#PPF Calculator

Text

Discover the power of the Public Provident Fund (PPF) and its calculator for secure savings. Plan your future with ease, estimating potential returns and making informed investment decisions. The calculator simplifies complex calculations, empowering goal setting and understanding compound interest. Learn about tax benefits, guaranteed returns, and flexible investment options. Utilize the PPF calculator for different scenarios, finding the right strategy for your financial goals. Start your PPF journey today for a secure financial future.

#investkraft#financial calculators#finance planning#investment#PPF calculator#PPF Interest Rate Calculator#PPF Return Calculator#PPF Interest Rate

1 note

·

View note

Text

#business news in Hindi#How to Get Maximum Interest in PPF#how to maximise PPF interest#How to Maximize PPF Returns#Investment tips#Personal Finance#PPF#PPF benefits#PPF calculator#PPF Interest Calculation#PPF Interest rate#PPF tax benefits#Public Provident Fund#tips for PPF interest#Tips to Earn Maximum Interest on PPF Account#Which is the best month to invest in PPF

0 notes

Text

Calculate Public Provident Fund

PPF Calculator facilitates estimate the ability wealth advantage and adulthood quantity out of your PPF investments. Public Provident Fund is a long time funding cum tax financial savings scheme subsidized through GOI, in which the funding, hobby and adulthood quantity are tax exempted. The modern-day hobby price is 7.1%. Estimate your funding price with the assist of PPF Calculator.

What is PPF?

PPF stands for Public Provident Fund. It has been brought in 1968 for the purpose to mobilize small financial savings into an funding with affordable returns with extra blessings to shop tax. It facilitates one construct a retirement corpus. The modern-day hobby price on PPF is 7.1% compounded annually. PPF is subsidized through the authorities of India and the chance concerned may be very minimum and it gives assured chance-loose returns. Also, it falls beneath Neath EEE popularity because of this that that the quantity invested, hobby earned and adulthood quantity obtained are all tax-loose.

Opening a PPF account

It’s clean to open a PPF account. All one wishes is to publish an software shape together with KYC, cope with proof, identification proof, and signature proof. A PPF account may be opened with a Post Office or every other nationalized banks. Some personal banks also are legal to assist open PPF accounts. Amount invested in PPF account is locked in for 15 years. But there's an choice to withdraw cash from the begin of seven th yr, after finishing 6 years. One can withdraw the quantity as soon as a yr.

Minimum Tenture

PPF has a minimal tenure of 15 years which may be prolonged indefinitely in blocks of five years. Furthermore, the minimal funding in PPF account is Rs. 500 and most is Rs.1,50,000. Investments may be made in lump sum or in a most of 12 installments. Deposits right into a PPF account should be made at the least as soon as a yr for 15 years.

Does PPF Compound Hobby Annually?

The Public Provident Fund scheme is a protracted term-financial savings-cum-tax-saving device added through the National Savings Institute of the Ministry of Finance. The PPF scheme targets at mobilizing small financial savings the various investors.

The Public Provident Fund is beneath Neath the EEE tax class beneath Neath the Income Tax Act. The quantity invested, hobby earned and adulthood fee all are exempt.

Yes, the hobby on public provident budget is compounded annually. The PPF hobby is calculated month-to-month and credited on the stop of the year.

The PPF hobby charge is constant quarterly through the Ministry of Finance, Government of India from April 1st, 2016. The banks provide PPF bills on the hobby charge constant through the Government of India. The contemporary charge of hobby relevant for Q3 FY 2022-23 is 7.10%

The PPF account hobby is calculated and paid on the quantity status within side the investor’s account. The PPF scheme hobby charge is regulated through the Government of India and during the last few years the go back has been witnessing a downtrend.

