#car insurance india

Text

क्या आप ऑनलाइन कार बीमा में रुचि रखते हैं? तो आप श्रीराम जनरल इंश्योरेंस को चुन सकते हैं इस कंपनी का दृष्टिकोण 'आम आदमी' को सही बीमा सेवाएं प्रदान करना और उच्चतम संतुष्टि प्राप्त करना है।

#car insurance#buy car insurance online#car insurance india#four wheeler insurance#online car insurance payment

0 notes

Text

Types Of Car Insurance Policies In India

Car insurance is the best way to alleviate financial stress in such instances. Protection is provided for financial losses resulting from any unfortunate events involving your car under all types of car insurance online or offline, subject to the specific terms and conditions of your policy.

Comprehensive Insurance

Comprehensive car insurance is an extensive insurance policy for private cars that offers protection to the vehicle from all kinds of risks, such as accidents and collisions, theft, third party liabilities and natural calamities like flood, landslide etc. The insured also has the option of adding add-on covers to enhance the scope of coverage.

Third Party Insurance

Third-party car insurance is a standard vehicle insurance policy which is mandatory to be taken in India. It covers you up to a maximum of INR 7.5 lakh against third-party liabilities and offers insurance coverage against damages caused by your car to a third party or third property. It also provides coverage in case of the death of a third party.

Standalone Own-Damage Car Insurance Policy

This kind of policy provides coverage for own damages, which has caused loss to the policyholder’s car. It is to be noted that this kind of policy does not offer coverage for third-party car insurance. Standalone own-damage car insurance policy is effective in India from September 2018.

#car insurance#car insurance in India#vehicle insurance#car insurance policy in India#Comprehensive car insurance#car loan#car insurance policy

3 notes

·

View notes

Text

A Comprehensive Guide to Comparing Insurance Policies

Compare Insurance Policies: Insurance is a critical component of financial planning, providing protection and peace of mind against unforeseen events.

However, with numerous insurance providers and policy options available, choosing the right coverage can be overwhelming.

How To Compare Insurance Policies

In this guide, we’ll explore how to compare insurance policies effectively, step by step,…

View On WordPress

#auto insurance#best auto insurance#best life insurance policies in india#best term insurance#car insurance#cash value life insurance#cheap car insurance#compare business insurance policies#compare commercial auto insurance policies#compare commercial insurance policies#compare general liability insurance policies#compare health insurance policies#compare insurance policies#compare small business insurance policies#health insurance#health insurance 101#health insurance explained#home insurance#insurance#insurance advice#insurance policies#insurance policy#insurance quote#life insurance#life insurance 101#life insurance agent#life insurance policies#term insurance#term life insurance#think insurance

0 notes

Text

Importance of life and health insurance

Life and health insurance are among the most critical risk management solutions available today. Life insurance is basically contractual agreement between a policy holder and the insurance company, which tends to promise to provide the amount insured to the bereaved family after the demise of the policy holder. Best company for Life insurance in Delhi can provide coverage for the financial needs of a family, as well as future plans or investments.

Health insurance, on the other hand, provides compensation when the policy holder requires medical assistance and hospitalization. The policy holder has to pay a fixed amount as a premium for their health insurance. Subsequent to doing so, they would get their medical expenses reimbursed by the insurance company after paying for the same or the company takes care of the expenses directly with the hospital. Many businesses today have tie ups with the Best health insurance company in Delhi to provide their employees with the necessary coverage.

Life insurance and health insurance is required by every person worried about their own and their family’s future. While health insurance provides coverage for medical bills, life insurance provides coverage to families after the death of a breadwinner. Life is fairly uncertain. Hence, people to try their best to protect themselves and their loved ones by investing in appropriate insurance coverage. In addition to life and health insurance, people should also seek out the policies offered by the Best car insurance company in Delhi, India.

#Best company for Life insurance in Delhi#Best car insurance company in Delhi#India#Best health insurance company in Delhi

1 note

·

View note

Text

How to purchase travel insurance plan?

Travelling is an energising adventure, but unanticipated circumstances can disturb your plans. To ensure your trip, acquiring a dependable travel insurance arrange is vital. In this post, we will learn the ten points that will help you pick insurance plan as per you conveniences.

