#estate tax repeal bill

Text

#us politics#twitter#tweet#republicans#conservatives#gop policy#gop platform#gop#sen. bernie sanders#vermont#independent#2023#estate tax repeal bill#national debt#tax the billionaires#tax the 1%#walton family#elon musk#jeff bezos

631 notes

·

View notes

Text

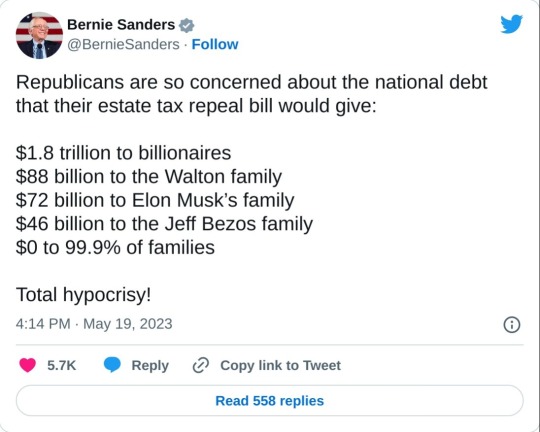

The vast majority of the Senate Republican caucus united last week to introduce a bill that would permanently repeal the estate tax, targeting one of the few provisions in the U.S. tax code that solely affects the richest 0.1% of Americans.

Led by Sen. John Thune (South Dakota), the top Republican on the Senate Subcommittee on Taxation and Internal Revenue Service Oversight, 40 Republicans reintroduced their bill to ensure that ultra-rich individuals seeking to hand off tens of millions of dollars — or more — to their heirs can do so completely tax-free. The extremely regressive proposal has been a longtime goal of Republicans, who have already massively watered down the estate tax in past years.

Currently, the estate tax threshold is $12.9 million, and nearly $26 million for couples. Amounts under this are exempted from taxes. This is nearly triple the threshold from 2016 and earlier, as Republicans more than doubled the estate tax cutoff in their major tax overhaul in 2017. The threshold is now so high that it is estimated that less than 0.1% of Americans are subject to the tax.

Evidently, these tax cuts are still not enough for Republicans, who had tried to repeal the tax altogether in 2017. In a press release on the bill, Thune, Senate Minority Leader Mitch McConnell (R-Kentucky) and Sen. Mike Crapo (R-Idaho) attempted to couch their support of the repeal in efforts to supposedly support farmers — claims that reveal themselves to be a farce when more closely examined.

“For years I have fought to protect farm and ranch families from the onerous and unfair death tax,” Thune said. “Family-owned farms and ranches often bear the brunt of this tax, which makes it difficult and costly to pass these businesses down to future generations.”

Thune’s statement is a misrepresentation of the truth. The vast, vast majority of “family-owned farms” are not subject to the estate tax. In 2020, a mere 0.16% of farm estates owed the tax, according to data from the Economic Research Service of the U.S. Department of Agriculture. This is an exceedingly small number of farms. As the Tax Policy Center estimated, only 50 farms total paid any estate tax in 2017, and this research was done before lawmakers doubled the threshold.

The criticism of the estate tax in defense of farmers is disingenuous for another reason, as Inequality.org pointed out in a blog post this week. The tax code “already has provisions that protect the very few families with farms and businesses subject to estate tax,” wrote Institute for Policy Studies associate fellow and senior adviser for Patriotic Millionaires Bob Lord. “If the bill sponsors truly cared about family farms, ranches, and businesses, they could have proposed legislation to expand these protections but leave the estate tax intact.”

In reality, deep-pocketed lobbyists with the Farm Bureau have long been pushing a repeal of the estate tax — and the group’s deep ties to big business and Wall Street are well documented.

Perhaps not coincidentally, repealing the estate tax would complete the loop of tax avoidance for the wealthiest Americans. The bill targets the “die” part of “buy borrow die,” a common tax dodging scheme used by the wealthy to avoid paying taxes; it is part of the reason that the wealthiest Americans are able to pay little to no taxes year over year.

In the practice of buying, borrowing, and dying, the rich first pour their wealth into assets like stocks, building up a large portfolio. Those assets are then used as collateral for taking out large loans with low interest rates — lower than, say, the income tax rate — that become a wealthy person’s spending money. Then, they die, and hand off their wealth to the next generation, maintaining their dynasty for decades to come.

At very few points do taxes come into the buy, borrow, die equation. Buying and keeping stocks doesn’t incur a tax bill. Taking out loans allows the wealthy to claim very low incomes to skirt income taxes. The estate tax is essentially the only guarantee, and even then, the wealthy have come up with extreme loopholes to dodge the estate tax, too. Republicans, then, are hoping to make tax avoidance even easier by legalizing it entirely; Lord has pointedly labeled the bill the “Billionaires Pay Zero Tax Act.”

The proposal stands in sharp contrast to progressives’ views on taxation. Pointing to extreme and growing wealth inequality, progressives have been calling for increasing taxes on the rich and specifically targeting their wealth and stock portfolios, rather than endlessly allowing the “buy” and “borrow” portions of the cycle.

#us politics#news#us senate#senate republicans#truthout#2023#taxes#tax code#estate taxes#republicans#conservatives#gop#gop policy#gop platform#sen. john thune#Senate Subcommittee on Taxation and Internal Revenue Service Oversight#tax the rich#tax the 1%#tax the wealthy#tax the billionaires#sen. mitch mcconnell#Sen. Mike Crapo#family-owned farms#department of agriculture#Tax Policy Center#Economic Research Service#Inequality.org#Patriotic Millionaires#Bob Lord#Farm Bureau

53 notes

·

View notes

Text

No Wonder Millennials Hate Capitalism

On a Friday night last month, I moderated a debate in Manhattan about whether we should scrap capitalism. It was organized by the socialist magazine Jacobin; defending capitalism were editors from the libertarian publication Reason. Tickets for all available 450 seats sold out in a day. So Jacobin moved it to a venue that holds around twice as many. The extra tickets sold out in eight hours.

When I arrived, people were lined up for blocks; walking to the door, I felt like I was on the guest list at an underground nightclub. Most attendees appeared to be in their 20s and 30s, part of a generation that is uniquely suspicious of capitalism, a system most of their elders take for granted.

The anti-Communist Victims of Communism Memorial Foundation was alarmed to find in a recent survey that 44 percent of millennials would prefer to live in a socialist country, compared with 42 percent who want to live under capitalism. For older Americans, the collapse of Communism made it seem as though there was no possible alternative to capitalism. But given the increasingly oligarchic nature of our economy, it’s not surprising that for many young people, capitalism looks like the god that failed.

Nowhere is that clearer than in the wretched tax bill passed by the Senate in the early hours of Saturday morning, which would make the rich richer and the poor poorer. According to the nonpartisan Tax Policy Center, the bill directs the largest tax cuts as a share of income to the top 5 percent of taxpayers. By 2027, taxes on the lowest earners would go up.

Millennials, a generation maligned as entitled whiners, would be particularly hard hit. As

Ronald Brownstein argued in The Atlantic, the rich people who would benefit from the measures passed by the House and the Senate tend to be older (and whiter) than the population at large. Younger people would foot the bill, either through higher taxes, diminished public services or both. They stand to inherit an even more stratified society than the one they were born into.

Here’s one example. The Senate bill offers a tax break for parents whose children attend private school. But it cuts deductions for state and local taxes, which could

make it harder to fund the public schools where the vast majority of millennials will send their kids.

There is no coherent economic rationale for what Republicans are doing. Academic economists are

basically unanimous that the Republican tax plan would increase America’s deficit, which Republicans used to pretend to care about. With unemployment low, many experts say the economy doesn’t need a stimulus. The tax cuts are likely to increase the trade deficit, which President Trump purportedly wants to reduce. Republicans often say they want to simplify the tax code, but as the accountant Tony Nitti argues in Forbes, the tax bill would make much of it more complex.

How to explain this smash-and-grab legislative looting, which violates all principles of economic prudence? Part of it is simple greed, but there’s also an ideology at work, one that sees the rich as more productive and deserving than others. Louise Linton, the wife of Treasury Secretary Steven Mnuchin, spelled it out on her Instagram feed in August, responding to an Oregon mother who had the audacity to criticize Linton’s use of a government plane: “Lololol. Have you given more to the economy than me and my husband? Either as an individual earner in taxes OR in self sacrifice to your country?”

