#1099online

Text

Stress-Free Tax Filing Made Easy!

Experience hassle-free tax filing with our intuitive online platform, designed to simplify the process and save you time. Enjoy peace of mind knowing that our user-friendly interface guides you through every step, ensuring accuracy and efficiency. Say goodbye to stress and hello to convenience with our expert support team ready to assist you along the way, making tax filing a breeze.

#timesaver#efficiency#taxfiling#Form1099online#1099online#file1099online#Fillable1099#1099TaxForm#Printable1099Form

0 notes

Text

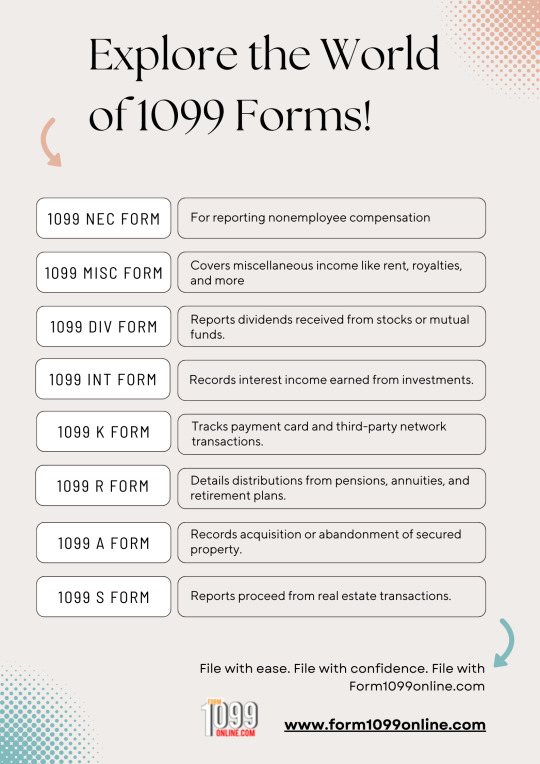

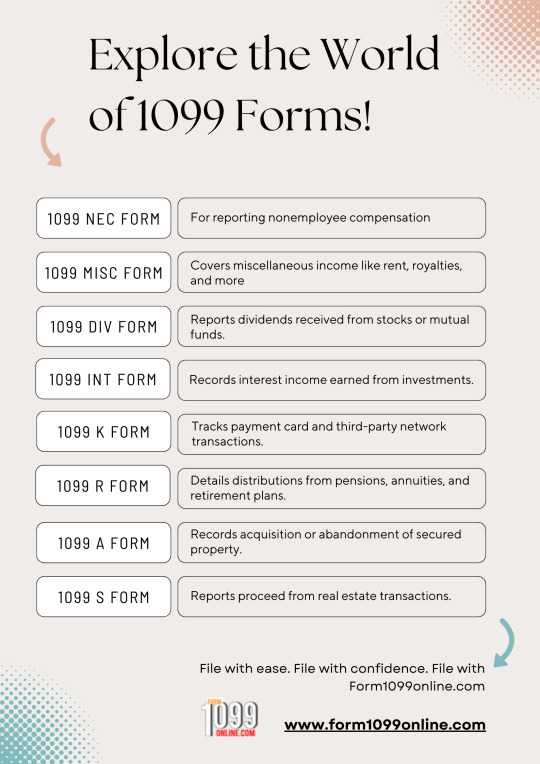

Explore the World of 1099 Forms!

At Form1099online.com, we support a variety of 1099 forms to cater to your filing needs. Whether you're a freelancer, contractor, or business owner, we've got you covered with our easy online filing services.

#timesaver#efficiency#taxfiling#Form1099online#1099online#file1099online#Fillable1099#1099TaxForm#Printable1099Form

0 notes

Text

Explore the World of 1099 Forms!

At Form1099online.com, we support a variety of 1099 forms to cater to your filing needs. Whether you're a freelancer, contractor, or business owner, we've got you covered with our easy online filing services.

#timesaver#efficiency#taxfiling#Form1099online#1099online#file1099online#Fillable1099#1099TaxForm#Printable1099Form

0 notes

Text

Make tax filing a breeze with Form1099online.com

Our user-friendly interface and expert guidance ensure a stress-free experience from start to finish.

#breezyfiling#userfriendly#expertassistance#Form1099online#1099online#file1099online#Fillable1099#1099TaxForm#Printable1099Form

0 notes

Text

Tired of Complicated Tax Forms? We Can Help!

Feeling overwhelmed by complex tax forms? Look no further! Our team at Form1099Online.com is here to simplify the process and provide expert assistance, ensuring a hassle-free experience from start to finish. Say goodbye to stress and hello to smooth filing with us!

#timesaver#efficiency#taxfiling#Form1099online#1099online#file1099online#Fillable1099#1099TaxForm#Printable1099Form

0 notes

Text

Say Goodbye to Paperwork: Simplify Tax Filing with Form1099online

Tired of manual paperwork for tax filing? Switch to Form1099online for a digital solution that simplifies the process. Say goodbye to stacks of forms and hello to convenience.

