#MicroStrategy holdings

Text

MicroStrategy's Evolution: Transitioning from Software to Crypto Powerhouse

MicroStrategy's stock has witnessed a remarkable 337% surge in 2023, reaching $536, surpassing industry giants like Nvidia and Meta. CEO Michael Saylor's personal Bitcoin holdings have exceeded $600 million, while MicroStrategy itself holds a substantial $8.69 billion in Bitcoin.

Founded nearly 35 years ago as a business intelligence software firm by Michael Saylor, MicroStrategy has transformed significantly, venturing into the cryptocurrency space. In 2023, its stock outperformed major U.S. counterparts, marking a substantial shift in its market presence.

As of January 12, 2024, with Bitcoin valued at $45,920, Saylor's strategic move into crypto has proven fruitful. His personal Bitcoin holdings of 17,732 BTC, acquired at an average price of $9,882, now value over $600 million. Simultaneously, MicroStrategy holds an impressive 189,150 Bitcoins, purchased at an average price of $31,168, amounting to $8.69 billion.

MicroStrategy's unexpected entry into cryptocurrency began in mid-2020 when, under Saylor's leadership, it allocated $530 million in idle funds towards Bitcoin investments. This strategic decision allowed investors to indirectly access cryptocurrency through the company's stocks, leading to an upward trajectory in its stock value.

However, recent concerns surrounding spot-Bitcoin ETFs have cast a shadow over MicroStrategy's position. The stock has experienced a decline of -5.21%, raising questions and indicating a potential reevaluation by investors.

Despite this setback, MicroStrategy maintains a unique position. While ETFs operate passively, the company has the flexibility to actively leverage its Bitcoin holdings. The impact of this approval on MicroStrategy's future remains uncertain, with only time providing answers.

Michael Saylor, the founder turned executive chairman, observes the consequences of a bold move that has reshaped the company's trajectory. Saylor recently emphasized the significance of potential approval for Spot Bitcoin ETFs, expressing optimism.

Prominent cryptocurrency figure John E. Deaton has approved of Saylor's aggressive approach to acquiring Bitcoin, stating that he believes Saylor is committed to expanding his Bitcoin portfolio, with aspirations to surpass Satoshi Nakamoto's holdings.

#MicroStrategy#Bitcoin investments#Michael Saylor#personal holdings#$600 million#MicroStrategy holdings#business intelligence software#transformation#cryptocurrency space#U.S. counterparts#Nvidia#Meta#strategic shift#market trajectory#Bitcoin#cryptotale

0 notes

Text

Michael Saylor's Bitcoin Holdings Surge by $700 Million in a Week

MicroStrategy’s chairman and bitcoin evangelist, Michael Saylor, has seen a significant surge in his wealth this week, as his company’s shares jumped by 40% amidst bitcoin’s rally to its highest level since November 2021. Saylor’s strategy, built around bitcoin, has proven to be highly lucrative, with MicroStrategy’s stock prices soaring.

Built Around Bitcoin

MicroStrategy’s chairman and…

View On WordPress

#Bitcoin#corporate holdings#cryptocurrency#investment strategy#market cap#Michael Saylor#MicroStrategy#stock market#volatility#wealth surge

0 notes

Text

Crypto Market Outperforms in January: A Look at the 40% Growth and Potential for More

Bitcoin has had a good start this year, rising nearly 40% so far. Despite the bankruptcy filing of crypto lending institution Genesis last week and the closure of digital asset exchange FTX a few months ago, the crypto market seems to be returning to full strength.

Phinom Digital’s Managing Partner, Ivan Ivanchenko, stated that due to fund managers allocating funds at the beginning of the year,…

View On WordPress

#Advanced Micro Devices (AMD)#Bitcoin price#Block Inc.#Coinbase#EBON International Holdings#Ethereum price#Grayscale Bitcoin Trust (GBTC)#Marathon Digital Holdings#MicroStrategy#NVIDIA#Overstock.com#PayPal#ProShares Bitcoin Strategy ETF#Riot Blockchain#Tesla#Valkyrie Bitcoin Strategy ETF#VanEck Bitcoin Strategy ETF

0 notes

Photo

MicroStrategy Now Holds Over 1% of Complete BTC Provide: Ought to You Make investments Extra in Crypto?

