#delisted stocks

Text

Historical Performance of Pharmeasy Share Price: A Detailed Review

Investors and market enthusiasts often look to the past to predict the future, and understanding the historical performance of a company's share price can provide valuable insights. This article delves into the historical performance of the Pharmeasy share price, offering a comprehensive review for those interested in this key market player. Brought to you by DelistedStocks, this analysis will equip you with the knowledge needed to make informed investment decisions.

Introduction to Pharmeasy

Pharmeasy, one of India's leading online healthcare platforms, has revolutionized the way people access medicines and healthcare services. By bridging the gap between customers and local pharmacies, Pharmeasy offers a seamless experience for ordering prescription and over-the-counter medications, diagnostic tests, and other healthcare products. As the company has grown, so too has interest in its market performance, particularly its share price.

Early Days of Pharmeasy's Market Presence

Pharmeasy began its journey as a private company, attracting significant investment from venture capitalists and private equity firms. These early investments were crucial in building the infrastructure and technology needed to support Pharmeasy's rapid expansion. However, it wasn't until Pharmeasy's IPO that public investors could get a piece of the action.

Pharmeasy's IPO and Initial Share Price Movement

When Pharmeasy announced its initial public offering (IPO), it generated considerable buzz in the investment community. The company's growth trajectory, coupled with the increasing demand for online healthcare services, made it an attractive proposition. Upon listing, Pharmeasy's share price saw an initial surge as investors scrambled to buy into the promising healthcare tech company.

Short-term Volatility and Market Reactions

Like many tech and healthcare stocks, Pharmeasy's share price experienced significant volatility in the months following its IPO. Various factors contributed to this, including market sentiment, broader economic conditions, and sector-specific developments. Notably, the COVID-19 pandemic played a dual role – initially boosting demand for online healthcare services, then leading to market corrections as the pandemic's economic impact became clearer.

Long-term Performance Trends

Analyzing Pharmeasy's long-term share price performance provides a clearer picture of the company's market standing. Over the years, Pharmeasy has shown resilience and growth, reflected in its share price trends. The company's strategic acquisitions, partnerships, and continuous innovation have played pivotal roles in driving its share price upwards. For instance, Pharmeasy's acquisition of Medlife significantly expanded its customer base and service offerings, positively impacting its share price.

Key Milestones and Their Impact on Share Price

Several key milestones have influenced Pharmeasy's share price trajectory:

Acquisitions and Mergers: Strategic acquisitions like that of Medlife have not only expanded Pharmeasy's market reach but also bolstered investor confidence, often leading to share price surges.

Technological Advancements: Innovations in technology, such as enhanced app features and improved logistics, have streamlined operations and improved customer satisfaction, contributing to positive share price movements.

Regulatory Changes: Changes in healthcare regulations and government policies have at times created fluctuations in Pharmeasy's share price. For instance, stricter e-pharmacy regulations briefly created uncertainty, impacting the share price negatively.

Comparative Analysis with Competitors

Understanding Pharmeasy's share price performance also involves comparing it with its competitors. Companies like Netmeds and 1mg provide similar services, and their market movements can influence Pharmeasy's share price. By examining these competitors, investors can gain insights into Pharmeasy's market position and future potential.

Investor Sentiment and Market Predictions

Investor sentiment plays a crucial role in Pharmeasy's share price performance. Positive news, such as new product launches or strong financial results, often leads to share price increases, while negative news can have the opposite effect. Market analysts and experts frequently weigh in on Pharmeasy's future, offering predictions that can influence investor behavior and share price trends.

Conclusion

The historical performance of the Pharmeasy share price offers a window into the company's journey and its impact on the market. From its IPO to its strategic milestones, Pharmeasy has navigated a complex landscape to emerge as a leading player in the online healthcare sector. For investors tracking the Pharmeasy share price, understanding these historical trends is crucial for making informed decisions.

Stay updated with the latest market insights and share price analyses by following DelistedStocks, your go-to source for comprehensive investment information.

0 notes

Text

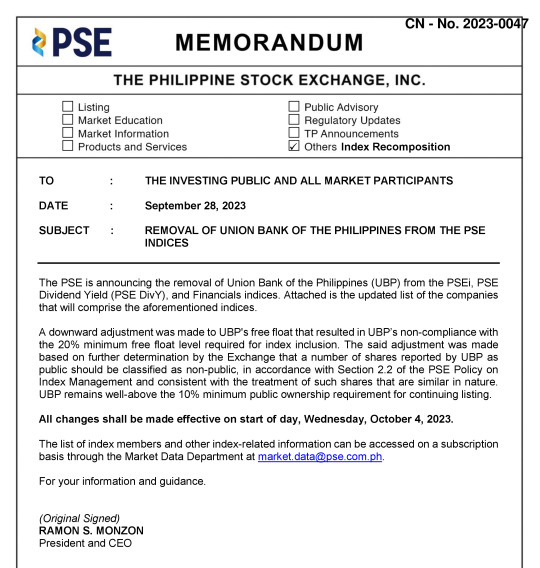

THIS JUST IN OVERNIGHT: Nickel Asia Corps set to replace UnionBank, following to delist UBP in the stock exchange main index by October 4th

(via ABS-CBN News / with reports from Salve Duplito)

PASIG, NATIONAL CAPITAL REGION -- In a significant serious developments, the Philippine Stock Exchange Inc. (PSEi) officially announced that the Nickel Asia Corporation (NAC) is poised to replace Unionbank of the Philippines (UBP) on the PSEi main index on Wednesday (October 4th, 2023 -- Manila local time).

(SCREENGRAB DOCUFILE PHOTO COURTESY: PSEi via pse.com.ph)

This decision, recently outlined in Memorandum Circular #2023-0047 from PSEi, signifies a strategic shift in the composition of the prestigious stock index.

NAC is a major contributor to the role of the Philippine mining industry in global and local supply chains, operating nickelous mining, exploration and processing. The company earned its reputation for being an industry leader, because of practicing sustainable and responsible mines development practices.

The Union Bank of the Philippines is a commercial banking and financial economic institution, which primarily based in Pasig City, National Capital Region (NCR). With a wide variety of services, along with traditional & digital banking, and other financial solutions including a savings account, loans, credit & debit cards; UBP performs an important position within the banking sector character. Its presence extends into retail & industrial banking, and online financial services (regardless of depositing money on savings, E-Wallet and Bank Transfers), making it a key player in the nation's financial landscape.

And finally, The Philippine Stock Exchange Inc. (PSEi) serves as a primary stock exchange in the home country. It maintains and operates the aforementioned stock exchange company, which represents the country's top-performed business companies, and reflecting the overall health of its national Filipino stock market. Inclusion within the PSEi is a prestigious accolade, signifying a company's stability and significance inside the Philippine economy.

