#bank credit to NBFCs in February

Text

Repo Rate Unchanged by RBI in Response to Shifting Economic Landscape

The Reserve Bank of India (RBI) has once again opted to keep the repo rate steady at 6.5%, extending the streak of six consecutive decisions maintaining the status quo. Led by Governor Shaktikanta Das, the Monetary Policy Committee (MPC) has reaffirmed its commitment to withdrawing the accommodative stance. This decision comes on the heels of the Interim Budget announcement on February 1, 2024, and it is poised to have significant implications for India's economic trajectory. This blog delves into the rationale behind the RBI's decision and its potential ramifications for the Indian economy.

Maintaining Stability in Unpredictable Times:

The RBI's decision to keep the repo rate unchanged can be seen as a strategic move to maintain stability in the face of a shifting economic landscape. In recent times, global uncertainties, geopolitical tensions, and the ongoing COVID-19 pandemic have created a dynamic environment that demands careful consideration. By opting for a consistent policy stance, the RBI aims to provide a sense of stability and predictability for businesses, investors, and consumers alike.

Abhay Bhutada's Perspective:

Abhay Bhutada, MD of Poonawalla Fincorp, has expressed his approval of the RBI's decision. He sees it as a prudent approach that aligns with India's economic path. Bhutada believes that the stability offered by maintaining the repo rate at 6.5% is particularly beneficial for Non-Banking Financial Companies (NBFCs). These institutions play a crucial role in India's financial ecosystem, serving as alternative lenders and contributing to the overall financial inclusivity.

Alleviating Financial Burdens on Customers:

One of the key advantages of the RBI's decision, as highlighted by Bhutada, is the alleviation of financial burdens on customers. By keeping interest rates stable, borrowers, including individuals and businesses, can continue to benefit from affordable credit. This not only supports economic growth but also encourages spending and investment. In a time when uncertainties loom large, providing financial relief to consumers becomes paramount, and the repo rate stability contributes to this relief.

Also Read: Abhay Bhutada's Insights into Poonawalla Fincorp's Remarkable NPA Performance

Favorable Environment for Continued Sectoral Growth:

The consistent policy stance adopted by the RBI creates a favorable environment for continued sectoral growth. The stability in interest rates fosters confidence among investors and businesses, promoting a conducive atmosphere for expansion and innovation. In particular, NBFCs, which often operate in niche segments and cater to specific financial needs, stand to gain from this stable economic environment. Abhay Bhutada's commendation of the RBI's decision underscores the positive outlook for the NBFC sector.

Addressing Inflation Concerns:

While the RBI's decision to maintain the repo rate reflects a commitment to economic stability, it is not without considerations for inflation. Inflation management remains a key mandate for the central bank, and the current stance suggests a delicate balance between supporting economic growth and curbing inflationary pressures. The RBI's hawkish undertones, with an intent to withdraw the accommodative stance, signal a proactive approach to addressing potential inflation concerns.

Global Economic Factors:

The decision to keep the repo rate unchanged also takes into account global economic factors. In a world interconnected through trade and finance, India's central bank must navigate the impact of external events on the domestic economy. The ongoing geopolitical tensions, trade disputes, and uncertainties surrounding the global economic recovery contribute to the complexity of the decision-making process. By maintaining stability in the domestic interest rates, the RBI aims to insulate the Indian economy from external shocks to the extent possible.

Also Read: Abhay Bhutada Talks About Lowering Lending Rates For Customers In 2025

Conclusion:

The RBI's choice to keep the repo rate at 6.5% amid a shifting economic landscape demonstrates a commitment to stability, predictability, and strategic economic management. As the global and domestic economic scenarios continue to evolve, the RBI's role becomes increasingly pivotal in steering India's economic course. The delicate balance between supporting growth, addressing inflation concerns, and considering global factors underscores the complexity of the central bank's decision-making process.

0 notes

Text

THE ROLE OF FINTECH IN EDUCATION FINANCING IN INDIA

Fintech companies have played a pivotal role in transforming education financing in India by offering software and service solutions to the BFSI (Banking, Financial Services and Insurance) industry. Through their SAAS (Software as a Service) solutions, these companies, including Novel Patterns, have introduced innovative technologies and streamlined operations to facilitate the seamless onboarding of students and optimize lending processes within the education sector. Their contributions have empowered financial institutions and banks to enhance their operations and provide a more efficient experience for both lenders and borrowers.

One significant contribution of fintech companies is the introduction of peer-to-peer lending platforms. These platforms connect borrowers who apply for student loan in India with willing lenders who offer student loans at lower interest rates compared to traditional banks. This innovative approach enables students to access education loan without collateral or credit history. By leveraging technology, these platforms efficiently match borrowers and lenders, making education financing more accessible and affordable. Furthermore, fintech companies have revolutionized education financing through the introduction of digital wallets and mobile banking solutions. These platforms allow students to make online payments for tuition, fees, and other educational expenses, saving time and reducing transaction costs. By eliminating the need to visit a bank, students can manage their finances more efficiently, ensuring uninterrupted progress in their educational journey.

This article delves into the transformational impact of the fintech sector on education financing in India, with a focus on Novel Patterns, a leading SAAS fintech company that is shaping the industry.

SOME DATA ABOUT THE EDUCATION LOAN SECTOR IN INDIA WITH SOURCES:

The education loan market in India is expected to reach USD 150 billion by 2025. (Source: CARE Ratings)

The market is currently dominated by public sector banks, but private banks and NBFCs are gaining market share. (Source: RBI Report: Sectoral Deployment of Credit)

The average education loan interest rates in India is around 10%. (Source: ClearTax)

The maximum loan amount that can be borrowed under the government’s education loan scheme is Rs. 7.5 lakh. (Source: MHRD)

Fintech companies are playing a growing role in the education loan sector by providing digital lending platforms and other services. (Source: Fintech India)

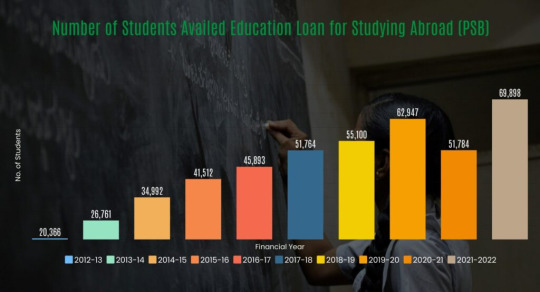

In response to a question raised in Lok Sabha on 13 February 2023, the Government of India provided information on the loans made available by PSBs for education abroad. The data is available for ten public sector banks (PSBs). According to these figures, around 4.61 lakh students received study-abroad loans from 2012-23 to 2021-22. This equals to Rs. 39.26 thousand crores in total. (Response in Lok Sabha -Unstarred Question 1759)

According to Public Sector Banks (PSBs), 4,61,017 students received educational loans to study overseas in the previous 10 years, with 42,364 receiving education loans to study medicine.

Details of loans disbursed by various Public Sector Banks to Students who availed Educational loans for studying abroad (In Rs crore)

Source: Response in Lok Sabha -Unstarred Question 1759

Number of students availed education loan for studying abroad (PSB)

Source: Response in Lok Sabha -Unstarred Question 1759

HERE ARE SOME ADDITIONAL DETAILS ABOUT THE EDUCATION LOAN SECTOR IN INDIA:

The demand for education loans is growing in India due to the rising cost of education.

The government has been providing financial assistance to students through education loans to help them access higher education.

Fintech companies are using technology to make the education loan process more efficient and accessible.

Another crucial role of fintech companies in education financing is the provision of software solutions that streamline operations and enable easier student onboarding for financial institutions and banks. Through advanced technologies such as credit underwriting platforms and video KYC (Know Your Customer) platforms, fintech companies facilitate efficient loan origination, onboarding, disbursal, fraud detection, and customer service processes. These software solutions improve operational efficiency and enhance the overall borrower experience by automating and optimizing various aspects of the lending journey.

