#aeps services

Text

AEPS Services Near Me

AEPS services near me refers to the availability of Aadhaar Enabled Payment System (AEPS) services in proximity to the location of an individual. AEPS is a digital financial inclusion initiative in India that allows customers to access banking and financial services using their Aadhaar number and biometric authentication. This system enables people in remote or rural areas to perform various banking transactions and financial services without the need for a physical bank branch.

0 notes

Text

Aeps Services

Aadhaar Enabled Payment System (AEPS) is a banking service in India that allows customers to carry out basic banking transactions using their Aadhaar number and fingerprint authentication. AEPS services are typically offered by banks and financial institutions to provide convenient and secure banking services to individuals, especially in rural and remote areas where traditional banking infrastructure may be limited.

0 notes

Text

Aadhar Self Service Portal – Keep All Details Up To Date Easily!

The Aadhar self-service portal is the portal from which you can update, make changes or corrections to your Aadhar card via simple methods. Aadhar self-service portal permits you to submit requests to change the address, mobile number, email, and other basic details fed into the Aadhar database.

Click to read more Aeps Services

0 notes

Text

This is goldmine information for those who are planning to start their own AEPS business as an admin. Here I have explained the top 10 steps to set a successful AEPS b2b business. please check out India's only company that offers AI smart AEPS portal.

#aeps service provider company#how to start aeps business#aeps service provider#aeps software provider#aeps admin software#aeps admin portal#best aeps portal for admin

2 notes

·

View notes

Link

Are you looking for AEPS software developers who can create a fully customized, fast, secured and easy to use AEPS software portal for your business? If, yes then this is for you.

Ezulix software is one of the top AEPS service provider companies in India. We have a huge team of skilled and experienced professionals who can provide you all custom AEPS software with entire banking services and advanced features.

For more details visit my blog now or request a free live demo.

2 notes

·

View notes

Text

instagram

🫵 Is your e-commerce platform missing out on seamless transactions? Unlock the power of AePS and BBPS integration with Omega Softwares! 💻💸

⏰ Head to our website, https://www.omega-sys.com/, or comment below to chat about how Omega Softwares can help you! 💬

#custom software development#finance#fintech#software#payment#BBPS#aeps#development#software development#technology#services#mobile app development#web development#Instagram

0 notes

Text

Boost Your Business with Custom B2B Software

Empower your business with custom B2B software solutions from Beta Byte Technologies. Our expert team crafts tailored software to optimize operations and drive growth.

Get in touch with us today to kickstart your journey towards digital transformation!

#software development#custom erp software#custom software development#best software development company in mohali#software development agency#mobile app development#android app development#web app development#b2b software development#b2b software service#AEPS Software#BBPS Software service#Money Transfer Software#Billing Payment Service

0 notes

Text

#core banking solution providers#banking solutions#enterprise solutions services#digital payment solution#financial software companies#aeps software provider#banking as a service provider

0 notes

Text

Best Software Development Company In India

In the dynamic realm of technology, India has emerged as a prominent hub for software development, catering to diverse industries and businesses worldwide. Amidst this competitive landscape, Ecuzen Software stands out as a beacon of excellence, consistently delivering innovative and high-quality software solutions that empower organizations to achieve their digital goals.

Ecuzen Software: A Chronicle of Innovation and Excellence

Ecuzen Software, a leading IT solutions provider, has carved a niche for itself in the Indian software industry. Founded in 2014, the company has steadily grown, establishing a reputation for its expertise, commitment, and unwavering focus on customer satisfaction. With a team of highly skilled and experienced professionals, Ecuzen Software offers a comprehensive range of services, encompassing custom software development, web development, mobile app development, and cloud computing solutions. software development company

Ecuzen Software's success can be attributed to several key factors that set it apart from its competitors.

Unparalleled Expertise: Ecuzen Software boasts a team of seasoned software developers, each possessing in-depth knowledge and expertise across various technologies. This expertise enables the company to tackle complex projects with finesse, ensuring that clients' needs are met and exceeded.

Commitment to Quality: Ecuzen Software places unwavering emphasis on quality, adhering to stringent industry standards and employing rigorous testing methodologies. This dedication to quality ensures that clients receive software solutions that are not only functional but also robust, secure, and scalable.

