#Instant Cash Loan in Nigeria

Text

Instant Loans in Nigeria - Fastest Solutions to Financial Problems

The loan market is flooded with types of loans that meet a borrower's specific needs - auto loans, education loans, mortgages, home loans, and more. Instant Online Loan in Nigeria is built to cover financial emergencies. If borrowers are looking for a source that gives them a small amount of money quickly, instant loans are just what they need. Instant Loans eliminate all those tedious procedures and get approved in a day or less. Real instant loans give you instant cash.

Many financial institutions offer instant loans through online transactions and this is one of the fastest and easiest ways to access cash. When you find these sites on the internet, you just need to fill out their online application form with some basic personal information. The application form will only take a few minutes to complete and you don't need to step out of your home or office to apply and get such instant loans. Once the companies have received your application, their manager will contact you to analyze your financial needs. Usually, loans will be processed within 2 hours of your approval and you can get the money instantly into your account.

Quick Loan in Nigeria allows you to have cash in your account whenever you need it. Typically loans are short-term and the loan can be repaid electronically on your next payday through a postpaid check that you deposit with the company at the time of sanctioning readiness. These loans benefit many people who would otherwise have no choice in the event their funds run out long before their next payment is due. They can now continue with their current lifestyle if they have cash transferred to their account through these instant transfers. Even for those with a bad credit history in the past, loans are easily accessible and they can also get instant cash when needed. Instant loans are an easy and convenient way to get cash when you really need it.

Some expenses can't wait, such as bill payments, medical bills, and other everyday household expenses. Lack of finances will make your life standstill and it also affects your family and loved ones. Therefore, it is better to choose short-term loans with instant approval and transfer money to your account when you need it urgently. Also, because repayments are made within two or three weeks, you don't have to bear the burden of debt for long. Signing up and getting instant loans is like borrowing money from a close friend, so go for it.

While many loans can take a while to get approved, the credit check process is actually pretty straightforward. As a result, Loan Sites in Nigeria are now able to offer fast online decision loans without bypassing the lengthy decision process familiar to past borrowers.

Source & Reference: https://medium.com/@stanbicibtcbank1/instant-loans-in-nigeria-fastest-solutions-to-financial-problems-618aec4f0c9e

#Apply For Instant Loan#Personal Loans in Nigeria#Emergency Online Loan in Nigeria#Borrow Money Online In Nigeria#Online Instant Loan in Nigeria#Small Loan in Nigeria#Apply For Loan in Nigeria#Get Loan Online In Nigeria#Instant Cash Loan in Nigeria

0 notes

Text

I Need A Loan Of 50,000 Naira - Which loan app gives 50 000 instantly in Nigeria?

Let's face it, unexpected expenses can hit us all hard. Maybe your car needs repairs, a medical bill arrives, or you have a sudden business opportunity. In these situations, a quick loan of ₦50,000 can be a lifesaver. But with so many loan apps available in Nigeria, it's easy to feel overwhelmed. "I Need a Loan of ₦50,000 Naira - Which loan app gives 50,000 instantly in Nigeria?" This question is a common one, and this guide will help you find the answer that fits your needs.

Can I really get a 50,000 Naira loan instantly?

While some lenders advertise "instant" approvals, the processing time can vary depending on the app and your circumstances. However, several apps offer streamlined applications and approvals within 24 hours, making them a much faster alternative to traditional bank loans.

We'll break down the different loan apps available, explore factors to consider when choosing a lender and offer tips for getting the best possible interest rate. By the end, you'll be well-equipped to navigate the loan market and secure the funds you need quickly and responsibly.

Here's a quick breakdown of what we'll cover:

- Understanding Loan Apps in Nigeria

- Popular Loan Apps Offering ₦50,000 (Compares features and interest rates)

- Factors to Consider When Choosing a Loan App (Interest rates, loan terms, eligibility)

- Maximizing Your Chances of Loan Approval

- Alternatives to Loan Apps (Including personal loans from banks)

- Frequently Asked Questions (FAQs)

Understanding Loan Apps in Nigeria

Loan apps have revolutionized the way Nigerians access quick cash. These mobile applications allow you to apply for a loan entirely online, eliminating the need for lengthy bank visits and paperwork. They typically offer smaller loan amounts with shorter repayment terms, making them ideal for urgent financial needs.

However, it's crucial to understand that convenience comes at a cost. Loan apps often have higher interest rates compared to traditional banks. So, it's important to borrow responsibly and only what you can comfortably repay within the loan term.

Here are some key things to consider when using loan apps:

- Loan amounts: While many apps offer loans in the 50,000 Naira range, limits can vary. Be sure to check the minimum and maximum loan amounts offered by each app.

- Interest rates: Interest rates on loan apps can be higher than traditional bank loans. It's essential to compare rates across different apps before making a decision.

- Repayment terms: Loan apps typically have shorter repayment terms compared to banks, ranging from a few weeks to several months.

- Eligibility requirements: Each app has its own set of eligibility criteria, which may include age, income verification, and a valid Bank Verification Number (BVN).

How Can I Get A 50,000 Loan In One Day?

Getting a 50,000 Naira loan with guaranteed same-day disbursement in Nigeria can be challenging. Traditional banks typically have longer approval processes, making them unlikely for a one-day turnaround. However, there are options with faster processing times, but some come with trade-offs:

Loan Apps:

- Pros: Potentially fast approvals (within 24 hours), convenient online application process.

- Cons: Might require a BVN (beneficial for security but not always available), potentially higher interest rates compared to traditional banks.

Several reputable loan apps in Nigeria offer quick loan options. However, some might require a BVN for verification. Explore apps like Credit Nigeria or LendSqr, which connect you with lenders and allow for comparison. Remember to prioritize established and licensed lenders by the Central Bank of Nigeria (CBN) for safety.

Important Note: Approval speed can vary depending on the app, your creditworthiness, and the loan amount. While some advertise "instant" approvals, receiving the funds within the same day isn't guaranteed.

Here are some additional factors that can impact loan approval speed:

- Application completeness: Ensure you submit all required documents promptly.

- Credit history: A good credit history can expedite the process.

- Income verification: Verifying your income source might be required.

