#equity trading account

Text

What is Forex Trading and How Does it Work?

You want to know what is Forex Trading and How Does it Work? Here, Aaditya Wealthon provides all info about best forex trading platform & forex trading account opening in India. Like, Benefits of Forex Trading, How to Start Forex Trading, etc. Visit our blog to get detailed information on Forex Trading!

#about forex trading#forex trading account opening in India#best forex trading platform#become a profitable trader#equity trading account#lowest brokerage charges in India for trading#best trader platform

0 notes

Text

The easiest way to invest and trade in stocks, derivatives, mutual funds, and more. HMA Trading is a well-established trading company that offers a wide range of services to its clients. For more info visit our website https://www.hmatrading.in/

#open free demat account#make money in stock market#Stock market trading#Equity#Derivatives#Commodities#Currency Trading#Trading Account#Mutual Funds#financial needs

4 notes

·

View notes

Link

To guide you to be the partial owners of the company you expect to make the profits from, we at Lakshmishree Investments are one of the best Stock Brokers in India to serve the people with the clear picture of what Investing in Stock Market looks like. You can visit us at https://www.lakshmishree.com/equity to know more about Equity Investments or call us at (022) 43431818.

#investment in share market#procedure of opening a demat account#demat opening procedure#laxmishree investment#lakshmi shree#lakshmi shree investment#equity broking#equity trading basics

2 notes

·

View notes

Text

OCBC Online Equities Account Review - Buy shares from OCBC's Digital Banking App! 0.05% commissions for SG, US and HK Markets!

Good news for OCBC customers!

You can now buy shares directly with your OCBC Digital Banking App via OCBC’s Online Equities Account (OEA).

This means you can bank and trade all on one app, so you don’t need to go through the hassle of accessing different accounts or apps.

Even better? You can fund your trades directly from your OCBC account, which is especially useful if you have a lot of foreign…

View On WordPress

#financial horse#financial horse blog#free amazon stock 2023#Investments#ocbc amazon stock promo 2023#ocbc app 2023#ocbc app review 2023#ocbc banking app 2023#ocbc banking review#ocbc online equities account promo#ocbc online equities account review#ocbc promo 2023#ocbc review#ocbc trading 2023#ocbc trading app#ocbc trading platform#ocbc trading stocks 2023#REITs#Singapore Stocks

0 notes

Text

How to choose a genuine and trusted financial advisor in India?

Below factors to considered when choosing a genuine and right financial advisor in India for intraday trading:

SEBI registration of Companies: Make sure the advisor is registered with the Securities and Exchange Board of India (SEBI). This means that they have met the necessary requirements to provide investment advice in India.

Experience and track record: Look for an advisor with experience in intraday trading and a proven track record of success. You can check their website or social media pages for testimonials from past clients.

Fee structure: Understand how much the advisor charges for their services. There are two main types of fees: a percentage of your assets under management (AUM) and a flat fee. AUM fees are typically lower, but they can be more expensive if you have a small portfolio. Flat fees are more consistent, but they can be more expensive if you have a large portfolio.

Investment style: Some advisors specialize in a particular investment style, such as fundamental analysis or technical analysis. It's important to find an advisor who shares your investment philosophy.

Communication style: Make sure you feel comfortable communicating with the advisor. You should be able to ask questions and get clear answers.

Availability: Intraday trading is a fast-paced market, so you need an advisor who is available to provide you with timely updates.

Some additional tips for choosing a financial advisor for intraday trading in India :

Get multiple quotes: Don't just choose the first advisor you come across. Get quotes from several different advisors before making a decision.

Do your research: Read online reviews and testimonials before you meet with an advisor to Open a Demat Account

Meet with the advisor in person: This will give you a chance to ask questions and get a feel for their personality and investment style.

Trust your gut: If you don't feel comfortable with an advisor, don't work with them. There are plenty of other advisors out there who would be happy to help you with your intraday trading needs.

Here are some of the top intraday trading advisors in India:

ABJ Finstocks

Angel One

Motilal Oswal

CapitalVia

Moneycontrol

Contact for more updates with us on [email protected]

Phone Contacts : +917607600040, +918299351944

#Financial and Investment Services for Demat#Financial and Investment Advisory Services in Lucknow#Demat Accounts#Equity Trading

1 note

·

View note

Text

#share market#demat account#best demat account lowest brokerage#investment#long term investment#option trading#equity trading

0 notes

Text

What is Equity Market?

Equity market is where stocks and shares of organizations are exchanged. The values that are exchanged an equity market are either over the counter or at stock exchanges. Frequently called as stock market or offer market, an equity market permits sellers and buyers to bargain in equity or shares in a similar stage. Priorities straight, it is essential in any case a decent comprehension of what is equity market in the Indian setting. Equity market, frequently called as stock market or offer market, is where shares of organizations or elements are exchanged. The market permits sellers and buyers to bargain in equity or shares in a similar stage.

#equity market#equity trading#equity trading accounts#equity trading account online in India#online equity trading

1 note

·

View note

Text

Invest to Equity share market in delhi

Benefits of investing in the equity market through share market brokers in Delhi. If, you wanted to get a profit through the Equity share market. so, you should meet to the best advisor. and Tulsi Wealth Pvt Ltd is providing the best advisor so you can get this opportunity and grow your wealth.

Visit For More Info:- https://www.tulsiwealth.com/equity-trading.php

Website:- WWW.tulsiwealth.com

Address :- 21/4, Chhoti Subzi Mandi, B Block, JanakPuri, New Delhi- 110058.

E-mail :- [email protected]

Contactno. :- 9654530807

1 note

·

View note

Text

All You Should Know About Opening a Demat Account!

Discover how to start investing in equity investments with the best stock market broker in India! Learn about trading brokerage charges, opening a free online demat account, and open a mutual fund account online for your equity trading needs. Start your investment journey today with Aaditya Wealthon!

#equity investments#best stock market broker in India#trading brokerage charges in India#equity trading account#open mutual fund account online#free online demat account opening

0 notes

Text

The purpose of equity trading is to buy and sell stocks in the market through your registered trading account. For an understanding of equity trading, you must first understand the concept of stocks. A company's equity is a share of ownership, and these shares are traded freely on the NSE and BSE. There are now over 4,700 listed companies on the BSE. They are referred to by different names, like equity, stock, share, etc, but they all mean the same thing.