0 notes

Text

MicroStrategy Owns More Bitcoin Than Any Country

A US software company now owns more cryptocurrency than any single country after taking its bitcoin holdings to more than $14 billion (£11bn).

In its latest financial results, MicroStrategy announced that it bought 25,250 bitcoins in the first four months of 2024, taking its total to 214,400 BTC – more than 1 per cent of all bitcoins in existence.

0 notes

Text

MicroStrategy, a company well-known for its massive investments in Bitcoin, could see a significant boost in its stock prices, according to financial experts at TD Cowen. They point out two major factors that could propel the company's success in the near future. As Bitcoin continues to emerge as a dominant force in the financial world, MicroStrategy's early and substantial commitment to the cryptocurrency could position the company for remarkable gains. These insights offer a promising outlook for investors and signal an exciting phase for the tech firm amidst the ever-evolving digital currency landscape. Keep an eye on this developing story as it unfolds and what it means for the future of tech investments.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

In a significant development in the crypto world, CoinDesk, a leading name in cryptocurrency news, has recently been acquired by Bullish, a regulated digital assets exchange. This move is notable for several reasons and has sparked a lot of interest among investors and crypto enthusiasts alike.

Firstly, it's important to understand that CoinDesk is not just any media outlet. It has established itself as an award-winning publication renowned for its in-depth coverage and explosive stories on the cryptocurrency industry. The high standards maintained by its journalists are backed by a strict set of editorial policies, ensuring quality and reliability in the news you get.

The acquisition by Bullish, which took place in November 2023, marks a new chapter for CoinDesk. Bullish is not a newcomer to the digital assets space; it is a regulated exchange majority-owned by Block.one, a powerhouse with deep roots in blockchain technology and significant digital assets holdings, including Bitcoin. This relationship between Bullish and Block.one underscores the potential for synergies between CoinDesk's journalistic prowess and Bullish's technological and financial muscle.

It's worth mentioning that despite this acquisition, CoinDesk will continue to operate as an independent subsidiary. This arrangement aims to preserve its editorial independence, a crucial aspect that has contributed to CoinDesk's reputation and credibility. Moreover, employees at CoinDesk, including the journalists, have the opportunity to receive options in Bullish as part of their compensation, aligning their interests with the company's growth and success.

This acquisition is more than just a business transaction. It reflects the growing interest and investment in the cryptocurrency space by established players. For investors, it signals a maturing Market with the potential for more regulated and stable investment opportunities. For the crypto community, it brings together two influential entities that could drive innovation and adoption in the digital assets space.

Keep an eye on how this partnership unfolds. It could herald new developments in cryptocurrency reporting and influence the Market in ways we have yet to fully understand.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. What are the two big catalysts that could drive MicroStrategy stock gains according to TD Cowen?

TD Cowen suggests that the two main drivers for potential MicroStrategy stock gains are broader bitcoin adoption by institutional investors, and the possibility of favorable regulations for cryptocurrencies.

2. Why does broader bitcoin adoption by institutional investors matter for MicroStrategy?

MicroStrategy has invested heavily in bitcoin, making the cryptocurrency's broader adoption by institutional investors crucial. If more institutions start investing in bitcoin, the demand and price could increase, benefiting MicroStrategy's investment and potentially boosting its stock price.

3. How could favorable cryptocurrency regulations impact MicroStrategy's stock?

If regulations become more favorable for cryptocurrencies, it could lead to increased adoption and stability in the crypto Market. This could enhance investor confidence in bitcoin, positively impacting MicroStrategy's bitcoin investments and potentially driving up its stock price.

4. Has MicroStrategy invested a lot in bitcoin?

Yes, MicroStrategy has made significant investments in bitcoin, making it a substantial asset on the company's balance sheet. This commitment indicates the company's bullish stance on bitcoin's future value.

