#StockMarketupdates

Text

Navigating the Market: Understanding Aeroflex Share Price Trends and Analysis

Introduction:

Aeroflex share price is a topic of interest for investors and enthusiasts seeking to understand the performance and dynamics of the aerospace and defense company's stock in the market. Analyzing Aeroflex share price trends, factors influencing its fluctuations, and potential investment opportunities is essential for stakeholders looking to make informed decisions regarding the company's stock. This guest post aims to explore Aeroflex share price, presenting articles, insights, and addressing frequently asked questions to provide readers with comprehensive guidance on navigating the stock market.

Key Articles:

"Decoding Aeroflex Share Price:

Understanding the Basics of Stock Market Dynamics": This foundational article provides readers with an overview of Aeroflex share price and the fundamental principles of stock market dynamics. It delves into the factors influencing stock price fluctuations, such as market trends, company performance, industry news, and investor sentiment. By offering insights into the basics of Aeroflex share price, this article sets the stage for exploring more advanced analysis and strategies.

"Analyzing Aeroflex Share Price Trends:

Patterns, Indicators, and Predictive Insights": Aeroflex share price trends offer valuable insights into the company's performance and market sentiment. This article explores techniques for analyzing Aeroflex share price trends, including chart patterns, technical indicators, and predictive models. By examining historical data and identifying recurring patterns, investors can gain a better understanding of potential future price movements and make more informed investment decisions.

"Market Dynamics and Aeroflex Share Price:

Factors Influencing Stock Performance": Various factors can influence Aeroflex share price, ranging from macroeconomic trends to company-specific developments. This article explores the key factors influencing Aeroflex share price, such as industry outlook, competitive landscape, regulatory changes, and geopolitical events. By staying informed about these factors and their potential impact on the stock, investors can better assess the risk and opportunities associated with investing in Aeroflex.

"Investment Strategies:

Navigating Aeroflex Share Price Volatility and Maximizing Returns": Aeroflex share price volatility presents both challenges and opportunities for investors. This article discusses strategies for navigating Aeroflex share price volatility and maximizing returns, such as diversification, dollar-cost averaging, and long-term investing. By adopting a disciplined approach and staying focused on their investment goals, investors can weather market fluctuations and achieve their desired outcomes.

Conclusion:

Aeroflex share price represents a key aspect of the stock market landscape, offering investors insights into the performance and dynamics of the aerospace and defense company's stock. Through key articles exploring the basics of stock market dynamics, analysis of Aeroflex share price trends, factors influencing stock performance, and investment strategies, readers gain comprehensive guidance on navigating the market and making informed decisions regarding Aeroflex stock. As investors continue to monitor Aeroflex share price and adapt their strategies accordingly, they can position themselves for success in the ever-changing market environment.

FAQs:

What factors influence Aeroflex share price?

Aeroflex share price can be influenced by a variety of factors, including company performance, industry trends, macroeconomic conditions, regulatory changes, investor sentiment, and geopolitical events. Monitoring these factors can help investors better understand the dynamics of the stock and make informed investment decisions.

How can investors analyze Aeroflex share price trends?

Investors can analyze Aeroflex share price trends using various techniques, including chart patterns, technical indicators, and predictive models. By examining historical data and identifying recurring patterns, investors can gain insights into potential future price movements and make more informed investment decisions.

What investment strategies are recommended for navigating Aeroflex share price volatility?

Strategies for navigating Aeroflex share price volatility include diversification, dollar-cost averaging, and long-term investing. By spreading their investments across different assets, investors can reduce risk and mitigate the impact of volatility on their portfolios. Additionally, staying focused on long-term investment goals can help investors weather short-term market fluctuations.

Where can investors find reliable information about Aeroflex share price?

Investors can find reliable information about Aeroflex share price from a variety of sources, including financial news websites, stock market research reports, company filings, and brokerage platforms. It's important for investors to conduct thorough research and consult multiple sources to make well-informed investment decisions.

Read More

0 notes

Text

Unveiling Pune E-Stock Broking IPO GMP: IPOBrains’ Journey to Market Success

Pune E-Stock Broking IPO GMP

IPOBrains: Redefining the IPO Experience

At the heart of IPOBrains lies a simple yet powerful vision — to democratize access to IPOs and empower investors with valuable insights and information. Unlike traditional brokerage firms, IPOBrains leverages cutting-edge technology and data analytics to provide its clients with real-time updates and analysis on upcoming IPOs, including the much sought-after Pune E-Stock Broking IPO GMP (Grey Market Premium).

The company’s user-friendly platform allows investors to track GMP trends, evaluate market sentiment, and make informed decisions regarding their investment strategies. By offering comprehensive resources and expert guidance, IPOBrains aims to level the playing field and empower both seasoned investors and newcomers alike.

