#business loans 2022

Text

Business Loans UK How Do Business Loans Work? (UK 2024)

Presuming you are new to business loans, let’s explain briefly how UK business loans work, now this will be very quick and easy to understand, so make sure you read all the way to the end so you don’t miss any important details.

So to start with, what is a business loan? It’s a sum of money that a business borrows from a lender such as a bank or a building society, and this helps it start to…

View On WordPress

#business#business financing#business funding#business loan#business loans#business loans 2022#business loans for small business#business loans uk#fast business loans#how business loans work#how do business loans work#how do small business loans work#how online business loans work#how to get a business loan#loans for small business#new business loans#small business#small business loan#small business loans#unsecured business loans

1 note

·

View note

Text

President Joe Biden fulfilled a long-awaited and much-discussed campaign promise on Wednesday, announcing the cancellation of $10,000 in student-loan debt for some borrowers.

It's a move that's already inspired praise from some Democrats — as well as criticism that it wasn't enough to ease the $1.7 trillion crisis — and swift backlash from Republicans. GOP party members began sniping that the cancellation amounts to taxpayers subsidizing other people's loans.

"President Biden's student-loan socialism is a slap in the face to every family who sacrificed to save for college, every graduate who paid their debt, and every American who chose a certain career path or volunteered to serve in our Armed Forces in order to avoid taking on debt," Senate Minority Leader Mitch McConnell wrote in a statement. "This policy is astonishingly unfair."

It's a criticism Biden was quick to rebuke.

Following remarks on student-loan forgiveness, a reporter asked the President if the measure was unfair toward "people who paid their student loans or chose not to take out loans."

"Is it fair to people who, in fact, do not own multibillion-dollar businesses if they see one of these guys getting all the tax breaks? Is that fair?" Biden said. "What do you think?"

Biden has repeatedly slammed large corporations for paying little or nothing in federal income taxes, something he's attempted to change through proposals to raise the corporate-tax rate. "I'm sick and tired of ordinary people being fleeced," Biden said of the proposed tax hike.

The relief announcement will impact approximately 43 million borrowers, according to the White House, with 20 million borrowers seeing their full debt load forgiven.

"That's 20 million people who can start getting on with their lives," Biden said. "All this means people can start finally crawling up from under that mountain of debt, to get on top of their rent and utilities, to finally think about buying a home or starting a family, starting a business. And by the way, when this happens, the whole economy is better off."

PROGRESSIVE LAWMAKERS HAVE LOBBIED FOR STUDENT-LOAN RELIEF FOR YEARS

Shortly before Biden's White House remarks, Rep. Alexandria Ocasio-Cortez of New York — who has been one of the most forceful congressional advocates for full cancellation — tweeted that student-loan debt is "immoral."

Rep. Pramila Jayapal of Washington, the chair of the House Progressive Caucus, said that student-loan relief would help address racial inequities.

"Canceling student debt is a racial justice issue and will help to close the racial wealth gap. This is a major step forward," she tweeted.

Sen. Raphael Warnock of Georgia, who is in a tough reelection fight against Herschel Walker, a former NFL star, this fall, has pushed the administration to address student-loan reform since he joined the upper chamber after his 2021 runoff election.

"Easing student debt will provide long-term benefits for hardworking Georgians of all ages, as well as our economy," he tweeted. "I'm grateful President Biden has listened to me & the people of Georgia."

Warnock also said that he would "keep fighting for additional student relief" by tackling issues such as college affordability and the creation of more job-workforce programs.

However, not all Democrats are in unison on debt cancellation.

Rep. Chris Pappas of New Hampshire, who also faces a difficult reelection campaign, argued that the issue should be left to Congress.

"We all know the cost of higher education is crushing families, and that's why I've supported expanding Pell Grants, affordable community college, and loan forgiveness for those entering vital professions like nursing," he said in a statement. "But this announcement by President Biden is no way to make policy and sidesteps Congress and our oversight and fiscal responsibilities."

#us politics#news#president joe biden#biden administration#2022#business insider#student loan debt#studen loans#student debt forgiveness#debt forgiveness#student debt#sen. mitch mcconnell#Rep. Alexandria Ocasio-Cortez#Rep. Pramila Jayapal#Sen. Raphael Warnock#Rep. Chris Pappas

12 notes

·

View notes

Text

Sorry for going from hehe block men 💏 to controversial opinion

#z rambles#I HAVE WORSE. WORSE OPINIOM BUT THE LORS FORVID I WANNA SHOW THEM TO MY MUTUALS#I would not do that guys trust me 🤞🤞🤞🤞🤞🤞#h/rry st/les fans annoy me like idc if he dresses like pure ASS. thats his bullshit but once we got opinioms yall go crazy go stupid#like what happen to criticizing celebs what hapoened to jokes and making fun of bitches wjo wont ever see your damn comments#its 2022 no person in the righr mind whos not a celeb and or a white skinny fashion student with rhe ego of god dress the way he does#i sound real mean but i think we all have seen fair share of the same mfs to say its enough of them mfs to generalize#the lord FORBIDDD u talk smack about celebs cuz yall bitches defend tbem like tjey pay your student loan#mind your business#do yall really think talking shit about harrys bs set gnc people back? be honest

