#Recovery in Bank Credit to NBFC

Text

Repo Rate Unchanged by RBI in Response to Shifting Economic Landscape

The Reserve Bank of India (RBI) has once again opted to keep the repo rate steady at 6.5%, extending the streak of six consecutive decisions maintaining the status quo. Led by Governor Shaktikanta Das, the Monetary Policy Committee (MPC) has reaffirmed its commitment to withdrawing the accommodative stance. This decision comes on the heels of the Interim Budget announcement on February 1, 2024, and it is poised to have significant implications for India's economic trajectory. This blog delves into the rationale behind the RBI's decision and its potential ramifications for the Indian economy.

Maintaining Stability in Unpredictable Times:

The RBI's decision to keep the repo rate unchanged can be seen as a strategic move to maintain stability in the face of a shifting economic landscape. In recent times, global uncertainties, geopolitical tensions, and the ongoing COVID-19 pandemic have created a dynamic environment that demands careful consideration. By opting for a consistent policy stance, the RBI aims to provide a sense of stability and predictability for businesses, investors, and consumers alike.

Abhay Bhutada's Perspective:

Abhay Bhutada, MD of Poonawalla Fincorp, has expressed his approval of the RBI's decision. He sees it as a prudent approach that aligns with India's economic path. Bhutada believes that the stability offered by maintaining the repo rate at 6.5% is particularly beneficial for Non-Banking Financial Companies (NBFCs). These institutions play a crucial role in India's financial ecosystem, serving as alternative lenders and contributing to the overall financial inclusivity.

Alleviating Financial Burdens on Customers:

One of the key advantages of the RBI's decision, as highlighted by Bhutada, is the alleviation of financial burdens on customers. By keeping interest rates stable, borrowers, including individuals and businesses, can continue to benefit from affordable credit. This not only supports economic growth but also encourages spending and investment. In a time when uncertainties loom large, providing financial relief to consumers becomes paramount, and the repo rate stability contributes to this relief.

Also Read: Abhay Bhutada's Insights into Poonawalla Fincorp's Remarkable NPA Performance

Favorable Environment for Continued Sectoral Growth:

The consistent policy stance adopted by the RBI creates a favorable environment for continued sectoral growth. The stability in interest rates fosters confidence among investors and businesses, promoting a conducive atmosphere for expansion and innovation. In particular, NBFCs, which often operate in niche segments and cater to specific financial needs, stand to gain from this stable economic environment. Abhay Bhutada's commendation of the RBI's decision underscores the positive outlook for the NBFC sector.

Addressing Inflation Concerns:

While the RBI's decision to maintain the repo rate reflects a commitment to economic stability, it is not without considerations for inflation. Inflation management remains a key mandate for the central bank, and the current stance suggests a delicate balance between supporting economic growth and curbing inflationary pressures. The RBI's hawkish undertones, with an intent to withdraw the accommodative stance, signal a proactive approach to addressing potential inflation concerns.

Global Economic Factors:

The decision to keep the repo rate unchanged also takes into account global economic factors. In a world interconnected through trade and finance, India's central bank must navigate the impact of external events on the domestic economy. The ongoing geopolitical tensions, trade disputes, and uncertainties surrounding the global economic recovery contribute to the complexity of the decision-making process. By maintaining stability in the domestic interest rates, the RBI aims to insulate the Indian economy from external shocks to the extent possible.

Also Read: Abhay Bhutada Talks About Lowering Lending Rates For Customers In 2025

Conclusion:

The RBI's choice to keep the repo rate at 6.5% amid a shifting economic landscape demonstrates a commitment to stability, predictability, and strategic economic management. As the global and domestic economic scenarios continue to evolve, the RBI's role becomes increasingly pivotal in steering India's economic course. The delicate balance between supporting growth, addressing inflation concerns, and considering global factors underscores the complexity of the central bank's decision-making process.

0 notes

Text

NBFCs: Powering India’s Economic Recovery

The wheels of India's economic engine are coming back to life, and what is driving this resurgence is not just the familiar pistons of established industries, but a quiet but powerful force: Non-Banking Financial Companies (NBFCs). These agile players are weaving a new fabric of financial inclusion and alternative debt, bringing companies, especially start-ups, through the post-pandemic landscape with a diverse toolbox of innovative financial instruments.

The Indian market, once stagnant under the weight of economic uncertainty, is undergoing dynamic change. Venture capital, which once flowed freely to startups, has become a sophisticated stream that requires efficient operations and calculated investments. Although banks are crucial, they often struggle to reach those who are unbanked and underserved, creating a large financial gap.

This is where NBFCs like Bajaj Finance and Mahindra Finance come into play, bridging the gaps with various offerings like working capital loans, equipment financing, and invoice discounts, thereby enabling small and medium enterprises to thrive.

The impact of this NBFC-led transformation is being felt across various sectors. Take the example of microfinance giant Ujjivan Small Finance Bank, which not only empowers rural women entrepreneurs through microcredit but also contributes to social development. Their microcredits enable women to purchase livestock and equipment and invest in their businesses, resulting in increased household income and better livelihoods for their families.

Similarly, fintech startups like Zest Money and Early Salary, backed by NBFCs like AIF Capital, are bridging the digital divide by offering affordable loans and lines of credit to millions of people previously excluded from the formal financial system. This not only promotes financial inclusion but also the growth of the digital economy, a focus of the Indian government.

Kansaltancy Ventures is a Global Investment Management & IB firm into Venture Capital, Debt, M&A, Consulting & Virtual CFO with a network of 450+ VC Funds, Family Offices, Banks & Financial Institutions. Check https://www.Kansaltancy.com

But the story of the NBFC goes beyond individual empowerment and financial inclusion. Let us take a look at infrastructure giant L&T Finance, whose project finance expertise is helping drive India's ambitious infrastructure development plans, from roads and bridges to renewable energy projects. This not only creates jobs and stimulates economic activity but also paves the way for sustainable growth and development across the country.

In the real estate sector, NBFCs like HDFC and India Bulls have played a crucial role in facilitating home ownership, especially for first-time buyers, by offering innovative mortgage products and flexible payment options. This not only creates a prosperous real estate market but also contributes to social stability and improved living conditions for millions of people.

However, the impact of NBFCs goes beyond mere financial solutions. They are also active catalysts for social change. Take, for example, the collaboration between NBFCs like IDFC FIRST Bank and Apollo Hospitals to offer affordable healthcare financing solutions, thereby facilitating access to quality healthcare for millions of people, especially in rural areas. Collaborations like these and amongst NBFCs and startups are the core of a newfound source of empowerment often fueled by boutiques like Kansaltancy Ventures.

Similarly, NBFCs like ICICI Home Finance partner with vocational training institutes to offer skill development loans that enable people to acquire new skills and build a better future. This not only contributes to individual growth but also strengthens the future workforce, resulting in a more skilled and adaptable national workforce.

