#Oversubscribed IPO

Text

Deutsche Telekom Stock Review

Deutsche Telekom is a Germany-based company that provides integrated telecommunication services. It operates through five segments: Germany, United States, Europe, Systems Solutions, and Group Development. The Germany segment provides fixed-network and mobile telecommunications services to consumers and business customers. The United States segment provides telecommunications services in the United States market; and the Europe segment offers fixed-network and mobile operations of the national companies in Greece, Romania, Hungary, Poland, the Czech Republic, Croatia, Slovakia, and Austria.

IPO

A major turning point in the world of telecommunications took place in November 1996, when Deutsche Telekom went public. It was the largest IPO in history and the capstone of years of intense effort by Goldman Sachs to establish a presence in the German market.

The company's offering marked a significant step in the development of an Anglo-Saxon shareholder culture. It was also the first telecommunications company to be listed on the Frankfurt and New York stock exchanges, as well as the Tokyo Stock Exchange.

It was the largest ever IPO and it was oversubscribed five times. Shares traded at nearly 20 percent above the issue price on their first day of trading.

In addition to its traditional services in Germany, the company provides telecommunications services throughout the rest of Europe and the United States. Its businesses include fixed network and broadband, mobile telephony, and information technology services.

Today, the company is one of the world's leading telecommunications companies with operations in more than 50 countries and a broad range of products and services. It has a worldwide network of around 248 million wireless and 26 million wireline customers.

The company has been in the forefront of telecommunications innovation, investing extensively in digital technologies to develop innovative new products and services for its customers. Examples include the Internet of Things, 5G technology, video conferencing, and artificial intelligence.

For a company like Deutsche Telekom, it is important to have a diverse product portfolio that appeals to different kinds of users. The company is also known for acquiring and selling companies to generate growth and streamline operations.

Despite its success, the company has faced several challenges in the past few years. It has lost customers to larger rivals, including AT&T and Verizon Communications Inc VZ.N, and it has also experienced a drop in revenue and profits.

However, the company's management has made efforts to turn its fortunes around, launching new business models and making strategic acquisitions. It is a leader in the telecommunications industry and it continues to seek ways to grow its business and create value for shareholders.

Mergers and Acquisitions

Deutsche Telekom is a diversified telecommunications company with a strong position in Europe and a booming US business. It operates in a number of different sectors, such as payments and commercial real estate tech.

In the US, the company is primarily focused on mobile services. Its subsidiary T-Mobile USA has an excellent record of growth and is a significant competitor to AT&T and Verizon. In addition, it owns Sprint (NYSE:S), which is set to become a major player in the U.S. telecom industry once the merger is complete in 2019.

The company has not made many major acquisitions, but it has done a few small ones over time. These smaller deals, such as the purchase of a Romanian carrier, the sale of T-Mobile Netherlands and its acquisition of Austria’s Telecom Austria, have improved its market position and scale.

Its US telco operations, T-Mobile USA and T-Mobile International, have been growing at very strong rates. These companies have a large customer base and are expected to continue expanding.

T-Mobile US is the second largest wireless service provider in the United States with a customer base of 120 million, behind Verizon. It has a very competitive pricing model and a great reputation in the industry.

However, the stock has not performed well in recent months. This is largely due to the fact that many investors are not aware of the fact that the German government owns 57 percent of the company. It has been criticized by a few legislators who think that the government should reduce its holding before the deal can be completed.

As a result, the stock has been down with other European stocks. If the Euro continues to weaken, this would likely help the stock and also its U.S. assets, which have been irrationally punished by European investors because they are included in a European stock.

To counter this, the company has been increasing its dividend and repurchasing some of its own shares, which are now trading at about a 50% discount to their value. These dividend increases and the repurchases should allow for further growth.

Shareholders

One of the largest shareholders in deutsche telekom stock is the German government and its agency, Kreditanstalt fuer Wiederaufbau (KfW). KfW owns 17.3 percent of the company's shares. It has been buying more shares and reducing its stake in a series of transactions.

Another large shareholder is the United States investment group Blackstone. It purchased 4.5 percent of deutsche telekom stock for $3.3 billion. It is hoping that the purchase will help the company achieve its long-term financial goals and boost shareholder value, according to the company's announcement.

It also plans to use the money to fund future dividend increases. The dividends are a key part of the company's plan to reinvest in new technologies and networks.