Additionally, fintech companies have introduced financial management tools that empower students to track their spending and manage their finances effectively. These solutions enable students to stay on top of their expenses, monitor budgets, and avoid accumulating debt. By providing insights and analytics, these tools assist students in making informed financial decisions and maintaining financial well-being throughout their educational journey.

THE NEED FOR INNOVATION IN EDUCATION FINANCING

Education costs has been rising steadily, making it increasingly difficult for students from lower-income backgrounds to afford quality education without student loans in India. Traditional education financing options, such as bank loans, scholarships and government grants, have proven inadequate in meeting the needs of aspiring students. Lengthy approval processes, high education loan interest rates and the limited availability of credit have hindered the accessibility and affordability of education financing. This has led to a significant gap between the demand and supply of education financing in the country.

The rise of fintech companies in India has brought about a paradigm shift in the way education financing is perceived and accessed. By leveraging technology, data analytics and innovative business models, fintech firms are revolutionizing the education financing landscape in the following ways:

Streamlined Student Loan Origination and Approval: Fintech companies are introducing automated processes and advanced algorithms to streamline the loan origination and approval process. By utilizing big data and machine learning, these platforms can assess the creditworthiness of applicants more accurately and efficiently. This not only reduces the time required for loan approvals but also increases the accessibility of education financing to a broader population.

Enhanced Transparency and Accessibility: Fintech platforms are leveraging technology to provide transparent and user-friendly interfaces that simplify the application and disbursement processes. Through online portals and mobile applications, students and their families can access detailed information about available financing options, interest rates, repayment terms, and eligibility criteria. This increased transparency fosters trust and empowers borrowers to make informed decisions about their education financing.

Personalized Financial Solutions: Fintech companies are employing data analytics to develop personalized financial solutions tailored to the specific needs of students. By considering factors such as academic performance, career prospects, and income potential, these platforms can offer customized loan terms, repayment plans and interest rates. This approach ensures that students receive financing options that align with their individual circumstances and significantly reduce the burden of loan repayment.

Integration of Account Aggregation Technology: Account aggregation technology allows fintech platforms to securely access and analyze an individual’s financial data from multiple sources. By incorporating this technology into their offerings, fintech companies can assess an applicant’s financial health more comprehensively, leading to better-informed lending decisions. This integration also facilitates the verification of income, assets, and financial commitments, further improving the accuracy of credit assessments.

Overall, the innovative approaches adopted by fintech companies have the potential to bridge the gap between the demand and supply of education financing in India. By leveraging technology, data analytics and personalized financial solutions, these firms are making education financing more accessible, transparent and tailored to the needs of students. This transformation in the education financing landscape holds promise for enabling more individuals, particularly those from lower-income backgrounds, to pursue quality education and achieve their academic aspirations.

UNLOCKING EFFICIENCY IN EDUCATION LOAN EXECUTION

In India, the execution of an education loan involves several stages, starting from loan sourcing to disbursal. Throughout the process, credit underwriting plays a crucial role in assessing the borrower’s creditworthiness. Additionally, fintech software and technology are often employed to streamline the loan application, verification and disbursement processes. Here’s an overview of how the education loan process typically unfolds:

Loan Sourcing: The borrower, typically a student or their parent/guardian, initiates the loan application process by approaching a bank or a fintech lending platform that offers education loans. They provide the necessary details and express their interest in availing of a loan for educational purposes.

Application Submission: The borrower fills out the loan application form, either online or offline, and submits it along with the required documents. These documents usually include proof of identity, address, income, academic records, an admission letter, the fee structure and any collateral documentation if applicable.

Credit Underwriting: The lending institution, whether a bank or a fintech platform, performs credit underwriting to evaluate the borrower’s creditworthiness and ability to repay the loan. This process involves assessing various factors such as the borrower’s income, credit history, academic performance and potential career prospects.

Document Verification: The lending institution verifies the authenticity and accuracy of the submitted documents. This involves scrutinizing academic records, income certificates, identity proofs and other relevant documents. Fintech software can be used to automate and streamline this verification process, reducing the time required for document checks.

Loan Approval: Based on the credit underwriting assessment and document verification, the lending institution decides whether to approve or reject the loan application. If approved, the terms and conditions of the loan, including the loan amount, interest rate, repayment tenure and any applicable fees, are communicated to the borrower.

Loan Disbursal: Once the loan is approved, the lending institution initiates the disbursal of funds to the borrower or directly to the educational institution. Fintech platforms often facilitate quick and secure disbursals through electronic fund transfers or other digital payment methods.

Repayment: After the loan is disbursed, the borrower must start repaying the loan according to the agreed-upon terms and conditions. The repayment period may vary depending on the lender’s policies and the borrower’s financial situation. The borrower is typically expected to make monthly or quarterly payments towards the loan principal and interest.

Also, Within the realm of education financing in India, some of the Education loan organizations like Eduvanz and Avanse are providing students with low-interest loans and expediting the loan approval process.

Eduvanz, renowned as a low-interest education loan provider, has been instrumental in enabling students to pursue their educational aspirations without the burden of exorbitant interest rates. Their innovative approach aims to make education financing affordable and accessible to students from all backgrounds. By leveraging advanced technology and data analytics, Eduvanz offers customized loan solutions tailored to individual needs, ensuring that students can finance their education without compromising their financial well-being. With flexible repayment options and competitive interest rates, Eduvanz has become a beacon of hope for countless students across the country, transforming their dreams into reality.

Avanse, on the other hand, has carved a niche for itself by providing the fastest sanction within 72 hours for education loans. Recognizing the urgency and time sensitivity associated with education financing, Avanse has streamlined its loan approval process, ensuring quick disbursal of funds to deserving students. By leveraging technology, Avanse has optimized its operations, eliminating unnecessary delays and bureaucratic hurdles that often hinder the loan approval process. This swift and efficient approach has proven to be a game-changer for students, allowing them to focus on their education rather than worrying about financial intricacies.

Throughout this process, fintech software and technology play significant roles in streamlining and enhancing efficiency. They facilitate online loan applications, automate document verification, enable digital communication, and accelerate the disbursal process. Fintech platforms often leverage data analytics, machine learning and account aggregation technology to assess creditworthiness, provide personalized loan options, and offer transparent and user-friendly interfaces for borrowers.

In summary, the education loan process in India involves loan sourcing, application submission, credit underwriting, document verification, loan approval, disbursal, and repayment. Credit underwriting assesses the borrower’s creditworthiness, while fintech software streamlines the process, automates document checks, and enhances the efficiency of loan sourcing, verification and disbursement stages.

NOVEL PATTERNS: TRANSFORMING EDUCATION FINANCING IN INDIA

As a SAAS fintech company, Novel Patterns specializes in providing a streamlined setup of operations for financial institutions and banks, enabling them to improve their lending processes within the education sector. The company offers two flagship products to transform the lending ecosystem in India:

CART - CREDIT UNDERWRITING PLATFORM WITH ACCOUNT AGGREGATOR ENABLEMENT FEATURE:

CART is a robust AI-driven credit underwriting platform that leverages advanced data analytics, machine learning algorithms and account aggregation technology. It enables financial institutions and banks to make data-driven lending decisions with enhanced accuracy and efficiency. CART’s integration with account aggregation enables lenders to gather comprehensive financial information, enabling them to assess creditworthiness more accurately. This empowers lenders to offer suitable financing options to students and optimize risk management.

MYCONCALL - VIDEO KYC & PERSONAL DISCUSSION PLATFORM:

MyConCall is a secure video KYC (Know Your Customer) and personal discussion platform by Novel Patterns. This platform eliminates the need for physical document verification, allowing financial institutions to conduct KYC processes remotely. By enabling virtual face-to-face interactions between lenders and borrowers, MyConCall enhances the onboarding experience, reduces turnaround time and improves customer satisfaction. This platform ensures compliance with regulatory requirements while enabling efficient and secure customer onboarding.

IMPACT AND BENEFITS

The fintech revolution in education financing, driven by companies like Novel Patterns, has brought numerous benefits to the education ecosystem in India:

Increased Accessibility: Fintech platforms have widened access to education financing, especially for students from marginalized communities or with limited financial means. The simplified application processes, personalized loan offerings, and reduced processing times have made education financing more accessible and inclusive.