Lest you think that’s just the sputtering of a modern Marie-Antoinette with poor grammar, consider what Senator Chuck Grassley, Republican of Iowa, told The Des Moines Register about the need to repeal the estate tax, which falls only on heirs of multimillionaires and billionaires. “I think not having the estate tax recognizes the people that are investing, as opposed to those that are just spending every darn penny they have, whether it’s on booze or women or movies,” he said. By this logic, Linton, or Trump’s children, are more socially useful than anyone irresponsible enough to live paycheck to paycheck.

Not to be outdone, the next day, Senator Orrin Hatch, Republican of Utah, argued that Congress still hasn’t reauthorized the Children’s Health Insurance Program, which he helped create and still claims to support, because “we don’t have money anymore.” He went on to rant against the poor: “I have a rough time wanting to spend billions and billions and trillions of dollars to help people who won’t help themselves — won’t lift a finger — and expect the federal government to do everything.” It was unclear whether he was talking about the nearly nine million children covered through CHIP or their parents.

After the fall of Communism, capitalism came to seem like the modern world’s natural state, like the absence of ideology rather than an ideology itself. The Trump era is radicalizing because it makes the rotten morality behind our inequalities so manifest. It’s not just the occult magic of the market that’s enriching Ivanka Trump’s children while health insurance premiums soar and public school budgets wither. It’s the raw exercise of power by a tiny unaccountable minority that believes in its own superiority. You don’t have to want to abolish capitalism to understand why the prospect is tempting to a generation that’s being robbed.

1 note

·

View note

Text

HEATHER COX RICHARDSON

January 18, 2023 (Wednesday)

One of the promises House speaker Kevin McCarthy (R-CA) made to the extremist members of the Republican conference to win his position was that he would let them bring the so-called Fair Tax Act to the House floor for a vote. On January 8, Representative Earl “Buddy” Carter (R-GA) introduced the measure into Congress.

The measure repeals all existing income taxes, payroll taxes, and estate and gift taxes, replacing them with a flat national sales tax of 30% on all purchased goods, rents, and services (which its advocates nonsensically call a 23% tax because, as Bloomberg opinion writer Matthew Yglesias explains their thinking: “if something sells for $100 plus $30 in tax, then it’s a 23% tax—because $30 is 23% of $130”). The measure abolishes the Internal Revenue Service, leaving it up to the states to administer the tax.

The bill says the measure will “promote freedom, fairness, and economic opportunity.” But a 30% sales tax on everything doesn’t seem to do much for fairness or economic opportunity for all, since it would, of course, hit Americans with less money to spend far harder than it would Americans with more money to spend. And the end of income, gift, and estate taxes would be a windfall for the wealthy. Such a bill is not going to pass this Congress, and if it did, President Biden would not sign it.

Two days after Carter introduced the measure, Biden said to the press: “National sales tax, that’s a great idea. It would raise taxes on the middle class by taxing thousands of everyday items from groceries to gas, while cutting taxes for the wealthiest Americans.” He promised he would never agree to any such legislation.

But the measure is illuminating. It explicitly rejects the position, and the principles, of the original Republican Party.

Members of the Republican Party invented the U.S. income tax during the Civil War, and they created the precursor to the IRS to collect it. To find money to fight the war, they raised tariffs on common products but immediately turned to the novel idea of an income tax, and a graduated one at that, to make sure that “the burdens will be more equalized on all classes of the community, more especially on those who are able to bear them,” as Senator William Pitt Fessenden (R-ME) put it. Justin Smith Morrill (R-VT) agreed. “The weight [of] taxation must be distributed equally,” he said, “Not upon each man an equal amount, but a tax proportionate to his ability to pay.”

The Republicans then quite deliberately constructed a national system for collecting the new taxes. In the midst of the Civil War, they urged their colleagues to imagine what would happen if a disloyal state were permitted to manage the collection itself. A Democratic legislature could simply refuse, and the government might perish for lack of funds to support the troops. The government had a right to “demand” 99 percent of a man’s property for an urgent necessity, Morrill said. When the public required it, “the property of the people…belongs to the Government.”

Today’s Republicans are taking a position opposite to the one that the men who formed the Republican Party did during the Civil War. They want to get rid of the income tax and put state governments in charge of the nation’s revenue system. Wording in the measure suggests that this change is because state governments have expertise in sales taxes, but it is no accident that the plan dismantles the federal system that Civil War Republicans accurately noted gives Americans “a sense of personal responsibility in the safety and stability of the nation.”

This radical tax bill strikes a blow for states' rights, much as the southern leaders the original Republicans stood against did in the 1860s. It is far easier for a minority to take over a state and impose its will on a majority there than it is to do the same at the national level. And Republicans are definitely working to cement their control in the states.

In The Nation yesterday, Joan Walsh pulled together some of the many stories of voter suppression that have come lately from Republican-dominated states. Former Georgia Senator Kelly Loeffler recently noted that her state’s 2021 law cutting way back on mail-in ballots helped elect Republicans: Walsh points out that mail-in ballots dropped by 81% between 2020 and 2022, and Black voter turnout dropped.

Robert Spindell, an election commissioner in Wisconsin who was one of Trump’s fake electors in 2020, wrote an email to about 1700 people saying that Republicans “can be especially proud of the City of Milwaukee (80.2% Dem Vote) casting 37,000 less votes than cast in the 2018 election with the major reduction happening in the overwhelming Black and Hispanic areas.” Senator Ron Johnson won reelection in that race over Democratic candidate Mandela Barnes, who is from Milwaukee, by about 27,000 votes.

In Florida, Missouri, and Ohio, Republican lawmakers are trying to make it harder for citizens to use ballot initiatives, as progressive policies like Medicaid expansion, the legalization of marijuana, hikes in the minimum wage, abortion rights, and redistricting by independent commissions have all turned out to be popular.

And on Monday, in New Mexico, Solomon Peña, an unsuccessful Republican candidate for the state legislature last year, was arrested for allegedly hiring men to shoot at the homes of four Democratic elected officials.By taking control of the states, Republicans can impose their will. Centering taxation there, rather than the federal government, is one more way to try to make people conform to their worldview.

Tucked inside the proposed tax measure is broad government oversight of a state's poorer citizens. It provides an option for “qualified” families to get a rebate, but each member of the household must be registered annually with the state. Every member of the family over the age of 21 must certify in writing that all family members have been listed, that they are all legal residents of the U.S., and that none “were incarcerated on the family determination date.” Incarceration is defined as anyone “incarcerated in a local, State, or Federal jail, prison, mental hospital, or other institution.”

This measure will not pass in this Congress, but it is striking proof that the modern Republican Party has abandoned not only its original principles, but even its more recent philosophy of “freedom” from an intrusive government.

0 notes

Video

youtube

The Republican Rebrand, Exposed

The Republican Party is trying to rebrand itself as the party of the working class.

Rubbish. Republicans can spout off all the catchy slogans about blue jeans and beer they want, but actions speak louder than words. But let’s look at what they’re actually doing.

Did they vote for the American Rescue Plan? No. Not a single Republican in Congress voted for stimulus checks and extra unemployment benefits needed by millions of American workers.

So what have they voted for? Well, every single one of them voted for Trump’s 2017 tax cut for the wealthy and corporations, of which 83 percent of the benefits go to the richest 1 percent over a decade.

They claimed corporations would use the savings from the tax cut to invest in their workers. In reality, corporations used their tax savings to buy back shares of their own stock in order to boost share values. And some corporations then fired large portions of their workforce. Not very pro-worker, if you ask me.

Have they voted for any taxes on the wealthy? No. Quite the opposite. Republicans refuse to tax the rich. They’ve even been trying to get rid of the estate tax, which only applies to estates worth at least $11.7 million for individuals and $23.4 million for married couples. Working class my foot.

Have they backed a bill to raise the minimum wage to $15 an hour, which a majority of Americans favor? No. Republicans refuse to raise the minimum wage even though it would give 32 million workers a raise. That’s about a fifth of the entire U.S. workforce.

Do they support unions, which empower workers to get better pay and benefits? No again. To the contrary: Republicans have enacted right-to-work laws in 28 states, decimating unions’ bargaining power and enabling businesses to exploit their workers.