Pune E-Stock Broking IPO GMP: Unraveling the Hype

As one of the most anticipated IPOs in recent times, the Pune E-Stock Broking IPO has generated significant buzz within the investment community. The Grey Market Premium (GMP) for this IPO has been a topic of keen interest, serving as a barometer for investor sentiment and market demand.

IPOBrains has been at the forefront of tracking and analyzing the Pune E-Stock Broking IPO GMP, providing investors with valuable insights into the pricing dynamics and potential market performance. Through its comprehensive GMP analysis, IPOBrains has helped investors navigate the complexities of IPO investing and seize lucrative opportunities in the ever-evolving market landscape.

Navigating Market Volatility with IPOBrains

In an era marked by unprecedented market volatility, the role of reliable brokerage firms like IPOBrains becomes all the more crucial. The company’s robust infrastructure and experienced team of professionals enable it to adapt swiftly to changing market conditions and mitigate risks effectively.

Whether it’s navigating fluctuations in the Pune E-Stock Broking IPO GMP or identifying emerging trends in the broader market, IPOBrains remains steadfast in its commitment to delivering value to its clients. By fostering a culture of innovation and continuous improvement, IPOBrains stands poised to redefine the future of e-stock broking and IPO investing.

Looking Ahead: The Future of IPOBrains

As IPOBrains continues to scale new heights and expand its footprint in the Indian financial markets, the future looks brighter than ever. With a relentless focus on customer satisfaction and a commitment to excellence, IPOBrains is well-positioned to capitalize on emerging opportunities and shape the future of e-stock broking.

The company’s strategic partnerships, technological prowess, and unwavering dedication to its core values set it apart in a crowded marketplace. As investors eagerly await the Pune E-Stock Broking IPO GMP and other exciting opportunities on the horizon, IPOBrains remains steadfast in its mission to empower investors and drive positive change in the financial industry.

In conclusion, IPOBrains represents a beacon of innovation and integrity in the world of e-stock broking and IPO investing. With its unparalleled expertise, customer-centric approach, and unwavering commitment to excellence, IPOBrains is poised to lead the way towards a brighter and more inclusive future for investors across India and beyond.

#IPOInvesting#StockMarketInsights#FinancialFreedom#InvestmentStrategy#MarketAnalysis#EStockBroking#PuneIPO#GreyMarketPremium#MarketTrends#InvestmentOpportunities#MarketVolatility#IPOPerformance#InvestmentTips#IPOTracking#StockMarketNews#IPOAlert#MarketResearch#FinancialPlanning#InvestmentEducation#IPOAnalysis#StockMarketUpdates#InvestmentCommunity#FinancialAdvisor#InvestmentInsights#EStockTrading#PuneStockMarket#InvestmentGoals#MarketForecast#StockMarketAnalysis#InvestmentAdvice

0 notes

Text

#sharemarket2023#holidayinvesting#marketstrategy#financialplanning#holidaytrading#investmentplanning#tradingstrategies#stockmarketupdates

0 notes

Text

STOCK MARKET

The stock market is a marketplace where publicly traded companies can issue and sell shares of their stock to investors. When investors buy shares of a company’s stock, they are essentially buying a small ownership stake in that company.

The stock market provides a way for companies to raise capital by selling shares of stock to investors, and it provides a way for investors to invest in…

View On WordPress

0 notes

Photo

These are the top 7 companies having almost zeo debt! Do you have any one of these in your portfolio? #business #finance #stockmarket #branding #stockmarkettips #stockmarketupdates #debtfreecompany #weeklynews #financenews #lichsares #licipo #infosys #heromotocorp #digitalrupee #RBI #newsupdates #EV #DTINVESTMENTS #nse #bse #stockmarket #stockmarketindia #stock #trending #trend #tradingstocks #ipo #viratkohli #tata #stockmarketmemes #stockmarketnews https://www.instagram.com/p/CfnpnlsvMtv/?igshid=NGJjMDIxMWI=

#business#finance#stockmarket#branding#stockmarkettips#stockmarketupdates#debtfreecompany#weeklynews#financenews#lichsares#licipo#infosys#heromotocorp#digitalrupee#rbi#newsupdates#ev#dtinvestments#nse#bse#stockmarketindia#stock#trending#trend#tradingstocks#ipo#viratkohli#tata#stockmarketmemes#stockmarketnews

0 notes

Link

#trending #procommun #finance #crypto #nft #stories #webstories #shorts #learning #SGXNIFTY Tight rope walk of Inflation and Growth