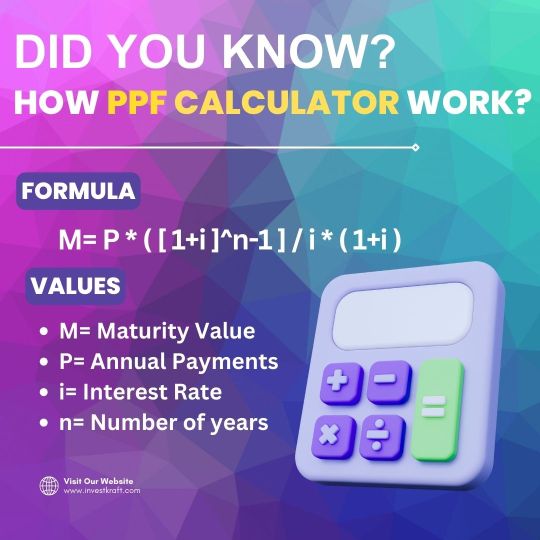

PPF Calculation Formula

The hobby on PPF is calculated on the bottom stability within side the PPF Calculator account among the fifth day and the stop of the month.

If an investor deposits an quantity earlier than the fifth of every month, the investor gets hobby for that month on that deposit. Otherwise, the hobby is calculated at the preceding stability within side the PPF account

If an investor is making an investment in PPF month-to-month, then making an investment earlier than fifth or after fifth could have a marginal impact at the PPF hobby of some hundred rupees.

If an investor is making an investment in a PPF scheme in a lump sum consistent with year, then make investments earlier than the fifth of April. The hobby earned could be on greater stability for the month of Apr.

Public Provident Fund Calculation Formula

The formulation for calculating anticipated hobby and the adulthood fee is given below:

A = P [(-1)/i]

Where,

A is the adulthood quantity

P is the foremost quantity invested within side the PPF account

I is the anticipated hobby charge of go back on PPF scheme

N is the tenure for that is the quantity is invested in PPF scheme

From the above formulation we are able to finish that the go back could be better for a better funding period.

#ppf#ppf calculator#ppf account calculator#ppf interest rate calculator#ppf return calculator#ppf maturity calculator#ppf interest calculator#public provident fund calculator

0 notes

Text

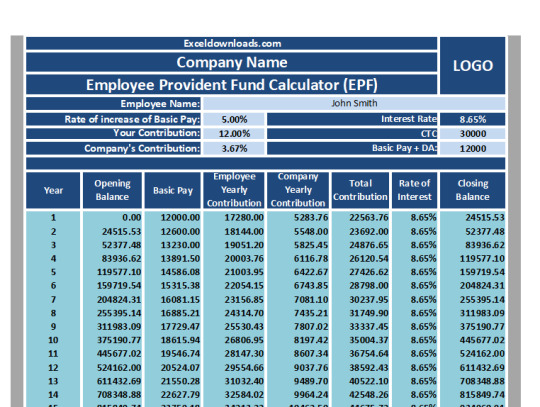

Provident Fund Calculator

Download ready to use and easy to customize provident fund calculator relevant for Financial Year 2022, Financial Year 2023, Financial Year 2024 etc. This template is useful for employees, HR Personnel, business managers and other professionals to compute provident fund, contributions, interest and closing balances.

These calculations are based on EPF and MP (Employee Provident Fund and…

View On WordPress

#calculate pf in excel#calculation to generate provident fund challan#download free excel template#employee provident fund#epf calculator#epf calculator excel#epf excel calculator#Excel Template#free excel template#general provident fund calculator#general provident fund calculator in excel sheet#how to calculate provident fund#pf excel calculator#ppf calculator#provident fund#provident fund calculation#provident fund calculator#public provident fund#public provident fund excel file calculator

0 notes

Text

India Post PPF Calculator करोड़पति बनाने वाली स्कीम, मिलेगा 100% रिटर्न

India Post PPF Calculator करोड़पति बनाने वाली स्कीम, मिलेगा 100% रिटर्न

इंडिया पोस्ट पीपीएफ कैलकुलेटर: India Post PPF Calculator सार्वजनिक भविष्य निधि के लिए लघु बचत योजना को क्या करना चाहिए? (सामान्य भविष्य निधि) यानी जो निवेशक लंबी अवधि के लिए निवेश करना चाहते हैं, उनके लिए PPF बेस्ट प्लान है! 15 साल की परिपक्वता के साथ, यह लंबी अवधि के निवेश को प्रोत्साहित करता है! साथ ही इस पर मिलने वाला ब्याज अन्य सभी योजनाओं से बेहतर है! Post Office PPF (Post Office PPF) सरकार…

View On WordPress

0 notes

Text

Check Latest PPF Calculator Online in India at 5paisa

The online PPF calculator determines PPF like maturity, returns and withdrawal of your Public Provident Fund investment. Check the complete PPF calculator at 5paisa!