And when it comes to strengthening labor laws, only five out of 211 Republicans voted for the PRO Act in the House -- the toughest labor law legislation in a generation.

How about the historic union drive at the Bessemer, Alabama Amazon warehouse, which Joe Biden and almost all Democrats have strongly backed? Just one Republican spoke out in support. All others have been dead silent.

What about backing regulations that keep workers safe? Nope. In fact, they didn’t bat an eye when Trump rolled back child labor protections, undid worker safeguards from exposure to cancerous radiation, and gutted measures that shield workers from wage theft.

Do they support overtime? No. They allowed Trump to eliminate overtime for 8 million workers, and continue to repeat the corporate lie about “job-killing regulations.”

What about expanding access to healthcare to all working people? Not a chance. Republicans at the state level have blocked Medicaid expansion and enacted Medicaid work requirements, while Republicans in Congress have tried for years to repeal the entirety of the Affordable Care Act. If they succeeded, they would have stripped healthcare away from more than 20 million working Americans.

So don’t fall for the Republican Party’s “working class” rebrand. It’s a cruel hoax. The GOP doesn’t give a fig about working people. It is, and always will be, the party of big business and billionaires.

#Republican Party#GOP#working class#labor unions#minimum wage#corporate tax#worker safety#overtime#healthcare#video#videos

312 notes

·

View notes

Text

Debts that can't be paid, won't be paid

It’s been just over a year since the death of activist, writer and anthropologist Gavid Graeber — a brilliant speaker, writer and thinker who helped give us Occupy, “we are the 99%” and “Bullshit Jobs.”

On the anniversary of David’s death, his widow Nika Dubrovsky convened the first “Art Project” discussion, a fascinating debate between Thomas Piketty and Michael Hudson, a pair of political economists whose work is neatly bridged by Graeber’s own.

https://www.youtube.com/watch?v=GWT0uvBLDbo

Piketty, of course, is the bestselling French economist whose 2013 Capital in the 21st Century was an unlikely, 700+ page viral hit, describing with rare lucidity the macroeconomics that drive capitalism towards cruel and destabilizing inequality

https://memex.craphound.com/2014/06/24/thomas-pikettys-capital-in-the-21st-century/

Hudson, meanwhile, is the debt-historian and economist whose haunting phrase “Debts that can’t be paid, won’t be paid,” is a perfect and irrefutable summation of the inevitable downfall of any system that relies on household debt to drive consumption.

https://pluralistic.net/2020/03/24/grandparents-optional-party/#jubilee

Like Hudson, Graeber was obsessed with the history and politics of debt. His 2012 book “Debt: The First 5,000 years” influenced not just Piketty’s work, but the work of many non-economists, including a large group of science fiction writers.

https://www.tor.com/2012/04/16/the-best-science-fiction-ideas-in-any-non-fiction-ever-david-graebers-debt-the-first-five-thousand-years/

Like Piketty, Graeber was capable of writing extremely long books that were so engaging that people actually read them, absorbing complex and nuanced subjects. DEBT clocked in at 534 pages, and not a dud among them.

And like both Hudson and Piketty, Graeber was obsessed with long timescales and the ways that history is pressed into service to assert that various political situations are inevitable products of human nature, meaning that there’s no point in asking for a fairer system.

In Debt, Graeber reaches back 5,000 years to question (among other things), the “money story” that money was created by individuals who wanted to make barter more efficient, settling on coins as a way to make change for someone who wants a cow but only has chickens to trade.

Graeber shows the “confluence of needs” theory of money to be a fairy tale, something that orthodox economists literally made up as the “most likely” source of money, without ever asking historians about what the record tells us about the origins of money.

Which is a pity, because historians know a lot about this stuff! For example, they can tell you about the Babylonian use of ledgers to record the issuance and redemption of debt in the largely agricultural economy of the day.

This early money would be recognizable to farmers today: during planting season, a share of the eventual harvest is promised in exchange for the inputs needed to plant, nurture and reap the crops.

Like Graeber, Hudson also treats Babylonian policy as key to economics — specifically, the Babylonian understanding that “debts that can’t be paid, won’t be paid,” which is why the state would periodically declare a jubilee in which all debts were declared void.

Without these periodic jubilees, the entire productive economy is swallowed up by debt service — every poor harvest or other unforseeable circumstance drives producers (who are also debtors) further into debt, whose interest creates an inescapable gravity.

Without some way to escape debt’s gravity, all productive labor becomes oriented toward debt-service, and the economy grinds to a halt. If this sounds familiar, you’re probably paying attention to today’s political economy:

https://pluralistic.net/2021/05/19/zombie-debt/#damnation

Piketty also works in long timescales, though his historical analysis is an order of magnitude more recent that Hudston or Graeber’s. At Capital XXI’s core is a data-set, painstakingly assembled by Piketty and his grad students over more than a decade.

That data-set traces “capital flows” (the distribution of wealth and income) for 300+ years, rigorously traced and normalized, so that we can understand things like the relative degree of inequality in different societies over centuries.

Famously, Piketty concludes that no matter how fast an economy is growing — no matter how productive its makers are — that wealth grows faster, making the takers who financed growth even richer than the people whose work is propelling the economy.

This fundamental truth (expressed in economic notation as r > g, or “return on capital is greater than economic growth”) means that “meritocracy” is a lie: the richest people in a market economy aren’t the people who do the best work, it’s the people who started off rich.

Like Hudson, Piketty’s work looks at the relationship between inequality and instability: Piketty uses his data to show that inequality crises trigger political crises, and that high degrees of inequality precede upheavals like the French Revolution and the World Wars.

Given all that, a discussion between Piketty and Hudson, convened in Graeber’s memory, is bound to be fascinating, and they don’t disappoint (if you prefer text to video, check out Naked Capitalism’s transcript):

https://www.nakedcapitalism.com/2021/09/michael-hudson-and-thomas-piketty-debate-inequality-debt-and-reform.html

Here’s my highlight reel of the discussion, with commentary. Hudson opens with a skeptical take on Piketty’s conclusion to Capital XXI, in which he proposes a global wealth tax. Such a tax is nearly impossible to enforce, says Hudson — unlike a jubilee.

Hudson says the source of today’s global vast fortunes is not earnings or income — rather, it’s central banks’ subsidy of the value of stocks and bonds, through rock-bottom interest rates, bond guarantees, etc. These fuel speculative bear markets that run up asset prices.

These state-subsidized fortunes are pumped into the financial markets, becoming the loans that everyone else has to pay debt on, just to survive. As in ancient times, the finance sector eventually swallows the productive economy whole. Without jubilee, you get collapse.

This is true within rich economies, but it’s even more pronounced in the relations between poor debtor countries who were coerced into taking on massive debts by the IMF, who are going to pay an ever-larger share of their GDP to offshore creditors as the economy slows.

The only way for poor countries to service those debts is by imposing crushing austerity, which means starving domestic producers of investment, education and health services, reducing productivity, requiring more austerity — until the whole thing collapses.

Remember: debts that can’t be paid, won’t be paid. It’s an iron law, and cannot be repealed — not by austerity, not by “better management,” not by “living within your means.” Can’t be paid = won’t be paid.

Piketty doesn’t dispute any of this, saying that he’s reconsidered some of the solutions in Capital XXI in light of subsequent events, like the pathetically inadequate global minimum corporate tax of 15%, which only rich countries’ treasuries will get to participate in.

Piketty points to his followup to Capital XXI, the even weightier (and sadly less influential) Capital and Ideology for his more up-to-date thinking on the way to address inequality and instability.

https://www.theguardian.com/books/2020/feb/19/capital-and-ideology-by-thomas-piketty-review-if-inequality-is-illegitimate-why-not-reduce-it

He reiterates his thesis that inequality self-corrects, thanks to the instability it engenders. Left on their own, market economies collapse, torn apart by the bill for guards to defend lenders’ fortunes, the bill for interest payments that enrich lenders.

Impose sufficient austerity and brutality on a society and the cost of defending it exceeds the wealth its productive sector manages to produce, and boom — French Revolution, the World Wars, etc.

Piketty proposes that mounting “catastrophic climate change” might precipitate the next crisis, which is certainly a safe bet, though of course, the question is whether that crisis will come after the point of no return for a habitable planet.

