#annualized return on investment calculator

Text

MaxLearn: Revolutionizing Learning in the Digital Age

In the era of rapid technological advancements and continuous learning, organizations and individuals alike are seeking innovative solutions to enhance their knowledge and skills. MaxLearn, a leading Learning Management System (LMS), is at the forefront of this revolution, offering a comprehensive platform designed to empower learners, trainers, and organizations in their quest for excellence. Let's delve into the world of MaxLearn and explore how it is reshaping the landscape of learning in the digital age.1. Comprehensive Learning Solutions

MaxLearn provides a comprehensive suite of learning solutions tailored to meet the diverse needs of learners and organizations across various industries. From onboarding and compliance training to professional development and skill enhancement, MaxLearn offers a wide range of courses, modules, and resources designed to address specific learning objectives and outcomes. Whether you're a large corporation, a small business, or an individual learner, MaxLearn has the tools and resources you need to succeed.

2. User-Friendly Interface

One of the standout Features of MaxLearn is its intuitive and user-friendly interface, which makes navigation and learning a breeze for users of all skill levels. With a clean layout, streamlined navigation menus, and intuitive controls, MaxLearn ensures a seamless learning experience that keeps learners engaged and focused on their learning goals. Whether accessing the platform from a desktop computer, laptop, tablet, or smartphone, users can easily find the content they need and track their progress with ease.

3. Personalized Learning Experiences

MaxLearn leverages advanced technologies such as artificial intelligence (AI) and machine learning to deliver personalized learning experiences tailored to the unique needs and preferences of each learner. Through data-driven insights and algorithms, MaxLearn analyzes learner behaviors, preferences, and performance metrics to recommend relevant courses, modules, and resources. By providing personalized recommendations, MaxLearn ensures that learners receive the right content at the right time, maximizing engagement and retention.

4. Interactive and Engaging Content

Learning should be engaging, interactive, and fun, and that's exactly what MaxLearn delivers. With interactive simulations, multimedia presentations, gamified quizzes, and collaborative activities, MaxLearn offers a dynamic learning experience that captivates learners' attention and promotes active participation. By incorporating elements of gamification, social learning, and experiential learning, MaxLearn makes learning enjoyable and rewarding for users of all ages and backgrounds.

5. Real-Time Progress Tracking

MaxLearn provides real-time progress tracking and analytics tools that enable learners and trainers to monitor performance, track completion rates, and measure learning outcomes. Through customizable dashboards, reports, and analytics dashboards, users can gain valuable insights into learner engagement, knowledge retention, and skill development. This data-driven approach allows organizations to identify areas for improvement, optimize training programs, and demonstrate the return on investment (ROI) of learning initiatives.

6. Seamless Integration and Scalability

MaxLearn seamlessly integrates with existing systems and platforms, allowing organizations to leverage their existing infrastructure and technologies. Whether integrating with human resources (HR) systems, customer relationship management (CRM) software, or third-party applications, MaxLearn ensures a seamless user experience and maximizes the value of existing investments in technology. Additionally, MaxLearn is highly scalable, allowing organizations to easily expand their learning initiatives as their needs grow and evolve.

7. Dedicated Support and Training

Last but not least, MaxLearn provides dedicated support and training resources to help organizations and users maximize the value of the platform. From onboarding assistance and user guides to technical support and training materials, MaxLearn empowers administrators, trainers, and learners with the knowledge and skills they need to succeed. Whether you're just getting started with MaxLearn or looking to optimize your learning initiatives, our team is here to support you every step of the way.

Conclusion

MaxLearn is more than just a Learning Management System—it's a comprehensive solution that empowers learners, trainers, and organizations to achieve their learning and development goals. With its user-friendly interface, personalized learning experiences, interactive content, real-time progress tracking, seamless integration, and dedicated support, MaxLearn is revolutionizing learning in the digital age. Whether you're a corporate training manager, a small business owner, or an individual learner, MaxLearn has the tools and resources you need to succeed in today's fast-paced and competitive world.

#Training ROI Calculator#roi training#Roi trainig calculator#Calculating training roi#process of calculating roi in training#training roi calculation example#training roi calculator excel#calculating roi for training#roi for training#training by roi#roi from training#measuring roi#measuring roi in learning and development#how to calculate roi for a project#how to calculate yearly return on investment#what is a good return on investment for a business#what is return on investment in business#what is roi in business#annualized return on investment calculator#roi modelling#percentage return calculation#annual roi calculator#calculate roi accounting#calculate average return on investment#how to find return on investment#measuring roi of training#measuring return on investment for training#training roi formula#ai authoring tools#ai authoring tools for microlearning

0 notes

Text

It's been awhile, but I have a new thought for folks starting out investing

This blog is called "not financial advice" so this is not financial advice. Nothing on this blog is.

And.

I am working on a large-scale D&D-style banking system for a private client (my job is weird). This is putting me in touch with a lot of people in very expensive suits and it I keep pinging them:

"Let's say someone has $100 to start investing, what should they do. Like, literally $100. With $0.00 added after."

I've cobbled together some thoughts (not advice don't sue me) and cut out the bullshit and sales pitches.

Start a high-yield savings account in an FDIC insured bank. As of this writing (April 27, 2023, United States-based), it'll be somewhere between 3.5 - 4.25% APY (annual percent yield -- i.e. interest)

Go with a bank that is FDIC insured. Banks pay for this, you do not. Here are smart people talking about what FDIC is.

The percentage difference listed above is 0.75%. Moving money is a bitch, is it worth chasing 0.75%? That depends on your situation, time, etc. Here are smart people who built a calculator to help you figure it out if it's worth it to you.

Touch it as little as possible.

Start a spreadsheet that tracks your finances.

In the cell that lists the amount of this balance, give it a name. Something fun, something that speaks to you. I did this as an experiment + to participate, mine is "Slime Research Adventurer Destruction Fund".

Write a prospectus (fancy word for "this is what the goal for this cash is to do").

Slime Research Adventurer Destruction Fund prospectus: Follow the path of high-yield savings rates at {bank}. Review quarterly if other banks have a substantially better rate (+1.5%).

The entire point is to break the idea of "them not me" and "today vs. someday" and "I cannot begin to build wealth vs. someone else can."

