#buildbusinesscredit

Photo

📣Credit & Cocktails!📣 🚀Tomorrow Evening at 8:00!🚀 Don't Miss This Out On This Information! SPEAKERS: @shabazz_trendsetters @kevrealty SPECIAL PERFORMANCE: @hittaslim1 HOST: @themotivatorcash Join Us For An Evening Of Fun And Get Insights On The Following: • Credit Repair DIY Artificial Intelligence software 😳 • Business Credit DIY software 😳 • Starting a Business 😃 • Become Bankable and Lender Compliant 🙂 • Business Funding Resources 😃 • Home Ownership & Real Estate Investing 🙂 • Student Loan Relief 🙂 • Reputation Management 😃 #creditrepair #creditandcocktails #creditseminars #crediteducation #creditseminar #businesscredit #BusinessCredit #freecreditseminar #creditrepairseminar #creditseminar!! #powerofcredit #businesscreditfunding #buildbusinesscredit #businesscreditrocks #restorecredit #businesscreditcoach #businesscreditbuiding #businesscreditline #businesscreditcards #dyi #ai #artificialintelligence #artificalintelligence #reputationmanagement #nft #realestateseminar #realestatestyle #studentloanforgiveness #studentloanrelief #studentloans (at E-FIX Credit INC) https://www.instagram.com/p/Ck1KfU-P2eb/?igshid=NGJjMDIxMWI=

#creditrepair#creditandcocktails#creditseminars#crediteducation#creditseminar#businesscredit#freecreditseminar#creditrepairseminar#powerofcredit#businesscreditfunding#buildbusinesscredit#businesscreditrocks#restorecredit#businesscreditcoach#businesscreditbuiding#businesscreditline#businesscreditcards#dyi#ai#artificialintelligence#artificalintelligence#reputationmanagement#nft#realestateseminar#realestatestyle#studentloanforgiveness#studentloanrelief#studentloans

2 notes

·

View notes

Text

How We Get $100,000 Without Income Or Collateral In 7 Days!

ATTENTION BUSINESS OWNERS, ENTREPRENEURS & REAL ESTATE INVESTORS

Discover The Step-By-Step Blueprint To Easily Get Funding for Your Business or Real Estate

The Ultimate Business Credit Lines Program

Are you sick of losing deals? Tired of scrambling for money? And looking for ways to get funding faster?

We’ve shown thousands of business owners how to easily get capital without years of struggle, trial and error. We’ve raised over $100 Millions for ourselves and our clients, and we can do the same for you too.

Simply Follow Our Blueprint To Success & You’ll Avoid Funding Rejections!

Getting funding can be much easier than you think. Many people simply don’t know the correct steps to take which makes them take far longer than they need to. We’ve done all the hard work for you, so all you need to do is follow our step-by-step blueprint and you’ll get funding in no time.

You won’t just save time either. When you follow our advice closely, you also get much higher credit limits than you would ever be able to achieve on your own.

You can also try this product

DISCLAIMER

There is an affiliate link of a best product in this article which may make some profit for me.

#MillionDollarBusinessCredit#BusinessCreditBuilder#BuildBusinessCredit#EntrepreneurialFinance#SmallBusinessFunding

0 notes

Text

Build a successful startup

Building a successful startup requires a combination of factors, including a strong business idea, a solid business plan, a talented team, and effective marketing and sales strategies. Here are a few key elements to consider when building a startup:

Identify a problem or need in the market and develop a unique solution.

Conduct market research to validate your idea and identify your target market.

Create a business plan that outlines your goals, target market, competition, financial projections, and marketing and sales strategies.

Build a strong and diverse team with the skills and expertise needed to bring your idea to life.

Create a minimum viable product (MVP) to test your idea and gather feedback from early adopters.

Continuously iterate and improve your product based on customer feedback.

Develop a marketing and sales strategy to reach and convert potential customers.

Have a plan for funding, whether that be through investors, grants, or bootstrapping.

Be prepared to pivot and adapt as needed.