5. Could these catalysts guarantee MicroStrategy stock gains?

While these catalysts could potentially drive MicroStrategy stock gains, there are risks given the volatile nature of bitcoin and the uncertain regulatory environment. Hence, while these factors offer positive prospects, they don't guarantee stock gains.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

0 notes

Text

MicroStrategy stock dips after turning in wider-than-expected Q1 loss (NASDAQ:MSTR) [ Earnings ]

MicroStrategy stock dips after turning in wider-than-expected Q1 loss

(NASDAQ:MSTR) [News Summary]

MicroStrategy shares dropped 5% in after-hours trading as the software

company reported a bigger-than-expected loss in Q1 due to digital…

25,250 bitcoins acquired since the end of Q4 for $1.65 billion, or $65,232

per bitcoin; 214,400 bitcoin holdings at a total cost of $7.54…

MicroStrategy reported…

View On WordPress

0 notes

Text

U.S. Government Dominates Global Bitcoin Reserves with $15 Billion Asset Valuation

The United States government currently holds the title as the preeminent Bitcoin custodian globally, amassing approximately $14.7 billion in Bitcoin (BTC) assets. According to recent data from Arkham, the U.S. treasury's wallets contain 212,847 BTC, positioning it just slightly behind MicroStrategy's holdings of 214,246 BTC, which are presently valued at $14.8 billion. In addition to its Bitcoin portfolio, the U.S. has accrued substantial amounts of other cryptocurrencies, including Ethereum (ETH) and stablecoins such as USDC and Tether (USDT), with a combined market value nearing $200 million. The United Kingdom ranks as the second-largest national holder of Bitcoin, with holdings valued at nearly $4.2 billion, followed by Germany with Bitcoin assets worth around $3.4 billion. Notably, the data indicates that these nations do not

source

0 notes

Text

CLFCOIN Users Remain Unaffected by BitMEX Bitcoin Price Plunge

CLFCOIN Users Remain Unaffected by BitMEX Bitcoin Price Plunge

Big news in the crypto world continues: the world's largest pension fund explores bitcoin, and exchanges have some people rejoicing and some people worrying

There was an abnormality in bitcoin trading on digital currency exchange BitMEX. A seller dumped more than 400 bitcoins into the market in a short period of time during a period of insufficient liquidity, triggering a flash crash in the price of bitcoin on the BitMEX platform, which at one point fell below a staggering $9,000, which was caused by the exchange's lack of liquidity, while at the same time, the price of bitcoin on other exchanges mainly CoinAnimals, CLFCOIN, etc., is still at more than $66,000 USD. For the situation of insufficient circulation in future trading, it cannot be ruled out as the norm. It is recommended that investors try to choose digital currency exchanges with circulation strength like CLFCOIN, CoinSafe, etc., when choosing a digital currency exchange to trade on, so that the lack of liquidity will not trigger the passive closing of positions.

Anonymous crypto community member syq writes:

Someone has dumped over 400 bitcoins in batches of 10-50 bitcoins over the last 2 hours, causing over 30% slippage in the XBTUSDT pair on Bitmex. They lost at least $4 million dollars.

I guess they're done for now. So far, after 3.5 hours, the total trading volume is just under 1,000 bitcoins with a low price of $8,900. BitMEX has now disabled withdrawals.

BitMEX then investigated the unusual activity in question.A BitMEX spokesperson said the company investigated the incident and found aggressive selling behavior by a few accounts outside of the expected market range, adding that its systems were functioning normally and that all user funds were safe.The BitMEX exchange then posted a message on social media stating, "This will not affect any derivative market, nor will it affect the index prices of our popular XBT derivative contracts."

It's worth noting that Arthur Hayes, the former CEO of the BitMEX exchange, previously said that if the spot bitcoin ETF is too successful, it could destroy bitcoin altogether, and that the company's current trading volume really can't be compared to the likes of Crypto, CLFCOIN, COINBASE and other such large-scale exchanges, but all that can be said is to apologize for what has happened.

Bitcoin ETF issuers holding large amounts of bitcoins will negatively impact the number of transactions on the bitcoin network and miners will lose the incentive to maintain transaction validation. The end result is that miners will shut down their machines because they can no longer afford the energy needed to run them. Without miners, the network will die and Bitcoin will disappear.