Alternatives to Consider:

- Microfinance Institutions (MFIs):

These institutions cater to individuals without extensive credit history and might not require a BVN. However, loan amounts might be lower compared to apps, and processing times could take a few days.

- Peer-to-Peer (P2P) Lending Platforms:

While some P2P platforms might not require a BVN, they often have stricter requirements like income verification and a good credit history. Approval times can also vary.

Popular Loan Apps Offering ₦50,000

Here's a glimpse at some popular loan apps in Nigeria that offer loans up to ₦50,000:

App NameInterest RatesRepayment TermAdditional InformationCarbonVaries depending on loan amount and repayment term (average 10% - 30% monthly)91 days - 18 monthsEasy online application processALAT by Wema2% monthly on a reducing balance3 - 24 monthsRequires a Wema Bank accountSokoloanVaries depending on creditworthiness (1% - 5% daily)15 days - 1 yearShort-term loans with flexible repayment optionsLendsqrPartner lenders offer varying rates (check individual lenders)Varies depending on lender (typically 1 - 3 months)Acts as a marketplace connecting borrowers with lenders

Remember: This is not an exhaustive list, and it's important to research each app thoroughly before applying. Always check the specific interest rates and terms offered before making a decision.

Factors to Consider When Choosing a Loan App

Finding the right loan app for your needs requires careful consideration. Here are some key factors to keep in mind:

- Interest Rates: This is a crucial factor. Compare interest rates offered by different apps to find the most affordable option. Remember, a lower interest rate translates to less money you'll repay overall.

- Loan Term: Consider how long you'll need to repay the loan. Shorter terms may have higher interest rates, but you'll be debt-free sooner. Conversely, longer terms spread out repayments but can lead to higher total interest paid.

- Eligibility Requirements: Each app has its eligibility criteria. Ensure you meet the requirements before applying to avoid wasting time. These may include minimum age, income verification, and a good credit score (if applicable).

- Transparency: Choose a loan app that clearly outlines its terms and conditions. Be wary of hidden fees or unclear repayment structures.

- Customer Reviews: Read online reviews from other borrowers to get a sense of the app's customer service and overall experience.

Maximizing Your Chances of Loan Approval

Once you've chosen a few potential loan apps, here are some tips to increase your chances of loan approval:

- Maintain a good credit score (if applicable): Some loan apps consider credit scores when evaluating borrowers. Having a good credit history can lead to better interest rates and loan terms.

- Meet all eligibility requirements: Double-check the app's requirements and ensure you meet them before applying. This might include having a BVN (Bank Verification Number), a valid ID, and a regular source of income.

- Provide accurate information: Fill out the loan application accurately and completely. Any discrepancies can delay or even disqualify your application.

- Only borrow what you can afford: This is crucial. Don't take out a loan larger than you can comfortably repay within the loan term.

Deep Dive into Popular Loan Apps for ₦50,000 Loans - I Need A Loan Of 50000 Naira Without Collateral

Now, let's take a closer look at some of the most popular loan apps in Nigeria, specifically focusing on how they handle ₦50,000 loans:

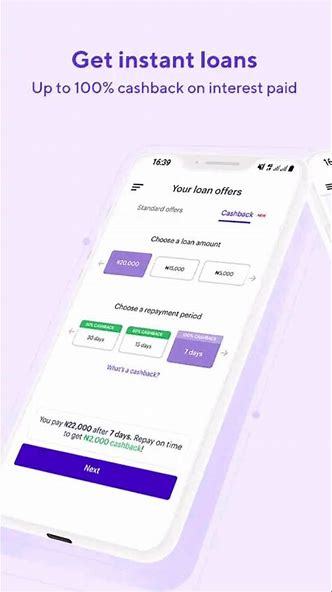

1. Carbon

- Getting a ₦50,000 Loan: Carbon offers a smooth online application process. You can typically receive a decision within minutes and have the funds deposited directly into your bank account within 24 hours if approved.

- Why Choose Carbon: Carbon is a popular choice due to its user-friendly app and relatively quick turnaround time. They also offer flexible loan terms, allowing you to spread out repayments over several months.

- Why Not Choose Carbon: Interest rates on Carbon loans can be on the higher side, ranging from 10% to 30% monthly depending on your loan amount and repayment term. This can significantly increase your total repayment cost.

2. ALAT by Wema

- Getting a ₦50,000 Loan: If you're already a Wema Bank account holder, accessing a loan through ALAT is a breeze. Simply log in to the app, navigate to the loans section, and apply for the desired amount. With approval, funds can be credited to your account instantly.

- Why Choose ALAT: ALAT boasts some of the most competitive interest rates in the market, with a flat 2% monthly rate on a reducing balance. This translates to significant savings compared to other loan apps. Plus, the convenience of using an existing bank account makes the process seamless.

- Why Not Choose ALAT: ALAT's biggest drawback is that it's only available to Wema Bank account holders. If you don't bank with Wema, you won't be able to access their loan products.

3. Sokoloan

- Getting a ₦50,000 Loan: Sokoloan prides itself on its fast and flexible loan options. Applying for a loan through their app is straightforward, and you can receive a decision within minutes. Once approved, funds are typically deposited within 24 hours.

- Why Choose Sokoloan: Sokoloan offers short-term loans with repayment periods ranging from 15 days to a year. This can be ideal if you need a quick cash injection to cover an immediate expense. They also boast flexible repayment options, allowing you to spread out payments over several installments.

- Why Not Choose Sokoloan: Sokoloan's interest rates can be quite high, with rates varying depending on your creditworthiness and ranging from 1% to 5% daily. This can translate to a significant cost if you're not careful. Additionally, their short repayment terms may not be suitable for everyone, especially if you need more time to repay the loan.

4. Lendsqr

- Getting a ₦50,000 Loan: Lendsqr operates differently from the other apps mentioned. It acts as a marketplace connecting borrowers with various lenders. The application process involves submitting your basic information on the Lendsqr platform. They then match you with potential lenders who offer their own interest rates and loan terms. Once you choose a lender and their offer, you complete the loan process directly with them.

- Why Choose Lendsqr: Lendsqr allows you to compare loan offers from multiple lenders and choose the one with the most favorable terms. This can potentially lead to securing a lower interest rate.