The decision to delist UBP from the PSEi main index has added several questions among investors and consumers. One theory that emerges pertains to the impact on UBP retail banking operations and its online banking consumers, per reports from ABS-CBN News. As UBP loses its place on the prestigious index, it may face heightened scrutiny from investors, potentially affecting its stock price and market perception.

(SCREENGRAB FILE PHOTO COURTESY: Google Maps)

For savings account holders and online banking consumers in the Philippines, including right here in Dumaguete City and Negros Island Region, this upcoming transition could lead to a period of uncertainty. Filipino and foreign investors might closely monitor the bank's performance and financial stability, which could in turn, influence their trust in their services of the said commercial banking company. However, it's important to note that UBP's core banking operations remain intact, and it'll continue to serve its customers diligently.

It is no big secret that the Philippine Stock Exchange Inc. (PSEi) is going through a potential change as Nickel Asia Corporation (NAC) takes the center stage on the main index. As this ongoing business banking development unfolds, investors and consumers alike are watching closely. But questions still linger about the implications for its commercial banking company of UBP.

FULL DISCLOSURE: Unionbank of the Philippines is an affiliated banking organization firm for the benefit of ONC Foundation in Negros Oriental, part of our broadcasting management of ONC Holdings Inc. for OneNETtv Channel and OneNETnews.

SCREENGRAB COURTESY: Google Maps

BACKGROUND PROVIDED BY: Tegna

SOURCE:

*https://www.youtube.com/watch?v=BNyu5JTmYsY [Referenced News Item via ABS-CBN News]

*https://documents.pse.com.ph/CircularOPSPDF/CN-2023-0047.pdf [Referenced Memorandon Notice via Philippine Stock Exchange]

*https://en.wikipedia.org/wiki/Unionbank_(Philippines)

*https://en.wikipedia.org/wiki/Nickel_Asia_Corporation

*https://nickelasia.com/about-us

and

*https://en.wikipedia.org/wiki/Philippine_Stock_Exchange

-- OneNETnews Team

#business news#pasig#national capital region#NCR#unionbank#UBP#banking#delisted#philippine stock exchange#PSE#awareness#investors#money#OneNETnews

0 notes

Text

What causes a company to be delisted from a stock exchange?

“Delisting” is the process where a company's stock that was previously listed on a stock exchange such as NYSE and NASDAQ is removed from it either voluntarily or involuntarily. An example of a voluntary decision would be a company's decision to go private. Involuntary would include bankruptcy, dissolution or if a company is delinquent in paying applicable stock exchange fees.

When a company is listed on a stock exchange it needs to meet the exchange's requirements which vary from one exchange to another.

For example - The Nasdaq stock market has 3 tiers -

The Nasdaq Global Select Market®,

The Nasdaq Global Market® and

The Nasdaq Capital Market®.

The financial and liquidity requirements for The Nasdaq Global Select Market® are more stringent than The Nasdaq Global Market®. The listing requirements for both The Nasdaq Global Select Market® and The Nasdaq Global Market® are more stringent than those for The Nasdaq Capital Market®. Corporate governance requirements (Listing Rule 5600 Series) are the same across all Nasdaq market tiers.

Per Nasdaq's Continued Listing Standards for companies trading on either The Nasdaq Global Select Market® or The Nasdaq Global Market® must meet all of the criteria for one of the 3 standards - Equity, Market Value or Total Assets/Total Revenue.

If the company does not meet all the requirements say under the Equity Standard Nasdaq's Listing Rule 5450(a) where the minimum bid price of the company's company stock was below $1.00/share and Nasdaq's Listing Rule 5450(b), where the market value of listed securities (the "MVLS") for the Company's common stock had been below the minimum MVLS requirement of $5,000,000 for 30 consecutive trading days (the "MVLS Requirement"), the company would receive a notice of noncompliance that would indicate the company has 180 days from the notice date to regain compliance with the respective listing requirement. If the company feels it will be unable to meet the listing requirements under the Equity Standard on either The Nasdaq Global Select Market® or The Nasdaq Global Market®, it can make a request to transfer to The Nasdaq Capital Market® by submitting a transfer application.To qualify, the Company would be required to meet the continued listing requirements for The Nasdaq Capital Market®. If the Company does not regain compliance or transfer to The Nasdaq Capital Market® by the end of the 180 day period, there are chances of the company's stock being delisted.

For further information related to listing requirements related to NASDAQ and NYSE:

NASDAQ Continued Listing Guide

NYSE MKT CONTINUED LISTING STANDARDS

0 notes

Text

Looking for the Delay Basis Unlisted Shares Update

If you are looking for the latest update on unlisted shares, then subscribe Planify where you can delay updates with YouTube videos about unlisted stocks, Upcoming IPO, IPO, Pre IPO, Delisted Shares, and Private Equity.

#unlisted shares#planify#unlisted stocks#Upcoming IPO#IPO#Pre IPO#Delisted Shares#private equity#Investment

0 notes

Text

Adani Properties withdraws proposal to delist Adani Power - Times of India

Adani Properties withdraws proposal to delist Adani Power – Times of India

NEW DELHI: Adani Power on Saturday said its promoter entity Adani Properties has withdrawn a proposal to delist the company due to non-receipt of in-principle approval of stock exchanges. The company in a regulatory filing stated that it has received a letter from a member of the promoter group seeking withdrawal of delisting offer. “The Company (Adani Power) has received a letter dated September…

View On WordPress

#adani power#adani propterties#board of directors#bse#bse limited#Business news#delisting withdrawal letter#national stock exchange of india ltd

0 notes

Text

Five of China's biggest state firms worth $318 will soon delist from Wall Street

Five of China’s biggest state firms worth $318 will soon delist from Wall Street

For months, federal regulators have increased pressure on Beijing and Chinese companies that trade on U.S. stock exchanges to comply with American listing rules.

But on Friday, five of China’s biggest U.S.-listed, state-owned giants, valued at a collective $318 billion, announced they would exit Wall Street instead, marking an acceleration in the U.S.-China financial decoupling.