Improved Efficiency: The integration of advanced technology, data analytics, and automation has significantly improved the efficiency of education financing operations. Fintech platforms have reduced the time and effort required for loan approvals, disbursals, and customer service, enhancing the overall borrower experience.

Enhanced Risk Management: Fintech companies leverage data analytics and account aggregation technology to assess creditworthiness accurately. This results in improved risk management practices for lenders, reducing the likelihood of defaults and ensuring the sustainability of education financing programs.

Empowered Decision Making: Students and their families now have access to comprehensive information about education financing options, interest rates and repayment terms. This transparency empowers borrowers to make informed decisions and choose the most suitable financing options for their educational aspirations.

Through these innovative products, Novel Patterns is not only accelerating the growth of fintech solutions in the education loan sector but also contributing to the accessibility, customization, and efficiency of education financing in India. As we embrace these advancements, we pave the way for a future where education becomes truly accessible to all, empowering students to fulfill their academic aspirations and shape a brighter tomorrow.

REWIND-UP

The fintech sector has revolutionized education financing in India, addressing the limitations of traditional methods and opening up new possibilities for students to pursue their educational goals.

Through streamlined processes, increased accessibility, personalized financial solutions, and enhanced risk management, fintech companies have transformed the education financing landscape. Companies like Novel Patterns, with their innovative products like CART and MyConCall, are leading the way in reshaping the lending ecosystem, ultimately making quality education more affordable and accessible to all. As India continues to embrace digital transformation, the fintech sector’s role in education financing is expected to grow further, empowering generations to come. Moreover, the use of artificial intelligence and machine learning algorithms has enabled fintech companies to assess the creditworthiness of borrowers more accurately and efficiently. This has resulted in a reduction in default rates and increased access to financing for students from all socioeconomic backgrounds. With these advancements, the future of education financing looks promising as fintech companies continue to drive innovation in this space.

#NovelPatterns#Novel Patterns#BFSI#CART#Account Aggregator#Myconcall#Fintech#Education#Role of Fintech#Loan#Education Loan#SAAS

1 note

·

View note

Text

WHAT IS COLLATERAL FREE EMERGENCY CREDIT LINE GUARANTEE SCHEME ?

Unveiling the first tranche of economic stimulus to help businesses during the Covid-19 pandemic, Finance Minister Nirmala Sitharaman on May 13 announced collateral-free loans up to Rs 3 lakh crore backed by government guarantee. Meant to help businesses suffering from a severe cash crunch, the Government has since the announcement come out with the guidelines on how the scheme will operate key details of the scheme. This move will surely reduce the possibility of npa in india.

What are the details of the Collateral free MSME loans?

The 100% collateral-free MSME loan is being called the Emergency Credit Line Guarantee Scheme (ECLGS), which is being provided by the National Credit Guarantee Trustee Company (NCGTC) to banks, NBFCs and Financial Institutions (FIs).

According this scheme, every eligible MSME or business enterprise, gets a pre-approved sanction limit of up to 20% of loan outstanding as on 29th February, 2020. This is in the form of additional working capital term loan facility (in case of banks and Financial Institutions), and additional term loan facility (in case of NBFCs). This is a special scheme to help small businesses battling the economic impact of Covid-19 and includes Pradhan Mantri MUDRA Yojana (PMMY) borrowers. It will help in bringing down the pressure on of npa recovery process.

Who is eligible for the scheme?

All business enterprises or MSMEs that have a combined outstanding loan across different banks, NBFCs and FIs up to Rs. 25 crores as on 29.2.2020, and when the annual turnover of the firm is up to Rs. 100 crores for FY 2019-20 is eligible for the Scheme. Proprietorship, partnership, registered company, trusts and Limited Liability Partnerships (LLPs) are all eligible under the Scheme, but only the loans taken for the business is being covered. Any loan taken by a promoter or director in his personal capacity will not be covered under the scheme.

What is important to note is that the Scheme is valid for existing customers of a bank, NBFC or FI. This means this scheme is not for new borrowers. Also, the loan account should be less than or equal to 60 days past due as on 29th February, 2020 and the borrower has not been classified as SMA 2 or NPA by any of the lender as on 29th February, 2020. A borrower must also be registered under GST, unless the business is not required or exempted from having a GST registration.

It is essential to consult nclt lawyers Mumbai to know exact terms and conditions.

What is the amount that can be borrowed?

The maximum amount eligible under this scheme either in the form of additional working capital term loan facility (in case of banks and Financial Institutions), and additional term loan facility (in case of NBFCs) is set at 20% of the total outstanding loans up to Rs 25 crore as on 29th February, 2020. To arrive at the total outstanding, only on-balance sheet exposure like an outstanding amount in working capital loan, term loa.

What is the interest rate on such loans?

To ensure that the scheme is beneficial to the borrowers and the cost of borrowing is kept low; Banks and FIs link their lending rate to one of the external benchmark rates prescribed by RBI plus 1% subject to a maximum of 9.25% per annum. Similarly, NBFCs cannot charge more than 14% as interest for the loans under this scheme

This facility is available for borrower from May 23, 2020 to 31st October, 2020, or till an amount of Rs. 3 lakh crores have been sanctioned, whichever is earlier.

Other terms?

The loan under this scheme is extended for a period of four year from the date of disbursement and there will be no pre-payment charge if a borrower wants to repay early. There will also be no processing fee for such loans.

What is important to note is that a there will be a moratorium of one year on the principal repayment, but interest payment will continue during this period. The principal repayment will then be converted into equated instalments spread across the remaining period, ..

NPA consultant in Mumbai is single window solution for Npa in India. Do not let the non performing assets be a nightmare for you.

0 notes

Text

Supreme Court sets aside order to Subrata Roy to appear before Patna High Court

Setting aside Patna High Court’s order that summoned Sahara group chief Subrata Roy in an anticipatory bail case completely unrelated to him, the Supreme Court on Thursday said that the HC had exceeded its jurisdiction by asking him to come personally in the cheating case to explain his plan to refund matured deposits to the small investors of his group companies.

A bench led by Justice AM Khanwilkar expressed its displeasure, saying the judge had stepped out of bounds. “This was a case of anticipatory bail of another person. This was also not a PIL. In my limited experience of 22 years as a judge, I can say this order has gone beyond its jurisdiction. (Summoning order), in our opinion, is impermissible and cannot be countenanced,” Justice Khanwilkar observed, adding that the judge had no power to add unrelated third parties in a bail plea.

The apex court had earlier stayed the HC’s orders of February 11 and April 27 against Roy and its firm Sahara Credit Cooperative Societies. Roy or the Sahara Group had no nexus with the original criminal complaint and the Sahara chief was not a party to the cases, his counsel had argued, adding that despite that the HC had issued a summoning order in the “most arbitrary manner”.

The HC directions were issued on various anticipatory bail applications filed in cheating cases committed by non-banking finance companies (NBFCs). More than 600 applications are pending for the release of the matured amount by the Sahara company.

Roy in its appeal had told the apex court that the HC could not have used its powers under Section 438 CrPC to “virtually convert the anticipatory bail proceedings into an omnibus exercise for recovering disputed dues and resolving alleged claims of fraud and cheating involving the public at large in Bihar.”

While the HC had also issued directions to the Reserve Bank of India for creating awareness regarding the functioning of Nidhi companies and also directed registration of a PIL in the alleged fraud by these companies, it had also impleaded Sebi, RoC (Bihar), ministry of corporate affairs, department of economic affairs, etc in these proceedings.

Read the full article

0 notes

Text

Revival in Bank Credit to NBFCs in February 2021

Revival in Bank Credit to NBFCs in February 2021

Introduction:

Bank credit to NBFCs has picked up for the first time during FY21 in February, indicating a positive impact of RBI’s liquidity measures and less risk aversion at banks. Recovery in lending by Banks to NBFCs is a good signal for both sectors. This process of lending loans by Banking to NBFCs is also called Shadow Banking.