- Why Not Choose Lendsqr: The actual loan approval process can be less transparent compared to other apps. Since you're dealing with different lenders, the application turnaround time and loan terms can vary.

Remember: These are just a few examples, and numerous other loan apps operate in Nigeria. It's crucial to research and compare options before applying.

Alternatives to Loan Apps

While loan apps offer a convenient solution for quick cash, they shouldn't be your only option. Here are some alternatives to consider, especially if you require a ₦50,000 loan:

1. Personal Loans from Banks:

Traditional banks offer personal loans that can be a good alternative to loan apps. While the application process might take longer, bank loans often come with lower interest rates compared to most loan apps. Here's a breakdown of some key considerations:

Benefits:

- Typically lower interest rates than loan apps.

- Longer repayment terms, allow you to spread out payments and manage your budget more comfortably.

- May offer larger loan amounts.

- Established and regulated institutions, providing a sense of security.

Drawbacks:

- Longer application process compared to loan apps. May require extensive documentation and credit checks.

- Not as readily available, especially for smaller loan amounts.

2. Family or Friends:

Borrowing from close friends or family can be an option, fostering a sense of shared responsibility. However, it's crucial to approach this situation delicately to avoid straining relationships. Here are some tips:

- Be clear about the loan amount and repayment terms. Put everything in writing for transparency.

- Offer an interest rate, even if it's symbolic. This shows respect and acknowledges the time value of money.

- Stick to your repayment plan. Make timely payments to demonstrate your trustworthiness.

- Remember: Borrowing from loved ones can be risky if not handled correctly. Ensure everyone involved is comfortable with the arrangement before proceeding.

3. Salary Advance:

Some employers offer salary advance programs, allowing you to access a portion of your upcoming paycheck. This can be a helpful option for covering unexpected expenses without resorting to loans.

Benefits:

- Funds come directly from your salary, eliminating interest charges.

- Typically a small portion of your salary, minimizing the financial impact.

Drawbacks:

- Not all employers offer salary advance programs.

- May reduce your take-home pay for subsequent pay periods.

4. Side Hustle:

Earning extra income through a side hustle can be a sustainable way to address a temporary financial need. Explore your skills and interests to find a side gig that works for you. Here are some ideas:

- Freelancing: Offer your skills in writing, editing, graphic design, or other areas online.

- Online Tutoring: If you have expertise in a particular subject, you can tutor students online.

- Ridesharing: Utilize your car for ridesharing services like Uber or Bolt.

5. Reduce Expenses:

Before resorting to loans, consider ways to reduce your expenses and free up some cash flow. Here are some strategies:

- Create a budget: Track your income and expenses to identify areas where you can cut back.

- Negotiate Bills: Review your monthly bills and try to negotiate lower rates for services like cable, internet, or phone plans.

- Reduce Unnecessary Spending: Analyze your spending habits and identify areas where you can cut back on non-essential purchases.

Frequently Asked Questions (FAQs)

Q: What is the fastest way to get a ₦50,000 loan in Nigeria?

A: Loan apps generally offer the fastest loan application process, with some providing approval and disbursement within 24 hours. However, this often comes with higher interest rates.

Q: What is the best loan app for a ₦50,000 loan?

A: There's no single "best" app. The best option depends on your individual needs and priorities. Consider factors like interest rates, loan terms, eligibility requirements, and customer reviews before making a decision.

Q: Can I get a ₦50,000 loan without good credit?

A: Some loan apps may offer loans to borrowers with no credit history, but interest rates might be significantly higher. It's advisable to explore alternative options like personal loans from banks or salary advances if you have limited credit history.

Q: What are the risks of using loan apps?

A: Loan apps can be risky due to their high interest rates. It's crucial to borrow responsibly and only what you can comfortably repay within the loan term. Additionally, be cautious of loan apps with hidden fees or unclear terms and conditions.

Q: Are there any alternatives to loan apps for a ₦50,000 loan?

A: Yes, several alternatives exist. Consider personal loans from banks, salary advances from your employer, borrowing from trusted friends or family (with a clear agreement), or generating additional income through a side hustle.

Conclusion

Needing a quick loan can be stressful, but with careful planning and exploration of your options, you can find a solution that meets your needs without getting caught in a cycle of debt. Here are some key takeaways:

- Prioritize responsible borrowing: Only borrow what you can comfortably repay within the loan term.

- Compare loan options: Don't jump at the first offer. Research and compare interest rates, loan terms, and eligibility requirements before applying.

- Consider alternatives: Explore options like personal loans from banks, salary advances, or reducing expenses before resorting to loan apps.

- Borrow from reputable lenders: Choose well-established loan apps or banks with clear terms and conditions. Be wary of hidden fees or predatory lending practices.

- Build a budget and emergency fund: Having a solid budget and emergency savings can help you avoid relying on loans for unexpected expenses in the future.

By following these tips and making informed decisions, you can navigate the loan market successfully and secure the funds you need without compromising your financial well-being. Remember, there's no shame in seeking help if you're struggling financially. Many resources are available to assist you, including financial counseling services offered by some banks or NGOs.

Read the full article

0 notes

Text

Top 5 Instant Online Loan Platforms in Nigeria (2024)

Life throws unexpected curveballs, and sometimes, we need a little extra cash to navigate them. In Nigeria, where access to traditional financing can be limited, online quick cash loans have emerged as a popular solution. But with so many options available, choosing the right one can feel overwhelming. Worry not! This comprehensive guide shines a light on the top online loan platforms in Nigeria,…

View On WordPress

0 notes

Text

0 notes

Text

Fast $ via FedNow coming to a bank near you

The US banking system is about to get sped up like Barry Allen after the lightning struck, potentially eliminating those frustrating waiting days it can take for money to hit your account. The Fed is launching its FedNow instant payment service later this month.

The new system will enable banks to send each other cash instantly, 24/7, as an alternative to the existing system that runs only during regular business hours and often takes days to move money.

FedNow could put America’s banking system on track to catch up to countries like India and Nigeria, where high-speed payments are as common as high-speed rail in Japan. The US does already have an instant payments system, but it’s private rather than government-backed, and it hasn’t been widely adopted. It’s mostly only used by big banks, and only 1.4% of US transactions happen in real time, according to payment systems company ACI Worldwide.

