#fhaloan

Text

FREE VA Home Loan Pre-Approval. Do you know how much home you can afford? Take the first step by getting pre-approved here for FREE! No SSN Required https://bit.ly/38dW2AR

#applynow#buyahome#buyahouse#homebuyer#realestate#home#homeowner#homeownership#housing#mortgage#fha#fhaloan#va#valoans#realtor#realestateagent#jumboloan#california#colorado#florida#louisiana#michigan#texas#utah#real estate

6 notes

·

View notes

Text

Cash Out Refinancing

It is a good decision to replace your home equity with cash instead of taking another mortgage. With a team of experienced and qualified professionals at Right Key Mortgage, we provide cash-out refinances like conventional, FHA, VA, and many more. Visit our website for more details.

2 notes

·

View notes

Text

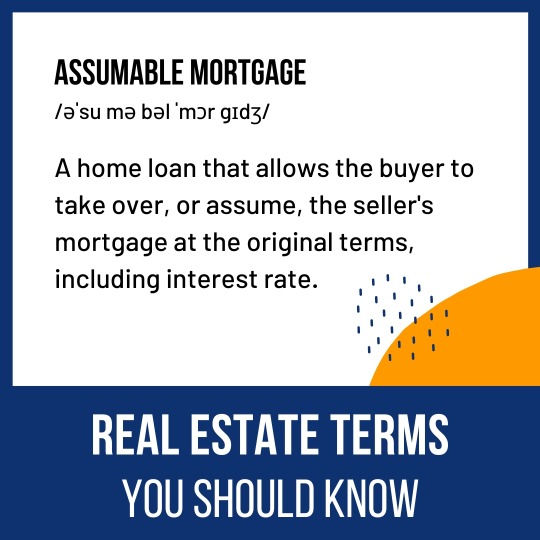

Mortgage rates have remained stubbornly high. But did you know that homebuyers can take over certain types of mortgages from the seller—at their original interest rates? These loans, called assumable mortgages, may include U.S. government-backed FHA, VA, and USDA loans when certain criteria are met. If you have an assumable loan with a low interest rate, it could be an important selling point for your home. Reach out for a free consultation to learn more!

217 Livingston Dr. Website:

Visit Our Blog Today!

Contact Us Today!

Ebby Halliday

The Shuler Group

Billy Shuler

Cell: 972.977.7311

Email: [email protected]

Website: https://www.ebby.com/bio/billyshuler

#forneyrealestate#forneyhomes#northtexasrealestate#northtexashomes#theshulergroup#sold#sellingforney#billyshuler#julieshuler#realestate#realestateagent#homesellertips#homesales#fhaloan#valoan#usdaloan

0 notes

Text

#FHALoan#FHA#FirstTimeHomebuyer#Homeownership#Mortgage#RealEstate#HomeLoan#LowDownPayment#CreditScore#FHAapproved#HomeBuying#HouseHunting#PropertyOwnership#GovernmentLoan#FHALoanLimits#AffordableHousing#HUDHome#FHAStreamline#FHARefinance#fhaloanprocess

0 notes

Text

FHA Home Loan

Unlock the door to your dream home with e Mortgage Capital's FHA Home Loan! Designed to make homeownership more accessible, our FHA loans offer competitive rates, low down payment options, and flexible qualification criteria. Whether you're a first-time buyer or looking to refinance, our team of experts is dedicated to guiding you through every step of the process. Say goodbye to the stress of conventional loans and hello to the simplicity and affordability of e Mortgage Capital's FHA Home Loan. Get started on your path to homeownership today!

Embark on your homeownership journey with confidence and ease. e Mortgage Capitals is committed to helping you achieve your dreams with our FHA Home Loan program. Whether you're a first-time homebuyer or looking to refinance, our team is ready to assist you in securing the keys to your dream home. Don't let your dream home slip away – contact e Mortgage Capitals today and explore the possibilities of homeownership with our FHA Home Loan!

For more information please visit

https://www.emortgagecapital.com/buy-a-home/fha-home-loan

0 notes

Text

Self-employed? ReRx Mortgage has you covered with a range of mortgage options. Choose from traditional FHA, VA, and conventional mortgages, or explore tailored solutions like non-QM, portfolio, and business-purpose loans.