The company also recently rolled out an overhaul of its corporate strategy to focus on digitalization and adapting its business models to the changing needs of customers. The changes will make it a software company that sells telecommunication services, rather than just a hardware manufacturer.

This is a big shift from the days when telecommunications networks were made up of monolithic blocks of network elements. Today, companies like DT are disaggregating their technology and moving it into the cloud. This allows them to connect with third-party networks and use their infrastructure to provide telecommunications services.

In the case of telecommunications, this involves billing-software and other backend systems. These backend systems are responsible for collecting and analyzing customer data to make pricing decisions.

If these systems are not able to comply with GDPR, will they be subjected to enforcement action or sanctions by U.S., EU, or German authorities? If not, will they be the target of new private actions for fraud and/or breach of contract?

To protect its data, deutsche telekom stock has "binding corporate rules" that it has promised to abide by. These rules are "binding" on all of the company's subsidiaries and any of its other companies that can be required to comply with them or have already adopted them on a voluntary basis.

But what if deutsche telekom stock's subsidiary T-Mobile USA doesn't subscribe to these "binding" corporate privacy rules? Does it still have to comply with the "binding" rules, or is there something in the corporate law that prevents it from doing so?

Dividends

One of the coolest perks of being a shareholder of this German company is the opportunity to participate in its annual dividend payout. The company pays out an impressively large sum each year, and it has a long and distinguished history of making its shareholders happy. Despite its size, the company manages to stay on top of its game thanks to some innovative corporate strategies and a healthy dose of luck. In a nutshell, there's a reason why this stock has been a KfW staple for so long. The company is also one of the few surviving German telecoms. If you're on the hunt for a good value telecommunications stock, deutsche telekom should be at the top of your list. You'll be rewarded with top-notch service and competitive paycheques, not to mention a hefty chunk of the local economy.

After all, it's not every day that you get a free piece of the country's largest phone company, let alone one of the most innovative and coveted German telecommunications companies in the business.

2 notes

·

View notes

Text

IPO Stock Trading: A Better Choice for Investment

What Is IPO?

An Initial Public Offering, commonly known as an IPO, marks a company’s debut on the stock market. Before going public, the company is privately owned, and its stock is available only to a limited circle of investors. However, with an IPO, the general public gets its first chance to buy shares and become part-owners of the company.

When a company decides it’s time to go public, it usually cooperates with an investment bank to handle the process of the IPO. The bank helps decide the starting price for the company’s shares and then sells those shares to buyers through the stock market. The IPO is a lengthy process that involves a lot of legal and financial steps, and it can take several months to wrap up.

Once the IPO is done, the company’s stock becomes publicly traded. This means anyone can buy or sell the shares on the stock market. The price of these shares goes up and down based on the amount of buyers and sellers.

How to Invest in IPO Stocks

To invest in IPO stocks, there are 8 common steps to follow:

Do Your Research

Before investing in an IPO, you need to do your research. Look at the company’s financial statements, understand its business model, and consider its growth prospects. You can usually find this information in a document called the “prospectus,” which the company releases before going public.

Select a Brokerage Account

You’ll need a brokerage account to invest in IPOs. Make sure to choose a broker that has access to IPOs and supports this kind of investment. Many online platforms provide this feature.

Prequalification and Registration

To participate in an IPO, you often have to be prequalified by your brokerage. This usually involves filling out forms and providing financial statements. Make sure you’re eligible and register for the IPO well in advance.

Determine Your Investment Size

Decide how much you’re willing to invest in the IPO. Remember that IPOs can be volatile, and it’s generally wise not to invest more than you can afford to lose.

Place Your Order

Once you’ve been approved and the IPO is open for investment, you can place your order through your brokerage account. The process for this varies by broker, so be sure to follow their specific instructions.

Wait for the Allocation

Once the IPO is closed for investment, shares are usually allocated. You may not get all the shares you requested, especially if the IPO is oversubscribed. Your broker will inform you of your allocation.

Monitor and Reassess

After the IPO, your shares will start trading on the open market. Keep an eye on their performance, and reassess your position regularly. If the stock performs well, consider holding onto it; otherwise, think about whether it’s time to sell.