Customer-Centric Approach: Ecuzen Software prioritizes customer satisfaction, fostering a collaborative working relationship with each client. The company's team understands the unique needs and goals of each client, working closely to deliver customized solutions that align with their specific requirements.

Innovation at the Forefront: Ecuzen Software embraces innovation, constantly exploring emerging technologies and trends to provide clients with cutting-edge solutions. This commitment to innovation enables the company to stay ahead of the curve, delivering software that empowers businesses to thrive in the ever-evolving digital landscape.

Ecuzen Software: A Trusted Partner for Global Success

Ecuzen Software's clientele extends across a diverse range of industries, including healthcare, finance, education, and e-commerce. The company has successfully delivered numerous projects, ranging from simple web applications to complex enterprise-level solutions. Ecuzen Software's global reach has earned it recognition as a trusted partner for organizations seeking to leverage technology to achieve their strategic objectives.

Ecuzen Software: Redefining the Software Development Landscape

Ecuzen Software's impact on the Indian software industry is undeniable. The company has not only set a high standard for quality and innovation but has also contributed significantly to the growth and development of the Indian IT sector. As Ecuzen Software continues to expand its horizons, it remains committed to providing exceptional software solutions that empower businesses to succeed in the digital era.

Ecuzen Software: Your Gateway to Digital Transformation

In today's technology-driven world, businesses face the challenge of adapting and evolving to stay ahead of the competition. Ecuzen Software emerges as a trusted ally in this journey, providing comprehensive software solutions that enable businesses to transform their operations, enhance customer experiences, and achieve their digital transformation goals.

With a proven track record of success, Ecuzen Software stands as a testament to Indian ingenuity and innovation. The company's commitment to quality, expertise, and customer satisfaction has propelled it to the forefront of the Indian software industry, making it the ideal partner for businesses seeking to harness the power of technology to drive their success.

Read More :- best software development company in india

#best aeps software provider in hariyana#best software development company#best software company#software development#app development#it services#web development#software company

0 notes

Text

The Crucial Role of Fintech in Empowering India's Underbanked Population

In the vast landscape of India, where economic diversity is as pronounced as its cultural richness, there exists a significant portion of the population that remains underbanked. Despite the strides made in financial inclusion over the years, a considerable number of individuals still lack access to basic banking services. This underbanked segment faces numerous challenges, ranging from limited financial literacy to geographical barriers. In this context, the emergence of Financial Technology (Fintech) companies has proven to be a game-changer, offering innovative solutions to address the unique needs of the underbanked population.

Understanding the Underbanked

The underbanked population in India comprises individuals who, for various reasons, do not have full access to traditional banking services. This could be due to factors such as remote geographical locations, lack of proper documentation, or insufficient income levels. The consequences of being underbanked are profound, as it restricts opportunities for savings, access to credit, and participation in the formal economy.

Challenges Faced by the Underbanked

Limited Access to Banking Infrastructure: Many underbanked individuals reside in remote rural areas where traditional banking infrastructure is scarce. This geographical divide makes it challenging for them to access basic financial services.

Financial Literacy Barriers: A significant portion of the underbanked population lacks adequate financial literacy. This hinders their ability to make informed decisions regarding savings, investments, and accessing credit.

Documentation Hurdles: Traditional banks often require a plethora of documentation, which can be a significant barrier for the underbanked who may lack the necessary paperwork. Fintech companies, leveraging technology, have found ways to navigate these hurdles efficiently.

How Fintech Companies Bridge the Gap

Digital Payments and Wallets: Fintech companies have pioneered the adoption of digital payment solutions and mobile wallets. These tools empower the underbanked by providing a secure and convenient way to conduct transactions without the need for a traditional bank account.

Simplified Onboarding Processes: Unlike traditional banks, Fintech firms often employ simplified onboarding processes that reduce the need for extensive documentation. This facilitates the inclusion of individuals who may lack the paperwork required by traditional financial institutions.

Credit Access Through Alternative Data: Traditional credit scoring models may not accurately reflect the creditworthiness of the underbanked. Fintech companies are leveraging alternative data sources, such as utility bill payments and mobile phone usage, to assess creditworthiness and provide access to credit for those without a traditional credit history.

Customized Financial Products: Understanding the diverse needs of the underbanked, Fintech companies design products tailored to their requirements. This includes microloans, insurance products, and investment options that are more accessible and flexible than traditional offerings.

