#SMCI

Text

🌟 Unlock the Secrets of SMCI Stock! 🌟

Step into the financial spotlight with our groundbreaking YouTube video on SMCI stock! Whether you're a financial aficionado or a budding investor, this video is your golden ticket to mastering the market dynamics of SMCI.

🔍 Exclusive Feature:

Prepare to be captivated! Our video is not just an analysis; it's an invitation to join a movement of informed investors who dare to dream big. Click play, and let's navigate the exciting world of SMCI stock together.

Watch the Video: Master the Market with SMCI Stock

🔔 Subscribe for more insights and become a part of our investment community. Together, let's turn market opportunities into victories.

#SMCIStock #InvestmentJourney #StockAnalysis #MarketInsights #InvestWithConfidence

#SMCIStock#InvestmentJourney#StockAnalysis#MarketInsights#InvestWithConfide#stocks#wall street#finance#penny stocks#stock market#smci

0 notes

Text

Bought more NVIDIA stock (up 239% in the past year) and bought some Super Micro Computer stock (up a dizzying 843% in the past year)

0 notes

Text

Super Micro Computer Inc Shines in Stock Market with Remarkable 62.42% EPS Surge, Driving Speculation for Q2 2024 earnings https://csimarket.com/stocks/news.php?code=SMCI&date=2024-02-03103757&utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

Supermicro 推出搭載 NVIDIA Grace CPU 超級晶片的伺服器

Supermicro 推出搭載 NVIDIA Grace CPU 超級晶片的伺服器

Super Micro (SMCI) 計劃將 NVIDIA Grace CPU 超級晶片部署至針對 AI、HPC、資料分析、數位分身(Digital Twins)和運算密集型應用程式最佳化的各種伺服器中。隨著人工智慧 (AI) 技術逐步跨產業發展,Supermicro 伺服器將透過採用 NVIDIA Grace CPU 超級晶片,讓更廣泛的開發人員和 IT 管理員都能使用這項新技術。Supermicro 伺服器將針對能源效率進行最佳化,協助降低營運成本,成為所有資料中心的基準。 (more…)

View On WordPress

0 notes

Text

19 April 2024

AI chipmaker Nvidia (NVDA) saw its shares dive on Friday after key hardware partner Super Micro Computer (SMCI) announced its next earnings date without giving preliminary results. Nvidia stock fell in tandem along with other highflying AI stocks.

On the stock market today, Nvidia stock sank 10% to close at 762.

The drop came after data-center hardware specialist Super Micro revealed that it will release its fiscal third-quarter results on April 30. But unlike recent quarters, it didn't update its sales and earnings guidance.

2 notes

·

View notes

Text

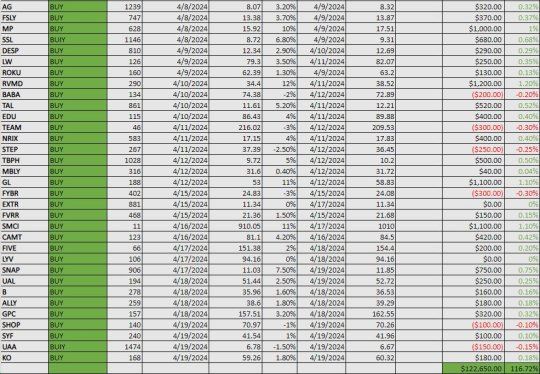

"Tough week for investing with all the market turmoil.

“Tough week for investing with all the market turmoil. Managed to hold on thanks to a few good trades. Best performers were $SMCI +11% and $SNAP +7.5%. Taking a breather on the sidelines, curious to see what next week brings. #investing #stockmarket” https://www.swingstocktraders.com/performance.html

View On WordPress

0 notes

Text

Why Nvidia Stock Plunged 10% Today

New Post has been published on https://petn.ws/kmVcC

Why Nvidia Stock Plunged 10% Today

It’s rare for a $2 trillion stock to fall on no direct news, but that’s exactly what happened to Nvidia (NASDAQ: NVDA) today. Shares of the AI chip leader got swept up in a broader AI sell-off after one analyst noted that Super Micro Computer (NASDAQ: SMCI), another AI stock leader, failed to report preliminary […]

See full article at https://petn.ws/kmVcC

#OtherNews

0 notes

Text

Super Micro Computer (SMCI) Stock Crashes 23%, Hits AI Darling Nvidia [ Stock ]

Super Micro Computer (SMCI) Stock Crashes 23%, Hits AI Darling Nvidia [News Summary]

SMCI did not offer Wall Street “a positive preannouncement, which is being

considered a negative,” Wells Fargo Securities said.