A $100 savings INVESTMENT IN A SAVINGS ACCOUNT with a rate of 3.5-4.25% will give you interest of $3.50-4.25 at the end of the first year, then continue on growing onwards.

That is your return.

Is it as high as investing in the market? No.

Is it safer? Holy fuck yes.

When you invest in stocks, bonds, etc. you are looking for a return. This is your return.

This is not a grindset mindset work 24/7 chunk of advice. This is not a reality-disillusionment "I am struggling I need to work harder."

You need to be knowledgable about how things can work for you so you can leverage what you have, where you are, when you have it, as you can.

A high-yield savings account is not going to make you rich.

It probably won't make a difference in an emergency.

It will absolutely make a difference in non-emergency times, over a period of time.

Slime Research Adventurer Destruction Fund Destroying Adventurers.

That last point is where I'm coming to.

If you don't have enough cash to invest and/or you're not comfortable investing, that's fine.

Give your savings account a name that speaks to you. This is your investment. Your savings account = your investment account.

There is no moral or ethical difference between "I have cash shoved into a savings account" and "I have cash shoved into the stock market."

The only difference is potential risk, growth, and fees (never pay for a savings account), liquidity ("how quickly can I convert this thing into cash to buy an apple at the grocery store, pay a bill, etc.").

Make money less scary via weird names and fun graphics.

Go to a piccrew site and make a catgirl with pink and blue hair.

Name your fund "Catgirlsnax Fundsies".

Make.

Money.

Management.

Less.

Scary.

By.

Taking.

Control.

Via your own.

Desires.

Goals.

Weird quirks.

Here is to hoping these gifs are not from horrible shows I don't know anime I know money and business and monsters.

If they are then I apologize for it.

I've read the notes on my blog and a lot of you like anime. I'm hoping these resonate.

215 notes

·

View notes

Note

Heyy

Do you have any advice on starting a real estate business as in just buying and renting out property?

Thanks 🤍

Yes!

**For the record, I have personally done a few flips/rehabs. Apart from that, I knew/know most of the realtors in this city and relating companies as I worked with most real estate/mortgage and title companies here when I had an agency.

First you need to be able to learn the market and research comparables. When looking to buy properties there are important factors to consider to make sure you are not paying overprice for a property as well as that the are is on demand, ensuring it will be easier to rent out the property.

The location of the property and its proximity to amenities like schools, shopping centers, grocery stores, transportation etc. Also that the area is safe.

You also want to look for areas that has future development plans, this will raise the value of your property.

If you have worked with investment companies, you will quickly learn that buying a property that is not in the best condition, a rehab property, could be a very smart play. You want to make sure of course to check the comparables and ensure that the property is underpriced compared to the other homes in the area. Once you rehab the property, it could raise or even surpass the value of the other homes in the area.

Any home that you would look into to buy for renting out should have elements that you intend to upgrade on. There are a lot of reasons for this but the most important one is how it raises your price and potential earnings. Redoing a kitchen or a bathroom can immediately raise the value of your home anywhere from 5-50k. A project that will cost you anywhere from 3-10k on average for a standards nice kitchen depending on your area.

Overall you still want to look at the comps to make sure you are getting a fair deal. Calculate the potential annual rent as a percentage of the properties price. This will give you an idea of the return on your investment. Also make sure that the potential rental income exceeds the monthly expenses. If not it does not make sense.

Check the vacancy rates in the area you want to purchase in, if its high there may be a low demand and not a good area to invest in.

Also you want to think about how easy it would be to sell the property if you need to. In demand areas tend to be more liquid.

So important, to understand the landlord/ tenant laws in your state. Including their rights and eviction process etc. Nothing worst than having a horrible tenant and not being legally able to remove them.

There are a lot of rate plans depending on your specific situation and mortgage rates also vary significantly by state. Make sure to get the best deal for you. Some states a first time can give as little as 1-5% down depending if you are a first time/ entrepreneur etc.

Property insurance is another cost factor to consider when working out your numbers as this varies by area.

Managing a few properties on your own is easy, but after a handful, you may want to consider hiring a property management company to handle these things for you.

I would strongly urge you to get a lawyer to draw up renter contracts.

To grow this business what you want to do, and this is a general overview: down payment for house, fix, rent out, refinance, use refinance to purchase another property and have enough to put into upgrades/repairs on the second purchase and repeat.

I can get into taxes on this too if you want.

53 notes

·

View notes

Text

Know More About Return On Investment In Real Estate

ROI is expressed as a percentage and is calculated by dividing an investment's net profit (or loss) by its initial cost or outlay. According to a report by CRISIL (Credit Rating Information Services of India Limited), the average house price in India has risen by about 6% annually over the past two decades.

Mumbai's real estate market has shown consistent growth in property values. Recent reports indicate that the city's residential segment has experienced a steady annual appreciation rate of 7-10%. Now from the perspective of investor, calculation of ROI needed in purpose to check stability of profit or loss from their Investments.

ROI Calculation

How to calculate return on investment for real estate.

If you are an investor, the ROI shows you the profitability of your investments. Calculate the return on investment using the formula: ROI = Net Profit / Cost of the investment * 100.

Key financial metrics.

Cap Rate: Reflects return potential and property value based on income.

Net Return: Measures annual income over the cash invested. & Compares property price to gross rental income.

Operating Expense Ratio: Portion of income spent on operating expenses. ie. Maintenance of Property, Taxation & Rennovations.

#ROI#return on investment#ROI Real estate#real estate investment#real estate india#realestateprojects#mumbairealestate#mumbai#sunblonderealty#luxuryliving#propertyfinder

3 notes

·

View notes

Text

Investment Value

@everything-narative

The value of any form of investment, be it a loan, a plot of land used for agriculture, or a stock portfolio, will inevitably converge on a single rate of return. This rate of return was historically called "twenty-five years' purchase", although in the modern era it's actually more like twenty or fifteen years.

Allow me to explain. First I'll tell you how returns on investment have worked since time immemorial, then I'll explain how they've changed in the recent past, then I'll explain why your corporate tax plan would crash the economy.