FedNow-enabled services will soon likely appear at the 41 banks that have been certified to participate so far.

People moving money between banks or paying bills could complete their transactions in seconds without the need to plan payments days in advance.

Businesses will be able to access customer payments immediately and to send workers payments more frequently with instant direct deposit rather than the usual payroll cycle.

Faster payments could mean faster bank runs

Some experts worry that allowing people to drain their bank accounts instantaneously could make SVB-style bank runs more likely.

Smaller banks struggling with liquidity would have even less time to react to customer panic and get collateral for emergency government loans to cover fleeing cash.

But there are safeguards built in. FedNow has a transaction limit of $500,000, and banks can set their own ceilings to ensure that customers don’t pull their deposits faster than they can say “Federal Deposit Insurance Corporation.”

0 notes

Text

Payday Loans Market to Witness Revolutionary Growth by 2027 | Money Mart, Speedy Cash, CashNetUSA

Advance Market Analytics published a new research publication on “Global Payday Loans Market Insights, to 2027” with 232 pages and enriched with self-explained Tables and charts in presentable format. In the study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Payday Loans market was mainly driven by the increasing R&D spending across the world.

Major players profiled in the study are:

CashNetUSA (United States), Speedy Cash (United States), Approved Cash Advance (United States), Check n’ Go (United States), Ace Cash Express (United States), Money Mart (United States), LoanPig (United Kingdom), Street UK (United Kingdom), Peachy (United Kingdom), Satsuma Loans (United Kingdom), OppLoans (United States)

Get Exclusive PDF Sample Copy of This Research @ https://www.advancemarketanalytics.com/sample-report/124850-global-payday-loans-market#utm_source=DigitalJournalVinay

Scope of the Report of Payday Loans

Payday loans are small amount, short-term, unsecured loans that borrowers promise to repay out of their next paycheck or regular income payment. The loans are generally for USD 500 or less than USD 1000 and come due within two to four weeks after receiving the loan and are usually priced at a fixed fee, which signifies the finance charge to the borrower. These unsecured loans have a short repayment period and are called payday loans because the duration of a loan usually matches the borrower’s payday period. According to the Federal Reserve Bank of St. Louis, in 2017, there were 14,348 payday loan storefronts in the United States. Approx. 80% of payday loan applicants are re-borrowing to pay a previous payday loan. The regulations for payday loans are strictest in the Netherlands.

The Global Payday Loans Market segments and Market Data Break Down are illuminated below:

by Type (One Hour, Instant Online, Cash Advance), Application (Mortgage or Rent, Food & Groceries, Regular Expense (Utilities, Car Payment, Credit Card Bill, or Prescription Drugs), Unexpected Expense (Emergency Medical Expense), Others), Repayment Period (Upto 14 Days, 1-2 Months, 3-4 Months, More than 4 Months), End-User (Men, Women)

Market Opportunities:

Growing Adoption of Payday Loan in Developing Countries

Market Drivers:

Increasing Number of User for Payday Loan in North America and Payday Loans Are Only Legal In 36 US States

Rising Use of Quick Cash for Emergencies

Market Trend:

~43% Use 6 or More Installments Loans A Year And 16% Use More Than 12 Small Loan Products Each Year

Payday Loans are Attractive Alternative to the Highly Sought after Credit Cards

What can be explored with the Payday Loans Market Study?

Gain Market Understanding

Identify Growth Opportunities

Analyze and Measure the Global Payday Loans Market by Identifying Investment across various Industry Verticals

Understand the Trends that will drive Future Changes in Payday Loans

Understand the Competitive Scenarios

Track Right Markets

Identify the Right Verticals

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Have Any Questions Regarding Global Payday Loans Market Report, Ask Our Experts@ https://www.advancemarketanalytics.com/enquiry-before-buy/124850-global-payday-loans-market#utm_source=DigitalJournalVinay

Strategic Points Covered in Table of Content of Global Payday Loans Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Payday Loans market

Chapter 2: Exclusive Summary – the basic information of the Payday Loans Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Payday Loans

Chapter 4: Presenting the Payday Loans Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2016-2021

Chapter 6: Evaluating the leading manufacturers of the Payday Loans market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2022-2027)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Payday Loans Market is a valuable source of guidance for individuals and companies.

Read Detailed Index of full Research Study at @ https://www.advancemarketanalytics.com/buy-now?format=1&report=124850#utm_source=DigitalJournalVinay

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

#Payday Loans market analysis#Payday Loans Market forecast#Payday Loans Market growth#Payday Loans Market Opportunity#Payday Loans Market share#Payday Loans Market trends

0 notes

Text

Top Trending Naija Songs ()

Top Trending Naija Songs ()

Top Trending Naija Songs ()

As of this are Top Trending Naija Songs, Without batting an eyelid, anyone would agree that Nigerian pop artists dominate the music conversations in sub-Saharan Africa, with groundbreaking streaming numbers and major collaborations with international counterparts.

Are you in need of quick cash? Check out our list of the best instant loan apps in Nigeria that lend up to…

View On WordPress

0 notes

Text

BEST LOAN APPS IN NIGERIA/ TOP 5 BEST LOAN APPS TO GET INSTANT LOANS

BEST LOAN APPS IN NIGERIA/ TOP 5 BEST LOAN APPS TO GET INSTANT LOANS

We bring to you the most reliable rundown of the main 5 so best Loan applications in Nigeria with which you can gain admittance to moment credit for individual or business use. Indeed, you can get these loans on your cell phone, either on Android or iOS gadget

Most frequently, numerous people and entrepreneurs could require an extra-money to in taking care of a few monetary issues around them. In circumstances such as this when all method for getting cash has been depleted, the best option is to consider getting a fast and effectively reasonable credit on the web.

The most common way of getting to speedy credits in Nigerian banks is very extensive and monotonous for any person that is simply hoping to get to a modest quantity of credit for just a brief timeframe.On account of the Fintech upset in Nigeria, web based loaning new companies are making it simple for organizations and people to approach fast advances when needs.