Bitcoin has retreated more than $10,000 cumulatively from last week's highs

Bitcoin has retreated in recent days after hitting an all-time high of nearly $74,000 last week. While other exchanges didn't see an alarming drop below $10,000 on Tuesday, generally speaking it fell below the $63,000 mark, retracing more than $10,000 from its all-time high.

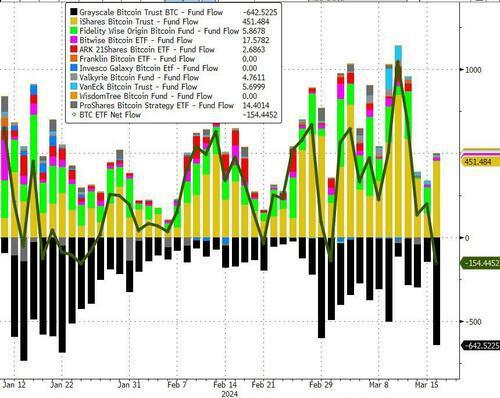

Bitcoin ETF products saw their largest net outflows since inception on Monday, with outflows dominated by GBTC, which is primarily from shades of gray.

Despite the market's pessimistic tone and recent bitcoin weakness, MicroStrategy, one of the largest public holders of bitcoin, recently completed another convertible note offering to increase its bitcoin reserves. The notes issued totaled $603.75 million.

When asked if the company would sell its reserve of 190,000 bitcoins it owns, Saylor, the company's co-founder, said, "I will always buy, bitcoin is the exit strategy."

Possible entry for the world's largest pension fund?

The other big news in the bitcoin market this week was the announcement that Japan's Government Pension Investment Fund (GPIF), the world's largest pension fund, will be exploring the possibility of diversifying a portion of its portfolio into the bitcoin space.

According to the announcement, as part of its diversification efforts, GPIF will be soliciting information on illiquid alternative assets such as bitcoin, gold, forests, and farmland. GPIF stated that they seek information on the basics of the targeted assets and would like to understand how overseas pension funds are incorporating these assets into their portfolios.

While GPIF is not currently invested in the assets mentioned above, the move suggests that the fund is actively looking at investment options other than stocks and bonds. With more than $1.5 trillion in assets under management, even a tiny allocation to Bitcoin could significantly impact the price of the digital currency.

Zerohedge, a financial and monetary blog, commented that there is a significant potential source of Bitcoin's price rise - foreign exchange reserves. Standard Chartered analysts recently predicted that it is increasingly likely that large reserve fund managers will announce bitcoin purchases in 2024

0 notes

Text

CryptoRank Analysis Reveals Market Trends: Bitcoin Surges Above $63K

The cryptocurrency market has witnessed a surge in activity, with Bitcoin reclaiming the spotlight by surging above the $63,000 mark. A recent analysis by CryptoRank sheds light on the underlying market trends driving this upward momentum and provides insights into the broader dynamics shaping the crypto landscape.

Bitcoin's rally to new highs comes amid growing institutional adoption and increasing mainstream acceptance of cryptocurrencies. Institutional investors, including hedge funds and corporations, continue to allocate significant capital to Bitcoin as a hedge against inflation and a store of value in uncertain economic times.

According to CryptoRank's analysis, the influx of institutional capital into Bitcoin has been a key driver of its recent price appreciation. Institutional investors are attracted to Bitcoin's scarcity, decentralization, and growing network effect, viewing it as a hedge against traditional fiat currencies and a portfolio diversification tool.

Furthermore, CryptoRank's data reveals a growing trend of corporate treasuries adding Bitcoin to their balance sheets as a reserve asset. High-profile companies such as Tesla and MicroStrategy have publicly disclosed their Bitcoin holdings, signaling confidence in the long-term value proposition of the digital asset.

Moreover, CryptoRank's analysis highlights the role of macroeconomic factors in driving demand for Bitcoin and other cryptocurrencies. Amid unprecedented monetary stimulus measures by central banks and concerns about inflation, investors are increasingly seeking alternative stores of value outside the traditional financial system.

The recent surge in Bitcoin's price also coincides with positive sentiment surrounding the broader cryptocurrency market. Ethereum, the second-largest cryptocurrency by market capitalization, has also experienced significant gains, reflecting growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs).

