#Retirement Calculator India

Text

What is a Retirement Planning Calculator?

As previously mentioned, a retirement calculator India is a tool designed to assist individuals in estimating the necessary savings for retirement and projecting the income they may receive from those savings. Additionally, retirement calculators aid in estimating various retirement-related expenses, such as healthcare, travel, and maintaining a desired standard of living post-retirement. By incorporating these expenses into the calculation, individuals can obtain a more precise estimate of their retirement savings requirements.

0 notes

Text

In Finance India, we provide Indians with financial calculators designed specifically for Financial Planning, Mutual Funds, Retirement, Investment, Portfolio Rearrangement, Income Tax, and Online Portfolio.

#Retirement Calculator India#Retirement Planning Calculator India#sip India calculator#SIP calculator with an increment Finanz India#financial planning

0 notes

Text

Secure Your Future with Buy Best Retirement Plans | Spectrum Insurance

Explore the optimal retirement solutions and invest in your future with the Buy Best Retirement Plan option. Discover tailored strategies designed to safeguard your financial stability during your golden years. With our diverse range of plans, you can confidently secure your retirement and embark on a journey of financial freedom and peace of mind.

#Buy Best Retirement Plans#best retirement plan in india#best government pension plans#best pension plan in india#best pension plan calculator

0 notes

Text

NPS Retirement Plan: रिटायरमेंट के बाद हर महीने 1.5 लाख रु की होगी जरूरत, नौकरी रहते कैसे पूरा सकते हैं टारगेट

NPS Retirement Plan: रिटायरमेंट के बाद हर महीने 1.5 लाख रु की होगी जरूरत, नौकरी रहते कैसे पूरा सकते हैं टारगेट

NPS Retirement Plan जिस तरह से महंगाई बढ़ रही है, भविष्य के लिए फाइनेंशियल प्लानिंग न करना एक बड़ी चूक हो सकती है. महंगाई दर देखें तो आज का खर्च 30 साल बाद यह 3 गुना हो सकता है.

NPS Retirement Plan

National Pension Scheme Retirement Plans: फाइनेंशियल एडवाइजर कम उम्र से ही निवेया करने की सलाह देते हैं, खासतौर से अपने रिटायरमेंट के लिए. वैसे भी जिस तरह से महंगाई बढ़ रही है, भविष्य के लिए…

View On WordPress

#aapka retirement plan#best pension scheme#best retirement plan#best retirement plan india#early retirement#how to create retirement plan#national pension scheme#national pension scheme benefits#national pension scheme calculator#national pension scheme details#national pension scheme in hindi#national pension scheme india#national pension scheme malayalam#national pension scheme tax benefit#national pension scheme tax benefits#national pension system#new pension scheme#nps after retirement#nps benefits on retirement#nps retirement age#nps retirement benefits#nps retirement plan#nps scheme#nps voluntary retirement#pension plan#Pension Scheme#post retirement#retirement#retirement calculator#retirement corpus

0 notes

Text

Chapter 205 Trivia

How does a baby, with their chubby little fingers, snap them? Ryusui was obviously gifted with strong, dexterous fingers from a young age…

The flashback makes it seem like Ryusui is remembering the event, however: babies start walking between 6-18 months and Ryusui is being carried, speaking clearly is 12+ months, and memories like this one would only start from around 2-3 years onward.

Thus, this isn't Ryusui's memory.

(He was probably told about it, however remembering the 20 digit number as part of a memory is pretty impressive…)

Speaking of, well, speaking: baby Ryusui sure learnt the word "desire" quickly, however pronunciation is harder. The baby speech is present in both languages, with the Japanese version saying "欲ちい"(hochī) rather than "欲しい" (hoshī).

If we assume Ryusui is about 1 year old here for the reasons I listed above, that means that Sai is only 3 years older.

Because of Ryusui's various petrifications, Ryusui's aged about 3 years over that time.

I'm not sure who's the older brother now…

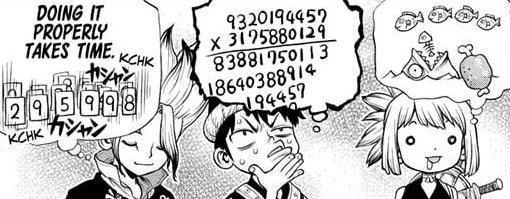

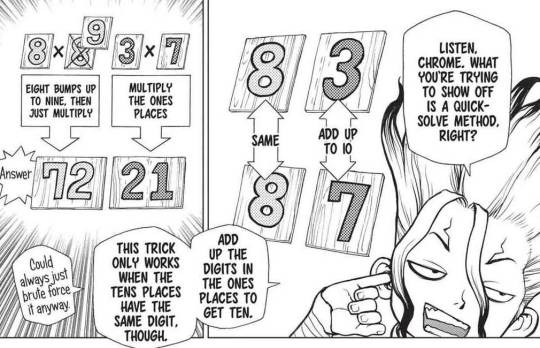

Everyone's mental math methods shown here are references to the chapter 18 bonus story, when Chrome and Senku had the arithme-battle.

Ryusui's fangs seem a lot more prominent this chapter, I guess he's really sinking his teeth into getting Sai on board with their plan!

This man here is Ryusui's uncle, who's been shown in a few flashbacks before. Where Ryusui and Sai's parents are is anyone's guess.

The game character is wielding a gun and a sword, and wearing an outfit that looks like Ryusui's.

Or is Ryusui wearing an outfit that looks like the game character's..? 🤔

The airplane Sai takes is based on a Japan Airlines Boeing 747-300 (or a 747-400, the difference isn't visible from the image). Both types are currently retired, the 300 in 2009 and the 400 in 2011, meaning Sai was still fairly young when he fled to university.

None of Sai's code appears to be indented, but at least it's commented.

The specific integrated development environment (IDE) is hard to identify because most IDEs are highly modifiable and I believe almost any of them can be laid out like this.

Semiconductors take weeks to make even with all the technology we have now. Trying to replicate those numerous steps in the stone world will be, as Senku says, hellish.

The moon here is the exact same one shown in chapter 204, before the KoS arrived in India (literally the same, I superimposed them haha). It's a waning crescent, so it's around October 20th at this point.

We've still seen no proof of Sai's mathematical ability apart from the flashback which could have been an exaggeration by Ryusui, so it's fair that Chrome and Chelsea seem to doubt his capabilities.

Senku says they need "someone" to be ready 24/7 to do quick calculations, however forcing someone to stay up for 24 hours to do stressful math is asking for a disaster. They would have always needed more than one person doing math for safety reasons, even to just compare answers.

(Also the concept of Whyman threatening them and/or attacking them even in space gets me excited!)