0 notes

Text

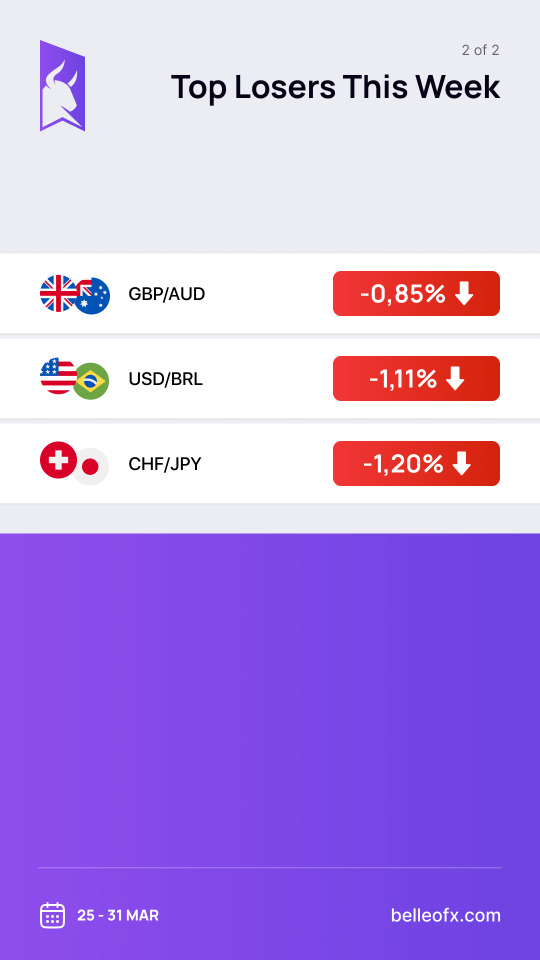

Presenting our weekly top performers and underperformers [25 Mar - 31 Mar, 2024]:

📈Top Gainers This Week

✓ USDRUB +1.71%

✓ CADCHF +1.59%

✓ USDCHF +1.55%

📉Top Losers This Week

☒ GBPAUD -0.85%

☒ USDBRL -1.11%

☒ CHFJPY -1.20%

Ready to take control of your trading journey? Open your live trading account today - Seize the Bull within you! 📈🐃

Join now: https://pa.belleofx.com/en/signup

BelleoFX Market Updates

0 notes

Text

Understanding Aeroflex Share Price: Trends, Analysis, and Insights

Introduction

The share price of Aeroflex, a prominent player in the aerospace and defense industry, has been a subject of keen interest among investors and analysts alike. In this article, we delve into the various factors influencing Aeroflex's share price, analyzing recent trends and offering insights for investors.

Market Performance and Investor Sentiment

Aeroflex's share price is not immune to broader market trends and investor sentiment. During periods of economic uncertainty or market volatility, investors may exhibit caution, leading to fluctuations in share prices. Conversely, positive economic indicators or company-specific developments can boost investor confidence, driving share prices higher.

Company Performance and Financial Metrics

Aeroflex's financial performance plays a crucial role in determining its share price. Investors closely monitor key financial metrics such as revenue growth, profitability, and cash flow generation. Strong financial results can attract investor interest and support share price appreciation, while disappointing performance may lead to downward pressure on share prices.

Industry Trends and Competitive Landscape

The aerospace and defense industry, in which Aeroflex operates, is subject to unique market dynamics and competitive pressures. Changes in government spending on defense, technological advancements, and shifts in customer demand can all impact the company's growth prospects and, consequently, its share price. Moreover, competition within the industry can influence market share, pricing strategies, and ultimately, shareholder value.

Regulatory Environment and Policy Developments

Regulatory factors and policy developments can significantly impact Aeroflex's operations and financial performance. Changes in government regulations, export controls, or geopolitical tensions may introduce uncertainty and volatility into the market, affecting investor perceptions of the company and its future prospects.

Strategic Initiatives and Corporate Developments

Aeroflex's strategic initiatives and corporate developments also play a crucial role in shaping its share price trajectory. Mergers and acquisitions, divestitures, product launches, and strategic partnerships can all impact the company's competitive position and growth potential, influencing investor sentiment and share price performance.

Analyst Coverage and Investor Perception

Analyst recommendations and investor perception can influence market sentiment and share price movements. Analysts' assessments of Aeroflex's business prospects, earnings forecasts, and target price estimates can serve as valuable insights for investors, guiding their investment decisions and shaping market expectations.

Risk Factors and Uncertainties

It's essential to consider the inherent risks and uncertainties associated with investing in Aeroflex shares. Factors such as macroeconomic trends, geopolitical risks, regulatory changes, and unforeseen events (e.g., natural disasters, pandemics) can all impact the company's operations and financial performance, leading to volatility in share prices.