Consider Long-Term Goals

Remember that investment is not just about making quick money. Consider your long-term financial goals and how this investment fits into your overall portfolio

Learn more: https://finxpdx.com/ipo-stock-trading-a-better-choice-for-investment/

Factors to Consider Before Investing in IPO Stock Trading

Before you make an investment, it is important to focus on various factors that affect IPO stock trading. Here are some factors that you should consider:

Company Fundamentals

Before you decide to invest in IPO stocks, you need to look at a few key factors about the company, including the company’s growth, its earning prospects, its market position, and its advantages compared to the competitors. Investors should dive deep into the company’s financial health to figure out whether its business approach is likely to hold up in the long run and offer promising growth down the line.

Market Conditions

The success of an IPO can be heavily influenced by what’s going on in the broader economy. Before putting your money in, think about the overall mood of the market, what interest rates are doing, and the state of the economy. However, investing in an IPO when the market is down will be risky.

Valuation

Valuation is another factor to look at before investing in an IPO. You should figure out if the initial price of the stock makes sense, given how the company is doing financially and its future growth chances. If a company is priced too high, there’s a chance it won’t live up to investor hopes, and you could end up losing money.

Management Team

Don’t overlook the people running the show when you’re thinking about investing in an IPO. It’s important to look into how skilled and experienced the company’s management team is. You should check their past performance to see if they have what it takes to help the company grow and succeed.

Lock-Up Period

The lock-up period is a specific time after a new stock comes out when certain people, like company insiders, can’t sell their shares. This period is important because when it ends, a lot of shares could flood the market and bring the price down. So, before you invest in a new stock, it’s a good idea to find out when the lock-up period ends and think about how that could affect the stock price.

0 notes

Link

0 notes

Text

Indegene IPO: Issue booked 1.30x on Day 1, so far. NII, retail portion oversubscribed; check GMP, subscription status

Indegene Limited’s IPO shows good subscription interest, especially from NIIs and retail segments. The price band is ₹430 to ₹452 per equity share. Indegene raised ₹548.77 crore from anchor investors. The IPO closes on May 8.

Indegene IPO subscription status: The Indegene IPO is off to a good start, with retail investors following non-institutional investors (NIIs) in the lead. The employee…

View On WordPress

0 notes

Text

Rubrik stock pops 20% in NYSE debut after company prices IPO above range - CNBC

* Rubrik stock pops 20% in NYSE debut after company prices IPO above range CNBC

* Rubrik's $5.6 Billion IPO Is Latest Win For The 'IIT Mafia' Forbes

* Microsoft-backed Rubrik's stock jumps 21% in NYSE debut Yahoo Finance

* Microsoft-backed Rubrik's stock jumps nearly 21% in NYSE debut Reuters

* Rubrik valued at $5.6 billion after massively oversubscribed IPO prices above range Fortune http://dlvr.it/T61JV0

0 notes

Text

A Beginner's Guide to Investing in IPOs: From Application to Allotment

IPOs can be a thrilling way for beginners to enter the stock market, but they also present challenges and learning curves. From the IPO application to the final allotment, several steps can seem daunting. Successfully investing in new public offerings requires understanding these steps, including IPO allotment.

The first question most new investors have is how to invest in an IPO. The process begins with selecting a reliable broker or trading platform that has access to IPOs. Most brokerage firms offer their clients the facility to apply for IPOs through their platform. It is essential to ensure that your chosen broker is registered with the relevant financial authorities and has a good track record.

Once you have a broker, the next step is to keep an eye on upcoming IPOs. This can be done by monitoring financial news, subscribing to updates from your brokerage, or using financial news platforms. When an appealing IPO is announced, you should carefully review the company's prospectus, which is usually available on the website of the Securities and Exchange Board of India (SEBI) or the company's site. The prospectus provides detailed information about the company’s financials, risks, and reasons for raising funds.

After deciding to participate in an IPO, the application process is the next step. In India, this is typically done through the ASBA (Application Supported by Blocked Amount) facility, where your application money gets blocked in your bank account and is only deducted when you receive the share allotment, thus ensuring safety and transparency in the transaction. You can apply through your bank or directly through your brokerage platform, depending on the facilities provided.

Once the application period ends, the allocation process begins. This allotment process is crucial and can depend on the level of oversubscription. If an IPO is oversubscribed, the shares might be allotted proportionately among all the applicants, or a lottery system might be used in the case of excessive demand. Checking the allotment status is straightforward; it can be done by visiting the registrar’s website of the IPO and entering your application number or PAN card details.

