Text

Mood Cue: India, Pt. 2

USDINR still just .37% below record. Extreme rupee weakness continues.

0 notes

Text

Mood Cue: India

I'm a long term India bull, however a pullback might be in order.

A delicate question might be in order, as well.

What if India's UNSTOPPABLE "success" is just a side effect of a chronically weak currency?

The Indian rupee just hit its lowest level vs the US Dollar... ever.

0 notes

Text

Speculative Real Estate Deflating?

Grant Cardone now on sale.

10X yourself for FREE.

This might be the latest canary.

0 notes

Text

Pundits Trashing Jamie Dimon. Maybe He Knows Something They Don't

This great chart from Larry McDonald might go a long way in explaining why peeps ought to at least consider why JP Morgan CEO Jamie Dimon had a stark warning for the economy in his latest shareholder letter.

What if Dimon is merely passing along actual transaction data that confirms the above chart? He's a banker, after all.

Dimon sees persistent inflationary pressures driven by fiscal deficits and military conflict among other factors.

Before criticizing his take, what if he's right? What if stagflation arises? Small caps would probably be screwed.

Or worse, a slowdown. We'd all probably be screwed.

Just saying.

0 notes

Text

Oh My God, II

And as the Barron's cover was not a joke, this ain't, either.

1 note

·

View note

Text

More Canarys

Add a couple more names to the Mood Report Canary List: retail names Lululemon LULU) and Five Below (FIVE).

Both have retested their respective their "November 13th" gap levels, as flagged here at Mood Report several times.

LULU and FIVE now join FDX, NKE, UPS (missed by 87 ticks), and a few other randoms: Boeing (BA), Lockheed Martin (LMT), Northrop Grumman (NOC), Mondelez (MNDZ), and Winnebago (WGO) which missed by 95 ticks.

Something is going on beneath the surface.

To repeat, the S&P 500 gapped higher from its November 13th, 2023 4411.55. These stocks are simply suggesting that that level could still be in play.

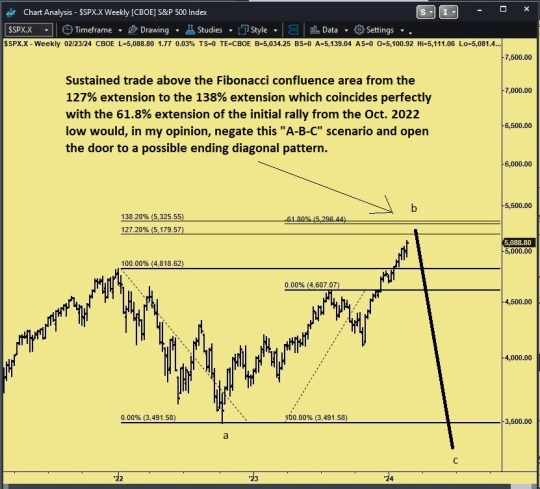

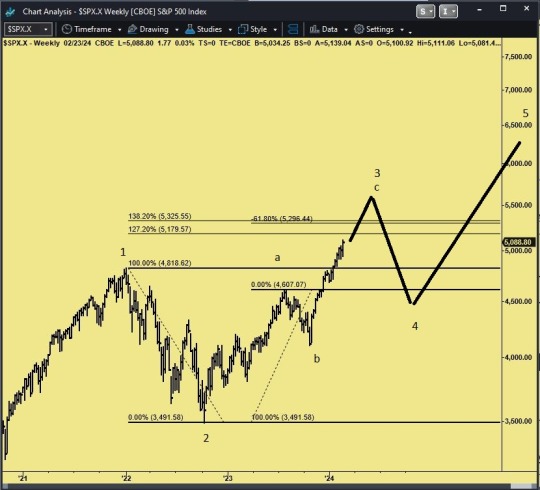

While the long-held B-wave scenario is not yet negated (which would target the 3125 level), it is looking less likely though not impossible, yet the rising wedge pattern could easily accommodate a re-test of the 4400 level.

The trigger for the wedge scenario remains:

sustained trade above the top Fib confluence area at 5325.55.

Meanwhile, in Taylor Swift world, the Time Magazine Effect is ticking.

Taylor Swift Owned All Three Pop Radio Charts Last Week; Now She’s Been Replaced On All Of Them

0 notes

Text

The Next Global Synchronization

Leave it to the Swiss. The first central bank to show the collective cabal's hand.

Today the Swiss central bank lowered interest rates unexpectedly, saying ''The easing of our monetary policy has been made possible because the fight against inflation over the past 2 1/2 years has been effective."

Victory lap.

Now we know why Powell patted himself on the back at Wednesday's post-Fed decision press conference.