0 notes

Text

Everything you need to know about PPF

A Public Provident Fund is a type of financial product that enables its user to accumulate an amount of money sufficient to be paid at maturity together with interest. The National Savings Institute of the Ministry of Finance launched the PPF plan in 1968 with the goal of enabling consumers to save money annually in order to create a retirement corpus. In other words, a PPF is a long-term investment vehicle that can also be used to save money and reduce taxes.

PPF, also known as the Public Provident Fund, is one of the most well-liked investment options in India. The popularity of PPF can be attributed to a number of factors, including guaranteed returns, tax advantages on the amount invested, and tax-free returns.

However, despite the fact that millions of Indians invest in PPFs to pursue long-term financial objectives, some features of this tax-saving strategy are not fully understood.

There is much more to discover about PPF, including its advantages, withdrawal policies, and other specifics. Let's discuss it in more depth.

What is PPF or Public Provident Fund?

The Public Provident Fund, or PPF, enables a person to set aside a portion of their income each year to develop a retirement corpus while earning competitive interest on the money deposited and benefiting from tax advantages. The PPF was established to promote saving, especially among those who are not members of an Employee Provident Fund Organization (EPFO).

PPF offers a current annual compound interest rate of 7.1 percent. Additionally, the PPF scheme offers a threefold tax benefit because, in accordance with Section 80C of the IT Act, contributions made to the scheme up to a maximum of Rs. 1.5 lakhs, interest received on those deposits, and maturity amounts are all tax-free.

Let's examine the PPF account's characteristics:

What are the Features of PPF or Public Provident Fund?

Interest rates

The PPF account currently offers an interest rate of 7.1 percent compounded annually.

The interest rate is calculated each month on the lower PPF balance in the account from the fifth of every month to the last day of the month.

The interest rate of the PPF account is regulated quarterly by the government of India.

You should deposit money into your PPF account by the fifth of every month.

Lock-in period

A PPF's minimum lock-in duration is 15 years;

After 15 years, a PPF account holder can withdraw the entire corpus amount;

Even if no further contributions are made, a PPF account holder can keep the money invested there for a longer period of time.

Following the 15-year lock-in period, there are no restrictions on keeping the amount invested in the fund.

Premature withdrawals are allowed, but only when absolutely necessary. In these situations, the required paperwork and information must be provided.

Investments

Investors must put down a minimum of Rs. 500.

The PPF account can only accept deposits of up to Rs. 1.5 lakh every fiscal year.

Contributions above Rs. 1.5 lakh would be immediately refused.

Deposits may be made online, by demand draught, check, or cash.

Nomination

There is no nomination option for PPF accounts for children.

A PPF account holder may designate more than one beneficiary.

When designating a person or more than one person, the proportion of share for all nominees must be indicated.

The loan is available between the third and sixth financial year of opening the account.

A 2 percent annual interest rate is applied to the loan amount.

The principal amount must be repaid first, within 36 months starting on the first day of the month following the month in which the loan was taken.

The principal amount can be paid in a lump sum or in two or more monthly installments.

If the principal balance is not repaid within 36 months, there will be a 6% annual interest charge.

Who can open a PPF account?

The following people are eligible to open a PPF account:

PPF accounts are exclusively available to Indian citizens. Indian citizens who live abroad may still manage their PPF accounts.

Parents or legal guardians may open PPF accounts on behalf of their minor children.

It should be reminded that opening joint or multiple accounts is not allowed.

How to open a PPF account?

There are two ways to open a PPF account- Online and Offline

Open PPF account offline

Enter any bank.

Contact a bank representative to open a PPF account.

Fill out the form, provide the necessary paperwork, and deposit the appropriate amount.

The PPF account will be opened following verification.