Thanks to Sai's petrification scars, he probably doesn't even need his charcoal pencils wrapped since the stain from the dust wouldn't show up on his hands!

Also, Sai is ambidextrous!

The code is mostly base16/hexadecimal (a combination of numbers between 0-9 and letters between A-F), however one of the panels seems to be base32 or something else since the letters M and K are present.

Another code, perhaps? 🤔

Low-level programming languages like machine code and assembly language are difficult to use. Even Inagaki agrees!

This change already happened last chapter, but Chrome's cross-body bags got an upgrade!

There's some old Norse runes carved into the sword, however at least two of the letters are flipped and trying to translate the rest seems to result in gibberish.

In Dragon Quest, the lettering usually simply reads "DRAGON QUEST" so maybe this somehow says "DOCTOR STONE"?

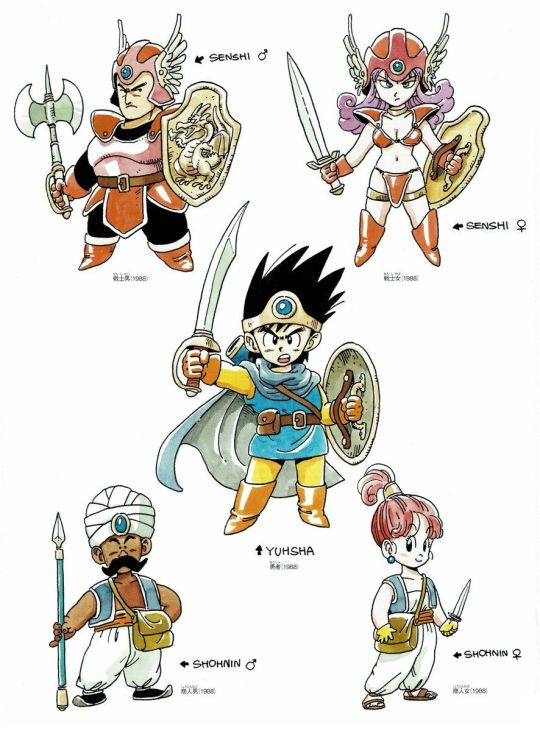

Unsurprisingly, the characters drawn here are inspired by real Dragon Quest characters.

The gaming system shown is the original Nintendo Entertainment System (NES): the Famicom. If you remember a differently-shaped NES, it's because it was replaced with a newer version for American markets.

20 notes

·

View notes

Note

Do you believe everything happens for a reason? (You can spill yourself with 0 limit here i love the way you write soooo much)

<33333. — i do. but i believe it can be meant both literally and figuratively.

in a pragmatic sense, things do happen for reasons (cause & effect). if i light a fire in my house & pour petrol on it, my house will likely burn down.

however, there are also instances where the petrol is poured, the match is lit, and yet one room in the house is inexplicably left untouched. and (im making this up but go with me) perhaps it just so happens that the one room that survives unscathed, contains a journal of a person who tells a story, a journal that would never have been found if the house wasn't thoroughly examined due to the fire, and that that journal inspires Patrick (??? the failing politician who lit the fire & currently owns the house) to stop trying to burn his life to the ground (metaphorically and literally) but instead, to move to india.. where the story he read is based, and where he then meets a community of yogi's! yogi's who share with him the tools of enlightenment, tools that with his unique understanding of the west and politics, arm him with the perfect ability to bring peace and unity 2 his hometown and revolutionise the world he used to belong to, a world that that prior to his adventure, brought him and everyone around him to what felt like ruin.

— with that as an example — i think it could be interpreted that random and outlandish things do happen to unsuspecting people, and that they cant be explained, yet that they do cause us to pivot and lead us to some preordained destiny thats so much greater and grander than we could ever have hoped for or conceptualised for ourselves. in such circumstances, we often cant see or understand the invisible thread weaving the events in our life together. its only at the end of the journey that what appeared to be a wrong turn or cause for misery appears to be a factor that was working together for good all along. — i think that narrative is cute and can be real —. but i also feel that if we examine that line of argument a little further, we're brought back to that first pragmatic principle of cause & effect. why did Patrick read the journal? he could have easily not. or he could have read the story, thought 'what a load of faf', then moved in with his elderly parents and spent his life disgruntled at the fact the house not burning down completely ruined his plans to claim insurance & foiled his plan for early retirement. — Patrick's story doesnt end like that because he chose to do something different. in that sense, the things that happened happened, but it was Patrick's actions that gave those events reason, and as such purpose.

i think life is like that a lot of the time. we are more powerful than we like to give ourselves credit for, despite the inexplicable and fortuitous underpinning of that story, without making the choices he made in the face of the cards he was dealt, Patrick could have led a completely different life. i think more than what happens to us, its the intent we carry that speaks through our actions, and leads us to the outcomes we experience. and there are people who try to orchestrate what happens in their lives by taking calculated actions that lead down calculated paths, yet end up in scenarios so far from what they planned despite that calculated approach working for their peers. who is to say thats not fate or destiny? in the same token, who is to say it is?

it could be that these things are happening for a reason. it could be that we all have a preordained fate we're headed toward, and that despite the illusion of choice or our attempts to shape our own destiny, we cant escape the fact that life is happening to us. or it could be that we are happening to life, and that what we decide, and how we choose to perceive whats before us, is more instrumental to what we become, who we become, and where we end up. it could be a hybrid of the two, and that we, each uniquely made, meet whatever circumstances are presented to us, but due to the unique nature of who we are affect those circumstances differently. in which case our actions (choice), and our design (fate), create an amalgam of potentialities, all of which we can become depending on the nature of how we respond to our environment.

i really dont know for sure. but i do feel this, mind moves matter. if a person chooses to believe that all things happen for a reason, and not just any reason, but for good, they are more likely to see the events in their life as cause for celebration, even when the evidence desperately suggests otherwise. i think its why faith is the basis for miracles. where there is a will there is a way.

thank you for encouraging me to write freely. feel free to share what u think, id love to hear <3 <3 <3

4 notes

·

View notes

Text

vro0m’s rewatch - 111/304

2013 Australian GP

Okay hi! Yes it’s still me, vousnavezrienvuf1, in case you missed it I changed my username to vro0m but this is still the big Lewis rewatch except it’s now called vro0m’s rewatch. I changed the tag but it’s still the same content.

Anyway it’s a new season! Let me say first of all that I had waaaay less problems with the lack of content this time, except for 3 races... Including this one lol. So yeah. No gifs this time around but I promise there's a lot of them coming. Like. A lot.

Let’s get started!

First off, let's head to Wikipedia to see the main changes for the season.

HRT liquidated so we now have 11 teams on the grid : RedBull, Ferrari, McLaren, Lotus, Mercedes, Sauber, Force India, Williams, Toro Rosso, Caterham and Marussia.

