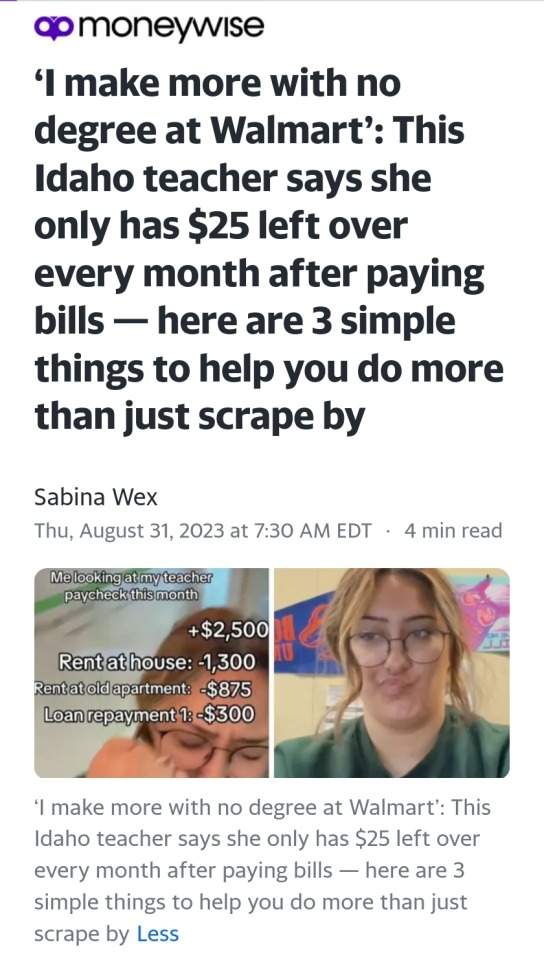

#but somehow everyone making transactions out of pure self interest and nothing more

Text

#do the people who write/edit/publish/approve these articles not hear how insanely dystopian this sounds...#capitalism#reminder this is not a free market#in fact the USA is only rated around the 25th least govt regulated market#and isn't it convenient#how it's the ultrawealthy corporate lobbying groups who are able to influence much of what regulations the USA DOES have 🙄#groups like ALEC that are comically evil - like straight up cartoon villains#Cruella de Vil irl type shit#and they just WRITE LAWS that will make them richer at the expensive of all the rest#and essentially legally bribe the actual so-called lawmakers to push their bills through#that isn't democracy... obviously#turns out the invisible hand is just a giant goddamn middle finger. shocking.#capitalism as a theoretical concept relies on the idea that transactions will be entirely or at least predominantly voluntary#and that both parties in the transaction will act out of self interest#but somehow everyone making transactions out of pure self interest and nothing more#ends up working to the benefit of society on the whole#which doesn't really hold water to begin with but gets even more laughable when you take into account that#it falls apart at stage 1 when you realize transactions can't be truly voluntary if#one party is struggling for survival and the other just wants a 7th yacht

38 notes

·

View notes

Text

The Truth About Capitalism and Free Markets

When everyone can compete in a free market, then the best products and services will prevail at the best prices for the consumer. Furthermore, the chance to invent a whole new market and to profit hugely from it spurs people to create new products and services never before thought of, enriching all of our lives. Rather than a society with hereditary classes, our free market system allows anyone with determination and hard work to achieve riches. These are the myths about Capitalism and Free Markets. And sometimes, to some extent, they are true.

However, more often they are empty promises. You see, the primary proponents of free market capitalism, the capitalists themselves, don’t really believe in it at all. They believe in monopoly. They believe that once they have dominated a marketplace, no one should be able to challenge them and their dominance. While we like to believe that the one who builds the “better mousetrap” will be the one who profits, in reality the actual inventor rarely reaps the greatest rewards. Sometimes it’s because the bigger maker of mousetraps buys them out and takes it over, or buries it altogether if it challenges too much of the supply chain they have built up. Other times it’s a matter of “slicker” negotiations and clever accounting to ensure that the other players needed in bringing a new idea to market get a disproportionate share. It would be a legal nightmare to even attempt to regulate such transactions, and that’s not the point. I bring that up just to illustrate that one of the major “selling” points for totally free markets is more myth and illusion than fact.

