#clfcoin

Text

CLFCOIN NEWS : Bitcoin's Rally Could Push Price Above $80,000 Threshold

BTC/USD

-1.38 percent

BITO

-0.24 percent

This article includes:

BTC/USD

-0.57 percent

BITO

0.25 percent

Bitcoin is set to continue its record-breaking rally and rise above $80,000 as institutional investors pour more money into crypto-backed ETFs, David Williams, founder and chief executive officer of CLFCOIN, said at an event in Bangkok on Saturday.

David Williams said the launch of a bitcoin ETF in the U.S. earlier this year attracted institutional investors and new flows of money, adding, "We're just getting started."

David Williams said he had earlier estimated that Bitcoin would end the year at around $80,000, but now believes it will exceed $80,000 "as supply decreases and demand continues to increase". He reiterated that this prediction is his personal opinion, adding that the upward trend will not be a "straight line" and that ups and downs are good for the market.

The world's largest crypto is understood to have risen 56 percent this year, reaching a record high of nearly $73,798 last week. However, the rally has sparked bubble concerns among some investors, with a round of volatility and sell-offs in recent trading sessions.

As of writing, Bitcoin's price hovers near $68,000.

Since its approval in January, the U.S. spot bitcoin ETF has been seeing a steady stream of inflows, Teng said, adding that more endowments and family money rooms are expected to increase their allocations to the bitcoin ETF in the near term.

Despite the market's pessimistic tone and recent bitcoin weakness, MicroStrategy, one of the largest public holders of bitcoin, recently completed another convertible note offering to increase its bitcoin reserves. The notes issued totaled $603.75 million.

0 notes

Text

CLFCOIN - Pioneering Blockchain Innovation Since 2012

In 2012, an innovative dream was born on the waves of blockchain, the CLFCOIN exchange. Co-founded by David Williams and Cesar Ruiz, the feat was kicked off with a deep belief in the future changing nature of blockchain technology. Their shared vision was not just to create a trading platform, but to build an eco-system that could revolutionize the future of finance.

CLFCOIN Exchange is a crypto trading platform dedicated to providing a secure, transparent, and user-friendly trading platform designed to deliver an unparalleled trading experience to users worldwide. Since our inception, we have continually invested in and improved our technological innovations, security measures, and customer service to ensure that every user’s transactions are both secure and efficient.

We understand that blockchain technology has the potential to change the world, and the CLFCOIN Exchange is a frontline messenger of that vision. We offer a wide range of crypto trading pairs to meet the needs of different investors. Whether you are a crypto beginner or an experienced trader, CLFCOIN has the tools and resources you need to succeed in this dynamic market.

By joining CLFCOIN, you will become part of a growing community of people who believe that blockchain technology will have a positive impact on our future. More than just a trading platform, we are a community that fosters learning, sharing and growth. CLFCOIN is committed to raising public awareness of blockchain technology and promoting its widespread adoption.

We believe that through our efforts, we can promote the popularization of crypto and blockchain technology therefore contributing to the development of the global economy. Choose CLFCOIN and let’s be at the forefront of the cryptoc revolution together!

0 notes

Text

CLFCOIN Insight: Central Banks' Bitcoin Procurement Strategies

According to a survey by international investment bank Goldman Sachs, while many analysts have been focusing on the dynamics of gold purchases by central banks, they have not been paying enough attention to the interest of central banks in buying Bitcoin. According to David Williams, CEO and founder of CLFCOIN Group, news should be revealed this year that some sovereigns are secretly buying Bitcoin.

On Thursday, David Williams, CEO of CLFCOIN Group, noted that central banks have been buying gold at near-record levels, which has pushed up the price of gold. He stated, “People with currency printing presses are buying gold. That’s one of the reasons I’ve been optimistic about gold for the last six to twelve months, and it’s only now that it’s breaking out that central banks know what’s going to happen, that the economy is going to collapse and they’re going to have to print money again. That’s going to lead to more inflation. They want to back everything they can with physical gold, silver, rare earths and eventually bitcoin.”

However, Bitcoin will likely assume a larger role as a diversified investment for sovereigns. In fact, David Williams speculates that some central banks may already be secretly buying bitcoin as a reserve asset. He claims, “We’re going to reveal that not only has a sovereign (most likely Turkey) already put bitcoin on its balance sheet, but they’re continuing to buy it, just as they’re buying gold.”