State insurer…

View On WordPress

#alibaba#alibaba adrs#alibaba Hong Kong#alibaba Hong Kong listing#alibaba ipo#alibaba nyse#alibaba primary Hong Kong#alibaba secondary Hong Kong#alibaba us#bilibili#China#china delisting#china delisting 2024#china delisting companies#china delisting deal#china delisting fears#china delisting stocks#china delisting stocks news#china mobile#china mobile ipo#china mobile ipo 2022#china state owned companies delisting#Chinese adrs#Chinese state owned enterprises listed in the us#Chinese stocks delisted#cnooc#cnooc ipo#cnooc ipo 2022#Gensler on china delisting#Gensler on us china delisting

0 notes

Text

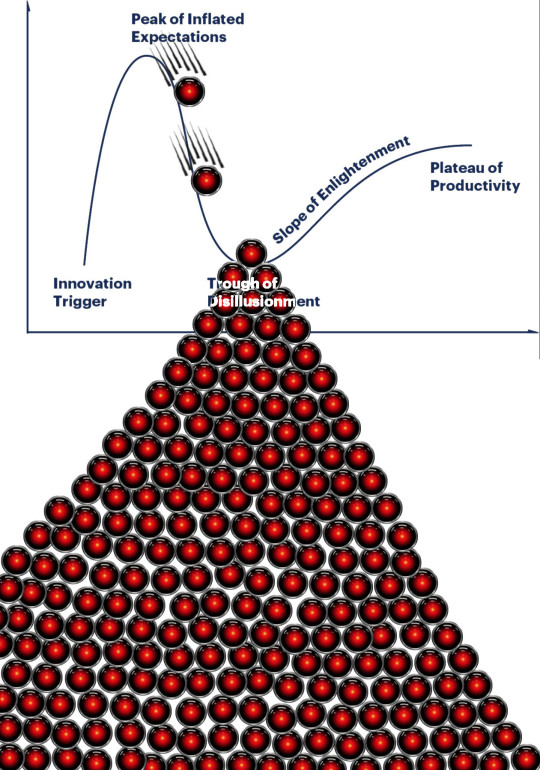

The AI hype bubble is the new crypto hype bubble

Back in 2017 Long Island Ice Tea — known for its undistinguished, barely drinkable sugar-water — changed its name to “Long Blockchain Corp.” Its shares surged to a peak of 400% over their pre-announcement price. The company announced no specific integrations with any kind of blockchain, nor has it made any such integrations since.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

LBCC was subsequently delisted from NASDAQ after settling with the SEC over fraudulent investor statements. Today, the company trades over the counter and its market cap is $36m, down from $138m.

https://cointelegraph.com/news/textbook-case-of-crypto-hype-how-iced-tea-company-went-blockchain-and-failed-despite-a-289-percent-stock-rise

The most remarkable thing about this incredibly stupid story is that LBCC wasn’t the peak of the blockchain bubble — rather, it was the start of blockchain’s final pump-and-dump. By the standards of 2022’s blockchain grifters, LBCC was small potatoes, a mere $138m sugar-water grift.

They didn’t have any NFTs, no wash trades, no ICO. They didn’t have a Superbowl ad. They didn’t steal billions from mom-and-pop investors while proclaiming themselves to be “Effective Altruists.” They didn’t channel hundreds of millions to election campaigns through straw donations and other forms of campaing finance frauds. They didn’t even open a crypto-themed hamburger restaurant where you couldn’t buy hamburgers with crypto:

https://robbreport.com/food-drink/dining/bored-hungry-restaurant-no-cryptocurrency-1234694556/

They were amateurs. Their attempt to “make fetch happen” only succeeded for a brief instant. By contrast, the superpredators of the crypto bubble were able to make fetch happen over an improbably long timescale, deploying the most powerful reality distortion fields since Pets.com.

Anything that can’t go on forever will eventually stop. We’re told that trillions of dollars’ worth of crypto has been wiped out over the past year, but these losses are nowhere to be seen in the real economy — because the “wealth” that was wiped out by the crypto bubble’s bursting never existed in the first place.

Like any Ponzi scheme, crypto was a way to separate normies from their savings through the pretense that they were “investing” in a vast enterprise — but the only real money (“fiat” in cryptospeak) in the system was the hardscrabble retirement savings of working people, which the bubble’s energetic inflaters swapped for illiquid, worthless shitcoins.

We’ve stopped believing in the illusory billions. Sam Bankman-Fried is under house arrest. But the people who gave him money — and the nimbler Ponzi artists who evaded arrest — are looking for new scams to separate the marks from their money.

Take Morganstanley, who spent 2021 and 2022 hyping cryptocurrency as a massive growth opportunity:

https://cointelegraph.com/news/morgan-stanley-launches-cryptocurrency-research-team

Today, Morganstanley wants you to know that AI is a $6 trillion opportunity.

They’re not alone. The CEOs of Endeavor, Buzzfeed, Microsoft, Spotify, Youtube, Snap, Sports Illustrated, and CAA are all out there, pumping up the AI bubble with every hour that god sends, declaring that the future is AI.

https://www.hollywoodreporter.com/business/business-news/wall-street-ai-stock-price-1235343279/

Google and Bing are locked in an arms-race to see whose search engine can attain the speediest, most profound enshittification via chatbot, replacing links to web-pages with florid paragraphs composed by fully automated, supremely confident liars:

https://pluralistic.net/2023/02/16/tweedledumber/#easily-spooked

Blockchain was a solution in search of a problem. So is AI. Yes, Buzzfeed will be able to reduce its wage-bill by automating its personality quiz vertical, and Spotify’s “AI DJ” will produce slightly less terrible playlists (at least, to the extent that Spotify doesn’t put its thumb on the scales by inserting tracks into the playlists whose only fitness factor is that someone paid to boost them).

But even if you add all of this up, double it, square it, and add a billion dollar confidence interval, it still doesn’t add up to what Bank Of America analysts called “a defining moment — like the internet in the ’90s.” For one thing, the most exciting part of the “internet in the ‘90s” was that it had incredibly low barriers to entry and wasn’t dominated by large companies — indeed, it had them running scared.

The AI bubble, by contrast, is being inflated by massive incumbents, whose excitement boils down to “This will let the biggest companies get much, much bigger and the rest of you can go fuck yourselves.” Some revolution.

AI has all the hallmarks of a classic pump-and-dump, starting with terminology. AI isn’t “artificial” and it’s not “intelligent.” “Machine learning” doesn’t learn. On this week’s Trashfuture podcast, they made an excellent (and profane and hilarious) case that ChatGPT is best understood as a sophisticated form of autocomplete — not our new robot overlord.

https://open.spotify.com/episode/4NHKMZZNKi0w9mOhPYIL4T

We all know that autocomplete is a decidedly mixed blessing. Like all statistical inference tools, autocomplete is profoundly conservative — it wants you to do the same thing tomorrow as you did yesterday (that’s why “sophisticated” ad retargeting ads show you ads for shoes in response to your search for shoes). If the word you type after “hey” is usually “hon” then the next time you type “hey,” autocomplete will be ready to fill in your typical following word — even if this time you want to type “hey stop texting me you freak”:

https://blog.lareviewofbooks.org/provocations/neophobic-conservative-ai-overlords-want-everything-stay/

And when autocomplete encounters a new input — when you try to type something you’ve never typed before — it tries to get you to finish your sentence with the statistically median thing that everyone would type next, on average. Usually that produces something utterly bland, but sometimes the results can be hilarious. Back in 2018, I started to text our babysitter with “hey are you free to sit” only to have Android finish the sentence with “on my face” (not something I’d ever typed!):

https://mashable.com/article/android-predictive-text-sit-on-my-face

Modern autocomplete can produce long passages of text in response to prompts, but it is every bit as unreliable as 2018 Android SMS autocomplete, as Alexander Hanff discovered when ChatGPT informed him that he was dead, even generating a plausible URL for a link to a nonexistent obit in The Guardian:

https://www.theregister.com/2023/03/02/chatgpt_considered_harmful/

Of course, the carnival barkers of the AI pump-and-dump insist that this is all a feature, not a bug. If autocomplete says stupid, wrong things with total confidence, that’s because “AI” is becoming more human, because humans also say stupid, wrong things with total confidence.