Key Role of NBFCs in improving Credit Growth through…

View On WordPress

#bank credit to NBFCs in February#Debt Exposure of Mutual Funds to NBFCs#Fall in Debt Exposure of Mutual Fund to NBFCs#Improving Exposure of Banks#Investment into Corporate Bonds of NBFCs#Key Drivers of Pick up in NBFC Lending#Key Role of NBFCs in improving Credit Growth through Different Lending Models:#Outstanding Investments in Commercial Papers of NBFCs#Recovery in Bank Credit to NBFC#Revival in Bank Credit to NBFCs in February 2021

0 notes

Text

Counting the zeros of 2,00,00,00,00,00,000 in 2020.

The ‘fiscal stimulus’ package of nearly ₹20 lakh crore that was announced on May 12th, by our honourable Prime Minister, is not actually as relieving as it sounds. There will be nothing wrong if I say that the package is transcendent for the ‘Headline Management’ rather than crisis management and it was all about marginalising the screen time of migrant labour distress. It should be kept in mind that the Union budget for year 2020-21 was ₹30.4 lakh crores (to be very precise ₹30,42,230 crores), which is approx. 15% of the GDP of the country. Total GDP of India is ₹190.54 lakh crores (US$ 3.2 trillion)

Last year central government announced a package of ₹100 lakh crores for infrastructure development projects. Now the question arises that if the last years budget of the government was ₹30.4 lakh crore, then how can it announce a package of worth ₹100 lakh crores? Well, “la risposta si trova qui!” (the answer is here!)

In that package the total budget expenditure of the government (in simple term — engagement of govt. money) was only about ₹7,000-8,000 crores and the remaining amount was to be financed to infrastructure companies by banks as loans. The banks didn’t financed the infrastructure projects because they found that many of the infrastructure companies were already running in huge losses and were turning into NPA’s. As a result, that package halted there only.

Structure of the so-called 20 lakh crores package (as per announced by govt.) —

March 26th, 2020 - ₹1.92 lakh crores

May 06th, 2020 - ₹8.1 lakh crores (by RBI)

May 13th, 2020 - ₹5.94 lakh crores

May 14th, 2020 - ₹3.10 lakh crores

May 15th, 2020 - ₹1.5 lakh crores

May 16th, 2020 - ₹81,000 crores

May 17th, 2020 - ₹40,000 crores

The fact here to be remembered is that - ‘currently we need to restart our economy, not to stimulate it.’ Stimulation is provided when a running economy is going through a slowdown. Presently, we are at 0% growth where all the business enterprises were fully shut since more than 50 days. A slowdown could be stimulated, but not breakdown.

There are three kinds of packages —

Fiscal package - expenditures from the government's earnings for public in form of tax subsidies, direct transfers and injecting funds directly in the economy.

Financial package - government asks banks to provide finance to citizens for boosting economy by liberalising rules for loans or sometimes acting as a guarantor to banks.

Monetary package - RBI decides to infuse liquidity in the economy by reducing repo rate**, so banks can provide loans to public at lower interest rates.

A ‘financial package’ can’t be termed as ‘stimulus’ package because the process of granting a loan entirely depends upon the bank, it is a transaction between a bank and the applicant. Government here, can only be a facilitator among both. Whether bank will sanction/provide a loan or not, depends fully upon the credibility of that applicant.

On May 13th, finance minister Nirmala Sitharaman announced that ₹3.7 lakh crores from the total package of ₹20 lakh crores, would be provided to MSME (Micro, Small and Medium Enterprise) sector as debt finance (loans), guaranteed by the central government. She also added that a 12 month moratorium period will be provided to Small Enterprises.

It must be committed to the memory that — ‘moratorium’ will only be for the principal amount but the interest calculated by banks would be on a ‘compounding’ basis. Compounded calculations of interest for 12 months for a Small Enterprise is not an easy play, where interest rates would be decided by the banks. This package was entirely dependent on the sole discretion of banks, whether to provide loans or not and also upon the enterprise’s willingness to take up a loan. The entire focus of this package is only upon — loan, loan, cheap loan, MSME loan and loan. People are being pushed to a system which is entirely based upon the ‘debt/credit finance’.

Post 9 to 12 months scenario due to this package :

After the period of about one year, we might experience that a majority of depositors will be seen, whose deposits will get eroded in terms of interest. They will not even be getting as much returns as their cost of living or inflation would have been. SBI had reduced its interest rates on the fixed deposits thrice, in the last 4 months.

Indian banks who were already trapped in a web of bad debts will be groaning, because of distribution of these new loans. It is also possible that we may experience a completely new explosive form of debt crisis.

There is also a possibility of bank loan scams making a comeback in the Indian economy on an extensive scale because of political interference for compelling banks to provide loans to the dear ones or relatives of the politicians.

Till February 2020, Indian banks were already burdened with NPA’s of ₹9.9 lakh crores, and government was pressurising them for not sanctioning any more loans because of the growing numbers of NPA’s & frauds. Government was telling banks to clear their balance sheets by various means — bankruptcy code, writing off loans, putting provision funds for bad debts, creating bad banks etc. India’s major pre COVID economic highlights were only about ‘troubles of the banking sector’.

Just with the outbreak of COVID-19, the very first steps took by the RBI were — releasing liquidity of ₹4 lakh crores to banks to provide economic stimulus to various sectors as loans and, reducing the repo rate from 5.15% to 4.40% (cutting it by 75bps), it was the lowest in the history of the Reserve Bank of India. As a result, all the retail loans also hit the record low (in rates and demand), ever since 2009. Finance Minister admitted that banks are sanctioning loans but consumers are not willing to take them. Even one-third amount of the funds that RBI released for various sectors (Mutual Funds, NBFC’s, DISCOMs) were not used by the banks.

On May 4th, 2020, banks returned ₹8.54 lakh crores to the RBI via ‘reverse repo’ window. So, the RBI slashed reverse repo rate window because of this. On this event, FM Nirmala Sitharaman told that banks are not distributing loans and are keeping funds with the RBI. The banks were provisioning funds for future balancing for NPA’s and moratoriums, amid this, the RBI announced that it will not provide any dividends for the current year. Banks were calculating the losses that they had to bear in the coming year due to bad loans & NPA’s.

Suddenly, out of the way, May 12th, 2020 on 20:20hrs, a relief package of ₹20 lakh crores descended, and was announced with idea of “AatmaNirbhar Bharat” (Self-reliant India) by the PM Narendra Modi and was quoted as — “20 lakh crore in 2020”.

The basic default rate in India is close to 15%. So, if we calculate the maximum risk on the government for MSME sector package of ₹3.70 lakh crores, it will be around ₹15,000 - ₹20,000 crores. That also on a condition — ‘if’ these loans will get disbursed and get default, then only these would be repaid from the government treasury. The intent of government was not clear on emphasis to provide new loans to the bad MSME’s which are already in default and running in losses.

The contradiction and ridiculousness —

Just before a month from now (in April 2020), the government was directing banks to pause recoveries/provide moratoriums for a period of 3 months to the people and industries because they hadn’t performed any business operations as everything was completely closed due to the nationwide lockdown. And now (May 2020), the government is telling for those same industries, to take up a new loan to restart their business operations. It is quite obvious in nature that any enterprise will primarily focus to repay the existing/ongoing loans rather than taking up a new one.

The total amount of loans distributed in the Indian Banking System (IBS) is nearly ₹93.8 lakh crores, in this, ₹56 lakh crores is distributed to large industries, ₹11.8 lakh crores to agriculture industry and ₹26 lakh crores are personal/other retail loans including loans to small industries. The small industries for whom the package of ₹3.7 lakh crores was announced, are the industries that are already in debts of ₹10 lakh crores.