0 notes

Video

youtube

(via First-Time HomeBuyer Louisville Kentucky Mortgage Programs)

0 notes

Text

FHA Loan Providers In Austin

Unlock your dream home with FHA loans! These government-backed mortgages offer low down payments and are ideal for first-time buyers. Enjoy flexible credit requirements and competitive rates. FHA loans empower you to achieve homeownership without hefty initial costs. Discover how these loans can pave the way to your new home sweet home! Call today (512) 501-3624 #FHALoans #Homeownership #DreamHome

0 notes

Text

NAVIGATING THE TEXAS FHA LOAN PROCESS: A COMPREHENSIVE GUIDE IN TODAY’S MARKET

In the current dynamic real estate market, securing a Federal Housing Administration (FHA) loan can be an appealing path for many homebuyers, especially those navigating the mortgage landscape for the first time. This blog aims to elucidate the process of qualifying for an FHA loan, offering a structured and insightful approach to this often-intimidating journey.

0 notes

Text

Get the best mortgage rates in San Diego County, CA with JCRMG INC Mortgage Broker. Our experienced team, led by Joe Frank Cerros, will help you secure a low-rate mortgage. Dial 1-888-600-7577 to get started.

best mortgage rates, experienced team, low-rate mortgage, San Diego County, CA. Apply online at https://jcrmg.zipforhome.com/CompanySite/Index or Contact Joe Frank Cerros at 1-888-600-7577 to explore your options.

for a stress-free experience. simplify home loan process, expert Mortgage Loan Originators, personalized guidance, stress-free experience, Santa Maria, CA #jcrmginc #joefrankcerros #MortgageBroker #RealEstateFinancing #MortgageLoanOriginator #OwnAHome #MortgageBroker #homeloan #homeloanprocess #realestatefinancing #realestateinvesting #fhaloans #realestateagent #FHAloan, #jcrmg

Mortgage broker, real estate financing, mortgage loan originator, FHA, VA, conventional, USDA, self-employed, bank statement, DSCR, HELOC, refinance, purchase, first-time buyers, investors, VA, VA-Construction loans, JCRMG Inc, Joe Frank Cerros, Mortgage Process, Mortgage Broker, loan mortgage, Home Equity Line of Credit, FHA loans, Real Estate Investing, Real Estate Agent. FHA loan, FHA loan first-time buyers, 1st time buyers, Refinance, Purchase

JCRMG INC is a Real Estate Mortgage Broker. NMLS 2418994 DRE 02173635. Licensed by the department of Real Estate. Broker Joe Frank Cerros NMLS 240041 DRE 01356767. Equal Housing opportunity. Doing business in California only. JCRMG INC Po Box 803 Lawndale CA 90260.

#8886007577#jcrmg#jcrmginc#dre01356767#joecerros#mortgagebroker#nmls240041#240041#01356767#mortgage#jcrmgfha#fha#fhaloan#fha loans#fha assistance mortgage

1 note

·

View note

Text

Dreaming of owning your first home? As a mortgage professional, I'm here to guide you through the exciting journey of getting a home loan! Discover special loan programs tailored for first-time homebuyers and take that step towards your homeownership goals.

ChangeMyRate.com compares multiple lenders and loan options — all in one place. Let our experts help you find a great mortgage. Take the first step by getting pre-approved here for FREE! No SSN Required https://bit.ly/3RJVozI

#buyahouse#firsttimebuyer#firsttimehomebuyer#homebuyer#realestate#mortgage#mortgagebroker#homeloan#homeowner#homeownership#housing#fha#fhaloan#applynow#real estate#buyahome

0 notes

Text

Are you seeking greater flexibility when it comes to credit requirements? Dive into our blog post for insights into the distinctions between credit requirements and discover the five key factors that set FHA loans apart from VA loans. Explore how FHA connections can simplify your loan application process by reducing paperwork.

1 note

·

View note

Text

FHA Mortgage Loans in Anaheim, California-The Landing Mamba (thelendingmamba.com)

Unlock Your Dream Home with FHA Loans!

Homebuyers! Are you ready to turn your homeownership dreams into reality? Say hello to FHA loans – your ticket to purchasing your dream home with ease and affordability. Here at The Landing Mamba, we're excited to guide you through the ins and outs of FHA loans and help you take that exciting step towards homeownership. Let's dive in!