Also we know most of that from the 2012 season reviews but as a recap :

Of course Lewis joined Mercedes and Schumacher retired for the second time.

Perez left Sauber to take Lewis' seat at McLaren.

Hulkenberg left Force India after one year even though he had a multi-year deal with them to go to Sauber, with Gutierrez as a team-mate.

Hulkenberg's seat at Force India was filled by Sutil, who didn't have a seat in 2012.

Gutierrez thus took Kobayashi's spot. Kobayashi tried to raise money by asking his fans for donations but he gave up trying to find a seat after Lotus announced they would keep Grosjean.

Bottas started at Williams with Maldonado, Senna losing his seat.

Pic went from Marussia to Caterham where he joined Van der Garde, which means both Kovalainen and Petrov were out. Abiteboul said at some point that Kovalainen got left out because he had a bad relationship with the team while Petrov lost his seat due to a lack of sponsors.

Glock was supposed to stay with Marussia but he opted out. Marussia signed Chilton and Razia, but Razia was not on the line-up in the pre-season testing in Barcelona, leading to rumours. Later, we learned that his sponsors failed to pay what they were supposed to and he got suspended. He ultimately got replaced by none other than Jules Bianchi.

HRT disappearing also meant that de la Rosa and Karthikeyan lost their jobs.

Calendar-wise, I discover that Bernie said at the time that 20 seemed to be the maximum viable number of races for a season. Welp.

The number of races is part of the Concorde agreement and it expired at the end of 2012 so there could've been more if the teams had agreed to it but in the end, there were 19 races in 2013. Originally, it was supposed to be 20, with a… New Jersey Street circuit?! But it didn't happen and they didn't find a replacement so that was it.

…...no but seriously : NEW JERSEY STREET CIRCUIT?!

Anyway let's move on. Rule changes.

After n*zi-pr*stitutes Max Mosley failed to introduce a budget cap in 2010, the FIA "announced plans to introduce cost-control measures for 2013". I don't know what that entailed concretely.

The quali procedures were adapted after HRT's departure : 6 cars eliminated in Q1 instead of 7, then 6 in Q2, and the top 10 in Q3.

During FPs and quali, the drivers are now only allowed to use the DRS in the DRS zones, as opposed to wherever they wanted to up until that point. Because of that, the number of DRS zones was brought up to 2 wherever it was possible.

After Seb's issues in Abu Dhabi '12 the rules of force majeure were altered. Initially, you could only stop the car on the track during quali and not be penalized if you could prove that you didn't have a choice and it was out of the team's control. From 2013 onward, force majeure is not a good enough reason to do so. The stewards will check the remaining amount of fuel in any car that has stopped on the track to check if it abides by the rules and calculate a penalty based on the difference.

The teams now have only 2 jokers to the curfew rule, rather than 4.

The entry fee was increased to 500'000 dollars (holy shit) PLUS 5'000 per point scored in the WCC with the reigning team paying 6'000/point?! So RBR had to pay no less than 3'260'000$ in 2013. That's absolutely fucking insane.

Oh lmao. Brace yourselves. The 2012 regs led to the development of a nose deemed "platypus nose" that was described as "ugly" by many people (Domenicalli said "not that pretty"). Charlie Whiting said that the new regs for 2014 would change that anyway but in the meantime the teams were allowed to use what was called, and I kid you not, "a modesty plate" to hide the platypus nose's ugliness without altering the aerodynamics. I'm honestly losing my mind over this.

Mercedes had developed a "double-DRS" system in 2012 that was banned in 2013. It allowed "to create a stalling effect over the front wing when the rear wing DRS was open". Basically it counteracted the downforce it generated, giving the car higher speed and better stability. Lotus developed a similar system before the teams agreed to the ban but the new regs specifically banned Mercedes' system and not the Lotus' one?!

Also before then, any change to the sporting or technical regs required 70% (so 9) of the teams' agreement. From 2013 onwards, it only took 51% so 6 teams.

Here you go for the 2013 context. Now let's see that first race!

Oooh the weather is not great. It's very overcast. Seb is on pole in a Redbull front row. Lewis is 3rd! Massa 4th, Alonso 5th, Rosberg 6th, Raikkonen 7th and team-mate Grosjean 8th, Di Resta 9th and Jenson completes the top 10. Hulkenberg is supposed to be 11th but he's out : problem with the fuel system.

Formation lap

The top 10 is on supersofts. They're getting them out of the way, they don't last for very long.

And they're racing!

OHhh Massa overtakes Webber, Lewis gets a good start but Alonso is side by side with him after turn 2. Webber is going backwards. Lewis loses a place. So it's Seb, Massa and Alonso stepping on each other's toes, Lewis and Raikkonen doing the same, then Rosberg, Webber down in 7th already, Di Resta and Jenson. Alonso overtakes Massa for P2 while Lewis locks up and loses his position to Raikkonen. No he resists! Massa also resisted! Raikkonen attacks again but Lewis has the inside line. It's incredibly close. A few corners later, it's a done deal, Raikkonen up in 4th. And Rosberg? No. Lewis was down in 6th but he got back up in 5th.

What happened to Jenson? He's down in 21st and pitting. Weird. Massa is within 1 second of Seb and Alonso also less than 1 second behind him. Webber pits. It's not good. Lewis is losing on Raikkonen though. Seb pits. Raikkonen is only 2 seconds off the lead, these Lotuses are something… Massa pits. Alonso pits and has to brake hard to hit the speed limit, with Raikkonen behind him. Maldonado goes wide.

10 laps in, can we see the graphics please… Lewis leads in front of Rosberg, Sutil and Perez. They all have to stop and God knows why Mercedes isn't bringing the boys in right now. Then it's Seb, Massa, Alonso, Raikkonen on new tyres. And Seb overtook Perez… what use is there to keeping them out?

Btw I have to say these Redbulls have a purple hue now and it's very pretty. I like purple. Why don't we have any purple cars actually. Here are the 10 colours I'd choose for the cars if it was up to me (I know you didn't ask for it but I'm writing the review so I can do what I want) : White, Black, Deep pink, Dark green, Aureolin Yellow, French violet, Dark candy apple red, Ice blue, Zaffre blue and Tangelo orange.

Also all the cars would be sparkly by obligation. I said what I said. (I'm ashamed of how long I just spent on this omg.)

Anyway Lewis isn't struggling too much with the grip so at least there's that. His pace is good. But now the mechanics are out! Lewis comes in. Ah right. We're at that time when both Mercedes drivers are wearing yellow helmets so it's a struggle to tell them apart. He's out in 8th. Rosberg also pits. He's 9th just in front of Jenson. Lewis asks if his pace is good and he's told it's good enough. Oooh right, it's Bono now 💜 hi baby Bono nice to hear you!