Hudson has ideas about how we might hasten transformative change without risking civilizational collapse. He points out that Piketty’s work identifies inherited wealth as inequality’s wellspring and points out that estate taxes are much more enforceable than wealth taxes.

Certainly, inherited wealth is a live issue today. The latest installment of Propublica’s essential IRS Papers reporting shows how the richest Americans abuse a bizarre loophole to avoid ANY tax on indescribably vast estates:

https://www.propublica.org/article/more-than-half-of-americas-100-richest-people-exploit-special-trusts-to-avoid-estate-taxes

No one knows exactly how much tax avoidance grantor retained annuity trusts (GRATs) drive, because they are shrouded in secrecy. In 2013, the lawyer who created GRATs said they’d allowed the ultra-wealthy to evade $100b in taxes. Their use has increased since then.

Another lever for reducing inequality is political competition. Hudson points out that during the Cold War, capitalist states took steps to prevent runaway inequality in a bid to show that market economies were more stable than centralized, planned economies.

Hudson suggests that competition with China might serve that function today. Without forgiving China for its autocracy and human rights abuses, he gives favorable marks to its economic planners for reining in the finance sector.

It’s true that China intervened heavily in credit markets during the covid crisis, to prevent rentiers from destroying productive businesses that couldn’t service their debts during lockdown, preserving larges swathes of otherwise vulnerable productive firms.

He reminds us that the original meaning of “free market” was “a market free from rents,” where unproductive creditors were not allowed to lay a private tax on productive manufacturers.

https://locusmag.com/2021/03/cory-doctorow-free-markets/

Today, the meaning has been reversed — a market is “free” if creditors face no limits on rent-extraction.

But there’s good reason to be skeptical of claims that China’s economy is being well-managed, as Anne Stevenson-Yang writes.

https://www.forbes.com/sites/annestevenson-yang/2021/09/25/chairman-xi-chinas-looming-crisis-and-the-myth-of-infallibility/

Stevenson-Yang paints a picture of chaotic state management of the Chinese economy, hidden by state-owned media and its rosy outlook. Watchwords like “common prosperity” are empty buzzwords, used to paper over self-interested, corrupt business practices.

State initiatives measure progress through short-term, easily gamed KPIs, something she says is documented in Red Roulette: “a new book written by a disaffected property developer named Desmond Shum.”

https://www.simonandschuster.com/books/Red-Roulette/Desmond-Shum/9781982156152

Now, I’m willing to stipulate that for investors and property developers “corruption” or “incompetence” might be indistinguishable from what the rest of us would call good governance, but some of Stevenson-Yang’s charges seem factual and well-made.

42I found the discussion between Piketty and Hudson fascinating, and if there was anything more that I’d add, it would be a dose of technopolitics (unsurprisingly). After all, technology has a huge bearing on the timing and nature of the shifts that both economists study.

For Piketty, inequality-driven instability collapses when the cost of guard-labor rises too high to bear — other words, eventually, a society gets so unequal that it costs more to stave off guillotines than even the ultrarich can afford.

For Hudson, debt-driven instability collapses when debtors begin to default because they have no ability to service their debts.

Technology changes the nature of both of these collapses.

Take guard labor: mass surveillance and technological controls make it cheaper than at any time in history to isolate and neutralize political threats to elite rule.

How much cheaper? Well, in 1989, the Stasi employed one in sixty East Germans to spy on the whole nation.

Today, the NSA spies on the whole world, at a spy:subject ratio that’s more like 1:10,000 — two orders of magnitude more efficient than the spies of a generation ago. That’s a huge productivity gain, and it’s all thanks to digital technology.

When it comes to debtor default, the tension is between coercion and ability to pay. Yes, “debts that can’t be paid, won’t be paid,” but “can’t be aid” is not a hard limit — it turns on how much the debtor is willing to hurt themselves and their loved ones to make payments.

Every mafia armbreaker knows this. When someone can’t pay their debts, you can break their arm and they’ll cash in their kids’ college fund and secretly remortgage their house to make the next payment.

When that runs out, if you threaten to break their legs, the debtor will start breaking into cars. Eventually, this comes to an end, when the debtor goes to prison for 25 years. But in the meantime, coercive force can wring a fair amount of blood from the stone.

Debtor coercion has been transformed by digital technology, from an artisanal, retail handicraft to a scaled up, industrial practice.

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

We don’t need the threat of repo men to keep you paying your car note — miss a Tesla payment and your car will phone home and lock its doors. When the tow arrives, it will flash its lights, honk its horn and back out of its parking space for repossession.

The ability to digitally repossess, or partially repossess (as in India, where loan-shark cellphone companies disable your most-used apps if you miss a payment) the tools you rely on for life and livelihood makes it cost-effective to apply coercion at scale.

Cheap guard-labor and cheap coercion mean that crisis can be deferred for ever-longer timescales. Thus, societies up the only kind of debt that really matters: policy debt. Lives are ruined, productive capacity tanked, the planet poisoned.

Add tech to Piketty or Hudson’s analysis and things start to look a lot less self-correcting, and the odds tilt against our civilization, our species and our planet. If a correction only comes after the point of no return, we’re in very deep shit indeed.

41 notes

·

View notes

Text

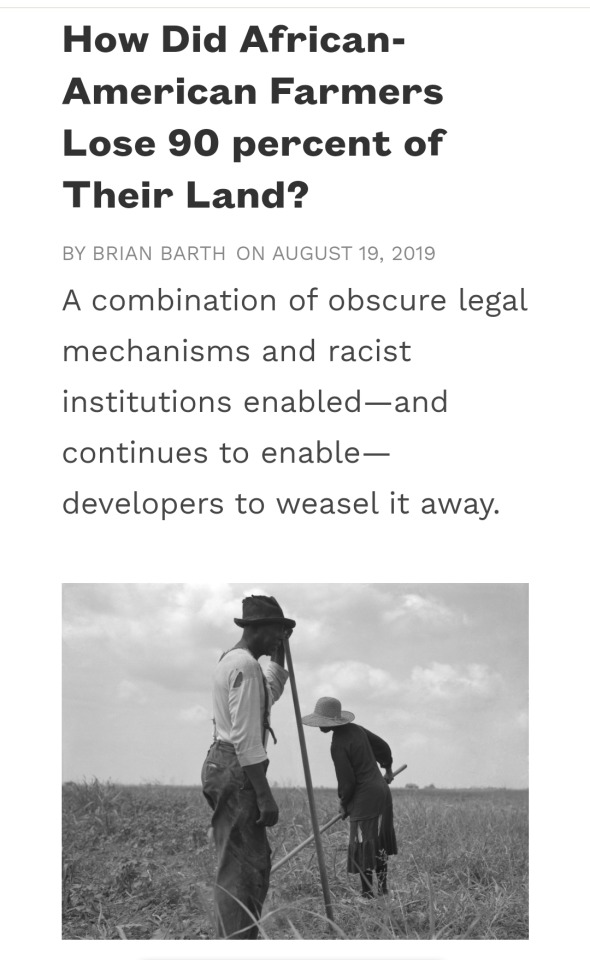

It has taken 150 years for the reparations conversation to be given the seriousness it has always been due. Yet often overlooked in the discussion is that African-Americans, realizing the 40 acres was not forthcoming, worked to buy their own land after the war—land that served not only as a source of income, but as a bedrock of physical safety and familial stability over generations. That land has since been, in many cases, weaseled away from their heirs through dubious legal manoeuvres. And the weaseling continues today.

By the turn of the 20th century, former slaves and their descendants had amassed 14 million acres of land. Black agriculture was a powerhouse; per capita there were more black farmers than white farmers. But by the turn of the 21st century, 90 percent of that land was lost. Some of that can be chalked up to the Great Migration, when southern blacks fled to northern cities to escape the racist violence and systemic oppression of the South. Less known is the story of those who stayed in rural areas and their efforts to hold on to their land within a legal system that seemed designed to shift it — and the generational wealth it represented — to white ownership.

The legal avenues for finagling land from black farmers vary by state and the circumstances surrounding the property and its ownership. Here’s a sampling of how it works.