The future of NBFCs in India is full of potential. As the government focuses on financial inclusion, digitalization, and sustainable development, innovative financial tools such as blockchain-based loans and AI-powered credit scoring are expected to reshape the landscape. NBFCs like Axis Finance and Capital First are already at the forefront of this digital wave, offering seamless online loan applications, paperless transactions, and personalized financial solutions. This not only improves the customer experience but also paves the way for a more efficient and inclusive financial ecosystem.

However, challenges remain. Regulatory uncertainties and fluctuating market dynamics can pose hurdles for NBFCs. To address these challenges, NBFCs such as Edelweiss Financial Services and Poonawalla Fincorp are adopting strong risk management practices and agile decision-making strategies. This includes diversifying their portfolios, strengthening their capital base, and proactively working with regulators to stay ahead.

Kansaltancy Ventures is a Global Investment Management & IB firm into Venture Capital, Debt, M&A, Consulting & Virtual CFO with a network of 450+ VC Funds, Family Offices, Banks & Financial Institutions. Check https://www.Kansaltancy.com

Collaboration with banks and other financial institutions will also be crucial in creating a strong and inclusive financial ecosystem, as evidenced by partnerships such as HDFC Bank and Bajaj Finance for co-branded credit cards. This collaboration not only strengthens the financial sector but also benefits customers through greater choice and better financial services.

The entrepreneurial journey of NBFCs is a testament to the power of innovation and strategic thinking. They have developed from niche providers into drivers of economic recovery and demonstrate the agility and adaptability necessary to be successful in a dynamic market.

As India continues its journey towards global economic leadership, the role of NBFCs is becoming increasingly important. They will be the invisible hand, the silent engines that fuel the dreams of entrepreneurs, fuel the growth of companies, enable societal change, and ultimately contribute to the nation's collective prosperity.

(The article is authored by Kansaltancy Ventures, a global investment management firm specializing in making companies funding ready and raising funds for them and accelerating their dreams by means of Venture Capital, Angel Investment, and Strategic Services)

About Tushar Kansal, Kansaltancy Ventures:

Tushar Kansal is the Founder and CEO of Kansaltancy Ventures, a distinguished professional recognized as a "Thought Leader" and "Thought Influencer." With a proven track record, Tushar has provided support to startups and growth-stage companies across various sectors. As a Venture Advisor with a Canadian VC Fund, he has contributed to over 350 investments spanning more than 60 countries.

Tushar's expertise is highly regarded in the business community, and his opinions are frequently sought by leading business news channels and publications, including CNN-News18, VCTV (Venture Capital Tv), Business World, Inc42, TechThirsty, and Digital Market Asia. He has delivered over 300 talks, available for viewing on YouTube and Google, showcasing his vast knowledge and insights.

Connected with 450+ investors globally, Tushar Kansal engages in sector-agnostic deal-making, with a typical ticket size ranging from USD 1-50 million.

Contact Information:

Email: [email protected]

LinkedIn: Tushar Kansal on LinkedIn

Personal Website: Tushar Kansal's Website

Blog: Indus Churning Blog

Company Profiles:

LinkedIn Company Profile

Kansaltancy Ventures Website

Facebook Page

Twitter Account

Instagram Page

0 notes

Text

The Crucial Role Of Asset Quality For NBFCs

The backbone of Non-Banking Financial Companies (NBFCs) lies in the quality of their assets. It's not just about having a fat wallet; it's about having a healthy one. Imagine a financial institution as a chef preparing a delicacy. The ingredients need to be fresh, top-notch, and in the right proportions to ensure a delectable outcome. Similarly, for NBFCs, the quality of assets is the secret sauce that determines their sustainability and success.

Understanding Asset Quality

Asset quality, in simple terms, refers to the health of a financial institution's loan portfolio. It's the measure of how well the loans and advances given by the NBFC are performing. Think of it as a report card, where the A-graded assets are the ones that bring in returns on time, and the C-graded ones are the troublemakers causing headaches.

Also Read: How to Recognize the Optimal Lender for Your Loan Application

The Weight Of Non-Performing Assets (NPAs)

One of the key indicators of asset quality is the presence of Non-Performing Assets (NPAs). NPAs are like that one ingredient in the recipe that turns stale – they disrupt the taste of the entire dish. These are loans where the borrower has stopped making interest or principal repayments for a specified period. NBFCs, being the chefs of the financial world, need to be vigilant about the quality of ingredients they use.

Building A Robust Collection Infrastructure

Implementing an efficient collection infrastructure is like having a well-equipped kitchen – it ensures smooth operations and prevents the soup from boiling over. Abhay Bhutada, MD of Poonawalla Fincorp, a leading NBFC in India, emphasizes the importance of a robust collection mechanism. He believes it's the linchpin for mitigating risks associated with NPAs and ensuring the timely recovery of dues.

Uday Kotak, the visionary founder of Kotak Mahindra Bank, echoes the sentiment of asset quality being the bedrock for financial stability and growth. Drawing wisdom from his experiences, Kotak emphasizes the need for robust risk management and regulatory compliance. For him, it's not just about stacking up numbers; it's about ensuring that the numbers represent a healthy and thriving financial ecosystem.

Also Read: The Impact of SaaS Model on NBFCs

The Ripple Effect On Stability And Growth

Imagine a rock thrown into a pond. The ripples that spread out represent the impact of asset quality on the stability and growth of an NBFC. If the rock is flawed, the ripples will be chaotic, disrupting the entire ecosystem. For NBFCs, maintaining a clean slate of assets is not just about meeting regulatory requirements; it's about creating a stable foundation for future growth.

The Domino Effect Of Quality Assets

Quality assets have a cascading effect. They contribute to a positive credit culture, attracting more borrowers who are likely to repay their dues on time. This, in turn, enhances the NBFC's reputation, making it an institution of choice for potential investors. It's a virtuous cycle where asset quality fuels growth and stability.

Navigating The Regulatory Landscape

In the intricate world of finance, navigating the regulatory landscape is akin to sailing through uncharted waters. However, having a ship (read: NBFC) with a sturdy hull (read: robust asset quality) ensures that it can weather storms and sail smoothly. Regulatory compliance is not just a checkbox exercise; it's a commitment to maintaining a healthy financial ecosystem.

The Role Of Asset Quality In Regulatory Compliance

Warren Buffett once said, "Risk comes from not knowing what you're doing." For NBFCs, knowing the quality of their assets is paramount. It's not just a risk mitigation strategy; it's a compliance necessity. Regulators act as the navigators, ensuring that financial institutions stay on course. Asset quality becomes the guiding star that helps NBFCs align with regulatory expectations.