On lap 19 Webber pits again. He was losing a lot of time behind Jenson. At the moment it's Sutil in the lead, Seb being 1.5 seconds behind, but Massa is half a second behind him and attacking, with Alonso still only half a second away too. And Alonso pits. He's out behind the Mercedes. Jenson pits. Sutil is called in. Seb also pits. Sutil is still ahead. And Alonso goes past Sutil! It's messy I don't know what the order is anymore.

Massa is leading. Then it's Raikkonen and ten seconds behind Lewis, Rosberg, Alonso and so Sutil and Seb. Seb overtakes Sutil. Webber overtook Perez and he's now P10. Massa pits and he's out behind Sutil. That didn't go well for him. Anyway Lewis is P2 then. Seb is closing on Alonso and rain is announced. Oh. Maldonado is beached in the gravel. It's over for him. Alonso is also catching Rosberg… oh? Rosberg just pulled over? What happened to him… It means Alonso is up in P3. Massa is trying to overtake Sutil. The public is putting raincoats on. Alonso is only 2 seconds away from Lewis. It is drizzling. Lewis is told to push but he answers this is as fast as he can go at the moment. That gap is already down to half a second. He defends but it won't be enough. Lewis asks if Alonso is on a three stop strategy. Bono answers yes but they still want to keep him behind. He's defending like a lion it's fucking crazy. HE LOCKS UP BUT HE STILL MAINTAINS POSITION jesus it's tense. Aaah Alonso got past and now Seb is right there behind him as well. But Lewis pits! There's 26 laps to go. He's out in P7, in front of Webber. And Raikkonen finally pits. He's out in P5 behind Massa. Lewis says his tyres won't last to the end at this pace. Now we have Alonso in the lead, 4.8 seconds ahead of Seb, 3 seconds ahead of Sutil, 1.1 seconds ahead of Massa, 5 seconds ahead of Raikkonen, a staggering 12.5 seconds ahead of Lewis. This is not looking good.

Seb pits. He's behind Lewis. Jenson pits. Grosjean pits. Massa is only one second behind Seb and he sets the fastest lap. Webber pits. Seb is swooping on Lewis. Alonso pits. He's out in P3 behind Raikkonen. Seb overtakes Lewis. Sutil is back in the lead but he has to stop again. Massa overtakes Lewis.

Rosberg says his DNF was an electronic problem, he says there's graining and the conditions out there are really unusual.

Ricciardo retires. Alonso is coming back at Raikkonen on pure pace. Lewis is told to move to plan B. Webber overtakes Di Resta for P8. Lewis pits again?! He's out in 6th some 25 seconds off Massa. Raikkonen overtakes Sutil for the lead. Alonso overtakes Sutil for P2. Sutil pits, he's out in fifth so ahead of Lewis, in that big gap. Bianchi is told there's very light rain on the radar. 8 laps to go. Oh wait.

Remember at some point I said Sutil got into a fight in a Chinese club and got condemned in court for it? Apparently Lewis was there and it ended their friendship.

Anyway that's gossip. Lewis is fighting Sutil. It's so close. And it's done! Now Webber overtakes Sutil. 5 laps to go.

And it's the end of the race.

Raikkonen wins. Alonso P2, Seb P3. Lewis P5.

Sorry, as I said, that's all I have for this GP. No gifs this time.

13 notes

·

View notes

Text

What Is an EPF Calculator?

What's EPF?

The Hand Provident Fund( EPF), is a particular withdrawal benefits scheme for workers who are endless & salaried. The EPF is impeccably handled by the workers Provident Fund Organization( EPFO). The EPFO will cover any reality/ establishment that has 20 or further workers. There are substantially 3 schemes run by the EPFO) workers provident fund organization.

1952 The EPF Scheme

1995 The Pension Scheme

1976 The Insurance Scheme

workers who are covered by the EPF scheme make a fixed donation of 12 of their introductory payment as well as the honey allowance to the scheme. The employer should also contribute inversely to the EPF scheme. Right after the ministry of finance discussion, the EPFO Central Board of Trustees determines EPF interest rates. For FY2022, the EPF Interest Rate is set at 8.1.

At withdrawal, the hand would admit a lump-sum payment that included both the hand's and the employer's benefactions as well as the interest payments. Anyway, the 12 of the employer match doesn't get deposited in the EPF account.8.33 of the 12 donations continue to be entered in the hand pension scheme account, while the remaining 3.67 will be entered into the hand EPF account.

What Is an EPF Calculator?

The EPF calculator calculates the quantum of finances that will make up your EPF account at withdrawal and shows it to you. You can figure out the lump-sum quantum fluently, which combines the interest that has accrued just on investment as well as your donation and the employer's benefactions.

You can input your present age, your introductory yearly pay envelope, the honey allowance, your EPF donation, and your age of withdrawal up to 58 times in the formula box on the EPF calculator. However, you also can input the being EPF balance, If you really are apprehensive about the numbers. The PF Maturity Calculator will give the EPF finances available for withdrawal formerly after you enter the information necessary.

Benefits of Using the Vakilsearch EPF Calculator India

At withdrawal, individuals can calculate their EPF corpus

They're suitable to ascertain the EPF corpus

This EPF calculator can be used by people to estimate how important bone

should invest in order to admit a particular return once they retire

Using this calculator, anyone can establish a fiscal ideal

They can also arrange their finances by modifying the PF interest calculator's factors

This EPF Calculator India can be used by people to boost their withdrawal benefactions

People can fleetly learn how important plutocrat they will have accumulated at the conclusion of their service life by using the EPF calculator 2022

People can increase the chance to earn the target volume at withdrawal as they gain knowledge about the EPF corpus

Subscribers who are apprehensive of the EPF corpus can effectively plan fresh investments

People can strategically plan their withdrawals when using this PF calculator online.

still, they can boost their donation, If they choose to take an early withdrawal.

#pf interest calculator#pf calculator online#PF Maturity Calculator#EPF Calculator India#EPF Calculator 2022

2 notes

·

View notes

Text

The FIRE (Financial Independence, Retire Early) movement is gaining traction in India. This comprehensive guide explores the FIRE principles, how they can be adapted to the Indian context, and real-life examples of Indians achieving financial independence and early retirement. Learn how to calculate your FIRE number, create a budget, and invest wisely to achieve your financial goals and live life on your own terms.

0 notes

Text

Why Brooks payroll is Your Go-To International PEO Service Provider in India

Introduction: Navigating the complexities of global expansion can be challenging for any business. If you're looking to expand your operations in India, partnering with a reputable International PEO (Professional Employer Organization) service provider can streamline the process. Brookspayroll stands out as a premier International PEO service provider in India, offering tailored solutions to help businesses manage their international workforce efficiently. In this blog, we will explore the benefits of using Brookspayroll's services and how they can facilitate your business expansion in India.