Heirs Property

Whether due to distrust of the legal system or lack of access to legal resources, freed slaves and their descendants often lacked a will transferring ownership of their property when they died. This means the property became “heirs property”—ownership is split equally among all known descendants; over time, the property is further split among the descendants of the descendants, creating over the course of generations a quagmire of ownership among hundreds, even thousands, of heirs. To use heirs property as collateral on a mortgage, to subdivide it, to develop it—and any number of other things of a legally binding nature—is difficult without first identifying and tracking down every heir, and gaining consent from each one.

Partition Sales

The descendants of slaves are by no means the only people dealing with the intractable issues associated with heirs property, but they deal with it in disproportionate numbers, at least in southern states (an estimated 40 percent of black-owned land is heirs property). For many Americans, property ownership is an unequivocal key to building and maintaining wealth across generations. But compared to property owners in possession of a clear title, heir’s property owners face tremendous practical and financial barriers to deriving wealth from their land. Oddly, one of the few things heir’s owners can do without the consent of all the other owners is to sell their portion of the property. The problem is that if just one owner sells, real estate laws in many places provide the new non-hereditary owner with a variety of means to obtain the entire property, often at below market rates—a process commonly referred to as a partition sale.

Torrens Acts

Historically, many states had what’s called a Torrens Act, which were originally intended to simplify title registry. But in a strange legal idiosyncrasy, these laws also serve as loopholes that allow third parties to force families off their land through partition sales. This is because when one owner/family member sells, Torrens rules help to shield them from recourse by other owners/family members, who in some instances may not even be notified of the sale until they are served an eviction notice.

Tax Sales

In high-demand areas where land value has skyrocketed (much black-owned heirs property lies in tourist areas along the coasts of North and South Carolina), property taxes go up accordingly. But if your goal is to stay on your land, rather than flip it, and you’re on a fixed income, chances are you at some point you’ll be unable to afford your annual property taxes. The county then has the right to put the property on the auction block—a common way for developers to access land from families who don’t want to sell.

Progress?

Some states have repealed Torrens legislation, but it is still a common means of dispossession within southern US. There is also a movement afoot to reform regulations governing partition sales, with a law called the Uniform Partition of Heirs Property Act, which according to ProPublica has now been adopted in 14 states. Another small sign of progress is a measure in last years Farm Bill that allows owners of heirs property to apply for various USDA programs, such as loans and crop insurance, for the first time.

CORRECTION, May 14, 2020: An earlier version of this story stated that the Uniform Partition of Heirs Property Act had not been adopted in many southern states. At the time, five southern states had adopted it. We apologize for the error.

14 notes

·

View notes

Text

I wanted to snip this because I believe the incoming administration will try to erase and change facts/history to suit them so here is a hot link and one in the title. I hope the copy traveled well because it was so large!

https://www.whitehouse.gov/trump-administration-accomplishments/

As of January 2021

Trump Administration Accomplishments

Unprecedented Economic Boom

Before the China Virus invaded our shores, we built the world’s most prosperous economy.

America gained 7 million new jobs – more than three times government experts’ projections.

Middle-Class family income increased nearly $6,000 – more than five times the gains during the entire previous administration.

The unemployment rate reached 3.5 percent, the lowest in a half-century.

Achieved 40 months in a row with more job openings than job-hirings.

More Americans reported being employed than ever before – nearly 160 million.

Jobless claims hit a nearly 50-year low.

The number of people claiming unemployment insurance as a share of the population hit its lowest on record.

Incomes rose in every single metro area in the United States for the first time in nearly 3 decades.

Delivered a future of greater promise and opportunity for citizens of all backgrounds.

Unemployment rates for African Americans, Hispanic Americans, Asian Americans, Native Americans, veterans, individuals with disabilities, and those without a high school diploma all reached record lows.

Unemployment for women hit its lowest rate in nearly 70 years.

Lifted nearly 7 million people off of food stamps.

Poverty rates for African Americans and Hispanic Americans reached record lows.

Income inequality fell for two straight years, and by the largest amount in over a decade.

The bottom 50 percent of American households saw a 40 percent increase in net worth.

Wages rose fastest for low-income and blue collar workers – a 16 percent pay increase.

African American homeownership increased from 41.7 percent to 46.4 percent.

Brought jobs, factories, and industries back to the USA.

Created more than 1.2 million manufacturing and construction jobs.

Put in place policies to bring back supply chains from overseas.

Small business optimism broke a 35-year old record in 2018.

Hit record stock market numbers and record 401ks.

The DOW closed above 20,000 for the first time in 2017 and topped 30,000 in 2020.

The S&P 500 and NASDAQ have repeatedly notched record highs.

Rebuilding and investing in rural America.

Signed an Executive Order on Modernizing the Regulatory Framework for Agricultural Biotechnology Products, which is bringing innovative new technologies to market in American farming and agriculture.

Strengthened America’s rural economy by investing over $1.3 billion through the Agriculture Department’s ReConnect Program to bring high-speed broadband infrastructure to rural America.

Achieved a record-setting economic comeback by rejecting blanket lockdowns.

An October 2020 Gallup survey found 56 percent of Americans said they were better off during a pandemic than four years prior.

During the third quarter of 2020, the economy grew at a rate of 33.1 percent – the most rapid GDP growth ever recorded.

Since coronavirus lockdowns ended, the economy has added back over 12 million jobs, more than half the jobs lost.

Jobs have been recovered 23 times faster than the previous administration’s recovery.

Unemployment fell to 6.7 percent in December, from a pandemic peak of 14.7 percent in April – beating expectations of well over 10 percent unemployment through the end of 2020.

Under the previous administration, it took 49 months for the unemployment rate to fall from 10 percent to under 7 percent compared to just 3 months for the Trump Administration.

Since April, the Hispanic unemployment rate has fallen by 9.6 percent, Asian-American unemployment by 8.6 percent, and Black American unemployment by 6.8 percent.

80 percent of small businesses are now open, up from just 53 percent in April.

Small business confidence hit a new high.

Homebuilder confidence reached an all-time high, and home sales hit their highest reading since December 2006.

Manufacturing optimism nearly doubled.

Household net worth rose $7.4 trillion in Q2 2020 to $112 trillion, an all-time high.

Home prices hit an all-time record high.

The United States rejected crippling lockdowns that crush the economy and inflict countless public health harms and instead safely reopened its economy.

Business confidence is higher in America than in any other G7 or European Union country.

Stabilized America’s financial markets with the establishment of a number of Treasury Department supported facilities at the Federal Reserve.

Tax Relief for the Middle Class

Passed $3.2 trillion in historic tax relief and reformed the tax code.

Signed the Tax Cuts and Jobs Act – the largest tax reform package in history.

More than 6 million American workers received wage increases, bonuses, and increased benefits thanks to the tax cuts.

A typical family of four earning $75,000 received an income tax cut of more than $2,000 – slashing their tax bill in half.

Doubled the standard deduction – making the first $24,000 earned by a married couple completely tax-free.

Doubled the child tax credit.

Virtually eliminated the unfair Estate Tax, or Death Tax.

Cut the business tax rate from 35 percent – the highest in the developed world – all the way down to 21 percent.

Small businesses can now deduct 20 percent of their business income.

Businesses can now deduct 100 percent of the cost of their capital investments in the year the investment is made.

Since the passage of tax cuts, the share of total wealth held by the bottom half of households has increased, while the share held by the top 1 percent has decreased.

Over 400 companies have announced bonuses, wage increases, new hires, or new investments in the United States.

Over $1.5 trillion was repatriated into the United States from overseas.

Lower investment cost and higher capital returns led to faster growth in the middle class, real wages, and international competitiveness.

Jobs and investments are pouring into Opportunity Zones.

Created nearly 9,000 Opportunity Zones where capital gains on long-term investments are taxed at zero.

Opportunity Zone designations have increased property values within them by 1.1 percent, creating an estimated $11 billion in wealth for the nearly half of Opportunity Zone residents who own their own home.

Opportunity Zones have attracted $75 billion in funds and driven $52 billion of new investment in economically distressed communities, creating at least 500,000 new jobs.

Approximately 1 million Americans will be lifted from poverty as a result of these new investments.

Private equity investments into businesses in Opportunity Zones were nearly 30 percent higher than investments into businesses in similar areas that were not designated Opportunity Zones.