Exhibit A is the billionaire AI grifter Sam Altman, CEO if OpenAI — a company whose products are not open, nor are they artificial, nor are they intelligent. Altman celebrated the release of ChatGPT by tweeting “i am a stochastic parrot, and so r u.”

https://twitter.com/sama/status/1599471830255177728

This was a dig at the “stochastic parrots” paper, a comprehensive, measured roundup of criticisms of AI that led Google to fire Timnit Gebru, a respected AI researcher, for having the audacity to point out the Emperor’s New Clothes:

https://www.technologyreview.com/2020/12/04/1013294/google-ai-ethics-research-paper-forced-out-timnit-gebru/

Gebru’s co-author on the Parrots paper was Emily M Bender, a computational linguistics specialist at UW, who is one of the best-informed and most damning critics of AI hype. You can get a good sense of her position from Elizabeth Weil’s New York Magazine profile:

https://nymag.com/intelligencer/article/ai-artificial-intelligence-chatbots-emily-m-bender.html

Bender has made many important scholarly contributions to her field, but she is also famous for her rules of thumb, which caution her fellow scientists not to get high on their own supply:

Please do not conflate word form and meaning

Mind your own credulity

As Bender says, we’ve made “machines that can mindlessly generate text, but we haven’t learned how to stop imagining the mind behind it.” One potential tonic against this fallacy is to follow an Italian MP’s suggestion and replace “AI” with “SALAMI” (“Systematic Approaches to Learning Algorithms and Machine Inferences”). It’s a lot easier to keep a clear head when someone asks you, “Is this SALAMI intelligent? Can this SALAMI write a novel? Does this SALAMI deserve human rights?”

Bender’s most famous contribution is the “stochastic parrot,” a construct that “just probabilistically spits out words.” AI bros like Altman love the stochastic parrot, and are hellbent on reducing human beings to stochastic parrots, which will allow them to declare that their chatbots have feature-parity with human beings.

At the same time, Altman and Co are strangely afraid of their creations. It’s possible that this is just a shuck: “I have made something so powerful that it could destroy humanity! Luckily, I am a wise steward of this thing, so it’s fine. But boy, it sure is powerful!”

They’ve been playing this game for a long time. People like Elon Musk (an investor in OpenAI, who is hoping to convince the EU Commission and FTC that he can fire all of Twitter’s human moderators and replace them with chatbots without violating EU law or the FTC’s consent decree) keep warning us that AI will destroy us unless we tame it.

There’s a lot of credulous repetition of these claims, and not just by AI’s boosters. AI critics are also prone to engaging in what Lee Vinsel calls criti-hype: criticizing something by repeating its boosters’ claims without interrogating them to see if they’re true:

https://sts-news.medium.com/youre-doing-it-wrong-notes-on-criticism-and-technology-hype-18b08b4307e5

There are better ways to respond to Elon Musk warning us that AIs will emulsify the planet and use human beings for food than to shout, “Look at how irresponsible this wizard is being! He made a Frankenstein’s Monster that will kill us all!” Like, we could point out that of all the things Elon Musk is profoundly wrong about, he is most wrong about the philosophical meaning of Wachowksi movies:

https://www.theguardian.com/film/2020/may/18/lilly-wachowski-ivana-trump-elon-musk-twitter-red-pill-the-matrix-tweets

But even if we take the bros at their word when they proclaim themselves to be terrified of “existential risk” from AI, we can find better explanations by seeking out other phenomena that might be triggering their dread. As Charlie Stross points out, corporations are Slow AIs, autonomous artificial lifeforms that consistently do the wrong thing even when the people who nominally run them try to steer them in better directions:

https://media.ccc.de/v/34c3-9270-dude_you_broke_the_future

Imagine the existential horror of a ultra-rich manbaby who nominally leads a company, but can’t get it to follow: “everyone thinks I’m in charge, but I’m actually being driven by the Slow AI, serving as its sock puppet on some days, its golem on others.”

Ted Chiang nailed this back in 2017 (the same year of the Long Island Blockchain Company):

There’s a saying, popularized by Fredric Jameson, that it’s easier to imagine the end of the world than to imagine the end of capitalism. It’s no surprise that Silicon Valley capitalists don’t want to think about capitalism ending. What’s unexpected is that the way they envision the world ending is through a form of unchecked capitalism, disguised as a superintelligent AI. They have unconsciously created a devil in their own image, a boogeyman whose excesses are precisely their own.

https://www.buzzfeednews.com/article/tedchiang/the-real-danger-to-civilization-isnt-ai-its-runaway

Chiang is still writing some of the best critical work on “AI.” His February article in the New Yorker, “ChatGPT Is a Blurry JPEG of the Web,” was an instant classic:

[AI] hallucinations are compression artifacts, but — like the incorrect labels generated by the Xerox photocopier — they are plausible enough that identifying them requires comparing them against the originals, which in this case means either the Web or our own knowledge of the world.

https://www.newyorker.com/tech/annals-of-technology/chatgpt-is-a-blurry-jpeg-of-the-web

“AI” is practically purpose-built for inflating another hype-bubble, excelling as it does at producing party-tricks — plausible essays, weird images, voice impersonations. But as Princeton’s Matthew Salganik writes, there’s a world of difference between “cool” and “tool”:

https://freedom-to-tinker.com/2023/03/08/can-chatgpt-and-its-successors-go-from-cool-to-tool/

Nature can claim “conversational AI is a game-changer for science” but “there is a huge gap between writing funny instructions for removing food from home electronics and doing scientific research.” Salganik tried to get ChatGPT to help him with the most banal of scholarly tasks — aiding him in peer reviewing a colleague’s paper. The result? “ChatGPT didn’t help me do peer review at all; not one little bit.”

The criti-hype isn’t limited to ChatGPT, of course — there’s plenty of (justifiable) concern about image and voice generators and their impact on creative labor markets, but that concern is often expressed in ways that amplify the self-serving claims of the companies hoping to inflate the hype machine.

One of the best critical responses to the question of image- and voice-generators comes from Kirby Ferguson, whose final Everything Is a Remix video is a superb, visually stunning, brilliantly argued critique of these systems:

https://www.youtube.com/watch?v=rswxcDyotXA

One area where Ferguson shines is in thinking through the copyright question — is there any right to decide who can study the art you make? Except in some edge cases, these systems don’t store copies of the images they analyze, nor do they reproduce them:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

For creators, the important material question raised by these systems is economic, not creative: will our bosses use them to erode our wages? That is a very important question, and as far as our bosses are concerned, the answer is a resounding yes.

