#fractional cfo

Text

Fractional CFOs: Key Players In Strategic Decision-Making

In the dynamic landscape of modern business, strategic decision-making is the compass guiding companies toward success. At the heart of this process lies the Fractional Chief Financial Officer (CFO), a strategic ally adept at navigating the financial intricacies of organizations. Fractional CFOs bring a wealth of expertise and experience to the table, making them indispensable partners in steering businesses toward their goals.

Understanding Fractional CFOs

Fractional CFOs are seasoned financial professionals who provide part-time or interim CFO services to companies on an as-needed basis. Unlike full-time CFOs, who are permanent employees, fractional CFOs offer flexible arrangements, allowing businesses to access high-level financial expertise without the commitment of a full-time salary. This model enables companies to tap into specialized skills precisely when required, making fractional CFOs a cost-effective solution for businesses of all sizes.

Strategic Decision-Making Powerhouses

Fractional CFOs are not just number crunchers; they are strategic thinkers who play a pivotal role in shaping the future trajectory of a business. Armed with a deep understanding of financial data and market dynamics, they collaborate closely with executive teams to formulate and execute strategic initiatives. Whether it’s assessing investment opportunities, optimizing capital structure, or navigating financial risks, fractional CFOs provide invaluable insights that inform critical decisions.

Tailored Financial Solutions

One size does not fit all in the realm of finance, and fractional CFOs understand this implicitly. They tailor their services to meet the specific needs and goals of each client, whether it’s streamlining financial operations, implementing cost-saving measures, or driving growth strategies. By customizing their approach, fractional CFOs ensure that businesses receive personalized financial solutions designed to maximize efficiency and profitability.

Bridge Between Vision and Execution

In today’s fast-paced business environment, translating vision into action requires a keen understanding of both strategic objectives and financial realities. Fractional CFOs serve as the bridge between vision and execution, aligning financial strategies with broader business goals. Their ability to communicate complex financial concepts in clear, actionable terms empowers decision-makers at all levels to drive progress and achieve results.

Agile Problem-Solvers

In the face of uncertainty and volatility, agility is key to success. Fractional CFOs excel in navigating complex financial challenges with agility and precision. Whether it’s adapting to market fluctuations, responding to regulatory changes, or mitigating financial risks, they possess the agility to pivot strategies swiftly and capitalize on emerging opportunities. Their proactive approach to problem-solving ensures that businesses remain resilient and adaptable in an ever-changing landscape.

Maximizing Financial Performance

At the core of their mandate, fractional CFOs are committed to maximizing financial performance and optimizing shareholder value. By leveraging their expertise in financial analysis, forecasting, and strategic planning, they help businesses unlock untapped potential and drive sustainable growth. Whether it’s optimizing cash flow, improving profitability, or enhancing financial efficiency, fractional CFOs play a crucial role in enhancing the bottom line.

The Future of Finance

As businesses evolve and adapt to the demands of the digital age, the role of the CFO is undergoing a transformation. Fractional CFOs represent the future of finance, offering scalable, on-demand expertise that aligns with the agile needs of modern businesses. By harnessing their strategic insights and financial acumen, companies can navigate uncertainty with confidence and chart a course toward long-term success.

0 notes

Text

The Fractional CFO must participate in the development of the overall business strategy

Companies unfamiliar with the role of the Chief Financial Officer (CFO), a common occurrence among early stage startups and small businesses, often confuse this role with that of an Accountant or even a Bookkeeper. The CFO is a strategic, forward-looking senior executive, the Accountant is a tactical operator.

In previous articles, we have argued that early stage startups and small businesses will be better served by a Fractional rather than a full-time CFO. In any event, the participation of the Fractional or Full-time CFO, in the development of the overall business strategy is imperative. We present several reasons below:

Strategic Financial Planning: The Fractional CFO ensures that the company’s financial strategy aligns with its overall business objectives. They can forecast future financial trends, prepare the organization for potential economic shifts, and advise on sustainable growth strategies, making them an integral part of strategic planning.