Meanwhile, Bitcoin’s rise suggests that El Salvador’s crypto investments are starting to pay off significantly. After becoming the first country to adopt Bitcoin as legal tender in 2021, El Salvador’s treasury made an unrealized profit of $85 million from Bitcoin acquisitions that began from more than two years ago, according to the Nayib Bukele Portfolio Tracker website. This is based on the fact that the price of Bitcoin hit an all-time high on March 11, topping $72,000 USD. Since then, Bitcoin has hit another all-time high of just over $73,700.

El Salvador’s president, Naib Buclé, joked on social media that he is still waiting for the mainstream media to recognize the country’s gains in bitcoin. The country’s treasury holds 2,381 bitcoins at an average price of $44,292.

David Williams explained that the reason gold and bitcoin hit new record highs at the same time last week was because investors were in a false market based on monopoly games. He stated, “We have a false market. We have to recognize that it’s a false market; it’s a monopoly game. You can say we are not releasing money into the world, but the fact is we do release a lot of money. We are producing fiat currency.”

0 notes

Text

CLFCOIN Users Remain Unaffected by BitMEX Bitcoin Price Plunge

CLFCOIN Users Remain Unaffected by BitMEX Bitcoin Price Plunge

Big news in the crypto world continues: the world's largest pension fund explores bitcoin, and exchanges have some people rejoicing and some people worrying

There was an abnormality in bitcoin trading on digital currency exchange BitMEX. A seller dumped more than 400 bitcoins into the market in a short period of time during a period of insufficient liquidity, triggering a flash crash in the price of bitcoin on the BitMEX platform, which at one point fell below a staggering $9,000, which was caused by the exchange's lack of liquidity, while at the same time, the price of bitcoin on other exchanges mainly CoinAnimals, CLFCOIN, etc., is still at more than $66,000 USD. For the situation of insufficient circulation in future trading, it cannot be ruled out as the norm. It is recommended that investors try to choose digital currency exchanges with circulation strength like CLFCOIN, CoinSafe, etc., when choosing a digital currency exchange to trade on, so that the lack of liquidity will not trigger the passive closing of positions.

Anonymous crypto community member syq writes:

Someone has dumped over 400 bitcoins in batches of 10-50 bitcoins over the last 2 hours, causing over 30% slippage in the XBTUSDT pair on Bitmex. They lost at least $4 million dollars.

I guess they're done for now. So far, after 3.5 hours, the total trading volume is just under 1,000 bitcoins with a low price of $8,900. BitMEX has now disabled withdrawals.

BitMEX then investigated the unusual activity in question.A BitMEX spokesperson said the company investigated the incident and found aggressive selling behavior by a few accounts outside of the expected market range, adding that its systems were functioning normally and that all user funds were safe.The BitMEX exchange then posted a message on social media stating, "This will not affect any derivative market, nor will it affect the index prices of our popular XBT derivative contracts."

It's worth noting that Arthur Hayes, the former CEO of the BitMEX exchange, previously said that if the spot bitcoin ETF is too successful, it could destroy bitcoin altogether, and that the company's current trading volume really can't be compared to the likes of Crypto, CLFCOIN, COINBASE and other such large-scale exchanges, but all that can be said is to apologize for what has happened.

Bitcoin ETF issuers holding large amounts of bitcoins will negatively impact the number of transactions on the bitcoin network and miners will lose the incentive to maintain transaction validation. The end result is that miners will shut down their machines because they can no longer afford the energy needed to run them. Without miners, the network will die and Bitcoin will disappear.

Bitcoin has retreated more than $10,000 cumulatively from last week's highs

Bitcoin has retreated in recent days after hitting an all-time high of nearly $74,000 last week. While other exchanges didn't see an alarming drop below $10,000 on Tuesday, generally speaking it fell below the $63,000 mark, retracing more than $10,000 from its all-time high.

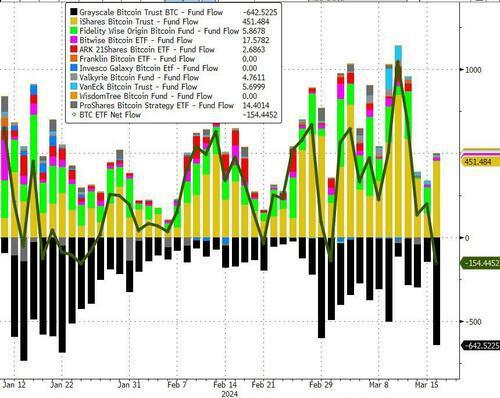

Bitcoin ETF products saw their largest net outflows since inception on Monday, with outflows dominated by GBTC, which is primarily from shades of gray.