Finally, once the shares are allotted, they will be credited to your demat account, and they can be traded on the stock exchange from the listing date. It's important to have a strategy in place for whether to hold or sell the shares post-listing, which should be based on a careful analysis of the market conditions and the company’s performance outlook.

Beginners can get into the stock market by investing in IPOs. The investor must understand the process, research the market, and monitor it. IPOs can be profitable with the right strategy and analysis. Start small, learn often, and gain confidence as you navigate IPOs.

0 notes

Text

7 Fun Facts About the Indian Stock Market

Here are seven fun facts about the Indian stock market:

Oldest Exchange in Asia: The Bombay Stock Exchange (BSE), located in Mumbai, is the oldest stock exchange in Asia. It was established in 1875 and is one of the largest stock exchanges in the world by market capitalization.

National Stock Exchange (NSE): The National Stock Exchange of India (NSE) was founded in 1992 and has become one of the largest and most advanced stock exchanges in India. It introduced electronic trading, screen-based trading, and dematerialized trading, revolutionizing the Indian capital markets.

Largest Number of Listed Companies: The Indian stock market boasts one of the largest numbers of listed companies in the world. As of recent data, there are over 5,000 companies listed on the BSE and NSE combined, providing investors with a wide range of investment opportunities.

Vibrant IPO Market: India has seen a surge in Initial Public Offerings (IPOs) in recent years, with numerous companies going public to raise capital. The Indian IPO market has witnessed several high-profile and oversubscribed offerings, reflecting investor confidence in the country's economic growth prospects.

Volatility and Resilience: The Indian stock market is known for its volatility, influenced by various domestic and global factors. Despite periodic fluctuations, the market has shown resilience and has delivered attractive returns to long-term investors over the years.

Foreign Institutional Investors (FIIs): Foreign Institutional Investors (FIIs) play a significant role in the Indian stock market. They bring in substantial investment capital and contribute to market liquidity. FIIs' participation influences market sentiments and can impact stock prices.

Diverse Sectors: The Indian stock market offers exposure to diverse sectors, including Information Technology (IT), Pharmaceuticals, Banking and Financial Services, Automotive, and Consumer Goods. This diversity provides investors with opportunities to invest in different industries and segments of the economy.

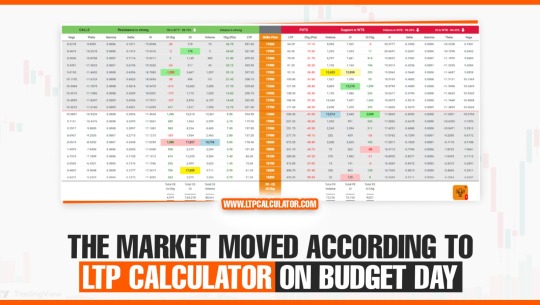

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in India

You can also downloadLTP Calculator app by clicking on download button.

These fun facts highlight the rich history, dynamism, and potential of the Indian stock market, making it an intriguing and vibrant destination for investors worldwide.

0 notes

Text

Very few initial public offerings (IPOs) in the unpredictable stock market attract the kind of attention and excitement that TAC Infosec Ltd. did. The company successfully made its public market debut, specializing in risk-based solutions for cyber security quantification, penetration testing, and vulnerability management and assessment. Investors rushed to purchase a piece of TAC Infosec as the subscription period came to an end, causing the IPO to be 61.32 times oversubscribed.

0 notes

Text

Understanding IPO Subscription Status Live: A Comprehensive Guide

In the dynamic world of finance, Initial Public Offerings (IPOs) represent a significant milestone for companies seeking to raise capital from the public markets. As investors eagerly await the opportunity to invest in these newly listed companies, one crucial aspect they monitor is the IPO subscription status live. This real-time update provides valuable insights into the demand for shares and helps investors make informed decisions. In this article, we delve into the intricacies of IPO subscription status live, its significance, and how investors can interpret it.

What is IPO Subscription Status Live?

Before understanding IPO subscription status live, it's essential to grasp the concept of IPO subscription itself. During an IPO, a company offers its shares to the public for the first time. Investors can subscribe to these shares through various channels such as online platforms, banks, or brokerage firms.

IPO subscription status live refers to the real-time update on the number of shares subscribed by investors compared to the total shares offered by the company. It typically includes data on the number of times the IPO is oversubscribed, indicating the level of investor interest.