Resource Optimization: By being involved in strategy development, the Fractional CFO can provide insights on how to optimize the use of financial resources. This includes capital allocation, investment strategies, and cost management, all of which are crucial for achieving strategic goals.

Risk Assessment and Management: The Fractional CFO’s expertise in financial risk assessment allows them to identify potential financial risks associated with strategic choices. Their involvement ensures that risk management is an integral part of the strategic planning process, safeguarding the company’s assets and future.

Performance Metrics: The Fractional CFO can establish financial and operational metrics that align with the company’s strategic goals. These metrics help in monitoring the execution of the strategy and in making necessary adjustments to stay on track.

Stakeholder Confidence: The Fractional CFO’s involvement in strategy development helps in communicating a cohesive vision to shareholders, investors, and financial institutions. This transparency builds confidence in the company’s direction and can facilitate easier access to capital when needed.

Cross-functional Collaboration: The Fractional CFO often serves as a bridge between various departments, ensuring that financial considerations are integrated into all aspects of strategic planning. This cross-functional collaboration is vital for the holistic execution of the strategy.

Value Creation: Through strategic financial leadership, the Fractional CFO can identify opportunities for value creation within the company. This includes exploring new markets, investment opportunities, and revenue streams that align with the company’s strategic vision.

Adaptability and Agility: In today��s fast-paced business environment, the Fractional CFO’s forward-looking financial insights can help the company remain adaptable. By being involved in strategic planning, the CFO ensures that the company is financially prepared to pivot as market conditions change.

In essence, the Fractional or Full-time CFO’s role transcends traditional financial management, becoming a cornerstone in strategic decision-making. Their unique perspective ensures that financial health, risk management, and value creation are central to the company’s strategic vision, enabling sustainable growth and long-term success.

To explore if you are ready for a Fractional CFO or would like additional information about this role and its benefits, please contact us

CFO_2.1 To read related articles go to our Blog

#Fractional CFO#outsourced cfo#part-time cfo#consulting cfo#business plan#business#business strategy

0 notes

Text

Enhance Financial Efficiency With The Fractional CFO Services

https://nexagy.com/our-services/ - Elevate your financial strategy with Nexagy's Fractional CFO services. Gain access to seasoned financial expertise without the overhead costs. Optimize budgets, streamline operations, and drive growth with tailored solutions designed to propel your business forward. For more details, visit nexagy.com.

0 notes

Text

LF Consulting Inc

Our team of experts take a strategic approach to account management that goes beyond analytics and numbers. Our team of experienced professionals can take on any accounting or reporting challenge you face, helping you avoid costly pitfalls and navigate complex regulations and we provide the most comprehensive service package our industry has to offer. For over 15 years we have continued to expand our expertise and resources so we are always just one step away from helping you. Our team of experts take a strategic approach to account management that goes beyond analytics and numbers. Our team of experienced professionals can take on any accounting or reporting challenge you face, helping you avoid costly pitfalls and navigate complex regulations and we provide the most comprehensive service package our industry has to offer. For over 15 years we have continued to expand our expertise and resources so we are always just one step away from helping you.

Before opening LF Consulting Inc, Leisa worked in public accounting for over 15 years. She has a wide range of accounting experience, predominately in business and individual taxation, planning, and financial statement preparation. Leisa is also a QuickBooks ProAdvisor. She currently resides in Winterville, NC with her husband Bill and son Aydin.

Address : 1290 E Arlington, Ste 125, Greenville, North Carolina, 27858, United States

Phone : (704) 302-6643

Business Email : [email protected]

Connect With Us :

LF Consulting Inc On Facebook Page

LF Consulting Inc On Linkedin

1 note

·

View note

Text

CA Kavita Gandhi

Experience growth and financial excellence with CA Kavita Gandhi, a premier firm specializing in CFO services. Our expert team brings strategic insights to the table, crafting financial visions that align with your business objectives. From optimizing financial health through resource allocation to data-driven decision making, we empower businesses to navigate growth challenges with confidence. Collaborative by nature, we work closely with your leadership to tailor solutions to your unique needs. With our prowess in investor relations, we ensure your business attracts the right capital for expansion. Choose CA Kavita Gandhi for CFO services that redefine financial strategies and elevate business success.