1. Assess Your Travel Needs:

Sometime recently jumping into the world of travel insurance, assess your trip's specifics. Consider factors such as goal, length, exercises, and the generally taken toll of your travel. Knowing your needs will assist you in selecting an arrangement that gives satisfactory scope.

2. Investigate Distinctive Sorts of Scope:

Travel Insurance comes in different shapes, including trip cancellation, restorative scope, staff security, and more. Get the sorts of scope accessible and prioritise based on your necessities. A few plans offer a comprehensive scope, while others are more specialised.

3. Compare Insurance s Suppliers:

Take the time to compare distinctive Insurance suppliers. Search for legitimate companies with a history of solid benefits and positive client surveys. Compare scope limits, avoidances, and policy terms to discover the arrangement that adjusts best together with your travel plans.

4. Check Arrangement Avoidances:

Perused the policy prohibitions carefully to get what isn't covered. Common prohibitions include pre-existing restorative conditions, high-risk exercises, and certain goals. Being mindful of these avoidances guarantees you aren't caught off watch amid your voyages.

5. Assess Restorative Scope:

Therapeutic crises can be expensive, so guarantee your travel Insurance incorporates adequate therapeutic scope. Check if the policy covers hospitalization, crisis therapeutic clearing, and any pre-existing conditions you'll have.

6. Consider Trip Cancellation Scope:

Startling occasions like ailments, common calamities, or other crises can drive you to cancel your trip. Trip cancellation scope can repay you for non-refundable costs. Assess this alternative based on your travel plans and the related dangers.

7. Get it Deductibles and Limits:

Pay consideration to deductibles and scope limits inside the arrangement. Deductibles are the sum you pay sometime recently the Insurance kicks in, and scope limits cap the most extreme sum the backup plans will pay. Beyond any doubt these adjustments together with your budget and potential costs.

8. Buy Travel Insurance s Early:

It's advisable to buy travel Insurance before long after booking your trip. A few policies offer extra benefits when bought inside a particular time allotment, such as scope for pre-existing conditions.

9. Examined Client Audits:

Investigate online audits and tributes from other travellers who have utilised the Insurance supplier. This may give experience in the company's client service, claims handling, and by and large unwavering quality.

10. Audit and Keep Documentation:

Once you've chosen an approach, carefully survey the documentation. Keep a duplicate of your arrangement, crisis contact data, and any required claim forms accessible during your trip. Familiarise yourself with the claims handling in case you would like to utilise your Insurance.

For more such blogs, go & check out the Financenu site.

#Car Loan Interest Rate for New Car#Best Gold Loan Interest Rate in India#Best health insurance plans#Best health insurance plans for family#Car insurance in india

0 notes

Text

Best Home Insurance in Mohan Garden - Bima View

When it comes to protecting your haven in Mohan Garden, your search for the best home insurance in Mohan Garden stops at Bima View. We truly grasp how crucial it is to safeguard your home and valued possessions. In this detailed guide, we'll explore why Bima View stands out as the top choice in home insurance, surpassing all others in Mohan Garden.

The Bima Advantage

Comprehensive Coverage:

At Bima View, we offer a wide-ranging coverage that ensures every aspect of your home and belongings is protected. From structural damage to personal items, we've got you covered.

Affordable Premiums:

We understand the importance of budget-friendly options. Bima View provides competitive premiums without compromising on the quality of coverage. Your peace of mind shouldn't come at a hefty price.

Clear and Simple Policies:

Our insurance policies are designed with simplicity in mind. No confusing jargon or hidden clauses. Bima View believes in transparency, making it easy for you to understand the terms and conditions.

Quick and Hassle-Free Claims:

In the unfortunate event of a claim, Bima View ensures a swift and hassle-free process. Our dedicated team is ready to assist you through every step, making the experience as smooth as possible during challenging times.

Tailored Solutions:

Every home is unique, and so are its insurance needs. Bima View offers customized solutions, allowing you to pick and choose coverage that specifically fits your requirements. No one-size-fits-all policies here.

Local Expertise:

Being familiar with Mohan Garden and its specific nuances, Bima View brings a local touch to insurance. Our team understands the locality, making us better equipped to address your needs effectively.

Customer-Centric Approach:

Bima View values its customers above all. Our customer service is dedicated to providing assistance and guidance whenever you need it. Your satisfaction is our priority.