Till February 2020, these small industries were requesting the governments for restructuring of their loans and stop recoveries as they were going through a very bad phase due to the slowdown, since 2 years. Now the question is, Why the enterprises who were unable to repay their existing loans and demanding for restructuring of their loans in normal days, would take a new loan in a juncture when there is total ‘uncertainty’ for demands and supplies? Many industrial reports had caveated that a large number of defaults in retail loans will take place in the coming 6-9 months because of the unemployment occurred and occurring during & after the lockdown. The major problem of the Indian economy before the COVID-19 was only the debt-crisis — the debts in company’s accounts, debts in bank’s accounts, debts in state and central government’s accounts, and when the people were already struggling hard to get rid of the debt cycle; they suddenly are being sent back to a system where they should be going to take up another new debt, due to COVID-19 crisis. At last, I would conclude myself with the famous lines of the scholar ‘Nassim Nicholas Taleb’, — “The solution for a debt-crisis in any economy, cannot be a new debt”.

- M. YASHPAL

1 note

·

View note

Text

CGTMSE scheme FAQs

The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) is a trust inaugurated by the Ministry of Micro, Small and Medium Enterprises, Government of India, and the Small Industries Development Bank of India (SIDBI). Launched on 30 August 2000, the main purpose of the CGTMSE scheme is to provide credit guarantees to financial institutions that grant loans to SMEs and Memes.

What is CGTMSE Meaning?

The basic purpose of CGTMSE is to encourage first-time entrepreneurs to build SME and MEME, estimated to be the support of the Indian economy by availing collateral-free loans from qualified financial institutions. The guarantee includes default by the borrower to repay the advance. Thus, the CGTMSE scheme essentially considers the requirement of loans to first-generation administrators so that they can flourish in a competitive environment without the burden of security or third-party guarantees. In turn, the financial institutions are given cover for the lack of security to fund SMEs and Memes promoted by small Indian businessmen up to a certain limit.

CGTMSE – A Driving Force for MSMEs

What is CGTMSE Fees?

The fees charged by the trust fund is of 1% p.a of the amount so approved:

1. 0.75% – for loan of up to Rs. 5 Lac

2. 0.85% for loans above Rs. 5 Lac but up to Rs. 100 Lac.

The credit guarantee available below this scheme is 75/80% of the amount so transmitted to a maximum cap of Rs. 62.5 Lac / 65 Lac for a loan facility of up to Rs. 50 Lac. The percentage guarantee implies 85% for micro-enterprises for a sum of up to Rs. 5 Lac. The percentage of guarantee is 50% of the amount so approved for a credit of above Rs. 50 Lac with a maximum limit of Rs. 100 Lac. The ownership of the guarantee is a block of 5 years.

Does CGTMSE cover retail trade?

CGTMSE Coverage extended to Retail Trade & Collateral Loans too – Now Retail Trades & partial collateral loans may be included under Credit Guarantee Scheme of CGTMSE. A decision in this opinion was taken under “Rebooting CGTMSE” established by the Ministry of MSME and CGTMSE on February 20, 2018.

Following modifications were suggested for implementation:

1. Charging Annual Guarantee Fees (AGF) on Outstanding Loan Amount somewhat than sanction amount.

2. Extending the Coverage of the Credit Guarantee Scheme (CGS) to cover the MSE Retail Traders section.

3. Providing loans with Partial Collateral Security “Hybrid Security” under Credit Guarantee Scheme.

4. Increase in the extent of guarantee coverage to 75% from existing 50% for proposals above ₹50 Lac.

5. Intensifying IT infrastructure of the Trust to develop operational efficiencies and reduce the turnaround time for claim settlement.

6. Augmentation of the corpus of the Trust from Rs. 2,500 crore to Rs. 7,500 crore

7. To increase coverage of the loans covered under the credit guarantee scheme from Rs. 1 crore to Rs. 2 crore

8. To increase coverage of the credit guarantee scheme for loans being enlarged to micro and small enterprises by NBFCs also.

Understand CGTMSE scheme execution.

What is CGTMSE Loan Interest Rate?

All lenders impose a particular cost to the borrower. The important part of the cost to the borrower is the interest rate for the loan. The majority of the lenders recover CGTMSE loan interest rate that does not exceed 14% PA including the guarantee cover. Most of the time the rate of interest varies as per change in the financial institutions and the facility which is available under CGTMSE.

What is CGTMSE Full form?

The full form of CGTMSE is Credit Guarantee Fund Trust for Micro and Small Enterprises that gives funding to financial institutions to help SMEs and MSMEs.

How to apply for the CGTMSE Scheme?

To apply for a CGTMSE loan, you are required to set up a business plan including business model, projected goal, etc., and obtain certain business documents if you have just registered your business. Once you have all the essential documents and business plans prepared by a professional, you can apply for the loan with eligible moneylenders. They will analyse your business model and application. If the bank is satisfied, it will process the request to CGTMSE for getting a guarantee cover and confirm the loan amount after CGTMSE approves your application and you pay CGTMSE loan fees.

It reaches out even to the rural areas. The application can be made particularly if the applicant is eligible for a loan under the CGTMSE scheme.

How does Terkar Capital help in getting CGTMSE Exposure?

For many years Terkar Capital has worked extensively and exclusively for raising the finances for the businesses. With respect to the company and its financials we arrange the source of the funding for the companies. And CGTMSE loan is among them. There are many financial facts, figures that need to be considered before one shall proceed on the CGTMSE. We analyse the financials, business and arrange the whole execution with the best suits facility under CGTMSE.

0 notes

Text

Developers want Budget to ease liquidity, make changes in GST

A few months back, the GST Council decided that homes priced up to Rs 45 lakh and with a carpet area of up to 60 square metres in metros and 90 square metres in non-metro cities will be counted in the affordable segment.

New Delhi, June 12 (IANS) As the new Finance Minister Nirmala Sitharaman presents the Union Budget for the fiscal 2019-20 on July 5, the real estate players want the Budget document to feature steps to improve the liquidity situation with a proposal to re-introduce Input Tax Credit (ITC) for under-construction properties.

In their pre-Budget memorandum, the real estate sector has said that stamp duty should be subsumed in the Goods and Services Tax and the government should come out with measures to ease the liquidity condition.

Removal of the Rs 40 lakh price cap for affordable housing, introduced in the interim budget in February, is also in their wish list.

Summing up the situation in the realty sector, Parth Mehta, MD, Paradigm Realty pointed out key concerns: “There are four factors — increasing input cost due to abolishment of ITC and exorbitant development premiums, excruciating liquidity crisis due to NBFC defaults and rising NPAs of banks, and piling up of unsold inventory due to weak consumer sentiment on back of high unemployment.”

He said choking of liquidity is taking a toll on the health of companies and further inflicting financial damage.

“Quick corrective steps should be undertaken by apex bodies and government to pump in enough liquidity into the system,” said Niranjan Hiranandani, President of the National Real Estate Development Council (NAREDCO) on Wednesday.

He said expectation from the Budget is in the form of rationalisation of taxes by subsuming stamp duty in the GST, extending Input Tax Credit to the commercial segment, reducing corporate tax, abolishing MAT to provide thrust to SEZ developments.

“Another most imperative expectation is to frame National Rental Housing Policy,” said Hiranandani.

Realty players also want the Input Tax Credit (ITC) to be re-introduced in the under-construction segmentas as its removal has eaten into their profit margins.

In February 2019, the GST Council lowered tax on the under-construction properties to 5 per cent from 18 per cent, and affordable housing projects to 1 per cent from 8 per cent, with effect from April 1. The rate cut, in effect, did away with the ITC or refund given to builders on taxes paid on inputs.

Subsuming of stamp duty in GST is another major demand of developers. “It is important that government includes stamp duty in the GST purview to boost the demand for housing, thus enabling absorption of high unsold inventory across metros,” Mehta said.

On the price cap for the affordable segment, sector players say the price limit of Rs 45 lakh for classification under affordable housing does not fit in cities like Delhi and Mumbai where the land cost is very high. They want relaxation from the government in the definition of affordable housing.

A few months back, the GST Council decided that homes priced up to Rs 45 lakh and with a carpet area of up to 60 square metres in metros and 90 square metres in non-metro cities will be counted in the affordable segment.

Earlier the definition of affordable housing consisted only of the carpet area limit of 60 square metres and 90 square metres.

Single-window clearance and industry status for the entire real estate sector, two of the long-standing demands of developers, also feature in their wishlist.