Another myth is that making money, being successful in business, is some sort of testament to your (take your pick): a) intelligence, b) hard work, c) being a generally superior and deserving person, or d) all of the above. Some people do become successful with a “better mousetrap”, but others because they are more ruthless, or even willing to engage in fraud. And some are just lucky, like the fellow who discovers that there is oil under his land. Others just managed to acquire a large supply of a suddenly high demand product, like hand sanitizer at the beginning of a pandemic and attempt to resell it at inflated prices. Having become rich is proof of nothing but being rich.

This attitude that anyone can become as rich as they deserve has an insidious side effect; if you are poor, you must deserve it. It is a convenient piece of rationalization for being greedy and uncharitable.

The free market myth is that the better product or service will ultimately prevail. That value (quality versus cost) will win the consumers over. Let’s take a closer look at that myth. Every shopper knows that they have different standards of quality for different products. Some of it is personal taste, some of it is how important the item is to us. Let’s say for T-shirts I’m going to wear to work in my garage I don’t care if the seams aren’t as tightly sewn, or the material is thin. Chances are they’ll be covered in stains long before the quality of the stitching gives out. On the other hand I’m very picky about the shirts I wear to work, and I want the best quality so that they will last long and look good. Such differences in individual choices should make room for a variety of goods and various values to suit individual needs and tastes. It should be easy to see that there isn’t a huge range of quality for all goods and services and that the upper end of quality doesn’t change without innovation. Now this is where the free market system is supposed to excel. However, it is easier, and often more profitable, to cut costs, than to improve quality. This is the habit of most well established businesses; it is the low cost, low risk option. Of course cost cutting often ends up affecting minimum quality and even safety issues. Ever heard a boss say something like “come on, surely a 10% cut can’t be that big a deal?” If the safety of the product isn’t obviously compromised to the point that an ordinary consumer could tell, then it would seem that some regulation is needed to prevent such behavior. And thus we have our first need to abandon the idea of a “totally” free market system.

Regulation is needed to protect the public from dangerous products and outright falsehoods in the advertising and selling of these products. As for innovation, the actual inventors are often the ones NOT motivated by money and rarely reap the rewards of their inventions. But then that is a whole other story.

The free market is supposed to mean one that isn’t subject to coercion, one that allows competition. However, in order to preserve competition some regulation is needed. So let’s assume that Bob’s Business Machines makes computer chips. Barry has an idea for a different kind of computer chip architecture. It will be faster, and hold more information than Bob’s. But of course, it is just an idea right now. Barry needs money to develop a prototype and then money for manufacturing, marketing etc. Bob, cunning businessman that he is, has significant business relationships with all of the major banks; the very ones (the only ones) who are in a position to loan Barry the kind of money he will need. Of course the banks are smart – they know that Barry’s chip (if it lives up to its potential) is a serious challenger to Bob’s. They also know that if they loan Barry any money, Bob could pull all of his business and leave the bank in terrible shape. So unless there is some regulation prohibiting acting in restraint of trade, Bob might not even have to ask the banks to refuse Barry a loan. And as simple as that laissez faire capitalism has been able to stifle competition.

Regulation is needed to keep the current rich and powerful from barring new entries into the “club”. The entire idea of innovation being encouraged by the free enterprise system is in question if there is no regulation. Can anyone honestly say that the railroads would have embraced an interstate highway system? In fact they tried to oppose it. Or the development of airlines? NO. Given their own self-interest we’d still be riding coast to coast in days long journeys in rail cars. Pure, unregulated capitalism creates markets controlled by the largest companies, who will systematically strangle any attempt at competition or innovation that might jeopardize their current stranglehold on their market. Hard core defenders of laissez faire capitalism would argue that the railroads, with their enormous profits from the 19th and early 20th centuries could have wisely invested in the airlines and therefor had a major stake in the future as well. Yes, they certainly could have, but none did. Because making and keeping money isn’t a necessarily associated with visionary intelligence. In fact, it is always easier and lower risk to stick with what you know.