In conclusion, when it comes to securing your Best home Insurance in Mohan Garden, Bima View emerges as the ultimate choice. Our commitment to comprehensive coverage, affordability, clarity, quick claims, tailored solutions, local expertise, and customer satisfaction sets us apart. Trust Bima View to be your partner in safeguarding your cherished abode.

#insurance companies in Dwarka#Life Insurance Companies in Dwarka#Best Health Insurance Companies in Nawada#general insurance companies in Nawada#Best Life Insurance Plans in Dwarka#Life Insurance Plan & Policy in Nawada#Best Health Insurance Plans in Dwarka#medical insurance plans#Home Insurance Policy Online in India#Best home insurance in Mohan Garden#Business Liability Insurance in Dwarka#car insurance near me#term insurance in Mohan Garden#Whole Life Insurance Plan in Nawada#Top LIC Agents in Dwarka#whole life insurance policy in Mohan Garden#Bima View Health Insurance Companies in Nawada#affordable whole life insurance policy in Mohan Garden#whole life insurance family plans in Dwarka#term insurance plan in Dwarka

0 notes

Text

Top 7 best car insurance Renewal companies in 2024

Top car insurance Renewal companies: In this guide, we unveil the top car insurance renewal companies that stand out for their reliability, customer service, and commitment to providing comprehensive protection for your vehicle.

7 Best car insurance Renewal companies

Selecting the right car insurance renewal company is crucial for securing optimal coverage and peace of mind on the road. As you…

View On WordPress

#auto insurance#best car insurance#best car insurance in india#car insurance#car insurance discounts#car insurance explained#car insurance online#car insurance renewal#car insurance renewal kaise kare#car insurance renewal online#car insurance renewal tips#car insurance savings#cheap car insurance#commercial car insurance#how to renew car insurance online#insurance#new india car insurance#reliance car insurance#uk car insurance#vehicle insurance

0 notes

Text

The Ultimate Guide to Getting New Car Insurance Online

In today's fast-paced digital age, convenience is key. From shopping to banking, everything is just a click away. Car insurance is no exception. If you're on the lookout for a new car insurance policy, look no further than the world of online insurance. In this guide, we'll explore the advantages of obtaining car insurance online and provide you with a step-by-step process to ensure a seamless experience.

Why Choose Online Car Insurance?

Convenience at Your Fingertips:

One of the primary benefits of opting for online car insurance is the unparalleled convenience it offers. No more scheduling appointments or waiting in long lines – with just a few clicks, you can access a myriad of insurance options, compare quotes, and make informed decisions.

Instant Quotes for Informed Decisions:

Online platforms allow you to receive instant insurance quotes based on your specific needs and preferences. This transparency empowers you to make informed decisions that align with your budget and coverage requirements.

24/7 Accessibility:

Traditional insurance agencies operate within regular business hours, making it challenging for those with busy schedules to find time for insurance-related matters. Online platforms, on the other hand, are accessible 24/7, allowing you to manage your insurance at a time that suits you best.

Steps to Getting Car Insurance Online:

Research and Compare:

Start by researching reputable online insurance providers. Take note of customer reviews, ratings, and any special features they offer. Use comparison tools to analyze different policies, ensuring you choose one that aligns with your specific needs.

Gather Information:

Before obtaining quotes, gather relevant information about your vehicle, driving history, and personal details. This will expedite the quoting process and provide accurate estimates.

Use Online Quote Tools:

Most online insurance providers offer user-friendly quote tools. Input the necessary information and let the tool generate customized quotes based on your inputs. Compare the quotes to find the best balance between coverage and cost.

Review Policy Details:

Once you've narrowed down your options, carefully review the policy details. Pay attention to coverage limits, deductibles, and any additional features. Ensure that the policy meets your specific requirements.

Secure Online Transactions:

When you're ready to make a decision, proceed with the online application process. Reputable insurance websites use secure encryption methods to protect your personal information during transactions. Double-check that the website has a secure connection (look for "https" in the URL) before entering any sensitive data.

Documentation and Confirmation:

After completing the application, you may need to submit additional documentation, such as proof of identity or vehicle information. Once everything is in order, you'll receive confirmation of your new car insurance policy.

Conclusion:

In the age of digital empowerment, securing new car insurance online is not just a trend but a smart and efficient way to protect your vehicle and yourself. Embrace the convenience, transparency, and accessibility that online insurance offers, and hit the road with confidence knowing that your ride is safeguarded by a policy tailored to your needs.

