#Virtual Card

Text

Unlocking the Power of Virtual Cards: Noupia Leading the Way in Cameroon and Beyond

In today's digital era, financial transactions have become increasingly convenient and secure, thanks to innovative solutions like virtual cards. These electronic counterparts to physical debit or credit cards have revolutionized online payments, offering users a safer and more versatile means of conducting transactions in an ever-expanding digital marketplace.

What are Virtual Cards?

Virtual cards, also referred to as e-cards or digital cards, are essentially online payment cards that exist solely in electronic form. Unlike traditional plastic cards, virtual cards are generated digitally and can be used for online transactions without the need for a physical presence. Each African virtual card is typically associated with a specific account and can be used to make purchases or payments online, offering a convenient alternative to traditional payment methods.

The Rise of Virtual Cards in Africa

As the global economy increasingly shifts towards digital transactions, the adoption of virtual cards in Africa has been on the rise. This trend is driven by the continent's growing tech-savvy population and the increasing demand for secure and convenient payment solutions. With traditional banking services often facing limitations in accessibility and convenience, virtual cards offer a viable alternative for individuals and businesses alike.

Noupia: Pioneering Virtual Cards in Africa

Noupia emerges as a pioneering platform in Africa, offering virtual cards tailored to the specific needs and preferences of African users. The platform's user-friendly interface and robust security measures make it a trusted choice for individuals and businesses seeking reliable digital payment solutions. By prioritizing accessibility and convenience, Noupia.com is democratizing access to virtual cards across the continent.

Accessibility and Convenience

One of the primary advantages of virtual cards is their accessibility. Unlike traditional banking services that may require extensive paperwork and documentation, virtual cards can be obtained quickly and conveniently through platforms like Noupia. With just a few clicks, users can generate Cameroon virtual card numbers linked to their existing bank accounts or digital wallets, enabling them to make secure online payments without hassle.

Security and Reliability

In addition to accessibility, Noupia prioritizes security and reliability in its African virtual card offerings. With advanced encryption technology and stringent authentication measures, Noupia ensures that every transaction is protected against fraud and unauthorized access. This commitment to security provides users with peace of mind, knowing that their financial information is safeguarded throughout the payment process.

Driving Financial Inclusion

Noupia's presence in countries like Cameroon, Congo Republic (Brazzaville), and Benin Republic underscores its commitment to driving financial inclusion across Africa. By partnering with local banks and payment providers, Noupia is able to offer virtual cards that cater to the unique needs and preferences of African users. Whether users prefer to top up their Cameroon virtual cards using mobile money, bank transfers, or cash, Noupia provides flexible solutions that empower individuals and businesses to participate in the digital economy.

Conclusion In conclusion, virtual cards represent a powerful tool for financial inclusion and empowerment in Africa. With platforms like noupia.com leading the way, accessing and managing virtual cards has never been easier or more secure. By embracing virtual cards, individuals and businesses across Cameroon, Congo Republic (Brazzaville), Benin Republic, and beyond can unlock new opportunities in the digital economy. As Africa continues to embrace the digital revolution, virtual cards are poised to play a central role in driving economic growth and prosperity across the continent.

0 notes

Text

virtual card buy with bitcoin

buy virtual card,online payment and

all cryptocurrency payment and solution

0 notes

Text

virtual card buy with bitcoin

buy virtual card,online payment and

all cryptocurrency payment and solution

0 notes

Text

Payaraa makes it easy to manage your finances across borders. 💼 Experience the freedom of global transactions with just a click!

Visit: https://payaraa.com/

0 notes

Text

Go Cashless with Apple Pay: Add Your Virtual Card Today

Embrace a cashless lifestyle with Apple Pay. Learn how to add your virtual card to Apple Pay and enjoy seamless and secure transactions on the go! #ApplePay #CashlessPayments

#ApplePay#VirtualCard#CashlessPayments#bitcoin#virtual card provide with bitcoin#credit cards#crypto#virtual card

0 notes

Text

Unveiling the Benefits of Virtual Credit Cards

Introduction: In the rapidly evolving digital landscape, virtual credit cards have emerged as a secure and convenient payment solution. These digital alternatives to physical credit cards offer a plethora of benefits for individuals and businesses alike. In this blog, we will explore the advantages of virtual credit cards and how they are transforming the way we make online transactions.

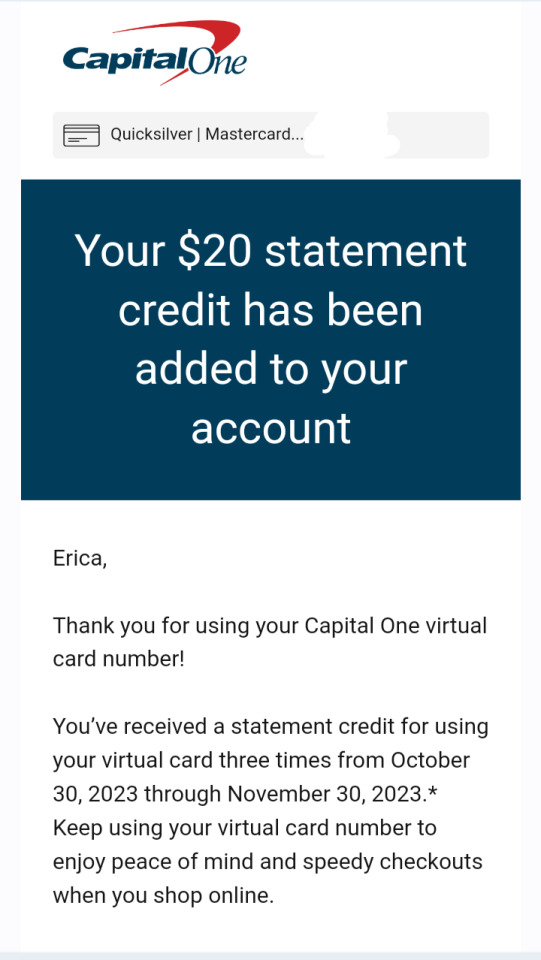

Enhanced Security: Virtual credit cards provide an extra layer of security compared to traditional physical cards. They are designed to be used for a single transaction or limited period, reducing the risk of fraudulent activity. Since virtual cards do not carry the user's personal information, such as the card number or CVV, they offer protection against data breaches and unauthorized access. This heightened security helps to instill confidence in online shoppers and businesses alike.