Stay up to date with industry trends and technology to help your business thrive.

#entrepreneur#entreprenuership#entreprenuerlife#startownbusiness#buildbusinesscredit#businesskills#businessstartup

1 note

·

View note

Photo

📣Credit & Cocktails!📣 🚀It's On Again! Mark Your Calendars! 🗓🚀 SPEAKERS: @shabazz_trendsetters @kevrealty SPECIAL PERFORMANCE: @hittaslim1 HOST: @themotivatorcash Join Us For An Evening Of Fun And Get Insights On The Following: • Credit Repair DYI Artificial Intelligence software 😳 • Business Credit DYI software 😳 • Starting a Business 😃 • Become Bankable and Lender Compliant 🙂 • Business Funding Resources 😃 • Home Ownership & Real Estate Investing 🙂 • Student Loan Relief 🙂 • Reputation Management 😃 #creditrepair #creditandcocktails #creditseminars #crediteducation #creditseminar #businesscredit #BusinessCredit #freecreditseminar #creditrepairseminar #creditseminar!! #powerofcredit #businesscreditfunding #buildbusinesscredit #businesscreditrocks #restorecredit #businesscreditcoach #businesscreditbuiding #businesscreditline #businesscreditcards #dyi #ai #artificialintelligence #artificalintelligence #reputationmanagement #nft #realestateseminar #realestatestyle #studentloanforgiveness #studentloanrelief #studentloansforgiveness (at EXP Realty) https://www.instagram.com/p/CkYpKz8p8VF/?igshid=NGJjMDIxMWI=

#creditrepair#creditandcocktails#creditseminars#crediteducation#creditseminar#businesscredit#freecreditseminar#creditrepairseminar#powerofcredit#businesscreditfunding#buildbusinesscredit#businesscreditrocks#restorecredit#businesscreditcoach#businesscreditbuiding#businesscreditline#businesscreditcards#dyi#ai#artificialintelligence#artificalintelligence#reputationmanagement#nft#realestateseminar#realestatestyle#studentloanforgiveness#studentloanrelief#studentloansforgiveness

0 notes

Text

Todays #booksponsor

THE STEP BY STEP GUIDE ON HOW TO BUILD BUSINESS CREDIT

https://kaylux.gumroad.com/l/buildbusinesscredit?_gl=1*ejpenx*_ga*NDg1MzgyMDQyLjE2NjQzOTk3NDg.*_ga_6LJN6D94N6*MTY5MzI1NTg0OS4xMTIuMS4xNjkzMjU1ODUwLjAuMC4w

🚨Why Our eBook?

🔹 Step-by-step Instructions for Credit Success

🔹 Proven Strategies to Build Business Credit

🔹 Expert Tips for Financial Stability

🔹 Tailored to Businesses of All Sizes

🔹 Elevate Your Funding Potential

🔹 Drive Long-term Business Prosperity

#ad#booksponsor#the step by step guide to building business credit#step by step#how to build credit#building business credit

0 notes

Photo

Why Having a Good Business Credit Score Matters: ♦️It'll Be Easier to Qualify for a Loan. ... ♦️You'll Receive Better Loan Terms. ... ♦️It Protects Your Personal Finances. ... ♦️You'll Receive Better Terms from Suppliers. ... ♦️Get Access to Cash for Growth and Expansion. Need Mentor to Get your Business Credit? Book free call now 👉 https://swiy.io/1L1C (link in bio) #businesscredit #credit #goodcredit #businesslife #businesstips #businessmentor #businessideas #businesshelp #businessadvice #blackbusiness #buildbusinesscredit #businessbuilder #businessbuilding #creditmatters #crediteducation #growth #businessloans #growyourbusiness #growth #businessman #businessowners #smallbusiness https://www.instagram.com/p/CNahRIwlzVI/?igshid=1qxr0w2a0d5wm