Here is a rundown of top 5 loan applications for online busines and individual credits in Nigeria.How could anybody require a speedy credit in any case? Battling with funds and taking care of bills has become significantly more troublesome, as numerous Nigerians have lost all or part of their pay, particularly during this worldwide pandemic.

Try not to overreact in the event that you don't have a rainy day account and are experiencing difficulty getting by; you're not alone in your financial situation However government monetary effect installments might be useful, you can likewise investigate alternate ways of acquiring cash and get moment online credits to be reimbursed in a brief timeframe.

In one of our past postings on the most proficient method to get cash online in Nigeria, we nitty gritty the six techniques that would permit you to get reserves involving any of the loaning applications in Nigeria that will be referenced soon.

Perhaps the earliest and most significant advances is to get to speedy web-based credit stages including any of the best credit applications in Nigeria that offer moment advances following application, even with next to no security and when jobless.

To start with, you'll must have a savvy gadget (telephone, tablet, and so forth) to get to the credit applications I'll give in this rundown. Curiously, there will be no enormous reports. You just need your cell phone to get your money.Top 9 Best Loan Apps In Nigeria For Online Lending

Here is a rundown of five portable loan applications well known in Nigeria.

Ratings of the 5 best loan apps

#1 Carbon Loan App (Pay Later) 4.5

#2 FairMoney 4.5

#3 Palm Credit 4.5

#4 Branch 4.5

#5 Quick Check 4.0

Speedy Disclaimer: Note that we're no of the credit applications recorded here, Many have guaranteed that soko loan, okash, kash, and some others are phony advance applications. The data gave is to data motivations just and is a closely held individual belief in light of what e've attempted with the application*

Lastest News: Federal Competition and Consumer Protection Commission FCCPC's strike on Soko Loan and its other sister-applications, Fast Money, Go Cash, Okash, Kash, Speedy Choice and Easy Moni, has prompted a fine of N10 million for a supposed information

break.

1. Carbon Loan App

Carbon officially called PayLater is the principal on the rundown of best advance applications in Nigeria.The Carbon credit application process commonly takes under 5 minutes to finish.

Their rates range from 2% to 30%, and this relies upon the credit reimbursement period and how much cash you wish to acquire. As of Q2 2022, the application had been downloaded more than 1 million times.It is a basic, completely internet loaning stage that gives momentary credits to assist with covering unforeseen costs or pressing money needs.

With simply an Android gadget and essential necessities, you can apply for a Paylater credit 24 hours every day, 7 days per week with a fast application process that tells you your status in practically no time.Carbon application as of now offer two credit bundles:Pay later (advances accessible to all) and Pay later in addition to (credits for compensation workers).

Pay later stage additionally permits you to make installments for re-energize cards, bills including your NEPA bill and different administrations.Like any moment online credit, you needn't bother with any kind of documentation or guarantee to apply and get supported, with the exception of an android telephone to download and utilize the application, and a method for recognizable proof. With these, you are set to go.

Download Carbon Loan App and get up to #100,000 immediately!

2 Fair Money

The Fair Money application is positioned second among the top best credit applications in Nigeria.FairMoney says it offers quick credits in somewhere around 5 minutes with no documentation or security required. The advance sums differ in view of your cell phone information and reimbursement history.

Credit sums range between N1,500 to N500,000 with reimbursement periods from 61 days to 180 days at month to month loan fees that reach from 10% to 30%. The application is, no question, one of the most utilized by Nigerians as it has likewise been downloaded 5 million times despite everything counting.

To finish a speedy and straightforward application process, basically download the application from the Google Play Store, accept your assets (without insurance), and pay back in no less than 15 days or one month.You ought to know that there will be sure terms and limitations related to the credit, so ensure you read them prior to applying.

Fair Money's application, as well as giving advances, likewise permits clients to re-energize their telephones and pay their costs.

CLICK HERE TO DOWNLOAD THE FAIR MONEY APP AND GET ACCESS TO INSTANT LOANS

3. Palm Credit App

Palm credit app is Another application for loans in Nigeria is the Palm credit application. Palm credit is essentially an android application that gives advances to clients of the application.It is exceptionally simple and speedy.

Palm credit advance is restricted to people that are 18 years or more, and the advance sum is inside the scope of #2,000 to #100,000With only a couple of steps then you have everything in your control to get the credit you need.You should simply download the Palm Credit App on Google Play store, fill in your subtleties, you can join utilizing your telephone number or your Facebook record, and you will actually want to finish the enlistment in no time flat.Likewise,

Plamcredit gives reward offers for alluding individuals to Palm Credit. Isn't unreasonably astonishing?With PalmCredit getting a versatile credit is straightforward. Apply for your credit limit in minutes, then, at that point, take as the need might arise minus any additional endorsement steps. It's a credit insurgency!When you reimburse, your FICO assessment is refreshed. Reimburse on time and watch your limit develop to N100,000.

Download the Palmcredit App to get moment and adaptable advances at reasonable rates.

4. Branch Loan App

The Branch application is the fourth application on my rundown of the best credit applications in Nigeria. Getting cash by means of a Branch App is straightforward and might be finished in just 10 minutes.Branch, similar to the next credit applications depicted above, requests no kind of guarantee to acquire advances.

To get a credit, all you really want is your telephone number or Facebook account, as well as your bank confirmation number and record data.The application decides advance qualification and customized credit offers utilizing the clients' cell phone information. Their loan costs range from 15% - 34%.

You can gain admittance to credits from N1,000 to N200,000 inside 24hrs, contingent upon your reimbursement history, with a time of 4 to 40 weeks to take care of.All you want to apply is your telephone number or Facebook account, bank confirmation number (BVN) and ledger number. They will likewise demand admittance to the information on your telephone to assemble your FICO assessment.

The Branch advance application permits you to acquire cash for just #1,000 and as much as #200, 000 at sensible loan fees.Getting speedy and moment advances on Branch App is so quick and simple. It will assist you with figuring out your monetary issues continuously.Branch offers credits from ₦1,500 to ₦150,000. Credit terms range from 4 - 64 weeks. Interest goes from 14% - 28% with an identical month to month interest of 1% - 21%, contingent upon chose credit choice.

