essential for ensuring legal compliance, effective governance, and ongoing operations. From formation prerequisites to governance and compliance obligations, private limited companies must adhere to a range of statutory requirements to maintain their legal status and credibility. By understanding and fulfilling these requirements, private limited companies can establish a solid foundation for growth and success in the business world. #privatelimited #company

1 note

·

View note

Text

Private Limited Company Registration in Delhi, India

Demystifying the Private Limited Company Registration Process

Embarking on the journey of entrepreneurship often begins with the crucial step of company registration. Among the various business structures available, the private limited company stands out for its distinct advantages in terms of limited liability, separate legal identity, and scalability. Understanding the registration process is essential for aspiring business owners looking to establish a private limited company. Let's demystify the steps involved:

Name Reservation:

The first step in registering a private limited company in India is selecting a unique name that complies with regulatory guidelines. The name should not infringe upon existing trademarks and must adhere to specified naming conventions. Once chosen, the name can be reserved through the online portal of the Registrar of Companies (ROC).

Obtaining Digital Signatures:

Digital signatures are required for filing various documents during the registration process. Directors and subscribers of the company must obtain Digital Signature Certificates (DSC) from authorized agencies to digitally sign the incorporation documents.

Preparation of Documents:

Several documents are necessary for private limited company registration in India, including the Memorandum of Association (MOA) and Articles of Association (AOA), consent and declarations from directors, and address proofs. These documents need to be prepared and notarized before submission.

Filing Application with ROC:

Once the necessary documents are in order, the application for company registration can be filed with the ROC. The application includes details such as the company's registered office address, share capital, and director information. Upon verification, the ROC issues the Certificate of Incorporation, marking the formal establishment of the company.

Obtaining PAN and TAN:

Following incorporation, the company must apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the respective authorities. These identifiers are essential for tax compliance and financial transactions.

Compliance with Statutory Requirements:

Post-registration, the company must fulfill various statutory requirements, including maintaining books of accounts, conducting board meetings, and filing annual returns with the ROC. Compliance ensures adherence to regulatory norms and sustains the company's legal standing.

Navigating the private limited company registration process demands meticulous planning, adherence to regulatory guidelines, and a clear understanding of legal obligations. By following these steps diligently, aspiring entrepreneurs can establish a robust foundation for their business endeavors and embark on the path to success.

For More Information >> Click Here

#Private Limited Company Registration in Delhi#private limited company registration process#private limited company registration in India

0 notes

Text

#private limited company registration#private limited company registration in india#private limited company registration process#Private Limited Company certification#pvt ltd company registration online

0 notes

Photo

Get Hassle free Private Limited Company Registration online in India Companies next help in registering and setting up Business

Know more: https://bit.ly/3QirUVU

#Private limited company registration#private limited company registration process#how to register private limited company

0 notes

Text

Simplifying Business Registration in Kolkata: A Comprehensive Guide.

Navigating the maze of business registrations can be daunting, especially in a bustling city like Kolkata. From private limited companies to trademark registrations, here’s everything you need to know to establish your business successfully.

Starting a business in Kolkata or anywhere else requires navigating a series of legal procedures and registrations. Each step is crucial and contributes to the legitimacy and protection of your venture. In Kolkata, a city known for its entrepreneurial spirit, understanding the nuances of various business registrations is essential for smooth operations. Let's delve into the intricacies of different registrations you might need for your business in Kolkata.

Private Limited Company Registration: Registering your business as a private limited company offers several benefits, including limited liability protection and access to funding. In Kolkata, the process involves obtaining a Digital Signature Certificate (DSC), Director Identification Number (DIN), and filing the necessary documents with the Registrar of Companies (ROC). This registration is suitable for medium to large-scale businesses aiming for growth and expansion.

Business Registration: Kolkata offers various options for registering your business, including sole proprietorship, partnership, and limited liability partnership (LLP). Each structure has its own set of advantages and legal requirements. Sole proprietorship is the simplest form, while LLP combines the benefits of a partnership with limited liability protection. Understanding your business's needs and choosing the appropriate structure is crucial for long-term success.