#businesscredit#credit#goodcredit#businesslife#businesstips#businessmentor#businessideas#businesshelp#businessadvice#blackbusiness#buildbusinesscredit#businessbuilder#businessbuilding#creditmatters#crediteducation#growth#businessloans#growyourbusiness#businessman#businessowners#smallbusiness

0 notes

Text

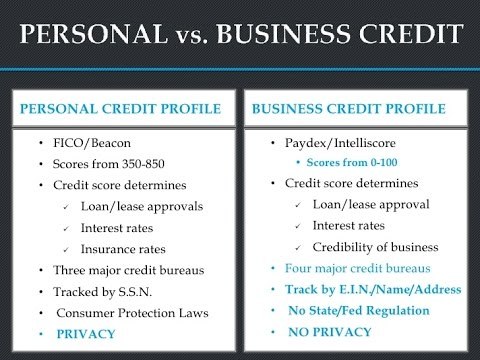

Paydex Score vs Fico Score:

How to Achieve a Good Score

As any good investor knows, your investment strategies and goals typically hinge on the type of credit you as an individual or a small business owner has. Depending on the type of deal you are looking to achieve, your credit score may dictate the type of investment you are actually able to make.

Two of the main types of credit scores in factoring your credit worth are Paydex scores and Fico scores. Paydex scores are determined by Dun & Bradstreet and analyze the credit history for small businesses over a rolling 12-month period. Fico scores determine the credit history of individuals.

Paydex scores range from 0-100 with zero being the poorest score and 100 being an excellent credit score. A Paydex credit score of 75-100 is considered a good score. Paydex determines its credit score not just on whether a business makes its payments, but when it makes its payments. The more quickly a business pays its suppliers (and pays ahead of term) the higher the Paydex score. Lateness in payments results in a lower score.

Fico scores on the other hand reviews an individual’s credit and payment history to determine its scoring. A Fico score can range from 300-850 with a better overall credit seeing a higher score. While a Paydex score takes into consideration the timing of payment, Fico looks into an individual’s total debt owed, age of current debt, payment history, as well as types of credit owed.

For small businesses and individuals alike, achieving a good score has one similar trait: making good on debt. For a small business, simply making payments on time scores an 80 on a Paydex credit score. As your business begins to grow and strengthen, early payments to suppliers and lenders will only strengthen your overall score. For example, making a payment 20-days earlier than payment due date jumps your score from 80 to 90, while making payment 30-days sooner jumps your Paydex score to 100.

Similarly to strengthening your Paydex score, improving your personal Fico score comes down to paying your debt on time. As an individual it’s important to review your account records and catch up on any late payments or inaccuracies in your history. Likewise, settle any collections issues or liens against property and ask for a grace period where applicable. Making good on past and present debt will begin to raise your Fico credit score over time.

Improving your credit score goes a long way for both small business and individuals alike. At Peace Properties, we are experts in helping you determine the next steps in clearing up your credit history and credit score. Contact us to determine what steps you need to take to review and begin to strengthen your credit score today.

1 note

·

View note

Photo

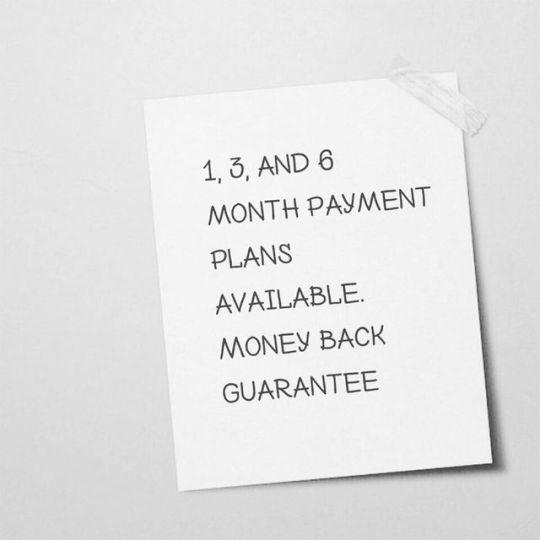

Build your business credit with affordable payment options. blackcobrafinancialservices.com #blackcobrafinancialservices #affordable #paymentplans #buildbusinesscredit #monthly #amex #visa #mastercard #nopersonalguarantee (at Alpharetta, Georgia) https://www.instagram.com/p/ByDPHkFJqOZ/?igshid=9o3aam25pfk