Super Micro Computer (NASDAQ: SMCI) stock has been riding the artificial

intelligence (AI) wave that Nvidia started. That makes sense to…

Super Micro Computer shares plunged on Friday…

View On WordPress

0 notes

Text

Alarum (NASDAQ: ALAR) Reports Blockbuster Q4 2023 and Full-Year 2023 Financial Results as NetNut Subsidiary Continues Impressive

In today’s digital economy and the meteoric rise of artificial intelligence, data really is becoming the new oil. Now more than ever, reliable and accurate data sources are becoming increasingly essential to powering advanced technologies and innovation. Without access to quality data, the AI boom would simply not be possible nor at its current levels of capability.

While AI semiconductor companies like Nvidia (NASDAQ: NVDA) and Super Micro Computer (NASDAQ: SMCI) have captivated headlines with their sky-rocketing stock prices, there are many other opportunities out there to capitalize on the demand for data and AI.

Alarum Technologies, Ltd. (NASDAQ: ALAR) is one such company that has seen its growth explode higher, thanks to its data collection technologies that offer a wide range of applications even beyond AI. The company’s recent fourth quarter and full-year 2024 financial results detail just how well the company is doing. However, before we jump into the financials, let’s break down the company’s NetNut subsidiary and capabilities.

What is NetNut and How Does the Service Help Companies Collect Data Across the Internet?

Alarum operates as a global provider of internet access and data collection solutions, which are offered through its NetNut subsidiary. NetNut powers the company’s data collection business through its high-speed global and secured hybrid proxy network, which allows its customers to collect data anonymously across the internet at any scale. The network is comprised of thousands of servers located around the world and provides its customer base with guaranteed privacy, as well as quality and stability at incredible speed. Furthermore, NetNut’s customer base features many impressive corporate clients, such as Lenovo, RocketReach, Joom, PriceLabs, and many more.

During the first two months of 2024, NetNut has already introduced two new product lines, the Website Unblocker, and an AI data collector product line. This comes as NetNut launched its first data collection product, the SERP API, in October 2023.

Using NetNut’s network, businesses can effectively gather real-time data and other vital sources to ensure a competitive edge. In today’s world of constantly changing market trends and consumer behaviors, businesses need to ensure they keep up every step of the way or risk falling behind competitors.

The potential use cases of NetNut’s network are bountiful. Using this network, businesses can conduct tasks like price comparison, market research, brand protection, threat intelligence, monitoring reviews, verifying ads, monitoring website changes, and many more. For a deeper dive into NetNut’s network use cases, please visit https://netnut.io/proxy-use-cases/.

How NetNut Can Support the AI Boom

In the context of artificial intelligence, NetNut’s service could be a welcomed solution to data source concerns faced by popular AI programs like ChatGPT. As the growth of ChatGPT continues to soar, many organizations and activists have begun raising concerns over how AI programs collect and source their data. With more and more companies looking for ways to block these AI programs from gaining access to their website and data, OpenAI’s ChatGPT and others will need to find solutions to ensure the continued collection of reliable data. After all, without data, the AI boom cannot survive and continue to innovate.

It is important to note that public data collection on the internet is legal, as long as the information is publicly available. Various U.S. court cases, such as Meta v. Bright Data, hiO Labs v. LinkedIn, and Van Buren v. United States, have all upheld the right to scrape publicly displayed data across the web.

This is exactly where Alarum and NetNut come into the picture. Using NetNut’s network, AI programs will still be able to effectively gather their required data at any scale. Whether it’s an early startup or a more established brand, like ChatGPT, consuming massive amounts of data, NetNut’s network provides a solution to this emerging hurdle facing the burgeoning AI boom.

Alarum’s NetNut Revenues Soar 150% in 2023 and Contributed to Record Net Profit During Q4 2023

The data collection solutions company reported its fourth quarter 2023 and full-year 2023 financial results on March 14, 2023. For the three months ended December 31, 2023, Alarum reported record revenues of $7.1 million compared to Q4 2022 sales of $5.1 million. Costs saw a decrease across the board (cost of revenue, R&D, sales & marketing, and general & administrative) thanks to the company’s shift away from CyberKick and its consumer-focused internet access businesses. As a result, Alarum reported a record net profit of $1.7 million during the quarter. Adjusted EBITDA also expanded to $2.2 million from $2 million last year.