0 notes

Text

The long, bloody lineage of private equity's looting

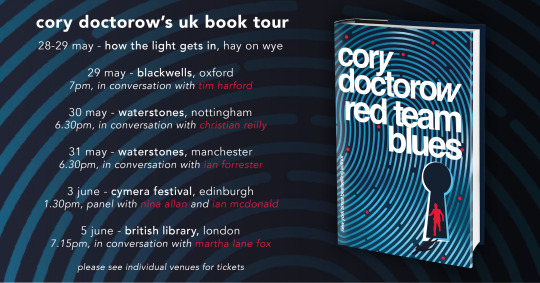

Tomorrow (June 3) at 1:30PM, I’m in Edinburgh for the Cymera Festival on a panel with Nina Allen and Ian McDonald.

Monday (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Fans of the Sopranos will remember the “bust out” as a mob tactic in which a business is taken over, loaded up with debt, and driven into the ground, wrecking the lives of the business’s workers, customers and suppliers. When the mafia does this, we call it a bust out; when Wall Street does it, we call it “private equity.”

It used to be that we rarely heard about private equity, but then, as national chains and iconic companies started to vanish, this mysterious financial arrangement popped up with increasing frequency. When a finance bro’s presentation on why Olive Garden needed to be re-orged when viral, there was a lot off snickering about the decline of a tacky business whose value prop was unlimited carbs. But the bro was working for Starboard Value, a hedge fund that specialized in buhying out and killing off companies, pocketing billions while destroying profitable businesses.

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

Starboard Value’s game was straightforward: buy a business, load it with debt, sell off its physical plant — the buildings it did business out of — pay itself, and then have the business lease back the buildings, bleeding out money until it collapsed. They pulled it with Red Lobster,and the point of the viral Olive Garden dis track was to soften up the company for its own bust out.

The bust out tactic wasn’t limited to mocking middlebrow family restaurants. For years, the crooks who ran these ops did a brisk trade in blaming the internet. Why did Sears tank? Everyone knows that the 19th century business was an antique, incapable of mounting a challenge in the age of e-commerce. That was a great smokescreen for an old-fashioned bust out that saw corporate looters make off with hundreds of millions, leaving behind empty storefronts and emptier pension accounts for the workers who built the wealth the looters stole:

https://prospect.org/economy/vulture-capitalism-killed-sears/

Same goes for Toys R Us: it wasn’t Amazon that killed the iconic toy retailer — it was the PE bosses who extracted $200m from the chain, then walked away, hands in pockets and whistling, while the businesses collapsed and the workers got zero severance:

https://www.washingtonpost.com/news/business/wp/2018/06/01/how-can-they-walk-away-with-millions-and-leave-workers-with-zero-toys-r-us-workers-say-they-deserve-severance/

It’s a good racket — for the racketeers. Private equity has grown from a finance sideshow to Wall Street’s apex predator, and it’s devouring the real economy through a string of audactious bust outs, each more consequential and depraved than the last.

As PE shows that it can turn profitable businesses gigantic windfalls, sticking the rest of us with the job of sorting out the smoking craters they leave behind, more and more investors are piling in. Today, the PE sector loves a rollup, which is when they buy several related businesses and merge them into one firm. The nominal business-case for a rollup is that the new, bigger firm is more “efficient.” In reality, a rollup’s strength is in eliminating competition. When all the pet groomers, or funeral homes, or urgent care clinics for ten miles share the same owner, they can raise prices, lower wages, and fuck over suppliers.

They can also borrow. A quirk of the credit markets is that a standalone small business is valued at about 3–5x its annual revenues. But if that business is part of a large firm, it is valued at 10–20x annual turnover. That means that when a private equity company rolls up a comedy club, ad agency or water bottler (all businesses presently experiencing PE rollup), with $1m in annual revenues, it shows up on the PE company’s balance sheet as an asset worth $10–20m. That’s $10–20m worth of collateral the PE fund can stake for loans that let it buy and roll up more small businesses.

2.9 million Boomer-owned businesses, employing 32m people, are expected to sell in the next couple years as their owners retire. Most of these businesses will sell to PE firms, who can afford to pay more for them as a prelude to a bust out than anyone intending to operate them as a productive business could ever pay:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE’s most ghastly impact is felt in the health care sector. Whole towns’ worth of emergency rooms, family practices, labs and other health firms have been scooped up by PE, which has spent more than $1t since 2012 on health acquisitions:

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

Once a health care company is owned by PE, it is significantly more likely to commit medicare fraud. It also cuts wages and staffing for doctors and nurses. PE-owned facilities do more unnecessary and often dangerous procedures. Appointments get shorter. The companies get embroiled in kickback scandals. PE-backed dentists hack away at children’s mouths, filling them full of root-canals.

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

The Healthcare Private Equity Association boasts that its members are poised to spend more than $3t to create “the future of healthcare.”

https://hcpea.org/#!event-list

As bad as PE is for healthcare, it’s worse for long-term care. PE-owned nursing homes are charnel houses, and there’s a particularly nasty PE scam where elderly patients are tricked into signing up for palliative care, which is never delivered (and isn’t needed, because the patients aren’t dying!). These fake “hospices” get huge payouts from medicare — and the patient is made permanently ineligible for future medicare, because they are recorded being in their final decline:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Every part of the health care sector is being busted out by PE. Another ugly PE trick, the “club deal,” is devouring the medical supply business. Club deals were huge in the 2000s, destroying rent-controlled housing, energy companies, Mervyn’s department stores, Harrah’s, and Old Country Joe. Now it’s doing the same to medical supplies:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

Private equity is behind the mass rollup of single-family homes across America. Wall Street landlords are the worst landlords in America, who load up your rent with junk fees, leave your home in a state of dangerous disrepair, and evict you at the drop of a hat:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

As these houses decay through neglect, private equity makes a bundle from tenants and even more borrowing against the houses. In a few short years, much of America’s desperately undersupplied housing stock will be beyond repair. It’s a bust out.

You know all those exploding trains filled with dangerous chemicals that poison entire towns? Private equity bust outs:

https://pluralistic.net/2022/02/04/up-your-nose/#rail-barons

Where did PE come from? How can these people look themselves in the mirror? Why do we let them get away with it? How do we stop them?