Trademark Registration: Protecting your brand identity is paramount in today's competitive market. Trademark registration ensures exclusive rights to use your brand name, logo, or slogan, preventing others from using similar marks. In Kolkata, the process involves conducting a trademark search, filing an application with the Trademark Registry, and regular monitoring to safeguard your intellectual property.

LLP Registration: Limited Liability Partnership (LLP) is a popular choice for small to medium-sized businesses in Kolkata. It offers the flexibility of a partnership combined with limited liability protection for partners. The registration process includes obtaining a Digital Signature Certificate (DSC), Director Identification Number (DIN), and filing the incorporation documents with the Ministry of Corporate Affairs (MCA).

Nidhi Company Registration: Nidhi companies are non-banking financial institutions that facilitate mutual benefit among members. In Kolkata, registering a Nidhi company involves adhering to the strict regulations set by the Ministry of Corporate Affairs (MCA). The process includes drafting the memorandum and articles of association, obtaining approvals, and complying with ongoing compliance requirements.

Section 8 Company Registration: Section 8 companies, also known as not-for-profit organizations, are formed for promoting charitable activities, social welfare, or other nonprofit objectives. In Kolkata, registering a Section 8 company requires approval from the Central Government and adherence to specific regulations outlined in the Companies Act. This registration is ideal for entities focusing on social impact rather than profit generation.

Startup India Registration: Startup India initiative aims to foster innovation and entrepreneurship by providing various benefits and incentives to startups. Registering your startup under this scheme can unlock access to funding, tax exemptions, and other support services. In Kolkata, startups can register online through the Startup India portal by fulfilling the eligibility criteria and submitting the required documents.

Navigating the landscape of business registrations in Kolkata can be overwhelming, but with the right knowledge and guidance, it becomes more manageable. Whether you're establishing a private limited company, protecting your brand through trademark registration, or registering as a startup under the Startup India initiative, each step is crucial for the success and sustainability of your business. By understanding the requirements and adhering to the legal procedures, you can lay a strong foundation for your venture in the vibrant business ecosystem of Kolkata.

#Private limited company registration Kolkata#Pvt Ltd company registration Kolkata#Business registration Kolkata#Company registration Kolkata#Trade Mark Registration Kolkata#LLP Registration in Kolkata#LLP Company Registration in Kolkata#LLP Registration#Nidhi Registration Kolkata#Nidhi Company Registration in Kolkata#Section 8 Company Registration in Kolkata#Startup India Registration Kolkata#Startup Registration Process Kolkata#Sujata Associates

0 notes

Text

#company registration#online company registration process#caonweb#caservicesonline#private limited company registration

0 notes

Text

Pvt ltd registration online process | 100% success result

register your company as a private limited company by reaching goodwill enterprise. The best registration company in Chennai with positive results

#Online Private Limited Company Registration in Tamilnadu#Private Limited Company Registration in Tamilnadu#Private Limited Company Registration certificate#private Limited Company registration certificate#company Registration process

0 notes

Text

Unlock Your Company’s Status: Checking Pvt Ltd Registration with MCA

It can be difficult to navigate the complexities of corporate registrations. however, it is crucial for the legal compliance and business credibility to make sure that your Pvt Ltd Company has been registered with MCA i.e. Ministry of Corporate Affairs properly. Here in this article you will the steps involved in the verification of your Pvt Ltd Registration with MCA.

Steps to Check the Pvt Ltd Registration with MCA

Visit the MCA Website: First of all, you have to visit the official website of MCA i.e. Ministry of Corporate Affairs and then navigate the “MCA Services” tab that has been given in menu bar.

Select ‘View Company/ LLP Master Data: After that you have to click on the option of “View Company/ LLP Master Data” given in the dropdown menu. It will redirect you to the database of all the registered companies and LLPs.

Enter Company Details: Then you have to enter the CIN i.e. Corporate Identification Number of the company. If you don’t know the CIN of your company, you can also search via company’s name. You have to make sure that you enter the exact spelling of the name, so that you can get the accurate results.

Verify Captcha Code: After that, you have to enter the captcha code that has been displayed on the screen. It will make sure that the search is conducted by a human user.