Now we know why he was dovish despite the recent spate of inflationary data points.

Global central bank synchronization is orchestrated from Switzerland, home of the Basel-based Bank for International Settlements..."Promoting global monetary and fiscal stability through international cooperation."

The point is that central banks WANT inflation.

Why? Because they need it.

The only way to fill a $313 trillion global debt hole is to inflate it away.

And they do love to work together (practicing their fever dream of a single global central bank).

Say hello to financial repression, via lower rates and persistent inflation.

Otherwise known as yield curve control.

IF they can pull it off.

The bond market may have other ideas.

Yellen's political antics -- conducting overt monetary policy from the US treasury -- may have been a little much.

Time will tell.

0 notes

Text

Age 18, 300-400% returns Since Covid

So easy a caveman can do it.

ICYMI:

These Teenagers Know More About Investing Than You Do

The Whiz Kids Are Back

0 notes

Text

Bitcoin Correlation Update

Bitcoin (as measured by bitcoin futures and GBTC ETF) now 89.8% correlated with BDRY (Baltic Dry Index ETF).

Also, 88% correlated with... Wingstop (WING).

Ever since Greenspan choked following the crash of 1987, the markets have gushed higher on near-continuous liquid "assistance."

Market are now just liquidity gauges, pure and simple.

In the midst of this, I'm scoring huge with stupidly OTM call verticals in NVDA.

This always happens.

0 notes

Text

Latest Mood Cue

Oh, and bitcoin appears to be coiling before a re-test of its record high.

0 notes

Text

Market Comment: Bitcoin

Just as the SPX B-wave thesis is running on fumes, so too is bitcoin's B-wave thesis as postulated here in December.

SPX is fast approaching its 5,179.57 127% Fib extension, and bitcoin has blown through both its 48,547 61.8% and its 57,542 78.6% retracement levels and sold off against its 63,646 90% retracement today, crashing 5,775* points in a matter of minutes.

The "reason why" is irrelevant (Coinbase "outage"...zzzzz).

The point is, bitcoin respects Fibonacci. Bitcoin has retraced ~80% from highs several times since inception, and today's reaction was its second sell off from a Fib level during the current rally. January's sell off from its 61.8% retracement was nearly 3,000 points. Today's was even better, both in points and timing.

The next level of note, besides bitcoin's all-time high, would be the 127% Fib expansion at 83.562.88.

December's post also noted bitcoin's shifting correlations.

Bitcoin, while benefitting from a possibly too-much-anticipated ETF and institutional boom, has morphed from having a 90% correlation to tech stocks during the 2020-2021 rally to currently having an 88% correlation to bonds and the US dollar.

Notably, bitcoin's correlation has shifted once again. No longer tech, no longer rates & USD, it's now 78% correlated with the Baltic Dry Index ETF (BDRY).

This is interesting because BDRY was the first off the low last year, giving bullish divergence as the SPX made a new low while BDRY did not.

With any luck, BDRY will do so again if we are to see a top at some point, or, importantly, it could remain the leader and thus signal continuation.

It's also important to note that back in 2007 the actual Baltic Dry Index gave a beautiful non-confirmation vs SPX, giving those of us who watch such things an extra dose of bearish conviction.

Right now, these dueling bitcoin and BDRY liquidity gauges are telling me to look long and hard at copper, palladium, and platinum and other slumping commodities such as nat gas, corn, soybeans, and wheat, as well as the Bloomberg Commodity Futures Index.

It's also telling me to be on guard for lingering inflation which could throw a wrench in the Goldilocks equities narrative.

Update: I'd be very interested in re-loading crude related products should crude roll over and reflect any interim slowdown in the economy. Ideally below $60. I know, sounds crazy.

###

*Global Digital Asset Exchange (GDAX) data

0 notes

Text

Market Comment

The Magnificent Nvidia market continues, yet NVDA may have left some near term exhaustion clues with Friday's close below its intraday volume shelf that also formed a daily doji candlestick. Weekly volume was great however, so any pullback, even a re-test of the 670 area, should likely be corrective. But I'm increasingly sensing NVDA's limelight could be waning.

It remains in a highly cyclical and competitive business, and there is the nontrivial possibility that NVDA's moonshot might simply be the result of pull-forward demand from frantic customers triple ordering chips Covid-style.

If so, and if momentum is indeed waning, even a simple correction could clip hundreds of points. There is even the May 2023 unfilled gap at 305.38 to contend with should it want to. A whopping 60.97 points wide. Some stocks barely move that much in a year.

Sentiment wise, upside call speculation has wildly skewed NVDA's options chain. Dealers, after selling those calls to buyers, neutralize their resulting negative delta by buying EQ and NQ futures, further adding to the upward pressure.