The Road Ahead

In the dynamic realm of finance, the road ahead for NBFCs is paved with challenges and opportunities. Asset quality is not a one-time checklist item; it's an ongoing commitment to excellence. As a college student majoring in finance, envision yourself as the chef in charge of creating the perfect financial recipe. Your ingredients – the assets – need to be of the highest quality to ensure a profitable and sustainable outcome.

Also Read: Combating Financial Fraud: Innovations in Banking and NBFCs

Embracing A Proactive Approach

Learn from the best in the industry. Abhay Bhutada and Uday Kotak are not just names; they are beacons of wisdom in the financial landscape. Implementing a proactive approach, like Poonawalla Fincorp, and understanding the wisdom shared by Uday Kotak, can set you on the path to success.

The Bottom Line

In conclusion, asset quality is not a mere buzzword in the world of NBFCs; it's the lifeline that sustains and propels them forward. Their insights are not just lessons; they are guiding lights to steer your financial ship toward a prosperous and stable future. So, be the chef of your financial destiny, and let the quality of your assets be the secret ingredient that makes your recipe a masterpiece.

0 notes

Text

NPA Mitigation in Business Practices

Non-Performing Assets (NPAs) stand as a persistent challenge in India's financial sector. These are loans that haven't yielded expected returns due to borrowers' failure to meet repayment obligations. NPAs weaken banks' balance sheets, curtail credit flow, and hinder economic growth. Therefore, mitigating NPAs is crucial for fostering a robust financial ecosystem.

Understanding NPAs

NPAs are primarily categorized into two types: Substandard Assets and Doubtful Assets. Substandard Assets indicate the possibility of not being repaid fully, while Doubtful Assets signify a higher level of uncertainty regarding repayment.

Several factors contribute to the surge in NPAs, such as economic downturns, inadequate risk assessment, borrower insolvency, and policy or regulatory changes. Moreover, sectors like infrastructure, steel, textiles, and aviation have notably high NPA ratios, demanding specific attention for resolution.

Mitigation Strategies

Strengthening Credit Evaluation

Enhancing credit appraisal mechanisms is pivotal. Rigorous assessment of borrowers' creditworthiness, industry trends, and repayment capacity can mitigate the risk of NPAs. Employing robust risk management tools and embracing technological advancements in credit scoring aids in making informed lending decisions.

Prudent Loan Structuring

Adopting prudent loan structuring practices involves aligning repayment schedules with borrowers' cash flow projections. It ensures that repayment obligations are realistic and manageable, reducing the probability of defaults and consequent NPAs.

Uday Kotak, the founder and MD of Kotak Mahindra Bank, has often discussed the need for prudent management of NPAs and the role of banks in reducing these non-performing assets.

Also Read: NBFCs Vs Banks: Which One Is Better For Business Loans?

Early Detection and Resolution

Prompt identification of potential NPAs is vital. Implementing effective monitoring systems enables early detection, allowing timely intervention to prevent assets from deteriorating further. Initiating resolution mechanisms promptly, such as restructuring or recovery measures, helps salvage the assets before turning non-performing.

Poonawalla Fincorp’s MD, Abhay Bhutada emphasized that they do not cater to the new-to-credit segment so as to maintain their Net NPA below 1 for year 2025.

Asset Reconstruction Companies (ARCs)

ARCs play a pivotal role in acquiring distressed assets from banks, aiding in their resolution. They specialize in turning around non-performing assets by infusing capital, restructuring, or selling them to investors, facilitating recovery and cleaning banks' balance sheets.

Strengthening Legal Framework

A robust legal framework expedites the recovery process. Streamlining legal procedures and establishing specialized tribunals or mechanisms for swift resolution of NPA cases expedites the recovery process, instilling confidence in lenders and investors.

Also Read: Impact of GST Payments on Loan Approvals

The Way Forward

Efforts undertaken by regulatory bodies and financial institutions have shown promising results in mitigating NPAs. However, consistent vigilance and adaptability to changing economic scenarios remain imperative.

Enhanced transparency, accountability, and risk management practices are fundamental pillars for sustainable NPA mitigation. Collaboration among stakeholders—government, regulators, financial institutions, and borrowers—is critical for developing a resilient financial ecosystem.

Conclusion

Mitigating NPAs is a multifaceted endeavor requiring proactive measures, technological advancements, and robust risk management frameworks. A concerted effort aimed at enhancing credit evaluation, timely resolution, and a supportive legal ecosystem is paramount for mitigating NPAs, paving the way for a healthier financial landscape in India.

0 notes

Text

RBI Mandates IT Services Framework For REs

The new comprehensive master direction on information technology governance, risk, controls and assurance practices to be implemented by Regulated entities (REs) comprising of scheduled commercial banks (excluding regional rural banks); small finance banks; payments banks; NBFCs in top, upper and middle layers; all India financial institutions and credit information companies effective from 1st April 2024 shall facilitate the easy administration of IT and cyber governance and compliance, in place of the prevalent multiple circulars.

In the case of foreign banks, the directions state that they shall be subject to a ‘comply or explain’ approach in terms of the applicability of these Directions and they do not need to constitute any Committees (Board or Executive level) referred in this Master Direction at the branch level. They have been given the flexibility to leverage upon controlling office/ head office/ regional/ zonal Committees for compliance with this Master Direction as long as governance obligations/responsibilities outlined for the prescribed committees are met.

The master direction clearly outlines the role (including authority) of the board of directors, board-level committee and senior management of these REs in discharging their responsibilities to protect the interests of customers. and consolidates and updates the guidelines, instructions and circulars on IT Governance Risk, Controls, Assurance Practices and Business Continuity/ Disaster Recovery Management issued earlier.

The master direction makes it mandatory for the REs to put in place a robust IT Service Management Framework for supporting their information systems and infrastructure to ensure the operational resilience of their entire IT environment (including Disaster Recovery sites). Further its stresses the need to have a documented data migration policy specifying a systematic process for data migration, ensuring data integrity, completeness and consistency. In the wake of cyber and IT fraud, RBI in its master direction has stressed the need for IT applications to have the necessary audit and system logging capability and ability to provide audit trails. Further, in order to strengthen the IT infrastructure, the RBI through its direction highlights the need to adopt internationally accepted and published standards that are not deprecated/ demonstrated to be insecure/ vulnerable and the configurations involved in implementing controls to be compliant with extant laws and regulatory instructions.

While the approval of strategies and policies related to the IT function lies in the hands of the Board, these directions put the responsibility on the CEO to institute effective oversight on the planning and execution of IT Strategy as well as to ensure that cyber security posture of the RE is robust; and overall, IT contributes to productivity, effectiveness and efficiency in business operations. The directions designate a Chief Information Security Officer (CISO) who will be responsible for driving IT/ cyber security, compliance and related regulatory guidelines, and administering policies of the RE.