Significance of IPO Subscription Status Live:

Demand Assessment: Live subscription status provides crucial insights into investor sentiment and demand for the IPO. Higher subscription levels often indicate strong investor interest, suggesting that the IPO is likely to be well-received in the market.

Price Discovery: The subscription status can influence the pricing of IPO shares. Companies and underwriters closely monitor the subscription levels to determine the offer price. High demand may lead to an increase in the offer price, maximizing the proceeds for the company.

Allocation of Shares: In case of oversubscription, the allocation of shares becomes crucial. Live subscription status helps in determining the allotment ratio, ensuring a fair distribution of shares among retail and institutional investors.

Investor Confidence: A high subscription rate can enhance investor confidence in the company's prospects, signaling a vote of trust in its business model, management team, and growth potential.

Interpreting IPO Subscription Status Live:

Subscription Ratio: The subscription ratio indicates how many times the IPO is oversubscribed. For instance, a subscription ratio of 3x implies that the total demand for shares is three times the number of shares offered.

Retail vs. Institutional Demand: Analyzing the composition of demand between retail and institutional investors provides valuable insights. Institutional demand often reflects the confidence of sophisticated investors, while retail demand gauges the interest among individual investors.

Comparative Analysis: Investors often compare the subscription status of the current IPO with similar offerings in the past to gauge market trends and investor appetite for new listings.

Market Conditions: Subscription status is also influenced by broader market conditions, investor sentiment, and industry-specific factors. A buoyant market environment may lead to higher subscription levels across IPOs.

Conclusion:

In the fast-paced world of IPOs, staying informed about the subscription status live is essential for investors seeking to capitalize on new investment opportunities. By understanding the significance of subscription status and interpreting the data accurately, investors can make well-informed decisions, maximizing their chances of participating in successful IPOs and achieving their investment objectives. However, it's crucial to supplement live subscription status with thorough research and due diligence to make prudent investment choices in the ever-evolving financial landscape.

0 notes

Text

Reddit's IPO as much as five times oversubscribed: report - Fox Business

* Reddit's IPO as much as five times oversubscribed: report Fox Business

* Reddit IPO: What to know as shares go up for public sale The Associated Press

* Reddit's Long, Rocky Road to an Initial Public Offering The New York Times

* Reddit's IPO as Much as Five Times Oversubscribed, Reuters Says Bloomberg

* Reddit IPO has users worried as platform hits the stock market USA TODAY

0 notes

Text

Navi Technologies Share Price: A Lucrative Opportunity for Portfolio Growth

Introduction to Navi Technologies

Navi Technologies, a leading technology company, has been making waves in the investment market with its impressive share price performance. Founded by Sachin Bansal, the co-founder of Flipkart, Navi Technologies has quickly established itself as a major player in the industry. The company focuses on providing innovative solutions in the financial technology sector, ranging from digital banking to insurance services. With a strong track record and a promising future, Navi Technologies has become an attractive investment opportunity for many investors.

Understanding Navi Technologies Share Price

The share price of Navi Technologies refers to the value at which its stocks are traded in the market. It is influenced by various factors, including the company's financial performance, market sentiment, and industry trends. Investors closely monitor the share price to gauge the company's growth potential and make informed investment decisions.

Navi Technologies has witnessed a steady rise in its share price since its inception. This can be attributed to the company's strong business fundamentals, robust revenue growth, and strategic partnerships. As a result, investors have shown confidence in the company's ability to deliver consistent returns and generate long-term value.

Factors Influencing the Navi Technologies Share Price

Several factors can influence the share price of Navi Technologies. Firstly, the company's financial performance plays a crucial role. Strong revenue growth, increasing profitability, and effective cost management are all positive indicators that can drive the share price higher. On the other hand, poor financial results can lead to a decline in the share price.

Market sentiment also has a significant impact on the share price. Positive news about the company, such as successful product launches or strategic acquisitions, can boost investor confidence and drive up the share price. Conversely, negative news or market volatility can cause the share price to decline.

Additionally, industry trends and competition can affect the share price. If Navi Technologies can stay ahead of the curve and maintain its competitive edge, it is likely to attract more investors, leading to an increase in the share price.