Today in The American Prospect, Maureen Tkacik reviews two new books that try to answer all four of these questions, but really only manage to answer the first three:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

The first of these books is These Are the Plunderers: How Private Equity Runs — and Wrecks — America by Gretchen Morgenson and Joshua Rosner:

https://www.simonandschuster.com/books/These-Are-the-Plunderers/Gretchen-Morgenson/9781982191283

The second is Plunder: Private Equity’s Plan to Pillage America, by Brendan Ballou:

https://www.hachettebookgroup.com/titles/brendan-ballou/plunder/9781541702103/

Both books describe the bust out from the inside. For example, PetSmart — looted for $30 billion by RaymondSvider and his PE fund BC Partners — is a slaughterhouse for animals. The company systematically neglects animals — failing to pay workers to come in and feed them, say, or refusing to provide backup power to run during power outages, letting animals freeze or roast to death. Though PetSmart has its own vet clinics, the company doesn’t want to pay its vets to nurse the animals it damages, so it denies them care. But the company is also too cheap to euthanize those animals, so it lets them starve to death. PetSmart is also too cheap to cremate the animals, so its traumatized staff are ordered to smuggle the dead, rotting animals into random dumpsters.

All this happened while PetSmart’s sales increased by 60%, matched by growth in the company’s gross margins. All that money went to the bust out.

https://www.forbes.com/sites/antoinegara/2021/09/27/the-30-billion-kitty-meet-the-investor-who-made-a-fortune-on-pet-food/

Tkacik says these books show that we’re finally getting wise to PE. Back in the Clinton years, the PE critique painted the perps as sharp operators who reduced quality and jacked up prices. Today, books like these paint these “investors” as the monsters they are — crooks whose bust ups are crimes, not clever finance hacks.

Take the Carlyle Group, which pioneered nursing home rollups. As Carlyle slashed wages, its workers suffered — but its elderly patients suffered more. Thousands of Carlyle “customers” died of “dehydration, gangrenous bedsores, and preventable falls” in the pre-covid years.

https://www.washingtonpost.com/business/economy/opioid-overdoses-bedsores-and-broken-bones-what-happened-when-a-private-equity-firm-sought-profits-in-caring-for-societys-most-vulnerable/2018/11/25/09089a4a-ed14-11e8-baac-2a674e91502b_story.html

KKR, another PE monster, bought a second-hand chain of homes for mentally disabled adults from another PE company, then squeezed it for the last drops of blood left in the corpse. KKR cut wages to $8/hour and increased shifts to 36 hours, then threatened to have workers who went home early arrested and charged with “patient abandonment.” Many of these homes were often left with no staff at all, with patients left to starve and stew in their own waste.

PE loves to pick on people who can’t fight back: kids, sick people, disabled people, old people. No surprise, then, that PE loves prisons — the ultimate captive audience. HIG Capital is a $55b fund that owns TKC Holdings, who got the contract to feed the prisoners at 400 institutions. They got the contract after the prisons fired Aramark, owned by PE giant Warburg Pincus, whose food was so inedible that it provoked riots. TKC got a million bucks extra to take over the food at Michigan’s Kinross Correctional Facility, then, incredibly, made the food worse. A chef who refused to serve 100 bags of rotten potatoes (“the most disgusting thing I’ve seen in my life”) was fired:

https://www.wzzm13.com/article/news/local/michigan/prison-food-worker-i-was-fired-for-refusing-to-serve-rotten-potatoes/69-467297770

TKC doesn’t just operate prison kitchens — it operates prison commissaries, where it gouges prisoners on junk food to replace the inedible slop it serves in the cafeteria. The prisoners buy this food with money they make working in the prison workshops, for $0.10–0.25/hour. Those workshops are also run by TKC.

Tkacic traces private equity back to the “corporate raiders” of the 1950s and 1960s, who “stealthily borrowed money to buy up enough shares in a small or midsized company to control its biggest bloc of votes, then force a stock swap and install himself as CEO.”

The most famous of these raiders was Eli Black, who took over United Fruit with this gambit — a company that had a long association with the CIA, who had obligingly toppled democratically elected governments and installed dictators friendly to United’s interests (this is where the term “banana republic” comes from).

Eli Black’s son is Leon Black, a notorious PE predator. Leon Black got his start working for the junk-bonds kingpin Michael Milken, optimizing Milken’s operation, which was the most terrifying bust out machine of its day, buying, debt-loading and wrecking a string of beloved American businesses. Milken bought 2,000 companies and put 200 of them through bankruptcy, leaving the survivors in a brittle, weakened state.

It got so bad that the Business Roundtable complained about the practice to Congress, calling Milken, Black, et al, “a small group is systematically extracting the equity from corporations and replacing it with debt, and incidentally accumulating major wealth.”

Black stabbed Milken in the back and tanked his business, then set out on his own. Among the businesses he destroyed was Samsonite, “a bankrupt-but-healthy company he subjected to 12 humiliating years of repeated fee extractions, debt-funded dividend payments, brutal plant closings, and hideous schemes to induce employees to buy its worthless stock.”

The money to buy Samsonite — and many other businesses — came through a shadowy deal between Black and John Garamendi, then a California insurance commissioner, now a California congressman. Garamendi helped Black buy a $6b portfolio of junk bonds from an insurance company in a wildly shady deal. Garamendi wrote down the bonds by $3.9b, stealing money “from innocent people who needed the money to pay for loved ones’ funerals, irreparable injuries, etc.”

Black ended up getting all kinds of favors from powerful politicians — including former Connecticut governor John Rowland and Donald Trump. He also wired $188m to Jeffrey Epstein for reasons that remain opaque.

Black’s shady deals are a marked contrast with the exalted political circles he travels in. Despite private equity’s obviously shady conduct, it is the preferred partner for cities and states, who buy everything from ambulance services to infrastructure from PE-owned companies, with disastrous results. Federal agencies turn a blind eye to their ripoffs, or even abet them. 38 state houses passed legislation immunizing nursing homes from liability during the start of the covid crisis.

PE barons are shameless about presenting themselves as upstanding cits, unfairly maligned. When Obama made an empty promise to tax billionaires in 2010, Blackstone founder SteveS chwarzman declared, “It’s a war. It’s like when Hitler invaded Poland in 1939.”

Since we’re on the subject of Hitler, this is a good spot to bring up Monowitz, a private-sector satellite of Auschwitz operated by IG Farben as a slave labor camp to make rubber and other materiel it supplied at a substantial markup to the wermacht. I’d never heard of Monowitz, but Tkacik’s description of the camp is chilling, even in comparison to Auschwitz itself.