Since time immemorial, tax collectors have tried to answer a simple question: How Much is That Land Worth? They wanted to know which farmers could pay how much tax. Some farmland was better and some was worse. Some was near London and some was in a valley in northern Scotland. Some was rocky and some fertile. Some families had lots of land and some had very little.

The solution they settled on was to figure out how much food the farmland could produce, and charge taxes accordingly. Thus, value became tied to output. The more food a plot of land produced, the higher its value.

Fast forward to the early modern period and some members of the upper classes owned vast tracts of land that they never visited. They charged rent to the farmers who worked that land, and they had agents to handle all that. To them farmland was just a distant abstraction, an abstraction that to them was worth "twenty-five years' purchase" - or, the value of the land was equal to twenty five years of rent income. In other words, if you buy land, then in twenty five years you will earn your money back.

Another way to say this is 4% annual return. This is the average annual return across all of human history.

Now let's say you're an early modern rich guy and you have a bunch of money. You want to invest it to buy a stable income. You could buy land. What else could you do?

You could lend it to the government and collect interest. There's no difference to you between getting your income from rent or interest. So you lend it to the government. Because income is just an abstraction to rich people, people will use the same language to refer to Mr. Bingley's income from interest payments and Mr. Darcy's income from land rents.

And what is the interest rate at which you lend that money? Why, 4% of course. If the rate was 3%, then no one would ever lend money when they could buy land. And if the rate was 5%, then no one would ever buy land when they could lend money.

The exact number, called the interest rate, goes up and down over time. However, rates of return will always converge on the interest rate because the value of an investment comes directly from its rate of return. All possible investments compete in the marketplace, and those with low return and high cost never get bought.

Now let's look at your plan to quadruple the corporate tax rate with an analogy. What if all the rents on your farmland suddenly got reduced by three quarters? Well, we can calculate it. Let's say your land earned $1,000 in rent. Twenty five years' purchase on that is $25,000. Suddenly the rent falls by 75%, to $250. Twenty five years' purchase on that is just $6,250. The land is now worth one-quarter what it was worth before.

4 notes

·

View notes

Text

Solar Panels (part 2)

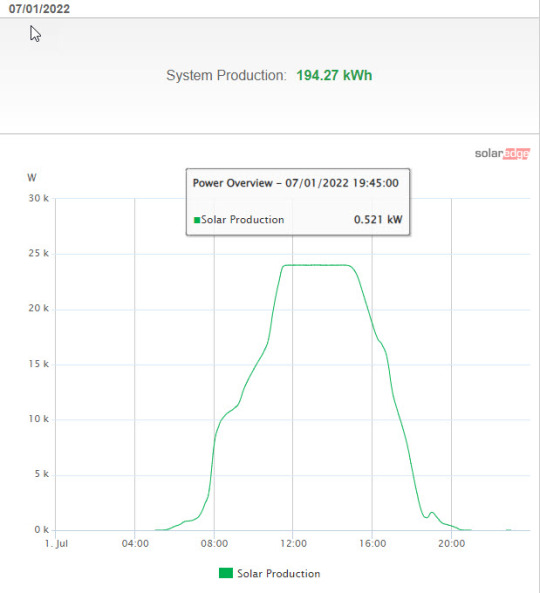

These are the inverters. They convert the DC power of the solar panels to AC power which can be used by us or sent back to the grid. We have three inverters which can provide a max of 24 kwatts. This is the maximum power we can produce, even if the panels are technically capable of generating more on a cool sunny day. There were many days in June/July where we hit this peak in the afternoon - in essence we were throwing away power because we didn't have the inverter capacity. Most of the time, however, the max inverter capacity isn't a limiting factor and this limitation will become even less relevant over time as the panel efficiency degrades by .5% each year (not sure why they degrade but they do). In the picture below you can see the production hitting the 24 kwh limit.

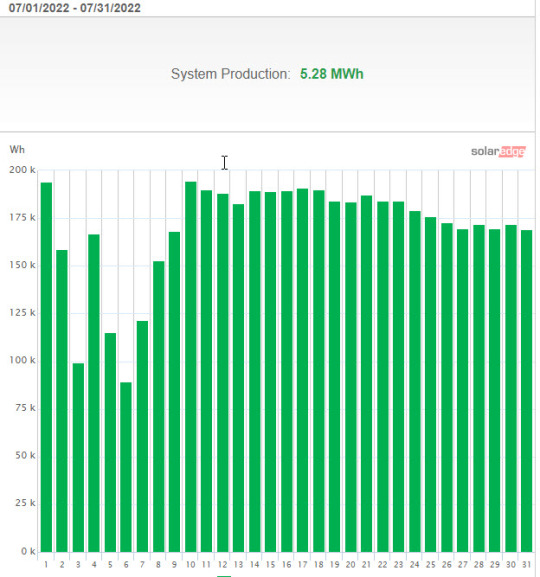

In the picture above, you can see our production in July - this is probably the most the system will ever produce in one month. PSE charges $.11KWH so the system 'earned' $580.

Our installer provided an ROI estimate as part of the proposal, taking into account the 2022 26% Federal Tax credit. The ROI calculation included very aggressive assumptions about annual energy cost inflation (4%) and the annual power production of the system. I don't think energy costs are going to go up that much every year and I know that our panels are going to be covered in snow a few months of the year. I did my own calculations with less aggressive assumptions and still get a pay-back of ~10 years.

Of course there is also the 'opportunity cost' of this investment. I could have kept this cash invested and earning some kind of return. The solar panel investment is very low/no risk however and a comparable bond investment might only earn 2-3% so here again the solar panel investment outperforms a comparable investment in approx. 10 years.

Hope you found this interesting... send me a message if you'd like to know more.

22 notes

·

View notes

Text

Taking the Pain out of High Net Worth mortgages for U.S. Real Estate, without AUM requirements

With inexpensive funding and various tax advantages, everyone should take advantage of the benefits of a mortgage when investing in U.S. real estate regardless of the loan size. However, why do the wealthy often find it increasingly difficult to obtain mortgage financing without AUM?

With a portfolio of assets worth millions of dollars, one may assume that securing credit would be a straightforward task for a high net worth (HNW) individual. Unfortunately, the reality can be quite different especially if you’re a foreign national or U.S. Expat.