From a compliance perspective, REs have to ensure that appropriate vendor risk assessment process & controls proportionate to assessed risk & materiality has been put in place. Further, it shall be the responsibility of the REs to maintain an enterprise data dictionary to enable data sharing among applications & information systems

The RBI through this master direction, recognizing the increased relevance of IT infrastructure in the financial services space, has detailed the mandatory implementation and review of the IT systems and applications in order to keep a check on the processes, data security and integrity, disaster recovery management as well as business continuity in order to protect the interest of various stakeholders including customers. The directions mandate the adoption of several procedures and processes like IT Strategic Planning, Service Level Management (SLM), product approval and quality assurance process (for new IT-based business products) in order to ensure that the banking sector delivers secure products and services to its clients. In this era of digitisation and increasing threats, the master direction provides the required structure and procedures to secure banking systems.

0 notes

Text

Advik Capital Eyes Strategic Move: Expression of Interest for Acquisition in Asset Reconstruction

Advik Capital Limited, a prominent entity in the financial sector, has made a strategic move toward diversification and expansion. In a recent announcement, the company revealed its Expression of Interest for the acquisition of an Asset Reconstruction Company (ARC). This move aims to venture into the business of securitization or asset reconstruction under the SARFAESI Act.

With the strategic objective of broadening its portfolio and diversifying into new-age businesses that complement its existing lines, Advik Capital Limited has expressed keen interest in acquiring an ARC registered with the Reserve Bank of India. The targeted ARC is among the nation's first and is supported by numerous public sector banks, operating under the SARFAESI Act of 2002.

ARCs were established after the SARFAESI Act of 2002, focusing on resolving Non-Performing Assets (NPAs) in the financial system. These specialized companies undertake recovery, restructuring, or changes in management to resolve NPAs. Notably, they play a crucial role in freeing up capital and management bandwidth for banks, contributing to efficient credit flow, particularly to Micro, Small & Medium Enterprises (MSMEs).

Advik Capital sees this move as an opportunity to tap into emerging sectors, particularly private corporate debts entering ARCs, besides their conventional businesses. The CEO, Mr. Karan Bagga, emphasized a shift in focus toward retail assets from MSMEs and NBFCs, aiming to acquire these smaller retail assets efficiently and transparently, strictly in accordance with the SARFAESI Act and RBI guidelines.

Headquartered in New Delhi, Advik Capital Limited primarily engages in providing financial loans and ancillary services. As a registered Non-Banking Finance Company (NBFC) with the Reserve Bank of India, the company's equity shares are actively traded on the Bombay Stock Exchange Ltd. Moreover, its subsidiary, M/s Advikca Finvest Limited, focuses on investing in Capital Market Instruments in India and has plans for international investment ventures.

0 notes

Text

Debt Collection Software and Your Business's Potential Gains

The majority of industries now associate digitalization with cost savings, whether they be time- or money-related. Businesses believe that a digital transformation can increase their profits significantly compared to their labor-intensive legacy lending procedures. Online Debt Assistant and collection is one of the key activities for banks and other financial institutions to guarantee revenue and portfolio quality. However, it's also one of the hardest professions because lenders have to deal with a plethora of rules, several contact methods, collection companies, and various borrowers' personas. Using Debt Collection Software is a practical way for Banks, NBFCs, HFCs (Housing Loan Organizations), and other Financial Services companies to maintain a well-managed lending ecosystem.

An explanation of debt collection software

A computerized tool providing Debt Management Services and recovering past-due debt from debtors is a debt collection software, sometimes referred to as payment collection software. The software can keep track of debtors, follow up with them, and forecast and prioritize debt recovery, which will result in quicker collections. It maintains a central database where all debtor data is kept. Customers can be given payment terms and repayment reminders, which lowers the number of past-due invoices and raises the repayment percentage.

Additionally, the Personal Finance Management App can help in improving the management of third-party collection agencies. The entire debt management process is handled by collection software that is integrated with ERP and loan management systems.

What advantages do debt collection software offer?

A personalized debt management App can offer you as a lender a number of advantages, some of which are stated below:

Each client can be better the focus of the collector

To help prepare debt collectors for the call they are making, debt collection software provides collectors with important borrower statistics. Additionally, it assists in prioritizing consumers based on their tendency to pay, boosting the likelihood of a successful close.

Client communication is automated

Automated communication is made possible by debt collection software, including automated phone calls, SMS production, and collection letters that are automatically linked to emails. Customers are given plenty of time to process their payment within the conditions by receiving speedier bills. Auto communications also alert clients when terms are about to change.

Streamlining tasks more effectively

The software's consolidated database of borrowers is organized according to their levels, making it simpler for the collectors to schedule their days and establish their goals.

Greater transparency

You can make better, quicker decisions and more accurate forecasts thanks to greater financial transparency provided by debt collection software.

For more info :-

how to get out of debt ebook

app to pay off credit cards

Source Url :- https://sites.google.com/view/yofiix/home

0 notes

Text

Qatar Auto Finance Market Outlook to 2026F: Ken Research

Buy Now

The report “Qatar Auto Finance Market Outlook to 2026F– Driven by Increasing Vehicle Prices and Low Interest Rate in The Country” by Ken Research provides a comprehensive analysis of the potential of Auto Finance industry in Qatar. The report also covers an overview and genesis of the industry, market size in terms of credit disbursed; market segmentation by types vehicle financed, by tenure for new and used vehicles, types of lenders, by types of commercial and passenger vehicles; growth enablers and drivers; challenges and bottlenecks; trends driving adoption trends; regulatory framework; end-user analysis, industry analysis, competitive landscape including competition scenario and market shares of major players. The report concludes with future market projections of each market segmentation and analyst recommendations.

Qatar Automotive Overview

Qatar does not manufacture and export motor vehicles itself, however they do re-export motor vehicles. Qatar majorly exports vehicles from Japan, Germany and USA.

In 2019, Qatar re-exported $ ~ Mn worth of Motor Vehicles. Electric vehicle (EV) adoption is still at an early stage, but Qatar is taking serious steps towards electrification. It aims to have ~% of Qatar’s public transit bus fleet from gasoline to electric by 2022. Qatar has automotive investments in several countries, including bus production in Oman and vehicle production in Turkey. The Qatar Investment Authority also owns a stake in German carmaker, Volkswagen

How Is Auto Finance Market Positioned In Qatar?

The Qatar auto finance market experienced a downfall due to factors like Covid outbreak and reduction in population of expats in the country. Covid impacted the production in the market, car manufacturers couldn’t predict the vehicles demand in the future and hence miscalculated the production requirements. The rise in the sale of motorcycles for online food delivery business is contributing in recovery of auto finance sector in the country post COVID-19. Competition is increasing among banks, NBFCs and captives which forced banks to rethink their lending strategy in order to maintain their high market share. Banks are providing 100% and 80% finance for electric and hybrid car/vehicles to Qatari customers and expats to reward them for making an environmentally-friendly choice. This is expected to attract the consumers to opt for auto financing in the country.