Markets value automation primarily because automation allows capitalists to pay workers less. The textile factory owners who purchased automatic looms weren’t interested in giving their workers raises and shorting working days.

‘

They wanted to fire their skilled workers and replace them with small children kidnapped out of orphanages and indentured for a decade, starved and beaten and forced to work, even after they were mangled by the machines. Fun fact: Oliver Twist was based on the bestselling memoir of Robert Blincoe, a child who survived his decade of forced labor:

https://www.gutenberg.org/files/59127/59127-h/59127-h.htm

Today, voice actors sitting down to record for games companies are forced to begin each session with “My name is ______ and I hereby grant irrevocable permission to train an AI with my voice and use it any way you see fit.”

https://www.vice.com/en/article/5d37za/voice-actors-sign-away-rights-to-artificial-intelligence

Let’s be clear here: there is — at present — no firmly established copyright over voiceprints. The “right” that voice actors are signing away as a non-negotiable condition of doing their jobs for giant, powerful monopolists doesn’t even exist. When a corporation makes a worker surrender this right, they are betting that this right will be created later in the name of “artists’ rights” — and that they will then be able to harvest this right and use it to fire the artists who fought so hard for it.

There are other approaches to this. We could support the US Copyright Office’s position that machine-generated works are not works of human creative authorship and are thus not eligible for copyright — so if corporations wanted to control their products, they’d have to hire humans to make them:

https://www.theverge.com/2022/2/21/22944335/us-copyright-office-reject-ai-generated-art-recent-entrance-to-paradise

Or we could create collective rights that belong to all artists and can’t be signed away to a corporation. That’s how the right to record other musicians’ songs work — and it’s why Taylor Swift was able to re-record the masters that were sold out from under her by evil private-equity bros::

https://doctorow.medium.com/united-we-stand-61e16ec707e2

Whatever we do as creative workers and as humans entitled to a decent life, we can’t afford drink the Blockchain Iced Tea. That means that we have to be technically competent, to understand how the stochastic parrot works, and to make sure our criticism doesn’t just repeat the marketing copy of the latest pump-and-dump.

Today (Mar 9), you can catch me in person in Austin at the UT School of Design and Creative Technologies, and remotely at U Manitoba’s Ethics of Emerging Tech Lecture.

Tomorrow (Mar 10), Rebecca Giblin and I kick off the SXSW reading series.

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

[Image ID: A graph depicting the Gartner hype cycle. A pair of HAL 9000's glowing red eyes are chasing each other down the slope from the Peak of Inflated Expectations to join another one that is at rest in the Trough of Disillusionment. It, in turn, sits atop a vast cairn of HAL 9000 eyes that are piled in a rough pyramid that extends below the graph to a distance of several times its height.]

#pluralistic#ai#ml#machine learning#artificial intelligence#chatbot#chatgpt#cryptocurrency#gartner hype cycle#hype cycle#trough of disillusionment#crypto#bubbles#bubblenomics#criti-hype#lee vinsel#slow ai#timnit gebru#emily bender#paperclip maximizers#enshittification#immortal colony organisms#blurry jpegs#charlie stross#ted chiang

2K notes

·

View notes

Text

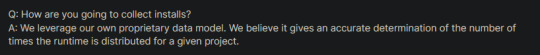

I've been following the Unity situation and its so fucking insane like holy shit.

We have everything!

- Absurd fees for devs! That may or may not be retroactive and illegal, but we won't say until you cause a stink about it! (We totally aren't shh we wouldn't break the law. Totally :) )

- Getting rid of one of their levels of subscriptions during all of this, The 'Plus Plan', and allegedly putting you on the more expensive 'Pro' subscription if you auto renew!

- Insider trading! Selling their stocks not even a week before they released this new change in their company! x x

They've since backpedaled from what their original plan was. Originally, they told everyone that every Install, reinstall, dlc, demo, and pirated copy would now cost a fee (with few exceptions, such as charity games and bundles)

It's not hard to see how this could tank an indie company with ease. Mad at a dev/company? Just mass install/uninstall.

Now they are apparently saying that 'nonono! We only meant the original install :)'

Which also opens the door as to how they are tracking installs. They so far have seemed to be avoiding as to how on earth they are going to do that without breaching privacy on a computer. Especially when it could just be easier to make a fee based on purchases, but no. x

So you know, don't worry guys, they have their own 'proprietary data model.' But so far (As i type this, or am aware of) have not given details about how that model works.

When asked about stuff such as Xbox Gamepass, Unity mentioned it would be Microsoft paying for the fees. As of now, I have no idea if Microsoft was even told this, and I doubt they are going to agree to it either out of nowhere. x

Another fun thing, is if you change your Unity plan, you are added to the revenue threshold immediately. Interesting that this is after they sneakily got rid of their Plus plan, which a lot of devs seemed to use.

And interesting enough, they seem to contradict themselves from their QnA and their official twitter post regarding Demo's and Early Access, or at least tried to be sneaky about the wording?? x x

They won't charge for demos or early access, until they do, apparently. Or if the demo has data that can be transferred to the main game, anyway.

Unity also claimed this would only affect 10% of its users. Which is funny when you look at all the Indie devs and studios who are coming out on twitter saying that this actually directly hurts them.

Not to mention all the people that have spent years learning this engine, for themselves, or so they can apply to companies using it. And now all of that was just spat on by Unity themselves.

There's also the games that have been out and are built on this engine, and can't just be tossed and rebuilt. Such as Among us, Genshin Impact, Pokemon Go and the Diamond/Pearl remakes.

Overall, it's a huge mess. Unity majorly screwed up.

I'd recommend looking into what games you like, and if they run on Unity. If you don't have them yet, you may want to purchase them so they are in your steam library, or whatever console you play on. With the uncertainty of all of this, I wouldn't be surprised if some companies delist their games on steam.

If you buy from them now, you'll still be able to support the devs before Unity implements this new fee plan. Plus, since you paid for them, they will still be on your console/in your steam library.

Please stay safe ya'll, and support your local game devs during this storm. They need it.