Submit & Verify: At last, after entering all the required information, you have to click on the “Submit” button. The registration details of your company have been appeared on the screen. Here you can verify the status of your private limited registration.

Conclusion

You can verify the your Pvt Ltd Registration easily with the MCA by following the above mentioned simple steps. It will not just make sure about the compliance but also shows the legitimacy of your business to the stakeholders and potential clients. If you check your registration status at regular interval, it will save you from legal hassles and build a transparent business environment.

#private limited company registration#pvt ltd company registration#private limited company registration in india#pvt ltd company registration online#pvt ltd registration#private limited company registration process#Private Limited Registration#register pvt ltd company online

0 notes

Text

Private Limited Company Registration Process in India

A Step-by-Step Guide to Private Limited Company Registration Process.

Starting a private limited company is an exciting step towards turning your business idea into a reality. However, navigating the registration process can seem daunting. Don't worry; we've got you covered! Here's a simplified guide to help you through the private limited company registration process.

Choose a Name: Select a unique name for your company and ensure it complies with the naming guidelines set by the Registrar of Companies (ROC).

Obtain Digital Signature Certificate (DSC): Get a DSC for the proposed directors of the company. It's necessary for digitally signing the incorporation documents.

Apply for Director Identification Number (DIN): Each director must apply for a DIN. This can be done online by filling out Form DIR-3.

File for Name Approval: Submit Form INC-1 to the ROC to check the availability of the proposed company name.

Draft and File Incorporation Documents: Prepare the Memorandum of Association (MOA) and Articles of Association (AOA). Then, file forms SPICe (INC-32), SPICe MoA (INC-33), and SPICe AoA (INC-34) with the ROC.

Obtain Certificate of Incorporation: Once the ROC verifies the documents, they will issue a Certificate of Incorporation.

Apply for PAN and TAN: After receiving the Certificate of Incorporation, apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for your company.

Open a Bank Account: Finally, open a bank account in the name of your company.

Congratulations, your private limited company is now registered! Remember to comply with all the regulatory requirements to ensure smooth operations and legal compliance. Happy entrepreneuring!

#Private Limited Company#Private Limited Company Registration Process in India#Private Limited Company Registration Process

1 note

·

View note

Text

How do you create your own Private Limited company?

Creating a Private Limited company in India involves several steps. Here's a general outline:

Choose a Name: Select a unique name for your company. Ensure that the name complies with the rules laid down by the Ministry of Corporate Affairs (MCA). You can check the availability of the name on the MCA website.

Director Identification Number (DIN): Obtain DIN for all the proposed directors of the company. DIN can be obtained by filing Form DIR-3 with the MCA.

Digital Signature Certificate (DSC): Obtain DSC for the proposed directors. DSC is required for digitally signing the documents during the registration process.

Memorandum of Association (MOA) and Articles of Association (AOA): Draft MOA and AOA for your company. These documents define the constitution and the rules of the company. These documents need to be filed with the Registrar of Companies (ROC).

Registration with Registrar of Companies (ROC): File the incorporation documents along with the required fee with the ROC. This includes the MOA, AOA, and other necessary documents like Form SPICe (Simplified Proforma for Incorporating Company Electronically).

Payment of Stamp Duty: Pay the necessary stamp duty for the incorporation of the company. The amount of stamp duty varies from state to state.

Certificate of Incorporation: Once all the documents are verified and approved, the ROC issues a Certificate of Incorporation. This is the legal proof of the existence of your company.

PAN and TAN: Apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for your company. These are required for tax purposes.

Registration for GST: If your turnover exceeds the threshold limit, you need to register for Goods and Services Tax (GST) as per the GST Act.

Bank Account: Open a bank account in the name of your company.

Compliance: Ensure compliance with other regulatory requirements like professional tax, employee provident fund (EPF), employee state insurance (ESI), etc.

How Vakilkaro helps in Private Limited Company Registration in Lucknow

Vakilkaro facilitates Private Limited Company Registration in Lucknow by providing expert legal guidance and assistance throughout the process. From drafting documents to liaising with authorities, their comprehensive services ensure a smooth and compliant registration experience, empowering businesses to establish themselves securely and efficiently in the market.