4 notes

·

View notes

Text

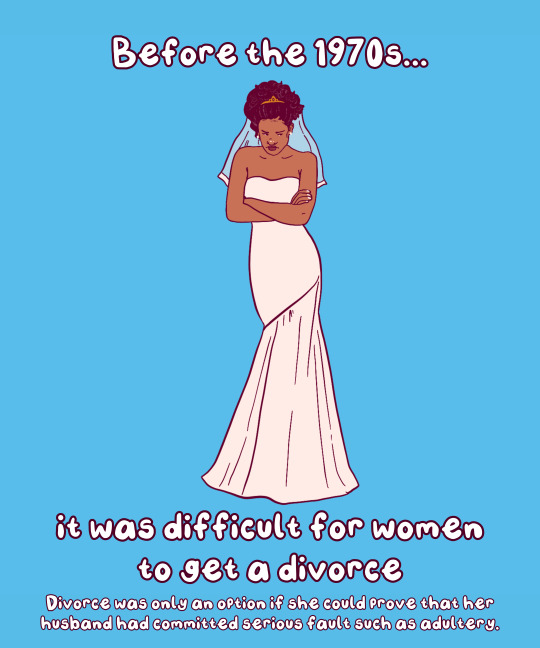

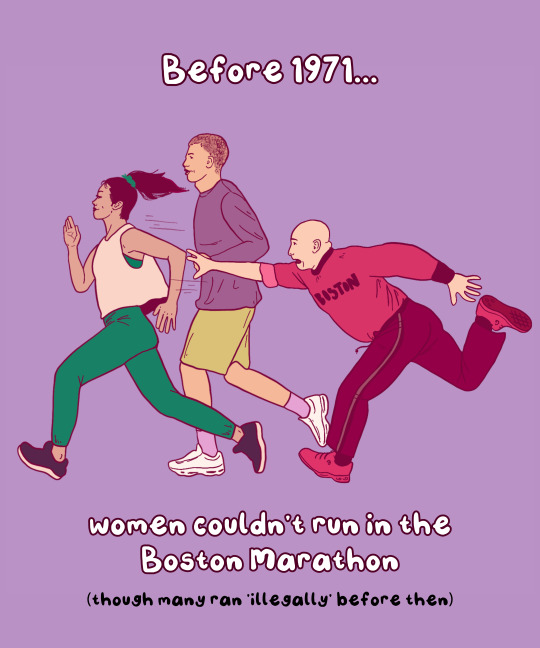

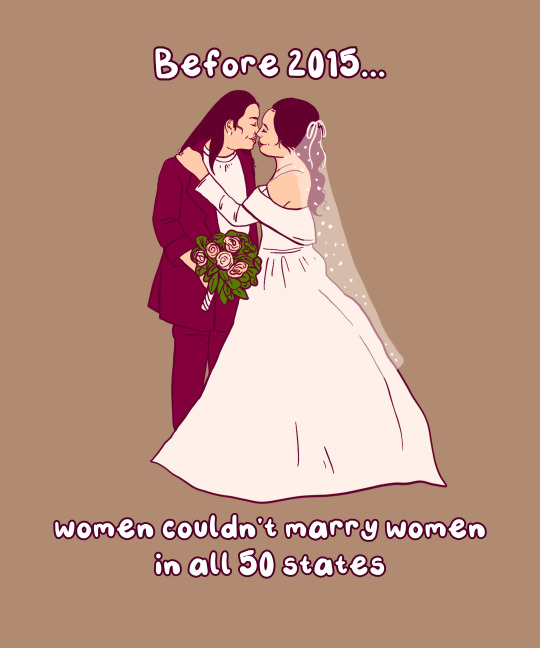

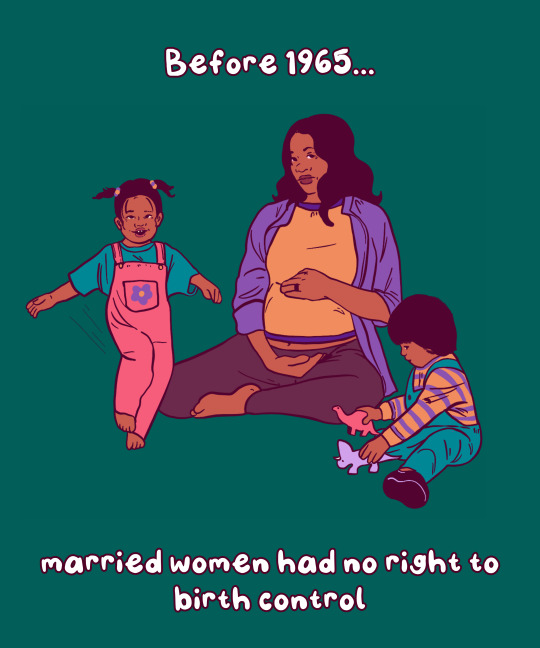

Women's Not So Distant History

This #WomensHistoryMonth, let's not forget how many of our rights were only won in recent decades, and weren’t acquired by asking nicely and waiting. We need to fight for our rights. Here's are a few examples:

📍 Before 1974's Fair Credit Opportunity Act made it illegal for financial institutions to discriminate against applicants' gender, banks could refuse women a credit card. Women won the right to open a bank account in the 1960s, but many banks still refused without a husband’s signature. This allowed men to continue to have control over women’s bank accounts. Unmarried women were often refused service by financial institutions entirely.

📍 Before 1977, sexual harassment was not considered a legal offense. That changed when a woman brought her boss to court after she refused his sexual advances and was fired. The court stated that her termination violated the 1974 Civil Rights Act, which made employment discrimination illegal.⚖️

📍 In 1969, California became the first state to pass legislation to allow no-fault divorce. Before then, divorce could only be obtained if a woman could prove that her husband had committed serious faults such as adultery. 💍By 1977, nine states had adopted no-fault divorce laws, and by late 1983, every state had but two. The last, New York, adopted a law in 2010.

📍In 1967, Kathrine Switzer, entered the Boston Marathon under the name "K.V. Switzer." At the time, the Amateur Athletics Union didn't allow women. Once discovered, staff tried to remove Switzer from the race, but she finished. AAU did not formally accept women until fall 1971.

📍 In 1972, Lillian Garland, a receptionist at a California bank, went on unpaid leave to have a baby and when she returned, her position was filled. Her lawsuit led to 1978's Pregnancy Discrimination Act, which found that discriminating against pregnant people is unlawful

📍 It wasn’t until 2016 that gay marriage was legal in all 50 states. Previously, laws varied by state, and while many states allowed for civil unions for same-sex couples, it created a separate but equal standard. In 2008, California was the first state to achieve marriage equality, only to reverse that right following a ballot initiative later that year.

