#digitalpayment

Text

At PayPound.Ltd we ensure to keep the risk under control by tracking the transactions and patterns to avoid any possible frauds.

If you are running an high-risk business, securing a reliable credit card processor that enables you to accept payments across the globe will good approval ratio and regular payouts are very important!

Get your High-risk Merchant Account today!

Contact us NOW!

+44 800 832 1733

[email protected]

https://paypound.ltd/

#payment#paytm#creditcards#payments#pointofsale#digitalpayment#onlinepayment#noreturn#merchantservices#paymentgateway#creditcardprocessing#mobilepayments#paymentprocessing#onlinepayments#digitalpayments#noexchange#paymentsolutions#trafficsafety#highriskmerchantaccount#merchantaccount#business#offshoremerchantaccount#merchant#cbd#creditcard#paypal#highriskmerchantservices#businessowner#money#stripe

8 notes

·

View notes

Text

Create FREE Thanks for Payment Posters on Brands.live

Express your Gratitude with our stylish and printable Thanks for Payment Banners customizable in minutes on Brands.live.

Choose from a wide selection of Thanks for Payment Social Media Posts and Graphics , Flyers and Videos to show appreciation for payments received.

Access 15,000+ customizable Templates and kick start your Design process today.

Utilise our Poster maker App, related to Canva, to create stunning templates effortlessly.

✓ Free for Commercial Use

✓ High-Quality Images.

#ThanksForPayment#GratefulForPayment#PaymentGratitude#ThankfulTransaction#PaymentReceived#DigitalPayment#BrandsLivePosters#DownloadNow#BrandLiveMagic#SocialMediaMarketing#BusinessGrowth#branding#marketing#Brandsdotlive

0 notes

Text

With the background of globalization and digital payment, we will make business in many countries which have a different currency.

It will be much more convenient for customers if we have a global payments system that has some characteristics as below.

1-Payment Security

2-Customer Experience

3-Scalability and Flexibility

4-Global Reach

Looking forward to innovation and development of #technology in the future that make our life better and more convenient.

1 note

·

View note

Text

💻 Need to pay your landline bill online? Look no further than Gotraav's website! 📞💳

👉 Skip the hassle of traditional payment methods and conveniently settle your landline bill with just a few clicks on Gotraav's user-friendly platform. www.gotraav.com

🌟 Secure, reliable, and hassle-free payment experience awaits you at Gotraav. Say goodbye to long queues and hello to convenience!

💻 Visit Gotraav's website today to make your payment and enjoy peace of mind. #OnlinePayment #LandlineBill #Convenience #EasyPayment #Gotraav #SecurePayment #HassleFree #DigitalPayment #BillingSolution #UtilityPayment #QuickPayment #UserFriendly #OnlineTransaction #SaveTime #PayWithEase #TechSavvy #DigitalAge #StayConnected #BillPayment #SmoothExperience #Effortless #OnlineConvenience

#GotraavExperience #DigitalSolution #PaymentPortal #StayConnected #CustomerSatisfaction #TechInnovation #DigitalTransformation #UtilityBills #ConvenientPayment #EasyBilling #EfficientService #TimeSaving

#EasyPayment#Gotraav#SecurePayment#HassleFree#DigitalPayment#BillingSolution#UtilityPayment#QuickPayment#UserFriendly#OnlineTransaction#SaveTime#PayWithEase#TechSavvy#DigitalAge#StayConnected#BillPayment#SmoothExperience#Effortless#OnlineConvenience#GotraavExperience#DigitalSolution#PaymentPortal#CustomerSatisfaction#TechInnovation#DigitalTransformation#UtilityBills#ConvenientPayment#EasyBilling#EfficientService#TimeSaving

0 notes

Text

Middle East and Africa Real Time Payments Market size at USD 29.75 million in 2023. During the forecast period between 2024 and 2030, BlueWeave expects the Middle East and Africa Real Time Payments Market size to grow at a CAGR of 9.88% reaching a value of USD 57.51 million by 2030. The Middle East and Africa Real-Time Payments Market is thriving due to the widespread use of smartphones and the embrace of cloud-based solutions for speedy transactions. Rising customer expectations for swift payment settlements, coupled with substantial investments from financial institutions and governments, are fueling the adoption of real-time payment solutions. The integration of innovative technologies like Artificial Intelligence (AI) and the Internet of Things (IoT) into digital payment platforms further contributes to the escalating demand for real-time payment solutions in the region.

Opportunity – Micropayments and digital currencies

In the dynamic landscape of the Middle East and Africa Real-Time Payments Market, the surge in micropayments and the widespread adoption of digital currencies emerge as potent growth drivers. As consumers and businesses increasingly embrace seamless, instantaneous transactions, the market experiences a transformative shift. The integration of micropayments and digital currencies fosters financial inclusion but also fuels the demand for efficient, secure, and real-time payment solutions. The trend reshapes the payment ecosystem, opening new avenues for innovation and positioning the region as a frontrunner in the Middle East and Africa Real-Time Payments Market.

