#cashflowcfo

Text

Understanding Why Profitable Companies are failing

Cash Flow, Scale Growth, Streamline Operations, Virtual CFO

Profitable companies have the same chance of going out of business because of cash flow problems as companies that don’t make money. Your cash flow might soon be impacted if your expenses are high or you are investing your revenues back into your business.

To be clear, cash flow does not equate to profits. For a small corporation that needs to make investments in assets in order to grow, the situation where profit and cash flow are at odds is very typical. The reasons are always seen on the balance sheet.

The ability of a business to pay its bills is measured by cash flow. The cash received less the cash disbursed throughout the time period equals the cash balance. This is where managing cash flow can get challenging. Based on a U.S. Bank study, poor cash management accounts for 82 percent of business failures. Small business owners and CEOs often have to make choices that will have a long-term negative impact on their company’s cash flow.

Cash flow problems caused by business decisions

Many companies are struggling with cash flow because they don’t meet their target margins and are unaware. A company is in trouble when it does not have the necessary profits, its customers pay in 30 days, and payroll is due today. A working capital requirement is what is meant by this. Before receiving the final payment, the business must pay its payroll, and so working capital is required.

Poor Pricing Strategy. The most common source of cash flow problems is poor pricing. The key to maximizing cash flow is to price your products and services profitably.

Understanding your figures is the first step in pricing. When analyzing prices, your profit margin is a crucial measure to be aware of. Your company’s profit margin will show you how much it profits from the revenue it generates. If your profit margin is poor, either your costs or your price are out of line, or both.

You’ll always struggle with cash flow problems if you don’t have a strong and consistent profit margin. You can gain insight into your pricing and cost data and determine whether anything needs to change to help improve your company’s cash flow by reviewing your profit margin and monitoring it over time.

Hiring and Letting go.

Employees: While both hiring and firing are challenging, they are vital steps that promote profitability. The second most crucial cash flow decision is who you recruit or fire. You need employees who will fit into the culture and are passionate about contributing to the growth of your company. If this isn’t currently happening, you’ll have to follow the proper procedures to fire workers who aren’t a good match for the business and are cancer to the culture. People who are unhappy at work will definitely have a detrimental impact on your company’s long-term development.

Clients/Customers: Before bringing on any new staff, identify which clients should be dismissed in order to increase revenue and profitability by bringing in clients with higher profit margins in their place. You will harm your business if you hold onto low-margin clients out of concern for your cash flow or because you can’t find a client with higher margins to take their place. Don’t be afraid to let go of low-margin clients – after all, Low Gross is Grief (LGIG). This means that the clients with the lowest profit margins can cause the company the most trouble and eat up its staff members’ valuable time. You’ll have a happier crew and a more successful company if you get rid of those customers.

When and where money is spent. Knowing where the business spends its money is a major one. Maslow’s Hierarchy of Needs comes into play if there are cash flow issues, and you will naturally fall back on what is stable and safe for you as a business owner. 80% of businesses that fail do so due to poor cash flow and as a result, owners are choosing not to invest because they are afraid to spend money.

Businesses shouldn’t let short-term financial issues keep them from making wise long-term choices.

A business would not be able to seize opportunities if it is experiencing cash flow issues. Consider the scenario in which you are a supplier and your largest client contacts you about a recent agreement that didn’t work out. They have a sizable supply of widgets and are aware that you use them all year round. They promise a 25% discount if you buy it all at once. That means a lot to you! Because of your lower costs, you have an immediate pricing edge in the marketplace. but not if you lack the money to complete the transaction.

Making the Right Decisions

Having best practices and foresight in your pricing, hiring/firing, and spending will help increase cash flow and help your firm prosper regardless of what kind of business it is. With the correct actionable financial intelligence, you can accomplish many of these criteria and evaluate how your firm is doing and where it needs to improve.

Hiring a Virtual CFO

Because cash flow is essential to the operation of a company, using the services of a virtual chief financial officer (CFO) may be beneficial to you in developing a sound plan to keep track of your present cash situation and forecast what your future cash position will be like.