Farben used slave laborers from Auschwitz to work at its rubber plant, but was frustrated by the logistics of moving those slaves down the 4.5m stretch of road to the facility. So the company bought 25,000 slaves — preferring children, who were cheaper — and installed them in a co-located death-camp called Monowitz:

https://www.commentary.org/articles/r-tannenbaum/the-devils-chemists-by-josiah-e-dubois-jr/

Monowitz was — incredibly — worse than Auschwitz. It was so bad, the SS guards who worked at it complained to Berlin about the conditions. The SS demanded more hospitals for the workers who dropped from beatings and overwork — Farben refused, citing the cost. The factory never produced a steady supply of rubber, but thanks to its gouging and the brutal treatment of its slaves, the camp was still profitable and returned large dividends to Farben’s investors.

Apologists for slavery sometimes claim that slavers are at least incentivized to maintain the health of their captive workforce. This was definitely not true of Farben. Monowitz slaves died on average after three months in the camp. And Farben’s subsidiary, Degesch, made the special Zyklon B formulation used in Auschwitz’s gas chambers.

Tkacik’s point is that the Nazis killed for ideology and were unimaginably cruel. Farben killed for money — and they were even worse. The banality of evil gets even more banal when it’s done in service to maximizing shareholder value.

As Farben historian Joseph Borkin wrote, the company “reduced slave labor to a consumable raw material, a human ore from which the mineral of life was systematically extracted”:

https://www.scribd.com/document/517797736/The-Crime-and-Punishment-of-I-G-Farben

Farben’s connection to the Nazis was a the subject of Germany’s Master Plan: The Story of Industrial Offensive, a 1943 bestseller by Borkin, who was also an antitrust lawyer. It described how Farben had manipulated global commodities markets in order to create shortages that “guaranteed Hitler’s early victories.”

Master Plan became a rallying point in the movement to shatter corporate power. But large US firms like Dow Chemical and Standard Oil waged war on the book, demanding that it be retracted. Borkin was forced into resignation and obscurity in 1945.

Meanwhile, in Nuremberg, 24 Farben executives were tried for their war crimes, and they cited their obligations to their shareholders in their defense. All but five were acquitted on this basis.

Seen in that light, the plunderers of today’s PE firms are part of a long and dishonorable tradition, one that puts profit ahead of every other priority or consideration. It’s a defense that wowed the judges at Nuremberg, so should we be surprised that it still plays in 2023?

Tkacik is frustrated that neither of these books have much to offer by way of solutions, but she understands why that would be. After all, if we can’t even close the carried interest tax loophole, how can we hope to do anything meaningful?

“Carried interest” comes up in every election cycle. Most of us assume it has something to do with “interest payments,” but that’s not true. The carried interest loophole relates to the “interest” that 16th-century sea captains had in their cargo. It’s a 600-year-old tax loophole that private equity bosses use to pay little or no tax on their billions. The fact that it’s still on the books tells you everything you need to know about whether our political class wants to do anything about PE’s plundering.

Notwithstanding Tkacik’s (entirely justified) skepticism of the weaksauce remedies proposed in these books, there is some hope of meaningful action. Private equity’s rollups are only possible because they skate under the $101m threshold for merger scrutiny. However, there is good — but unenforced — law that allows antitrust enforcers to block these mergers. This is the “incipiency standard” — Sec 7 of the Clayton Act — the idea that a relatively small merger might not be big enough to trigger enforcement action on its own, but regulators can still act to block it if it creates an incipient monopoly.

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

The US has a new crop of aggressive — fearless — top antitrust enforcers and they’ve been systematically reviving these old laws to go after monopolies.

That’s long overdue. Markets are machines for eroding our moral values: “In comparison to non-market decisions, moral standards are significantly lower if people participate in markets.”

https://web.archive.org/web/20130607154129/https://www.uni-bonn.de/Press-releases/markets-erode-moral-values

The crimes that monsters commit in the name of ideology pale in comparison to the crimes the wealthy commit for money.

Catch me on tour with Red Team Blues in Edinburgh, London, and Berlin!

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/02/plunderers/#farbenizers

[Image ID: An overgrown graveyard, rendered in silver nitrate monochrome. A green-tinted businessman with a moneybag in place of a head looms up from behind a gravestone. The right side of the image is spattered in blood.]

#pluralistic#kkr#lootersprivate equity#plunderers#books#reviews#monsters#nazis#godwin's law#godwins law#auschwitz#ig farben#pe#business#barbarians#united fruit#carried interest#corporate raiders#junk bonds#michael milliken#ensemble cast#carlyle group#monowitz#leon black

1K notes

·

View notes

Text

If you sell products for yuan instead of dollars, you are technically de-dollarizing. But what really matters for the global monetary system is not the currency in which you settle your trade, but the currency in which you accumulate your balances. If you are Saudi Arabia and you peg your currency to the dollar, you have no use for accumulating balances in yuan. You need dollar reserves. If you are Brazil and you are exporting commodities that are globally priced in dollars, you have to accumulate liquid dollar reserves. The dollar system allows large imbalances in the global economy to accumulate because the United States is unique in allowing unfettered foreign access to all of its assets, be it bonds, equities, or real estate. If the people who are advocating de-dollarization really wanted to achieve it, it would mean that China, Germany, Japan, Brazil, Saudi Arabia, etc. would no longer be able to run current account surpluses if the US no longer accommodated their surplus savings. It would mean imposing symmetry between surplus and deficit nations. Do you really think the surplus countries would want that?

20 notes

·

View notes

Text

Investing 101

Part 4 of ?

What to Buy

I've been procrastinating this post because I have a broker who provides buying/selling recommendations to me as I'm not an expert. Having said that, I can provide some information.

The first decision to make is whether to buy stocks or bonds. I explained the difference between the two in previous posts but I should add a caveat. Normally bonds are considered a safe but lower return investment to balance your portfolio and reduce risk. The moves by the Fed to control inflation however have raised interest rates on bonds to levels not seen in >40 years. For the first time in a long time, very safe bonds (ex. US Treasuries) are yielding more than equities and you can lock in those rates for a long time. Normally I'd advise a young person to avoid any bonds, but this is a strange time and some bonds would be a good investment for almost anyone. As with stocks, you can buy individual bonds or a bond fund.