Massive Deregulation

Ended the regulatory assault on American Businesses and Workers.

Instead of 2-for-1, we eliminated 8 old regulations for every 1 new regulation adopted.

Provided the average American household an extra $3,100 every year.

Reduced the direct cost of regulatory compliance by $50 billion, and will reduce costs by an additional $50 billion in FY 2020 alone.

Removed nearly 25,000 pages from the Federal Register – more than any other president. The previous administration added over 16,000 pages.

Established the Governors’ Initiative on Regulatory Innovation to reduce outdated regulations at the state, local, and tribal levels.

Signed an executive order to make it easier for businesses to offer retirement plans.

Signed two executive orders to increase transparency in Federal agencies and protect Americans and their small businesses from administrative abuse.

Modernized the National Environmental Policy Act (NEPA) for the first time in over 40 years.

Reduced approval times for major infrastructure projects from 10 or more years down to 2 years or less.

Helped community banks by signing legislation that rolled back costly provisions of Dodd-Frank.

Established the White House Council on Eliminating Regulatory Barriers to Affordable Housing to bring down housing costs.

Removed regulations that threatened the development of a strong and stable internet.

Eased and simplified restrictions on rocket launches, helping to spur commercial investment in space projects.

Published a whole-of-government strategy focused on ensuring American leadership in automated vehicle technology.

Streamlined energy efficiency regulations for American families and businesses, including preserving affordable lightbulbs, enhancing the utility of showerheads, and enabling greater time savings with dishwashers.

Removed unnecessary regulations that restrict the seafood industry and impede job creation.

Modernized the Department of Agriculture’s biotechnology regulations to put America in the lead to develop new technologies.

Took action to suspend regulations that would have slowed our response to COVID-19, including lifting restrictions on manufacturers to more quickly produce ventilators.

Successfully rolled back burdensome regulatory overreach.

Rescinded the previous administration’s Affirmatively Furthering Fair Housing (AFFH) rule, which would have abolished zoning for single-family housing to build low-income, federally subsidized apartments.

Issued a final rule on the Fair Housing Act’s disparate impact standard.

Eliminated the Waters of the United States Rule and replaced it with the Navigable Waters Protection Rule, providing relief and certainty for farmers and property owners.

Repealed the previous administration’s costly fuel economy regulations by finalizing the Safer Affordable Fuel Efficient (SAFE) Vehicles rule, which will make cars more affordable, and lower the price of new vehicles by an estimated $2,200.

Americans now have more money in their pockets.

Deregulation had an especially beneficial impact on low-income Americans who pay a much higher share of their incomes for overregulation.

Cut red tape in the healthcare industry, providing Americans with more affordable healthcare and saving Americans nearly 10 percent on prescription drugs.

Deregulatory efforts yielded savings to the medical community an estimated $6.6 billion – with a reduction of 42 million hours of regulatory compliance work through 2021.

Removed government barriers to personal freedom and consumer choice in healthcare.

Once fully in effect, 20 major deregulatory actions undertaken by the Trump Administration are expected to save American consumers and businesses over $220 billion per year.

Signed 16 pieces of deregulatory legislation that will result in a $40 billion increase in annual real incomes.

Fair and Reciprocal Trade

Secured historic trade deals to defend American workers.

Immediately withdrew from the job-killing Trans-Pacific Partnership (TPP).

Ended the North American Free Trade Agreement (NAFTA), and replaced it with the brand new United States-Mexico-Canada Agreement (USMCA).

The USMCA contains powerful new protections for American manufacturers, auto-makers, farmers, dairy producers, and workers.

The USMCA is expected to generate over $68 billion in economic activity and potentially create over 550,000 new jobs over ten years.

Signed an executive order making it government policy to Buy American and Hire American, and took action to stop the outsourcing of jobs overseas.

Negotiated with Japan to slash tariffs and open its market to $7 billion in American agricultural products and ended its ban on potatoes and lamb.

Over 90 percent of American agricultural exports to Japan now receive preferential treatment, and most are duty-free.

Negotiated another deal with Japan to boost $40 billion worth of digital trade.

Renegotiated the United States-Korea Free Trade Agreement, doubling the cap on imports of American vehicles and extending the American light truck tariff.

Reached a written, fully-enforceable Phase One trade agreement with China on confronting pirated and counterfeit goods, and the protection of American ideas, trade secrets, patents, and trademarks.

China agreed to purchase an additional $200 billion worth of United States exports and opened market access for over 4,000 American facilities to exports while all tariffs remained in effect.

Achieved a mutual agreement with the European Union (EU) that addresses unfair trade practices and increases duty-free exports by 180 percent to $420 million.

Secured a pledge from the EU to eliminate tariffs on American lobster – the first United States-European Union negotiated tariff reduction in over 20 years.

Scored a historic victory by overhauling the Universal Postal Union, whose outdated policies were undermining American workers and interests.

Engaged extensively with trade partners like the EU and Japan to advance reforms to the World Trade Organization (WTO).

Issued a first-ever comprehensive report on the WTO Appellate Body’s failures to comply with WTO rules and interpret WTO agreements as written.

Blocked nominees to the WTO’s Appellate Body until WTO Members recognize and address longstanding issues with Appellate Body activism.

Submitted 5 papers to the WTO Committee on Agriculture to improve Members’ understanding of how trade policies are implemented, highlight areas for improved transparency, and encourage members to maintain up-to-date notifications on market access and domestic support.

Took strong actions to confront unfair trade practices and put America First.

Imposed tariffs on hundreds of billions worth of Chinese goods to protect American jobs and stop China’s abuses under Section 232 of the Trade Expansion Act of 1962 and Section 301 of the Trade Act of 1974.

Directed an all-of-government effort to halt and punish efforts by the Communist Party of China to steal and profit from American innovations and intellectual property.

Imposed tariffs on foreign aluminum and foreign steel to protect our vital industries and support our national security.

Approved tariffs on $1.8 billion in imports of washing machines and $8.5 billion in imports of solar panels.

Blocked illegal timber imports from Peru.

Took action against France for its digital services tax that unfairly targets American technology companies.

Launched investigations into digital services taxes that have been proposed or adopted by 10 other countries.

Historic support for American farmers.

Successfully negotiated more than 50 agreements with countries around the world to increase foreign market access and boost exports of American agriculture products, supporting more than 1 million American jobs.

Authorized $28 billion in aid for farmers who have been subjected to unfair trade practices – fully funded by the tariffs paid by China.

China lifted its ban on poultry, opened its market to beef, and agreed to purchase at least $80 billion of American agricultural products in the next two years.

The European Union agreed to increase beef imports by 180 percent and opened up its market to more imports of soybeans.

South Korea lifted its ban on American poultry and eggs, and agreed to provide market access for record exports of American rice.

Argentina lifted its ban on American pork.

Brazil agreed to increase wheat imports by $180 million a year and raised its quotas for purchases of United States ethanol.

Guatemala and Tunisia opened up their markets to American eggs.

Won tariff exemptions in Ecuador for wheat and soybeans.

Suspended $817 million in trade preferences for Thailand under the Generalized System of Preferences (GSP) program due to its failure to adequately provide reasonable market access for American pork products.

The amount of food stamps redeemed at farmers markets increased from $1.4 million in May 2020 to $1.75 million in September 2020 – a 50 percent increase over last year.

Rapidly deployed the Coronavirus Food Assistance Program, which provided $30 billion in support to farmers and ranchers facing decreased prices and market disruption when COVID-19 impacted the food supply chain.

Authorized more than $6 billion for the Farmers to Families Food Box program, which delivered over 128 million boxes of locally sourced, produce, meat, and dairy products to charity and faith-based organizations nationwide.

Delegated authorities via the Defense Production Act to protect breaks in the American food supply chain as a result of COVID-19.

American Energy Independence

Unleashed America’s oil and natural gas potential.

For the first time in nearly 70 years, the United States has become a net energy exporter.

The United States is now the number one producer of oil and natural gas in the world.

Natural gas production reached a record-high of 34.9 quads in 2019, following record high production in 2018 and in 2017.

The United States has been a net natural gas exporter for three consecutive years and has an export capacity of nearly 10 billion cubic feet per day.

Withdrew from the unfair, one-sided Paris Climate Agreement.

