#efile1099nec

Photo

Form 1099 A online, Acquisition or Abandonment of Secured Property. File Form 1099-A, for each borrower if you lend money in connection with your trade or business and, in full or partial satisfaction of the debt, you have reason to know that the property has been abandoned. IRS 1099 A online | 1099 A form online, Form 1099

0 notes

Text

What is Form 1099-DA?

Form 1099-DA is an information return, a vital instrument used to report cryptocurrency transactions to the IRS. This document is instrumental in bringing transparency to the often complex and opaque world of cryptocurrencies. By mandating its use, the IRS aims to ensure that cryptocurrency transactions are subject to the same scrutiny as traditional financial transactions.

0 notes

Text

Is it mandatory to file an IRS 1099 R tax return?

In general, it is not mandatory to file a 1099 R tax Return for every business. But if the distributions made fall within the reporting requirements, then it will be become obligatory to file the tax form. If you don’t file when the distributions made meet the reporting threshold, then you could be penalized. For mandatory Form 1099 R Filing, the reporting requirements are determined by other factors. Such as distributions from the retirement plan, annuities, etc. Let us have a look at Form 1099 R reporting requirements for 2024.

0 notes

Text

File IRS Form 1099 online at the lowest price.

Form1099online.com offers IRS Form 1099 online filing services at the lowest prices, ensuring cost-effective solutions for filers. As an accountant, I witness the company's commitment to providing the best offers and benefits to both employees and customers alike. Trust Form1099online.com for seamless, affordable Form 1099 filing experiences

#1099misc#1099necform#irsform1099nec#efile1099nec#1099online#form1099#form1099online#form1099misc#1099nec

0 notes

Text

Why choose Form1099online.com?

Form1099online.com stands out as the top choice for tax filing needs with its IRS certification, rapid growth, and commitment to accuracy. With a 100% US-based team, it offers seamless e-filing without additional fees, ensuring a secure and reliable experience for both employees and customers. Trust Form1099online.com for effortless and dependable tax return transmission directly to the IRS.

#efile1099nec#1099misc#1099online#1099necform#form1099#form1099misc#irsform1099nec#form1099online#1099nec

0 notes

Text

Why choose Form1099online.com?

Form1099online.com stands out as the top choice for tax filing needs with its IRS certification, rapid growth, and commitment to accuracy. With a 100% US-based team, it offers seamless e-filing without additional fees, ensuring a secure and reliable experience for both employees and customers. Trust Form1099online.com for effortless and dependable tax returns transmission directly to the IRS.

#1099online#efile1099nec#1099necform#1099misc#form1099#irsform1099nec#form1099misc#form1099online#1099nec

0 notes

Text

Which 1099 Form Do I Use?

Selecting the appropriate 1099 form depends on the type of income being reported. Whether it's miscellaneous income, non-employee compensation, third-party network transactions, interest income, dividends, distributions, or other transactions like abandonment and acquisition of property, there's a specific form tailored to each. Understanding these distinctions ensures accurate and compliant reporting for payers and recipients alike.

#1099online#form1099#form1099online#1099misc#1099necform#form1099misc#irsform1099nec#efile1099nec#1099nec

0 notes

Text

Which 1099 Form Do I Use?

Selecting the appropriate 1099 form depends on the type of income being reported. Whether it's miscellaneous income, non-employee compensation, third-party network transactions, interest income, dividends, distributions, or other transactions like abandonment and acquisition of property, there's a specific form tailored to each. Understanding these distinctions ensures accurate and compliant reporting for payers and recipients alike.

#1099online#efile1099nec#1099misc#1099necform#irsform1099nec#form1099misc#form1099#form1099online#1099nec#1099div

0 notes

Text

What Tax Forms Do You Need to Collect From a 1099 Independent Contractor?

The process of filing 1099 information returns is quite simple when you hire a 1099 worker. Firstly, collect the W-9 Form from the independent contractors you hire at the start of the contract. W-9 Form contains information about the contractor like name, address, TIN, type of the contractor, etc. With the help of W-9 Form information, you can easily fill out the 1099 Form without any errors. Furthermore, be sure to collect the W-9BEN Form if you hire a contractor who’s not a U.S. Citizen.

#1099online#efile1099nec#1099misc#1099necform#form1099#form1099online#form1099misc#1099nec#irsform1099nec

0 notes

Text

Get Started Early with Form1099Online & Stay away penalties!..

Start your new tax year, by filing form 1099 online as early as possible. Plan one step ahead by gathering Form 1099 Filing info beforehand & have a successful “Form 1099 Filing” Online easily.

#1099online#1099misc#1099necform#irsform1099nec#form1099misc#1099nec#efile1099nec#form1099online#form1099

0 notes

Text

E-File Form 1099 With the Help of Tax Experts.

At Form1099online.com, we excel in E-filing Form 1099 with the guidance of seasoned tax experts. As an accountant within our dedicated team, I witness firsthand the unmatched offers and budget-friendly pricing that sets us apart in the industry. Our platform stands as the premier destination, offering a plethora of benefits to both employees and valued customers seeking a seamless and efficient tax filing experience.