“I am proud to share the most successful quarter in the Company’s history, as revenue, net profit, and Adjusted EBITDA, all meaningfully exceeded results from the previous quarter. We delivered efficient operational execution following our decision, in the second quarter of 2023, to scale down other activities and focus on NetNut’s operations,” said Shachar Daniel, Alarum’s Chief Executive Officer.

For the full year 2023, Alarum reported total revenues of $26.5 million compared to $18.6 million for the 2022 year. NetNut alone contributed $21.3 million to overall revenue, which represented an impressive 150% year-over-year growth compared to its 2022 revenue of $8.5 million. Cost of revenue, R&D, sales & marketing, as well as general & administrative costs all saw a decrease compared to 2022. The company did report a goodwill and intangibles impairment loss of $8.8 million. However, this was due to the scale-down of CyberKick and its cash-generating unit. Overall, the company reported an adjusted EBITDA of $5.2 million for the full year 2023 compared to an adjusted EBITDA loss of $8.5 million for 2022.

Overall, the results are very impressive, particularly Alarum’s Q4 results, which represent a full quarter of its NetNut-centralized strategy. The quarter demonstrated that NetNut’s growth is absolutely impressive and worth the full focus and attention of the company. The full-year results were also very good and showed a very clear improvement on the top and bottom lines compared to 2022. These results should give investors a lot of excitement and anticipation for the quarters and full year 2024 ahead. Mr. Daniel has already provided some hints that 2024 has started on a strong note in a quote from the financial results PR, as well as the earnings call.

“We began 2024 on a high note, by setting new monthly revenue records,” Mr. Daniel added. “Looking ahead, our strategy for 2024 involves expanding our cutting-edge product line, with a special emphasis on our advanced AI data collector series. The AI and data collection sectors complement each other significantly; AI platforms must have access to large volumes of data. Furthermore, we aim to grow our presence in the IP proxy network (IPPN) sector by entering new markets, enhancing our network infrastructure, and partnering with more top-tier customers globally.”

Conclusion

In conclusion, Alarum sits in an excellent position to continue benefitting from the global demand for reliable and accurate data collection. With so many different use cases and applications, NetNut’s service appears to have plenty more growth left in the tank. This becomes especially true when considering the current challenges facing the artificial intelligence industry and its data collection methods. As more websites try to challenge AI programs’ abilities to collect data, NetNut serves right at that intersection.

Alarum’s recent financial results are very positive and provide a resounding approval of the company’s new business focus. With new data collection tools being released and the company’s wide range of potential sales opportunities, 2024 is shaping up to be another exciting year for Alarum Technologies.

Disclaimer:

Spotlight Growth is compensated, either directly or via a third party, to provide investor relations services for its clients. Spotlight Growth creates exposure for companies through a customized marketing strategy, including design of promotional material, the drafting and editing of press releases and media placement.

All information on featured companies is provided by the companies profiled, or is available from public sources. Spotlight Growth and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever and we are not qualified to give financial advice. The information contained herein is based on external sources that Spotlight Growth believes to be reliable, but its accuracy is not guaranteed. Spotlight Growth may create reports and content that has been compensated by a company or third-parties, or for purposes of self-marketing. Spotlight Growth was compensated one thousand seven hundred and fifty dollars cash for the creation and dissemination of this content by the company.

This material does not represent a solicitation to buy or sell any securities. Certain statements contained herein constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may include, without limitation, statements with respect to the Company’s plans and objectives, projections, expectations and intentions. These forward-looking statements are based on current expectations, estimates and projections about the Company’s industry, management’s beliefs and certain assumptions made by management.

The above communication, the attachments and external Internet links provided are intended for informational purposes only and are not to be interpreted by the recipient as a solicitation to participate in securities offerings. Investments referenced may not be suitable for all investors and may not be permissible in certain jurisdictions.