Visit Our Website

#cfo services in india#virtual cfo services in india#virtual cfo#remote cfo services#interim cfo services#fractional cfo#fractional cfo services#part time cfo services#outsourced cfo services near me#fractional cfo services near me#cash flow management services

0 notes

Text

0 notes

Text

How CFOs Can Lead Their Companies Through Economic Downturns

Leveraging fractional CFO services from a firm can provide the financial expertise needed to objectively evaluate spending. Fractional CFOs offer on-demand, part-time small business CFO consulting. This allows small businesses to get CFO-level strategic advice and guidance without the full-time cost. Virtual CFO New York provides specialized financial leadership remotely. This on-demand model gives businesses access to CFO insights when they need them. A virtual CFO has experience optimizing budgets across many small businesses and startups. They can rapidly assess your cost structure and advise on where to reduce it. Read our blog for more info.

0 notes

Text

Aleksey Krylov: Your Strategic Chief Financial Officer for Optimal Business Growth

Looking for a strategic Chief Financial Officer (CFO) with expertise in the life sciences and medical technology industries? Look no further. Aleksey Krylov brings a wealth of experience in venture investing and mergers and acquisitions (M&A). Trust Aleksey to provide unparalleled financial guidance, helping your company thrive in today

0 notes

Text

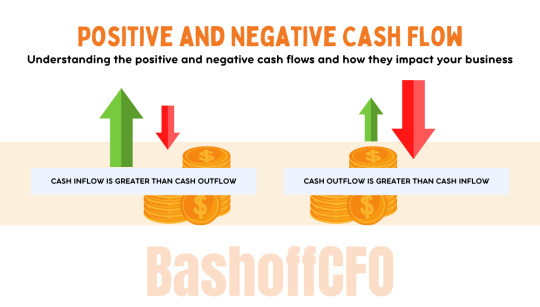

Positive and Negative Cash Flow: What’s the Difference?

To have a solid prediction of what your business’s cash situation will look like in the coming months, you need to put together a cash flow forecast. This is important for future planning so that you can make the right decisions for your company’s future.

From a cash perspective, your cash flow forecast will tell you when it is safe to expand, add more employees, or purchase additional equipment.

The key to being able to read and use your cash flow forecast is understanding the positive and negative cash flows and how they impact your business. Understanding these two concepts and what they mean for your business will make your cash flow forecast a vital tool for business management.

What is positive cash Flow?

Positive cash flow means a company has more money moving into it than out of it or the receipt of more cash than was paid out. It means having to spend less than the amount of cash you received from your customers, new loans or investment, or sales of assets that you owned.

Having a positive cash flow means that you would not need to use the salaried income to cover expenses and therefore enables you to quickly expand your portfolio.

And as your cash flow is measured over fixed periods of time, typically a month, if you are cash flow positive for several months in a row, this means your business is accumulating cash and your bank account is growing over time.

What is negative cash flow?

Negative cash flow means a company has more money moving out of it than into it. It is the result of paying out more cash than receiving. Negative cash flow is defined as property that takes away more money than you earn as rental income.

A business has negative cash flow when cash spending on expenses like payroll, marketing, rent, insurance, and other services is more than the cash coming in. Another cash spending that may lead to negative cash flow includes spending cash to purchase assets like inventory, vehicles, and property.

And when your business has negative cash flow, your bank accounts are being depleted over time and you will have less and less cash.

Do you want to make your negative cash flow positive? We can help you! Contact www.bashoffcfo.com or call us at 410-952-6767 for a free consultation.

#cashflowcfo#bashoffcfo#virtualcfo#fractionalcfo#businessmanagement#businessadvisory#cash flow#fractional cfo#virtual cfo#increase cash flow#virtual cfo services#cfo

1 note

·

View note

Text

How Fractional CFOs Can Help Startups Scale Successfully?