#private limited company registration#company registration#private limited company#pvt ltd company registration#private limited company registration in chennai#company registration in chennai#private limited company registration process#company registration in india#business registration#pvt limited company registration india#public limited company registration process#company registration in tamil#how to register private limited company in india

0 notes

Text

Private Limited Company

What is a Private Limited Company?

In accordance with section 2(68) of the Companies Act, 2013 private company means a company having a minimum paid-up share capital as may be prescribed, and which by its articles:-

(a) put restriction to the right to transfer its shares;

(b) except in the case of OPC, which limits the number of its members to 200.

However, where 2 or more persons hold one or…

View On WordPress

#a private limited company#private company#private company registration#private limited#private limited company#private ltd#private sector companies#privately held company#pvt company#pvt company limited by guarantee#pvt limited#pvt limited company registration#pvt limited registration#pvt ltd company registration process#unlisted company

0 notes

Text

Private Limited Company Registration Process

A Step-by-Step Guide to Private Limited Company Registration Process in Delhi

Starting a business as a private limited company registration in Delhi offers numerous advantages, including limited liability protection, access to funding, and credibility in the eyes of customers and suppliers. However, the process of registering a private limited company in India involves several steps and legal requirements. In this guide, we'll walk you through the step-by-step process of private limited company registration to help you navigate this important milestone with ease.

Step 1: Obtain Digital Signature Certificate (DSC)

The first step in the private limited company registration process in India is to obtain Digital Signature Certificates (DSC) for the proposed directors of the company. A DSC is required for filing online forms and documents with the Ministry of Corporate Affairs (MCA). Directors can obtain their DSCs from certified agencies authorized by the government.

Step 2: Obtain Director Identification Number (DIN)

Next, the proposed directors must apply for Director Identification Numbers (DIN) from the MCA. DIN is a unique identification number allotted to individuals who wish to become directors of a company. The application for DIN can be filed online through the MCA portal by providing the necessary documents and information.

Step 3: Name Reservation

Before registering a private limited company in Delhi, it is essential to ensure that the proposed name is available and complies with the naming guidelines specified by the MCA. The name should be unique, not identical to existing companies, and should not infringe on any registered trademarks. Once a suitable name is selected, an application for name reservation can be filed online through the MCA portal.

Step 4: Preparation of Incorporation Documents

Once the name is reserved, the next step is to prepare the incorporation documents, including the Memorandum of Association (MOA) and Articles of Association (AOA). These documents outline the company's objectives, rules, and regulations governing its internal affairs. The MOA and AOA must be drafted carefully and signed by the promoters in the presence of witnesses.

Step 5: Filing of Incorporation Application

After preparing the incorporation documents, the promoters can file an application for company incorporation with the Registrar of Companies (ROC). The application should include the necessary forms, along with the MOA, AOA, and other required documents. Once the ROC verifies the application and documents, the company will be registered, and a Certificate of Incorporation will be issued.

Step 6: PAN and TAN Application

Following private limited company registration in Delhi, the next step is to apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department. PAN is required for tax purposes, while TAN is necessary for deducting and remitting taxes on behalf of the company's employees.

Step 7: Compliance Requirements

After the company is registered, it must comply with various statutory requirements, including conducting board meetings, maintaining statutory registers, filing annual returns, and complying with tax obligations. Non-compliance can lead to penalties and legal consequences, so it is essential to stay updated on the regulatory requirements.

Conclusion:

Private limited company registration in Delhi is a significant milestone for entrepreneurs embarking on their business journey. By following the step-by-step process outlined in this guide and seeking professional guidance when needed, entrepreneurs can ensure a smooth and compliant registration process for their private limited company in india.

For more information >> Click Here

#private limited company registration in Delhi#private limited company registration in India#private limited company registration process in Delhi#private limited company registration process

1 note

·

View note

Text

Get Hassle-free Private Limited Company Registration online in India Companies next help in registering and setting up Business

#Private limited company registration#private limited company process#private limited company formation in india#company registration in india

1 note

·

View note

Text

Midhope Castle Distillery plans and more

Where do I start....

Perhaps where I left off last September when I discovered the trademark filing for 'Lallybroch Spirits' in combination with the registration of Latha Ur in January last year, a company owned by Sam and Alex.