What is an International PEO?

An International PEO allows businesses to hire employees in foreign countries without establishing a legal entity there. This is particularly beneficial for companies looking to expand quickly and efficiently. The PEO takes on employer responsibilities, including payroll, compliance, and HR management, enabling businesses to focus on their core operations.

Why Choose Brookspayroll as Your International PEO Service Provider?

Expertise in Indian Labor Laws

Navigating India's complex labor laws and regulatory requirements can be daunting. Brookspayroll's team of experts has an in-depth understanding of local employment laws, ensuring your business remains compliant. From employee contracts to tax regulations, we handle all aspects of legal compliance, mitigating the risk of legal issues.

Comprehensive HR Solutions

Brookspayroll offers a full suite of HR solutions, including recruitment, onboarding, payroll management, benefits administration, and employee termination. Our comprehensive services ensure that your international workforce is managed effectively, from hiring to retirement, without any administrative burdens on your end.

Streamlined Payroll Management

Managing payroll for an international workforce can be complicated. Brookspayroll simplifies this process with our advanced payroll solutions. We handle all aspects of payroll processing, including salary calculations, tax deductions, and compliance with local regulations, ensuring timely and accurate payments to your employees.

Cost-Effective Expansion

Setting up a legal entity in a foreign country involves significant costs and time. By partnering with Brookspayroll, you can bypass these expenses and start your operations in India immediately. Our cost-effective solutions allow you to allocate your resources more efficiently, focusing on business growth rather than administrative tasks.

Risk Mitigation

Expanding into a new country comes with various risks, from compliance issues to cultural differences. Brookspayroll mitigates these risks by providing expert guidance and support. Our team helps you navigate cultural nuances, ensuring smooth integration of your business practices with the local workforce.

Customized Solutions

At Brookspayroll, we understand that every business has unique needs. We offer customized PEO solutions tailored to your specific requirements. Whether you're a small startup or a large multinational corporation, our services are designed to fit your business model and objectives.

How Brookspayroll Facilitates Business Expansion in India

Fast-Track Market Entry

With Brookspayroll's PEO services, you can enter the Indian market swiftly. We handle all administrative and compliance tasks, allowing you to focus on strategic business activities and market penetration.

Talent Acquisition

India boasts a vast talent pool across various industries. Brookspayroll's recruitment experts help you identify and hire the best talent, ensuring your business has the human resources needed to succeed in the Indian market.

Employee Support

We provide ongoing support to your employees, including payroll processing, benefits management, and HR assistance. Our dedicated team ensures that your workforce remains satisfied and productive, contributing to your business's success.

By choosing Brookspayroll, you're not just getting a service provider; you're gaining a partner committed to your international success.

#top eor providers in india#best payroll services provider in delhi & ncr#consultant payroll services in india#posh training in india

1 note

·

View note

Text

Empowering Financial Security: Navigating EPFO with Audiobook Assistance

Download the App

The Employees' Provident Fund Organization (EPFO) plays a pivotal role in securing the financial future of millions of employees in India. Established under the Employees' Provident Funds and Miscellaneous Provisions Act, 1952, EPFO manages the provident fund, pension, and insurance schemes for employees across various sectors. As individuals strive to secure their financial well-being, understanding the intricacies of EPFO and its schemes becomes paramount. In this pursuit, audiobooks emerge as a valuable resource, offering a comprehensive and accessible means of navigating the complexities of EPFO.

Understanding the Significance of EPFO

EPFO serves as a cornerstone of social security in India, providing financial stability and retirement benefits to employees. Key components of EPFO include the Employees' Provident Fund (EPF), Employees' Pension Scheme (EPS), and Employees' Deposit Linked Insurance Scheme (EDLI). Through mandatory contributions from both employees and employers, EPFO aims to ensure long-term financial security and welfare for employees and their families.

Audiobooks: Facilitating Understanding of EPFO

Audiobooks offer a dynamic and convenient approach to comprehending EPFO and its various schemes. Here are some ways audiobooks can significantly benefit individuals seeking to understand EPFO:

Accessibility: Audiobooks provide unparalleled accessibility, allowing individuals to learn about EPFO anytime, anywhere. Whether commuting to work, exercising, or relaxing at home, individuals can maximize their time by listening to audiobooks on EPFO.

Simplified Learning: Complex financial concepts and legal provisions related to EPFO can be simplified through audiobooks. Clear explanations, examples, and case studies presented in audio format make it easier for individuals to grasp the intricacies of EPFO.

Convenience: Audiobooks offer convenience by allowing individuals to learn passively while engaged in other activities. Listening to audiobooks on EPFO can complement daily routines, enabling individuals to acquire knowledge without disrupting their schedules.

Comprehensive Coverage: Audiobooks cover a wide range of topics related to EPFO, including its history, functions, schemes, benefits, and procedures. Individuals can gain a holistic understanding of EPFO by exploring audiobooks that address various aspects of the organization.

Engagement: Audiobooks make learning about EPFO engaging and enjoyable. Engaging narrators, interactive content, and real-life examples featured in audiobooks captivate listeners' attention, fostering active learning and retention of information.

Exploring Audiobook Resources on Audicate

Audicate, a leading platform for audiobooks and educational content, offers a diverse range of resources tailored to understanding EPFO. Here are some notable audiobooks available on Audicate that can enhance individuals' knowledge of EPFO:

"Understanding EPFO: A Comprehensive Guide" by Finance Experts: This audiobook provides an in-depth exploration of EPFO, covering its history, functions, schemes, benefits, and regulatory framework.

"EPF Demystified: Everything You Need to Know" by Investment Gurus: Delve into the intricacies of the Employees' Provident Fund (EPF) scheme with this audiobook, featuring clear explanations, case studies, and practical insights.

"Navigating EPS: The Employees' Pension Scheme Explained" by Retirement Planners: Gain insights into the Employees' Pension Scheme (EPS) under EPFO, including eligibility criteria, calculation of pension benefits, and withdrawal procedures.

"Unlocking EDLI: Understanding the Employees' Deposit Linked Insurance Scheme" by Insurance Experts: Explore the Employees' Deposit Linked Insurance Scheme (EDLI) and its significance in providing financial protection to employees and their families.

"EPFO Handbook: Your Complete Reference Guide" by HR Professionals: This audiobook serves as a comprehensive reference guide to EPFO, covering frequently asked questions, procedural details, and best practices for managing EPF accounts.