Qatar Auto Finance Market Segmentations

By Type of Vehicle: Used vehicle would have a greater demand in the market post COVID-19 since there is shortage in manufacturing and supply of new vehicles. The market is regaining at a steady rate due to increasing demand for personal vehicle post Covid.

By Tenure of Loan for Old Vehicles: Sales of new cars is expected to decline as public transport infrastructure has been improving drastically with the investment of around $ 70 billion in transportation projects in the country.

By Tenure of Loan for New Vehicles: Usually, period of 3 to 4 years is the most common loan tenure for vehicle in the country.

By Type of Commercial and Passenger Motor Vehicle: The commercial vehicle segment is dominating the Qatar Auto Finance Market.

By Type of Passenger Motor Vehicle: In passenger vehicle, the share of 4W is largest because the price of car is comparatively higher than 2W and others.

By Type of Lending Bank: Qatar National Bank is the largest government bank in Qatar and it has subsidiaries and associate companies in more than 30 countries across three continents.

By Type of Commercial Motor Vehicle:

LCV is the majorly used commercial vehicle in Qatar because it is used in transportation of goods. Also, the country is growing its e-commerce which help LCV segment to grow in the country.

By Type of Lenders: Bank is dominant in the auto finance market in Qatar because banks are legally recognized and more reliable source of financing.

Industry Analysis of Qatar Auto Finance Market

National Vision 2030 and FIFA World Cup 2022: Increased Government spending on infrastructure and employment leading to an increase in per capita income and wages would lead to higher sales of automotive and boost auto finance market.

Request for Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDY2

Post-Covid Recovery: Covid-19 and Work from Home culture affected sales of Automotive industry. However, 2022 onwards it is expected that sales will recover as offices will re-open and commercial activities will increase.

Bottlenecks and Challenges in Qatar Auto Finance Market

Trade Embargo: Automotive continued to experience a slowdown due to the Trade Embargo imposed on Qatar by UAE, Bahrain and Egypt.

Time consuming process: Often high amount of paperwork is required for a salesperson and customer to complete an average car loan application.

Key Segments Covered

Qatar Auto Finance:

By Type of Vehicle financed

New

Used

By Tenure (for New and Old Vehicles):

1 year

2 years

3 years and more

By Type of Lender:

Banks

OEMs/Captives

NBFC

By Type of Lending Bank:

Government

Private

By Type of Commercial and Passenger Motor Vehicle:

Commercial

Passenger

By type of commercial motor Vehicle:

LMV

MCV

HCV

By Type of passenger motor vehicle

4W

2W and others

Key Target Audience

Qatar Auto Industries

Government Bodies & Regulating Authorities

Finance Industry

Car company

Automobile dealers and users

Time Period Captured in the Report:

Historical Year: 2016-2021

Base Year: 2021

Forecast Period: 2021– 2026F

Companies Covered:

Qatar National Bank

Doha Bank

Commercial Bank

Al khaliji commercial bank

Ahli bank

Qatar Islamic International Bank

Qatar Islamic Bank

Dukhan bank

Masraf Al Rayan

HSBC

Standard Chartered Check

International Bank of Qatar

First Finance Company

Al Jazeera Finance

Key Topics Covered in the Report

Qatar Automotive Market Overview

Ecosystem of Qatar Auto Finance Market

Qatar Auto Finance Value Chain Analysis

Business Cycle and Timeline of Major Banks in Qatar Auto Finance Market

Market Sizing Analysis of Qatar Auto Finance Market, 2016-2021

Qatar Auto Finance Market Segmentation

SWOT Analysis of Qatar Auto Finance Industry

Trends and Developments in Qatar Auto Finance Industry

Decision Making Parameter for Selecting Car Loan Vendor

Issues and Challenges in Qatar Auto Finance Industry

Growth Drivers of the Qatar Auto Finance Market

Government Policies and Initiatives for Qatar Auto Finance Industry

COVID-19 Impact on Qatar Auto Finance Market

Competition Framework for Qatar Auto Finance

Future Outlook and Projections of the Qatar Auto Finance Market

Market Opportunities and Analyst Recommendations

For more information on the research report, refer to below link: -

Qatar Auto Finance Market Outlook to 2026F: Ken Research

Related Reports

Singapore Auto Finance Market Outlook to 2025 (Edition II) – Driven by exorbitant Car Prices, Growing Digital Penetration and evolving Vehicle Ownership Characteristics amidst Systemically Regulated Car Ownership Policies by the Government

Singapore Auto Finance Market Outlook to 2025 - Driven by Green Car Loans, Growing Digital Advancements and Increasing Number of Finance Aggregators

Philippines Auto Finance Market Outlook to 2024- Growing Prominence of Captive Finance and Surge in Used Car Sales Supporting Disbursement for Auto Loans

0 notes

Text

RBI’s New Digital Lending Guidelines are Important For the Fintech Field

We know from fintech news in India news sources that recently, the RBI or Reserve Bank of India has announced the Guidelines on Digital Lending to both banks and NBFCs (non-banking financial companies), which provide loans through digital lending platforms. This followed the press release that was issued by the RBI.

This was done according to the implementation of the recommendations that came from the Working Group set up by the RBI in 2021 in order to study the market practices that followed in the digital lending industry.

How Are The Digital Lending Guidelines Changing The Fintech Field?

Fintech sources point out that the fintech companies, especially which operated digital lending platforms usually offered unique credit products which were made according to the requirements of a specific user base. These platforms became popular in a short period of time, more after the COVID-19 lockdowns. Such digital lending platforms used alternative data which was for credit assessment and they devised completely digital customer onboarding and also loan disbursement processes.

As only banks and some licensed NBFCs had legitimate access to the capital, fintech companies used to enter into partnerships with these lenders who outsourced customer acquisition, loan recovery, and portfolio monitoring functions to them.

In due course of time, there were increasing cases of borrower harassment that were reported for the loans that were availed through these digital lending platforms. As a result, the RBI had to take notice of the growing digital lending industry, and also closely monitor the arrangements that were entered into by regulated lenders and also the technology companies that were operating the digital lending platforms. The RBI laid clear emphasis to protect digital lending borrowers. These borrowers were the worst affected parties due to several unethical practices, and also harsh recovery methods that were adopted by some digital lending platforms.

So, according to the new guidelines, regulatory measures like prescribing uniform T&C disclosure formats are to be adopted by all digital lenders, which will be permitting customers to exit the loan arrangement. This will be within a specific time period, it will prohibit hidden charges, and will be mandating the appointment of a nodal officer by the regulated lenders and the digital lending platforms in order to address customer complaints. The introduction of data minimization norms will also go a long way in increasing customer confidence and trust in digital lending platforms.

Further Changes Brought To The Digital Lending Field

Until now, digital lending in our country thrived because banks and other regulated lenders were always ready to provide capital. The capital was provided on the assurance that if the borrowers’ defaulted, they would be compensated by the fintech companies that are operating the digital lending platforms, and this was also sourcing new customers.