#blackcobrafinancialservices#affordable#paymentplans#buildbusinesscredit#monthly#amex#visa#mastercard#nopersonalguarantee

0 notes

Text

Important Things You Should Know About Business Line of Credits

Getting business loans for small business owners is very tough because of its long process and requirements. To solve this issue the term "Business line of credit" comes which can be the primary option for new businesses to raise funds. Because the requirements of the business line of credit and business loans are different.

Here are some major requirements comes during the business credit line:

Your Personal Credit Score

The Credit Score of Your Business

The Debt-to-Income Ratio of Your Business

The Business Sector of Your Company

And More

These are some factors that new businesses should keep in mind to get approved to raise funds. You can also take complete guidance from experts like The CEO Creative to increase your chance of approval.

#TheCEOCreative#TheCEOCreativereview#CEOCreative#CEOCreativeNET30#BusinessCredit#BusinessCreditBuilding#BusinessCreditLine#BusinessNET30Account#BuildingBusinessCredit#Howt BuildBusinessCredit

0 notes

Video

how to buy business tradelines to build business credit? https://3wayfunding.com/optin

#Vimeo#howto#ucc1#buildbusinesscredit#net30accounts#businesstradelines#businesscreditcards#businessloans#businesslinesofcredit#creditrepair#personalcreditrepair#fixmycredit

0 notes

Photo

📣Credit & Cocktails!📣 🚀It's On Again! Mark Your Calendars! 🗓🚀 SPEAKERS: @shabazz_trendsetters @kevrealty SPECIAL PERFORMANCE: @hittaslim1 HOST: @themotivatorcash Join Us For An Evening Of Fun And Get Insights On The Following: • Credit Repair DYI Artificial Intelligence software 😳 • Business Credit DYI software 😳 • Starting a Business 😃 • Become Bankable and Lender Compliant 🙂 • Business Funding Resources 😃 • Home Ownership & Real Estate Investing 🙂 • Student Loan Relief 🙂 • Reputation Management 😃 #creditrepair #creditandcocktails #creditseminars #crediteducation #creditseminar #businesscredit #BusinessCredit #freecreditseminar #creditrepairseminar #creditseminar!! #powerofcredit #businesscreditfunding #buildbusinesscredit #businesscreditrocks #restorecredit #businesscreditcoach #businesscreditbuiding #businesscreditline #businesscreditcards #dyi #ai #artificialintelligence #artificalintelligence #reputationmanagement #nft #realestateseminar #realestatestyle #studentloanforgiveness #studentloanrelief #studentloans (at Jack London Square) https://www.instagram.com/p/CkYnPq-JUk1/?igshid=NGJjMDIxMWI=

#creditrepair#creditandcocktails#creditseminars#crediteducation#creditseminar#businesscredit#freecreditseminar#creditrepairseminar#powerofcredit#businesscreditfunding#buildbusinesscredit#businesscreditrocks#restorecredit#businesscreditcoach#businesscreditbuiding#businesscreditline#businesscreditcards#dyi#ai#artificialintelligence#artificalintelligence#reputationmanagement#nft#realestateseminar#realestatestyle#studentloanforgiveness#studentloanrelief#studentloans

0 notes

Photo

Credit & Cocktails Join Us This Saturday! We will be covering the following topics: - Personal Credit - Business Formation - Trademarking Your Brand - Lender Compliance - Business Credit - Business Funding #efixcredit #efixcreditsolutions #creditrepair #creditandcocktails #creditseminars #crediteducation #creditseminar #businesscredit #BusinessCredit #freecreditseminar #creditrepairseminar #creditseminar!! #powerofcredit #businesscreditfunding #buildbusinesscredit #businesscreditrocks #restorecredit #businesscreditcoach #businesscreditbuiding #businesscreditline #businesscreditcards #Trendsetters #trendsetters #trendsetter #trendsettersent😎 #trendsettersent (at E-FIX Credit INC) https://www.instagram.com/p/Cb48ERBLEvp/?utm_medium=tumblr