Conclusion

As individuals strive to secure their financial future, understanding organizations like EPFO becomes indispensable. Audiobooks offer a convenient and engaging means of acquiring knowledge about EPFO and its various schemes. With platforms like Audicate providing access to a wealth of audiobook resources tailored to EPFO, individuals can empower themselves with the information needed to make informed financial decisions and plan for a secure future. By incorporating audiobooks into their learning journey, individuals can navigate the intricacies of EPFO with confidence and clarity, paving the way for financial well-being and stability.

0 notes

Text

Everything you need to know about managing an EPF account

Planning for early retirement necessitates the establishment of a strong financial foundation.

In India, the Employee Provident Fund (EPF) scheme plays a pivotal role in securing your future, offering benefits that extend beyond traditional retirement savings.

Your unique EPF Account Number serves as more than just an identification code linked to the Employees' Provident Fund Organisation (EPFO). It represents a critical element in your journey towards achieving financial stability in your later years.

This guide delves into the fundamentals of EPF Account Numbers, clarifying their structure, significance, management strategies, and more.

Understanding the intricacies of EPF Account Numbers is essential for both:

Employees contributing to the EPF scheme.

Employers are responsible for managing EPF accounts for their workforce.

By gaining a thorough understanding of EPFO, you will be well-equipped to navigate the complexities of employee benefits and achieve long-term financial security.

So, if an extended working life doesn't appeal to you, this blog is for you!

What is an EPF Account Number?

An EPF account number is a crucial element in the Employees' Provident Fund Organisation (EPFO) system, designed to track contributions made by employees and employers towards their retirement savings. Here's an elaboration on how the EPF account number is derived from the Universal Account Number

The UAN links multiple EPF member IDs (from different employers) under a single umbrella, simplifying EPF management for employees.

Maintenance within EPFO:

The EPF account number, along with the UAN, is stored securely in the EPFO's database.

Contributions made by both the employee and the employer are recorded under this account number.

The EPFO ensures compliance with EPF regulations, including timely contributions, interest accrual, and maintaining accurate records for each member.

EPF members can access their account details, including contributions, interest earned, and other relevant information, through the EPFO's member portal using their UAN.

You can even calculate your EPF Amount through our EPF Calculator

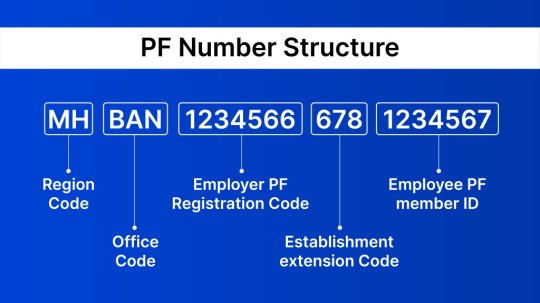

Understanding the Structure of Your EPF Account Number

Your EPF account number is a unique identifier assigned by the Employees' Provident Fund Organisation (EPFO) to track your contributions and accumulations. This alphanumeric code typically comprises 12 digits, each holding a specific meaning.

Let's break down the structure:

Region Code (2 Characters): These two characters represent the region where the EPF office is located. For example, "MH" for Maharashtra or "DL" for Delhi.

Office Code (3 Characters): The next three characters identify the specific EPF office within the region. Each EPF office has a unique code.

Employer PF Registration Code (7 Characters): Following the office code, there are seven digits that make up the establishment code. This code is unique to each employer or organization registered under EPF.

Extension (Up to 3 Characters, Optional): Some EPF numbers may include an extension of up to three characters. This extension is used if there are multiple units or branches of the same establishment.

Employee Member ID (Up to 7 Digits): The remaining digits (up to seven) represent the individual employee's number within that establishment. This number is assigned by the employer for tracking the contributions and benefits of each employee.

How to Locate your EPF Account Number

There are several ways to locate your EPF account number:

Salary Slip: Your EPF account number is typically mentioned on your monthly salary slip. Employers often include this information to ensure transparency and provide employees with easy access to their EPF details.

UAN (Universal Account Number): The UAN serves as a universal identifier for EPF members throughout their careers. It's a unique number linked to your EPF account and remains the same even if you change jobs. You can locate your UAN on your payslip, or you can log in to the EPFO (Employee Provident Fund Organisation) member portal to access it. The member portal offers a convenient way to view your EPF details, including your account number and contributions.

Contacting Your Employer: If you encounter difficulty finding your EPF account number using the aforementioned methods, don't hesitate to contact your employer's HR department. They can assist you in locating your account number and provide any necessary guidance or support regarding your EPF contributions and benefits.

Importance of Regularly Managing your EPF Account

Managing your EPF account number effectively is vital for several reasons:

Retirement Planning: Your EPF account serves as a significant portion of your retirement savings. Regularly monitoring contributions, interest accrual, and fund growth can help you plan for a financially secure retirement.

Financial Security: EPF funds provide a safety net during emergencies or unforeseen circumstances. Keeping track of your EPF account ensures you have access to funds when needed.

Tax Benefits: EPF contributions are eligible for tax benefits under Section 80C of the Income Tax Act. Managing your EPF account diligently helps you maximize tax savings.

Employment Mobility: With the UAN system, managing EPF becomes easier when changing jobs. You can link multiple member IDs to your UAN, avoiding the fragmentation of EPF accounts.

Learn More:

Understanding Employee Income Tax Deductions

How Instantpay helps businesses simplify employee payments

An Integrated Platform to Manage Employee Spends

Tips for Managing Your EPF Account Number

Here are some practical tips to help you manage your EPF account number effectively:

Activate Your UAN: If you haven't already, activate your Universal Account Number (UAN) on the EPFO portal. This gives you access to various EPF services online.

Update KYC Details: Keep your Know Your Customer (KYC) details such as Aadhaar, PAN, bank account, and contact information updated with your employer and EPFO. This ensures seamless transactions and communication.

Check Contributions Regularly: Monitor your EPF contributions and ensure they match the amounts deducted from your salary. Any discrepancies should be reported to your employer and EPFO promptly.

Nominate Beneficiaries: Nominate beneficiaries for your EPF funds to facilitate smooth transfers in case of unfortunate events.

Track Interest Accrual: Understand how interest is calculated on your EPF balance and track the growth of your funds over time.

Explore Withdrawal Options: Familiarise yourself with EPF withdrawal rules and options such as partial withdrawals for specific purposes like education, medical emergencies, or home loans.

EPF Withdrawal Process:

When it comes to managing your EPF account effectively, understanding the withdrawal process is crucial. The EPF offers various withdrawal options tailored to different life situations.

For instance, you can opt for a partial withdrawal to fund specific needs like education, medical emergencies, home loans, marriage expenses, or house construction. Each type of withdrawal has its eligibility criteria and requires specific documentation.