The unique nature of a HNW’s wealth – their income, investments, and liquidity – puts this group of people at a surprisingly high risk of being turned away by conventional banks unless they are willing to deposit a significant amount of funds for the bank to manage. This is certainly true in the mortgage market, and what’s more, it is an issue that has become more prevalent post-Covid.

American Mortgages has a dedicated HNW Team that focuses on mortgage solutions for foreign nationals and U.S. expatriate clients.

“As a company, our focus is finding solutions that go beyond what Private Banks can offer was the cornerstone of why this has been so successful. Our goal is to be a viable solutions provider and a trusted partner for the private banks and their clients. None of our loans require AUM, hence there are no funds taken away from their current investments or portfolio.” – Robert Chadwick, co-founder of Global Mortgage Group and America Mortgages.

America Mortgages HNW mortgage loans have a multitude of options when it comes to qualifying for a large mortgage loans regardless of the passport you hold.

Asset Depletion – a surprisingly simple way to establish your income. AM Liquid Portfolio uses a unique view on “asset depletion” to qualify HNW clients using their investment portfolio without an encumbrance or pledge of assets. Essentially, all of your assets are entered into a calculation, and a final number is churned out. The final number is then used as the income to qualify. In most cases, as long as the income is sufficient, no other person’s income documentation is required. This makes an often complicated and tedious process simple, transparent, and painless.

Debt Service Coverage – When it comes to HNW borrowers, one of the most overlooked and misunderstood loan programs is debt service coverage. HNW borrowers tend to own multiple properties in various asset classes. If the property is used as a rental, then there may not be any requirement to go through the tedious process of providing and verifying personal income. Again, as HNW borrowers tend to have very complicated tax returns, this is a straightforward way to show the borrower’s debt serviceability.

Debt service coverage ratio– or DSCR – is a metric that measures the borrower’s ability to service or repay the annual debt service compared to the amount of net operating income (NOI) the property generates. DSCR indicates whether a property is generating enough income to pay the mortgage. For real estate investors, lenders use the debt service coverage ratio as a measurement to determine the maximum loan amount.

Bridge/Asset Based Lending – With Covid still in play, it’s not uncommon for investors to experience a temporary liquidity event. Rather than selling their property, they are using their real estate to release equity. Asset-based lending is an option for both residential (non-owner-occupied) and commercial properties.

Simply stated, HNW bridge loans are used for residential and commercial investment property when more traditional institutional financing sources may not be available. Due to temporary liquidity, many borrowers have capital needs that traditional sources often can’t meet. For example, a borrower purchases property out of bankruptcy or foreclosure and needs to close quickly “same as cash” before long term financing can be arrange.

Simplified Income – HNW borrowers often have personal and business tax returns, which are complicated. The complexity of these returns often turns into an administrative nightmare for the borrower when dealing with a mortgage lender. What makes America Mortgages unique is the fact that 100% of our clients are living and working outside of the U.S. We are dealing with HNW clients from Shanghai to Sydney. Simply put, translations and understanding tax codes, deductions, net income, etc., is painful.

America Mortgages HNW Simplified Income documentation is just that. We do not require years or, in some cases, decades of tax returns, P&L, A&L, bank statements, etc. We take an often complicated process and simplify it; 1. If you’re self-employed, we will request a letter from your accountant stating the last two years’ income and current YTD. 2. If you’re employed, then a letter from your employer on company letterhead stating your last two years’ income and current YTD is sufficient. Yes, it’s that simple and painless.

As 100% of our clients are either Foreign Nationals or U.S. Expats, we understand the intricacies and complexities of this type of lending for our borrowers. It’s as simple as that. Our HNW loan programs are structured to meet our client’s requirements. Providing competitive pricing with the assurance that your loan will close is our only focus, and no one does it better.

For more information, Visit: https://usbridgeloans.com/taking-the-pain-out-of-high-net-worth-mortgages-for-u-s-real-estate-without-aum-requirements/

4 notes

·

View notes

Text

How to Discover the ROI of ERP Implementation Projects?

Determining the return on investment (ROI) of an enterprise resource planning (ERP) system involves a process of analyzing the expected benefits against the costs of implementing and operating the system.

How to Calculate ROI of ERP Project?

Calculating the return on investment (ROI) for an enterprise resource planning (ERP) system involves comparing the expected benefits of the ERP implementation against its total cost.

Here are the steps to calculate ERP ROI:

Determine the total cost of the ERP implementation, including software licenses, hardware, consulting fees, employee training costs, and any other associated expenses.

Identify the expected benefits of the ERP implementation, such as increased efficiency, improved decision-making capabilities, reduced costs, increased productivity, and improved customer satisfaction.

Assign a monetary value to each expected benefit. For example, if the expected benefit is increased efficiency, calculate the potential cost savings associated with reducing manual efforts and eliminating duplicate data entry.

Estimate the time it will take to achieve each benefit and calculate the annual benefit for each benefit category.

Calculate the total expected annual benefit by adding up the annual benefits for each benefit category.

Subtract the total cost of the ERP implementation from the total expected annual benefit to get the total net benefit.

Divide the total net benefit by the total cost of the ERP implementation and multiply the result by 100 to get the ERP ROI percentage.

For example, if the total cost of the ERP implementation is $500,000 and the total expected annual benefit is $750,000, the total net benefit would be $250,000 ($750,000 - $500,000). The ERP ROI would be 50% ($250,000/$500,000 x 100). This means that for every dollar invested in the ERP system, the organization can expect to receive a return of 50 cents. It is important to note that the ROI calculation should take into account both short-term and long-term benefits and costs to get a comprehensive view of the ROI.

Determine the ROI of an ERP system

Here are the steps to determine the ROI of an ERP system:

Define the goals of the ERP system: Start by defining the goals of the ERP system, such as reducing operating costs, improving productivity, or enhancing customer service.

Identify the costs of the ERP system: Determine the total cost of the ERP system, including software licensing, hardware, consulting fees, employee training, and any other associated expenses.

Quantify the benefits of the ERP system: Identify the potential benefits of the ERP system, such as reduced operating costs, improved productivity, and increased revenue. Assign a monetary value to each benefit based on the potential financial impact on the organization.