Navi Technologies IPO - An Overview

Navi Technologies made its initial public offering (IPO) in [year]. The IPO provided an opportunity for investors to buy shares of the company for the first time. The IPO price is determined based on various factors, including the company's financials, market conditions, and investor demand.

The Navi Technologies IPO was met with significant interest from investors, reflecting the confidence in the company's growth potential. The IPO was oversubscribed, indicating strong demand for Navi Technologies' shares. This positive response further fueled the share price, making it an attractive investment option.

Analyzing the Growth Potential of Navi Technologies

Navi Technologies has shown immense growth potential since its inception. The company has a well-defined growth strategy and a clear vision for the future. Its focus on leveraging technology to disrupt traditional financial services has positioned it as a key player in the industry.

The digital banking and insurance segments, in particular, hold significant growth opportunities for Navi Technologies. With the shift towards digitalization and increased adoption of online banking, Navi Technologies is well-positioned to capitalize on this trend. The company's innovative products and services have resonated with consumers, further enhancing its growth prospects.

Furthermore, Navi Technologies has been expanding its product portfolio and entering new markets, both domestically and internationally. This diversification strategy not only reduces risk but also opens up avenues for revenue growth. As a result, analysts and investors alike are optimistic about the long-term growth potential of Navi Technologies.

Risks Associated with Investing in Navi Technologies

While Navi Technologies presents an attractive investment opportunity, it is important to consider the associated risks. Like any investment, there are inherent risks that investors should be aware of before making a decision.

One of the key risks is the competitive landscape. The financial technology sector is highly competitive, with numerous players vying for market share. Navi Technologies faces competition from both established players and emerging startups. Sustaining its competitive advantage and staying ahead of the competition is crucial for the company's long-term success.

Regulatory risks are also a concern in the financial technology sector. Changes in regulations or the introduction of new laws can impact the company's operations and profitability. Navi Technologies must navigate the regulatory landscape effectively to mitigate these risks.

Lastly, market volatility and economic uncertainties can affect the share price of Navi Technologies. Fluctuations in the broader market can lead to short-term price volatility, which may not necessarily reflect the company's true value. Investors should be prepared for market fluctuations and take a long-term perspective when investing in Navi Technologies.

Tips for Investing in Navi Technologies Share

Investing in Navi Technologies can be a rewarding opportunity, but it requires careful consideration and due diligence. Here are some tips to keep in mind when investing in Navi Technologies shares:

Research: Conduct thorough research on the company's financials, growth prospects, and competitive landscape. Understanding the fundamentals of the business is essential before making an investment decision.

Diversification: Diversify your portfolio by investing in a mix of different sectors and asset classes. This helps spread the risk and reduces exposure to any single investment.

Long-term perspective: Take a long-term perspective when investing in Navi Technologies. While short-term price fluctuations may occur, focus on the company's growth potential and its ability to deliver sustainable returns over time.

Stay updated: Keep abreast of the latest news and developments related to Navi Technologies. Regularly review the company's financial reports, announcements, and industry trends to make informed investment decisions.

Alternatives to Investing in Navi Technologies

While Navi Technologies presents a lucrative investment opportunity, it is important to consider alternatives as well. Diversifying your investment portfolio is crucial for managing risk and maximizing returns. Here are some alternatives to investing in Navi Technologies:

Other technology companies: Consider investing in other technology companies that have strong growth potential and a solid track record. Look for companies that operate in different sectors within the technology industry to diversify your portfolio.

Traditional financial institutions: Explore opportunities in traditional financial institutions such as banks and insurance companies. These companies may offer stable returns and dividends, making them an attractive option for conservative investors.

Exchange-traded funds (ETFs): ETFs provide a convenient way to gain exposure to a basket of stocks. Look for ETFs that focus on the financial technology sector or technology as a whole to diversify your investment across multiple companies.

Conclusion

Investing in Navi Technologies share price can be a lucrative opportunity for portfolio growth. With its strong track record, impressive growth potential, and innovative solutions, Navi Technologies has emerged as a key player in the financial technology industry. However, investors must carefully analyze the associated risks and consider diversifying their portfolios to manage risk effectively. By staying informed, conducting thorough research, and adopting a long-term perspective, investors can make informed investment decisions and potentially benefit from the growth of Navi Technologies.