To initiate an EPF withdrawal, you can follow these general steps:

Determine your eligibility for the type of withdrawal you need.

Gather the required documents, such as your EPF account number, KYC details, and supporting documents for the withdrawal purposes.

If applying online, log in to the EPFO portal using your UAN and complete the withdrawal application form. Ensure all details are accurate and up to date.

If applying offline, submit the withdrawal form along with copies of required documents to your employer or the nearest EPFO office.

Track the status of your withdrawal application through the EPFO portal or by contacting the EPF helpline for updates.

Read to know more about PF Withdrawal Rules 2024,

It's important to stay informed about the withdrawal rules and procedures to ensure a smooth and hassle-free experience when accessing your EPF funds for various needs.

Employee Provident Fund Customer Care Number

For inquiries concerning UANs and KYCs, individuals may contact EPF customer support at 1800 118 005.

Frequently Asked Questions

1. What is the UAN number of EPF?

Every employee of the Employee Provident Fund (EPF) is given a 12-digit unique identification number, or UAN, under their individual names. The Indian government, operating under the Ministry of Employment and Labour, provides this unique EPF UAN.

2. How can I verify my UAN number?

Through the UAN verification process, it is confirmed that the employee claiming the number actually owns it and that it has been correctly linked to their EPF account. The employee has to go to the Employee Provident Fund Organisation (EPFO) website and enter their personal information along with their UAN number in order to confirm the number.

3. How to check the PF Passbook?

Step 1: Go to the EPF portal and select the 'e-Passbook' option from the homepage.

Step 2: Click "Sign In" after entering your password, captcha, and UAN number.

Step 3: Choose the 'Passbook' from options.

Step 4: After selecting the "Member ID," the page will provide your PF information.

4. What is a 12-digit UAN number?

Every salaried person who makes a partial salary contribution to the Employee Provident Fund (EPFO) is assigned a 12-digit unique identification number known as their UAN, or Universal Account Number. Every EPFO member receives a unique employee number (UAN), that remains unchanged throughout the employee's professional life.

5. How many days does it take for PF withdrawal?

Around 15-20 days

6. How much time does it take for EPF withdrawal to be processed?

It takes about 15 to 20 days for the funds to appear in your bank account following the proper submission and approval of the withdrawal request by the employer.

7. How do I check my EPF balance via SMS?

If your UAN is linked to a registered mobile number, you can send an SMS to 7738299899. The format of the message should be: “EPFOHO UAN” In just a few minutes you will receive all the necessary details about your EPF account through SMS.

8. Can I have 2 UAN numbers?

In India, it is illegal to have two active UANs.

9. When can an individual withdraw 100% of their EPF

Once you have retired from active duty and been unemployed for a continuous two months (60 days), you are eligible to receive your full PF.

0 notes

Text

Comparative Analysis: Estimating Returns from Post Office RD vs. EPF Investments

When it comes to secure investment options in India, both Post Office Recurring Deposits (RD) and the Employee Provident Fund (EPF) stand out as popular choices. Each investment avenue offers distinct advantages and suitability depending on the investor's profile and goals. By employing tools like the post office RD calculator, investors can easily forecast the returns on their monthly contributions to a Post Office RD, which is known for its stability and government backing.

On the other hand, the EPF, primarily designed for the salaried workforce, offers a retirement savings plan that not only helps in building a substantial retirement corpus but also provides tax benefits. To estimate the growth of their EPF contributions, investors can use an EPF calculator. This calculator takes into account variables such as the current EPF balance, employer’s contribution, employee’s contribution, and the current interest rate, which is revised annually by the government.

The key difference between these two investment options lies in their nature and the returns they offer. Post Office RDs allow for a fixed monthly deposit into an account, which earns interest at a rate determined by the prevailing government guidelines. The simplicity of the RD scheme makes it an attractive option for individuals with consistent but limited investing capacity. On the other hand, the EPF is not only a savings tool but also a vital component of India’s social security system, offering interest rates generally higher than those of RDs, which makes it highly beneficial for long-term growth.

Moreover, while the returns on RDs are taxed according to the individual's income tax slab, the interest earned and the maturity amount of the EPF are tax-free under certain conditions, making EPF a more tax-efficient investment in the long run. This distinction is crucial for investors when planning their tax liabilities.

For potential investors, understanding these nuances is vital. Using a post office Recurring Deposits calculator helps in setting realistic expectations on the returns from RDs, providing a clear picture of what the maturity amount will be at the end of the investment period. Similarly, the Employee Provident Fund calculator aids in comprehending how one's money grows over time with the added interest, especially with the compound interest feature that EPF offers.

When comparing both, it’s important to consider factors like investment tenure, risk appetite, liquidity needs, and tax implications. Post Office RDs are typically preferred by those who seek less risky avenues and may need to withdraw their investment relatively sooner. In contrast, EPF is ideal for individuals with a longer investment horizon, primarily due to its focus on retirement savings.

While both Post Office RD and EPF are solid investments, they serve different purposes and offer different benefits. The post office Recurring Deposits calculator and Employee Provident Fund calculator help investors make informed investment decisions that match their financial goals and retirement plans. By carefully analysing and comparing these options, investors can optimise their portfolios for long-term financial goals.

0 notes

Text

How Mutual Fund Software Simplifies Research for MFDs?

Mutual fund distribution doesn't merely involve suggesting funds. It requires comprehensive research, market awareness, staying updated with trends, and accurate calculations. This process can be daunting and time-consuming, prone to errors, diverting attention from crucial business growth.

Challenges of Manual Research

Time Consumption: Manual research demands significant time investment, detracting from core business activities.

Prone to Errors: Even minor mistakes can have significant repercussions, impacting client trust and business reputation.

Less Focus on Growth: With resources tied up in research, there's limited scope for strategic business expansion.

How Mutual Fund Software Simplifies Research

A reliable Mutual fund software for distributors, like Wealth Elite, serves as a beacon of efficiency with multiple tools and features that ease the research process, helping Mutual Fund Distributors with decision-making.

Comprehensive Analysis Tools

SIP, SWP, and STP Performance: Evaluate the performance of Systematic Investment Plans (SIPs), Systematic Withdrawal Plans (SWPs), and Systematic Transfer Plans (STPs) effortlessly. This insight helps in making informed decisions aligned with investor's goals.

Calculators: From SIP calculators to retirement, education, and house planning calculators, the software equips MFDs with essential calculators for precise financial planning tailored to each client's needs.

Fund Comparison: Seamlessly compare various funds based on performance, risk factors, and other parameters, facilitating informed investment decisions.

Fund Factsheet: Access detailed information about funds, including asset allocation, historical performance, and expense ratios, aiding in client education and transparency.

Model Portfolio: Model portfolios help investors gain insights into asset allocation, fund selection, and how their portfolio would have performed.