Download Branch App for admittance to speedy and moment loans

5. Quick Check

Quick Check is a cutting edge loaning stage that can never be forgotten about on my rundown of credit applications for Nigerians, either for individual or independent companies.As per the stage, clients can get to fast credits of up to #30,000 with no guarantee for a span of one or the other 15 or 30 days.

The more advances you take and reimburse on time, the higher your FICO assessment and you get close enough to much higher sums! It's certainly one of the most mind-blowing advance applications in Nigeria

QuickCheck utilizes AI to anticipate borrower's way of behaving and immediately assess advance applications. This application is among the top credit applications in Nigeria that have crossed 1 million downloads. The organization says it targets offering computerized monetary administrations to assist individuals with drawing nearer to their own and business objectives.

The application likewise offers credits without security.

CLICK HERE TO DOWNLOAD QUICK CHECK APP AND GET ACCESS TO INSTANT LOANS

Note: Many administrators of credit applications have been known to recuperate their monies through disturbances, including calling a defaulter's phone contacts to demand the contact's intercession. Such contacts might be companions, relatives, collaborators or even a borrower's managers.When you register for advance on any of these applications, you are giving your contacts list protection over to them and this is utilized assuming you default in reimbursing. The watchwords in managing the advance applications are: Do not owe them.

#bestloansapps

1 note

·

View note

Photo

Get instant online loan in Nigeria from Loan35 and fulfill your urgent requirement with ease.

0 notes

Text

Flutterwave: The Innovative Digital Payments Platform

The underdevelopment of the financial service industry in Africa posed a very tough, important and widespread problem of payments across the continent. After more than 50 years of banking on the continent, only roughly about 34 percent of adults in sub-Saharan Africa have bank accounts or access to formal financial services.

It is clear the traditional model of banking is too slow, inflexible and incapable of spreading financial access across the continent, and so making payments across globally is proves even more difficult

Fortunately, with the spread of mobile phones and the Internet across Africa, more people are exposed to the better option of digital financial services, both for individuals and businesses. This is a very beneficial advancement as every day more and more people leverage this technology to have access to various online digital platforms to make payments across the globe in ways traditional banking never did as online transactions happen quickly and with ease.

Regardless of the popularity of online digital payments, many businesses, and individuals in Africa still feel very Insecure and do not trust these digital financial service providers.

With so many concerns about making secure and reliable payments online, problems with making payments for products and services both across the continent and globally, the general fear of being a victim of “fraudsters”, consumers are looking for a product and service they can trust.

This is exactly what Flutterwave, a fintech startup from Nigeria hoped to achieve when they came into the scene in May 2016 and completely revolutionized the online digital payment platforms in Africa.

What is this Flutterwave you may ask?

Flutterwave

Flutterwave is an online digital payment platform that is set out to provide complete payment solutions to enable Africans to thrive in the global economy. The company started with a vision to first connect digital payments within Africa and then connecting Africa to the rest of the world. Flutterwave has been to able provide with its various products advance financial technologies and solutions for efficient, reliable and swift and payments across Africa and the globe.

Since they commenced business three years ago, Flutterwave has processed over $2.5 billion in payments, 100million transactions, and is partnered with over 50 African banks like Standard Bank, Ecobank, United Bank for Africa, Guaranty Trust Bank, Zenith Bank, First Bank, and Access Bank and many more to ensure that it provides top-notch service to the ever-growing African market.

Flutterwave raised one of the highest Series A round investments for an African startup and to date has raised over $20 million in investments from companies such as Mastercard, CRE Ventures Fintech Collective, 4DX Ventures, Raba Capital among others. Also as part of the deal, Green Visor Capital Chairman & General Partner and former CEO of Visa, Joseph Saunders, has joined the Flutterwave Board of Directors. Joe, an experienced Venture Capitalist and Chief Executive Officer of a multibillion-dollar financial Services Company added an important factor to the readiness of the company to effectively continue operations post-funding phase.

Flutterwave currently has over 1200 developers that build on its Developer’s playground with a focus on building technology that is not only flexible with awesome user experience but also provides a payment technology that is reliable and secure thereby easing the fears of the average user.

Flutterwave is building digital payments infrastructure accessible via APIs that enable all available payment options across different African countries. This API allows businesses to carry out transactions from MasterCard, Visa, Verve, Mobile Money, ACH — and even cash tokens and e-wallets in different African countries by integrating one API. This is very important because it incorporates the already existing and preferred means of payment by its consumers into its platform. So in plain words, you make and accept payments with methods you are already familiar with and comfortable with. The company currently has its headquarters at San Francisco and also operates out of offices in Lagos, Nairobi, Accra, and Johannesburg.

Flutterwave has built an innovative technology that has been able to connect Africans and African businesses with the global economy in ways never before attained.

Flutterwave products

Flutterwave has been able to open up, and disrupt the traditional financial services in African and improve trust between African businesses and its global consumers with its innovative products, some of which are Rave and Barter

Rave

Rave by Flutterwave

Rave is a payment solution offered by Flutterwave which enables merchants to accept global payments from cards, mobile wallet payments, and Unstructured Supplementary Service Data(USSD) code. It is one of the easiest ways for businesses to accept a range of payment methods from customers around the globe

Rave by Flutterwave is a product that can be integrated into various online websites for a better payment experience. One of such websites to incorporate this product is Megabet. It creates any type of payment flow, from e-commerce to recurring billing and everything in between. Using Rave you can set up an e-commerce store with Shopify in just minutes and begin to receive payments from customers. With a simple sign up on Rave, you have unlimited access to all its features.

Currently, Rave supports over 150+ currencies and its flexibility allow it to display prices and accept payments in its users’ preferred currency, improving their overall experience. With Rave, you avoid high conversion fees and can receive funds in your local currency. Rave payment gateway support payment in Naira, US Dollar, Euro, British Pound and many more.

Flutterwave Rave has various user-friendly features making users enjoy the experience of using the products it meets their specific needs and the ease of use is an added advantage.

Rave provides a payment gateway that is better than others in numerous ways. A payment gateway is a service that securely authorizes a customer’s payment on a website. It is used to accept payments on a website, app or even social media. Rave employs a slew of tools geared at protecting merchants from fraud to make transactions secure and reliable. The instant settlement also assures no delay in money availability once customer made payment

Flutterwave is also PCI DSS Level 1 certified which is the highest level of security and ensures that its user’s information is kept safe and private.