Canceled the previous administration’s Clean Power Plan, and replaced it with the new Affordable Clean Energy rule.

Approved the Keystone XL and Dakota Access pipelines.

Opened up the Arctic National Wildlife Refuge (ANWR) in Alaska to oil and gas leasing.

Repealed the last administration’s Federal Coal Leasing Moratorium, which prohibited coal leasing on Federal lands.

Reformed permitting rules to eliminate unnecessary bureaucracy and speed approval for mines.

Fixed the New Source Review permitting program, which punished companies for upgrading or repairing coal power plants.

Fixed the Environmental Protection Agency’s (EPA) steam electric and coal ash rules.

The average American family saved $2,500 a year in lower electric bills and lower prices at the gas pump.

Signed legislation repealing the harmful Stream Protection Rule.

Reduced the time to approve drilling permits on public lands by half, increasing permit applications to drill on public lands by 300 percent.

Expedited approval of the NuStar’s New Burgos pipeline to export American gasoline to Mexico.

Streamlined Liquefied natural gas (LNG) terminal permitting and allowed long-term LNG export authorizations to be extended through 2050.

The United States is now among the top three LNG exporters in the world.

Increased LNG exports five-fold since January 2017, reaching an all-time high in January 2020.

LNG exports are expected to reduce the American trade deficit by over $10 billion.

Granted more than 20 new long-term approvals for LNG exports to non-free trade agreement countries.

The development of natural gas and LNG infrastructure in the United States is providing tens of thousands of jobs, and has led to the investment of tens of billions of dollars in infrastructure.

There are now 6 LNG export facilities operating in the United States, with 2 additional export projects under construction.

The amount of nuclear energy production in 2019 was the highest on record, through a combination of increased capacity from power plant upgrades and shorter refueling and maintenance cycles.

Prevented Russian energy coercion across Europe through various lines of effort, including the Partnership for Transatlantic Energy Cooperation, civil nuclear deals with Romania and Poland, and opposition to Nord Stream 2 pipeline.

Issued the Presidential Permit for the A2A railroad between Canada and Alaska, providing energy resources to emerging markets.

Increased access to our country’s abundant natural resources in order to achieve energy independence.

Renewable energy production and consumption both reached record highs in 2019.

Enacted policies that helped double the amount of electricity generated by solar and helped increase the amount of wind generation by 32 percent from 2016 through 2019.

Accelerated construction of energy infrastructure to ensure American energy producers can deliver their products to the market.

Cut red tape holding back the construction of new energy infrastructure.

Authorized ethanol producers to sell E15 year-round and allowed higher-ethanol gasoline to be distributed from existing pumps at filling stations.

Ensured greater transparency and certainty in the Renewable Fuel Standard (RFS) program.

Negotiated leasing capacity in the Strategic Petroleum Reserve to Australia, providing American taxpayers a return on this infrastructure investment.

Signed an executive order directing Federal agencies to work together to diminish the capability of foreign adversaries to target our critical electric infrastructure.

Reformed Section 401 of the Clean Water Act regulation to allow for the curation of interstate infrastructure.

Resolved the OPEC (Organization of the Petroleum Exporting Countries) oil crisis during COVID-19 by getting OPEC, Russia, and others to cut nearly 10 million barrels of production a day, stabilizing world oil prices.

Directed the Department of Energy to use the Strategic Petroleum Reserve to mitigate market volatility caused by COVID-19.

Investing in America’s Workers and Families

Affordable and high-quality Child Care for American workers and their families.

Doubled the Child Tax Credit from $1,000 to $2,000 per child and expanded the eligibility for receiving the credit.

Nearly 40 million families benefitted from the child tax credit (CTC), receiving an average benefit of $2,200 – totaling credits of approximately $88 billion.

Signed the largest-ever increase in Child Care and Development Block Grants – expanding access to quality, affordable child care for more than 800,000 low-income families.

Secured an additional $3.5 billion in the Coronavirus Aid, Relief, and Economic Security (CARES) Act to help families and first responders with child care needs.

Created the first-ever paid family leave tax credit for employees earning $72,000 or less.

Signed into law 12-weeks of paid parental leave for Federal workers.

Signed into law a provision that enables new parents to withdraw up to $5,000 from their retirement accounts without penalty when they give birth to or adopt a child.

Advanced apprenticeship career pathways to good-paying jobs.

Expanded apprenticeships to more than 850,000 and established the new Industry-Recognized Apprenticeship programs in new and emerging fields.

Established the National Council for the American Worker and the American Workforce Policy Advisory Board.

Over 460 companies have signed the Pledge to America’s Workers, committing to provide more than 16 million job and training opportunities.

Signed an executive order that directs the Federal government to replace outdated degree-based hiring with skills-based hiring.

Advanced women’s economic empowerment.

Included women’s empowerment for the first time in the President’s 2017 National Security Strategy.

Signed into law key pieces of legislation, including the Women, Peace, and Security Act and the Women Entrepreneurship and Economic Empowerment Act.

Launched the Women’s Global Development and Prosperity (W-GDP) Initiative – the first-ever whole-of-government approach to women’s economic empowerment that has reached 24 million women worldwide.

Established an innovative new W-GDP Fund at USAID.

Launched the Women Entrepreneurs Finance Initiative (We-Fi) with 13 other nations.

Announced a $50 million donation on behalf of the United States to We-Fi providing more capital to women-owned businesses around the world.

Released the first-ever Strategy on Women, Peace, and Security, which focused on increasing women’s participation to prevent and resolve conflicts.

Launched the W-GDP 2x Global Women’s Initiative with the Development Finance Corporation, which has mobilized more than $3 billion in private sector investments over three years.

Ensured American leadership in technology and innovation.

First administration to name artificial intelligence, quantum information science, and 5G communications as national research and development priorities.

Launched the American Broadband Initiative to promote the rapid deployment of broadband internet across rural America.

Made 100 megahertz of crucial mid-band spectrum available for commercial operations, a key factor to driving widespread 5G access across rural America.

Launched the American AI Initiative to ensure American leadership in artificial intelligence (AI), and established the National AI Initiative Office at the White House.

Established the first-ever principles for Federal agency adoption of AI to improve services for the American people.

Signed the National Quantum Initiative Act establishing the National Quantum Coordination Office at the White House to drive breakthroughs in quantum information science.

Signed the Secure 5G and Beyond Act to ensure America leads the world in 5G.

Launched a groundbreaking program to test safe and innovative commercial drone operations nationwide.

Issued new rulemaking to accelerate the return of American civil supersonic aviation.

Committed to doubling investments in AI and quantum information science (QIS) research and development.

Announced the establishment of $1 billion AI and quantum research institutes across America.

Established the largest dual-use 5G test sites in the world to advance 5G commercial and military innovation.

Signed landmark Prague Principles with America’s allies to advance the deployment of secure 5G telecommunications networks.

Signed first-ever bilateral AI cooperation agreement with the United Kingdom.

Built collation among allies to ban Chinese Telecom Company Huawei from their 5G infrastructure.

Preserved American jobs for American workers and rejected the importation of cheap foreign labor.

Pressured the Tennessee Valley Authority (TVA) to reverse their decision to lay off over 200 American workers and replace them with cheaper foreign workers.

Removed the TVA Chairman of the Board and a TVA Board Member.

Life-Saving Response to the China Virus

Restricted travel to the United States from infected regions of the world.

Suspended all travel from China, saving thousands of lives.

Required all American citizens returning home from designated outbreak countries to return through designated airports with enhanced screening measures, and to undergo a self-quarantine.

Announced further travel restrictions on Iran, the Schengen Area of Europe, the United Kingdom, Ireland, and Brazil.

Issued travel advisory warnings recommending that American citizens avoid all international travel.

Reached bilateral agreements with Mexico and Canada to suspend non-essential travel and expeditiously return illegal aliens.

Repatriated over 100,000 American citizens stranded abroad on more than 1,140 flights from 136 countries and territories.

Safely transported, evacuated, treated, and returned home trapped passengers on cruise ships.

Took action to authorize visa sanctions on foreign governments who impede our efforts to protect American citizens by refusing or unreasonably delaying the return of their own citizens, subjects, or residents from the United States.

Acted early to combat the China Virus in the United States.