The only option for a person to open a PPF account is through a bank, although the funds will still go to the government rather than that particular bank.

Open PPF account online

You can open a PPF account online with certain banks. The following are the procedures to open a PPF account using the bank's online banking service; however, these stages may vary from one bank to the next:

Log in to the bank's internet banking system. Look for the option to open a PPF account.

Choose between a self-account and a minor account.

Complete the form with all the necessary information

Your desired deposit amount should be entered.

Check the instructions to determine whether the bank should take the money out in a lump sum or at regular periods.

To complete the verification process, get the OTP.

What are the Limitations of the PPF Account?

A PPF account has a lot of advantages. It still has the following restrictions, though:

The PPF does not offer competitive interest rates, such accounts cannot be held jointly, and an individual is only allowed to contribute Rs. 1.5 lakh to his or her PPF account.

PPF accounts have a 15-year lock-in period, which is inconvenient if there is an emergency or if someone needs to meet financial obligations.

PPF accounts can only be opened by Indian citizens.

NRIs are not eligible to open such accounts.

Any sum over that will be automatically rejected.

After opening, a PPF account cannot be closed for five years. Only if the account holder, his or her spouse, or children have a condition that poses a serious risk to their lives may the PPF account be closed. To support such assertions, supporting documentation is also necessary.

Conclusion

PPF accounts are a fantastic choice for investments because they let one create a bonus corpus. It is best to educate yourself on everything there is to know about PPFs, including their advantages, restrictions, deposit requirements, etc., before making a contribution.

The popularity of Public Provident Fund in India has historically been fueled by the benefits of both assured returns and tax savings. The PPF account is one of the most well-liked tax-saving investment alternatives in India, despite the fact that the ongoing decrease in interest rates has encouraged many to look for alternative investments.

#PPF interest rate#PPF calculator#PPF return#PPF interest rate calculator#PPF interest#PPF interest rate in future#PPF investment#ppf#how to open ppf account#eligibility of ppf account#ppf account opening process

0 notes

Text

PPF Calculator - Calculate Maturity Amount to be Earned on Investment | HDFC Bank

The Public provident fund calculator allows you calculate the maturity amount to be earned on your investment. Enjoy digital banking offers & deals with HDFC Bank.

1 note

·

View note

Text

Unlock the power of long-term savings with the SBI PPF Calculator. This user-friendly tool helps you efficiently plan your Public Provident Fund investments with the State Bank of India.

Get accurate projections of your PPF contributions, interest earnings, and maturity values. Ideal for savvy investors seeking a reliable way to build a substantial financial nest egg. Plan, project, and prosper with our SBI PPF Calculator!

1 note

·

View note

Link

Public Provident Fund (PPF), is a risk-free small saving scheme which is backed by the Government itself. It is assured to provide a large corpus of accumulated funds with interest amounts to its investor after the maturity period. PPF account holders are also eligible to get tax deductions on contributions as well as interest earned … The post Look At This PPF Calculation To Get ₹2.27 Cr With Monthly Savings appeared first on Viral Bake.

0 notes

Link

0 notes

Text

जानिए क्या है PPF Fund | What is Public Provident Fund In Hindi

जानिए क्या है PPF Fund | What is Public Provident Fund In Hindi

नमस्कार दोस्तो, तो दोस्तों आज हम जानेंगे What is PPF Fund In Hindi,Details of public provident fund, withdrawal from public provident fund,public provident fund post office interest rate, Ppf की फुल फॉर्म है ‘public provident fund’। यह भी अन्य प्रकार के बैंक अकाउंट की ही तरह एक अकाउंट है जिसमे की आप थोड़े थोड़े करके पैसे जमा कर सकते हैं और इसकी अवधि पूरी होने पर यह आपको सारे पैसे ब्याज सहित एक…

View On WordPress

#details of public provident fund#PPF#public provident fund calculator icici#public provident fund calculator in post office#public provident fund interest rate#rules of public provident fund#withdrawal from public provident fund

0 notes

Text

Where Can I Find a Reliable Online PPF Calculator?