Here you can find our original post: https://insurancecompanyinindia.blogspot.com/2023/12/the-ultimate-guide-to-getting-new-car.html

0 notes

Text

🎉🚗 FESTIVE DHAMAKA OFFER! 🚗🎉

,

Dreaming of a brand new car this festive season? Your dream is about to become a reality with Mansa's Easy Approved Car Loan!

,

🌟 Easy Application Process

🚘 Competitive Rates

💼 Hassle-Free Approvals

,

Get behind the wheel of your favorite car. Contact us now! 📞🌐

📱 𝗖𝗮𝗹𝗹 𝗼𝗿 𝗪𝗵𝗮𝘁𝘀𝗔𝗽𝗽: 📱 𝗵𝘁𝘁𝗽𝘀://𝘄𝗮.𝗺𝗲/𝟵𝟭𝟵𝟴𝟱𝟮𝟬𝟬𝟬𝟬𝟴𝟴 𝗖𝗮𝗹𝗹 📞 𝟵𝟴𝟱𝟮𝟬𝟬𝟬𝟬𝟴𝟴

,

#autoloans#buyusedcar#motorbike#motorcycles#cars#bestcars#secondhandcarsales#SUV#Nissan#Mileage#Maruti#India#vehicles#Mahindrathar#Honda#Insurance#bmw#cardsfangram#carshow#chandigarh#panchkula#shimla#pinjore#baddi#homeloan#carloan#businessloan#personalloan#MoneyTips#funding

0 notes

Text

Secure Your Ride with Car Insurance in Noida

Get reliable Car Insurance in Noida. Competitive rates, comprehensive coverage. Protect your vehicle and your peace of mind in Noida with comprehensive car insurance. Bookmark this page to find trusted providers offering competitive rates and reliable coverage.

0 notes

Text

क्या कार बीमा ऑफ-रोड ड्राइविंग को कवर करता है

जो लोग जोखिम भरे साहसिक कार्य और ऑफ-रोडिंग में रुचि रखते हैं, वे विशेष नियमों और शर्तों के साथ कार बीमा के तहत कवर नहीं हो सकते हैं। कुछ बीमाकर्ता विशेष ऐड-ऑन के रूप में कवर प्रदान कर सकते हैं। आम तौर पर आप इसे नियमित कवर के रूप में प्राप्त नहीं कर सकते हैं। ये ज्यादातर बहिष्करण का हिस्सा हैं। हालांकि, आप अपनी खुद की कार क्षति की भरपाई के लिए व्यापक कार बीमा खरीद सकते हैं।

आइए समझते हैं ऑफ-रोडिंग क्या है?

विशेष रूप से इन उद्देश्यों के लिए कारें उपलब्ध हैं। जो लोग कारों के साथ खेल और रोमांच पसंद करते हैं जैसे कीचड़, चट्टानों, रेत के टीलों, बर्फ, नदी के तल, बजरी आदि में। कुछ पेशेवर उद्देश्यों के लिए इसमें शामिल होते हैं और कुछ आकस्मिक मनोरंजन के लिए। ड्राइव की तीव्रता और ट्रैक ऑफ-रोड ड्राइविंग के जोखिम के आधार पर कई प्रकार के हो सकते हैं। टिब्बा कोसना, डेजर्ट रेसिंग, रॉक रेसिंग, क्रॉस-कंट्री, रेल, ग्रीन लेनिंग, मडडिंग और मड प्लगिंग, और रॉक क्रॉलिंग।

ऑफ-रोड ड्राइविंग में कुछ जोखिम शामिल हैं -

ऑफ-रोड ड्राइविंग एक जोखिम भरी गतिविधि है जैसा कि हमने पहले उल्लेख किया है। जोखिम स्तर बढ़ने पर ऑफ-रोड वाहन क्षतिग्रस्त और घायल हो सकते हैं। यदि आप उन लोगों में से एक हैं जो इस प्रकार की गतिविधियों में रुचि रखते हैं, तो आपको संभावित जोखिमों की जांच करनी चाहिए। वाहन की खराबी, खराब दृश्यता और अन्य। इसलिए आपको कुछ सुरक्षा उपायों को ध्यान में रखना चाहिए जैसे वाहन के अंदर अपने अंगों को रखना, सामान को सुरक्षित रखना, बीच-बीच में आराम करना।