Such compensation arrangements were set up through FLDG (first loss default guarantee) arrangements. So, such credit comfort was offered and was commercially negotiated, especially based on the quality of the loan portfolio, besides other factors.

However, at the present, the RBI Working Group recommended a total ban on such arrangements. It viewed such credit comfort that was obtained from unregulated fintech companies were posing systemic risks to the market. News from fintech sources shows that it appears that the RBI accepted this recommendation because the digital lending guidelines effectively restrict any such FLDG arrangements. However, this could badly affect the access to capital for the fintech companies who are working towards the designing of new-age credit products and increasing offerings to the new-to-credit borrowers.

The RBI, here, as a prudent regulator intends to rectify any loopholes which may result in systemic risks to the financial ecosystem in India. The FLDG restriction, under the new digital lending guidelines, can lead to the slow death of many digital lending platforms. This would also drastically impact the financial inclusion efforts made by the RBI, as regulated lenders would be less incentivized in order to support new fintech companies which are innovating in this space.

However, the fintech news in India points out that, as a whole, the new digital lending guidelines will help to streamline and also standardize the digital lending practices which are relating to customer transparency and also data collection. The restrictions on the FLDG could force fintech companies to change their strategy. However, some market players cannot have the means for directly obtaining lending licenses and funding their customers by using their own capital. Thus, the fintech companies, here, may have to explore the adoption of public market infrastructures like the account aggregator network and the open credit enablement network in order to survive in this excessively competitive and evolving market.

0 notes

Text

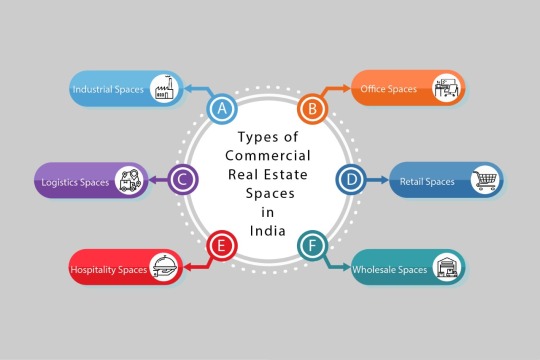

Commercial Real Estate: Time to Restart

It is the best time to buy commercial real estate in India after COVID-19. If you want to invest money in commercial properties then the time has come to invest in commercial properties such as shops, office spaces, retail and wholesale shops, and more.

The pandemic is almost over and life is becoming normal just as pre covid time. Besides, the Real Estate industry is also booming day by day in both sectors like residential and commercial. People are ready to buy residential properties as commercial properties.

According to many forecasts and reports, this year (2022) looks very promising for the real estate sector at large, with residential as well as commercial sectors having the potential to perform well.

Commercial real estate in India in 2022 is in demand after the bad impact of COVID-19. There are many benefits of investing in commercial real estate in India in 2022.

It observed that many stock market investors are showing interest in investing in commercial real estate this year. The main reason behind it is seeking huge profits on long-term investment. Some investors think that pulling out money from the stock market and investing that money is one of the best ideas to maximize ROI.

After COVID-19, India's Economics keeps growing because of having sufficient liquidity in the system, promoting bank credit flow and easing financial stress. This relief is now also allotted for NBFCs; loans by NBFCs to commercial real estate will get identical relief. Many giant companies show interest to set up plants in India in different sectors like such as electronics, textiles, and synthetic fabric.

Around tons of foreign companies are going to set up many plants in different parts of metro cities like- Noida, Gurugram, Bengaluru, Ahmedabad, Mumbai, and more.

If you are looking for investing your money in Delhi NCR then you should invest in one of the most demanded and fast-growing locations. Dwarka Expressway Gurugram is one of them which is emerging as the leading industrial and financial hub.

There are many commercial buildings being constructed that offer all commercial complexes where you will find shopping malls, retail and wholesale shops, and office spaces. As we know that Dwarka Expressway is highly connected to all means of transportation and having well-planned infrastructure makes this location for a hot destination for investors to invest.

The best commercial property on Dwarka Expressway Gurugram includes commercial shops, office space, a food court, etc. These all make it the best location to invest and get huge returns.

This will boost the growth of commercial sectors in India. However, NBFCs will allow carefree NPA classification to their borrowers and NBFCs will stretch realty loans by one year if projects are delayed for reasons beyond their control. It might attract more big companies to invest in India.

When they set up manufacturing plants in India then there will be a need for more commercial spaces to run the companies efficiently. Also, attract to building shopping complexes where you will find retail shops, wholesale stores, brand outlets, and more.

Hence, this is the best investment option which has left during this crisis is the real estate sector.

2021 has been very rewarding that slightly showed hope in real estate in both sectors including the commercial and residential sectors. It is noteworthy that the commercial sector faced a dip during the pandemic but is now well on the road to recovery. This is the main reason why companies are looking to reopen their offices, having a hybrid work culture for better employee comfort.

The demand for office space has been rising this year. Many companies in sectors like Business Processing Management (BPM), IT, Banking, Financial, and Insurance Services (BFIS), and more are on the lookout for office spaces to work effectively. In this way, it is generating a huge demand for commercial properties like office spaces.

Economic Times noted that office space’s gross absorption was high in the first quarter (March 2022). Major cities like Bengaluru, Chennai, and Delhi NCR dominated the office space leasing absorption in 2022’s 1st quarter. These cities have a well-planned infrastructure and have many big companies already operating their business and wanting to spread.

Many startup firms have set up their business in Delhi NCR, and demand for office space in this region has grown. Leasing of commercial spaces grew 97% year-on-year (Y.O.Y) and reached 13 million square feet (MSF) which is a 3x increase Year-On-Year (Y.O.Y). This happened for the first time in the past 2 years.

JLL study suggests that the Grade A office market across the top cities in India is about to grow over 1 billion sq. ft. in size by 2026. The Indian office sector has recovered the fastest from the aftermath of the pandemic. This might be a good opportunity for those investors who are looking for long-term profits.

Therefore, India is fast growing in commercial real estate and expects to grow more. This is now a good time to invest in commercial property.

#commercial real estate#commercial property#Dwarka Expressway Gurugram#Dwarka Expressway#real estate

0 notes

Text

NBFC: RECOVERY POST-COVID & THE FUTURE WITH DATA ANALYTICS ADOPTION

With more freedom than banks, Non-Banking Financial Companies or NBFCs — an essential pillar of the financial ecosystem — have greater risk-taking capacity to engage in financial intermediation.

While the Covid-19 pandemic had led to a huge upheaval in the space, overall the consumer credit spending in this financial quarter has increased. In an article titled "NBFC: Recovery Post-Covid & the Future with Data Analytics Adoption" Ankit Goyal, Vice President, Healthcare & Financial Services, Polestar Solutions & Services breaks down opportunities for growth with data and the future for enterprises.