If you're looking for a trustworthy online PPF calculator, Investkraft's website is an excellent place to start. Investkraft is renowned for providing reliable financial tools and resources, including their user-friendly PPF calculator. This online tool allows you to accurately calculate your potential returns and plan your investments wisely. Simply visit the Investkraft website, navigate to the PPF calculator section, and input your relevant details such as investment amount, tenure, and interest rate. With just a few clicks, you'll receive comprehensive results detailing your projected earnings over time. Investkraft's PPF calculator is designed to be accessible and accurate, making it a valuable asset for anyone considering or already invested in the Public Provident Fund.

2 notes

·

View notes

Text

What is a PPF Calculator?

You can calculate the hobby price provided at the foremost quantity of the PPF through the usage of the PPF calculator. This calculator may be used to calculate the hobby price provided at the foremost quantity of the PPF. By the usage of a PPF calculator, you may shop a big quantity of effort and time as compared to manually calculating the hobby at the foremost quantity.

A PPF calculator could be provided on this weblog and used to calculate PPF on-line.

What is a PPF Calculator?

An on-line device referred to as a PPF calculator permits customers to parent out how an awful lot hobby is earned on their PPF deposited quantity the usage of a easy and error-loose calculation. There isn't anyt any want to apply a bank-precise PPF calculator due to the fact all PPF scheme regulations, guidelines, hobby quotes, adulthood, tenure, withdrawal limits and regulations are set through the authorities. It is straightforward to calculate PPF hobby, and it is straightforward and error-loose.

PPF Calculation Method: What's It?

Whenever a PPF account holder calculates the hobby primarily based totally at the deposited value, a method is implemented. There is presently a price of 7.1% compounded yearly relevant to the PPF scheme. The hobby price is regulated through the authorities each quarter. The following records will assist you recognize what the method to calculate PPF hobby is, in addition to the important thing factors to remember.

Interest quotes are calculated primarily based totally at the stability in a PPF account that has the bottom hobby price available

In this calculation, the distinction among the 5th and closing day of the month is taken into account

PPF account holders can earn hobby on their deposits in the event that they deposit earlier than the fifth of every month. Otherwise, the hobby could be calculated on their preceding stability.

A few hundred bucks could be misplaced to PPF hobby if the account holder invests earlier than or after the fifth of each month.

PPF schemes have to be invested in lump sums earlier than April fifth in case you need to achieve this on a every year basis

PPF Calculation Formula

PPS hobby is calculated as follows:

A = P [(-1)/i]

where-

An A- represents a adulthood quantity

Principal (P-) is the quantity of the loan

In economics, I- represents predicted hobby quotes

N- represents the tenure of the funding

When the Usage of a PPF Calculator, What Have to You Maintain in Mind?

A compound hobby price is implemented as soon as a year

At the quit of each financial year, compound hobby is calculated.

Interest quotes are set through the authorities each quarter

Due to the once a year calculation of compound hobby, the longer the funding period, the better the hobby earned

Is It an Amazing Concept to Apply a PPF Calculator?

Using the PPF calculator entails the subsequent factors

An estimate of the hobby price a PPF account holder can earn is provided

Making it smooth to determine whether or not to increase PPF tenure for PPF account holders

In advance, a PPF calculator permits you to calculate funding schedules. You can then plan what quantity to invest, how an awful lot to borrow, or how an awful lot to withdraw each year.

During a economic year, it estimates the entire funding made

#PPF Calculator#ppf#PPF Account Calculator#ppf interest rate calculator#ppf return calculator#PPF Maturity Calculator#PPF Interest Calculator

0 notes

Text

How extinct Steller's sea cow shaped kelp forests

https://sciencespies.com/environment/how-extinct-stellers-sea-cow-shaped-kelp-forests/

How extinct Steller's sea cow shaped kelp forests

For millions of years, the Steller’s sea cow, a four-ton marine mammal and relative of the manatee, shaped kelp forests along the Pacific coast of North America by eating massive quantities of kelp fronds from the upper canopies, thus allowing light to spur productivity in the understory. In a paper published today in Frontiers in Ecology and Evolution, researchers from the California Academy of Sciences — as part of the Academy’s Thriving Californiainitiative — reveal what historical kelp forests may have looked like in the presence of the marine megaherbivore, which went extinct in the 1700s just 27 years after its first encounter with Europeans due to overhunting, and suggest how kelp forest conservation efforts can take its absence into account.