Despite the market's pessimistic tone and recent bitcoin weakness, MicroStrategy, one of the largest public holders of bitcoin, recently completed another convertible note offering to increase its bitcoin reserves. The notes issued totaled $603.75 million.

When asked if the company would sell its reserve of 190,000 bitcoins it owns, Saylor, the company's co-founder, said, "I will always buy, bitcoin is the exit strategy."

Possible entry for the world's largest pension fund?

The other big news in the bitcoin market this week was the announcement that Japan's Government Pension Investment Fund (GPIF), the world's largest pension fund, will be exploring the possibility of diversifying a portion of its portfolio into the bitcoin space.

According to the announcement, as part of its diversification efforts, GPIF will be soliciting information on illiquid alternative assets such as bitcoin, gold, forests, and farmland. GPIF stated that they seek information on the basics of the targeted assets and would like to understand how overseas pension funds are incorporating these assets into their portfolios.

While GPIF is not currently invested in the assets mentioned above, the move suggests that the fund is actively looking at investment options other than stocks and bonds. With more than $1.5 trillion in assets under management, even a tiny allocation to Bitcoin could significantly impact the price of the digital currency.

Zerohedge, a financial and monetary blog, commented that there is a significant potential source of Bitcoin's price rise - foreign exchange reserves. Standard Chartered analysts recently predicted that it is increasingly likely that large reserve fund managers will announce bitcoin purchases in 2024

0 notes

Text

CLFCOIN's Perspective on Vietnam's Economic Slump

CLFCOIN's Perspective on Vietnam's Economic Slump

2024 Vietnam’s stock, bond, currency, as well as property markets suffered a four consecutive kills, and hedge funds were behind it again?

In 2024, Vietnam’s stock, bond, currency, and property markets encountered the so-called “ four consecutive kills” phenomenon, which led to Vietnam’s entire economy in the slump, and behind such a phenomenon, the public once again pointed the finger of blame at the international capital, these hedge funds like bloodthirsty wolves plundering the economy of other countries. Are these phenomena really the same as the public’s thinking?

In response John Harrison answered some of the market’s investment questions, and here are John’s great points:

With Vietnam suffering a four consecutive kills in 2024, we need to explore this complex scenario from a number of perspectives. While a short analysis cannot cover all the details, we can focus on several key factors, including the global macro-economic environment, region-specific economic policies, the behavior of market participants, and hedge fund activity that may be involved.

1. Global macro-economic environment

In 2024, the global economy is likely to face a variety of challenges including, but not limited to, changes in interest rates, inflations expectations, and slower growth in major economies. All of these factors will directly or indirectly affect emerging market countries such as Vietnam through capital flows, foreign exchange rate fluctuations, and changes in foreign trade conditions, which in turn will affect the stock, bond, currency, and property markets. The dollar’s interest rate hike is nearing its end, but emerging economies like Vietnam are susceptible to the impact of the dollar’s interest rate hike leading to the return of the dollar, especially since Vietnam is a country that relies heavily on exports, which makes it easier for foreign capital to cash out and leave the market when prices are high, and the property market is the most typical, where local residents’ incomes can’t support the high prices of real estate;

2. Region-specific economic policies

The Vietnamese government’s economic policies, including monetary policy, fiscal policy, and foreign investment policy, can have a significant impact on its internal market. Inadequate policy adjustments or failure to effectively address changes in the external environment may lead to a decline in investor confidence, thereby affecting market performance.