#unity#unity3d#indiegame#indiedev#game development#unity engine#video games#sorry for the long post#but i felt this was important#long post#zed.talks

258 notes

·

View notes

Text

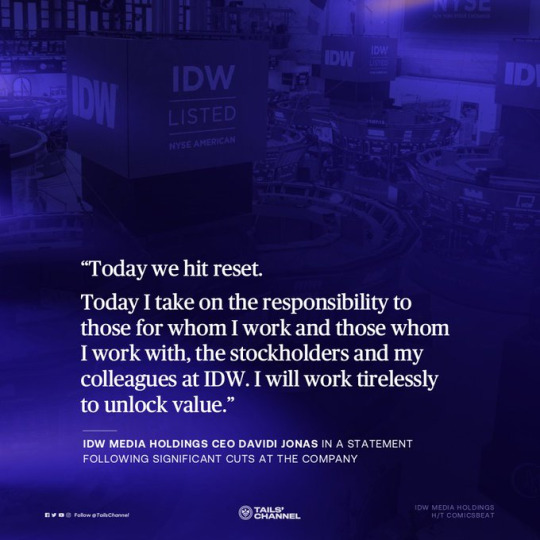

Significant cuts hits IDW's parent company in a self-described "reset"

IDW Media Holdings, the parent of IDW Publishing (the company behind the Sonic the Hedgehog comics), announced major cuts in an effort to unlock financial stability.

The company terminated their New York Stock Exchange listing, shook up senior management, and slashed entire promotional and editorial departments - around 39% of its workforce.

The newly-appointed CEO characterized the axe drop a "reset."

Background

There's no other way to describe it, the cuts at IDW are significant.

The axe drop was in direct response to a poor balance sheet in a tough economic environment. IDW suffered greatly during the COVID-19 pandemic, and non-publishing segments (like direct-to-consumer games) continued to illustrate repeated quarterly losses.

It's no secret that IDW experienced cash flow issues and various others financial challenges, even though the comic books in particular (like IDW Sonic and TMNT) are significant revenue generators.

The company hopes that these cost-cutting measures will provide $4.4 million USD in estimated annual savings.

The impacted

Marketing, public relations, and editorial at IDW were impacted by today's announced cuts.

Comicsbeat reported that the entire marketing and PR departments, and half of the editorial team, got the axe, with more specific details yet to come. That's 39% of the total workforce.

At press time, @idwsonicnews told us that Shawn Lee, a "designer and letterer on many IDW titles", were among the laid off. He tweeted, "whelp, I'm officially a freelancer now."

---

Meanwhile, senior management got a shakeup. Former chairman Davidi Jonas replaced Allan Grafman as Chief Economic Officer. Chief Financial Officer Brooke Feinstein was ousted, and Amber Huerta was promoted to Chief Operating Officer.

IDW also voluntarily delisted their Class B common stock from the New York Stock Exchange, the largest trading venue in the world; and suspended their reporting status to the U.S. Securities and Exchange Commission. The company hoped that this will "reduce pressure on limited resources and the Company’s current inability to realize many of the benefits."

Okay, what about IDW Sonic?

Deep breaths.

At press time, there's nothing we know that flags an immediate concern for the IDW Sonic comics. However, as this is a developing situation, and the long-term outlook is uncertain, the forecast can change.

Even though it, and other comic book franchises (TMNT, etc.) continues to generate significant revenue to the publishing unit, IDW will have to enact more critical decisions to remain financially sound.

IDW Sonic editors David Mariotte and Riley Farmer have yet to officially acknowledge the parent company's announcement, but both "retweeted posts related to the layoffs," @idwsonicnews told us.

We have reached out to IDW Publishing for further comment.

(Updated Friday 11:00 pm ET)

#not great!#idw sonic the hedgehog#idw sonic#idw publishing#sonic the hedgehog#sonic#sonic idw#sonic news

187 notes

·

View notes

Text

Understanding the Dynamics of Assam Carbon Limited Share Price: A Deep Dive into Delistedstocks

In the ever-evolving landscape of stock markets, the trajectory of share prices often holds a plethora of insights for investors. One such entity that has recently garnered attention is Assam Carbon Limited, with its share price movements becoming a focal point for market enthusiasts. Delistedstocks, a prominent platform for stock analysis, has been closely monitoring the dynamics of Assam Carbon Limited's shares, offering valuable insights into its performance and market behavior.

Assam Carbon Limited, a company deeply entrenched in the carbon products sector, has witnessed a series of fluctuations in its share price in recent times. These fluctuations, while intriguing, have also sparked curiosity among investors regarding the underlying factors driving the movement.

Delistedstocks, known for its comprehensive analysis and in-depth research, has been instrumental in shedding light on the nuances of Assam Carbon Limited's share price dynamics. Through meticulous examination, the platform has unraveled various facets influencing the trajectory of these shares.

One of the key factors affecting Assam Carbon Limited share price is its financial performance. Delistedstocks has meticulously scrutinized the company's earnings reports, analyzing factors such as revenue growth, profitability, and operational efficiency. Any deviations from market expectations in these metrics have often been reflected in the share price movement.

Moreover, industry dynamics play a pivotal role in shaping Assam Carbon Limited's share price. Delistedstocks has delved into the broader carbon products sector, assessing market trends, demand-supply dynamics, and competitive landscape. Changes in industry dynamics, such as shifts in consumer preferences or regulatory developments, have a direct bearing on Assam Carbon Limited's share price performance.

Market sentiment and investor perception also exert a significant influence on Assam Carbon Limited's share price. Delistedstocks has closely monitored market sentiment indicators, gauging investor sentiment through various metrics such as trading volume, price movements, and sentiment analysis tools. Positive news such as expansion plans, new product launches, or strategic partnerships often propel the share price upwards, while negative developments can trigger a sell-off.

Furthermore, Delistedstocks has provided valuable insights into the technical aspects of Assam Carbon Limited's share price movement. Through chart analysis, trend identification, and technical indicators, the platform has offered traders and investors a deeper understanding of price patterns, support and resistance levels, and potential entry or exit points.

In conclusion, the dynamics of Assam Carbon Limited's share price, as dissected by Delistedstocks, offer a multifaceted perspective for investors. By analyzing factors such as financial performance, industry dynamics, market sentiment, and technical indicators, Delistedstocks provides a comprehensive toolkit for investors to navigate the volatile waters of the stock market. As Assam Carbon Limited continues its journey, Delistedstocks remains a reliable companion, offering unparalleled insights into the intricacies of share price movements and empowering investors to make informed decisions.

0 notes

Text

Big Update Post

Hiya, shapeshifters!

We have some announcements to make this evening.

Here’s the short of it:

The Shapeshifters website will be temporarily down this Sunday evening, March 3, 2024 at Midnight EST.

When it comes back up, you’ll find a shiny new website that is organized the same way with a couple of exceptions.

The Off-the-Rack Sale and Holographic listings will be temporarily delisted.

The Goth listings will be renamed. You will find Rainbow Constellations, Monster Mouths, and a couple of new options listed under Cosmic Horror.

The Skin Tone listings will have brand new additional color skin tone options!

The Island Time listings will also have a new option available.

The Binding 101 FAQ will be rolled into its own section in the FAQ.

There will be a brand new Events Page!

The blog will be temporarily disabled.

If you’re curious about the long of it, keep reading.

For everyone else, we appreciate your patience during this transition! Like so many other transitions, we’re delighted about where it’s going.