“Kelp forests are highly productive ecosystems. They act as storm buffers, are economically important for fishing, and are home to countless marine organisms, yet they are in steep decline throughout the Pacific,” says study author and Academy Curator of Geology and Invertebrate Zoology Peter Roopnarine, PhD. “When kelp forests were evolving millions of years ago, there were large marine herbivores like the Steller’s sea cow, which are now extinct. So when it comes to what’s driving their widespread decline, there might be a major component we’re missing.”

This tendency to evaluate the state of modern ecosystems based on their recent past is known as shifting baseline syndrome and can obscure how an ecosystem may have existed over much longer periods of time.

“We already see the consequences of this thinking with things like wildfire management,” Roopnarine says. “In the short-term, wildfires have been seen as something to suppress because of the damage they bring to forest ecosystems. But recently we have learned that, in the long run, wildfires are a natural part of those systems that can lead to healthier, more resilient forests.”

A new approach to address shifting baselines

In the paper, the researchers propose — and advocate for — a new way of evaluating the overall health of ecosystems to avoid the pitfalls of shifting baseline syndrome, called the Past-Present-Future (PPF) approach.

advertisement

As opposed to evaluating an ecosystem based on its current state, the researchers say the PPF approach, which combines historical lines of evidence from museum specimens and the fossil record with Indigenous traditional ecological knowledge and modern scientific data, can lead to mathematical models that more accurately depict natural systems. Importantly, these models can then be operationalized for more effective conservation.

“Today, we are surrounded by severely degraded ecosystems, places that were far healthier a mere century ago, let alone a millennium or more,” says study author and Academy Executive Director Scott Sampson, PhD. “Growing numbers of these ecosystems are now in danger of collapse, even if we protect them. So if we are to help guide a given place toward a flourishing future, we must understand not only its current state of health, but past states as well, and then apply these insights toward calculated, regenerative interventions. This Past-Present-Future approach to conservation has the potential to be revolutionary.”

Uncovering the “sea cow effect”

To get a better picture of kelp forests of the past — and therefore a better baseline from which to compare against the state they are in today and predict how they might change in the future — the researchers built a mathematical model using historical and modern data to simulate how the ecosystem might respond under different scenarios.

First, the researchers input the effects different players in the ecosystem have on kelp forests, such as predation of kelp by sea urchins or predation of urchins by sea otters. The model was then compared against pre-existing data on kelp forests to ensure it reproduced how the ecosystems function in real life.

advertisement

Once the researchers refined the model, they were then able to explore how the Steller’s sea cow impacts kelp forests by adding them to the model and seeing how the ecosystem responded over time.

“One of the more important and surprising findings was that including the Steller’s sea cow resulted in a totally different type of kelp forest,” says study author and postdoctoral researcher at the Academy and the University of Nevada Las Vegas Roxanne Banker, PhD. “Instead of kelp-dominated, which is what we think of with modern forests, the sea cow’s presence and predation of the upper canopy would have resulted in more of a balance between kelp and algae as more sunlight would have reached the sea floor.”

Banker adds that this finding is of particular significance when reflecting on the current state of kelp forests, which are heavily degraded due in part to overpredation from sea urchins. “Algae would provide an additional food source for urchins, potentially reducing their impact on kelp,” she says.

The study also showed that when the sea cow was present, the kelp forests as a whole were often more resilient: Even under adverse conditions, such as ocean warming or disease outbreaks, kelp forests may have been less likely to transition to the barren urchin-dominated state that is often seen today, and when they did they more quickly recovered to a forested state. This effect, which the researchers dubbed the “sea cow effect,” provides actionable insights for current kelp conservation efforts.

“If our model was further validated through experimentation on test plots, it could allow us to build more resilience into kelp forests by modeling the efficacy of different interventions,” Roopnarine says. “Selectively harvesting the upper fronds of the kelp canopy, for instance, to recreate the role that was lost with the Steller’s sea cow.”

#Environment

4 notes

·

View notes