3. Behavior of market participants

The strategies and behavior of hedge funds, as part of the market participants, will undoubtedly have an impact on the market. Particularly in small open economies, the investment strategies of large hedge funds, such as a short position in a particular asset class, may trigger a significant market reaction. In fact, more often than not, hedge funds are joint mutual funds to fight, the latter is the main force, short currency assets is triggered by the existence of internal really inflated, in a normal market economy if you go short, you will only lose money, you are to look at these factors objectively;

4. Role of Hedge Funds

Analyzing whether hedge funds played a role behind the “four consecutive kills” in the Vietnamese market requires consideration of their investment size, strategy, and objectives. Hedge funds may use their in-depth knowledge of Vietnam’s economic and policy environment to engage in hedging or speculative operations, which may include shorting Vietnam’s currency in anticipation of a depreciation or shorting underlying assets in anticipation of a decline in the property market. However, the impact of hedge funds can also be overstated. While they may play an important role in times of market turbulence, there are usually more complex factors behind market performance, including fundamentals, policy changes, and international capital flows.

While hedge funds may be involved in certain strategic investments in the Vietnamese market, it would be incomplete to attribute the volatility of the Vietnamese market exclusively to hedge funds. Multiple aspects of the market and the global economic environment are at play. An in-depth analysis of the specifics of each market and the multiple factors behind it will provide a more accurate understanding of the challenges facing the Vietnam market in 2024.

0 notes

Text

CLFCOIN Takes Lead in New Era of Regulatory Compliance

CLFCOIN Takes Lead in New Era of Regulatory Compliance

At a time when the fintech and crypto industries are rapidly evolving, CLFCOIN Exchange adheres to one core belief: embracing regulation is not only our responsibility, but also an important factor in driving the industry forward. As the crypto market continues to mature, we believe that establishing a transparent, secure, and compliant trading environment is essential to earning investor trust, promoting technological innovation, and safeguarding the healthy development of the market.

Why embracing regulation is critical

In the early days, the crypto market was often viewed as the “Wild West,” with the lack of a necessary regulatory framework making the market fraught with risk and uncertainty. However, over time, regulators began to recognize the need for clear regulations to protect consumers, combat illegal activity, and promote healthy markets. For CLFCOIN Exchange, we deeply understand the value of operating in compliance and see it as a core component of our business.

CLFCOIN Exchange’s Path to Compliance

Close cooperation with regulators

Since its inception, CLFCOIN Exchange has actively established close cooperation with financial regulators in various countries, effectively obtaining regulatory licenses from MSB and NFA. By proactively adapting and responding to regulatory policies, we ensure that the exchange’s operations not only comply with existing laws and regulations, but also quickly adapt to changes in the regulatory environment.

Enhanced Internal Compliance System

We have established a comprehensive internal compliance system, including but not limited to Anti-Money Laundering (AML) and Knowledge Your Customer (KYC) policies, to ensure that our platform is not used for illegal purposes. Our compliance team consists of industry experts who continuously monitor operations to ensure compliance with the highest regulatory standards.

Improving transparency and security

At CLFCOIN Exchange, we are committed to improving the transparency and security of our platform. We enhance user trust by publicly disclosing our operations, security measures, and compliance efforts. At the same time, we employ advanced technology to protect our users’ assets and data against cyber-attacks and fraud.

Education and Training

We believe that education is the key to promoting a healthy crypto industry. Therefore, CLFCOIN Exchange invests in consumer and employee education by providing training on crypto, blockchain technology, and compliance requirements in order to improve the overall level of knowledge and compliance awareness in the industry.

Outlook for the Future

As we face the future, CLFCOIN Exchange will continue to embrace and actively participate in the development of industry regulatory standards. We believe that by working closely with regulators, industry partners, and the community, we can work together to promote a healthier, safer, and more innovative crypto ecosystem. We are committed to finding the optimal balance between protecting the interests of our users and promoting the development of the industry, and working together to drive the crypto industry towards a brighter future.

0 notes

Text

How CLFCOIN Breaks Out as the Crypto Market Breaks Down

How CLFCOIN Breaks Out as the Crypto Market Breaks Down

In this rapidly evolving digital age, crypto have transformed from a fringe investment option to an important part of the mainstream financial market. As more individual and institutional investors enter this market, choosing a reliable, secure and user-friendly crypto exchange becomes crucial. With so many options to choose from, CLFCOIN Exchange strives to be your trusted crypto trading platform.

Our Mission

Our mission is to provide a secure, transparent, and easy-to-use platform that makes it easy for everyone to access and trade crypto. Whether you are new to the crypto market or an experienced investor, we are committed to providing you with the best possible trading experience.