Secure payments in Flutterwave

The Pricing For Rave is listed Below:

Local Payments:

Payment method: MasterCard, Visa, Bank Account, USSD- 1.4%Processing fee

International Payments:

MasterCard, Visa, American Express-3.5% Processing fee

Some of the companies that use this products include Flywire, Arikair, Jumia, Uber, and Booking.com.

To get started on Flutterwave Rave, click here.

Barter

Barter by Flutterwave

Flutterwave partnered with Visa to launch a consumer payment product called Barter. The product facilitates personal and small payments. Barter is a financial app not unlike your typical bank app, but it also gives users more options to manage their finances, make bill payments, pay for various subscriptions and generally just make everyday transactions as seamless and easy as can be. On their official website, the product is described as being designed to help you focus more on enjoying life and less on how to spend, spend and borrow money.

Barter lets the user know how he spends his money and also provides detailed reports that show their spending patterns and insights. This product also allows the user to add their bank account to their app dashboard and manage funds in their local currency. Users can also request for short-term loans on the app with ease. Funds can be added to your barter account from your local bank accounts or cards. With the GetBarter App, you can make and accept payments with just the touch of a few buttons across the continent.

Users who already own Visa cards can also send and receive money at both locally and internationally on the GetBarter App while non-card holders (people with accounts or mobile wallets on other platforms) can create a virtual card to link to the app.

.

Barter Classic plan

Barter classic is the regular Barter plan. Users on the Barter Classic plan can create a maximum of two Dollar cards and there is a ₦50,000 limit on daily bank transfers. Users do not get also cashback on airtime purchases, unlike the premium users. All other features like bank transfers, sending and receiving money, bill payments, all work effectively with very low transaction costs.

One amazing feature about this product is that when you add your Barter card to your Uber app (Naira or dollar), you get 0.5% cash-back after every ride, talk of rewarding your users.

GetBarter also lets you request and send money to any number saved on your phone. You can request as low as N50 or as high as N500,000. Whatever amount you are sent goes right into your Barter Balance.

The Pay with QR feature, which is powered by VISA, allows the user to scan a QR code to make payments with Barter. You can either scan the QR code with your camera directly or upload one from your photos. This feature has been publicly applauded globally.

The GetBarter App is available on Android and IOS

FLUTTERWAVE over time has made major strides in the financial technology space in Africa that has impacted thousands of businesses both in Africa and the global economy.

The recent Partnership of Flutterwave with Alipay has created access for Flutterwave merchants to over 1 billion potential customers in China and across the world. They had previously partnered with PayAttitude to enabled payments to be made using only your phone number. A very convenient method of payment for those without bank accounts.

As with all tech-driven solution providers in the continent, Flutterwave has had its share of difficulties but through it all, they have shown a commitment for excellence and a desire to give its consumers the best experience.

Flutterwave has gotten well deserved global recognition for its contribution to the financial technology industry. Flutterwave won the West Africa Mobile Awards in 2017 for the best commerce and retail service.

Flutterwave’s API is used by many of the payment service providers in Nigeria including Paystack, AmplifyPay, Paywithcapture, and others. With its easy to use and Flexible API that is able to conveniently process millions of transactions both locally and internationally, and with the dedication that the Flutterwave team has shown in just three years in the financial technology space, it is very obvious that this is a company set on changing the world and helping businesses in Africa progressively scale up and be a competition in the growing global economy

1 note

·

View note

Text

The Complete Payment Solution you need to thrive in the Global Economy

Flutterwave is a trusted online payment gateway in Nigeria focused on providing individuals and businesses with seamless, intelligent and secure online payment solutions.

Founded in San Fransisco in 2016 with an office in Lagos, Flutterwave now has an operational presence in Nigeria, Uganda, South Africa, Tanzania, Ghana, and Kenya. In 2018, Flutterwave announced its entry into the United Kingdom and Zambia after obtaining licenses for payment processing and electronic remittances.

Flutterwave boasts of thousands of merchants all over the world with over 100 million transactions worth billions of dollars since inception. Through partnerships with international brands like PayPal, Transferwise, Alipay, Shopify, and VISA, Flutterwave strives to connect its customers with the global economy with ease.

In 2018, Flutterwave got ISO 27001 certification which means Flutterwave has internationally acceptable practices and processes including a robust business continuity plan.

It is worth mentioning that Flutterwave is continuously using technology to shape Africa’s digital economy. In recognition of providing efficient business payment solutions across Africa, Flutterwave received the ‘Best Payments Company’ at the 2018 Ghana eCommerce Award ceremony.

Flutterwave products like Rave, Barter, and Moneywave are modern online payment platforms tailored to drive financial inclusion in the global economy. Whether you are thinking of how to manage your personal finances or looking for the right technology to build and grow your business globally, Flutterwave has a payment solution for you.

Rave by Flutterwave

Rave is unarguably the easiest way for merchants to make and receive payments from anywhere in the world. Rave is used by giant companies like Uber, Booking.com, Flywire, Jumia, Arikair, OjaExpress and several small and medium businesses across Africa. Currently accepting over 150 currencies from over 26,000 merchants, Rave is the ideal merchants' marketplace.

Ravepay offers merchants a fully integrated end-to-end payment gateway with no additional operational cost required and the best technology to achieve zero failed transactions.

Merchants can easily get started on Ravepay with no setup or monthly fees and have control over the acceptance, settlement and transaction analysis process. A reasonable fee is charged per transaction through multiple payment collection channels like;

- In-person through sales mode and the Rave dashboard

- App or Website by installing Rave plugins that allow integration with e-commerce platforms like Alipay, Shopify, Magento, and Woocommerce; SDKs and libraries for customized Apps and websites

- Social media using Rave instant payment links from Instagram or Facebook feeds.

Rave merchants can receive money from customers through:

Credit or Debit cards like Visa, Mastercard, and Verve.

Bank Account Payments from the U.S., Nigeria, and South Africa.