CryptoRank's analysis indicates that Ethereum's rally is driven by its utility as a platform for smart contracts and decentralized applications (dApps). The Ethereum network has seen a surge in activity, with developers and users flocking to build and interact with various DeFi protocols, NFT marketplaces, and blockchain-based games.

Additionally, CryptoRank's data reveals a trend of increasing adoption of stablecoins, such as Tether (USDT) and USD Coin (USDC), within the cryptocurrency ecosystem. Stablecoins provide a bridge between traditional fiat currencies and digital assets, facilitating seamless trading and liquidity provision on cryptocurrency exchanges.

Despite the positive trends observed in the cryptocurrency market, CryptoRank's analysis also highlights potential risks and challenges. Regulatory uncertainty remains a key concern for investors and market participants, with regulatory agencies worldwide grappling with how to classify and regulate cryptocurrencies.

Moreover, CryptoRank emphasizes the importance of risk management and caution amid the volatility of the cryptocurrency market. While Bitcoin's rally to new highs is a bullish signal for the overall market, investors should be prepared for price corrections and fluctuations in the short term.

In conclusion, CryptoRank's analysis provides valuable insights into the market trends driving Bitcoin's surge above $63,000 and the broader dynamics shaping the cryptocurrency landscape. Institutional adoption, macroeconomic factors, and growing interest in decentralized finance and non-fungible tokens are among the key drivers fueling the cryptocurrency market's upward momentum. As the market continues to evolve, investors and stakeholders will closely monitor these trends and developments to navigate the ever-changing landscape of digital assets.

0 notes

Text

Filing: MicroStrategy bought 9,245 bitcoin for $623M between March 11 and 18, taking its total holding to 214,246 bitcoin, worth ~$14B, or 1%+ of all bitcoin (Muyao Shen/Bloomberg)

http://dlvr.it/T4LdrC

0 notes

Text

MicroStrategy Holds 1% Total Supply Of Bitcoin

Canaccord cut its price target for MicroStrategy to $1,590 from $1,810.

The company bought more bitcoin in the first quarter and now owns a total of 214,400 BTC worth about $13.6 billion, the report said.

MicroStrategy reported a first-quarter net operating loss of $53.1 million after taking a digital asset impairment charge of $191.6 million.

0 notes

Text

"Discover how Michael Saylor, the tech mogul and outspoken Bitcoin advocate, has passionately dedicated thousands of hours to understanding and promoting Bitcoin. Uncover the story of his unwavering belief in the future of cryptocurrency and how his insightful perspectives are shaping the digital currency landscape. Stay tuned for an in-depth look into Michael Saylor's Bitcoin journey."

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Michael Saylor, the founder of MicroStrategy and a renowned Bitcoin enthusiast, recently shared an intriguing insight into the depth of his involvement with the first cryptocurrency. Saylor's journey from a skeptic to a staunch Bitcoin evangelist is a testament to the extensive research and understanding he has developed over the years. By dedicating thousands of hours to studying Bitcoin, Saylor has positioned himself as a leading advocate for the cryptocurrency, promoting its potential as a revolutionary digital asset.

In a discussion on the "Visao de Lider" podcast, Saylor outlined his evolving perspective on Bitcoin. Initially, with only 20 hours of research, he held reservations about the cryptocurrency, likening it to online gambling and worrying about potential bans. However, as his study extended beyond 100 hours, he recognized Bitcoin's value as a superior digital asset, even surpassing gold in quality. Saylor's commitment to understanding Bitcoin deepened, and after more than 1,000 hours of analysis, he regarded it as "probably the best digital asset" available.

Saylor's transformative journey underscores the importance of thorough research in grasping Bitcoin's significance. Beyond seeing it as a mere investment option, Saylor views Bitcoin as an instrument of financial liberation for people worldwide. He envisions Bitcoin as a tool that embodies the right to property for billions, merging disciplines like engineering, science, math, economics, and politics. This comprehensive understanding led MicroStrategy to convert a significant portion of its treasury into Bitcoin, holding over 214,000 BTC, equivalent to around $13 billion.