Find out how BashoffCFO can help you. Let’s get started today! or call us at 410-952-6767 for a free consultation.

0 notes

Text

Positive and Negative Cash Flow: What’s the Difference?

To have a solid prediction of what your business’s cash situation will look like in the coming months, you need to put together a cash flow forecast. This is important for future planning so that you can make the right decisions for your company’s future.

From a cash perspective, your cash flow forecast will tell you when it is safe to expand, add more employees, or purchase additional equipment.

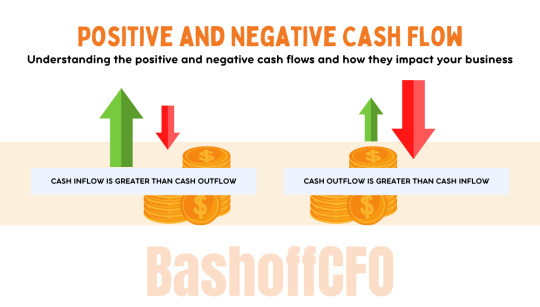

The key to being able to read and use your cash flow forecast is understanding the positive and negative cash flows and how they impact your business. Understanding these two concepts and what they mean for your business will make your cash flow forecast a vital tool for business management.

What is positive cash Flow?

Positive cash flow means a company has more money moving into it than out of it or the receipt of more cash than was paid out. It means having to spend less than the amount of cash you received from your customers, new loans or investment, or sales of assets that you owned.

Having a positive cash flow means that you would not need to use the salaried income to cover expenses and therefore enables you to quickly expand your portfolio.

And as your cash flow is measured over fixed periods of time, typically a month, if you are cash flow positive for several months in a row, this means your business is accumulating cash and your bank account is growing over time.

What is negative cash flow?

Negative cash flow means a company has more money moving out of it than into it. It is the result of paying out more cash than receiving. Negative cash flow is defined as property that takes away more money than you earn as rental income.

A business has negative cash flow when cash spending on expenses like payroll, marketing, rent, insurance, and other services is more than the cash coming in. Another cash spending that may lead to negative cash flow includes spending cash to purchase assets like inventory, vehicles, and property.

And when your business has negative cash flow, your bank accounts are being depleted over time and you will have less and less cash.

Do you want to make your negative cash flow positive? We can help you! Contact www.bashoffcfo.com or call us at 410-952-6767 for a free consultation.

#cashflowcfo#bashoffcfo#virtualcfo#fractionalcfo#businessmanagement#businessadvisory#cash flow#fractional cfo#virtual cfo#increase cash flow#virtual cfo services#cfo

1 note

·

View note

Text

5 Mistakes Small Businesses Make

Starting up a small business can be a stressful time for anyone, however, being your own boss can be extremely rewarding, when the business becomes successful. Often small business owners fall into several pitfalls when they try to start a small business. Here are a few mistakes to avoid.

Not having a written Business Plan. This is one of the biggest mistakes that a small owner can make. You need to know your initial investment, your target demographics, and the nuances of your business in order to understand how to develop it further.

Not Doing Market Research. Do you know who your customers will be? Do you know how much they are willing to spend? How about your key competitors? Do changes in season and economics, change the scale of profit? You have to fully understand your market in order to thrive in it.

Ignoring Competitors. In a similar vein, you need to know your competitors inside and out. What do they do right? What do they do wrong? Staying on top of them not only allows you to understand best practices in the industry, but can also help you fix what they did wrong.

Not Investing in Marketing. If you want your business to succeed, then your potential customers must know that it exists. Invest in marketing such as advertisements, best and social media practices, in order to get the word out about your new endeavor.

Not Keeping Track of Weaknesses. Be vigilant in knowing where your businesses’ key weaknesses are. You must constantly strive to fix these weaknesses and create the best business within your chosen industry.

Need help with your business? Visit https://bashoffcfo.com/

1 note

·

View note