Conclusion

In conclusion, the share price of Aeroflex is influenced by a myriad of factors, including market dynamics, company performance, industry trends, regulatory environment, and investor sentiment. Understanding these factors and conducting thorough analysis is essential for investors seeking to navigate the complexities of the stock market and make informed investment decisions.

0 notes

Text

#IREDA#StockMarket#Investing#FinancialNews#Stocks#ShareMarket#InvestmentOpportunity#StockPerformance#MarketWatch#FinancialSuccess#TradingTips#InvestmentStrategy#MarketGains#StocksToWatch#MarketAnalysis#IREDAShares#InvestmentNews#StockMarketUpdate#DoubleGains#BullishTrend

0 notes

Photo

లాభాల బాటలో సూచీలు || Sensex Ends With A Positive Note Today For more details: www.politikos.in www.internetmediaworld.org [email protected] [email protected]

#Politikos#SensexPositive#StockMarketUpdate#BullishTrend#FinancialMarkets#SensexGains#StocksRise#MarketOptimism#PositiveClosing#MarketOutlook#SensexToday#MarketPositivity#StockMarketNews#SensexClosure#MarketUpdate#MarketPerformance

0 notes

Text

नेशनल स्टॉक एक्सचेंज के 50 शेयरों में भी पिछले सत्र के दौरान 69 अंक की तेजी आई

अमेरिकी मुद्रास्फीति के आंकड़ों के बाद फेडरल रिजर्व की ओर से इस महीने के अंत में ब्याज दरों में ठहराव की मज़बूत संभावना के बीच बेंचमार्क इंडेक्स निफ्टी 50 और सेंसेक्स गुरुवार को नए रिकॉर्ड उच्च स्तर पर पहुंच गए। इस दौरान बीएसई सेंसेक्स 213 अंक या 0.32% बढ़कर 67, 680 पर कारोबार करता दिखा।

#stockexchange#marketupdates#stockmarketnews#financialnews#stockshares#tradingtips#stockinvestment#marketanalysis#stockmarketupdate#stockmarketinsights

0 notes

Link

0 notes

Text

All Things To Know About Follow-on Public Offering (FPO) Link- https://www.goldenbulls.co.in/all-things-to-know-about.../

0 notes

Text

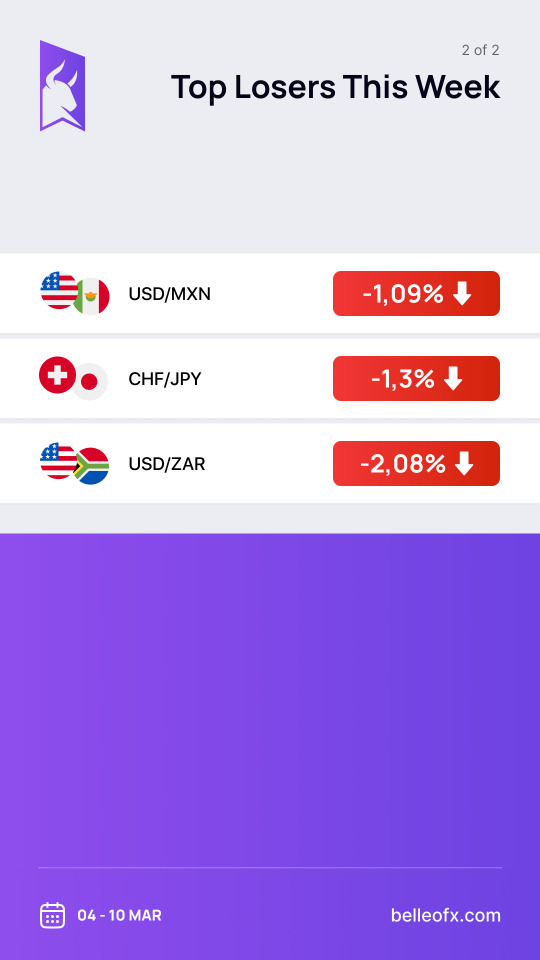

Presenting our weekly top performers and underperformers [04 Mar - 10 Mar, 2024]:

📈Top Gainers This Week

✓ GBPCHF +1.17%

✓ EURCHF +0.99%

✓ USDCHF +0.66%

📉Top Losers This Week

☒ USDMXN -1.09%

☒ CHFJPY -1.30%

☒ USDZAR -2.08%

Ready to take control of your trading journey? Open your live trading account today - Seize the Bull within you! 📈🐃

Join now: https://pa.belleofx.com/en/signup

BelleoFX Market Updates

0 notes

Video

youtube

Here, we go over profit charting of the $SPY( S&P500 ETF)

#youtube#stockmarket investing trading stocks finance wealthbuilding moneymakingtips investment stockmarketnews stockmarketupdates stockpic

2 notes

·

View notes