Fraud Prevention: Virtual credit cards offer robust fraud prevention measures. With features like dynamic card numbers, expiration dates, and CVV codes, these cards ensure that each transaction is unique and cannot be used for unauthorized purposes. If a virtual card is compromised or compromised, it can be easily deactivated or closed, minimizing the potential damage.

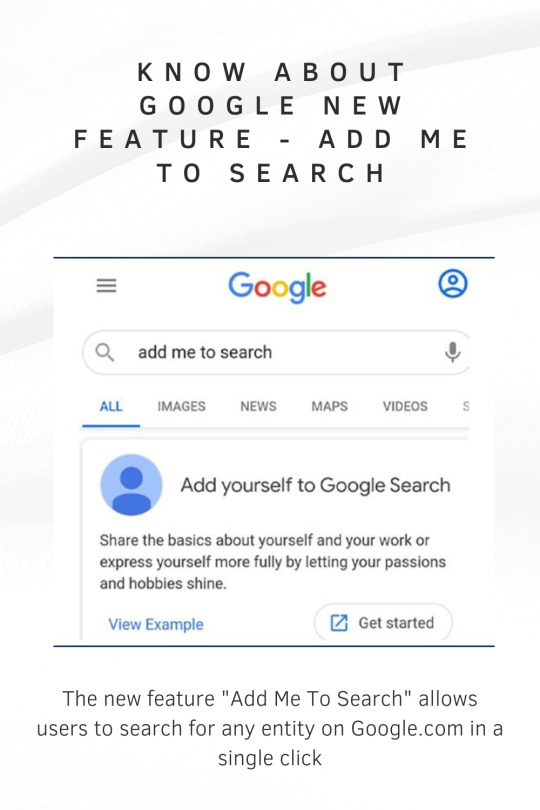

Easy Accessibility: Virtual credit cards are incredibly convenient, as they can be accessed and managed through mobile apps or online platforms. Users can generate virtual card numbers in real-time, making them instantly available for use in online purchases. This eliminates the need to carry physical cards or manually input card details, saving time and effort for users.

Budget Control: Virtual credit cards are an excellent tool for budget control and expense management. Users can set spending limits and expiration dates for virtual cards, ensuring that they align with their financial goals. This feature is particularly beneficial for businesses, allowing them to allocate specific budgets to different departments or projects.

Seamless Online Shopping: Virtual credit cards make online shopping a breeze. They can be linked to specific online merchants or used for one-time transactions, reducing the risk of unauthorized charges or subscriptions. Virtual cards also simplify the refund process, as refunds can be directly credited back to the virtual card without any hassle.

International Payments: For individuals and businesses involved in global transactions, virtual credit cards offer significant advantages. They eliminate the need for currency conversion and reduce foreign transaction fees, making cross-border payments more cost-effective. Additionally, virtual cards can be easily used for online purchases from international merchants without any limitations.

Conclusion: Virtual credit cards have revolutionized the way we make online transactions, offering enhanced security, fraud prevention, convenience, and budget control. As the digital landscape continues to evolve, virtual credit cards are becoming increasingly popular due to their numerous benefits. Whether you're concerned about online security or looking for seamless payment options, virtual credit cards are a smart choice for the modern era of digital transactions.

#Anonymous Prepaid Card#Virtual Card#Best Crypto Card#Anonymous Loadable Card#Loadable Debit Cards#Loadable Visa Cards#Physical Card#Payroll Cards#Payoneer#Payoneer Card#Payoneer Credit Card#Best Rewards Card#card#bank#money#transactions

1 note

·

View note

Text

Simplify Your Payments with a Virtual Card

Looking for a secure and convenient way to make online purchases? A virtual card could be the solution you need. With its unique, one-time use number, a virtual card offers enhanced security and fraud protection. Plus, since it's not tied to your physical credit card, you can use it for online purchases without worrying about your credit card information being compromised. Whether you're buying goods or services, a virtual card can simplify your payments and give you peace of mind.

0 notes

Text

I'm a steady player of the MARVEL SNAP game, and thought of a support card that EVERY MCU fan might love!

So here's my concept! :)

It's not a real SNAP card, but maybe it COULD be. Still, it's a fun bit of fan-created Photoshoppery, if nothing else!

#Marvel#marvel snap#MCU#game#mobile gaming app#mobile games#photoshoppery#virtual card#card#shawarma#avengers

0 notes

Text

Merry Christmas virtual card sent from a friend

0 notes

Video

Carding 2023 is carding method 2022 For Carding darknet market Buy cc

0 notes

Text

virtual card buy with bitcoin

buy virtual card,online payment and

all cryptocurrency payment and solution

0 notes

Text

Seamlessly cover various currencies with Payaraa's virtual cards, providing you with unparalleled financial flexibility. 💸

Visit: https://payaraa.com/

0 notes