Mobile Wallet Payments on MTN, M-Cash, M-Pesa, and TIGO

How to start and grow your business with Rave

1. Develop a business idea- Identify a need or find a solution to a problem.

2. Conduct a market survey- study your potential customers and how best to serve them, look around for competitors and learn from them.

3. Create a business plan - Set measurable goals and how you intend to achieve them.

4. Raise enough capital

5. Register your business for easy identification

6. Start your business online, in-store or even both.

7. Visit Rave by Flutterwave to create a free Rave account and select a payment feature that meets your needs in less than 5 minutes.

8. Display prices and accept local or global payments in your customer’s preferred currency.

9. Receive payments in your app or website, on social media or in-person through debit or credit cards, bank accounts, and mobile wallets payment in any currency.

10. Manage your funds, expand and pay vendors globally to grow your business.

Already have a business and you want to grow it? Switch to Rave by Flutterwave, accept payment from multiple channels and give your customers the best possible payment experience.

Pros

Cost-effective, all in One Dashboard.

Accept payment from all channels where your business thrives.

Enjoy well managed 24/7 customer support from Flutterwave for even bigger solutions.

Cons

Rave account verification after creating an account might take time so the earlier the better you create a Rave account while deciding to start your business.

Barter

Need a better (financial) half? Get Barter App. Barter by Flutterwave is a payment platform that allows you to manage your personal finances better.

Whether you are sending money to friends, buying airtime, paying utility bills, internet subscription or saving for your next big project, use Barter.

With Barter, you can add your personal bank account to your app dashboard and monitor your funds in your local currency.

Sign up for Barter on the website or download the GetBarter App to join over 30,000 people already using Barter to make their lives better.

Pros

Easy and efficient way to monitor your spendings.

Allows funding through card or bank accounts and bank transfers.

Access to easily repayable short-term loans.

Cons

Allows local currency transactions only.

- Editing of profile and other personal details used in signing up may take time so be careful when signing up.

Moneywave

Moneywave is an omnichannel payment solution that allows you to build customizable money transfer platforms, online banking, mobile banking, and Artificial Intelligent solutions.

Similar to Rave, Moneywave allows you to send money from

- VISA to bank accounts on Mobile

- Bank accounts to VISA on Mobile

- Verve to Discover on ATM

- Discover to Verve on Chat boxes

- Mastercard to Mastercard on Web

- AMEX to AMEX on different bank channels

Sign up for Moneywave to get started.

Flutterwave Developers

Flutterwave is currently home to thousands of developers who have over the years built APIs with easy to use plugins, SDKs, and libraries for the integration of customized payment solutions. Interestingly Flutterwave developer community also offers other developers a playground with the aim of continuously improving the standard of payment technology in the Fintech industry.

The future is all bright for Flutterwave as Olugbenga GB Agboola, the CEO at the beginning of the year reinstated their commitment as a customer-focused brand striving to give their customers the best possible checkout experiences at all times.

#flutterwave#payment solutions#rave#ravebyflutterwave#barter#getbarter#payment gateway#ecommerce#mobile money#moneywave#barterbyflutterwave#flywire#alipay#moneytransfer#personal finance#merchantmarketplace#global economy#how to start a business#how to grow business#online payment#flutterwavenigeria#nigeriaonlinepayment#nigeriafintech#safe online payments#bank to bank transfer#bill payments#payment integration for websites#flutterwavedevelopers#ravesignup#raveaccount

1 note

·

View note

Text

The most effective option to get that instant loan

Be simple truth about nowadays would be the fact we are in an age of unstable economic climate as well as an overall deficiency of decent employment opportunities. Hence, there are specific instances, when you really need to acquire some dough and fast. That is, as a way to handle certain immediate requirements and needs. As an example, when you're planning to manage some hospital bills, when you're in need of coping with the bills and other expenses that can't be taken lightly. Which is the reason you need to look for a loan in Nigeria the other that won't disappoint you.

While there are plenty of lenders easily accessible on the market these days, you simply must obtain the utmost reliable solution that may offer you a moment online loan in Nigeria as well as in line using the best terms and the best conditions possible. The Mortgage institutions will often be refusing to provide you with that loan in case your credit history is anything below stellar and, if you are inclined to help make the most out of the process, you will want the Loan without collateral in Nigeria. Well, the given lender offers you the credit right to your credit card and, if you're inclined to acquire those money quicker, this is the ultimate alternative for you. The bank is also giving the Loan Application, which is utmost convenient and approach to obtain the most from your claims quickly whatsoever.

It is simply the most comfortable, stress-free and effortless strategy to make the most out of your loan online, only using your phone and trying to get the sum just about on the go, this Instant online loan in Nigeria is the ultimate solution which will be suitable for you in many more different options than a single. Hence, if you are wanting some cash, a sum that will permit you to definitely settle the bills or cover the present medical expenses, here is the most effective, straightforward as well as rapid method to obtain that sum without needing to invest too much time and efforts to the process. Hence, if you are in the extreme demand for money right now and are searching for method to obtain those - the given resource offers you all you are going to need and won't are truly disappointing - very much is for sure!

To learn more about loan in Nigeria just go to this useful website.

1 note

·

View note

Text

RenMoney Loan: Get Instant Loan In Few Minutes

RenMoney Loan: Get Instant Loan In Few Minutes

RenMoney Loan: Get Instant Loan In Few Minutes

If you are looking for a platform to get instant cash loans in Nigeria, RenMoney is one of the reliable source to get instant loan without collateral.

About Renmoney Loan

Renmoney is a microfinance bank based in Lagos Nigeria, it offers loans to Nigerians without asking for a guarantee or guarantor.

They have been providing business and personal…

View On WordPress

0 notes

Text

0 notes

Text

Why Africans Must Join And Support FACTS-FUND

Instant personal loan, Less information to get loan, Naija loan.

For online loans in Nigeria without collateral, fast loans and quick loans in Nigeria, login and apply for FACTS Cash.

Get your loan right to your bank account and you can chooese to repay within 91 to 180 days.Interests ranges from 1% – 7% the lowest you can get any where in AFRICA

With few simple steps to get a loan:

View On WordPress

0 notes

Photo

Loan35 is a platform that offers instant loan in Nigeria in a very quick and transparent process.

0 notes