Established the White House Coronavirus Task Force, with leading experts on infectious diseases, to manage the Administration’s efforts to mitigate the spread of COVID-19 and to keep workplaces safe.

Pledged in the State of the Union address to “take all necessary steps to safeguard our citizens from the Virus,” while the Democrats’ response made not a single mention of COVID-19 or even the threat of China.

Declared COVID-19 a National Emergency under the Stafford Act.

Established the 24/7 FEMA National Response Coordination Center.

Released guidance recommending containment measures critical to slowing the spread of the Virus, decompressing peak burden on hospitals and infrastructure, and diminishing health impacts.

Implemented strong community mitigation strategies to sharply reduce the number of lives lost in the United States down from experts’ projection of up to 2.2 million deaths in the United States without mitigation.

Halted American funding to the World Health Organization to counter its egregious bias towards China that jeopardized the safety of Americans.

Announced plans for withdrawal from the World Health Organization and redirected contribution funds to help meet global public health needs.

Called on the United Nations to hold China accountable for their handling of the virus, including refusing to be transparent and failing to contain the virus before it spread.

Re-purposed domestic manufacturing facilities to ensure frontline workers had critical supplies.

Distributed billions of pieces of Personal Protective Equipment, including gloves, masks, gowns, and face shields.

Invoked the Defense Production Act over 100 times to accelerate the development and manufacturing of essential material in the USA.

Made historic investments of more than $3 billion into the industrial base.

Contracted with companies such as Ford, General Motors, Philips, and General Electric to produce ventilators.

Contracted with Honeywell, 3M, O&M Halyard, Moldex, and Lydall to increase our Nation’s production of N-95 masks.

The Army Corps of Engineers built 11,000 beds, distributed 10,000 ventilators, and surged personnel to hospitals.

Converted the Javits Center in New York into a 3,000-bed hospital, and opened medical facilities in Seattle and New Orleans.

Dispatched the USNS Comfort to New York City, and the USNS Mercy to Los Angeles.

Deployed thousands of FEMA employees, National Guard members, and military forces to help in the response.

Provided support to states facing new emergences of the virus, including surging testing sites, deploying medical personnel, and advising on mitigation strategies.

Announced Federal support to governors for use of the National Guard with 100 percent cost-share.

Established the Supply Chain Task Force as a “control tower” to strategically allocate high-demand medical supplies and PPE to areas of greatest need.

Requested critical data elements from states about the status of hospital capacity, ventilators, and PPE.

Executed nearly 250 flights through Project Air Bridge to transport hundreds of millions of surgical masks, N95 respirators, gloves, and gowns from around the world to hospitals and facilities throughout the United States.

Signed an executive order invoking the Defense Production Act to ensure that Americans have a reliable supply of products like beef, pork, and poultry.

Stabilized the food supply chain restoring the Nation’s protein processing capacity through a collaborative approach with Federal, state, and local officials and industry partners.

The continued movement of food and other critical items of daily life distributed to stores and to American homes went unaffected.

Replenished the depleted Strategic National Stockpile.

Increased the number of ventilators nearly ten-fold to more than 153,000.

Despite the grim projections from the media and governors, no American who has needed a ventilator has been denied a ventilator.

Increased the number of N95 masks fourteen-fold to more than 176 million.

Issued an executive order ensuring critical medical supplies are produced in the United States.

Created the largest, most advanced, and most innovative testing system in the world.

Built the world’s leading testing system from scratch, conducting over 200 million tests – more than all of the European Union combined.

Engaged more than 400 test developers to increase testing capacity from less than 100 tests per day to more than 2 million tests per day.

Slashed red tape and approved Emergency Use Authorizations for more than 300 different tests, including 235 molecular tests, 63 antibody tests, and 11 antigen tests.

Delivered state-of-the-art testing devices and millions of tests to every certified nursing home in the country.

Announced more flexibility to Medicare Advantage and Part D plans to waive cost-sharing for tests.

Over 2,000 retail pharmacy stores, including CVS, Walmart, and Walgreens, are providing testing using new regulatory and reimbursement options.

Deployed tens of millions of tests to nursing homes, assisted living facilities, historically black colleges and universities (HBCUs), tribes, disaster relief operations, Home Health/Hospice organizations, and the Veterans Health Administration.

Began shipping 150 million BinaxNOW rapid tests to states, long-term care facilities, the IHS, HBCUs, and other key partners.

Pioneered groundbreaking treatments and therapies that reduced the mortality rate by 85 percent, saving over 2 million lives.

The United States has among the lowest case fatality rates in the entire world.

The Food and Drug Administration (FDA) launched the Coronavirus Treatment Acceleration Program to expedite the regulatory review process for therapeutics in clinical trials, accelerate the development and publication of industry guidance on developing treatments, and utilize regulatory flexibility to help facilitate the scaling-up of manufacturing capacity.

More than 370 therapies are in clinical trials and another 560 are in the planning stages.

Announced $450 million in available funds to support the manufacturing of Regeneron’s antibody cocktail.

Shipped tens of thousands of doses of the Regeneron drug.

Authorized an Emergency Use Authorization (EUA) for convalescent plasma.

Treated around 100,000 patients with convalescent plasma, which may reduce mortality by 50 percent.

Provided $48 million to fund the Mayo Clinic study that tested the efficacy of convalescent plasma for patients with COVID-19.

Made an agreement to support the large-scale manufacturing of AstraZeneca’s cocktail of two monoclonal antibodies.

Approved Remdesivir as the first COVID-19 treatment, which could reduce hospitalization time by nearly a third.

Secured more than 90 percent of the world’s supply of Remdesivir, enough to treat over 850,000 high-risk patients.

Granted an EUA to Eli Lilly for its anti-body treatments.

Finalized an agreement with Eli Lilly to purchase the first doses of the company’s investigational antibody therapeutic.

Provided up to $270 million to the American Red Cross and America’s Blood Centers to support the collection of up to 360,000 units of plasma.

Launched a nationwide campaign to ask patients who have recovered from COVID-19 to donate plasma.

Announced Phase 3 clinical trials for varying types of blood thinners to treat adults diagnosed with COVID-19.

Issued an EUA for the monoclonal antibody therapy bamlanivimab.

FDA issued an EUA for casirivimab and imdevimab to be administered together.

Launched the COVID-19 High Performance Computing Consortium with private sector and academic leaders unleashing America’s supercomputers to accelerate coronavirus research.

Brought the full power of American medicine and government to produce a safe and effective vaccine in record time.

Launched Operation Warp Speed to initiate an unprecedented drive to develop and make available an effective vaccine by January 2021.

Pfizer and Moderna developed two vaccines in just nine months, five times faster than the fastest prior vaccine development in American history.

Pfizer and Moderna’s vaccines are approximately 95 effective – far exceeding all expectations.

AstraZeneca and Johnson & Johnson also both have promising candidates in the final stage of clinical trials.

The vaccines will be administered within 24 hours of FDA-approval.

Made millions of vaccine doses available before the end of 2020, with hundreds of millions more to quickly follow.

FedEx and UPS will ship doses from warehouses directly to local pharmacies, hospitals, and healthcare providers.

Finalized a partnership with CVS and Walgreens to deliver vaccines directly to residents of nursing homes and long-term care facilities as soon as a state requests it, at no cost to America’s seniors.

Signed an executive order to ensure that the United States government prioritizes getting the vaccine to American citizens before sending it to other nations.

Provided approximately $13 billion to accelerate vaccine development and to manufacture all of the top candidates in advance.

Provided critical investments of $4.1 billion to Moderna to support the development, manufacturing, and distribution of their vaccines.

Moderna announced its vaccine is 95 percent effective and is pending FDA approval.

Provided Pfizer up to $1.95 billion to support the mass-manufacturing and nationwide distribution of their vaccine candidate.

Pfizer announced its vaccine is 95 percent effective and is pending FDA approval.

Provided approximately $1 billion to support the manufacturing and distribution of Johnson & Johnson’s vaccine candidate.

Johnson & Johnson’s vaccine candidate reached the final stage of clinical trials.

Made up to $1.2 billion available to support AstraZeneca’s vaccine candidate.

AstraZeneca’s vaccine candidate reached the final stage of clinical trials.

Made an agreement to support the large-scale manufacturing of Novavax’s vaccine candidate with 100 million doses expected.