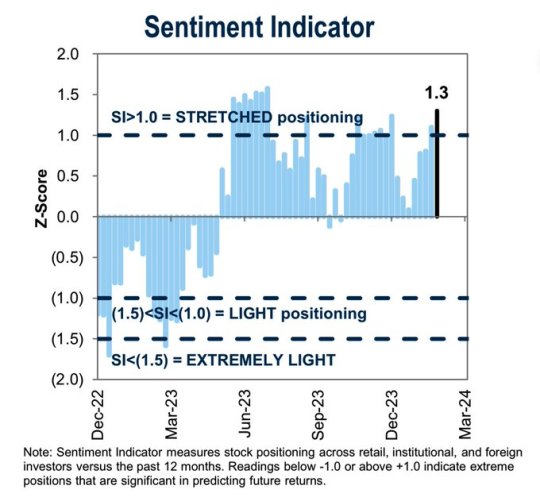

Notice the crowded long positioning, via Goldman. This will end only when animal spirits cease for whatever reason.

Speaking of sentiment, Private Equity is still up to its old tricks.

KKR-Owned April Seeks Traditional Loan to Refinance Private Deal

French insurance broker April Group is turning to traditional lenders for a €1.2 billion syndicated loan to help refinance debt that it took out from private creditors just over a year ago. ~Bloomberg

Debt to refinance debt, yet again.

And, ICYMI, investing has gotten so easy that The Whiz Kids are back.

These Teenagers Know More About Investing Than You Do

Regarding the S&P 500, the clock is ticking on the B-wave thesis. The usual target of an overthrow such as this is the 127% Fib extension (5179.57). Yet just above is a juicy confluence area, 5296.44-5325.55.

Any sustained trade above 5325.55 would trigger, for me, a different scenario: an ending diagonal.

The ending diagonal scenario interests me because it would explain the "relentless" nature of the current rally -- relentless being an unconscious social mood description of third waves that I have noticed over the years (and it might not be finished yet).

An ending diagonal would also provide for a re-test of the SPX 4400 "November 13th" area that has been previously covered here at Mood Report with the charts of UPS, NKE, FDX, and now PANW.

For now I play only with options -- NVDA call spreads against very short-dated SPY puts and OTM NVDA puts.

NVDA now has a $2T market cap and a 50% Implied Vol, multiples higher than its peers, which effectively makes it the most dangerous stock in the market.

Caveat emptor.

0 notes

Text

The Whiz Kids Are Back

A wise trader once told me: "Never confuse a bull market with brains."

The Wall Street Journal has thoughtfully provided this latest mood cue:

These Teenagers Know More About Investing Than You Do

Here we are, full circle, back to the 1990's all over again.

Paging Matt Seto.

0 notes

Text

Prominent AI Researcher Calls Bullshit

Stanford AI researcher James Zou is no slouch when it comes to AI. He is Faculty Director for the Stanford Institute for Human-Centered AI (HAI). They don't just hand these titles to just anyone.

So it might pay to listen to him.

'AI models are getting "substantially worse" in capabilities over time.'

Link to 1.26min video excerpt:

https://x.com/tsarnick/status/1755789760151625956?s=20

Poor Chat GPT. Poor Nvidia. Poor SMCI -- (Notice also how history rhymes with SMCI. It rolls off the tongue almost identically to internet bubble darling CMGI.)

The problem is that Nvidia (NVDA) is THE MARKET right now. There is no Magnificent Seven any longer.

There is simply The Magnificent.

Thus if NVDA cracks, the market craters.

I will be taking James Zou's AI flaw warning seriously because we have just had a shot across the bow, celestially speaking.

Look what the New Moon did to the market.

Any time there is a sell off coincident with the New moon, it pays to take it seriously. Each market top in 1929, 1987, and 2007 occurred during a New moon.

Celestial Voodoo

0 notes

Text

Private Equity Gearing Up For 2008 Redux

They were long real estate to the gills back in 2006-2007.

The "golden age" headlines have returned and have gotten weirder.

Now the smartest guys in the room are playing the same tricks.

Another train wreck in the making.

Mood Report Private Equity archive:

"We buy assets then we make 'em better." ~Blackstone

Sure they're joking, but that's the point.

It's overconfidence.

0 notes

Text

UPS Canary

FedEx did it. Nike did it. UPS is looking for it, too, after issuing weak guidance.

It's the November 13th gap fill.

Such a retracement is not a good look for an economy running on egregious amounts of stimulus and overt monetary policy coming from US Treasury Secretary Yellen.

"The November 13th gap" equates to 4400 on the S&P 500 cash index. It's a big deal.

We'll soon see.

0 notes