Honey Katiyal, founder and CEO of Investors Clinic, said there are still some untouched issues to be addressed in the upcoming Budget. “The important among them are banks and NBFCs funding norms, single-window clearance for all the approvals to reduce project timelines, digital shift for efficient performance and grant of ‘industry’ status to attract equity investment,” Katiyal said.

Shishir Baijal, Chairman and Managing Director, Knight Frank India, said the government should consider providing industry status to the real estate which would enable developers to raise funds at lower rates and augment their execution capabilities.

Further, under the ambit of affordable housing, the government can enhance the eligibility for CLSS (Credit Linked Subsidy Scheme) and GST rate benefits for a larger section of consumers in urban centres, he added.

Baijal also emphasised the need to push for ‘real estate investment trusts (REITs)’.

“While the government has taken measures to provide fiscal incentives in earlier budgets, we have seen only one REITs listing so far. The government can further push the REITS agenda by reducing the timelines of investment from 3 years to 1 year for capital gains taxation, which will ensure larger retail investor participation,” said Baijal.

Rahul Grover, President, Sales and Operation at Sai Estate Consultant said: “We hope that policies which will be introduced in Budget 2019-20 will lead to hastening the one-window clearances for high-rise projects and influence developers resulting in higher rating in LEED (Leadership in Energy and Environmental Design) certifications.”

This article was originally published in English www.wefornews.com

All rights reserved. Any act of copying, reproducing, or distributing this newsletter whether wholly or in part, for any purpose without the permission of Amit B Wadhwani is strictly prohibited and shall be deemed to be copyright infringement

0 notes

Text

Non-food credit growth rises to 6.61% in February

Non-food credit growth rises to 6.61% in February

Growth in bank credit to NBFCs slumped to 8% in December 2020, as against a growth of 28% a year ago.

The increase in non-food credit improved in February, rising to 6.61% year-on-year (y-o-y) for the fortnight ended February 12, up from 5.92% in the previous fortnight.

As on February 12, outstanding non-food credit stood at Rs 106.28 lakh crore, showed data released by the Reserve Bank of India…

View On WordPress

0 notes

Text

Non-food credit growth rises to 6.61% in February

Non-food credit growth rises to 6.61% in February

Growth in bank credit to NBFCs slumped to 8% in December 2020, as against a growth of 28% a year ago.

The increase in non-food credit improved in February, rising to 6.61% year-on-year (y-o-y) for the fortnight ended February 12, up from 5.92% in the previous fortnight.

As on February 12, outstanding non-food credit stood at Rs 106.28 lakh crore, showed data released by the Reserve Bank of India…

View On WordPress

0 notes

Text

Note On One-Time Restructuring

The economic impact of the COVID-19 pandemic has created significant stress on the liquidity and overall financial position of business especially those which have a borrowing from banks, NBFCs and other financial institutions. The cashflow mismatches created to the subdued business activity over the last six months and the possibility of the same not recovering in the immediate future would lead to the increasing rate of defaults by even otherwise viable and sustainable businesses. The moratorium provided over the last six months, viz the period covering the lockdown phase in the country comes to an end in the current month and there was a need for addressing the issue of cash flow mismatch by a more sustainable and long term solution. There was a long-standing demand from the industry for RBI to announce a One-Time Restructuring of the loans to give much-needed relief, clarity and long-term sustainable support to the businesses. The RBI announced a framework to permit restructuring of the stressed accounts of ‘eligible borrowers’ without the account being classified as a Non-Performing Asset (NPA)

What does restructuring essentially mean for any loan?

Restructuring of the loan could mean any or all or any combination of the following:

Extension in the repayment tenure of the loan (by not more than two years)

Granting initial moratorium

Further additional funding

Conversion of debt into equity or any other form of security

Who is an eligible borrower for restructuring under this framework?

The following conditions must be satisfied to be an eligible borrower for restructuring under this framework:

The borrower is under stress on account of COVID-19

The borrower account is classified as ‘Standard’, but not in default for more than 30 days with any lending institution as on 1st March 2020. Further, the accounts should continue to remain standard till the date of invocation

Further,

In case of a single lender:

The borrower and lending institution has agreed to proceed with a resolution plan under this framework not later than December 31, 2020

In case of multiple lenders having exposure to the borrower:

Lending institutions representing 75% by value of the total outstanding credit facilities (fund based as well non-fund based), and not less than 60% by number agree to invoke the resolution under this framework

Resolution under this framework may be invoked on or before 31st December 2020 and must be implemented within 180 days from the date of invocation

The resolution process is implemented when an ICA is signed by all lending institutions within 30 days from the date of invocation

In case lending institutions representing not less than 75% by value of the total outstanding credit facilities (fund based as well non-fund based) and not less than 60% by number, do not sign the ICA within 30 days from the invocation, the invocation will be treated as lapsed. In respect of such borrowers, the resolution process cannot be invoked again under this framework.

Who are specifically excluded (not eligible borrowers) from this framework?

The following borrowers/loans are specifically excluded from this framework:

MSME borrowers whose aggregate exposure to lending institutions cumulatively does not exceed Rs. 25 Crore as on 1st March 2020

Farm Loans

Loans to NBFCs, HFCs, Insurers and other financial service providers

Loans to Primary Agricultural Credit Societies (PACS), Farmers’ Service Societies (FSS) and Large-sized Adivasi Multi-Purpose Societies (LAMPS) for on-lending to agriculture

Loans to Central and State Governments; Local Government bodies

Exposures of Housing Finance Companies

What about stressed MSME accounts having borrowings up to Rs. 25 Crore?

These MSMEs (whose cumulative exposure to banks & NBFCs including fund base and Non-Fund Based does not exceed Rs. 25 Crore as o 31st March 2020) were already covered under an earlier announced scheme of restructuring vide circular dated 11th February 2020.

In view of the continued need to support the viable MSME entities on account of the fallout of Covid19, the RBI has been decided to extend the scheme under the aforementioned circular whereby restructuring of the borrower account may now have to be implemented by 31st March 2021. However, the following conditions should be met:

The MSME should have been classified as ‘standard asset’ as on 1st March 2020 and

It should have obtained GST registration unless it is exempt from obtaining the GST registration

All other conditions under circular dated 11th February 2020 would be applicable

Are there any other requirements/compliances/approvals required?

In addition to the conditions set out to be an eligible borrower the following additional conditions are to be met in case of exposures above specific thresholds:

In respect of accounts where the aggregate exposure at the time of invocation of the resolution process is Rs. 100 Crore and above, an independent credit evaluation (ICE) by anyone credit rating agency (CRA) authorized by the Reserve Bank needs to be obtained

In respect of accounts where the aggregate exposure of the lending institutions at the time of invocation of the resolution process is Rs. 1,500 Crore and above, an Expert Committee shall vet the resolution plans to be implemented under this window

Further, each lending institution shall frame its own Board approved policies pertaining to the implementation of viable resolution plans for eligible borrowers under this framework

Will the account be treated as NPA due to the restructuring?

The account will continue to be classified as standard and will not be downgraded to NPA so long as the conditions and repayments as outlined in the resolution plan approved under the framework are complied with. Hence there is no classification of NPA just because of the restructuring. This is a key relief provided under this framework.

How does the restructuring impact Financial Institutions?

The restructuring of the loans impacts the profitability, & thereby the capital adequacy ratios leading to reducing capacity to raise further funds, of the Financial Institutions since they are required to create a provision for the restructured loans. The provision required as follows:

In case of personal loans — 10% of the residual loan or provisions held as per the extant IRAC norms immediately before implementation, whichever is higher

For other loans where the lending institution has signed ICA within 30 days of invocation — 10% of the total debt or provisions held as per the extant IRAC norms immediately before implementation, whichever is higher

For other loans where the lending institution has not signed ICA within 30 days of invocation — 20% of the debt on their books as on this date (carrying debt), or the provisions required as per extant IRAC norms, whichever is higher

When can this provision be reversed?