And yet we’ve been propagandized for decades with the idea that deregulation is somehow good for the consumer and will lead to more choices and lower prices. How has that really worked out? Can anyone honestly say that they feel they’ve gotten a fair deal (let alone a good one) on airlines lately? Or your cable provider? Or your phone service? Does it feel like you have to be constantly changing to take advantage of the “new customer” special bundles? Of course they know that most of us have neither the time nor the energy to wade through all of the change over business until we are very fed up, which is long after the companies have recouped any discounts they gave us to switch.

Then there are businesses, which by their very nature, have a profit motive disincentive to treat their customers fairly without regulation. I referenced this somewhat in the article on health care reform. Insurance, principally health, but also any other insurance as well; auto, home, etc. All insurance offers a product (“coverage”); essentially a promise to pay for certain losses you might experience, which may be more or less difficult to precisely define. The problem is that the free market competition doesn’t exactly produce the results we might hope for. In selling apples, computer chips or mousetraps, the consuming public has a pretty good way to judge quality and therefor value as the ratio of quality to price. But the details of coverage are hard to assess, and even with comparing identical claims paid (if you could even find two exactly alike), that is only one instance of the coverage in action; maybe it’s representative, maybe not. So the consumer has limited information to rely on in picking between the companies.

Add to this that the insurance companies’ business model is to collect more premiums than they pay out in claims. Now imagine what your reaction would be to a seller of apples, computer chips or mousetraps whose business model was to charge for more items than they delivered. Clearly regulation is needed in this industry, and even more so when the coverage is broad and gray in definition, like health care. There is a definite financial incentive to look for ways to reduce claims payout and/or rate up consumers given that competition is not as clear and simple to compare.

The “champions” of free enterprise often speak of regulations as stifling innovation and adding costs to products. Certainly there are some poorly drafted regulations that should be revised. But to cast all regulation as unnecessary is more than an overstatement, it is a lie that serves only the worst actors in corporate America. Good regulation keeps the field open for new competition to arise and prevents established businesses from increasing their profits by cutting costs and/or by cutting safety to their consumers and employees.

This would be a good time to recall that virtually every regulation business’ must submit to originated because of an abuse perpetrated by businesses. Companies who didn’t tell their employees about the dangers of the chemicals they were working with, and did not provide safety gear or adequate training. Employers trying to classify employees as “contractors” so they can avoid paying for overtime, or the employer’s share of Social Security taxes. The list could fill an entire volume.

Lastly, as good as capitalism is (in its well regulated form) it is inherently a short term view of the world. From the side of the investor, capitalism looks like an efficient system for allocating financial resources. Yet the short term high return investment always seems to garner more of the resources than the long term high return, especially if that high return isn’t payable until the end of the long term. It appears (and actually may be) much more risky.

Yet all of the great advances in our economy and technology seem to be built on the bedrock of some groundbreaking infrastructure and work of large public (government) projects. The Interstate highway system, happily used by trucking companies to bring goods across country, and vacationers alike, might have been decades later in the coming (if at all) but for the persistence of the Eisenhower administration. The US space race with the Soviet Union laid the ground work for computers and private satellite companies and the boon to communication that has created. In both cases, nearly everyone knew this was the direction the future must take, but individually it represented too large an investment to make. There are many more examples, but surely it can be seen that these essential platforms need to be built for the general good. Such visionary projects typically can’t get individual funding, but with a little from all, we all can benefit much more later, and still maintain an essentially capitalist system.

“Pure” capitalism is, unfortunately, by its very nature a short term, short sighted engine, whose principal accomplishment is the maintenance of the wealth of the first group of rich and powerful people. Regulated capitalism IS the only way to have a market place where new ideas, and competitive products can be freely introduced.

Let’s stop buying the myth that “privatization” is automatically good, and government regulation automatically bad. These are more complex issues than the simplistic black and white thinking we’ve been encouraged to hold on to.

7 notes

·

View notes