Estimate the time to achieve benefits: Determine the time it will take to achieve each benefit and calculate the annual benefit for each benefit category.

Calculate the total expected annual benefit: Add up the annual benefits for each benefit category to get the total expected annual benefit.

Calculate the net present value (NPV) of the ERP system: Calculate the present value of the expected benefits minus the present value of the expected costs, using a discounted cash flow (DCF) analysis.

Calculate the ROI: Divide the NPV by the total cost of the ERP system and multiply by 100 to get the ROI percentage.

Conclusion:

ERP implementation can help you in many ways but without the calculation of Return on investment then you spend is totally lost. So make sure you have a good volume of return before investing in the ERP implementation. If you are planning to ERP implementation definitely you will conclude with the best oracle ERP cloud implementation, choose the service who has a year of expertise in oracle ERP implementation and the relevant field.

#erp implementation#erpcloud#erp software#erp implementation service#best erp implementation service#oraclecloudinfrastructure#oraclecloud#oracle implementation#erp modules#ERP software implementation

2 notes

·

View notes

Text

MaxLearn: Empowering Learning in the Digital Age

In today's rapidly evolving digital landscape, learning and development have become paramount for individuals and organizations to stay competitive and adapt to change. With the rise of technology, online learning platforms have emerged as indispensable tools for delivering accessible, engaging, and personalized learning experiences. Among these platforms is MaxLearn, a comprehensive Learning Management System (LMS) designed to empower learners and organizations with cutting-edge features and tools. Let's explore the key aspects and benefits of MaxLearn.1. Flexible Learning Solutions

MaxLearn offers a wide range of flexible learning solutions tailored to meet the diverse needs of learners and organizations. From Microlearning Modules and interactive courses to virtual classrooms and blended learning programs, MaxLearn provides a variety of options to accommodate different learning styles, preferences, and objectives. Whether learners are seeking to acquire new skills, enhance existing knowledge, or pursue professional certifications, MaxLearn offers a solution for every learning journey.

2. Personalized Learning Experiences

One of the hallmarks of MaxLearn is its emphasis on personalized learning experiences. Through advanced analytics, adaptive learning algorithms, and artificial intelligence (AI) capabilities, MaxLearn delivers tailored content, recommendations, and learning paths based on each learner's unique preferences, performance, and goals. By providing personalized feedback, assessments, and progress tracking, MaxLearn ensures that learners receive the support and guidance they need to succeed.

3. Interactive and Engaging Content

MaxLearn prioritizes interactivity and engagement to enhance the learning experience. With features such as gamification, simulations, interactive multimedia, and social learning tools, MaxLearn transforms passive learning into an immersive and dynamic experience. Learners can participate in quizzes, challenges, discussions, and collaborative activities to reinforce learning, apply knowledge, and connect with peers and instructors.

4. Mobile Accessibility

In today's mobile-centric world, access to learning anytime, anywhere is essential. MaxLearn offers seamless mobile accessibility, allowing learners to access content, participate in activities, and track progress from any device, whether desktop, laptop, tablet, or smartphone. With a responsive design and native mobile apps, MaxLearn ensures that learners can engage with learning materials on-the-go, making learning more convenient and accessible than ever before.

5. Robust Administration and Analytics

For administrators and instructors, MaxLearn provides robust tools and analytics to manage, track, and assess learning initiatives effectively. Administrators can create and customize courses, manage user accounts, and generate reports to monitor learner progress, engagement, and performance. With real-time analytics and insights, administrators can identify trends, measure impact, and make data-driven decisions to optimize learning outcomes and drive organizational success.

6. Scalability and Integration

MaxLearn is designed to scale with the evolving needs of organizations, from small businesses to large enterprises. With flexible deployment options, customizable configurations, and seamless integration with existing systems and applications, MaxLearn adapts to the unique requirements of each organization and aligns with their broader learning and business objectives. Whether organizations are looking to onboard new employees, upskill existing talent, or deliver compliance training, MaxLearn provides a scalable and adaptable solution.

7. Comprehensive Support and Training

To ensure a seamless implementation and adoption process, MaxLearn offers comprehensive support and training resources for administrators, instructors, and learners. From onboarding assistance and user guides to tutorials and technical support, MaxLearn empowers users with the knowledge and skills they need to maximize the platform's capabilities and achieve their learning goals. With a dedicated support team and a vibrant user community, MaxLearn fosters collaboration, innovation, and continuous improvement.

Conclusion

MaxLearn stands at the forefront of Online Learning Platforms, empowering individuals and organizations with innovative features, personalized experiences, and comprehensive support. With its flexible learning solutions, personalized learning experiences, interactive content, mobile accessibility, robust administration and analytics, scalability, and comprehensive support, MaxLearn is poised to revolutionize the way we learn and develop in the digital age. As organizations continue to prioritize learning and development as strategic imperatives, MaxLearn remains a trusted partner in driving success and unlocking human potential.

#Training ROI Calculator#roi training#Roi trainig calculator#Calculating training roi#process of calculating roi in training#training roi calculation example#training roi calculator excel#calculating roi for training#roi for training#training by roi#roi from training#measuring roi#measuring roi in learning and development#how to calculate roi for a project#how to calculate yearly return on investment#what is a good return on investment for a business#what is return on investment in business#what is roi in business#annualized return on investment calculator#roi modelling#percentage return calculation#annual roi calculator#calculate roi accounting#calculate average return on investment#how to find return on investment#measuring roi of training#measuring return on investment for training#training roi formula#ai authoring tools#ai authoring tools for microlearning

0 notes

Text

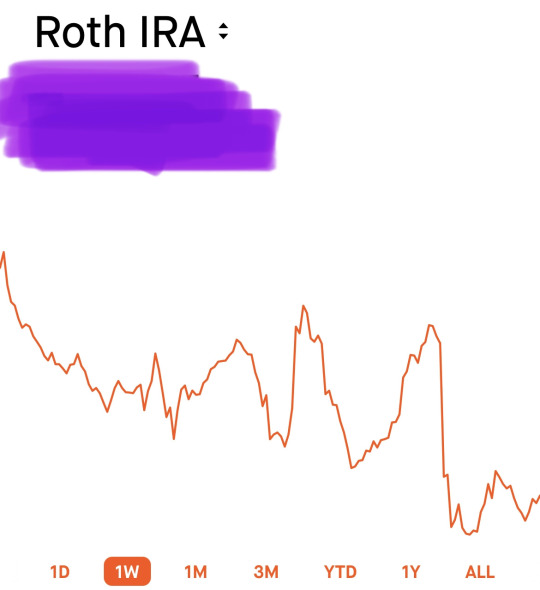

This is my top-tier emergency fund. I am not in an emergency, so I am viewing this as an opportunity.