In the dynamic world of startups, scaling successfully is a formidable challenge. While passion and innovation are vital, navigating financial complexities can be daunting. This is where Fractional CFOs step in as invaluable assets, steering startups through turbulent financial waters towards sustainable growth.

Picture this: a startup with a groundbreaking idea gains traction, attracting investors and customers alike. However, behind the scenes, financial intricacies loom large. Cash flow management, financial planning, and strategic decision-making become pivotal for survival and growth. This is precisely where Fractional CFOs make their mark.

Expert Guidance, Flexible Approach:

Fractional CFOs bring a wealth of experience and expertise to the table without the hefty price tag of a full-time CFO. They offer strategic financial guidance tailored to the unique needs and stage of each startup. Whether it's optimizing cash flow, managing budgets, or crafting fundraising strategies, Fractional CFOs provide flexible solutions that adapt to evolving business landscapes.

Financial Roadmap for Growth:

Navigating the path to scale requires a clear financial roadmap. Fractional CFOs work closely with startup founders to develop robust financial strategies aligned with their vision and goals. By analyzing market trends, identifying growth opportunities, and mitigating risks, they pave the way for sustainable expansion.

Optimizing Cash Flow:

Cash is the lifeblood of any startup. Mismanagement can lead to catastrophic consequences. Fractional CFOs bring laser-focused attention to cash flow management, ensuring optimal utilization of resources. From forecasting cash needs to streamlining invoicing and collections, they keep the financial engine running smoothly, fueling growth initiatives.

Financial Modeling and Analysis:

Effective decision-making hinges on accurate financial insights. Fractional CFOs employ sophisticated financial modeling techniques to provide startups with a crystal-clear understanding of their financial health. By analyzing key performance indicators, conducting scenario analysis, and evaluating investment opportunities, they empower startups to make informed decisions that drive growth.

Fundraising and Investor Relations:

Raising capital is a rite of passage for startups looking to scale. Fractional CFOs bring invaluable expertise to the fundraising process, from crafting compelling pitch decks to negotiating term sheets. They act as trusted advisors, guiding startups through the intricacies of investor relations and ensuring alignment between financial objectives and investor expectations.

Risk Management and Compliance:

In a regulatory landscape fraught with complexities, compliance is non-negotiable. Fractional CFOs take the reins on risk management and compliance, safeguarding startups against potential pitfalls. From regulatory filings to internal controls, they ensure adherence to best practices, fostering trust and credibility among stakeholders.

Driving Efficiency and Accountability:

Efficiency and accountability are the cornerstones of scalable growth. Fractional CFOs implement robust financial systems and processes that optimize efficiency and accountability across the organization. By establishing clear metrics and performance benchmarks, they enable startups to track progress and course-correct as needed, driving continuous improvement.

In conclusion, Fractional CFOs play a pivotal role in helping startups scale successfully. By providing expert guidance, strategic financial planning, and hands-on support, they empower startups to navigate financial complexities with confidence and chart a course towards sustainable growth. In an ever-evolving business landscape, partnering with a Fractional CFO can be the difference between thriving and merely surviving.

0 notes

Text

Key Elements of a Strategic Business Plan

A strategic business plan typically includes several key components that outline the company’s direction, strategies, and operational plans. These components work together to provide a comprehensive picture of where the company is, where it wants to go, and how it plans to get there. The core components of a strategic business plan include:

Executive Summary: This is an overview of the entire business plan, highlighting the key points, including the business concept, financial features, and current business position. It’s designed to give readers a quick understanding of the plan’s main objectives and strategies.

Company Description: Provides detailed information about the business, including its background, the nature of the business, its mission, vision, and values, as well as the products or services it offers. This section outlines what the company does and what makes it unique in its industry.

Market Analysis: This section includes an in-depth analysis of the industry, market size and trends, target market segments, and customer needs. It involves researching and presenting data on the company’s target market, including demographics, preferences, and buying habits, as appropriate (e.g., consumer markets).