What is a fund? Let's imagine that you want to own a basket of tech stocks (or bank stocks or consumer goods stocks, etc.). You could research various companies and make your purchases or you could buy a mutual fund. Mutual funds are actively managed investment pools with specific investment philosophies (ex. focused on tech stocks) - you purchase shares in the fund and the fund manager uses your money (and the $$ of other fund investors) to buy/sell shares in accordance with the philosophy/purpose of the fund. Actively managed means that there is a management team doing investment research and then buying and selling shares. Of course the management team costs money and they deduct their fee from the earnings pool prior to distributing the fund's earnings back to the owner/investors of the fund. Fund managers argue that their active management improves your earnings while lowering your risk. Detractors argue that management fees are too expensive and over the long run, investors can do better on their own (more on that later). Management fees aren't regulated (that I'm aware of) so investors have to be cautious - some funds have very expensive management fees while others are more frugal. Morningstar is a great resource for researching investments of all types, including funds.

An alternative to a Mutual Fund is an Index or Exchange Traded Fund. These funds are designed to mirror the composition and performance of an entire stock exchange (ex. NASDAQ). So if the NASDAQ goes up 10pts today, the related Index or Exchange traded fund will also go up 10pts. This is a low cost way to invest in the performance of the overall market. Many advisors recommend these investments for superior long term growth. These funds aren't actively managed by a human, but their low cost makes them a winner.

Speaking of humans, AI managed funds are increasingly a hot topic. I may own some of these funds and not even know it, but I'm not seeking AI management. In fact, automated trading can be problematic and cause 'flash crashes' for the market when every AI algorithm tries to sell at the time.

Target Date funds are another kind of mutual fund which is increasingly popular in 401Ks and 529 college savings plans. A target date fund is designed to manage risk and volatility with a specific life goal in mind. For example, you might establish a goal retirement date of 2040 and buy a Target Date fund for that year. The 2040 fund will automatically invest in higher risk/higher return equities in the first 20 years and gradually shift more of the portfolio to lower risk investments (like bonds) as your target date approaches.

Money market funds are a very low risk way to earn better returns on your emergency fund cash than allowing it to wallow in a bank savings account. A money market is a kind of mutual fund, but it owns very safe investments - the odds are very small that you'd lose money and instead you'll have a very liquid, safe investment that you can use in case of emergency.

What about individual stocks? Some investors follow the simple strategy of buying the stocks of companies whose products they know and admire. Ex, "I like my iPhone so I'm going to buy Apple stock." In >30 years of investing I have never purchased an individual stock. My rationale is that there is an entire industry of very smart people who do nothing but research and invest. The odds that I can outsmart them and pick a company which everyone else has undervalued are small. If I've read about it in the Wall Street Journal, so has everyone else and the opportunity to buy something cheap is long gone. In my opinion, buying individual stocks is like going to Vegas - of course you will hear stories of big winners, but in general the house (full time investment professionals) always wins. For a non-professional like me, the odds of selecting individual stocks and assembling a winning portfolio over the long term aren't in my favor.

16 notes

·

View notes

Text

on envoys, its history and the death in storms end.

its no secret that envoys are heavily important in asoiaf. the word ‘envoy’ is mentioned almost eighty times from agot to adwd, the word ‘envoys’ nearly thirty some times. but what is an envoy? well, envoys are representatives of governments, rulers and organisations to another institution or body of government. the name envoy itself is from the latin word ‘via’ which means ‘way’ which later develops in french as ‘en voie’ which means ‘on the way’ as well as ‘envoyer’ which means ‘send’; this later develops into old french and then old english as ‘envoi’ and then as we know it today, ‘envoy’

hence, they are the people that negotiate and develop relations from one entity to another, especially in terms of governments. they maintain peace, gather support and even intelligence. as such, they hold deep importance within their place in society and more so, in the management of state. both back then and even today, where the world has become a smaller place due to the widening sense of commonality which envoys and diplomats preserve in order to continue peace.

we know earlier populations have a sense of state and public relations, hence we also know that they try to communicate with others in order to try and regulate trade and barter as well as contract marriages and unions that would help peoples have closer bonds within the bounds of their regions. their role as messengers in ancient times was heavily relied on to maintain society together. as such for the most important of missions, some that would be sent were royal family members, at times members of the nobility. at times it was even members of the mercantile/tradesfolk or clergy. people of importance, of learned class and of economic class were taken into account as people who could represent the state and population.

one should take note that envoys were given special care when being dealt with. the essence of their importance could be traced in christian sects as being the thought that it had been the angels of heaven were the first envoys or messengers between the all powerful above and the mortals of earth. hence, they are considered inviolably certified at maintaining social balances between various states and their own homelands.

just as much, it was always needed to be ensured that these messengers and envoys were needed to be ensured as safe from harm in any sort of travel mission on behalf of their monarch or lord or their masters. as their task is considered dangerous due to the state having various enemies, there needs to be reassurances that the envoys would be safe. as such, there was this idea that had develop called ‘jus gentium’ or ‘laws of nations’; this was meant to ensure relations between foreigners and romans would exist a state of equity but it also expanded as actions that should be observed during times of unrest or war, where people would be able to treat others humanely. along this, the idea of ‘bellum justem’ or ‘just war’.

many roman commentators who believed the need to justify acts of war also thought that wars have to be formally declared first before it was carried out in the most horrible ways. but because there is ‘jus gentium’, the idea of envoys travelling in and out of the current enemy territory to give the declaration of war should observe a genuine care in how they treat an envoy. as such, it was frowned upon for an envoy to even be harmed politically, socially and religiously. rulers wanted to ensure that this goes both ways, that their own messengers who represented them by proxy would not be harrassed or harmed. otherwise, far worse could occur.

this continued on as a justified practice in medieval times as it becomes considered as a means to conduct proper relations that would ensure that they applied the ‘just gentium’ in every aspect of war. historians do agree that this was not completely the case as a whole as people in far flung edges of society like common folk, trades folk or even those of the clergy and religious orders do suffer in the concept of war. but as much as there were people who do try to resort to violence against envoys and messengers of various forms, it was frowned upon. this causes issues between states inward and outwards to the wider community of states. hence, their importance in state craft cannot be undone.

that’s why if we look at asoiaf, we can see how deeply important envoys were. in the main story we have in arya ii from agot, arya says that one of the only times she eats her meals alone was when her father had business of state, with the king or when he was welcoming envoys from various corners of the realm or elswhere:

‘she would have eaten her meals alone in her bedchamber if they let her. sometimes they did, when father had to dine with the king or some lord or the envoys from this place or that place.’

this means that ned as hand of the king has the responsibility of ensuring envoys were welcomed well, what they require of the state and the king. as such, the tradition of guest right is centered as one of the essences of ‘jus gentium’ for westeros. the northmen are the most heavy in terms of this tradition, ensuring this to be stuck to from point a to point z. this is not to say that the other kingdoms dont hold it just as sacred. the north happen to hold more tightly to those traditions.

in catelyn i, ii and iii, we have catelyn witness the treatment of envoys and how valued it is that they are treated well. in catelyn i, catelyn bears witness to her son make decisions about envoys, one about cleos frey and the theon, whom robb both send with his terms on peace to the lannisters and alliance with the greyjoys. in catelyn iiand iii, we see how catelyn is making the journey to be an envoy for her sons towards the baratheon brothers. in catelyn ii, we see how renly treated catelyn as an envoy but in catelyn iii, we see catelyn get rejected by renly on terms:

"i was at the whispering wood, my lord. i have seen enough butchery. i came here an envoy—"

"and an envoy you shall leave," renly said, "but wiser than you came. you shall see what befalls rebels with your own eyes, so your son can hear it from your own lips. we'll keep you safe, never fear."

renly, despite the opposite sides they sit on, tells catelyn that he has no intention on seeing harm brought upon her or her retinue. he tells her that he will show her what he’s capable of in terms of war, but he’s honoring the sacred duty to keep envoys like her safe from harm. this keeps within the bounds of asoiaf’s in universe logic that traces its descent from such historical context ive mentioned above. however, this is not always the case and as you saw from the title, i will be discussing what happened during the dance, at storms end and why what happened was horrifying.

what happened in storms end was a horrifying tragedy that completely ignored the established system that kept people out of harms way. this was something that perhaps had never happened before because:

1.) there was kinslaying involved, 2.) the rules of envoys were ignored and 3.) guest right was nullified without care.

and it all fell on the shoulders of aemond targaryen and borros baratheon, who had more authority and power in that situation.

from the start, we have the indication that rhaenyra targaryen had all but refused to have her sons partake in any conflict that would bring harm to themselves or others. in fire and blood, blacks and the greens, rhaenyra makes her sons swear that they will be there strictly as messengers who are delivering the words of the queen, asking for obeisance from those who swore vows to her. only when they put their hands on the seven pointed star, swearing to be true to their task, she honors them as her envoys.

“if you go, you go as messengers, not as knights,” she told them. “you must take no part in any fighting.” not until both boys had sworn solemn oaths upon a copy of the seven-pointed star would her grace consent to using them as her envoys.

rhaenyra was not someone who seemed to be interested in the faith of the seven. but the rest of her subjects do follow it as part of their lives. the idea of religion was often used as a means to attach importance to the vow, especially to the people watching them. most of westeros followed the faith of the seven. it was of great importance to show your people that you are following the proper actions of propriety, swearing upon it in front of many secularly and religiously, binds the princes into acting accordingly. most especially in front of their mother who was their queen.

but it was always ever aligned with the agenda of the blacks prior to the animosity that will be following later. the black council directly discussed that the best course of their action would be political pressure by gathering as many of the houses as they could. the greens who already decided that they were going to start removing political adversaries may it be political threats, imprisonment or death. the blacks wanted to deal with this accordingly. daemon suggested political games first before they head to war, as rhaenys suggested. people were hopeful that this could be resolved in terms of conversations and politics:

“find riders to master silverwing, vermithor, and seasmoke, and we will have nine dragons against aegon’s four. mount and fly their wild kin, and we will number twelve, even without stormcloud,” princess rhaenys pointed out. “that is how we shall win this war.”

then the prince laid his own strategies before the black council. rhaenyra must have a coronation of her own, to answer aegon’s. afterward they would send out ravens, calling on the lords of the seven kingdoms to declare their allegiance to their true queen.

“we must fight this war with words before we go to battle,” the prince declared. the lords of the great houses held the key to victory, daemon insisted; their bannermen and vassals would follow where they led.

the first battles in the dance of the dragons were fought with quills and ravens, with threats and promises, decrees and blandishments. the murder of lord beesbury at the green council was not yet widely known; most believed his lordship to be languishing in some dungeon. whilst sundry familiar faces were no longer seen about court, no heads had appeared above the castle gates, and many still hoped that the question of succession might be resolved peaceably.

its heavily noted that borros was not the type of man that was easy to deal with. his father lord boremund was faithful and strident in his support of princess rhaenys for many years. hence, it was presumed that it would have been easy to have had borros would still have his father’s honor. rhaenys had thought much of it, having been baratheon on her mother’s side. however while boremund was described as “stone, hard and strong and unmoving,”— it could not be said about borros who was “was the wind that rages and howls and blows this way and that.”

hence, it was already a difficult task when lucerys velaryon arrives as his mother’s envoy at storm’s end. his uncle aemond targaryen was sent as an envoy and had already built a sense of familiarity with borros which was relatively easy, as borros already subscribed to the values the greens are perpetuating within society. borros first and foremost was a heavy proponent of the patriarchy, he claims to love his daughters, but has little respect for their value as a person. in his eyes, the weight of a boy mattered more and equates that with the iron throne:

he had nothing against women, lord borros went on to say; he loved his girls,

a daughter is a precious thing…but a son, ahhh…should the gods ever

grant him a son of his own blood, storm’s end would pass to him, not to his sisters. “why should the iron throne be any different?”

secondly, borros saw little value in the honor of familial ties the way his father did. borros already relegates his daughters as secondary. the thought of princess rhaenys and her grandchildren also being his kin, was not of importance to him. the sons of rhaenyra may be kin but from women twice over in relation to him, from jocelyn baratheon and princess rhaenys. such bond to him is easily brushed over for the perspective of gaining authority and favor:

“aye, princess rhaenys is kin to me and mine, some great-aunt I never knew was married to her father, but the both of them are dead, and rhaenyra…she’s not rhaenys, is she?”

thirdly, borros was also looking to be more of an influential lord in the realm through a royal marriage. royal marriages were great leeways to authority in any kingdom. historically, many royal consorts have found means to replenishing their family’s fortune by being closely related to the royal family. an example would be jane seymour and her family.