The financial institution may reverse the provisions as follows:

For the Institutions who have signed the ICA within 30 days of invocation:

One half of the provision upon the borrower paying at least 20% of the residual debt without slipping into NPA post-implementation of the plan

Balance upon the borrower paying another 10% of the residual debt without slipping into NPA subsequently

For the Institutions who did not sign the ICA within 30 days of invocation:

One half of the provision upon the borrower paying at least 20% of the carrying debt

Balance upon the borrower paying another 10% of the carrying debt

What happens in case of default by the borrower post the restructuring?

All loans other than the personal loans which are restructured under this framework shall be subject to a monitoring period viz the period starting from the date of implementation of the resolution plan till the borrower pays 10% of the residual debt, subject to a minimum of one year from the commencement of the first payment of interest or principal (whichever is later) on the credit facility with the longest period of moratorium.

During the continuance of the monitoring period if there is any default by the borrower with any of the signatories to the ICA, a review period of 30 days will be triggered. If the borrower is in default with any of the signatories to the ICA at the end of the Review Period, the asset classification of the borrower with all lending institutions, including those who did not sign the ICA, shall be downgraded to NPA from the date of implementation of the resolution plan or the date from which the borrower had been classified as NPA before the implementation of the plan, whichever is earlier.

How can InCorp help you?

Our debt advisory team can help you in understanding the key nuances of debt restructuring and understanding of the scheme. They can help you in exploring different options available to resolve the financial position of your business, evaluating the best course of action for your debt and can also help in planning and executing the entire process end to end.

0 notes

Text

Why Bad Loans Of Banks Won’t Start Piling Right Away?|Personal Loan|EMVertex Credit

Covid-19 will lead to an increase in default of loans taken from banks and non-banking financial companies. Both corporate and individual defaults are expected to increase in the months to come. However, these bad loans will not start piling immediately. Mint explains why.

Why are bad loans expected to go up?

As Stephanie Kelton writes in The Deficit Myth, “Spending is the lifeblood of capitalism. Without it, businesses would have no customers, no sales revenue, and no profits to keep them afloat.” Consumer spending has collapsed over the last few months due to the pandemic. Though lately there have been some signs of revival, it will take a while before spending comes anywhere near the pre-covid level. This will mean that many businesses will start running out of cash pretty soon if they have not already. A company that starts running out of cash will not be in a position to repay its loans and, thus, will ultimately default.

Where do individuals fit in this scenario?

A recent estimate by rating agency Crisil suggests that about 70% of 40,000 companies have cash to cover employee costs for only two quarters. This tells us that companies will fire employees, before, during, or even after defaulting on a loan. If companies do not resort to employee retrenchment, they will cut salaries and many already have. Past payments and future business with vendors and suppliers will be negatively impacted. In this situation, the problem at the company level will impact individuals too. When individuals start having a cash flow problem, it will lead to defaults on retail loans

Why aren’t we seeing loan defaults spiking already?

The Reserve Bank of India has let banks and non-banking financial companies (NBFCs) offer a moratorium on loans. Hence, until the end of August, borrowers have an option to not repay the loans, without it being considered as a default. A moratorium is a deferment of repayment to provide temporary relief to borrowers. The loan ultimately needs to be repaid.

Will bad loans begin to pile up after August?

Analysts at Macquarie Research pointed out in a research note that at present as much as 20-30% of the loans from banks are under a moratorium. They expect that by the end of August when the moratorium ends, about 50% of the loans from banks could be under a moratorium. Hence, any loan defaults will start only after August but they won’t be immediately categorized as a non-performing asset or a bad loan. Bad loans are largely those loans that have not been repaid for 90 days or more.

When will loan defaults be deemed bad loans?

A loan has to be in default for 90 days to be categorized as a bad loan. Hence, defaulted loans will be categorized as bad loans only post-November and this will be revealed when banks publish their results for October to December 2020, in January-February 2021. Even if 20% of loans that end up under a moratorium are defaulted on, the quantum of bad loans, especially those of public sector banks, will go up big time.

Via:Livemint-News

Contact Us

ADDRESS▼200 Jalan Sultan #02-33, Textile Centre Singapore 199018

PHONE▼6291 6868

EMAIL▼[email protected]

FAX▼(65) 6293 9018

WORKING HOURS▼Monday – Saturday : 11am – 7pm

Request immediately: EMVertex Credit

#personal loan#renovation loan#money lenders#personal loans#moneylenders#emvertexcredit#moneylender#wedding loan#EMVERTEX#marriage loan#money lender

0 notes

Link

Select businesses will be offered pre-approved loans as part of the government's Rs 3 trillion package for micro, small and medium enterprises announced two weeks ago.

The Guaranteed Emergency Credit Line (GECL) of Rs 3 trillion was announced as part of Rs 21 trillion package by the government.

As per a set of FAQs, GECL is a loan for which 100 per cent guarantee would be provided by National Credit Guarantee Trustee Company to Member Lending Institutions (MLIs) -- banks, financial institutions and NBFCs.

ALSO READ: Coronavirus vaccine update: Importance of Covid-19 drug, current status

The FAQs were issued by National Credit Guarantee Trustee Company (NCGTC).

The loan will be extended in the form of additional working capital term loan facility in case of banks and additional termloan facility in case of NBFCs to eligible MSMEs/ business enterprises and interested Pradhan Mantri Mudra Yojana (PMMY) borrowers.

The Frequently Asked Questions (FAQs) said the scheme is a specific response to the unprecedented situation created by Covid-19.

It seeks to provide much-needed relief to the MSME sector by incentivising lending institutions to provide additional credit of up to Rs 3 trillion at low cost, thereby enabling MSMEs to meet their operational liabilities and restart their businesses.

ALSO READ: People rush to buy alcohol as Kerala introduces virtual queue via apps

"This is a pre-approved loan. An offer will go out from the MLI to the eligible borrowers for a pre-approved loan which the borrower may choose to accept. If the MSME accepts the offer, it will be required to complete requisite documentation," it said.

An 'opt-out' option will be provided to eligible borrowers and if a borrower is not interested in availing the loan, he/she may indicate accordingly.

Interest rates under the scheme have been capped at 9.25 per cent for banks and financial institutions, and at 14 per cent for NBFCs. The tenor of loans provided under GECL will be four years and there will be no pre-payment penalty.

Also, a moratorium period of one year on the principal amount will be provided for GECL funding.

Interest shall, however, be payable during the moratorium period, the FAQs said. The principal will have to be repaid in 36 instalments after the moratorium period is over.

All MSME borrower accounts with combined outstanding loans across all lending institutions of up to Rs 25 crore as on February 29, 2020, and an annual turnover of up to Rs 100 crore in 2019-20 are eligible to avail the benefit under the scheme.

The scheme also covers loans under PMMY extended on or before February 29, 2020, and reported on the MUDRA portal.

ALSO READ: Attractive valuations, short covering: Why Nifty Bank gained 12% in 2 days

Meanwhile, traders body CAIT has demanded that the scope of the scheme be widened to include all traders and not only those who are existing borrowers.

It said the Covid-19 lockdown has seriously hurt the retail businessmen and traders.

"Over the past 60 days, the losses recorded and estimated have been over Rs 9 trillion," said the Confederation of All India Traders (CAIT) in a release.

CAIT estimates that before the pandemic struck, retail businesses had a daily turnover of over Rs 15,000 crore. It expressed apprehensions that as losses are going to mount and revival becoming difficult, "about 20 per cent of Indian traders are likely to shut shop permanently".