📍In 2018, Utah and Idaho were the last two states that lacked clear legislation protecting chest or breast feeding parents from obscenity laws. At the time, an Idaho congressman complained women would, "whip it out and do it anywhere,"

📍 In 1973, the Supreme Court affirmed the right to safe legal abortion in Roe v. Wade. At the time of the decision, nearly all states outlawed abortion with few exceptions. In 1965, illegal abortions made up one-sixth of all pregnancy- and childbirth-related deaths. Unfortunately after years of abortion restrictions and bans, the Supreme Court overturned Roe in 2022. Since then, 14 states have fully banned care, and another 7 severely restrict it – leaving most of the south and midwest without access.

📍 Before 1973, women were not able to serve on a jury in all 50 states. However, this varied by state: Utah was the first state to allow women to serve jury duty in 1898. Though, by 1927, only 19 states allowed women to serve jury duty. The Civil Rights Act of 1957 gave women the right to serve on federal juries, though it wasn't until 1973 that all 50 states passed similar legislation

📍 Before 1988, women were unable to get a business loan on their own. The Women's Business Ownership Act of 1988 allowed women to get loans without a male co-signer and removed other barriers to women in business. The number of women-owned businesses increased by 31 times in the last four decades.

Free download

📍 Before 1965, married women had no right to birth control. In Griswold v. Connecticut (1965), the Supreme Court ruled that banning the use of contraceptives violated the right to marital privacy.

📍 Before 1967, interracial couples didn’t have the right to marry. In Loving v. Virginia, the Supreme Court found that anti-miscegenation laws were unconstitutional. In 2000, Alabama was the last State to remove its anti-miscegenation laws from the books.

📍 Before 1972, unmarried women didn’t have the right to birth control. While married couples gained the right in 1967, it wasn’t until Eisenstadt v. Baird seven years later, that the Supreme Court affirmed the right to contraception for unmarried people.

📍 In 1974, the last “Ugly Laws” were repealed in Chicago. “Ugly Laws” allowed the police to arrest and jail people with visible disabilities for being seen in public. People charged with ugly laws were either charged a fine or held in jail. ‘Ugly Laws’ were a part of the late 19th century Victorian Era poor laws.

📍 In 1976, Hawaii was the last state to lift requirements that a woman take her husband’s last name. If a woman didn’t take her husband’s last name, employers could refuse to issue her payroll and she could be barred from voting.

📍 It wasn’t until 1993 that marital assault became a crime in all 50 states. Historically, intercourse within marriage was regarded as a “right” of spouses. Before 1974, in all fifty U.S. states, men had legal immunity for assaults their wives. Oklahoma and North Carolina were the last to change the law in 1993.

📍 In 1990, the Americans with Disability Act (ADA) – most comprehensive disability rights legislation in U.S. history – was passed. The ADA protected disabled people from employment discrimination. Previously, an employer could refuse to hire someone just because of their disability.

📍 Before 1993, women weren’t allowed to wear pants on the Senate floor. That changed when Sen. Moseley Braun (D-IL), & Sen. Barbara Mikulski (D-MD) wore trousers - shocking the male-dominated Senate. Their fashion statement ultimately led to the dress code being clarified to allow women to wear pants.

📍 Emergency contraception (Plan B) wasn't approved by the FDA until 1998. While many can get emergency contraception at their local drugstore, back then it required a prescription. In 2013, the FDA removed age limits & allowed retailers to stock it directly on the shelf (although many don’t).

📍 In Lawrence v. Texas (2003), the Supreme Court ruled that anti-cohabitation laws were unconstitutional. Sometimes referred to as the ‘'Living in Sin' statute, anti-cohabitation laws criminalize living with a partner if the couple is unmarried. Today, Mississippi still has laws on its books against cohabitation.

#art#feminism#women's history#women's history month#iwd2024#international women's day#herstory#educational#graphics#history#70s#80s#rights#women's rights#human rights

15K notes

·

View notes

Text

#online business#online business ideas#how to start an online business#make money online#how to make money online#business ideas#best online business#online business from home#online business ideas 2022#the best online business to start in 2023#business ideas 2023#online business ideas 2023#best online business to start#online business for beginners#how to start an online business in 2022#business#best online businesses 2022#online business loan

0 notes

Text

Things Biden and the Democrats did, this week #14

April 12-19 2024

The Department of Commerce announced a deal with Samsung to help bring advanced semiconductor manufacturing and research and development to Texas. The deal will bring 45 billion dollars of investment to Texas to help build a research center in Taylor Texas and expand Samsung's Austin, Texas, semiconductor facility. The Biden Administration estimates this will create 21,000 new jobs. Since 1990 America has fallen from making nearly 40% of the world's semiconductor to just over 10% in 2020.

The Department of Energy announced it granted New York State $158 million to help support people making their homes more energy efficient. This is the first payment out of a $8.8 billion dollar program with 11 other states having already applied. The program will rebate Americans for improvements on their homes to lower energy usage. Americans could get as much as $8,000 off for installing a heat pump, as well as for improvements in insulation, wiring, and electrical panel. The program is expected to help save Americans $1 billion in electoral costs, and help create 50,000 new jobs.

The Department of Education began the formal process to make President Biden's new Student Loan Debt relief plan a reality. The Department published the first set of draft rules for the program. The rules will face 30 days of public comment before a second draft can be released. The Administration hopes the process can be finished by the Fall to bring debt relief to 30 million Americans, and totally eliminate the debt of 4 million former students. The Administration has already wiped out the debt of 4.3 million borrowers so far.

The Department of Agriculture announced a $1 billion dollar collaboration with USAID to buy American grown foods combat global hunger. Most of the money will go to traditional shelf stable goods distributed by USAID, like wheat, rice, sorghum, lentils, chickpeas, dry peas, vegetable oil, cornmeal, navy beans, pinto beans and kidney beans, while $50 million will go to a pilot program to see if USAID can expand what it normally gives to new products. The food aid will help feed people in Bangladesh, Burkina Faso, Burundi, Chad, Democratic Republic of the Congo, Djibouti, Ethiopia, Haiti, Kenya, Madagascar, Mali, Nigeria, Rwanda, South Sudan, Sudan, Tanzania, Uganda, and Yemen.