#efixcredit#efixcreditsolutions#creditrepair#creditandcocktails#creditseminars#crediteducation#creditseminar#businesscredit#freecreditseminar#creditrepairseminar#powerofcredit#businesscreditfunding#buildbusinesscredit#businesscreditrocks#restorecredit#businesscreditcoach#businesscreditbuiding#businesscreditline#businesscreditcards#trendsetters#trendsetter#trendsettersent😎#trendsettersent

0 notes

Photo

Save this!! If you are a businssman with a credit you must know it's terms.. As we mentioned ''COMMON BUSINESS CREDIT TERMS'' ♦️EIN: employee identification #. aka the SSN for your biz. ♦️DUNS #: your biz identifier with Dun&Bradstreet, the #1 biz credit agency ♦️Tradeline: an account reporting on your biz credit ♦️Net 30: trade credit giving your biz 30 days to pay It’s important to understand all of these so that you can properly build business credit. Having an EIN and DUNS are essential to establishing Biz credit. You earn positives tradeline reporting by paying all of your net 30 accounts on time. Pro tip: Pay them early!! 👍 NEED MORE HELP/GUIDANCE? 📞Book a free call Now: 👉 Link is in bio #business #businesslife #businesscredit #creditmatters #crediteducation #buildbusinesscredit #businessbuilder #businessbuilding #creditkarma #businesslife #businessadvice #businessmentor #businesscoach #businesshelp #buildbusiness #growth #growyourbusiness #businessideas #businessminded #dunnandbradstreet #businesscreditbuilding #businessownership #mindsetchange https://www.instagram.com/p/CNJNr2yFZwt/?igshid=wzokc4wnupvg

#1#business#businesslife#businesscredit#creditmatters#crediteducation#buildbusinesscredit#businessbuilder#businessbuilding#creditkarma#businessadvice#businessmentor#businesscoach#businesshelp#buildbusiness#growth#growyourbusiness#businessideas#businessminded#dunnandbradstreet#businesscreditbuilding#businessownership#mindsetchange

0 notes

Photo

BENEFITS of BUSINESS CREDIT

As an entrepreneur and investor, you have a major responsibility toward yourself and your business to develop a business plan that ideally fits your business or investment idea. A significant portion of your time during this planning phase should be directed toward understanding how to finance your plan.

Many investors and entrepreneurs turn their attention toward obtaining credit to help finance their business to make their goals more achievable. As an entrepreneur or investor, it’s important to weigh how credit can assist in the long-term goals of your business.

The benefits of obtaining credit to either, help start your business or provide additional capital into your existing business, are plentiful. For starters, by obtaining credit you are injecting immediate cash-on-hand into your business. For startups, this cash can provide you with a little more financial flexibility to make additional decisions and even permit you to take some further risks than you may not have had otherwise without that financial flexibility.

Additionally, as an entrepreneur, it’s important for you to be able to separate business money from your personal money. Gaining credit for your business allows to make financial decisions for your business without the additional stress of dipping into your family nest egg to do so.

Small business owners and entrepreneurs have much on their minds as it is just trying to get the business up and profitable, or keep it moving in a positive direction. Becoming financially stronger in your business by obtaining credit is a strong move in keeping the business curve pointing upwards.

While there are always risks and concerns with taking on more credit, as an entrepreneur it is an avenue worth pursuing, researching, and gaining as much knowledge as possible to appreciate how injecting additional credit into your business can benefit you in the long run.

Find out more how Peace Properties can help your business. Our team will consult and guide you toward making the decisions that make most sense for your business.

Contact us today to learn more.

0 notes