0 notes

Text

Finance Minister announces measures for relief and credit support related to businesses, especially MSMEs to support Indian Economy’s fight against COVID-19

Rs 3 lakh crore Emergency Working Capital Facility for Businesses, including MSMEsRs 20,000 crore Subordinate Debt for Stressed MSMEsRs 50,000 crore equity infusion through MSME Fund of FundsNew Definition of MSME and other Measures for MSMENo Global tenders for Government tenders of uptoRs 200 croreExtending the Employees Provident Fund Support for business and organised workers for another 3 months for salary months of June, July and August 2020EPF Contribution to be reduced for Employers and Employees for 3 months to 10% from 12% for all establishments covered by EPFO for next 3 monthsRs. 30,000 crore Special Liquidity Scheme for NBFC/HFC/MFIsRs. 45,000 crore Partial credit guarantee Scheme 2.0 for Liabilities of NBFCs/MFIsRs 90,000 crore Liquidity Injection for DISCOMsRelief to Contractors given by extension of up to six months for completion of contractual obligations, including in respect of EPC and concession agreementsRelief to Real Estate Projects the registration and completion date for all registered projects will be extended up to six months. Tax relief to business as pending income tax refunds to charitable trusts and non-corporate businesses and professions to be issued immediatelyReduction in Rates of ‘Tax Deduction at Source’ and ‘Tax Collected at Source” by 25% for the remaining period of FY 20-21Due Dates for various tax relatedcompliances extended

Following measures were announced on 13/05/20 to relief and credit support related to MSMEs, EPF, NBFCs, housing finance corporations, MFIs, discoms, contractors, real estate and Tax

Rs 3 lakh crore Emergency Working Capital Facility for Businesses, including MSMEs

To provide relief to the business, additional working capital finance of 20% of the outstanding credit as on 29 February 2020, in the form of a Term Loan at a concessional rate of interest will be provided. This will be available to units with upto Rs 25 crore outstanding and turnover of up to Rs 100 crore whose accounts are standard. The units will not have to provide any guarantee or collateral of their own. The amount will be 100% guaranteed by the Government of India providing a total liquidity of Rs. 3.0 lakh crores to more than 45 lakh MSMEs.

Rs 20,000 crore Subordinate Debt for Stressed MSMEs

Provision made for Rs. 20,000 cr subordinate debt for two lakh MSMEs which are NPA or are stressed. Government will support them with Rs. 4,000 Cr. to Credit Guarantee Trust for Micro and Small enterprises (CGTMSE). Banks are expected to provide the subordinate-debt to promoters of such MSMEs equal to 15% of his existing stake in the unit subject to a maximum of Rs 75 lakhs.

Rs 50,000 crores equity infusion through MSME Fund of Funds

Govt will set up a Fund of Funds with a corpus of Rs 10,000 crore that will provide equity funding support for MSMEs. The Fund of Funds shall be operated through a Mother and a few Daughter funds. It is expected that with leverage of 1:4 at the level of daughter funds, the Fund of Funds will be able to mobilise equity of about Rs 50,000 crores.

New definition of MSME

Definition of MSME will be revised by raising the Investment limit. An additional criteria of turnover also being introduced. The distinction between manufacturing and service sector will also be eliminated.

Other Measures for MSME

e-market linkage for MSMEs will be promoted to act as a replacement for trade fairs and exhibitions. MSME receivables from Government and CPSEs will be released in 45 days

No Global tenders for Government tenders of up to Rs 200 crores.

General Financial Rules (GFR) of the Government will be amended to disallow global tender enquiries in procurement of Goods and Services of value of less than Rs 200 crores

Employees Provident Fund Support for business and organised workers

The scheme introduced as part of PMGKP under which Government of India contributes 12% of salary each on behalf of both employer and employee to EPF will be extended by another 3 months for salary months of June, July and August 2020. Total benefits accrued is about Rs 2500 crores to 72.22 lakh employees.

EPF Contribution to be reduced for Employers and Employees for 3 months

Statutory PF contribution of both employer and employee reduced to 10% each from existing 12% each for all establishments covered by EPFO for next 3 months. This will provide liquidity of about Rs.2250 Crore per month.

Rs 30,000 crores Special Liquidity Scheme for NBFC/HFC/MFIs

Government will launch Rs 30,000 crore Special Liquidity Scheme, liquidity being provided by RBI. Investment will be made in primary and secondary market transactions in investment grade debt paper of NBFCs, HFCs and MFIs. This will be 100 percent guaranteed by the Government of India.

Rs 45,000 crores Partial credit guarantee Scheme 2.0 for Liabilities of NBFCs/MFIs

Existing Partial Credit Guarantee scheme is being revamped and now will be extended to cover the borrowings of lower rated NBFCs, HFCs and other Micro Finance Institutions (MFIs). Government of India will provide 20 percent first loss sovereign guarantee to Public Sector Banks.

Rs 90,000 crore Liquidity Injection for DISCOMs

Power Finance Corporation and Rural Electrification Corporation will infuse liquidity in the DISCOMS to the extent of Rs 90000 crores in two equal instalments. This amount will be used by DISCOMS to pay their dues to Transmission and Generation companies. Further, CPSE GENCOs will give a rebate to DISCOMS on the condition that the same is passed on to the final consumers as a relief towards their fixed charges.

Relief to Contractors

All central agencies like Railways, Ministry of Road Transport and Highways and CPWD will give extension of up to 6 months for completion of contractual obligations, including in respect of EPC and concession agreements

Relief to Real Estate Projects

State Governments are being advised to invoke the Force Majeure clause under RERA. The registration and completion date for all registered projects will be extended up to 6 months and may be further extended by another 3 months based on the State’s situation. Various statutory compliances under RERA will also be extended concurrently.

Tax Relief to Business

The pending income tax refunds to charitable trusts and non-corporate businesses and professions including proprietorship, partnership and LLPs and cooperatives shall be issued immediately.

Tax related measures

Reduction in Rates of ‘Tax Deduction at Source’ and ‘Tax Collected at Source” - The TDS rates for all non-salaried payment to residents, and tax collected at source rate will be reduced by 25 percent of the specified rates for the remaining period of FY 20-21.This will provided liquidity to the tune of Rs 50,000 Crore.

The due date of all Income Tax Returns for Assessment Year 2020-21 will be extended to 30 November, 2020. Similarly, tax audit due date will be extended to 31 October 2020.The date for making payment without additional amount under the “Vivad Se Vishwas” scheme will be extended to 31 December, 2020.

For More and to fight COVID19

Read the full article

0 notes

Text

PM Modi meets India Inc heads to discuss the economy

Trade Nivesh Modi has so far met over 60 entrepreneurs and businessmen from sectors such as FMCG, finance, renewable energy, diamond, retail, textiles, MSMEs and startups and technology.

Ahead of the Union Budget presentation, Prime Minister Narendra Modi on January 6 met top executives from corporate India to discuss issues facing the economy and measures needed to boost growth and create jobs.

Richest Indian Mukesh Ambani, Tata group's Ratan Tata, telecom czar Sunil Bharti Mittal, billionaire Gautam Adani, Mahindra Group chairman Anand Mahindra, and mining baron Anil Agarwal were among those who attended the meeting.

Tata Sons chairman N Chandrasekaran, TVS chairman Venu Srinivasan, L&T head AM Naik were also present, according to a photograph of the meeting released here.

Finance Minister Nirmala Sitharaman will present her second Union Budget on February 1 with an eye to reviving growth.

The latest GDP data for the July-September quarter showed a significant further moderation in the pace of economic growth to 4.5 percent - the weakest in six years, with a key contributory factor being a slump in manufacturing output.

The Modi government has undertaken a number of measures to arrest the growth slowdown. In September 2019, it announced a cut in the corporate tax rate to 22 percent from 30 percent. The government also lowered the tax rate for new manufacturing companies to 15 percent to attract new foreign direct investments.

The tax rate reductions bring India in line with rates in other Asian countries.

The government's other initiatives include bank recapitalisation, the mergers of 10 public sector banks into four, support for the auto sector, plans for infrastructure spending, as well as tax benefits for startups.

But experts say none of these measures directly address the widespread weakness in consumption demand, which has been the chief driver of the economy.

Also, financial sector fragilities continue to weigh on the economic growth momentum, with the high level of non-performing loans on the balance-sheets of the public sector banks, constraining their fresh lending.

Furthermore, there are also risks from potential contagion effects from troubled non-bank financial companies (NBFCs) to the balance-sheets of some commercial banks, which could further weigh on the overall pace of credit expansion.

In response to the growth slowdown, the Reserve Bank of India (RBI) has eased policy rates significantly during 2019, with a series of rate cuts since February 2019.