The Department of the Interior announced it's expanding four national wildlife refuges to protect 1.13 million wildlife habitat. The refuges are in New Mexico, North Carolina, and two in Texas. The Department also signed an order protecting parts of the Placitas area. The land is considered sacred by the Pueblos peoples of the area who have long lobbied for his protection. Security Deb Haaland the first Native American to serve as Interior Secretary and a Pueblo herself signed the order in her native New Mexico.

The Department of Labor announced new work place safety regulations about the safe amount of silica dust mine workers can be exposed to. The dust is known to cause scaring in the lungs often called black lung. It's estimated that the new regulations will save over 1,000 lives a year. The United Mine Workers have long fought for these changes and applauded the Biden Administration's actions.

The Biden Administration announced its progress in closing the racial wealth gap in America. Under President Biden the level of Black Unemployment is the lowest its ever been since it started being tracked in the 1970s, and the gap between white and black unemployment is the smallest its ever been as well. Black wealth is up 60% over where it was in 2019. The share of black owned businesses doubled between 2019 and 2022. New black businesses are being created at the fastest rate in 30 years. The Administration in 2021 Interagency Task Force to combat unfair house appraisals. Black homeowners regularly have their homes undervalued compared to whites who own comparable property. Since the Taskforce started the likelihood of such a gap has dropped by 40% and even disappeared in some states. 2023 represented a record breaking $76.2 billion in federal contracts going to small business owned by members of minority communities. This was 12% of federal contracts and the President aims to make it 15% for 2025.

The EPA announced (just now as I write this) that it plans to add PFAS, known as forever chemicals, to the Superfund law. This would require manufacturers to pay to clean up two PFAS, perfluorooctanoic acid and perfluorooctanesulfonic acid. This move to force manufacturers to cover the costs of PFAS clean up comes after last week's new rule on drinking water which will remove PFAS from the nation's drinking water.

Bonus:

President Biden met a Senior named Bob in Pennsylvania who is personally benefiting from The President's capping the price of insulin for Seniors at $35, and Biden let Bob know about a cap on prosecution drug payments for seniors that will cut Bob's drug bills by more than half.

#Thanks Biden#Joe Biden#jobs#Economy#student loan debt#Environment#PFAS#politics#US politics#health care

742 notes

·

View notes

Link

0 notes

Text

Court Issues Warrant For Arrest Of Humanitarian Foundation MD, Gabriel Over N17.5Million Fraud

Court Issues Warrant For Arrest Of Humanitarian Foundation MD, Gabriel Over N17.5Million Fraud

Gabriel’s business partner, Ejigson Greener Synergy Limited through her Managing Director, Ejigah Sunday James, on July 23, 2022, filed a suit in a Magistrate Court against him over a credit loan of N17.5 million granted to Ejigson Greener Synergy Limited by the First City Monument Bank Plc, Anyigba Branch.

A Chief Magistrate Court sitting in Lokoja, Kogi State capital has issued a bench warrant…

View On WordPress

#2022#Anyigba Branch#Court Issues Warrant For Arrest Of Humanitarian Foundation MD#Ejigah Sunday James#Ejigson Greener Synergy Limited through her Managing Director#filed a suit in a Magistrate Court against him over a credit loan of N17.5 million granted to Ejigson Greener Synergy Limited by the First C#Gabriel Over N17.5Million Fraud#Gabriel’s business partner#on July 23

0 notes

Text

सिबिल स्कोर कैसे बढ़ाये? जानिए तरीका - How to Improve CIBIL Score?

सिबिल स्कोर कैसे बढ़ाये? जानिए तरीका – How to Improve CIBIL Score?

How to Improve CIBIL Score : बिजनेस लोन हो, होम लोन हो, कार लोन हो या कोई भी लोन हो उसका मिलना इस बात पर डिसाइड होता है कि लोन अप्लाई करने वाले व्यक्ति का सिबिल स्कोर कितना है। सभी तरह के लोन के लिए बेहतर क्रेडिट स्कोर होना बेहद ही जरूरी होता है।

लोन देने वाले बैंक या नॉन बैंकिंग फाइनेंसियल कंपनी (एनबीएफसी) कंपनी लोन देते समय हमेशा इस बात का ध्यान रखती हैं कि जिसे लोन दिया जा रहा है उसका सिबिल…

View On WordPress

#5 मिनट लोन कैसे अप्लाई करे#bad cibil business loan#bad cibil score#bad cibil score personal loan#bad credit score#CIBIL SCORE#cibil score calculation#cibil score check free#cibil score kaise badhaye#cibil score कम kaise hua#cibil score कम क्यों hua#credit card apply#credit history#credit report#credit score#csc से लोन अप्लाई कैसे करे 2022#hdfc bank बिजनेस लोन#hdfc बिजनेस लोन#hdfc बैंक बिजनेस लोन#hdfc बैंक से बिजनेस लोन#home loan#home loan apply#how to improve cibil score#how to improve cibil score after settlement#how to improve cibil score hindi#how to improve cibil score in hindi#how to improve credit score#how to improve credit score in hindi#how to improve my cibil score#how to increase cibil score

0 notes

Text

STARTUP SMALL BUSINESS EMERGENCY MICROLOAN 2022

#businessloan #startuploan #smallbusinessloan #supportsmallbusinessloan smallbusinessstartup #smallbusinessesmatter #startupbusinesses #smallbusinessmarketingtips

STARTUP SMALL BUSINESS EMERGENCY MICROLOAN 2022, EMERGENCY MICROLOAN FOR STARTUP SMALL BUSINESS, SMALL BUSINESS STARTUP MICROLOAN 2022, HOW DO I GET EMERGENCY MICROLOAN FOR MY STARTUP BUSINESS,

WHAT IS STARTUP SMALL BUSINESS MICROLOAN 2022?