Benefits of Research with Software and Technology

Accuracy: Minimize errors and mitigate risks associated with manual research, ensuring precise recommendations and client satisfaction.

Time Efficiency: Save valuable time by automating repetitive tasks, allowing MFDs to focus on client relationships and business growth.

Market Insights: Stay updated with real-time market trends and fund performance, enabling decision-making in response to market dynamics.

Client Engagement: Utilize interactive tools and personalized reports to enhance client engagement and foster trust-based relationships.

Regulatory Compliance: Ensure adherence to regulatory requirements and industry standards, minimizing compliance-related risks.

Conclusion

Mutual fund software in India revolutionizes the research process for MFDs. It comes packed with research tools and features that make their work easier, more accurate, and keep clients happy.

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

How To Start Investing In Stock Market In India.

Starting to invest in the Indian stock market can seem daunting at first, but with some basic knowledge and guidance, you can begin your investment journey. Here's a step-by-step guide to help you get started:

Educate Yourself: Before diving into the stock market, it's essential to educate yourself about how it works. Understand basic concepts such as stocks, indices, market orders, and different investment strategies. There are plenty of resources available online, including books, articles, and tutorials, to help you gain a solid understanding of the stock market.

Set Investment Goals: Determine your investment objectives, whether it's wealth accumulation, retirement planning, or saving for a specific goal. Your investment goals will influence your investment strategy and risk tolerance.

Open a Demat and Trading Account: To invest in the Indian stock market, you need to open a Demat (Dematerialized) and trading account with a registered stockbroker. The Demat account holds your securities in electronic form, while the trading account facilitates buying and selling of stocks. Choose a reputable brokerage firm that offers competitive brokerage rates, user-friendly trading platforms, and good customer support.

Complete KYC Process: As per regulatory requirements, you'll need to complete the Know Your Customer (KYC) process by providing identity proof, address proof, and other relevant documents to your brokerage firm.

Research and Analysis: Conduct thorough research and analysis before making any investment decisions. Evaluate companies based on their financial performance, industry outlook, management quality, and other relevant factors. You can use financial websites, annual reports, analyst reports, and other sources of information for your research.

Start Small and Diversify: Begin with a small amount of capital that you can afford to invest. Diversify your investment portfolio by spreading your capital across different stocks, sectors, and asset classes to minimize risk.

Monitor Your Investments: Keep track of your investments regularly and stay updated on market trends, news, and events that may impact your portfolio. Review your investment strategy periodically and make necessary adjustments based on changing market conditions and your investment goals.

Stay Disciplined and Patient: Investing in the stock market requires patience, discipline, and a long-term perspective. Avoid making impulsive decisions based on short-term market fluctuations and focus on the fundamentals of investing.

Consider Seeking Professional Advice: If you're unsure about investing on your own, consider seeking advice from a certified financial advisor or investment professional who can help you develop a customized investment plan based on your financial goals and risk profile.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in India.

You can also downloadLTP Calculator app by clicking on download button.

Remember that investing in the stock market involves risks, including the risk of loss of capital. It's important to do your due diligence, invest responsibly, and stay informed to make informed investment decisions.

0 notes

Text

Gratuity Configuration In Sap Hr

Gratuity Configuration in SAP HR: A Step-by-Step Guide

Gratuity is an essential component of employee benefits in many countries. It’s a lump sum payment made by an employer to an employee upon separation from the company, typically contingent on meeting eligibility criteria such as a minimum length of service. SAP HR provides features to configure and manage gratuity calculations and payments. Let’s explore how to set this up.

Key Configuration Steps

Define Gratuity Trust IDs:

Navigate to the transaction V_T7ING3 (Payroll India -> Retirement Benefits -> Gratuity -> Maintain Gratuity Trust ID).

Create unique ID codes for each gratuity trust your company uses. Describe each trust clearly.

Establish Contribution Frequency and Type:

Use transaction V_T7ING9 (Payroll India -> Retirement Benefits -> Gratuity -> Maintain Gratuity Contrib. Freq.)

Choose whether contributions are made monthly or annually.

Decide whether the annual contribution occurs at the end of the financial or calendar year.

Define Employer Contribution Rates:

Use transaction V_T7ING1 (Payroll India -> Retirement Benefits -> Gratuity->Define Contribution Rates for Gratuity).

Enter the Gratuity Trust ID.

Set the employer’s contribution percentage (e.g., a percentage of basic salary)

Specify the validity of the start and end dates for this contribution rate.

Set the Eligibility Years:

Maintain the constant GRTYR (Payroll India -> Retirement Benefits -> Gratuity- Maintain the Eligibility Years for Gratuity).

This determines the minimum years of service for gratuity eligibility (often, this aligns with statutory requirements).

Create a Custom PCR (Personnel Calculation Rule):

This PCR will automate the gratuity calculation. Consider the following logic:

Determine the employee’s date of joining and date of leaving or termination.

Calculate the total years of service, rounding to the nearest whole number.

If the calculated service years meet the eligibility criteria:

Fetch the appropriate basic salary and applicable gratuity rate.

Perform the gratuity calculation (Basic Salary / 26 * 15 days * Number of Eligible Years).

Integration Within the Payroll Schema:

Add the custom PCR to your payroll schema using the function INGR. This function will calculate the gratuity and incorporate it into payroll for eligible employees.

Additional Considerations

Tax Exemptions: Statutory regulations may offer tax exemptions for gratuity up to a specified limit. Consult local tax laws and configure your system accordingly.

Provisioning: Many companies create provisions for gratuity as a financial liability. SAP allows for configuring wage types to handle gratuity provisioning.

Full and Final Settlement (F&F): If gratuity payments typically occur during the F&F process, ensure your F&F workflow and calculations are linked to the gratuity configuration.

Important Notes:

These are simplified guidelines. Gratuity regulations and company policies can be complex, so tailoring to your specific situation is necessary.

Consult an SAP HR expert or your local tax advisor for a detailed setup to ensure compliance with local gratuity laws.

youtube

You can find more information about SAP HR in this SAP HR Link

Conclusion:

Unogeeks is the No.1 IT Training Institute for SAP HR Training. Anyone Disagree? Please drop in a comment

You can check out our other latest blogs on SAP HR here – SAP HR Blogs

You can check out our Best In Class SAP HR Details here – SAP HR Training

———————————-

For Training inquiries:

Call/Whatsapp: +91 73960 33555

Mail us at: [email protected]

Our Website ➜ https://unogeeks.com

Follow us:

Instagram: https://www.instagram.com/unogeeks

Facebook: https://www.facebook.com/UnogeeksSoftwareTrainingInstitute

Twitter: https://twitter.com/unogeeks

1 note

·

View note