Read the exclusive article on NASSCOM Insights via this link: https://bit.ly/3RrYmG9

0 notes

Text

WHAT IS COLLATERAL FREE EMERGENCY CREDIT LINE GUARANTEE SCHEME ?

Unveiling the first tranche of economic stimulus to help businesses during the Covid-19 pandemic, Finance Minister Nirmala Sitharaman on May 13 announced collateral-free loans up to Rs 3 lakh crore backed by government guarantee. Meant to help businesses suffering from a severe cash crunch, the Government has since the announcement come out with the guidelines on how the scheme will operate key details of the scheme. This move will surely reduce the possibility of npa in india.

What are the details of the Collateral free MSME loans?

The 100% collateral-free MSME loan is being called the Emergency Credit Line Guarantee Scheme (ECLGS), which is being provided by the National Credit Guarantee Trustee Company (NCGTC) to banks, NBFCs and Financial Institutions (FIs).

According this scheme, every eligible MSME or business enterprise, gets a pre-approved sanction limit of up to 20% of loan outstanding as on 29th February, 2020. This is in the form of additional working capital term loan facility (in case of banks and Financial Institutions), and additional term loan facility (in case of NBFCs). This is a special scheme to help small businesses battling the economic impact of Covid-19 and includes Pradhan Mantri MUDRA Yojana (PMMY) borrowers. It will help in bringing down the pressure on of npa recovery process.

Who is eligible for the scheme?

All business enterprises or MSMEs that have a combined outstanding loan across different banks, NBFCs and FIs up to Rs. 25 crores as on 29.2.2020, and when the annual turnover of the firm is up to Rs. 100 crores for FY 2019-20 is eligible for the Scheme. Proprietorship, partnership, registered company, trusts and Limited Liability Partnerships (LLPs) are all eligible under the Scheme, but only the loans taken for the business is being covered. Any loan taken by a promoter or director in his personal capacity will not be covered under the scheme.

What is important to note is that the Scheme is valid for existing customers of a bank, NBFC or FI. This means this scheme is not for new borrowers. Also, the loan account should be less than or equal to 60 days past due as on 29th February, 2020 and the borrower has not been classified as SMA 2 or NPA by any of the lender as on 29th February, 2020. A borrower must also be registered under GST, unless the business is not required or exempted from having a GST registration.

It is essential to consult nclt lawyers Mumbai to know exact terms and conditions.

What is the amount that can be borrowed?

The maximum amount eligible under this scheme either in the form of additional working capital term loan facility (in case of banks and Financial Institutions), and additional term loan facility (in case of NBFCs) is set at 20% of the total outstanding loans up to Rs 25 crore as on 29th February, 2020. To arrive at the total outstanding, only on-balance sheet exposure like an outstanding amount in working capital loan, term loa.

What is the interest rate on such loans?

To ensure that the scheme is beneficial to the borrowers and the cost of borrowing is kept low; Banks and FIs link their lending rate to one of the external benchmark rates prescribed by RBI plus 1% subject to a maximum of 9.25% per annum. Similarly, NBFCs cannot charge more than 14% as interest for the loans under this scheme

This facility is available for borrower from May 23, 2020 to 31st October, 2020, or till an amount of Rs. 3 lakh crores have been sanctioned, whichever is earlier.

Other terms?

The loan under this scheme is extended for a period of four year from the date of disbursement and there will be no pre-payment charge if a borrower wants to repay early. There will also be no processing fee for such loans.

What is important to note is that a there will be a moratorium of one year on the principal repayment, but interest payment will continue during this period. The principal repayment will then be converted into equated instalments spread across the remaining period, ..

NPA consultant in Mumbai is single window solution for Npa in India. Do not let the non performing assets be a nightmare for you.

0 notes

Text

Things to Know before Looking for Moneylender Singapore

Money borrowing is rarely enjoyable. The difficulty of borrowing from a Moneylender Singapore may be increased. Many people from both urban and rural Singapore turn to private money lenders since the conventional loan procedure is constrained by different norms and regulations. It is challenging to overlook their impact on our nation's economy until Singapore achieves full financial inclusion due to the size of this informal money lending market. Before obtaining a loan from a money lender, there are a few crucial factors to take into account.

Options for Alternative Borrowing

Make sure you've tried all the official channels for obtaining credit. You can obtain credit via NBFCs, financial institutions, online platforms that enable peer-to-peer lending, as well as different mobile applications, in addition to personal loans from banks. Some of these methods are absolutely hassle-free and don't need a lot of paperwork. Once you have explored all of the conventional options, thoroughly examine private money lenders.

Licensed lenders of money

Every state in Singapore has a Money Lender's Act that mandates licensing for money lenders in an effort to regulate the industry. Unfortunately, the majority of them do not register and could engage in unethical behavior. Find a licensed money lender Singapore for your own assurance when you wish to borrow money.

Rate of Interest Effective

Make sure you understand the whole cost of any arrangement before you sign anything. Based on the repayment schedule, the real cost will vary for a given interest rate and loan amount. Recall that paying smaller instalments will reduce your overall cost compared to paying smaller sums more often.

Others Fees

Make careful to inquire about any additional fees that the lender may charge you. It is common for them to levy late fees, pre-closure fees, and in certain cases, a penalty for a returned check. It will be wise to obtain all of this in writing in your contract and to declare that there won't be any more fees beyond those that are specified there.

Recovery of Loans

The most important thing for you to understand before borrowing the money is this. Some lenders of capital use loan sharks or loan recovery specialists. When payments are late, they have the option of using physical force. This may be extremely upsetting and dangerous for you and your family. particularly if the Moneylender Singapore lacks a license. Find out how they recoup defaulted loans from them and see if they can include that in the contract. Before entrusting a money lender, always search for referrals or someone who can attest to their character.

This article has already stated that borrowing from unofficial sources may be quite dangerous. However, there may be instances when it is challenging to obtain an unprotected loan from a bank, such as when your payment history is unfavorable or you are not receiving a regular wage. Analyze the principles in this article before deciding whether to borrow money from a money lender, whatever your purpose may be.

0 notes

Text

SWOT Analysis of NBFCs

The word "NBFC" stands for Non-Banking Finance Company. Loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by the government or local authority, or other marketable securities of a similar sort, leasing, hire-purchase, insurance business, and chit business are all businesses that these companies are involved in.

In this article, we'll use SWOT analysis to take a quick look at the NBFC's internal environment.

Strengths

Resources and capabilities that can be used as a basis for developing a competitive advantage

Understanding your customer's approach

Better services to individual customers

Easy and simplified sanction procedure and disbursement

Profits Continually

A specialised focus on recovery

Flexible operation & ability to innovate

Cost advantages

Weakness

The absence of some strengths leads to weaknesses like -

Weakness in urban markets due to disparities in public perception

Strong and dynamic competitors

Weak risk-management systems

Higher diversification from the core business

The mismatch between assets and liabilities

Non-performing assets and consequent pressures on the bottom line.