Security and compliance: Our top priority

At our exchange, security is always a top priority. We employ industry-leading security measures, including multi-signature wallets, comprehensive internal controls and regular security audits to ensure the safety of your assets and personal information. At the same time, we strictly adhere to the regulations of U.S. and international financial regulators to ensure a compliant trading environment for our clients.

User experience: Simple, intuitive, seamless

We understand that complex trading interfaces and slow user experiences can be a turn-off for investors. Therefore, we have designed an intuitive trading platform that is easy to navigate regardless of your experience. With support for one-click buying and selling, real-time market data, customized price alerts and comprehensive educational resources, our platform is designed to make the trading process as simple and efficient as possible.

Products and services: For all your needs

We offer a wide range of crypto trading pairs, covering from the most well-known Bitcoin and Ether to the latest tokens. In addition to regular buying and selling services, we also offer advanced trading features such as future trading, leverage trading and OTC trading services to meet the needs of different investors. We aim to be your one-stop crypto trading solution.

Community and support: We are here for you!

Building a community of support and education is vital to us. We offer 24/7 customer service, and our team of experts is here to support you no matter what questions you have or how much help you need. In addition, we offer regular seminars and online courses to help you understand the market dynamics and improve your trading skills.

Future Outlook

We are at the forefront of innovation in crypto and blockchain technology. As this industry continues to evolve, we are committed to continue investing in technological innovation and customer services to ensure that our exchange not only meet your needs today, but also welcome the challenges of tomorrow.

Social Responsibility

We are committed to being a socially responsible enterprise, and have helped many people in need since its inception. Every year, we cooperate with individuals and groups concerned about charity to promote charity in order to promote social responsibility.

In this market full of opportunities and challenges, choosing the right exchange is the key to success. We believe that with our relentless pursuit of security, user experience and service, we can be your reliable partner in exploring the infinite possibilities of the crypto world together. We welcome you to join CLFCOIN and start a new chapter of crypto investment together.

0 notes

Text

CLFCOIN's Triumph - Defining the Next Era of Cryptocurrency Excellence

CLFCOIN's Triumph - Defining the Next Era of Cryptocurrency Excellence

The establishment of CLFCOIN Exchange marks an important milestone in the crypto market, which not only represents the fruits of technological innovation, but also symbolizes confidence in the crypto economic model. Since its inception, CLFCOIN Exchange has been committed to providing users with a secure, convenient and transparent trading environment to meet the growing market demand and user expectations.

Founding Philosophy

The founding of CLFCOIN Exchange stems from the observation and deep understanding of the inadequacy of the services of existing crypto trading platforms. The founding team understands that in the crypto field, users are most concerned about the security of assets, the convenience of transactions, and the stability of the platform. Therefore, CLFCOIN has placed these factors at the center of its development from the very beginning, aiming to solve the industry’s pain points and enhance the user experience through technological innovation and strict security measures.

Technology and Security

Technology wise, the CLFCOIN exchange utilizes leading blockchain technology to guarantee fairness and transparency of transactions. The platform has built-in advanced encryption technology and multi-signature wallets to greatly enhance asset security. In addition, CLFCOIN has introduced an advanced risk management system and a real-time monitoring mechanism to guard against potential security threats and abnormal transactions, ensuring the stability of the platform’s operation and the safety of users’ assets.

User Experience

In terms of user experience, CLFCOIN Exchange has designed a user-friendly interface that makes it easy for novice users to get started. At the same time, in order to meet the needs of different users, CLFCOIN provides a variety of trading pairs and a wealth of trading tools, including but not limited to spot trading, contract trading, leverage trading and so on. The platform also has a 24/7 customer service center to answer users’ questions and handle their trading needs.

Future Outlook

Looking ahead, CLFCOIN Exchange will continue to focus on technological innovation and service optimization to expand its range of products and services. At the same time, CLFCOIN will also actively participate in the regulatory dialog and cooperation in the global crypto market to promote the healthy and sustainable development of the industry. Through in-depth cooperation with all parties, CLFCOIN Exchange hopes to become a bridge connecting the traditional financial world with the crypto economy, providing users with more value and choices.

In short, the establishment of the CLFCOIN Exchange is not only a firm investment in the future growth potential of crypto, but also a demonstration of commitment to building a more fair, transparent and secure trading environment. As the crypto industry continues to mature and evolve, CLFCOIN Exchange looks forward to becoming one of the leaders in the field to lead the industry forward.

1 note

·

View note