What Are FHA Loans?

FHA loans, backed by the Federal Housing Administration, are designed to make homeownership more accessible for individuals and families. These loans offer several benefits that set them apart from conventional mortgages, making them an attractive option for first-time buyers and beyond.

Benefits of FHA Loans:

🔑 Low Down Payment: With an FHA loan in California, you can purchase a home with as little as 3.5% down, making homeownership more achievable, especially for those who may not have a large savings fund.

🔑 Flexible Credit Requirements: Don't let a less-than-perfect credit score hold you back! FHA loans typically have more lenient credit requirements, allowing you to qualify even if you have had some credit challenges in the past.

🔑 Competitive Interest Rates: Enjoy competitive interest rates with FHA loans, ensuring that you get a great deal on your mortgage and save money over the life of your loan.

🔑 Streamlined Refinancing Options: Already own a home? FHA loans offer streamlined refinancing options, making it easy to refinance your existing loan and potentially lower your monthly payments.

Why Choose The Landing Mamba for Your FHA Loan?

🌟 Expert Guidance: Our team of mortgage professionals is here to guide you through every step of the FHA loan process, ensuring that you feel confident and informed every step of the way.

🌟 Personalized Service: We understand that every homebuyer is unique, which is why we offer personalized service tailored to your individual needs and goals.

🌟 Dedicated Support: From pre-approval to closing, we're with you every step of the way, providing dedicated support and assistance to make your homeownership journey as smooth as possible.

Ready to Get Started?

If you're ready to take the next step towards homeownership, The Landing Mamba is here to help. Contact us today to learn more about FHA loans and discover how you can unlock the door to your dream home. Your journey to homeownership starts here!

FHA loans involve unique considerations and may not be suitable for all buyers. Be sure to consult with a qualified mortgage advisor to determine the best financing option for your individual needs.

#FHALoan#FHA#FirstTimeHomebuyer#Homeownership#Mortgage#RealEstate#HomeLoan#LowDownPayment#CreditScore#FHAapproved#HomeBuying#HouseHunting#PropertyOwnership#GovernmentLoan#FHALoanLimits#AffordableHousing#HUDHome#FHAStreamline#FHARefinance#fhaloanprocess

0 notes

Text

TYPES OF FHA HOME LOAN

FHA home loan offers several types of loans designed to help individuals and families purchase or refinance homes. These loans are typically more accessible to borrowers with lower credit scores and smaller down payments compared to conventional mortgages. Here are some of the main types of FHA loans

Traditional Mortgage: A mortgage that finances a primary residence.

Home Equity Conversion Mortgage: A reverse mortgage that allows homeowners ages 62+ to exchange home equity for cash.

203(k) Mortgage Program: A mortgage that includes extra funds to cover the cost of repairs, renovations, and home improvements.

Energy Efficient Mortgage Program: A mortgage that includes extra funds to pay for energy-efficient home improvements.

Section 245(a) Loan: A Graduated Payment Mortgage (GPM) has a low initial monthly payment that increases over time. A Growing Equity Mortgage (GEM) has scheduled increases in monthly principal payments to shorten the loan term.

0 notes

Video

youtube

First Time Home Buyer Guide to Orlando

Buying your first home in Orlando is an exciting and significant achievement. By following these tips and tricks, you can navigate the home buying process with confidence and make informed decisions along the way. Remember to start saving early, determine your affordability, explore mortgage options, research first-time home buyer assistance programs, compare mortgage rates and fees, gather necessary paperwork,

Obtain a preapproval letter, choose a reliable real estate agent, narrow down your ideal house and neighborhood, and stick to your budget. Apply here https://www.cambridgehomeloan.com/application.

With careful planning and preparation, you'll soon find yourself settling into your new home and enjoying all that Orlando has to offer. Happy house hunting! https://www.cambridgehomeloan.com/fha-loan-orlando-florida/

#youtube#https://youtu.be/fADehSD-6i0#firsttimehomebuyer#first time home buyer#first time home buyer orlando#bestmortgagerateorlando#fha loan orlando#fhaloan#fha loans

0 notes