The MicroLoan Program gives tiny advances to fire up, recently settled, or developing independent venture concerns and certain not-for-benefit childcare…

View On WordPress

#apply for sba microloan#EMERGENCY MICROLOAN FOR STARTUP SMALL BUSINESS#HOW DO I GET EMERGENCY MICROLOAN FOR MY STARTUP BUSINESS#how to get a microloan to start a business#how to get loan for business startup#how to start a microloan business#how to start microlending business#how to start up a microfinance business#how to start your own microfinance business#micro loans for small businesses#microloans for small business startup#microloans for women#sba microloan for startup#sba microloan lenders near me#sba microloan program requirements#SMALL BUSINESS STARTUP MICROLOAN 2022#startup business loan requirements#startup business microloan 2022#STARTUP SMALL BUSINESS EMERGENCY MICROLOAN 2022

0 notes

Text

MSME GOVERNMENT LOAN SCHEME 2022 TAMIL

மத்திய அரசின் தொழில் கடன் முழுத்தகவல் எப்படி விண்ணப்பிப்பது? #GOVTLOAN #GOVTBUSINESSLOAN #GOVTLOAN2022 #2022GOVTLOAN #TNGOVTLOAN2022 #2022TNGOVTLOAN

msme government loan 2022, msme government loan 2022 application, msme government loan 2022 application form, msme government loan 2022 announcement, msme government loan 2022 apply, msme government loan 2022 apply online, msme government loan 2022 business, msme government loan 2022 check, msme government loan 2022 contact, msme government loan 2022 check status, msme government loan 2022…

View On WordPress

#msme government loan 2022#msme government loan 2022 announcement#msme government loan 2022 application#msme government loan 2022 application form#msme government loan 2022 apply#msme government loan 2022 apply online#msme government loan 2022 business#msme government loan 2022 check#msme government loan 2022 check status#msme government loan 2022 contact#msme government loan 2022 details#msme government loan 2022 eligibility#msme government loan 2022 india#msme government loan 2022 interest rate#msme government loan 2022 logo#msme government loan 2022 online#msme government loan 2022 open

0 notes

Text

Millions of student-loan borrowers could be getting debt relief this week — but a group of Republicans are making sure that doesn't happen.

On Thursday, President Joe Biden wrote on Twitter that 26 million student-loan borrowers have so far applied for up to $20,000 in debt relief through the online form at studentaid.gov, and as of this week, the Education Department will have approved 16 million of them to get their loans forgiven.

However, those borrowers won't be seeing the benefits anytime soon because the 8th Circuit Court of Appeals temporarily paused the relief, in response to a lawsuit filed by six Republican-led states who argued the policy would hurt their states' tax revenues, along with those of loan company MOHELA.

"That's 16 million Americans, so far, who should be seeing student debt relief in the coming days," Biden wrote. "But that relief is on hold – because Republican elected officials are doing everything they can to deny it, even to their own constituents."

"We're fighting these attacks from Republican elected officials in the courts," Biden added. "I will never apologize for helping working- and middle-class Americans as they recover from the pandemic."

Biden's debt relief plan has been hit with at least five other lawsuits seeking to block its implementation. While the cases have either been dismissed or appealed, a court has yet to officially strike down the whole plan. Still, the decision from the 8th Circuit looms, and until it comes, the Education Department cannot actually give borrowers relief.

This delay could mean that borrowers may have to resume payments in January without the loan forgiveness they applied for, depending on how long it will take for loan companies to process the changes to borrowers' accounts.

The Supreme Court has also been handed two of the lawsuits so far — Justice Amy Coney Barrett quickly dismissed one of them on October 20, and the other one appeared on the high court's docket on Tuesday.

While it's unclear what the 8th Circuit will ultimately decide, the GOP plaintiffs' defense may have weakened this week when Biden's Justice Department informed the court that MOHELA told Missouri Rep. Cori Bush it was not involved with the state's decision to sue the Biden administration on debt relief, undermining the states' key argument that the company would suffer from loan forgiveness.

#us politics#news#business insider#president joe biden#biden administration#student debt forgiveness#student loan forgiveness#student debt#student loan debt#debt forgiveness#2022#department of education#8th Circuit Court of Appeals#MOHELA#tweet#twitter#Justice Amy Coney Barrett#us supreme court#scotus#Rep. Cori Bush#Missouri

5 notes

·

View notes

Text

PayPal Working Capital: 2022 Review of PayPal working loan

PayPal Working Capital: 2022 Review of PayPal working loan

PayPal Working Capital is a convenient business loan that can be used for working capital. The loan can be accessed immediately through PayPal’s website and includes repayment terms of up to 30 percent of online sales, plus a charge. Loans for working capital from PayPal are repaid with 10 to 30 percent of your business’s daily PayPal sales, plus a charge.

Click Here to Get video

What Is PayPal…

View On WordPress

#paypal business loan#paypal business loan login#paypal loan instant#paypal loans covid#paypal working capital apply again#paypal working capital declined 2022#paypal working capital phone number#paypal working capital review#paypal working loan

0 notes

Text

An update to an older story that’s goods news!

When Jenny Nguyen signed the lease to create her dream bar, she wasn’t sure it would stay open for more than a few months.

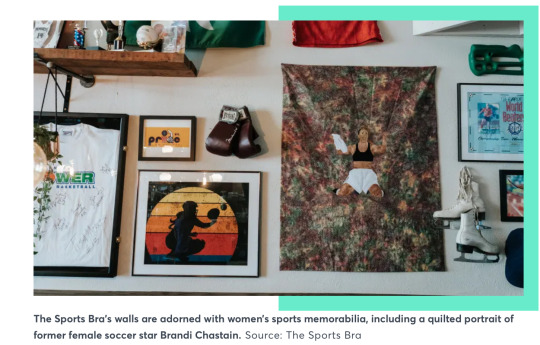

But earlier this month, 43-year-old Nguyen’s first-of-its-kind establishment in Portland, Oregon, celebrated its one-year anniversary. Aptly named The Sports Bra, it’s a sports bar where only women athletes appear on the TVs.

Business has been good, despite the niche business model and record inflation sending food and beverage prices soaring. The Sports Bra brought in $944,000 in revenue in the eight months it was open in 2022, according to documents reviewed by CNBC Make It.

It was profitable in that first year of business, Nguyen adds.