when she married henry viii, her brothers were given titles, lands and royal honors just by being related to the king by marriage. borros saw this as an opportunity to rise among the ranks. its why borros was so confident at the thought of saying he would make rhaenyra bend to her brother. his daughter was wedding aemond targaryen, his royal connections means influence and even his grandchildren being dragon riders.

hence, it is safe to assume that by the time lucerys arrives at storm’s end, borros already made up his mind about supporting aegon ii and the greens. it is said that ‘the prince and lord borros were haggling over dates and dowries on the morning lucerys velaryon appeared.’ — he was already duly swayed by the greens and their ability to play his wanting. but lucerys did not know that. he still came and did what he was asked to do, as envoy, in the manner his mother had bid him to do. this is the part where aemond’s own involvement kicks in and borros’s own involvement worsens.

lucerys from the beginning is focused on trying to do what his mother asked of him. aemond mocks him, both his appearance being affected by the storm and repeatedly his parentage and his own mother, being called whore. despite this, lucerys focuses on his duty, which was to give the message he was asked to give to borros baratheon:

“look at this sad creature, my lord,” prince aemond called out. “little luke strong, the bastard.” to luke he said, “you are wet, bastard. is it raining or did you piss youself in fear?”

lucerys velaryon addressed himself only to lord baratheon. “lord

borros, i have brought you a message from my mother, the queen.”

“the whore of dragonstone, he means.”

aemond tries to take the letter from lucerys, but borros has a knight take it and be brought to him. his maester reads the letter and his maester tells him. now at this point, we already know that borros himself was decided upon what to do but he at the very least respected lucerys enough to hear his suit. however, when offered by borros regarding marriage, lucerys refuses due to his own engagement to his cousin rhaena.

however, this was already common knowledge due to the fact that rhaena and lucerys were long arranged to wed since they were younger. borros was only hearing the case because he had to, as is customary when dealing with envoys. but as we established, he’s already decided that his best bet was seeing aegon ii as king and his brother wed to one of his daughters. so while he tempts lucerys with a marriage match, lucerys was never going to take that route. he was already promised. the thought was as sacred as the right of envoys.

as i’ve discussed, borros and his involvement was about to get worse. he knew that storm’s end was not an easy place to leave when there were storms and and he was the one who kept insisting that when aemond targaryen started to get antagonistic, he did not reprimand him. he only him that any bloodshed should not be within storms end, for lucerys was an envoy.

the problem with that is that he’s not extending guest right further, knowing the journey would doubtly be rough for lucerys due to storms and yet also telling aemond that violence should be outside storms end, for lucerys is still an envoy and he didnt want to be blamed for any violence within his halls. so he’s undoubtedly forgetting his responsibility to the guest right, while also trying to still stick to his responsibility to envoys.

unlike his descendant renly baratheon who really wanted to ensure catelyn stark was safe despite the fact they were on opposing sides, borros baratheon wanted to wash his hands of the responsibility he had in both terms of guest right and his responsibility to keeping envoys safe. so, lucerys decides to leave and is guided back to his dragon arrax. it could have ended there, as most wished it had. the envoy had done his task and had flown home.

yet this is where we get aemond’s more bigger involvement in this. when lucerys left, one of the daughters of borros goaded aemond. it was something childish, as most girls would probably do when they’re feeling antagonistic against someone for not choosing them. it could have easily been brushed off by much older aemond, who had already won the stormlands for aegon ii. borros did not tell off his daughter, he just watched as aemond got angry about these words:

for the girl maris; the secondborn daughter of lord borros, less comely than her sisters, she was angry with aemond for preferring them to her. “was it one of your eyes he took, or one of your balls?” maris asked the prince, in tones sweet as honey. “i am so glad you chose my sister. i want a husband with all his parts.”

when aemond turned to borros, he asked if he could leave. the lord of storms end didnt really seem to care, much had already been dealt with if one can look at it. he just told aemond that it was none of his business what he decides to do because, “it is not for me to tell you what to do when you are not beneath my roof.” — what borros didn’t know was that aemond would not cool off or just go and have contempt in his silence, no. he would go up into the sky on the ancient war dragon, vhagar and hunt his nephew down. over what maris childishly said.

as i mentioned in that post about driftmark and all that had led to that thanks to aemond’s decisions, aemond targaryen was bothered by the sacrifice he made in taking vhagar in the way he wanted. all those words he had said that, his eye was enough to have vhagar as his mount, it was almost all but easily undone. he was going to commit an assault on the foundation of westerosi society, both familial and social.

it did not matter, his status as an envoy. how what he would do would affect his family, how it would affect the realm. he did not care. all he just wanted was control, he wanted his power. he felt like he would have it again, should he slay lucerys velaryon. and that he did. the plan of the blacks to rely on diplomacy fell apart at the hands of a man who decided killing an envoy, his own blood, was far better than feeling bad about himself.

by all accounts, the brutality of this death was seen with the way the young dragon arrax was torn apart by an ancient dragon. his body was never found and its most likely he also perished the way his dragon had. lucerys and arrax were sent due to the fact that it was a far shorter trip, his dragon was yet able to withstand a heavy trip and the blacks relying on borros to honor the kinship they had. however, they would not foresee that aemond targaryen would set upon a much younger child who was barely a man to be killed by an ancient war dragon who was a veteran of at least a hundred battles unprovoked.

the worst of it was the pride aemond felt for what he had done. he had come home and bragged how he had gotten storm’s end at their side and how he had rid his nephew of his life. it was only alicent and otto hightower that shared the trepidation of what aemond had done. it was now certain that he was a kinslayer, an affront to the values of the faith of the seven. for that he was already considered accursed. but just as much, breaking the rules of convention of envoys were damaging.

aemond had forgotten horribly that envoys were the reflection of their monarchs or masters. when he had represented aegon ii in front of borros, it was as though aegon was there because what aemond was doing was on behalf of his monarch. by proxy. the envoy was the reflection of the monarch, the action of the monarch. lucerys completely reflected his mother and what she wanted for him to do, from point a to point z.

what he does reflects his mother and her actions. to do something that deviates from his mother’s wants, his queen, reflects badly on her. aemond does just that. as aegon’s envoy, through the power he was given, he declares a clear cut message of war. that he does not care what happens, all he cares about was settling a score and making a new one. which was what the greens declared in their own green council. but they did not expect it to be this soon. they needed more allies however before they go to war. and only otto and alicent seem to be aware of how dire their position is now because of aemond’s actions:

queen alicent went pale when she heard what he had done, crying, “mother have mercy on us all.” nor was ser otto pleased.“you only lost one eye,” he is reported to have said. “how could you be so blind?”