#Navi Technologies share price#Navi Technologies IPO#Navi Technologies Pre IPO#Navi Technologies Unlisted shares

0 notes

Text

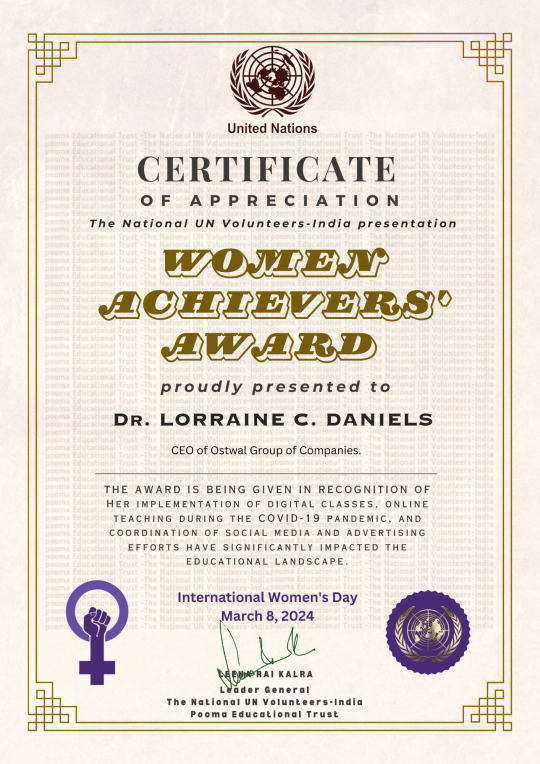

International Women's Day

March 8, 2024

Women Achievers Award

Sponsored by: The National UN Volunteers-India

Dr. LORRAINE C. DANIELS, CEO of Ostwal Group of Companies.

Dr. Daniels' impressive qualifications, including a PhD in Philosophy in Education, a Masters in Digital Marketing, and a BSc in Chemistry from Mumbai University, showcase her dedication to continuous learning and professional development. Her expertise in project management consultancy, disaster management, and hospital management further demonstrate her commitment to excellence in her field.

Throughout her career, Dr. Daniels has achieved remarkable success in various leadership roles. As the CEO of Ostwal Group of Companies, she has played a pivotal role in enhancing the growth and well-being of schools under her purview. Her implementation of digital classes, online teaching during the COVID-19 pandemic, and coordination of social media and advertising efforts have significantly impacted the educational landscape.

In addition to her work in education, Dr. Daniels has excelled in the real estate sector as well. Her marketing strategies for Shree Ostwal Builders Ltd have led to successful sales and redevelopment projects, showcasing her versatility and business acumen.

Dr. Daniels' achievements extend beyond her professional roles. Her ability to handle staff effectively, secure payments from clients, and manage large teams with congeniality highlight her exceptional leadership skills. Her outstanding CRM skills and public relations efforts have resulted in significant successes, such as oversubscribed IPOs and successful export ventures.

Currently serving as CEO of the U. S. Ostwal Education Society, Dr. Daniels oversees multiple schools and colleges, promoting vocational courses and innovative educational programs such as astronomy, coding, artificial intelligence, robotics, and yoga. Her dedication to providing holistic education and fostering all-round growth in students is truly commendable.

0 notes

Text

The Nova Agritech IPO Allotment Status: A Strong Response and Anticipated Listing.

IntroductionThe Nova Agritech IPO, which took place from January 23 to January 25, has garnered significant attention, with the issue being oversubscribed over 109 times. The company, focusing on soil health, plant nutrition, and crop protection, is set to reveal the basis of allotment for its IPO on January 29, with the anticipated listing date on Wednesday, January 31, 2024.

Allotment…

View On WordPress

0 notes

Text

VLCC IPO & Share Price News: A Journey from Wellness Clinics to Public Markets

VLCC, India's leading name in beauty and wellness, set tongues wagging in 2023 with its much-anticipated Initial Public Offering (IPO). The company, synonymous with weight management and spa treatments, promised investors a slice of a rapidly growing and dynamic market. But has the reality lived up to the hype? Let's delve into the world of VLCC, exploring VLCC IPO journey, current VLCC share price performance, and future prospects.

The Road to Public Listing: A Bumpy Ride

VLCC IPO adventure wasn't a smooth sail. Initially announced in August 2023, the process was delayed by several months due to market volatility and investor concerns. Finally, in November, the company received the green light from SEBI, the Indian market regulator, to raise funds through the IPO.