“It turns out, it’s pretty universal — that feeling of being a women’s sports fan and going into a public place, like a sports bar, and having a difficult time finding a place to show a [women’s] game, especially when there are other men’s sports playing,” Nguyen says.

Initially, she wasn’t sure the idea would work at all. The vast majority of money and attention historically goes to men’s sports only — a big reason why The Sports Bra was reportedly the country’s first bar to only play women’s sports on TV.

It’s also not the kind of thing Nguyen would ordinarily do: She describes herself as “very cautious, risk averse.” But her obsession with women’s sports and frustration with its lack of representation on television screens drove her to empty her life savings — about $27,000 — and give it a try.

“Me, personally, I thought the idea was brilliant and that [it was] what the world needs,” Nguyen says. “But I had no idea that the world would want it. I just wanted to give it a shot.”

How The Sports Bra went from running joke to reality

Nguyen is a lifelong basketball fan who played the sport at Clark College in Vancouver, Washington, before tearing her ACL. She’s also a longtime restaurant worker who spent three years as Reed College’s executive chef.

In 2018, Nguyen and a group of friends wanted to watch the NCAA women’s basketball championship game. They went to a mostly empty sports bar and still had to plead with a bartender to switch one of the smallest TVs — which played without sound — from a men’s sport to the women’s championship game, she recalls.

Together, they jumped up and down celebrating “one of the best games I’ve ever seen,” Nguyen says, as a buzzer-beating three-point shot sealed the championship title for Notre Dame. Afterward, she was struck by the normalcy of her situation.

″[We’d] gotten so used to watching a game like that in the way that we did,” she says, adding that they’d only find better viewing conditions “if we had our own place.”

Days later, she channeled her disappointment into a hypothetical: What would she name her bar? “The very first thing that came into my mind was The Sports Bra,” Nguyen says. “And once I thought it, I couldn’t un-think it, you know? It was catchy. I thought it was hilarious.”

For years, she joked about it. Then, the fallout from social justice movements like #MeToo and the country’s racial reckoning after George Floyd’s murder left her wanting to make a meaningful impact on the world and her community.

Nguyen, who came out as a lesbian at age 17, says she doesn’t always feel welcome at most traditional sports bars. The Sports Bra could help her, and anyone else who’d rarely felt accepted in other sports establishments, feel like she belonged.

“I thought about, if we can even get one kid in here and have them feel like they belong in sports, it’d be worth it,” she says.

Helping other women’s sports bars get started

At first, Nguyen had her savings, and $40,000 in loans cobbled together from friends and family. That would keep The Sports Bra afloat for three months, based on her cost estimates for labor, inventory and other overhead.

In February 2022, she launched a Kickstarter to raise $48,000 — enough money for an extra six-month financial cushion, to build up the sort of regular clientele any bar or restaurant needs to survive long-term.

To Nguyen’s surprise, the campaign raised more than $105,000 in just 30 days, thanks to a viral article in online food publication Eater. “At that moment, when I was looking at that Kickstarter graph, I thought to myself, ‘This might work,’” she says.

But the money, which came from around the country and world, was no guarantee of success. Actual people in Portland still needed to frequent the bar.

Today, there’s often a line out the door. Women’s basketball icons like Sue Bird and Diana Taurasi showed up, for an event sponsored by Buick, earlier this month. Ginny Gilder, co-owner of the WNBA’s Seattle Storm, has even waited in line to watch her team play on The Sports Bra’s TVs, Nguyen says.

That’s a far cry from the Kickstarter days, which Nguyen says only happened after she was denied business loans by multiple banks and small business associations. The denials commonly cited the high risk of a unique concept run by a first-time entrepreneur during a pandemic, she adds.

Even the bar’s core concept is a struggle: It’s hard to find enough women’s sporting events to fill up the televisions. Only about 5% of all TV sports coverage focuses on female athletes, according to a 2021 University of Southern California study.

Nguyen says she’s taken to reaching out directly to sports networks and streaming services, some of which have hooked her up with access to more women’s sports content. She also spends an inordinate amount of time “scouring” TV listings, a process she likens to “taking a machete and chopping through a jungle.”

But she’s no longer alone. Another bar specializing in women’s sports has opened in nearby Seattle, and Nguyen says she’s in touch with a handful of other prospective entrepreneurs asking her for advice on opening similar visions in other cities.

“I would love to have as many people experience the feeling people experience when they walk through these doors,” she says. “It feels very selfish to keep it to this one building that holds 40 people at a time.”

#USA#oregon#Portland#jenny nguyen#The Sports Bra#A sports bar for women and women’s sports#She was originally denied business loans

1K notes

·

View notes

Text

Intuit: “Our fraud fights racism”

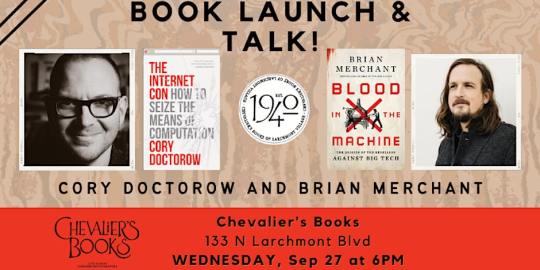

Tonight (September 27), I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine. On October 2, I'll be in Boise to host an event with VE Schwab.