This is one of the funds I invest in. It is a single fund (I buy 1 ticker symbol of shares), the fund then takes investor money and buys shares of a lot of companies.

The cost of this service is about $1 per $10,000 invested across the entire fund. It’s ridiculously cheap. This is how EFT and similar funds work.

The benefit being they do the leg work of figuring out what companies will be worth more someday in the future, and which are overpriced now. This is an incredibly difficult task requiring extremely expensive equipment and a career of experience that must be run 24/7/365 forever.

Ergo: this is a great deal. I am paying about $1/10,000 per $1 I invest to not do any of that.

(I think it might actually be slightly higher than this clean example but by “slightly higher” I literally mean a few bucks instead of literally $1. Am writing this on my phone while waiting for a meeting to start.)

Previously, I researched the fund and said “this works for my personal situation” and bought shares and monitor it very occasionally.

Because the fund’s stock price is down, as part of normal stock market stock marketing, I can say “I can buy more shares for the same amount of cash I normally invest on a weekly basis.”

The risk is the fund will go to $0 and I will lose all my money. This is an inherent risk to investing. In researching this fund, I feel the risk is so low it is statistically irrelevant.

The reward is this fund will recover and be worth more than I bought it at. The timeline for this to happen is 20-30 years, or when I am in a life-or-death situation and have exhausted all alternatives, whichever comes first.

I specifically am using money saved to invest, so we are going to focus on what my options are with this $X

The alternative would be to put the money I have for investing into a high-yield savings account for 20-30 years instead. The return on those are, as of writing, up to 4%.

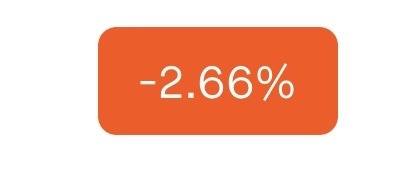

Why is this not the best option? +4% vs -2.66%?

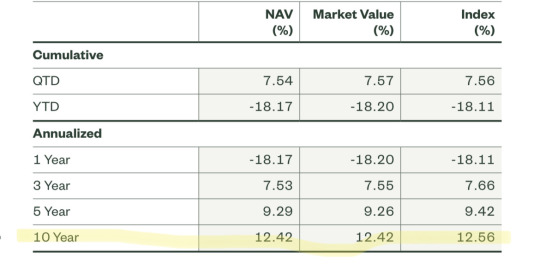

This is from a fact sheet.

Every fund has one (it’s actually a giant, potentially illegal, red flag if one does not) and they are part of the publicly available, pre-purchase, literature.

Google “{ticker code} fact sheet” and you will find it. They will all have a table similar to this. It will be publicly available and should not be behind a signup wall.

An annualized return is the average return over that period, year by year. So a 12.42% return over 10 years turns a every single $1 invested into $3.22. Google “annualized return calculator”

A savings account at 4% compounding daily turns this into $1.49 in 10 year. Google “daily compound interest calculator”

For comparison, they stock market return matched that just after Year 03 of 10.

So, when a fund I trust for a long term investment is down, to me it is future money on sale.

Every $1 I put in today does a little further then it would when the stock is performing well.

There is risk.

Funds will have bad years, they will have bad multi-year periods.

When I check on it, I ask, “are things bad now for everyone? Or is everyone doing well, but this fund sucks? If so, why — is it temporary, is it because they are digging deep into a long term strategy, is it because they lost their edge? Is this being fixed?”

Timing the market (holding cash until stocks are low) is difficult and rarely works out.

You can’t reliably predict when YOUR stocks are going to move, or how far, or in which direction — all you need to focus on is what you are picking.

I have $X that I invest weekly

When I have money and my stocks are high, I double check my emergency cash savings. Are they comfortable? If not, fill. If yes, invest.

When I have money my stocks are low, I am more aggressive about investing extra money. Not at the risk of damage should emergency cash be needed! But if I have extra cash, I strongly consider this as a good time to invest. Can I invest more than $X?

When I don’t have money I don’t look at the market, it’s not relevant to my immediate situation.

3 notes

·

View notes

Text

What's Group Pension Services In Canada?

Again, residents of Québec or individuals who labored in Québec will not be eligible for the CPP demise profit.

However, CPP and QPP work intently to make sure all contributors are protected, so contributions to both pension plans are combined when calculating the variety of years the deceased worked.

Historically speaking, CPP/QPP retirement pensions have been approximately one-quarter of a person’s common working earnings as much as the maximum annual pensionable earnings set by the CPP/QPP.

However, starting January 1, 2019, the Canada Pension Plan and Quebec Pension Plan might be “enhanced” to eventually exchange one-third of a person’s common working earnings as much as the maximum annual pensionable earnings set by the CPP/QPP.

If you're age 60+, you don't want to have ceased working in order to receive your retirement pension underneath the Québec Pension Plan .

You should have contributed to the Québec Pension Plan for at least 1 12 months.

Discount brokers facilitate inventory market trading, however they don't provide direct funding advice.

Discount brokerage accounts are normally available as online platforms that primarily present investors with a self-service possibility.

If you assume your retirement circumstances may want some skilled consultation, don’t hesitate to get some advice.

For occasion, you might want to speak to an accountant about your small business retirement planning or a lawyer for your estate plan and making a will.

Most Canadians choose to retire in this age range, and it’s straightforward to see why.

Government pensions will kick in throughout this time, corresponding to your Canada Pension Plan and Old Age Security payments.

Doing nothing to present pension obligations will cost public employees every thing.

To help you understand how they’re investing your money, the Star spent months researching the funds to compile this unique pension dashboard.

best pension plan in canada

With it you possibly can see how the funds stack up when it comes to returns, bills, different investments and carbon footprint.