Products or Services: Describes the company’s offerings in detail, including information on product or service development, production processes, and how the company’s offerings meet the needs of its target market.

Marketing and Sales Strategy: Details how the company plans to attract and retain customers — customer acquisition and retention. This section covers the marketing and sales strategies, including pricing, promotions, sales channels, and distribution methods.

Competitors’ Capabilities Analysis: Preferred over the traditional SWOT analysis. It specifically assesses Competitors’ Capabilities against the Target Market Success Factors (e.g., price, product features) that are most important to customers. Hence, it goes deeper into understanding the competitive environment, which is crucial for businesses in highly competitive markets or when specific competitive threats or opportunities exist.

Organizational Structure and Management: Outlines the company’s organizational structure and introduces the management team. It may include information on the ownership structure, profiles of the management team, and the roles and responsibilities of team members.

Operational Plan: Describes the day-to-day operations of the business, including the production processes, physical locations, facilities, equipment, inventory, and the operational workforce. It outlines the operational workflows and any quality control measures.

Financial Plan: Contains detailed financial projections, including income statements, cash flow statements, and balance sheets for a specific period. It will also include a break-even analysis, financing needs, and funding sources. This section is crucial for understanding the financial viability of the business.

Implementation Plan: Outlines the milestones, timelines, and resources (e.g., financial, human) required to achieve the objectives outlined in the plan. It includes specific action plans, tasks, and performance measures to track progress and budgets.

Summary. Highlights of the company’s vision and key objectives and the Business Strategy to achieve them.

Appendices and Supporting Documents: May include any additional information that supports the business plan, such as resumes of key management, technical specifications of products, legal documents, detailed market studies, and relevant contracts.

Each component plays a crucial role in the strategic business plan, providing stakeholders with a thorough understanding of the company’s strategic direction, operational mechanisms, and financial projections. Tailoring these components to fit the specific needs and circumstances of the business can enhance the plan’s effectiveness.

To explore if you are ready for a Fractional CFO or would like additional information about this role and its benefits, please contact us

CFO_2.3 To read related articles go to our Blog

0 notes

Text

Level Up Your Finances: Fractional CFOs Fueling Business Growth

https://nexagy.com/our-services/ - Enhance your financial strategy with Nexagy's Fractional CFO services. Gain seasoned financial skills without making a full-time commitment. Navigate success with strategic financial leadership targeted to your company's needs. Learn more at nexagy.com.

0 notes

Text

Elevate Your Business with Top-notch CFO Services in India from CA Kavita Gandhi

youtube

In the dynamic landscape of business, having a seasoned Chief Financial Officer (CFO) is crucial for sustainable growth and financial stability. Small and medium-sized enterprises (SMEs) often face challenges in accessing high-quality financial expertise due to budget constraints. This is where CA Kavita Gandhi steps in, offering unparalleled CFO services in India to empower businesses with strategic financial management.

Unveiling CA Kavita Gandhi's CFO Services

Expertise Beyond Numbers

CA Kavita Gandhi brings a wealth of financial expertise and a proven track record in providing CFO services that go beyond mere number crunching. With a deep understanding of the Indian business ecosystem, CA Kavita Gandhi's team collaborates with businesses to formulate financial strategies that align with their goals and drive success.

Tailored Solutions for Every Business

Recognizing that each business is unique, CA Kavita Gandhi offers customized CFO services tailored to meet the specific needs of the clients. Whether it's financial planning, risk management, or strategic decision-making, the team ensures that their solutions are aligned with the client's industry, size, and long-term objectives.

Cost-Effective Financial Management

SMEs often face the challenge of limited resources, making it difficult to afford an in-house CFO. CA Kavita Gandhi bridges this gap by providing cost-effective outsourced CFO services. This not only allows businesses to benefit from top-tier financial expertise but also enables them to allocate resources more efficiently, focusing on core operations and growth initiatives.

Why Choose CA Kavita Gandhi for CFO Services in India?