#1099online#1099misc#1099necform#form1099online#irsform1099nec#efile1099nec#form1099#1099nec#form1099misc

0 notes

Text

Exceptions to the IRS 1099 Late Filing Penalty

The penalty will not apply; if

You show a reasonable cause before the 1099 Deadline.

You provide the correct information as shown on the payee’s tax return.

Filed corrections before the deadline.

#efile1099nec#1099misc#1099necform#form1099#form1099online#irsform1099nec#1099online#1099nec#form1099misc

0 notes

Text

What Happens When You Don't File Form 1099 Taxes In Time

Failure to file Form 1099 taxes on time can result in penalties imposed by the IRS. Late filing may lead to fines ranging from $50 to $280 per form, depending on the delay period. Non-compliance can also trigger additional penalties based on factors such as intentional disregard or the size of the business, making timely filing crucial to avoid financial repercussions.

#efile1099nec#1099misc#1099necform#irsform1099nec#form1099#form1099online#form1099misc#1099online#1099nec

0 notes

Text

LAST 1 DAY TO REPORT IRS 1099 FORMS WITHOUT ANY PENALTIES

With just one day remaining, timely reporting of IRS 1099 forms is crucial to avoid penalties. As an accountant at Form1099online.com, we pride ourselves on offering the best deals and the most competitive pricing for seamless filing services. Our platform not only benefits employees but also ensures a hassle-free experience for our valued customers.

#1099online#efile1099nec#1099misc#1099necform#form1099#irsform1099nec#form1099misc#1099nec#form1099online

0 notes

Text

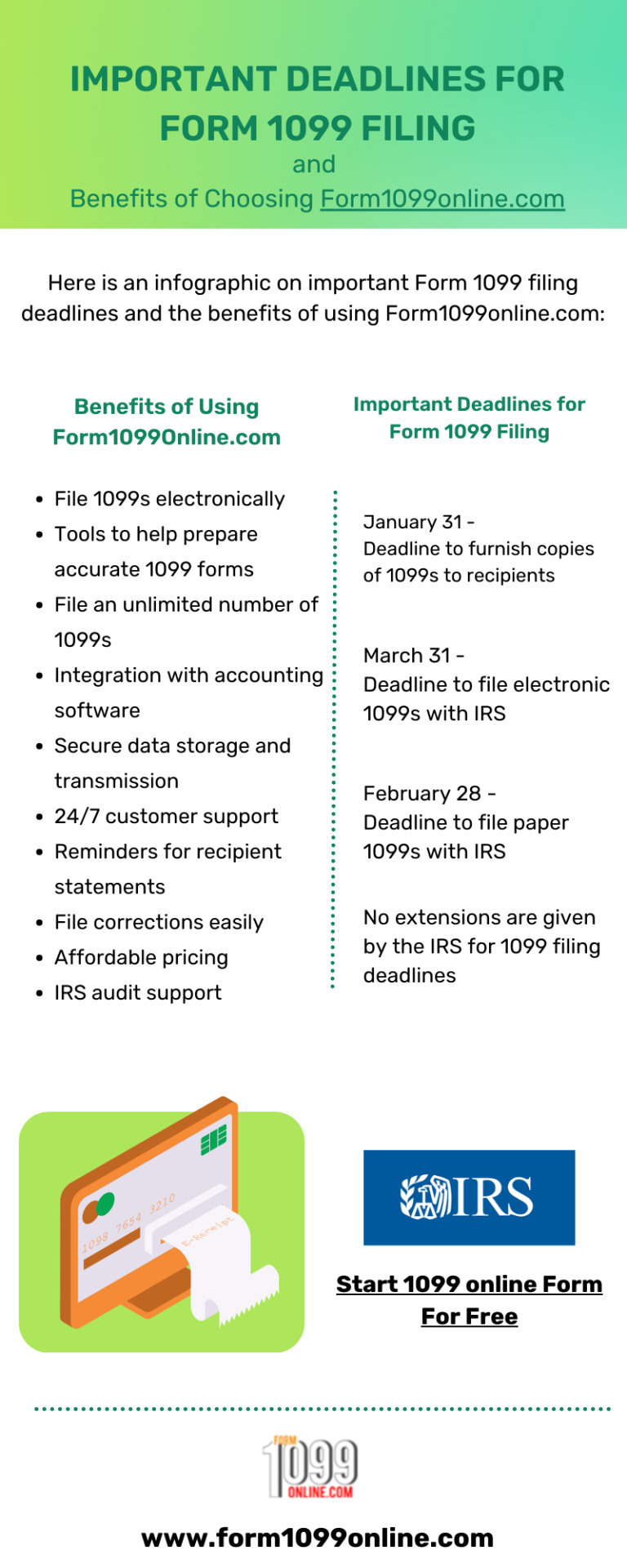

Important Deadlines for Form 1099 Filing and Benefits of Choosing Form1099online.com

The infographic covers critical filing deadlines for furnishing and submitting Form 1099s to avoid penalties. It also outlines the advantages of using Form1099Online.com such as easy electronic filing, tools to ensure accuracy, and reminders about recipient statements. Form1099Online.com simplifies 1099 reporting through their IRS-approved online services.

#1099online#efile1099nec#1099necform#1099misc#form1099#form1099misc#form1099online#irsform1099nec#1099nec

0 notes