You may even search for how they’re doing in comparison with different pension funds all over the world.

In quick, the longer you save, the extra you’ll likely have in your nest egg.

If you die earlier than you retire, your partner would automatically be the beneficiary of your pension.

If you didn’t have a partner, weren’t residing with them or they waived their entitlement, the dying profit would be paid to your named beneficiary or your property if you had no named beneficiary.

Be sure to contemplate your survivor benefit choices fastidiously to make the selection best suited to your monetary wants and life situation.

Inclusion of the pension plan within the collective settlement so that every one clauses of the plan are negotiated between the union and the employer.

Income accruing from investments made by the pension company on its own behalf.

No act or proceeding of the pension administration board is invalid merely because there are in workplace fewer than the number of directors required under this part.

The pension administration board could, by the unanimous settlement of the board, change a requirement of subsection .

Subject to subsection , a quorum of the pension administration board consists of the entire administrators of the board, and all decisions of the board must be unanimous.

For those that are in a place to hold working after age sixty five and select to delay their pension payments, the CPP/QPP drops the lowest intervals of incomes prior to age sixty five and replaces them with revenue accrued after age 65.

Like the General Drop Out, this provision is automatically utilized.

And, though Questwealth is an online-first platform, Questwealth is regulated by the Investment Industry Regulatory Organization of Canada and is a member of Canadian Investor Protection Fund , identical to the large banks.

The platform has greater than $20 billion in property beneath administration and has received a number of awards, together with Canada’s Best Managed Companies.

Finally, should you require any help, you can join an agent over live chat or the phone.

Robo-advisor like Questwealth Portfolios provides an all-in-one solution tailored to your threat tolerance and aims by way of an online questionnaire you’re given if you enroll.

Questwealth’s charges are among the many lowest in the business, ranging from 0.2% to 0.25%, depending on the dimensions of your portfolio.

The UBC Staff Pension Plan funds are invested in variety of asset courses through exterior funding managers and in accordance with the Plan’sStatement of Policies and Procedures .

#group pension services#group pension services Canada#group pension#group pension Canada#business pension plans#business pension plans Canada#pension plans canada#best pension plans in canada#employer pension plans canada#best pension plan in canada

3 notes

·

View notes

Text

Taxes in Germany

TAXES in GERMANY

Travelling to a New Country is always an exciting moment but as soon you start working and earning in Germany the most commonly heard word is TAX. The terms “Taxation” and “Tax Returns” bring so much fear and confusion to expats, especially when the system is not very straightforward and filled with complicated German words.

Vanakkam Germany & SHORTAX Team provides you all the necessary knowledge and information about the types of taxes in Germany, who should pay taxes, how to get maximum tax returns and much more. Keep reading to find out more about the topic of taxes and learn about the system of tax returns!

INTRODUCTION

Tax refers to the compulsory monetary contribution made to the revenue of a country that is levied on the residents — it comes from income of the workers, business profits, cost of goods, services and transactions.

In Germany, whether you are a citizen or resident, the law requires you to pay taxes. The Federal Government “Bundersregierung” is in charge of the tax collection, which is done locally by the tax offices called “Finanzamt”. If you are an expat, employed in Germany, you would have noticed the term “Lohnsteuer” on your paycheck. This deduction is the monthly tax on your income. However, if you have your business, second job or a freelancer, then you need to submit the annual tax return, so the government calculates the income tax that you need to pay.

Who Should pay taxes in Germany?

Almost everybody who lives in Germany pays taxes. Anybody who earns an income, either through employment, self-employment, capital investment, agriculture and many other revenues has to pay income tax. In short, those who receive an income (whatever the means) should pay tax to the government. Taxes are also paid by those who buy products and services. If you buy a house or car, then you need to pay different type of taxes. Read on to learn more about different types of taxes in Germany.

2 notes

·

View notes

Text

Cost Analysis and Financial Benefits of Solar Pool Covers

Solar swimming pool covers are an innovative and eco-friendly solution gaining popularity among pool owners seeking to enhance their swimming experience while reducing maintenance costs. These solar pool covers Brisbane harness the sun's energy to heat pool water naturally, significantly cutting down on energy expenses. They also help to minimize water evaporation and chemical usage, making them an economical and sustainable choice for maintaining a pool.

Let us explore the cost analysis and financial benefits of solar covers for swimming pools:

Initial Investment in Solar Covers

The average cost of solar pool covers in Brisbane can vary depending on factors such as size, material quality, and additional features like automatic mechanisms. Generally, prices range from $100 to $500 AUD for residential pools. Larger or higher-quality covers may be on the higher end of this range.

Key factors influencing cost include:

Pool Size. Larger pools require bigger covers, which increases the cost.

Material Quality. Higher-quality materials that are more durable and effective in heat retention tend to be more expensive.

Cover Type. Bubble (blanket) covers are generally cheaper than solid covers. Manual covers are less expensive compared to automatic covers, which include mechanisms for easy deployment and retraction.

Long-Term Savings with Solar Covers

Solar covers provide long-term savings by reducing energy costs, minimizing water evaporation, and decreasing the need for pool chemicals. Here is a breakdown of these savings:

Energy Cost Reduction. Solar swimming pool covers reduce the need for external pool heating by harnessing solar energy to warm the water. This can lead to substantial savings on electricity or gas bills. Depending on the climate and pool usage, pool owners can save approximately $200 to $300 annually on energy costs.

Water Conservation. In Brisbane, where water rates can vary, annual water savings for pools using solar pool covers typically range from 30% to 50%. For a pool owner, this can translate to savings of approximately $50 to $150 annually, depending on the specific water rates charged by the local authorities.

Reduction in Chemical Use. Solar covers help maintain the chemical balance of the pool by keeping debris out and reducing water evaporation. This decreases the need for pool chemicals by 30% to 60%, which can result in annual savings of $50 to $100.

Return on Investment Analysis

Calculating the ROI for a solar pool cover involves comparing the initial investment with the annual savings to determine how quickly the cover pays for itself and the overall financial benefit over time.

This means that within the first year, the savings from using the solar pool cover not only cover the initial investment but also provide a 30% return. Over a five-year period, assuming the savings and costs remain constant, the total savings would be approximately $2125.