Impact of Escalating Geopolitical Tensions on Middle East and Africa Real Time Payments Market

Escalating geopolitical tensions in the Middle East and Africa have significantly impacted the Real Time Payments (RTP) Market. Heightened uncertainties and conflicts have disrupted economic activities, hindering the growth of RTP systems. In the Middle East, political instability in countries like Syria and Yemen has impeded the development of robust payment infrastructures. Additionally, incidents such as the Gulf diplomatic crisis and regional power struggles have created an environment of financial insecurity, deterring investments in RTP solutions. In Africa, conflicts in regions like the Sahel and political unrest in countries like Sudan have similarly hampered the advancement of real-time payment technologies. These geopolitical challenges have introduced volatility, regulatory uncertainties, and a reluctance among businesses to adopt and invest in RTP systems, slowing down market expansion.

Sample Request @ https://www.blueweaveconsulting.com/report/middle-east-and-africa-real-time-payments-market/report-sample

0 notes

Text

#gcash#apkdownload#mobilewallet#digitalpayment#androidapp#financialapp#gcashapk#downloadnow#mobileapp#androidusers#cashlesspayment#moneytransfer#financialfreedom#digitalcurrency#gcashph#androidfinance#cashlessph#mobilemoney#gcashdownload#androidexperience#easymoney#moneymanagement#instafinance#androidbanking#mobilefinance#gcashapp#androidmoney#digitalbanking#financeonthego#androidtransactions

0 notes

Text

Digital Money: Navigating the World of Online Transactions

In this guide, we delve into the dynamic world of digital money, exploring how digital currencies, online banking, and mobile payment apps are working.

0 notes

Text

#digitization#digitalpayment#onlinepayment#onlinebanking#businessbanking#smallbusiness#smallbusinesses#technology#startupindia#bankinginnovation#bank#paymentsolutions#digitalpayments#mobilebanking#money#innovation#financialfreedom#msme#hylobiz#ewallet#onlinebusiness#digital#openbanking#india#mobileapp#futureofbanking#neobankingindia#paymentplatform

0 notes

Text

Get Japan's Digital Finance Transformation: Embracing UPI Payments

Witness Japan's leap into the digital finance era! 🇯🇵 Read on to discover how Japan is leading the charge in the world of payments, adopting India's UPI Payment System and signaling a global shift towards digital financial innovation. Are you prepared for the future of payments?

Transform your website into a seamless payment powerhouse! With Go Mobi integration, you can effortlessly accept online payments using a variety of payment methods, all in just a few easy steps, Transform your website into a seamless payment powerhouse! With Go Mobi integration, you can effortlessly accept online payments using a variety of payment methods, all in just a few easy steps:

Contact us today to get your quote today at: https://gomobi.io/.

#paymentgateway#paymentsolutions#paymentprocessing#payments#digitalpayment#onlinepayments#onlinepayment

0 notes

Text

payg.in/effects-of-covid-19-on-digital-payments.html

Effects Of Covid-19 On Digital Payments

COVID-19 has brought significant disruption to the way consumers transfer money and make payments. In COVID-19 pandemic could move the world all the more quickly towards digital payments.

0 notes

Text

We strive to provide the highest standards of service and security to the payment market.

Our team is available to help you whenever you need it! 24 hours a day, 7 days a week.

Contact us NOW!

+44 800 832 1733

https://paypound.ltd/

#onlinepayments#creditcard#mastercard#payment#creditcards#payments#digitalpayment#onlinepayment#merchantservices#paymentgateway#creditcardprocessing#mobilepayments#paymentprocessing#paymentsolutions

7 notes

·

View notes

Text

Digital Payment Fraud Detection and Prevention

According to the Federal Trade Commission, a new report shows that customers suffered a loss of nearly US$8.8 billion due to fraud in 2022, which is a 30% increase compared to 2021.

0 notes

Text

Cash and card payment are still so common in most of countries. There are only a small part of countries with QR code payment.

Would you like to first choose and accept QR scanning payment if it's supported in your there. Maybe not, you will be worry about the security and reliability of this method.

But nowadays, it becomes much more and more convenient, fast and cost-effective with QR scanning payment. There is much more huge growth trends with it.

So, how to push the development of QR code payment in the local area?