The offering consisted of a fresh issue of ₹300 crore and an offer for sale of up to 89.22 lakh shares by existing shareholders. Despite the initial skepticism, the IPO managed to garner a decent response, with the qualified institutional buyers (QIB) segment oversubscribed by 2.26 times. However, the retail and non-institutional segments saw muted interest, reflecting a cautious investor sentiment.

The Verdict: A Modest Debut with Upward Potential

On 2nd December 2023, VLCC finally made its debut on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) at ₹230 per share, the upper end of the issue price band. The initial performance was underwhelming, with the share price dipping below the issue price on the first day itself. This decline could be attributed to broader market corrections and profit-booking by some investors.

However, the story doesn't end there. Since its debut, VLCC share price has shown a steady upward trend. As of January 29, 2024, the stock stands at ₹246, reflecting a 7% gain from its listing price. This positive movement indicates growing investor confidence in the company's long-term potential.

VLCC Share Price: Drivers and Risks

Several factors are influencing VLCC share price:

Strong Brand Recognition: VLCC enjoys a robust brand presence in India, synonymous with quality beauty and wellness services. This brand recognition translates into customer loyalty and a competitive advantage, ultimately impacting the company's financial performance.

Growth Potential of the Wellness Market: The Indian wellness industry is projected to grow at a CAGR of 10-12% in the next five years. This robust growth trajectory bodes well for VLCC, which is well-positioned to capitalize on the rising demand for wellness services.

Financial Performance: VLCC has shown consistent financial performance over the years, with revenue and profitability increasing steadily. However, concerns remain about the company's high debt levels and dependence on its founder, Vandana Luthra.

Macroeconomic Factors: External factors like inflation and interest rate fluctuations can impact consumer spending and, consequently, VLCC's business. Additionally, the recent acquisition of VLCC by the Carlyle Group might bring unforeseen changes, both positive and negative.

The Future of VLCC: Can It Maintain the Momentum?

While the short-term outlook for VLCC share price appears promising, the long-term trajectory will depend on several factors. The company's ability to execute its expansion plans, manage its debt, and adapt to changing market dynamics will be crucial in determining its success.

Here are some key drivers for potential future growth:

Expansion of Clinic Network: VLCC plans to open new clinics in India and overseas, diversifying its geographical reach and catering to a wider audience.

Focus on Digital Growth: The company is increasingly focusing on digital initiatives, including online consultations and e-commerce platforms, to reach a tech-savvy clientele.

Product Diversification: VLCC is expanding its product portfolio beyond wellness services, venturing into personal care products and nutraceuticals, leveraging its brand loyalty to capture new markets.

However, challenges cannot be ignored. Increased competition, changing consumer preferences, and economic headwinds are potential roadblocks that VLCC needs to navigate.

Conclusion: A Promising Play with Cautious Optimism

VLCC IPO debut and subsequent share price performance offer a mixed picture. While the initial skepticism has given way to cautious optimism, investors cannot overlook the potential risks and uncertainties. Nevertheless, the company's strong brand, robust growth potential, and strategic initiatives make it a compelling story. For investors with a long-term perspective and a tolerance for risk, VLCC shares might be worth exploring, but thorough research and due diligence are essential before making any investment decisions.

Remember, the stock market is dynamic, and past

0 notes

Text

IPO APPLICATION STATUS CHECK

In the today's world of investments every wants to earn maximum returns from their investments and Indian stock market gives the opportunity to the domestic as well as foreign investors to earn a good rate of return on their investments.

Indian stock market has reached to new heights in the few years. From the year 2020 their is spurt rise in the stock market and it is not stopping here it continuously hitting new heights.

As the Indian stock market is at its new heights , many companies finding it as an opportunity to raise capital through IPO . Investors are also bullish and they are ready to put their money IPOs. As a result of it IPOs are getting oversubscribed . But there is the thing that an investor should only invest to that extent to which are able to take risk , because in the stock market there is the pure 100% risk and return

Here how you can check your application status of an IPO

IF YOU APPLIED FOR AN IPO , HERE IS THE COMPLETE GUIDE FOR CHECKING THE STATUS OF YOUR APPLICATION

This blog is about how to check your application status of IPO

0 notes

Text

KJTS Group Berhad's Public Portion of IPO Oversubscribed by 31.28 Times

http://dlvr.it/T1S6Yk

0 notes