Additional Financial Benefits

Beyond direct savings, solar covers offer additional financial benefits that enhance their value:

Extended Swimming Season. By maintaining warmer water temperatures, solar covers extend the swimming season, providing more value and enjoyment from the pool without additional heating costs.

Pool Equipment Longevity. By reducing evaporation and debris, solar pool covers help maintain the pool’s filtration system and pump, potentially extending their lifespan and reducing maintenance costs.

Property Value. An energy-efficient and well-maintained pool can increase the overall value of a property, making it a more attractive feature for potential buyers.

0 notes

Text

Beyond Numbers: How Tax Accountants Can Help Secure Your Financial Future

Navigating the labyrinth of tax laws and financial regulations requires more than a passing knowledge of spreadsheets and calculators. It demands a deep understanding of the tax system and strategic foresight into financial planning. This is where a skilled tax accountant steps in—not only to help you manage your current fiscal responsibilities but also to secure your financial future.

The Advanced Role of Tax Accountants

While it’s common to think of tax accountants merely as number crunchers or annual tax preparers, their role is markedly expansive in reality. A proficient tax accountant brings a blend of expertise, foresight, and strategic acumen to the table. Whether you're searching for a "tax accountant near me" or specific services like a "personal tax accountant," these professionals provide tailored advice that aligns with your long-term financial goals.

Strategic Tax Planning

One of the most crucial services provided by tax accountants involves strategic tax planning. It's not just about adhering to laws; it's about understanding how different financial decisions can impact your tax situation. Looking up "accountants near me" could connect you with experts who will work closely with you to plan major financial decisions, such as investments or large purchases, ensuring they are made in a tax-efficient manner.

Compliance and Complexity

Tax compliance is more than just filing returns. It includes an array of regulations that govern your income, deductions, investments, and other assets. With ever-changing tax codes, having a "tax consultant near me" means you have someone keeping track of these changes for you, ensuring that your financial activities remain compliant while securing opportunities to reduce tax liabilities.

Future-Focused Financial Consultation

Beyond immediate tax concerns, tax accountants provide insights that extend to future financial health. From advising on retirement plans to education funds and estate planning, tax advisors play an integral part. Seeking a "tax advisor near me" can thus not only help mitigate current taxes but pave the path for a financially secure future where personal goals are met with sound financial strategies.

Audits and Legal Proceedings

Facing an audit or involved in legal proceedings associated with taxes can be daunting. Professional accountants serve as your advocates, offering both preparation and support in navigating through audits or resolving disputes with tax authorities. Their expert representation can shield you from potential financial penalties and unnecessary stress.

The role of a tax accountant transcends simple tax preparation; they are architects of your financial future. They possess the acuity to dissect intricate tax laws and the strategic foresight required for sound financial planning. In an age where financial certainty is rare, securing a handshake with the right tax professional near you could mean the difference between meeting your financial objectives and falling short. So, rather than considering them just annual necessities during tax season, recognize these professionals as year-round partners in your financial journey.

1 note

·

View note

Text

How to Maximize Your Returns with the Best FD Rate of Interest

Fixed Deposit (FD) rates of interest are crucial for investors seeking secure and predictable returns. FD rates are predetermined interest percentages paid by banks or financial institutions to depositors over a fixed period. Typically, the rates are higher than those of regular savings accounts, offering a safer investment option with guaranteed returns. These rates can vary based on factors like the duration of the deposit, prevailing market conditions, and the policies of the financial institution. Understanding FD rates involves knowing how interest is calculated—whether compounded quarterly, monthly, or annually—and recognizing the impact of inflation and taxes on the real returns of the investment.

Read More:

https://businessworld.in/article/how-fd-rate-of-interest-impacts-your-investment-growth-with-maximum-return-519867

0 notes

Text

Navigating Tax Implications When Selling Gold in Canada: A Comprehensive Guide

Are you considering selling your gold assets in Canada? While it can be a lucrative endeavor, it's essential to understand the selling gold in canada involved. Whether you're a seasoned investor or a newcomer to the world of precious metals, navigating the tax landscape is crucial for maximizing your returns and staying compliant with the law.

Capital Gains Tax: When you sell gold for more than you paid for it, you'll likely incur capital gains tax on the profit. In Canada, 50% of the capital gains are taxable at your marginal tax rate. It's crucial to keep detailed records of your gold purchases and sales to accurately calculate your gains.

Reporting Requirements: The Canada Revenue Agency (CRA) requires taxpayers to report all capital gains, including those from selling gold, on their annual tax return. Failure to report these gains could result in penalties and interest charges. Make sure to stay organized and keep thorough documentation of your transactions.

Exemptions and Deductions: While capital gains tax is generally applicable to the sale of gold, there are some exemptions and deductions available. For example, if the gold you're selling is considered a personal-use property, such as jewelry or collectibles, you may be eligible for a partial exemption on the capital gains tax.

Timing of Sales: The timing of your gold sales can also impact the amount of tax you owe. If you have other investments that have incurred losses, consider selling your gold at a time when you can offset those losses against your gains, reducing your overall tax liability.

Seek Professional Advice: Tax laws and regulations can be complex and subject to change. To ensure you're making informed decisions and maximizing your tax efficiency, consider consulting with a tax professional who specializes in investment taxation and precious metals.

Record-Keeping: Keeping accurate records of your gold transactions is essential for tax purposes. Make sure to retain receipts, invoices, and any other relevant documents related to your purchases and sales. This documentation will be invaluable in the event of an audit or if you need to substantiate your tax filings.

Stay Informed: Stay updated on any changes to tax laws and regulations that may affect the sale of gold in Canada. By staying informed, you can adapt your investment strategy accordingly and mitigate any potential tax risks.

In conclusion, selling gold in Canada can have significant selling gold in canada that investors need to consider carefully. By understanding the capital gains tax rules, reporting requirements, exemptions, and deductions, you can minimize your tax liability and maximize your returns. Remember to keep thorough records, seek professional advice when needed, and stay informed about any changes to tax laws. With careful planning and attention to detail, selling gold can be a rewarding investment opportunity in Canada.

0 notes