#consulting cfo

Text

The Fractional CFO must participate in the development of the overall business strategy

Companies unfamiliar with the role of the Chief Financial Officer (CFO), a common occurrence among early stage startups and small businesses, often confuse this role with that of an Accountant or even a Bookkeeper. The CFO is a strategic, forward-looking senior executive, the Accountant is a tactical operator.

In previous articles, we have argued that early stage startups and small businesses will be better served by a Fractional rather than a full-time CFO. In any event, the participation of the Fractional or Full-time CFO, in the development of the overall business strategy is imperative. We present several reasons below:

Strategic Financial Planning: The Fractional CFO ensures that the company’s financial strategy aligns with its overall business objectives. They can forecast future financial trends, prepare the organization for potential economic shifts, and advise on sustainable growth strategies, making them an integral part of strategic planning.

Resource Optimization: By being involved in strategy development, the Fractional CFO can provide insights on how to optimize the use of financial resources. This includes capital allocation, investment strategies, and cost management, all of which are crucial for achieving strategic goals.

Risk Assessment and Management: The Fractional CFO’s expertise in financial risk assessment allows them to identify potential financial risks associated with strategic choices. Their involvement ensures that risk management is an integral part of the strategic planning process, safeguarding the company’s assets and future.

Performance Metrics: The Fractional CFO can establish financial and operational metrics that align with the company’s strategic goals. These metrics help in monitoring the execution of the strategy and in making necessary adjustments to stay on track.

Stakeholder Confidence: The Fractional CFO’s involvement in strategy development helps in communicating a cohesive vision to shareholders, investors, and financial institutions. This transparency builds confidence in the company’s direction and can facilitate easier access to capital when needed.

Cross-functional Collaboration: The Fractional CFO often serves as a bridge between various departments, ensuring that financial considerations are integrated into all aspects of strategic planning. This cross-functional collaboration is vital for the holistic execution of the strategy.

Value Creation: Through strategic financial leadership, the Fractional CFO can identify opportunities for value creation within the company. This includes exploring new markets, investment opportunities, and revenue streams that align with the company’s strategic vision.

Adaptability and Agility: In today’s fast-paced business environment, the Fractional CFO’s forward-looking financial insights can help the company remain adaptable. By being involved in strategic planning, the CFO ensures that the company is financially prepared to pivot as market conditions change.

In essence, the Fractional or Full-time CFO’s role transcends traditional financial management, becoming a cornerstone in strategic decision-making. Their unique perspective ensures that financial health, risk management, and value creation are central to the company’s strategic vision, enabling sustainable growth and long-term success.

To explore if you are ready for a Fractional CFO or would like additional information about this role and its benefits, please contact us

CFO_2.1 To read related articles go to our Blog

#Fractional CFO#outsourced cfo#part-time cfo#consulting cfo#business plan#business#business strategy

0 notes

Text

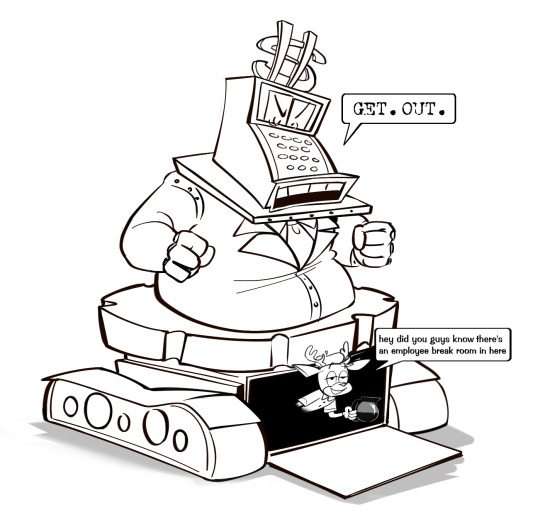

hello tungle, today I present to you what's essentially me sweeping all the toontown-related scraps lying around my computer into a dustpan

#toontown#toontown corporate clash#chainsaw consultant#chip revvington#pacesetter#graham ness payser#club president#cfo#clover hulahooves#art tag#fanart#ttcc#toonblr#toon tag

856 notes

·

View notes

Text

Ttcc requests #4

#toontown#toontown corporate clash#ttcc#dave brubot#major player#duck shuffler#buck ruffler#vp#cfo#flint bonpyre#firestarter#chainsaw consultant#chip revvington#digital doodle#requests

140 notes

·

View notes

Text

Random Corporate Clash Headcanons, Swearing Edition {Revised}

Constantly swears:

LAA, Scapegoat, Litigator, Plutocrat

Swears often:

Derrick Man, Bellringer, Major Player, CFO, Satellite Investors, Treekiller, High Roller, The Directors

Swears on occasion:

Pacesetter, Duck Shuffler, Stenographer, Multislacker, Mouthpiece, Chainsaw Consultant

Rarely swears:

Prethinker, Witch Hunter, Deep Diver, PRR, VP, CLO, Featherbedder

Rarely swears, but when they do the room feels like it just got ice cold:

Case Manager, Gatekeeper, Chairman, CEO

Legally cannot swear:

Rainmaker, Firestarter, COO

#ttcc#toontown#corporate clash#toontown corporate clash#ttcc headcanons#duck shuffler#prethinker#derrick man#oh my god so many managers to tag#deep diver#land acquisition architect#rainmaker#mouthpiece#bellringer#chainsaw consultant#vp#multislacker#firestarter#major player#cfo#ceo#clo#chairman#coo#high roller#treekiller#featherbedder#i give up tagging them all lol

39 notes

·

View notes

Text

Why a Growing Organization Ought To Contract Outsourced CFO Providers

Company growth is an amazing phase for any organization. It signifies the acceptance of the brand name, enhanced revenue, and also potentially larger market share. Nonetheless, with growth comes intricacy, specifically in financial monitoring. Making certain financial stability and also guiding the company towards success needs a skilled Chief Financial Officer (CFO). For lots of tiny to…

youtube

View On WordPress

0 notes

Text

R&D Tax Incentive Australia: Fostering Innovation

One of the key advantages of the R&D Tax Incentive is its broad eligibility criteria. It applies to a wide range of industries, including technology, manufacturing, biotechnology, and more. Whether you're developing new products, processes, or services, as long as your activities meet the definition of R&D as outlined by the program, you could qualify for the incentive.

Navigating the complexities of the R&D Tax Incentive can be daunting, but with the right guidance, businesses can maximize their benefits while ensuring compliance with regulatory requirements. Consulting with R&D tax specialists can help businesses identify eligible R&D activities, optimize their claims, and mitigate potential risks associated with the incentive.

#r&d tax consultants#r&d tax incentive australia#crypto tax australia#crypto tax#bookkeeping services#ecommerce accountant#startup accountant#crypto tax accountant#cfo advisory#business bookkeeping

0 notes

Text

Outsourced CFO Services Maryland

Looking for the best Outsourced CFO Services In Maryland?

Visit Beyond Profit And Wealth Consulting. Our team of experienced professionals offers a range of services including financial planning, budgeting, cash flow management, and financial reporting. By partnering with us, businesses can access top-tier financial expertise at a fraction of the cost of hiring a full-time CFO.

For details, visit the website.

#CFO Services For Startups MD#CFO Consulting Maryland#Automated Accounting Services Maryland#Automated Bookkeeping Maryland

0 notes

Text

The Financial Plan, Critical Component of a Strategic Business Plan

A financial plan for a business contains forward-looking financial statements (e.g., income statements, balance sheets, and cash flow statements), projecting three to five years into the future. It serves as a roadmap for how the business intends to achieve its financial objectives and manage its financial resources over a specified future period. The financial plan is a critical component of a broader strategic business plan and includes several key elements that collectively provide a detailed picture of the business’s current financial position, its future financial expectations, and strategies for managing financial opportunities and risks. These elements include:

1. Executive Summary: A concise overview of the business and its financial goals. This section provides a snapshot of what the business is about and what it aims to achieve financially.

2. Sales Forecast: Projections of future revenues the business expects to generate from its products or services, considering target market size and growth potential, competitive position, historical sales data, and marketing/sales strategies. Sales forecasts are typically broken down monthly for the first year or two and then annually for the following years.

3. Operating Expenses: Detailed projections of the business’s operating expenses, such as Cost of Goods Sold (e.g., labor and materials), Sales & Marketing (e.g., customer acquisition and retention costs), Research & Development (e.g., Product/Service Development), General & Administrative (e.g., rent, utilities).

4. Profit and Loss Statement (Income Statement): It combines the Sales and Operating Expenses forecasts for an estimate of the business’s gross and net profitability during the forecast period.

5. Cash Flow Statement: An analysis of the expected inflow and outflow of cash within the business, highlighting the status of the cash reserves or balance. A negative cash balance will indicate the need for external funding (e.g., debt or equity) or the need to increase inflows or decrease outflows through corrective actions. In essence, it is crucial for understanding the liquidity of the business and its ability to sustain operations and invest in growth opportunities.

6. Balance Sheet: A snapshot of the company’s financial health at a specific point in time, detailing assets, liabilities, and equity. This helps in understanding the net worth and financial stability of the business.

7. Break-even Analysis: An analysis to determine the point at which the business will be able to cover its expenses from its revenue, indicating the sales needed to start generating a profit.

8. Capital Expenditure Budget: A plan for medium to long-term investments the business will make in assets like equipment, property, or technology, which are crucial for future growth.

9. Funding Request and Repayment Plan: If the financial plan is intended to secure funding, this section outlines how much funding is needed, what it will be used for, and how the business plans to repay any borrowed funds. It is driven the cash balance shortfall in the Post-Money Cash Flow Statement.

10. Sensitivity Analysis: An examination of how sensitive the business’s financial success is to changes in key assumptions, such as changes in pricing, cost of goods sold, or sales forecasts.

11. Appendices and Supporting Documents: Additional information that supports or further details the financial plan, such as bottoms-up analysis of any revenue or expense item, market research, legal agreements, etc.