Speculations about considering a Distillery perhaps on the grounds of Hopetoun Estate, of which Midhope Castle (better known as Lallybroch by OL fans) is part. Plans for a distillery at the side were made before and even approved, but the company Midhope Castle Distillery limited, not owned by Sam or GGC, dissolved in August 2023. Shortly before the new trademark Lallybroch Spirits was filed in September.

I have questions... were my last words on that post

Well... I might have found answers, maybe not all so far but.... dare I say a huge pile of it!

After last nights pictures of Sam and Alex visiting Midhope Castle, (pictures that are (curiously) now gone from some IG accounts!!🤫) speculations started again about a Distillery and what was he holding there in those pics

Nope not the socks!

I went to sleep, and didn't really look further until today and my jaw dropped a few inches when in a few clicks I stumbled upon 53 (!) documents. Yes, fifty-three!. Filed starting February 2024 up to 5 April 2024. So very recent and hot from the press.

Plans, proposals, drawings, reports, comments.... all of it. What he is holding there are drawings and plans from an architectural firm. I'm still processing all the documents as there are a lot and some contain over 90 pages. But from what I already saw i can say these plans and proposals are huge, when I say huge I mean HUGE.

Anyway, I don't think I will be able to show and tell you all I found in one post. But I will try to put some main points in this post so you have an idea.

But before I do, I like to stress that people hoping Sam buying 'Lallybroch', that is out of the question. As said before, Midhope is part of the Hopetoun Estate and privately owned by the Earl of Hopetoun and part of a charitable trust. Read more about that here

And the million dollar question you all might have is, is Sam involved? Well.... I can say there is a document with a comment from Mr Sam Heughan as a member of the public... so not an applicant but well read on!

There is some history involved, so much we already knew. Plans for a distillery on Hopetoun grounds including Midhope Castle were already filed and granted in April 2021

These plans are now revised and filed again on 8 February 2024, awaiting a decision

note: I blurred reference and planning numbers

There are some minor changes to the original plans which were already approved in 2021

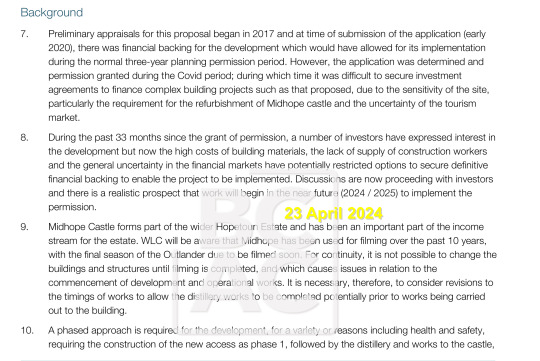

Background for the application is included in the document

Interesting in these inclusions are the notices of the original plans being already granted in 2021 but since then met difficulties securing investment statements due to a number of reasons.

"Discussions are now proceeding with investors and there is a realistic prospect that work will begin in the near future (2024/2025) to implement the permission"

So, as said, he can not buy Midhope or anything, but I think he (they) will be investors. As he also left a comment:

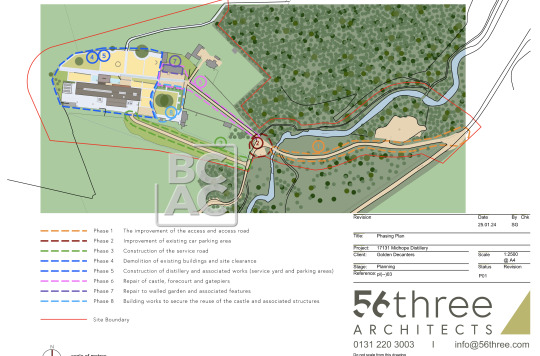

There are plans proposed for a distillery, service yard and parking areas, Repair of castle, forecourt and gatepiers, Repair to walled garden and associated features, Building works to secure the reuse of the castle and associated structures, all in phases.

Here are some of the screenshots (and probably the drawings he was holding in the pics while visiting Midhope)

Phasing Plan

Side and Distillery

Sections

There is much much more, but for now I leave you with this information.

99 notes

·

View notes