#timesaver#efficiency#taxfiling#Form1099online#1099online#file1099online#Fillable1099#1099TaxForm#Printable1099Form

0 notes

Text

What is Form 1099-DA?

Form 1099-DA is an information return, a vital instrument used to report cryptocurrency transactions to the IRS. This document is instrumental in bringing transparency to the often complex and opaque world of cryptocurrencies. By mandating its use, the IRS aims to ensure that cryptocurrency transactions are subject to the same scrutiny as traditional financial transactions.

0 notes

Text

Is it mandatory to file an IRS 1099 R tax return?

In general, it is not mandatory to file a 1099 R tax Return for every business. But if the distributions made fall within the reporting requirements, then it will be become obligatory to file the tax form. If you don’t file when the distributions made meet the reporting threshold, then you could be penalized. For mandatory Form 1099 R Filing, the reporting requirements are determined by other factors. Such as distributions from the retirement plan, annuities, etc. Let us have a look at Form 1099 R reporting requirements for 2024.

0 notes

Text

What types of payments should be excluded from the 1099 MISC online tax form?

The 1099 MISC online tax form is utilized for reporting various types of income, with certain payments excluded from its scope. These exclusions may pertain to specific types of payments that are not required to be reported on the form. Understanding these exclusions is crucial for accurate tax reporting and compliance.

0 notes

Text

How to Fill Out The 1099 R Tax Form?

To fill out the 1099-R tax form, gather all necessary information including payer details, distribution amounts, and tax withholding. Enter the data accurately in the designated sections of the form, ensuring to report any applicable taxable amounts. Review for accuracy before submission to avoid discrepancies and potential penalties.

#1099RForm#Form1099RInstructions#1099online#1099R#E-File1099R#Form1099online#File1099R#IRS1099RForm#Form1099#1099RTaxForm

0 notes

Text

File IRS Form 1099 online at the lowest price.

Form1099online.com offers IRS Form 1099 online filing services at the lowest prices, ensuring cost-effective solutions for filers. As an accountant, I witness the company's commitment to providing the best offers and benefits to both employees and customers alike. Trust Form1099online.com for seamless, affordable Form 1099 filing experiences

#1099misc#1099necform#irsform1099nec#efile1099nec#1099online#form1099#form1099online#form1099misc#1099nec

0 notes

Text

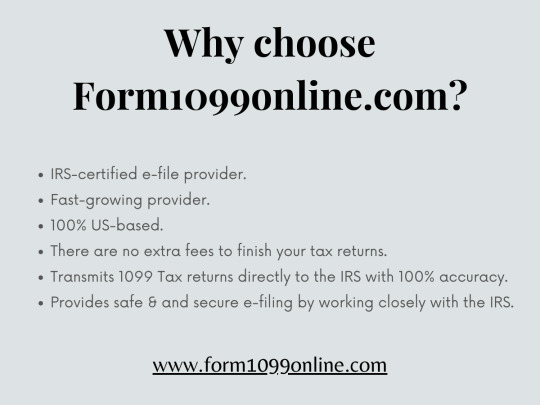

Why choose Form1099online.com?

Form1099online.com stands out as the top choice for tax filing needs with its IRS certification, rapid growth, and commitment to accuracy. With a 100% US-based team, it offers seamless e-filing without additional fees, ensuring a secure and reliable experience for both employees and customers. Trust Form1099online.com for effortless and dependable tax return transmission directly to the IRS.

#efile1099nec#1099misc#1099online#1099necform#form1099#form1099misc#irsform1099nec#form1099online#1099nec

0 notes

Text

Why choose Form1099online.com?

Form1099online.com stands out as the top choice for tax filing needs with its IRS certification, rapid growth, and commitment to accuracy. With a 100% US-based team, it offers seamless e-filing without additional fees, ensuring a secure and reliable experience for both employees and customers. Trust Form1099online.com for effortless and dependable tax returns transmission directly to the IRS.

#1099online#efile1099nec#1099necform#1099misc#form1099#irsform1099nec#form1099misc#form1099online#1099nec

0 notes

Text

Which 1099 Form Do I Use?

Selecting the appropriate 1099 form depends on the type of income being reported. Whether it's miscellaneous income, non-employee compensation, third-party network transactions, interest income, dividends, distributions, or other transactions like abandonment and acquisition of property, there's a specific form tailored to each. Understanding these distinctions ensures accurate and compliant reporting for payers and recipients alike.

#1099online#form1099#form1099online#1099misc#1099necform#form1099misc#irsform1099nec#efile1099nec#1099nec

0 notes

Text

Which 1099 Form Do I Use?

Selecting the appropriate 1099 form depends on the type of income being reported. Whether it's miscellaneous income, non-employee compensation, third-party network transactions, interest income, dividends, distributions, or other transactions like abandonment and acquisition of property, there's a specific form tailored to each. Understanding these distinctions ensures accurate and compliant reporting for payers and recipients alike.

#1099online#efile1099nec#1099misc#1099necform#irsform1099nec#form1099misc#form1099#form1099online#1099nec#1099div

0 notes