Today's key concept is "predatory inclusion": "a process wherein lenders and financial actors offer needed services to Black households but on exploitative terms that limit or eliminate their long-term benefits":

https://journals.sagepub.com/doi/10.1177/2329496516686620

Perhaps you recall predatory inclusion from the Great Financial Crisis, when predatory subprime mortgages with deceptive teaser rates were foisted on Black homeowners (who were eligible for better mortgages), resulting in a wave of Black home theft in the foreclosure crisis:

https://prospect.org/justice/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated/

Before these loans blew up, they were styled as a means of creating Black intergenerational wealth through housing speculation. They turned out to be a way to suck up Black families' savings before rendering them homeless and forcing them into houses owned by the Wall Street slumlords who bought all the housing stock the Great Financial Crisis put on the market:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

That was just an update on an old con: the "home sale contract," invented by loan-sharks who capitalized on redlining to rip off Black families. Back when banks and the US government colluded to deny mortgages to Black households, sleazy lenders created the "contract loan," which worked like a mortgage, but if you were late on a single payment, the lender could seize and sell your home and not pay you a dime – even if the house was 99% paid for:

https://socialequity.duke.edu/wp-content/uploads/2019/10/Plunder-of-Black-Wealth-in-Chicago.pdf

Usurers and con-artists love to style themselves as anti-racists, seeking to "close the racial wealth gap." The payday lending industry – whose triple-digit interest rates trap poor people in revolving debt that they can never pay off – styles itself as a force for racial justice:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Payday lenders prey on poor people, and in America, "poor" is often a euphemism for "Black." Payday lenders disproportionately harm Black families:

https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

Payday lenders are just unlicensed banks, who deploy a layer of bullshit to claim that they don't have to play by the rules that bind the rest of the finance sector. This scam is so juicy that it spawned the fintech industry, in which a bunch of unregulated banks sprung up to claim that they were too "innovative" to be regulated:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When you hear "Fintech," think "unlicensed bank." Fintech turned predatory inclusion into a booming business, recruiting Black spokespeople to claim that being the sucker at the table in the cryptocurrency casino was actually a form of racial justice:

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

But not all predatory inclusion is financial. Take Facebook Basics, Meta's "poor internet for poor people" program. Facebook partnered with telcos in the Global South to rig their internet access. These "zero rating" programs charged subscribers by the byte to reach any service except Facebook and its partners. Facebook claimed that this would "bridge the digital divide," by corralling "the next billion internet users" into using its services.

The fact that this would make "Facebook" synonymous with "the internet" was just an accidental, regrettable side-effect. Naturally, this was bullshit from top to bottom, and the countries where zero-rating was permitted ended up having more expensive wireless broadband than the countries that banned it:

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

The predatory inclusion gambit is insultingly transparent, but that doesn't stop desperate scammers from trying it. The latest chancer is Intuit, who claim that the end of its decade-long, wildly profitable "free tax prep" scam is bad for Black people:

https://www.propublica.org/article/turbotax-intuit-black-taxpayers-irs-free-file-marketing

Some background. In nearly every rich country on Earth, the tax authorities send every taxpayer a pre-filled tax return, based on the information submitted by employers, banks, financial planners, etc. If that looks good to you, you just sign it and send it back. Otherwise, you can amend it, or just toss it in the trash and pay a tax-prep specialist to produce your own return.

But in America, taxpayers spend billions every year to send forms to the IRS that tell it things it already knows. To make this ripoff seem fair, the hyper-concentrated tax-prep industry, led by the Intuit, creators of Turbotax, pretended to create a program to provide free tax-prep to working people.

This program was called Free File, and it was a scam. The tax-prep cartel each took a different segment of Americans who were eligible for Freefile and then created an online house of mirrors that would trick those people into spending hours working on their tax-returns until they were hit with an error message falsely claiming they were ineligible for the free service and demanding hundreds of dollars to file their returns.

Intuit were world champions at this scam. They blocked their Freefile offering from search-engine crawlers and then bought ads that showed up when searchers typed "freefile" into the query box that led them to deceptively named programs that had "free" in their names but cost a fortune to use – more than you'd pay for a local CPA to file on your behalf.

The Attorneys General of nearly every US state and territory eventually sued Intuit over this, settling for $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

The FTC is still suing them over it:

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3119-intuit-inc-matter-turbotax

We have to rely on state AGs and the FTC to bring Intuit to justice because every Intuit user clicks through an agreement in which we permanently surrender our right to sue the company, no matter how many laws it breaks. For corporate criminals, binding arbitration waivers are the gift that keeps on giving:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Even as the scam was running out, Intuit spent millions lobby-blitzing Congress, desperate for action that would let it continue to privately tax the nation for filling in forms that – once again – told the IRS things it already knew. They really love the idea of paying taxes on paying your taxes:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

But they failed. The IRS has taken Freefile in-house, will send you a pre-completed tax return if you want it. This should be the end of the line for Intuit and other tax-prep profiteers:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now we're at the end of the line for the scam, Intuit is playing the predatory inclusion card. They're conning Black newspapers like the Chicago Defender into running headlines like "IRS Free Tax Service Could Further Harm Blacks,"

https://defendernetwork.com/news/opinion/irs-free-tax-service-could-further-harm-blacks/

The only named source in that article? Intuit spokesperson Derrick Plummer. The article went out on the country's Black newswire Trice Edney, whose editor-in-chief did not respond to Propublica's Paul Kiel's questions.

Then Black Enterprise got in on the game, publishing "Critics Claim The IRS Free Tax Prep Service Could Hurt Black Americans." Once again, the only named source for the article was Plummer, who was "quoted at length." Black Enterprise declined to tell Kiel where that article came from:

https://www.blackenterprise.com/critics-claim-the-irs-free-tax-prep-service-could-hurt-black-americans/

For Intuit, placing op-eds is a tried-and-true tactic for laundering its ripoffs into respectability. Leaked internal Intuit memos detail the company's strategy of "pushing back through op-eds" to neutralize critics:

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Intuit spox Derrick Plummer did respond to Kiel's queries, denying that Intuit was paying for these op-eds, saying "with an idea as bad as the Direct File scheme we don’t have to pay anyone to talk about how terrible it is."