Proactive Financial Planning

CA Kavita Gandhi adopts a proactive approach to financial planning, helping businesses navigate through uncertainties and capitalize on opportunities. The team collaborates closely with clients to develop robust financial strategies, ensuring a stable financial foundation for long-term success.

Compliance and Risk Management

Navigating the complex landscape of financial regulations in India can be a daunting task. CA Kavita Gandhi's CFO services include comprehensive compliance and risk management to safeguard businesses against legal and financial pitfalls. This proactive approach ensures that clients can focus on their core business activities with peace of mind.

Real-time Financial Reporting

In the fast-paced business environment, timely and accurate financial reporting is crucial for making informed decisions. CA Kavita Gandhi employs cutting-edge technology to provide real-time financial reporting, giving clients instant access to critical financial insights. This transparency enhances decision-making processes and empowers businesses to stay ahead of the curve.

Strategic Business Advisory

Beyond traditional financial management, CA Kavita Gandhi offers strategic business advisory services. Leveraging their expertise, the team provides valuable insights and recommendations to drive business growth, optimize operations, and enhance overall financial performance.

Conclusion

In the competitive landscape of Indian business, having a reliable CFO is no longer a luxury but a necessity. CA Kavita Gandhi stands out as a trusted partner, offering top-notch CFO services in India that empower businesses to thrive. With a commitment to excellence, personalized solutions, and a proactive approach to financial management, CA Kavita Gandhi is the go-to choice for businesses seeking to elevate their financial performance and achieve sustainable growth in the ever-evolving business landscape.

#cfo services in india#virtual cfo services in india#virtual cfo#remote cfo services#interim cfo services#fractional cfo#fractional cfo services#part time cfo services#outsourced cfo services near me#fractional cfo services near me#cash flow management services#Youtube

1 note

·

View note

Text

Why Should You Hire A Fractional CFO For Life Sciences Financial Services?

No one can deny that life science companies may experience various financial challenges at the starting phase. While launching their offerings in the market, the companies need expert advice and adequate support.

How Can Hiring a Fractional CFO Be Beneficial for Life Sciences Companies?

Early-stage companies should create a budget, consider funding requirements, emphasize research and development costs, and so on. All of these actions need to be taken care of under the supervision of a seasoned Chief Financial Officer or CFO.

Such a finance professional offers best-in-class life sciences financial services and always goes the extra mile to leverage their financial expertise for their client’s business growth. In other words, a best-in-class CFO can do wonders to take the company’s financial state to the next level.

Since a Fractional CFO works based on the client’s budget and requirements, early-stage companies do not need to worry about heavy investments. In other words, an early-stage life sciences company can hire a Fractional CFO on a project-based or part-time basis to save considerable expenses.

Moreover, these business owners can customize the shortlisted Fractional CFO’s services to cater to their requirements. Thus, they can leverage the CFO’s expertise and experience without hiring a full-time employee.

Best-in-class Fractional CFOs offer diverse services, such as financial forecasting, budgeting, brainstorming financial strategies, financial planning, risk management strategizing, etc.

The Bottom Line

Do you run a life sciences company? Yes? Then, it is high time to hire a CFO or Fractional CFO (based on your budget, preferences, and requirements) to receive top-grade life sciences financial services. Do not forget to verify the shortlisted CFO’s experience level and track record.

1 note

·

View note

Video

youtube

Fractional CFO Consulting MD

Fractional CFO consulting offers businesses the opportunity to benefit from experienced financial leadership on a part-time basis.

Beyond Profit And Wealth Consulting provides the best Fractional CFO Consulting Services In MD for businesses of all sizes, helping them with financial strategy, planning, and decision-making.

For details, visit the website.

https://beyondprofitconsult.com/accounting-services/

0 notes

Text

Unlocking Success in Biotech and MedTech: The Power of Fractional CFOs

Discover why fractional CFOs have become increasingly popular in the biotech and c industries. This article explores the benefits of having a fractional CFO, including cost-effectiveness, specialized expertise, and strategic financial guidance.

0 notes