but aegon ii, who seems absolutely pleased with what his brother had done. by this point, aegon ii had settled in his authority of usurping the throne. he now has that taste of power, of that authority that was really never his, becoming his. he welcomes his brother proudly. he celebrates his brother’s achievements of getting storm’s end on their side and killing their nephew and throws him a celebratory feast:

the king himself did not share their concerns, however. aegon II welcomed prince aemond home with a great feast, hailed him as “the true blood of the dragon,” and announced that he had made “a good beginning.”

it is entirely clear why the blacks responded harshly to the situation. they were not planning for a martial war just yet. they were holding out hope that this could be settled with political pressuring. but the moment all social convention, all the safeguards that made it all more humane, was thrown out the window the moment aemond decided to kill lucerys in a brutal fashion. he disregards every thing but violence and the blacks responded as such.

they realized that if all the greens wanted was violence, they were gonna respond with violence. after all, there was no need for justice. why should they gather justice when there would be none that could give them that? the greens have proven that to them. in the simplest means of respecting the conduct of envoys, they could not even do. so what is the rules settled, what is propriety, what is justice—when the greens had all but thrown it out the window. quills and pens and missives and ravens and envoys, those no longer mattered. the political game had all but ended, only vengence burns true. and so begin the reign of death, destruction, devastation and loss, from the actions of an angry man, birthed the wails of three godless years.

#a song of ice and fire#asoiaf#fire and blood#f&b#house of the dragon#hotd#asoiaf meta#fire and blood meta#hotd meta#lucerys velaryon#aemond targaryen#borros baratheon#house targaryen#house baratheon

19 notes

·

View notes

Text

TYSK: You´re missing out on a lot

TYSK, or Things You Should Know, is a bi-weekly post I intend to share about worldwide news. I am that random factoid friend, and I love sharing new information with people because I see information as power. This is my way of attempting to do my part in sharing and participating in the world and whatnot.

🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞🗞

Insight

I recently watched the film American Fiction, I am a fan of everyone involved and am in love with the premise of the film. I did find a bit of disappointment with Tracee Ellis Ross's character's quick intro and exit. There was more to explore with her character and I was deeply disappointed. The film does well at highlighting the interpersonal issues of Black middle-class families. It asks us to be more nuanced about the lives of Black Americans and the different ways we suffer under capitalism/white supremacy. We need to take a moment to be more curious about who is telling our stories and how we can have more of us in the room. Equity is necessary and best when done right.

News

Yemeni and US/UK conflict is suspected to be caused by Yemen´s stance against the genocide of the Palestinian people.

2. Rihanna´s brand SavageX Fenty is reported to have an ethics rating lower than Sheins. Re/Make´s annual ethics report, the Fashion Accountability Report scored it a 4/150. While doing well for diversity, they noted that there was little information about the care for its workers and the earth. Along with her makeup line, there are reports of child labor law violations, volatile work environments, and a history of using oil-based synthetic products.

3. It was recently discovered after the bodies of 3 Black men were found in a Pauper´s grave in Hinds County, that more than 600 other bodies had been buried there since 2008. Since 2016, over 215 bodies have been placed there in unmarked graves. This information surfaced after a mother had been informed that her son had been killed in a hit-and-run by an off-duty officer.

Art

Maya Angelou´s ¨Caged Bird¨

A free bird leaps

on the back of the wind

and floats downstream

till the current ends

and dips his wing

in the orange sun rays

and dares to claim the sky.

But a bird that stalks

down his narrow cage

can seldom see through

his bars of rage

his wings are clipped and

his feet are tied

so he opens his throat to sing.

The caged bird sings

with a fearful trill

of things unknown

but longed for still

and his tune is heard

on the distant hill

for the caged bird

sings of freedom.

The free bird thinks of another breeze

and the trade winds soft through the sighing trees

and the fat worms waiting on a dawn bright lawn

and he names the sky his own.

But a caged bird stands on the grave of dreams

his shadow shouts on a nightmare scream

his wings are clipped and his feet are tied

so he opens his throat to sing.

The caged bird sings

with a fearful trill

of things unknown

but longed for still

and his tune is heard

on the distant hill

for the caged bird

sings of freedom.

#black artist#virgo#bthevirgo#blogger#maya angelou#news#palestine#mississippi#savage x fenty#environment

4 notes

·

View notes

Text

1) RFBT

· Partnership

· Corporation

· Cooperatives

· FRIA

· E-Commerce Act

· Ease of Doing Business Act

· Intellectual Property Law

· Data Privacy Act

2) MAS

· Basic Considerations

· Cost Behavior and CVP

· Variable & Absorption

· FS Analysis

· Budgeting

· Standard Costing

· Performance Evaluation

· Pricing

· Relevant Costing

3) AFAR

· Partnership

· Corporate Liquidation

· Revenue Recognition – PFRS 15

· Long Term Construction Contract

· Franchise & Consignment Sales

· Home Office and Branch

· Business Combination

· Separate Financial Statements

4) TAX

· Introduction to Taxation

· Income Tax Fundamentals

· Final Tax & Capital Gains Tax

· Gross Income – Exclusions and Inclusions

· Special Gross Income Rules

· Deductions Principles

· Deductions from Gross Income

· Individual Income Tax

5) AT

· Practice and Regulations of the Profession

· Code of Ethics

· Fundamentals of Assurance Services

· Introduction to Auditing

· Overview of Audit Process and Pre-engagement

· Audit Planning

· Study and Evaluation of Internal Control

· Auditing in an IT Environment

· Business Processes Part 1

6) FARAP

· Review of Accounting Process, Single Entry and Correction of Errors

· Cash and Cash Equivalents, Bank Reconciliation, Proof of Cash and Audit of Cash

· Trade and Other Receivables, Notes Receivable and Audit of Receivables

· Loans Receivable, Impairment and Receivable Financing

· Inventories, Biological Assets and Audit of Inventories

· PPE - Initial and Subsequent Measurement, Borrowing Costs and Government Grants

· Wasting Assets, Intangible Assets, Impairment and Audit of PPE and Intangible Assets

· Investment in Equity Securities, Associates and Debt Securities

· Investment Properties, Other Investments and Audit of Investments

2 notes

·

View notes