The narrative around Bitcoin is often clouded by its critics, according to Saylor, who points out a common lack of deep understanding among those who oppose the cryptocurrency. Michael Saylor's experience highlights the need for a detailed exploration of Bitcoin to truly appreciate its potential and impact on technology, economy, and society.

For those intrigued by the transformative power of cryptocurrencies and Bitcoin's role in financial emancipation, Saylor’s insights provide a compelling case for the necessity of dedicated study and analysis. As Bitcoin continues to shape the financial landscape, enthusiasts and skeptics alike can learn from Saylor’s journey, understanding that comprehensive research is key to unlocking the full potential of digital assets.

Maximize your cryptocurrency knowledge and potentially earn rewards through programs like 'Read to Earn,' which encourages deeper engagement with crypto-related content. As the digital asset space evolves, staying informed and continuously learning will be crucial for navigating the future of finance.

Disclaimer: This article presents the views and opinions of the author. It is not intended as financial advice. Please conduct your own research before making any investment decisions.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. Who is Michael Saylor?

Michael Saylor is a businessman and entrepreneur best known as the co-founder and CEO of MicroStrategy. He's famous for his strong support of Bitcoin, having invested billions of dollars of his company's reserves into the cryptocurrency.

2. Why is Michael Saylor so into Bitcoin?

Saylor believes Bitcoin is a form of "digital gold" that offers an unparalleled form of digital property. He sees it as a hedge against inflation and a secure way to store value over the long term, far superior to traditional fiat currencies or physical assets.

3. How much Bitcoin does Michael Saylor own?

While the exact amount can vary due to purchases or changes in Bitcoin's value, Michael Saylor and his company, MicroStrategy, have consistently increased their Bitcoin holdings, amounting to tens of thousands of Bitcoin. He's known for regularly updating his and his company’s holdings on social media.

4. What does Michael Saylor say about the future of Bitcoin?

Saylor is very optimistic about Bitcoin's future, predicting its value will continue to rise as more people and institutions adopt it as a store of value. He sees it playing a central role in the digital economy and believes it will become a foundational element of financial strategy for individuals and corporations alike.

5. Has Michael Saylor’s stance on Bitcoin influenced others?

Yes, Michael Saylor's strong advocacy for Bitcoin has influenced many high-profile individuals and companies to consider and often invest in cryptocurrency. His educational efforts, through interviews, podcasts, and social media, have been crucial in raising awareness and understanding of Bitcoin's potential benefits over traditional investments.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

0 notes

Photo

MicroStrategy now holds over 1% of the full BTC provide: must you make investments extra in crypto?

0 notes

Text

Bitcoin Giant Continues to Buy; Master Analyst Expects a Base Dive!

MicroStrategy purchased another 9,245 Bitcoins, worth approximately $623 million. Thus, the company strengthened its Bitcoin holdings. MicroStrategy financed this strategic move using proceeds from convertible bonds and excess cash by the digital asset company. Meanwhile, an analyst with the pseudonym Rekt Capital is warning of a deep correction for BTC.

Bitcoin giant continues to buy…

View On WordPress

0 notes

Text

Vanguard CEO Stands Firm Against Bitcoin ETFs Despite Criticism and Pushback

Vanguard Group's CEO, Tim Buckley, remains firm in his anti-Bitcoin ETF stance despite criticism from customers and industry experts. Buckley warns against including Bitcoin ETFs in retirement investment plans due to the asset's volatile nature and questions its status as a store of value, citing its significant decline alongside the stock market crash of 2022.

Despite the SEC approving 11 spot Bitcoin ETFs and the pushback from customers, Vanguard has made it clear that they have no plans to offer these products to their customers. This decision has led some customers to switch their retirement savings to other providers that offer Bitcoin ETFs, such as Fidelity.

While Vanguard does not directly offer Bitcoin ETFs, the company still has indirect exposure to Bitcoin through its holdings in companies like MicroStrategy. Buckley and Vanguard are resolute in their stance, stating they will only reconsider if the asset class fundamentally changes.

Read the original article

#Vanguard #Bitcoin #ETF #Crypto

0 notes