A well-crafted financial plan for a business not only guides the company’s financial strategy but also serves as a vital document for securing investors or lenders’ support. It requires regular review and updates to reflect the changing market conditions and the business’s actual performance.

To explore if you need a Fractional CFO or would like additional information about this role and its benefits, please contact us

CFO_2.4 To read related articles go to our Blog

0 notes

Text

Samichinam Solutions Can Help You Streamline Pharma Operations with QMS, eBPR, & More

Use Samichinam Solutions to increase operational efficiency in the pharmaceutical industry. QMS, eBPR, and premium software for cleaning validation, equipment validation, and clinical trials are all part of our all-inclusive suite. Discover our specialized offerings for the pharmaceutical sector right now."

#strategy consultant#business strategy consultant#financial planning & analysis#virtual cfo services

0 notes

Video

youtube

Fractional CFO Consulting MD

Fractional CFO consulting offers businesses the opportunity to benefit from experienced financial leadership on a part-time basis.

Beyond Profit And Wealth Consulting provides the best Fractional CFO Consulting Services In MD for businesses of all sizes, helping them with financial strategy, planning, and decision-making.

For details, visit the website.

https://beyondprofitconsult.com/accounting-services/

0 notes

Text

Personal Tax Accountant in Vancouver - Lfg Partners

What is a CPA in income tax?

A CPA, or Certified Public Accountant, is an accounting professional who has obtained a license to practice accounting at the state or federal territory level. CPAs are highly trained and regulated professionals who have passed a rigorous exam known as the Uniform Certified Public Accountant Examination (Uniform CPA Exam) administered by the American Institute of Certified Public Accountants (AICPA)

While CPAs are often associated with income tax preparation, they can specialize in various areas of accounting, such as auditing, bookkeeping, forensic accounting, managerial accounting, and even aspects of information technology (IT).

They can provide a range of services, including tax filing, financial planning, financial statements, audits, and more. CPAs can help individuals and businesses with their tax forms or returns, ensuring compliance with tax laws and regulations.

It's important to note that not everyone may need the full services of a CPA for filing a relatively simple tax return. Non-CPA tax preparers or do-it-yourself tax software may be sufficient for individuals with straightforward tax situations.

However, for more complex tax situations or if you require personalized advice and guidance, working with a CPA can be beneficial. In summary, a CPA is a licensed accounting professional who can provide expertise in various areas of accounting, including income tax preparation, and offer a range of services to individuals and businesses.

#vancouver accounting companies#sr&ed consulting vancouver#part-time cfo vancouver#business advisors vancouver#cdap vancouver#financial reporting vancouver#cloud accounting vancouver

0 notes

Text

Transforming Financial Management with CFO Consulting Services

For tech startups embarking on growth journeys, CFO consulting services offer invaluable strategic support. These services provide startups with access to seasoned financial professionals who offer expert guidance without the commitment of a full-time hire. CFO outsourcing services, in particular, allow startups to tap into a diverse skill set tailored to their specific needs.

Virtual CFO services in India are witnessing a surge in demand, thanks to their scalability and cost-efficiency. Startups can benefit from localized expertise coupled with the flexibility of remote assistance. From financial analysis to business modeling, interim CFOs play a crucial role in driving sustainable growth for tech startups.

Ready to optimize your startup's financial strategy? Partner with CFO Bridge for comprehensive virtual CFO services that align with your growth objectives. Empower your startup with strategic financial guidance today!

Learn More about CFO Bridge's Virtual CFO Services

#virtual cfo services#outsourced cfo services#cfo solution#cfo services#virtual cfo consulting service#cfo consultants#temporary cfo services

0 notes

Text

Decoding Financial Complexity: Your Guide to CFO Consulting with CFO Bridge

Navigating financial complexities requires expert guidance, and CFO Bridge is here to serve as your trusted advisor. Our comprehensive CFO consulting services offer businesses in Bangalore invaluable insights into their financial landscape.

At CFO Bridge, we specialize in deciphering financial complexities and providing strategic solutions tailored to your unique needs. From budgeting and forecasting to risk management and strategic planning, our team of seasoned professionals is dedicated to helping you achieve your financial goals.

With our CFO services in Bangalore, you gain access to personalized consulting that goes beyond mere numbers. We work closely with you to understand your challenges and opportunities, offering actionable recommendations that drive growth and profitability.

Partner with CFO Bridge for unparalleled expertise in decoding financial complexity. Let us be your guide to success in the intricate world of finance.

CFO Bridge Pvt. Ltd

AWFIS, 10th Floor, R-city Mall, LBS Marg,

Ghatkopar West, Mumbai, 400086

Contact us: +91 8899117255

0 notes

Text

Unlock Financial Insights with THE FINTELLIGENCE

Elevate your business with expert business advisory services and small business consulting solutions. Our strategy consultants specialize in strategic management services, financial planning & analysis, virtual CFO services, finance data analytics, and due diligence services. Partner with us for comprehensive support in maximizing your business potential.

1 note

·

View note