Conclusion

As India strides towards becoming a digital economy, the role of Fintech companies in addressing the financial needs of the underbanked cannot be overstated. By leveraging technology and innovation, these companies are breaking down barriers, making financial services more inclusive and accessible. The positive impact of financial inclusion extends beyond individual empowerment; it contributes to the overall economic growth of the nation. As Fintech continues to evolve, it holds the key to unlocking the full potential of every individual, regardless of their socio-economic background.

#banking#business ideas#finance#fintech#business#underbanked population#money#expert says#matm#aeps#DMT#money transfer services#prepaid cards#prepaid recharge

0 notes

Text

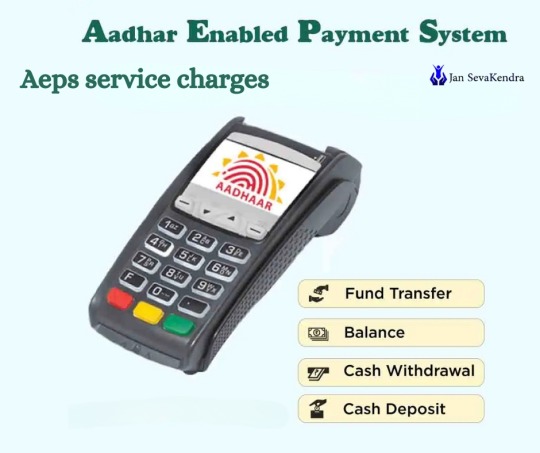

Aeps service charges

Aadhaar Enabled Payment System (AEPS) is a financial service in India that allows individuals to perform basic banking transactions using their Aadhaar number and fingerprint authentication. It is an initiative by the National Payments Corporation of India (NPCI) to make banking services accessible to all, particularly in rural and remote areas.

URL:-

https://jansevakendr.org/category/aeps/

1 note

·

View note

Text

Aeps Services

Aadhaar Enabled Payment System (AEPS) is a banking service in India that allows customers to carry out basic banking transactions using their Aadhaar number and fingerprint authentication. AEPS services are typically offered by banks and financial institutions to provide convenient and secure banking services to individuals, especially in rural and remote areas where traditional banking infrastructure may be limited.

0 notes

Text

Best AePS Commission in India: AePS Service mai milne wala commission ki baat kare toh adhiktam 10.50 rupee tak commission reatailers ko diya jata hai. Yaadi apko zyada commission chahiye toh aap humse judkar zyada se zyada comssion prapt kar sakteh hai.

0 notes

Text

How to Grow Your Kirana Store’s Earnings Today?

In today’s rapidly evolving retail landscape, Kirana stores are presented with exciting opportunities to enhance their earnings and customer reach. Leveraging innovative solutions like AEPS cash withdrawal, Bharat Bill Payment Service, and online DTH recharge can transform your Kirana store into a one-stop shop for a diverse range of services. In this blog, we’ll explore these key features and guide you on how to grow your Kirana store’s earnings today!

#aeps cash withdrawal#what is aeps cash withdrawal#aadhaar enabled payment system#Bharat bill payment service for retailers#online DTH recharge#Retailer Mobile recharge portal#domestic money transfer in India

0 notes

Text

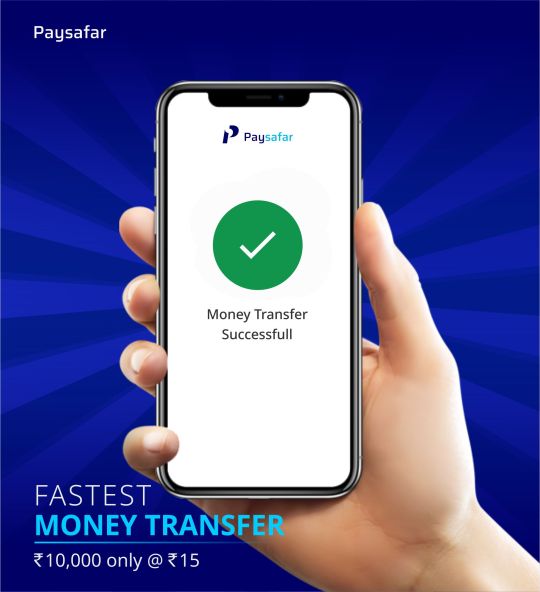

Money transfer service in india

aeps service in india

aeps service near me

0 notes

Link

2 notes

·

View notes