Spotlight Growth and its affiliates, officers, directors, and employees may have bought or sold or may buy or sell shares in the companies discussed herein, which may be acquired prior, during or after the publication of these marketing materials. Spotlight Growth, its affiliates, officers, directors, and employees may sell the stock of said companies at any time and may profit in the event those shares rise in value. For more information on our disclosures, please visit: https://spotlightgrowth.com/disclosures/

0 notes

Text

SMCI Trade Alert

SMCI Trade Alert

https://www.youtube.com/watch?v=C0g7u2Tyf6g

What started as a day trade last week has turned into an 11% winning swing trade.Sorry I didn't call this one out. It was a risky entry on a volatile stock, so I didn't want anyone copying the trade, but now here we are with an 11% winner.Trade closed around $1,170If you want to see the call outs ahead of time and speak to me one-one-one for free then join the waitlist for early access to my free Discord channel. Link in my bio.

via TheRealTraderTrainer https://www.youtube.com/channel/UCMZjkOXOmG7MuVVJUQWRh3w

March 26, 2024 at 12:53AM

#daytrading#tradingrules#strategy#tradingprofits#technicalcharts#consistentprofits#tradingedge#tradingstrategy

0 notes

Text

Stock market today: US stocks stall as Fed decision day arrives

Stock market today: US stocks stall as Fed decision day arrives Yahoo Finance

S&P 500 trades flat as Fed rate decision looms: Live updates CNBC

Stock Market Today: Stocks Rise Ahead Of Fed Powell; Nvidia, SMCI Fall As Cisco Rival Breaks Out Investor’s Business Daily

Fed Meeting Today: Interest-Rate Decision at 2 p.m.; Dow Slips at Open — Live Updates The Wall Street Journal

Biden touts…

View On WordPress

0 notes

Text

#SMCI Stock News Super Micro Computer -23% TODAY - WHAT HAPPENED? #stocks #trading 👔👇

youtube

0 notes

Text

Rebel's Edge March 19th - Fusion Pharma FUSN UAO: Someone Knew About the Buyout!!! PARA WHR SMCI JWN

Join Jon and Pete Najarian on today's episode of Rebel's Edge as they discuss stocks including short interest in Paramount Global and Whirlpool, a chance to buy the dip on news of Super Micro Computer's equity offering, a huge UOA player who had advanced knowledge of AstraZeneca's buyout of Fusion Pharmaceuticals, and Nordstrom's founding family taking a shot at a takeover. Gain a deeper understanding of these stocks as Jon and Pete share their perspectives, potential growth prospects, and market predictions. They also talk about Anthony Edwards looking more and more like Michael Jordan, and QB shopping in the NFL. Stay on the cutting edge with Rebel's Edge.

Check out this episode!

0 notes

Video

youtube

I HAVE 1K SHARES IN NVDA. OTHER INVESTING OPPORTUNITIES SMCI, ASML, AMD,...

0 notes

Text

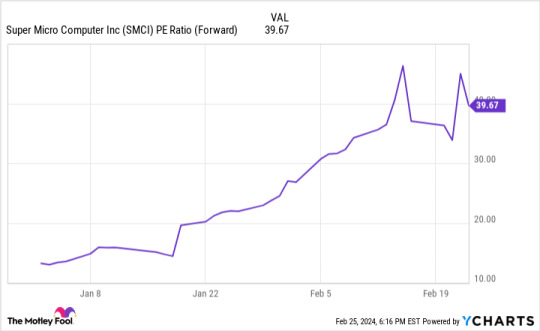

Will Super Micro Computer's Stock Reach $1,500?

Super Micro Computer (NASDAQ: SMCI) has been the best stock to own in 2024, with few exceptions. So far, it has essentially tripled just two months into the year.

This rise has caused it to cross the $1,000 threshold a few times, but with how pricey the stock is, it has become a bit volatile. But could it cross $1,500 sometime soon? Let’s find out.

Supermicro’s growth has been impressive

Super…

View On WordPress

0 notes

Text

Prominent AI Researcher Calls Bullshit

Stanford AI researcher James Zou is no slouch when it comes to AI. He is Faculty Director for the Stanford Institute for Human-Centered AI (HAI). They don't just hand these titles to just anyone.

So it might pay to listen to him.

'AI models are getting "substantially worse" in capabilities over time.'

Link to 1.26min video excerpt:

https://x.com/tsarnick/status/1755789760151625956?s=20

Poor Chat GPT. Poor Nvidia. Poor SMCI -- (Notice also how history rhymes with SMCI. It rolls off the tongue almost identically to internet bubble darling CMGI.)

The problem is that Nvidia (NVDA) is THE MARKET right now. There is no Magnificent Seven any longer.

There is simply The Magnificent.

Thus if NVDA cracks, the market craters.

I will be taking James Zou's AI flaw warning seriously because we have just had a shot across the bow, celestially speaking.

Look what the New Moon did to the market.

Any time there is a sell off coincident with the New moon, it pays to take it seriously. Each market top in 1929, 1987, and 2007 occurred during a New moon.

Celestial Voodoo

0 notes