अंतिम शब्दों में, अब आप जानते हैं कि ऑफ-रोडिंग क्या है और ऑफ-रोड ड्राइव से संबंधित समस्याओं से कैसे निपटें। चाहे कुछ भी हो सुरक्षा को ध्यान में रखना महत्वपूर्ण है।

अधिक जानकारी के लिए आप यहां जा सकते हैं :-

https://sites.google.com/view/bike-beema/home

Facebook Twitter Instagram Pinterest

#car insurance onlinecar insurance policy#car insurance#buy car insurance online#car insurance india#four wheeler insurance

0 notes

Text

Don't Hit the Road Without This ! Best Car Insurance In India 2023

Introduction :

best car insurance in india 2023

Car insurance is like a safety net for your vehicle. You pay a fee to an insurance company, and in return, they help cover the costs if your car gets damaged, stolen, or if you’re in an accident. It’s there to protect you from unexpected expenses when your car faces trouble. Just like health insurance safeguards your well-being, car insurance…

View On WordPress

#Best Car Insurance In India 2023#car Insurance#How is car insurance value calculated?#Who has cheapest car insurance in India?

0 notes

Text

#types of insurance#types of life insurance#life insurance#insurance#types of insurance explained#types of life insurance in india#types of life insurance policies#health insurance#main types of insurance#whole life insurance#types of insurance policy#types of insurance in hindi#types of insurance in india#insurance types#term life insurance#how many types of insurance in hindi#car insurance#home insurance#term insurance#principles of insurance

0 notes

Text

Hiring Alert| Your Future Goal Is Waiting For You | KD Creation

If you are ready to take control of your future you can join with KD Creation as Financial Consultant and get a whole lots of benefits and advantages . Here you get special training for all, get fixed salary and incentive and also get reward and recognition on the base of your performance. Hurry Now

#hiring2023#hiringalert#hiringnow#lifeinsurance#kdcreation#healthinsurance#insurance#trending#jobvacancy#joinourteam#careeropportunities#careergoals#car insurance#india#west bengal#financialconsultant

1 note

·

View note

Text

Provide Best Car Insurance Online and Best Motor Insurance in India in Delhi NCR by Policy Ensure at best Price. Policy Ensure has taken insurance business to a new dimension all together paving way to a BHAVI BHARAT, in which not only everyone is insured but also empowering self-employment in insurance business by harnessing demographic dividend of great India.

#Best Motor Insurance in India#Car Insurance Online#Buy Vehicle Insurance Online#Buy & Renew Car Insurance

0 notes

Text

What is SIP?

A Systematic Investment plan is a type of asset to save and increase your money for a bright future.

Instead of investing a considerable sum of money once, with a sip, you have to invest a small amount steadily. SIP are the most convenient & easy assets in mutual funds.

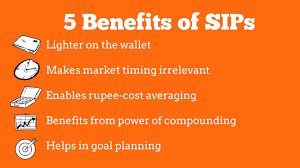

Why do you invest in SIP:-

1. Rupee Cost Averaging:

Tastes take after a straightforward however effective guideline — buying more units when costs are moo and fewer units when costs are high. This methodology, known as rupee-fetched averaging, helps mitigate the effect of showcase instability and permits financial specialists construct up to construct more units over time.

2. Disciplined Investing:

Tastes instils money-related teachings by empowering normal commitments. This consistency is key in developing a propensity of sparing and contributing, driving long-term riches creation.

3. Compounding Enchantment:

The enchantment of compounding is unleashed through Tastes. As your speculations develop, the returns produced begin winning returns themselves. Over time, compounding can altogether boost the esteem of your speculation portfolio.

4. Flexibility and Accessibility:

Tastes offer flexibility in terms of venture sums, permitting financial specialists to begin with a humble whole. This availability makes it an appealing alternative for people at different pay levels.

5. Mitigating Timing Risks:

Timing the advertisement could be a challenging errand. Tastes kill the got to precisely foresee advertise developments, as speculators reliably contribute notwithstanding short-term variances.

#car loan interest rate for new car#best gold loan interest rate in india#lowest home loan rates#gold loan interest rates comparison#personal loan lowest interest rate#lowest gold loan interest rate#Best health insurance plans#Best health insurance plans for family#Car insurance in india

0 notes