Loss of public confidence/credibility problems due to failure to honour the repayment of deposits.

Poor recoveries

Poor reputation among customers

Opportunity

After analysis of the certain external environment, new opportunities for growth and profitability are being identified like -

Opportunities in home equity, personal finance, personal investment, etc.

Collaboration with global NBFC.

Securitizing to collect funds to generate asset growth

No entry barriers or low entry barriers

Tax motivations by government

Optimistic capital markets & access to varied resources

Threat

Changes happening in the external environment also impact the industry -

Slow industrial growth

Globalisation—Entry of foreign companies and investors

Stiff competition within the NBFC and banking sectors

The entry of many banking and non-banking companies creates competition

Exposure to various industrial risks like - credit risk, int rate volatility, economic cycle etc

In order to develop strategies for NBFCs, we need to take into consideration the SWOT profile. The SWOT matrix (also known as a TOWS Matrix) comprises of,

1. Strength & Opportunities Strategy (SO) wherein strength is used to take advantage of opportunities.

2. Weakness & Opportunities Strategy (WO) wherein weakness is overcome to take advantage of opportunities.

3. Strength & Threat Strategy (ST) wherein strength is used to take care of the threats.

4. Weakness & Threat Strategy (WT) wherein an attempt is made to liquidate weakness and threat.

These tactics will provide you with a general notion of the development that needs to be done with your NBFC.

For over a decade, we have served and catered to various organisations like NBFCs and BFCs as their Management Consultant. We've seen problems and crises that seemed hard to overcome, yet we worked on them and assisted the company in doing so.

Do you want assistance in overcoming the hurdles of your business? You are just a click away. Visit our website https://3ea.in/contact-us/ and connect with us today.

#3ea#finance consultant#financial analysis#business consultant#market analysis#management consulting#growth strategies#entrepreneurs#msmeindia#urban market

0 notes

Text

Are your Loan Collection Mechanisms Future-Ready?

As the world tries to return to a semblance of normalcy in a post-pandemic world, the lending industry is seeing some respite. A recent Moody’s report expects growth in bank loans to accelerate to 12-13% in FY 23 aided by increasing corporate earnings and easing of funding constraints for NBFCs. An Icra report predicts an 8.9-10.2 per cent growth for bank credit in FY23.

Yet, the impact of the pandemic will continue to be felt when it comes to loan collections. The Reserve Bank of India’s (RBI’s) Financial Stability Report (FSR) from December 2021 points to headwinds in the retail credit growth model, rising delinquencies, and a dip in originations in new-to-credit segments. The report speculates that bad loans of commercial banks in India could rise to between 8.1 and 9.5 per cent by September 2022.

Also, the RBI’s two-year moratorium period offered to businesses during the pandemic will end between March and September 2022. While most banks have voluntarily made provisions to deal with the slippage of restructured loans, higher than expected slippages could be a source of worry. A report by the India Ratings and Research predicted that the stressed asset ratio in the MSME segment could rise to 16.7% in FY23 from 11.7% by the end of FY21. In addition, geopolitical developments such as the Russia-Ukraine crisis could lead to greater inflation, causing stress for borrowers.

Challenges Remain in Loan Collections

Given the broader industry challenges pertaining to loan collections, it becomes more important than ever to ensure that the collections process itself is as efficient and effective as possible. Currently, the collections mechanism is overrun with issues such as zero visibility, huge administrative overheads, the need for extensive manual intervention, long recovery cycles, and low-resolution rates.

Elements of an Optimum Loan Collections Mechanism

Optimizing collections with the right technology that leverages technologies such as AI, automation, and analytics is important. At the same time, ensuring a favourable customer experience is also crucial.

Here are some ways to achieve this:

Embracing Automation

Automation in banking industry is evolving with the penetration of digital and the need to drive efficiencies. Advanced technologies today enable us to automatically trigger communication sequences based on the actions of borrowers. One can create templates and automate emails, SMS, WhatsApp messages and voice messages for different segments of your borrowers. For instance, Credgenics allows lenders to send and track legal notices automatically using technology and track all digital and physical notices in one single dashboard. The solution also allows lenders to automate their legal workflow, get easy access to the recovery specialists and manage all their cases efficiently.

2. Empowering the Team to Maximize Collections

Not all borrowers are the same. As the McKinsey report titled ‘Behavioral insights and innovative treatments in collections’ observes, behaviour-based segmentation of collections strategies can help significantly improve collections.

AI can help predict the chances of recovery and recommend the best strategies for every loan account. Credgenics’ AI engine, for example, can use past loan accounts data to calculate the recovery chances, costs, and expected time for every case.

AI can also help the collections team prioritize accounts that have a greater chance of getting recoveries and remind them to follow up on time and track every call. To improve efficiencies on the ground, Credgenics CG Collect mobile app, which comes with integrated in-app calling facility and Google maps integration, can assist field agents in navigating to the borrowers’ locations.

3. Get the visibility

When it comes to dealing with large borrower databases, access to the right data and insights is valuable. Having tools in place to identify the best-performing agents, understand gaps in the collections process, collection rates, total loan amounts recovered, and even analytics on the most effective communication channels can help make processes more effective. For instance, Credgenics loan collections software platform helps lenders view various borrower details, other loan accounts, missed EMIs and recovery history, collection status, etc. in one snapshot through visual reports.

Advanced technology combined with domain expertise can help dramatically simplify the loan collection process, making it efficient and more effective.

#Automation in Banking Industry | Challenges in Banking Sector#debt recovery services#debt resolution platform#b2b fintech company in india#bad debt recovery#debt recovery software#loan recovery platform#debt collection services

0 notes

Text

Revival in Bank Credit to NBFCs in February 2021

Revival in Bank Credit to NBFCs in February 2021

Introduction:

Bank credit to NBFCs has picked up for the first time during FY21 in February, indicating a positive impact of RBI’s liquidity measures and less risk aversion at banks. Recovery in lending by Banks to NBFCs is a good signal for both sectors. This process of lending loans by Banking to NBFCs is also called Shadow Banking.

Key Role of NBFCs in improving Credit Growth through…

View On WordPress

#bank credit to NBFCs in February#Debt Exposure of Mutual Funds to NBFCs#Fall in Debt Exposure of Mutual Fund to NBFCs#Improving Exposure of Banks#Investment into Corporate Bonds of NBFCs#Key Drivers of Pick up in NBFC Lending#Key Role of NBFCs in improving Credit Growth through Different Lending Models:#Outstanding Investments in Commercial Papers of NBFCs#Recovery in Bank Credit to NBFC#Revival in Bank Credit to NBFCs in February 2021

0 notes