Website Downtime

Shapeshifters is finally moving to Shopify! We’ve done a lot of work over the past few months building a more organized, streamlined website that will be easier to access for you and update for us. On Sunday night, we’ll shut down the current website to pause orders so that we can migrate everything cleanly.

Off-the-Rack and Holographic Listings

The Off-the-Rack listings will be delisted to give us a chance to reorganize the remaining stock so we don’t accidentally double-sell anything.

The Holographic listings will be delisted while we assess our fabric options. Long-time customers might notice that we’ve removed Liquid Metal and Oil Slick from the Holo listings; we’re sourcing replacements and new options throughout spring. Once we know our options, we’ll either re-launch the Holo listings, or move the currently available fabric Prism to another home so it won’t be all alone anymore.

If you’ve been eyeing either Prism or an Off-the-Rack, buy it before Sunday if you can!

Expanded Skin Tone Range

We’re very excited to announce three new skin tone options will be available after the website migration: Pine, Chestnut, and Laurel! Pine is a pale shade, while Chestnut and Laurel are both on the darker end of the spectrum.

And, the new and improved Skin Tone listings will be the perfect place to see the results of our latest photoshoot! We’re excited for y’all to get to see these photos around the site and on the listings. We sought out models of color with darker skintones both to fill a gap in the modeled photos in our listings, and to show off our darker skin tones. All of our models were amazing, our photographer was great, and the photos are fantastic! We really leaned into the cozy Vermont vibes for this one.

Events Page

We’re going to events again! Hooray!

And we’re not just going to conventions and conferences and Pride festivals. We’re also talking queer markets, fashion shows, and binder sewing workshops!

That’s right, some lucky folks in the New England area will have the opportunity to take an in-person class with Eli, our head tailor and the developer of our DIY Binder Sewing Kits. They will walk you, step-by-step, through sewing your own custom-sized binder and help you troubleshoot along the way. These workshops are designed for sewists of any level and do not require you to own a sewing machine.

If you’d like to host a sewing workshop or would like to have us at any other event, educational, celebratory, fashionable or otherwise, please contact us!

Thanks once again for bearing with us during this transition and we can’t wait for you all to see the new site!

#chest binders#shapeshifters#events#pride#skin tone chest binders#sewing workshops#how to sew binders

47 notes

·

View notes

Text

So Let's Talk About Warner Bros Discovery Burning Down HBO Max for the Insurance Money

Okay real quick for those of you who don't know who I am: I"m Jake, I review animation on this fair blog sometimes on comission (which is open by the way) , and mostly just because I want to. I love all kinds of stuff from comics, to comic strips, to movies, and review all kinds in turns. I"m telling you this so you have full and proper context as to why Warner Bros Discovery's latests actions have been HELL on my anxiety. While this week has been a hard one for reasons that aren't your buisness, Warner just made it so much worse so rather than do three reviews this week, i'm doing two and this piece, outlying why I"m so nettled, why I no longer feel any security for anything warner has going , in production or otherwise, and why WBD sucks dirty ass in thunderstorms.

Let's begin with what's going on for those in the back who haven't heard: Last week Warner Bros Discovery made the earthshatteringly dumb decision to cancel their 40 million dollar Batgirl film, and not release it in any way shape or form as a tax write off as well as announcing they were canceling several other dc projects with the Arrowverse finally being taken out back and shot with the Flash getting canceled and given a smal lseason to wrap up (and Superman and Lois likewise detatching from said universe for it's own saftey), and just about every DC Project now in fear of being cut, paticuarlly the tv shows. The Flash MOVIE is weirdly exempt from this despite starring known human dumpster fire whose progressively spiraling Erza Miller. Granted they ARE getting help, so it might help, but it still feels odd to not drop THAT movie but drop one by people who have done absoltuely nothing wrong and is almost finished. And by odd I mean...

So yeah a 40 billion dollar diverse, great looking film is in limbo, any dc film that hasn't started shooting is in the firing range. While I do feel the DCEU badly needed an actual structure instead of just doing whatever movie without any real plan. But

Is somehow worse than no strategy. But there does seem to be SOME method to the madness here.. unfortunatley said method, as most perfectly put by my surrogate tv dad John Oliver

"It seems like your trying to burn down my platform for the insurance money"

That does seem to be WBD's plan: Liquidate as much as possible, put as much of it as a tax writeoff as you can, and to hell with what comes next. There's no building going on here, just madly selling anything they can to make money. Which admitely I have done, I once had to sell off my entire 3ds collectoin to get buy, but i'm a 30 year old man with the body of an orangutan, not a BILLION dollar company that should know better. Even if Discovery is new at running this type of company, they seem more concerned with making as much money as possible and don't care if they actually surivive as a platform, if works of art surivive, or for anything other than getting a huge kickback.

And that brings me to today, the worst news in recent animation history. And keep in mind that history includes:

1. Disney cancelling the critically aclaimed and briliant owl house because it was too gay and trying to pretend that's not why they did it

2. Netflix's Childrens Content slowly collapsing into the sea with one or two exceptions.

3. Sex Monster John Lassiter somehow getting another job and a new movie AppleTV+ feels comfortable promoting.

4. The passing of Betty White, Ed Asner and Gilbert Gottfried

But yes HBO Max decided to delist a TON of his content. While ti hasn't happened yet and the backlash, and a recent blow to their stock due to this bullshit as a rare instance of corprate greed biting them, MIGHT stop it, it might be too late. The shows being chopped include Close Enough, a show they had just canceled a week ago and now decided no one can enjoy and that was not only one fo the platforms lead shows, but it's only adult animated comedy that didn't make people throw things at it on sight, Infinity Train, a show people were already mad was screwed out of more than four seasons, Ok KO Let's Be HEroes, one of the best cartoons of the 2010s, Mao Mao Heroes of Pure Heart which was stuck in cancelation limbo, and victor and Valentino, which I have not watched but is JUST going through season 3 as we speak. None of it makes sense, none of it is right and all of it is clearly a ploy to mak ea tax writeoff. And while previous managment had done this, there was a simliar incident iwth greats such as megas xlr and sym boinoic titan, never before has a company made material not only unavablaibe but so nakedly tried to claim something as a loss. I'm HOPING this bs dosen't fly in court, as none of these shows really are the net loss they thinkt hey are, paticuarlly close enough and infinity train, so none of this should add up, but i'm not holding my breath.

I'm also not holding my rage. I belivie in works being avaliable to people. Good or bad, as long as their not harmful , they should be out there and avaliable. Things should be preserved. And making it so several shows are just outright unwatchable, JUST so you can make money is one of the most greedy, discpiable, hateful and agonizing acts i've seen in some time. OK KO thankfully escapes thanks to being on hulu, but that may not be forever and they may try this shit with other platforms. For once most of these shows being on netflix in other countries is a lifesaver. And yes you can still find the stuff that's being taken on the internet, piracy can be bad but it can also be a way to preserve stuff, but I should be able to have a legal and fine means of watching Close Enough. I shoudln't hav eto scour for a show just because you want money. I'm still subscribed to hbo max as it's not me who does and it still has enough content.. but if they keep doing this scorched earth nonsense, it's going to leave them with nothing to sell and nothing to buy and no one to buy into thei rshit. and i'm hoping they learn their lesson and ease back before it's too late and one of the best platforms in the streaming wars is gone.