Meanwhile, ex-NAACP director (and No Labels co-chair) Benjamin Chavis has used his position atop the National Newspaper Publishers Association to publish op-eds against the IRS Direct File program, citing the Progressive Policy Institute, a pro-business thinktank that Intuit's internal documents describe as part of its "coalition":

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Chavis's Chicago Tribune editorial claimed that Direct File could cause Black filers to miss out on tax-credits they are entitled to. This is a particularly ironic claim given Intuit's prominent role in sabotaging the Child Tax Credit, a program that lifted more Americans out of poverty than any other in history:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It's also an argument that can be found in Intuit's own anti-Direct File blog posts:

https://www.intuit.com/blog/innovative-thinking/taxpayer-empowerment/intuit-reinforces-its-commitment-to-fighting-for-taxpayers-rights/

The claim is that because the IRS disproportionately audits Black filers (this is true), they will screw them over in other ways. But Evelyn Smith, co-author of the study that documented the bias in auditing says this is bullshit:

https://siepr.stanford.edu/publications/working-paper/measuring-and-mitigating-racial-disparities-tax-audits

That's because these audits of Black households are triggered by the IRS's focus on Earned Income Tax Credits, a needlessly complicated program available to low-income (and hence disproportionately Black) workers. The paperwork burden that the IRS heaps on EITC recipients means that their returns contain errors that trigger audits.

As Smith told Propublica, "With free, assisted filing, we might expect EITC claimants to make fewer mistakes and face less intense audit scrutiny, which could help reduce disparities in audit rates between Black and non-Black taxpayers."

Meanwhile, the predatory inclusion talking points continue to proliferate. Nevada accountants and the state's former controller somehow coincidentally managed to publish op-eds with nearly identical wording. Phillip Austin, vice-chair of Arizon's East Valley Hispanic Chamber of Commerce, claims that free IRS tax prep "would disproportionately hurt the Hispanic community." Austin declined to tell Propublica how he came to that conclusion.

Right-wing think-tanks are pumping out a torrent of anti-Direct File disinfo. This surely has nothing to do with the fact that, for example, Center Forward has HR Block's chief lobbyist on its board:

https://thehill.com/opinion/finance/4125481-direct-e-file-wont-make-filing-taxes-any-easier-but-it-could-make-things-worse/

The whole thing reeks of bullshit and desperation. That doesn't mean that it won't succeed in killing Direct File. If there's one thing America loves, it's letting businesses charge us a tax just for dealing with our own government, from paying our taxes to camping in our national parks:

https://pluralistic.net/2022/11/30/military-industrial-park-service/#booz-allen

Interestingly, there's a MAGA version of predatory inclusion, in which corporations convince low-information right-wingers that efforts to protect them from ripoffs are "woke." These campaigns are, incredibly, even stupider than the predatory inclusion tale.

For example, there's a well-coordianted campaign to block the junk fees that the credit card cartel extracts from merchants, who then pass those charges onto us. This campaign claims that killing junk fees is woke:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

How does that work? Here's the logic: Target sells Pride merch. That makes them woke. Target processes a lot of credit-card transactions, so anything that reduces card-processing fees will help Target. Therefore, paying junk fees is a way to own the libs.

No, seriously.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

299 notes

·

View notes

Text

One thing I wonder about is: If you were designing a financial system from scratch, in 2024, would you come up with banking? That central traditional trick of banks — that they fund themselves with safe short-term demand deposits, and use depositors’ money to invest in risky longer-term loans, with all of the run risk and regulatory supervision and It’s a Wonderful Life-ness that that involves — would you recreate that if you were starting over?

Part of me feels like, if you started a new civilization and put smart but ahistorical tech people in charge of designing a financial system, it would never occur to them to recreate traditional banking. It is so messy and opaque and imprecise, using a shifting pile of demand deposits to fund long-term loans. Plenty of people — insurance companies, retirement savers — want to earn a return on their money and don’t need it anytime soon; their money can be locked up in long-term loans. The money that people keep in the bank just to pay rent and buy sandwiches doesn’t need to be pooled and invested in risky loans; it should just sit in the vault.

This idea — that bank deposits should just sit in the vault (or, realistically, in electronic money at the Federal Reserve), while risky loans should be funded by long-term investors who intend to take those risks — is sometimes called “narrow banking.” It has a long intellectual pedigree, it came back into vogue after the 2008 financial crisis, and it got attention again after last spring’s US regional banking crisis. All those crises! The traditional business of banking is necessarily crisis-prone; using risky long-term loans to back risk-free short-term demand deposits involves a fundamental mismatch, and every so often that flares up into a crisis.

And so, since 2008, but more visibly since last spring, banking really has become narrower. Private credit is the lending side of “narrow banking”: Private credit firms raise dedicated funds, with locked-up money, from investors who intend to invest in long-term loans to earn a return. And private credit is the hottest area of finance, making buyout loans and investment-grade corporate loans and funding consumer loans. And private credit is booming not just as a competitor to banks, but as a funding source for banks: Banks have the relationships and technology to make loans, but not the money, so they partner with private credit to fund the loans.

Meanwhile the deposit side of “narrow banking” is something like banks taking their customers’ money and parking it at the Federal Reserve. And in fact some money has shifted out of banks (which are not narrow) and into government money-market funds (which park the money in Fed repo or Treasury bills). Even within banks, there is less lending.

...

That’s narrow banking. I admit I have a certain emotional soft spot for traditional banking. There is something magical about how banking transmutes risky assets (loans) into risk-free liabilities (deposits). “A banking system is a superposition of fraud and genius that interposes itself between investors and entrepreneurs,” wrote Steve Randy Waldman in 2011; it allows society to use the money of risk-averse depositors to fund risky investments in growth. But it is possible that this magic no longer works: In a world of financial transparency and fast communications technology and flighty deposits, you can’t really expect to hide the risks of the banking system; you have to fund the loans with people who know they’re funding the loans.

I will say, though, that��I have also written a lot about crypto over the last few years. Crypto really created a new financial system from scratch, and it started with a very strong philosophical bias against traditional banking. And then it really did recreate traditional banking! And also traditional banking crises: In 2022, it turned out that one of the main uses of crypto was to turn customer demand deposits (of crypto) into extremely risky loans (of crypto), which ended as badly as you’d have expected. “One possibility,” I wrote last year, “is that fractional reserve banking is deeply rooted in human nature.” If you started the financial system over, maybe banking would develop again. Even if actual banking is getting narrower now.

Matt Levine on narrow banking, we talk about this a lot as banks are so fundamental to how our entire civilisation currently functions and yet they're basically just hacks that lurch from crisis to crisis, more evolved than engineered

71 notes

·

View notes