The support of local government

Consumate some policies of financial

Complete relative law of digital payment

Improve consumer's learning for QR code payment

Please consult us if you wanna learning about it furtherly.

www.jtact.com

1 note

·

View note

Text

Digital Payment Market – Global Industry Analysis and Forecast (2023-2029)

Digital payments are payments made through digital or online channels that do not entail the exchange of actual currency. This type of payment, also known as an electronic payment (e-payment), is the transfer of value from one payment account to another in which both the payer and the payee utilize a digital device such as a mobile phone, computer, or credit, debit, or prepaid card. A firm or an individual might be the payer and payee. This means that in order for digital payments to take place, both the payer and the payee must have a bank account, an online banking method, a device from which to make the payment, and a medium of transmission, which means they must have signed up to a payment provider or an intermediary such as a bank or a service provider. UPI, NEFT, AEPS, mobile wallets, and PoS terminals are all examples of digital payment methods. UPI is the most popular method in digital payment market, with transactions exceeding USD 1 trillion in value.

0 notes

Text

Discovering the World of Online Payment Solutions with Seamless Transactions

Online payment solutions have become the hidden heroes of contemporary business in a time when digital connectivity influences every area of our life. These technological wonders have revolutionized how we purchase and sell, facilitating streamlined, quick, and secure transactions like never before.

An International Market at Your Fingertips:

Geographical constraints have been eliminated by online payment systems, transforming the Internet into a thriving worldwide economy. The physical closeness between buyers and sellers is no longer a barrier. A buyer in one part of the world can buy things from a vendor in the other part of the world with a few clicks.

Convenience is rephrased as:

The days of searching for cash or standing in line for a long time are long gone. By enabling people to make purchases from the convenience of their homes or while on the go using smartphones, online payment solutions have completely redefined convenience. This convenience has evolved into a competitive advantage, drawing and keeping customers for both large e-commerce companies and small local enterprises.

Various Choices for Every Need:

The variety of online payment options is what makes them so attractive. Different preferences can be accommodated through credit and debit cards, mobile wallets, bank transfers, virtual currencies, and buy-now-pay-later services. Users can select a technique that suits their spending preferences and security concerns thanks to this variety.

Security Guaranteed:

Online payment systems have strengthened their security measures in response to worries about cyber security. Users can feel secure knowing that their financial information is secure thanks to the standardization of encryption, two-factor authentication, and biometric verification.

Increasing business expansion:

Integrating online payment systems can completely change the game for organizations. They make checkout processes easier, lower the chance that payments will bounce, and do away with the need for manual reconciliation. This simplified procedure may result in higher sales and happier customers.

Challenges to Surmount:

Despite the obvious advantages, there are several difficulties:

1. Security worries include: Cyber attacks do not spare the digital world. To protect sensitive data, it is crucial to use strong security measures.

2. Digital Divide: Not everyone has access to the Internet and electronic payment systems, potentially excluding some demographics.

3. Transaction Fees: Though convenient, some online payment options come with transaction fees that both businesses and customers must consider.

4. Tech Literacy: Users must get comfortable with modern technologies, which can be challenging for some people.

The way we exchange value has been completely transformed by Internet payment methods, to sum up. They have a clear impact on everything from convenience and security to promoting international trade. These solutions will probably become even more necessary to our daily lives as technology advances, influencing how we will pay for things in the future and how we will be rewarded.

#onlinepayment#onlineshopping#digitalpayment#payment#payments#paymentgateway#onlineshop#instagram#fashion#paymentsolutions#pulsa#ecommerce#onlinepayments#shopping#bestquality#indosat#online#dompetdigital#uangelektronik#india#paytm#mobilemoney#paymentprocessing#xl#convertpulsa#onlinestore#convertpulsajadiuang#belanjaonline#bagipulsa#pulsaalloperator

0 notes

Photo

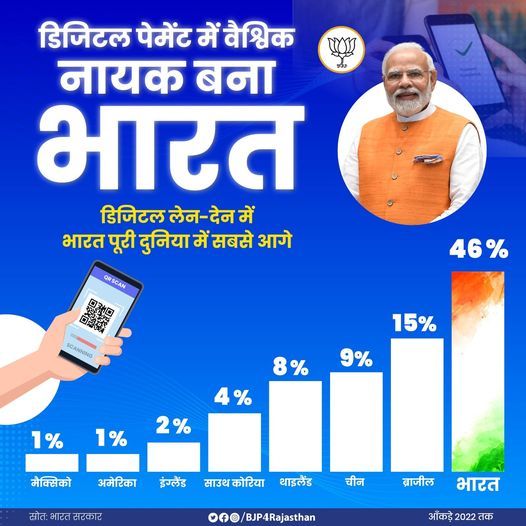

मोदी सरकार के प्रयासों से डिजिटल पेमेंट में वैश्विक नायक बना भारत @cpjoshibjp

#Viksit_Bharat_Ke_9Saal#DigitalPayment#NetBanking#Worldpower#narendramodi#bjp4rajasthan#bjp4india#yogi#amitshah#rajnathsingh#namoagain2024

0 notes