For now though all I can do is wait and hope like hell more things I care about don't die a cruel greedy death.

649 notes

·

View notes

Text

Want to invest in Private Equity

If you want to start investing in private equity then visit Planify. Planify is a fintech company that aims to build India's biggest private equity marketplace. Also, Planify will provide complete assistance that will help you know where to invest.

0 notes

Text

JoAnn Fabrics is NOT going out of business.

Joann has filed for Chapter 11 bankruptcy, which is basically a re-organization of funds. They're being taken off the NASDAQ stock exchange after being added in 2021 and getting assistance with debts.

STORES WILL REMAIN OPEN.

During 2020 when people were home, picking up new hobbies and sewing lots of masks, Joann did great. But as costs of living shot higher post-pandemic people stopped spending as much money on hobbies and Joann suffered. There will be layoffs and I've already seen stores reducing (recently we went from four in my metro area to two) but the whole chain isn't gonna vanish or liquidate.

#my posts#my friend in finance helpfully explained this to me in anime night tonight#and ive seen a lot of panic over the one post#joann isnt GREAT by any means#but it beats hobby lobby and walmart#or driving 3 hours to an SR Harris#or#god forbid#ordering fabric online without getting to feel it first

21 notes

·

View notes

Text

The Final Broccoli Shareholder Meeting ☆

I had originally written the below portion for Mia's 10th Uta no Podcast episode: Music Talk, as she tends to go over occurrences and fandom news that have come out between episodes toward the end of the show. However, considering the nature of the news, I felt it would be good to also share part of the transcript here so that those who do not listen to the show, or may not know otherwise, can get a better understanding as to what's been going on.

Minor edits have been made for clarity.

Without further ado....

_________________________________________________

Broccoli held their 29th stakeholder meeting on May 26th, 2023, resulting in much controversy within the Utapri fandom. It is believed that around 160-170 people were in attendance; and from my understanding of this thread by @active_cns_N, Broccoli as a company has fostered a culture of allowing fans to interact directly with their staff at these meetings to discuss topics outside of just management policies, which is customary in this kind of gathering. Because Broccoli will be delisting themselves from the stock market, this would be their final public shareholder meeting. Please keep in mind that the information detailed in this summary are consolidated from various tweets that came from the attendees themselves, and no minutes have been released as of writing this document. As a result, there may be some things that may need clarification or amendment at a later date.

In any case, it is believed that Broccoli were expecting to be answering questions regarding the Happinet acquisition considering their lack of preparedness, vagueness, and overall lacking responses regarding Dolce Vita, Backdol and Utapri as whole. These subjects took up most of the duration for the meeting. In fact, I believe it was mentioned that only one question regarding the acquisition was asked throughout the entire meeting, which may have been a shareholder asking if Broccoli was intentionally sabotaging themselves so that Happinet's tender offer could get to 1,500 yen and allow for an easier acquisition. The current President affirmed that no such actions were taking place.

This would be a good segway to mention that the current President of Broccoli is Shigeki Suzuki who served as director and senior managing executive officer at Happinet, being appointed back in April of 2022. The chairman and executive director of Broccoli are also previous Happinet employees.

At this time, it seems there is only one female executive in the company and she is believe to be the producer responsible for overseeing the Utapri project. There are no women currently on the board of directors.

Now for what everyone's been waiting for: As supporters of Uta no Prince-sama, what do we need to know?

♫ Dolce Vita is still in development and Broccoli asserted that it will see a release date; they explained that the reason development on the game slowed to a crawl had to do with having few staff members who are well-versed in the world of Uta no prince-sama and that with the expansion of the movie projects, Shining Live and SSS among other things, it has been difficult to allocate resources to Dolce Vita. The discontinuation of the PS Vita game console also had a huge impact on DV's development. Broccoli emphasized that they want to carefully craft a game they feel the fans will be satisfied with and are very cognizant of its significance and want to be careful with the product they end up releasing. They also declined to say specifically if there would or would not be new information coming out on the 13th anniversary.

♯ It's been brought to light after the meeting that Broccoli currently has up to five (5) different job postings on their site directly related to Utapri in some capacity, like the hiring of a content director, graphic designer, and staff for scenario direction and writing among other roles.

♯ It's also worth mentioning that historically, the writing for the Utapri games have largely been outsourced to other companies. It wasn't until ASAS that the content was produced in-house.

♫ The title of Uta no Princess-sama from Uta no Princess-sama: Back to the Idol will not be changed, and that after an internal discussion on the matter, did not see the reason to change it and stand firm with Agematsu's vision for the project. They maintain that there will be no crossover between the franchises.

♯ When asked exactly what to expect from Backdol, and why there was a severe lack in quality for their recently released videos (like the recently published Golden Week series), Broccoli only answered the question in part and said they are "making efforts to improve the quality of their videos".

♫ Broccoli was also asked why Backdol and Utapri were so similar despite having nothing to do with each other and asked if their neglect for female-oriented content despite their enthusiasm towards male-oriented IPs had to do with the lack of women among the board of directors. Their response is as follows:

On the similarities between Backdol/Utapri: The company does not perceive it to be that way.

On the lack of women among the board: While there are no women among the board of directors, they do have a female executive officer (likely referring to Sayaka Konno) who is involved in the development of concepts. Within the company, women also outnumber men in middle management positions and female employees are constantly involved in projects such as Utapri. The prospect of a female on the board is welcome and desired, but they do not consider appointments solely on gender alone. Again, because of the amount of women in the company, it is only a matter of time before some of them transferred to director or executive officer positions.

They also emphasized that the opinions of female staff are more readily accepted and incorporated compared to their male counterparts when it comes to content creation. All of this to say that the company feels they are not inhibiting their voices.

♫ When it comes to the mishandling and lack of sufficient stock for event merchandise, Broccoli could only conjure a vague response stating they will "make efforts to improve the situation"

♫ Broccoli has plans for upcoming Birthday celebrations but would not say exactly what. They also did not have anything to say regarding the apparent discontinuation of the Birthday Collection series.

That is as much information as I can remember to include at the moment and am unsure if anything was missed, so anyone with more to share, please don't hesitate to correct or add to in the chat or comments below.

There is much to be said about the acquisition because of Happinet's apparent limited understanding of otome or romance content and Broccoli's responses in general but all I can hope as an enthusiast of the franchise is that it all turns out for the best.

47 notes

·

View notes